- Home

- »

- Homecare & Decor

- »

-

Australia Kids Scooter Market Size Report, 2021-2028GVR Report cover

![Australia Kids Scooter Market Size, Share & Trends Report]()

Australia Kids Scooter Market Size, Share & Trends Analysis Report By Product (3 Wheel, 2 Wheel), By Type (Non-electric/Kick, Electric), By Distribution Channel (Offline, Online), And Segment Forecasts, 2021 - 2028

- Report ID: GVR-4-68039-408-0

- Number of Report Pages: 58

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

Report Overview

The Australia kids scooter market size was valued at USD 3.78 million in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 4.9% from 2021 to 2028. The growing concerns among parents with regard to improving child health are expected to be one of the main factors driving the demand for kids' scooters. Various health experts have recommended that scooting can improve body functionalities, such as metabolism, cardiopulmonary health, and blood circulation. In addition, this activity helps in increasing height, mobility, and immunity, which aids in the prevention of several diseases, such as obesity and related disorders. Revised safety laws in different cities have also led to an increasing number of kids riding scooters. In December 2019, the Australian Capital Territory (ACT) Government announced the legalization of the use of electric scooters on footpaths and shared paths, following increased public demand. With the legalization in place, Canberra residents can now use their e-scooters at up to 15 km/h on footpaths and up to 25 km/h in all other permitted locations.

Companies in the market are launching new products in attractive colors and designs. A number of players are also introducing non-electric scooters in a variety of shapes, designs, and functionalities to gain market share. For instance, in November 2019, Bird, a micro-mobility company based in Santa Monica, California, announced the launch of its three-wheeled kids' scooter Birdie in three colors: jet black, dove white, and electric rose. The variants were available for purchase through the holiday season at USD 129.

In order to gain a new customer base and boost revenue growth, several manufacturers are focusing on building innovative products, which are comfortable and safe and can be recognized by product experts and designers. Gaining experts’ and parents’ trust is one of the key factors to drive their sales in the years to come and establish their position in the market. For instance, in 2018, Globber’s EVO COMFORT all-in-one 3-wheel scooter for kids was voted as the best outdoor product by My Child during the Excellence Awards 2018. My Child is a renowned Australian magazine that aims to help parents by providing parenting tips and product information. Over 22,000 parents voted for their favorite product on My Child’s website and EVO COMFORT was voted as No1. This recognition helped elevate the company’s brand image and boost its revenue growth.

The recent outbreak of COVID-19 has impacted the growth of the market in Australia. With the local state's stay-at-home advisory and mandatory closure of nonessential businesses across Australia and the rest of the world, the delivery of kids' scooters is either halted or taking longer than usual. In addition, the industry is witnessing supply chain disruptions across the globe.

The demand for substitutes such as bicycles and skateboards has also increased, further challenging the growth of the market. According to Bicycles Online, the sales of bikes witnessed a 302% increase in sales in March 2020 compared to March 2019. With the trend continuing in April 2020, the company was estimated to sell 2,000 bikes that month. There has been a 267% increase in city (urban/commuter) bikes, 170% increase in mountain bikes, and 156% increase in kids' bikes sales in March 2020 compared to March 2019.

Type Insights

The non-electric/kick segment dominated the market with a revenue share of 76.0% in 2020 owing to its low cost and easy usage. Kick scooters are mainly used by kids in the age group of 4-14 years as they are relatively less complex, and parents prefer that children begin learning how to ride a scooter with these variants. An increasing number of children today lack sufficient physical exercise, and this has resulted in numerous health conditions, such as obesity and diabetes. The WHO has found that globally, lack of physical exercise is one of the leading causes of death. This has driven parents to engage their children in some form of physical activity or the other, with scooting emerging as a popular choice in Australia.

The electric segment is expected to expand at the fastest revenue-based CAGR of 6.2% from 2021 to 2028. The ongoing development of electric scooters (e-scooters) has evolved into an international business, thanks to the growing popularity among children. Moreover, the rising popularity of e-scooter rentals and e-scooter-sharing services has given the segment a tremendous boost. These services serve as a cost-effective method of transport and this is resulting in increased adoption of such scooters.

According to a survey by the Royal Automobile Club of Victoria in 2018, four out of five people said they preferred an electric scooter for commuting as a last-mile transport option, to go shopping, or just for fun. This trend has also significantly influenced purchasing behavior among parents looking to buy an electric scooter for their kids. The survey also revealed that 40% of the participants preferred to purchase a scooter rather than using a rental service. This is also likely to have a positive impact on the segment growth over the forecast period.

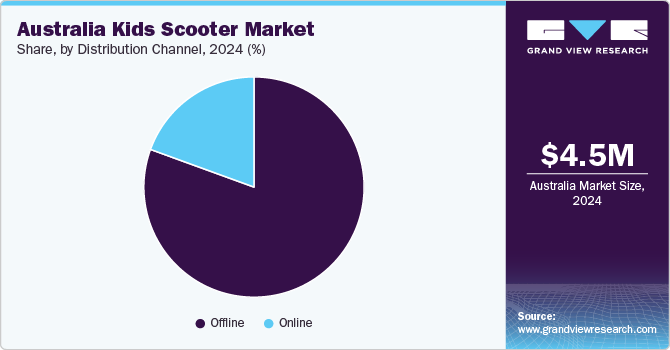

Distribution Channel Insights

In terms of value, the offline channel dominated the market with a share of 81.1% in 2020. This is attributed to the rising number of sporting goods retailing stores, resulting in increasing shelf space for the marketing of products. Consumers tend to purchase scooters for their kids from offline stores to find the right fit and understand the mechanism as well as functionality. Moreover, many retailers in the market have sales representatives that help consumers select the right product as per their needs. These representatives also offer a demo so that consumers can understand the working of the product.

Kids scooters are widely sold by offline stores, such as Kmart, Big W, and Decathlon. The growing presence of these retailers across the world will increase the product’s visibility, which is expected to have a positive impact on the growth of the market.

The online channel is estimated to register the highest revenue-based CAGR of 5.6% from 2021 to 2028. Consumer interest in online shopping is increasing due to the convenience it offers, lucrative offers and discounts, home delivery options, and the availability of varied products. Online marketplaces such as Amazon and eBay are offering products as per customer requirements. Moreover, facilities such as easy replacement, cash-on-delivery, and one-day delivery for Prime members from Amazon are driving the purchase of sports equipment from online sites.

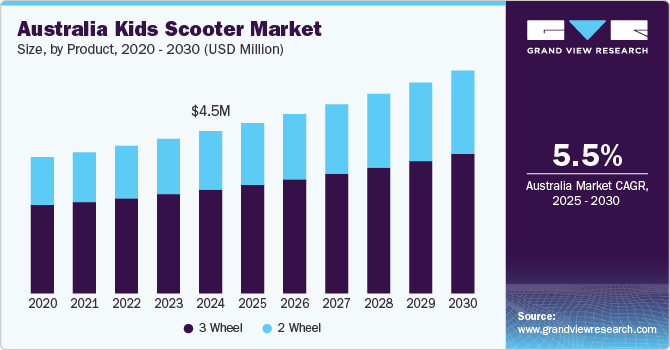

Product Insights

In terms of value, the 3-wheel segment dominated the market with a share of almost 65.0% in 2020. The segment is estimated to grow steadily during the forecast period. Enhanced features and multi-functionality are driving the demand for this product in the market. For instance, Globber’s EVO COMFORT all-in-one 3-wheel scooter for kids with features of a ride-on, walking bike, and scooter, was voted the best outdoor product by My Child at the Excellence Awards 2018. The product has a patented steering lock button, which locks the front wheel to only move forward and backward, making balancing easy for children. Additionally, the product has a 4-height adjustable T-bar that makes it adaptable for those up to 9+ years old. Over 22,000 parents voted for their favorite product on My Child’s website and EVO COMFORT was voted as No1.

The 2-wheel segment is expected to register the highest CAGR of 5.6% in terms of revenue from 2021 to 2028. Scooters with two wheels are generally popular among older kids with a well-developed sense of balance. Moreover, these scooters can achieve higher speeds and are designed to carry more weight. These are also made of durable materials, such as airplane-grade aluminum.

Various options for customization are also acting as major drivers for the market. Kids who are enthusiasts of scooter games are opting for modifications in order to ensure better performance. APEX Pro Scooters allow consumers to build bikes as per their needs by offering Australian-made components.

Key Companies & Market Share Insights

The market is characterized by the presence of several well-established players. These players account for a considerable market share, have diverse product portfolios, and have a strong presence across the country. Moreover, the market includes small to mid-sized players, who offer a selected range of kids' scooters.

In this day and age, social media has become an essential tool for marketing various products. Many kids scooter manufacturers are building social media presence as it is proven to connect brands with customers, increase brand awareness, and boost product sales. For instance, Micro Scooters Australia collects snaps of celebrities and their children with Micro Scooters and uses these as a promotional tool. Several stars such as Hugh Jackman, Jessica Alba, Sarah Jessica Parker, Christian Bale, and Samantha Cameron have been snapped with their kids on the company’s Micro Scooter. This is expected to increase brand visibility and help the company boost its revenue growth. Some prominent players in the Australian kids scooter market include:

-

Micro Scooters Australia

-

Globber

-

Razor USA LLC

-

Fuzion Scooter

-

Radio Flyer

Australia Kids Scooter Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 3.91 million

Revenue forecast in 2028

USD 5.53 million

Growth Rate

CAGR of 4.9% from 2021 to 2028 (Revenue-based)

Market demand in 2021

65.0 thousand units

Volume forecast in 2028

84.5 thousand units

Growth Rate

CAGR of 3.6% from 2021 to 2028 (Volume-based)

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD thousand/million, volume in thousand units, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel

Country scope

Australia

Key companies profiled

Micro Scooters Australia; Globber; Razor USA LLC; Fuzion Scooter; Radio Flyer

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the Australia kids scooter market report on the basis of product, type, and distribution channel:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2016 - 2028)

-

2 Wheel

-

3 Wheel

-

-

Type Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2016 - 2028)

-

Electric

-

Non-electric/Kick

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Thousand, 2016 - 2028)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The Australia kids scooter market size was estimated at USD 3,776.1 thousand in 2020 and is expected to reach USD 3,910.8 thousand in 2021.

b. The Australia kids scooter market is expected to grow at a compound annual growth rate of 4.9% from 2021 to 2028 to reach USD 5,528.3 thousand by 2028.

b. 3 Wheel scooters dominated the Australia kids scooter market with a share of 65.0%% in 2020. This is attributable to the product being developed with enhanced and multi-functionality features.

b. The non-electric/kick segment dominated the Australia kids scooter market with a revenue share of 76.0% in 2020.

b. The offline channel dominated the Australia kids scooter market with a share of 81.1% in 2020.

b. Some key players operating in the Australia kids scooter market include Micro Scooters Australia, Globber, and Razor USA LLC, Hugh Jackman, Jessica Alba, Sarah Jessica Parker, Christian Bale, and Samantha Cameron.

b. Key factors that are driving the Australia kids scooter market growth include Growing concerns among parents with regard to improving child health and its benefits related to increasing height, mobility, and immunity, which aids in the prevention of several diseases such as obesity and related disorders.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."