- Home

- »

- Medical Devices

- »

-

Australia & New Zealand Dental Biomaterials Market Report 2030GVR Report cover

![Australia & New Zealand Dental Biomaterials Market Size, Share & Trends Report]()

Australia & New Zealand Dental Biomaterials Market Size, Share & Trends Analysis Report By Type (Ceramic Biomaterials, Metallic Biomaterials), By Application (Orthodontics, Prosthodontics, Implantology), By End-use, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-195-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

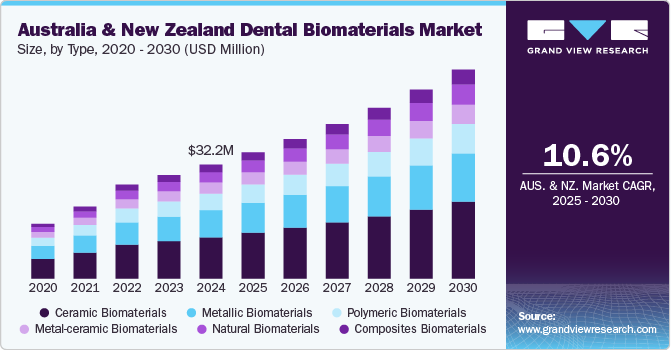

The Australia & New Zealand dental biomaterials market size was valued at USD 32.2 million in 2024 and is expected to grow a CAGR of 10.6% from 2025 to 2030. Dental biomaterials are specialized materials used in dentistry to repair, restore, or replace teeth and oral structures, ensuring functionality, durability, and aesthetics. Rising cases of dental caries are one of the major factors driving the market's growth. According to the InSight+ article published in February 2024, tooth decay, or dental caries, is the most common dental issue among children in Australia. Population data reveal two in five children have experienced dental caries in their primary teeth. This significant prevalence highlights the necessity for improved dental care strategies and the adoption of advanced dental biomaterials to manage and prevent tooth decay in young individuals effectively.

The rising incidence of Gingivitis drives the growth of the market. According to the Smilepath article published in October 2024, gingivitis, a common dental issue caused by plaque buildup, can lead to symptoms such as swelling, bleeding gum, and further complications if left untreated. While it is considered a mild condition, untreated gingivitis can escalate into more severe periodontal problems, necessitating restorative dental treatments. In New Zealand, approximately 70% of the population is affected by gingivitis, primarily due to inadequate dental hygiene practices. This widespread prevalence underscores the critical need for preventive and restorative dental care solutions. Dental biomaterials, such as composites, sealants, and periodontal regeneration materials, play a significant role in addressing these oral health challenges, driving their demand within the market.

The Australian government and other organizations are introducing various initiatives to increase awareness about the importance of oral health in the country. For instance, in February 2024, Ageless Smiles Dental Centre in Perth launched a new program to provide dental implants for pensioners, ensuring that seniors can access affordable and advanced dental care. This initiative addresses tooth loss among older adults, a demographic often requiring restorative dental solutions. Emphasizing the importance of maintaining oral health and improving the quality of life for seniors, the program highlights the growing demand for dental implants in the region. Dental biomaterials, such as titanium, zirconia, and bone graft substitutes, play a crucial role in these procedures, driving their adoption in the ANZ market. Initiatives like this improve accessibility and increase the use of biomaterials in restorative dentistry.

Moreover, in September 2024, a new dental clinic at Griffith University on the Gold Coast was established to enhance the community's access to affordable dental care. The facility caters to children and adults, offering essential dental services at reduced costs, with bulk billing options provided through Queensland Health. In 2023, the clinic served over 6,000 patients, and with its expansion, it is expected to increase patient capacity by nearly 20% in 2024. This development not only addresses the growing demand for accessible oral healthcare but also has implications for the dental biomaterials market in Australia and New Zealand. As the clinic supports a higher volume of dental procedures, the need for biomaterials such as composites, ceramics, and other vital solutions will likely rise, driving market growth in the region.

Market Concentration & Characteristics

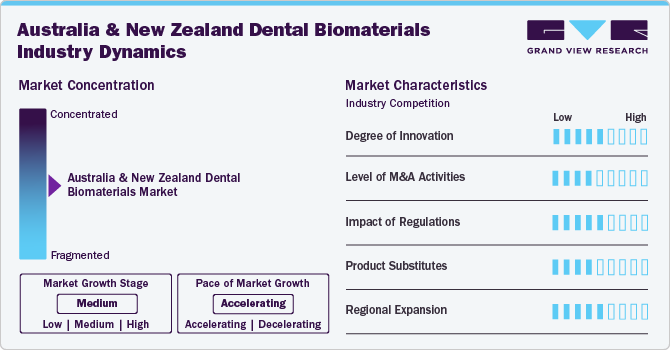

The industry is witnessing significant innovation, with advanced innovations in materials such as bioactive ceramics, nanotechnology-infused composites, and 3D-printed biomaterials. These advancements enhance dental restorations' durability, biocompatibility, and functionality, making treatments more effective and patient-friendly. Such progress reshapes dental care by offering superior restorative and preventive dentistry solutions.

Key players in the Australia & New Zealand dental biomaterials industry, such as Straumann Holding AG, ZimVie, Dentsply Sirona Inc, Geistlich Pharma AG, and Medtronic, actively engage in strategies like mergers and acquisitions and introduce innovative products to broaden their business offerings and strengthen their market presence.

Regulations significantly impact the market by ensuring the safety, efficacy, and quality of materials used in dental applications. Strict compliance standards for biomaterials and manufacturing processes enhance consumer and professional trust, encouraging the adoption of certified products. While these regulations ensure high-quality care, they can also increase development costs and timelines. Additionally, regional variations in guidelines require manufacturers to strategically align with local regulatory requirements to remain competitive in the market.

There are no direct substitutes. The indirect product substitutes include resin-based composites, which increasingly replace traditional amalgam fillings, while non-invasive solutions like clear aligners substitute conventional braces. Preventive care advancements like fluoride varnishes and dental sealants may reduce the need for restorative biomaterials. These trends could influence market demand, encouraging innovation to maintain relevance.

The Australia & New Zealand dental biomaterials industry is witnessing steady regional growth, driven by increasing oral health awareness and advancements in dental technologies. The region benefits from robust healthcare infrastructure and a rising focus on innovative biomaterials to meet the growing demand for restorative and preventive dental care.

Type Insights

Based on type, the ceramic biomaterials segment held more than 36% share in 2024. The increase in dental health awareness and technological advancements drive the segment's growth. Ceramic biomaterials, including zirconia and alumina, are widely utilized in dental crowns, bridges, and implants because they mimic natural teeth and provide long-lasting performance. Their increasing adoption is supported by advancements in material science, enabling enhanced strength and resistance to wear. For instance, in September 2024, research led by Professor Hala Zreiqat at the University of Sydney focused on developing advanced bioceramic scaffolds to improve bone healing in older patients. These innovative materials are designed to enhance bone regeneration, addressing the challenges of slower healing in aging populations. Incorporating nanotechnology, these bioceramics offer more robust, more durable alternatives to traditional metallic implants, reducing the risks of failure and infection and making them a promising option for dental applications, particularly in bone regeneration and implantology.

The metallic biomaterials segment is expected to grow during the forecast period. The increasing prevalence of dental diseases and technological advancements drive the market's growth. Metallic biomaterials are materials made from metals or metal alloys used in dental applications, such as implants, crowns, and bridges. They are chosen for their strength, durability, and resistance to corrosion, providing long-lasting solutions for restoring and replacing teeth. Common materials include titanium, stainless steel, and cobalt-chromium alloys. According to the Elsevier B.V. article published in 2023, recent advancements in dental metallic biomaterials have focused on the development of low-modulus titanium alloys, such as those made from non-toxic elements like niobium (Nb), tantalum (Ta), and zirconium (Zr). These new materials aim to address concerns regarding the toxicity of vanadium (V) and aluminum (Al) found in traditional titanium alloys like Ti-6Al-4V. Although the modulus of elasticity of these new β-type titanium alloys (55-85 GPa) remains higher than that of bone, it is significantly lower than that of conventional titanium alloys, improving their compatibility with bone structures.

End-use Insights

Based on end-use, the dental laboratories segment held more than 44.3% in 2024. Dental laboratories are specialized facilities that design, create, and customize dental devices, such as crowns, bridges, dentures, and implants, based on the specifications provided by dental professionals. Increasing investments and innovations in digital dentistry drive the growth of the Market. According to the KED Global News Network, in June 2024, as companies like Innovaid expand their presence, leveraging technological advancements in dental lab services, the demand for high-quality, efficient, and digitally enabled dental solutions is expected to rise. The global dental industry's rapid digital transformation and strategic expansion into regions like Australia offer significant opportunities for enhanced production capabilities and improved patient outcomes. The growing adoption of digital workflows in dental labs is driving the market forward, with a focus on reducing operational costs, improving accuracy, and enhancing the speed of dental procedures.

The dental hospitals and clinics segment is expected to grow during the forecast period. Dental clinics and hospitals in Australia and New Zealand are increasingly adopting advanced technologies to enhance patient care and treatment outcomes. Digital scanning tools are now commonly used, offering more accurate implant design and placement while eliminating the discomfort of traditional dental impressions. Additionally, 3D printing for custom dental implants and AI-powered diagnostic tools has further improved precision in dental procedures. These innovations improve dental treatments' functional and aesthetic results and enable minimally invasive techniques that reduce recovery time and patient discomfort. For instance, in April 2024, Macquarie Dental has been at the forefront of integrating advanced technologies into its practice. The clinic utilizes 3D printing to create custom dental implants, enhancing the precision of implant placements. Additionally, AI-driven diagnostic tools are being employed to improve the accuracy of diagnoses and treatment planning. These innovations contribute to more effective procedures, faster recovery times, and better patient outcomes.

Application Insights

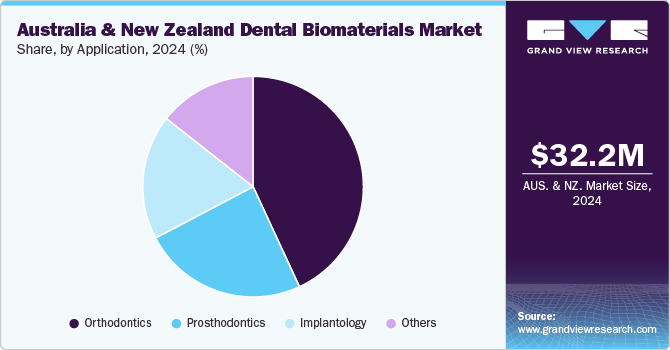

Based on application, orthodontics held a 43.1% market share in 2024 due to the increasing demand for orthodontic care and technological advancements. According to the Australasian Orthodontic Journal, in May 2024, about 10.4% of children aged 5 to 11 years sought orthodontic care, highlighting a notable demand for orthodontic services. This statistic reflects the increasing awareness of the importance of dental alignment from a young age and the rising adoption of orthodontic treatments such as braces and clear aligners. The growing prevalence of orthodontic cases directly drives the use of various dental biomaterials in orthodontics, including materials used for brackets, wires, and other dental devices. With more children and adults seeking orthodontic solutions for aesthetic and functional reasons, the demand for advanced, durable, and biocompatible materials is expected to continue expanding in the region. This trend also fuels innovation in dental biomaterials, contributing to the development of more efficient and effective orthodontic treatments in Australia and New Zealand.

The Implantology segment is expected to grow during the forecast period. The rise in dental diseases and advancements in technology have contributed to the growth of implantology. This dental specialty focuses on the study, design, and placement of dental implants to replace lost or damaged teeth. It involves using biocompatible materials, such as titanium, to create artificial tooth roots surgically embedded into the jawbone. These implants serve as stable foundations for crowns, bridges, or dentures. For instance, in November 2023, Researchers at the University of Melbourne introduced the Rectangular Block Implant (RBI), a new solution for patients with insufficient bone volume for traditional dental implants. The RBI is designed to optimize the use of available bones and minimize risks to surrounding nerves and veins. Early clinical trials have shown promising results, with successful placements in two patients demonstrating positive bone and soft tissue responses. As the first dental implant developed and manufactured in Australia, the RBI is set for further trials to confirm its effectiveness on a larger scale, marking a significant advancement in dental implantology.

Country Insights

Australia Dental Biomaterials Market Trends

Australia dominated the industry with more than 66.4% share in 2024. Increasing dental caries prevalence, technological advancements, and increasing number of Australians seeking dental care are driving the country's dental biomaterials market growth. According to the Australian Institute of Health and Welfare article published in 2024, in 2022-23, over half of the Australian population (52.3%) visited a dental professional, reflecting a rise from 49.4% in the previous year. This growing trend of dental visits highlights the expanding demand for advanced dental treatments, which fuels the need for high-quality dental biomaterials. As more Australians prioritize oral health, the market for dental biomaterials continues to thrive, driven by the adoption of innovative materials and technologies in dental procedures.

New Zealand Dental Biomaterials Market Trends

New Zealand dental biomaterials market is driven by the increasing preventive dental care and early intervention programs. According to the Ehinz article published in 2024, 56% of five-year-olds examined by community oral health services in New Zealand had no history of dental caries in 2022, with an average of just 2.0 decayed, missing or filled teeth. This strong oral health outcome reflects the effectiveness of preventive dental care and early intervention programs for young children. The increasing focus on maintaining oral health from an early age is driving demand for advanced dental biomaterials in the region. As more children receive proactive dental care, a growing need for high-quality, durable materials for therapeutic and preventive treatments fuels market growth.

Key Australia & New Zealand Dental Biomaterials Company Insights

Companies are focusing on strategic initiatives, such as introducing novel products through customization according to consumers’ needs, partnerships, collaborations, and mergers & acquisitions, to expand their product portfolio and extend leadership positions in the field of cardiology field. Moreover, the competition between key players will intensify in the coming years as they focus more on geographical expansion, strategic collaborations, and partnerships through mergers & acquisitions.

Key Australia & New Zealand Dental Biomaterials Companies:

- Straumann Holding AG

- ZimVie

- Dentsply Sirona Inc

- Geistlich Pharma AG

- Medtronic

- Ivoclar Vivadent

- 3M Company

- GC Corporation

- DSM-Firmenich AG

- SDI Limited

Recent Developments

-

In May 2023, Straumann expanded its portfolio by acquiring GalvoSurge, a move aimed at introducing innovative solutions for dental implants, particularly in peri-implantitis cleaning. This acquisition highlights the rising demand for laser-based treatments to address peri-implantitis, reflecting the growing interest in advanced therapeutic technologies within the dental industry.

-

In October 2022, SprintRay Inc. introduced OnX Tough, an advanced hybrid ceramic resin crafted for 3D printing dental prosthetics. Utilizing the company's exclusive NanoFusion technology, this resin offers exceptional strength and realistic translucency, ensuring superior quality and durability in dental restorations.

-

In February 2022, Ultradent Products Inc. introduced MTApex, a bioceramic root canal sealer designed for endodontic procedures. This versatile sealer is compatible with all endodontic obturation techniques, offering enhanced performance in root canal treatments.

Australia & New Zealand Dental Biomaterials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 35.5 million

Revenue Forecast in 2030

USD 58.8 million

Growth Rate

CAGR of 10.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-use, country

Country scope

Australia, New Zealand

Key companies profiled

Straumann Holding AG; ZimVie; Dentsply Sirona Inc; Geistlich Pharma AG; Medtronic; Ivoclar Vivadent; 3M Company; GC Corporation; DSM-Firmenich AG; SDI Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Australia & New Zealand Dental Biomaterials Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Australia & New Zealand dental biomaterials market report based on type, application, end-use and country:

- Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramic Biomaterials

-

Metallic Biomaterials

-

Polymeric Biomaterials

-

Metal-Ceramic Biomaterials

-

Natural Biomaterials

-

Composites Biomaterials

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthodontics

-

Prosthodontics

-

Implantology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Laboratories

-

Dental Product Manufacturers

-

Dental Academies and Research Institutes

-

Dental Hospitals and Clinics

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Australia

-

New Zealand

-

Frequently Asked Questions About This Report

b. The ANZ dental biomaterials market size was estimated at USD 32.2 million in 2024 and is expected to reach USD 35.5 million in 2025.

b. The ANZ dental biomaterials market is expected to grow at a compound annual growth rate of 10.6% from 2025 to 2030 to reach USD 58.8 million by 2030.

b. Australia dominated the ANZ dental biomaterials market with a share of 66.4% in 2024. This is attributable to rising awareness regarding biomaterials coupled with increasing cases of dental caries.

b. Some key players operating in the ANZ dental biomaterials market include Straumann Holding AG, ZimVie, Dentsply Sirona Inc , Geistlich Pharma AG, Medtronic, Ivoclar Vivadent, 3M Company, GC Corporation, DSM-Firmenich AG, SDI Limited

b. Key factors that are driving the ANZ dental biomaterials market growth include the increasing prevalence of cavities, rising aging population with dental disorders, and growing dental tourism in emerging countries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."