- Home

- »

- Biotechnology

- »

-

Automated Cell Counting Market Size, Industry Report, 2033GVR Report cover

![Automated Cell Counting Market Size, Share & Trends Report]()

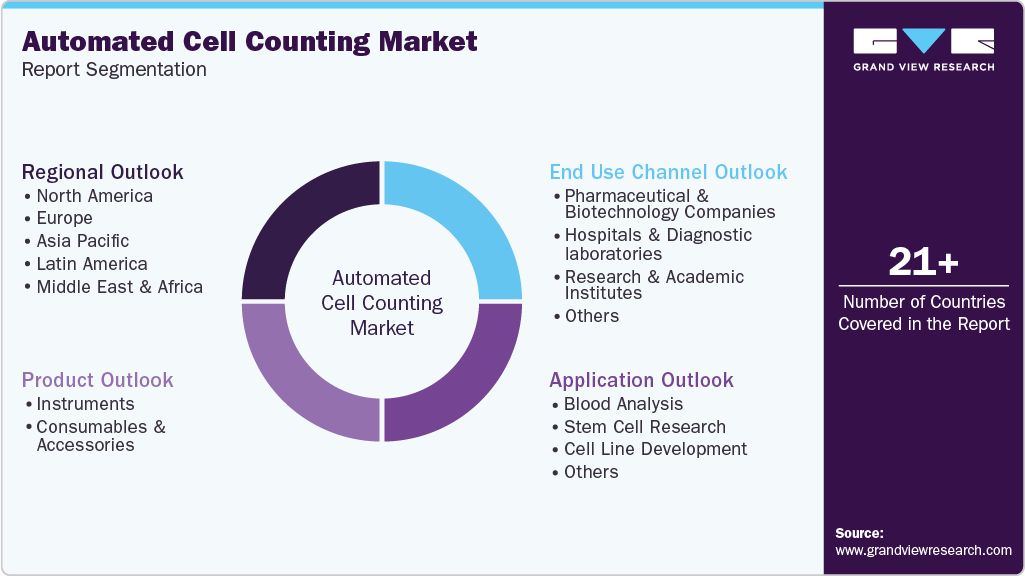

Automated Cell Counting Market (2026 - 2033) Size, Share & Trends Analysis Report, By Product (Instruments, Consumables & Accessories), By Type (Flow Cytometers), By Application (Cell Line Development), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-160-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automated Cell Counting Market Summary

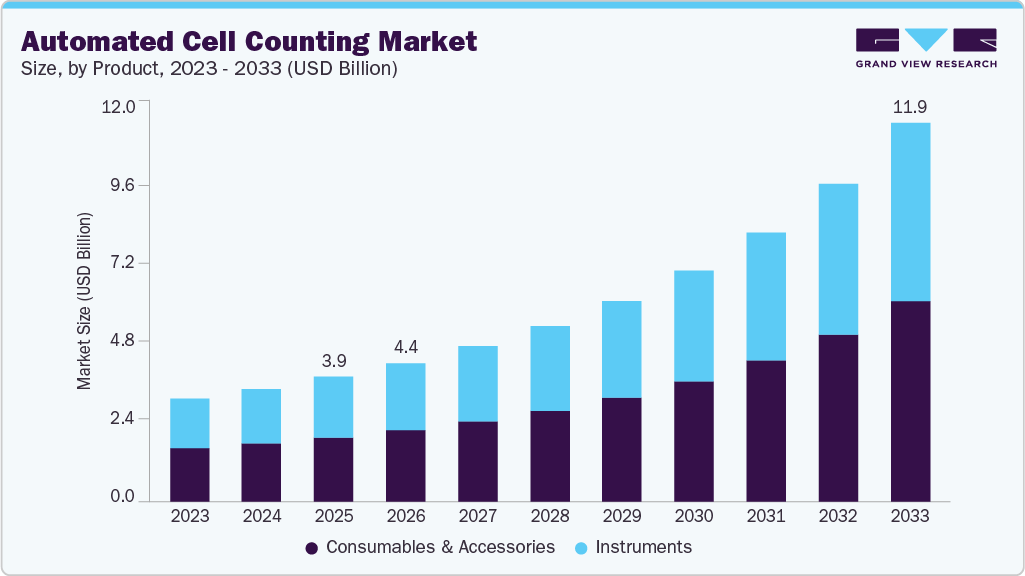

The global automated cell counting market size was estimated at USD 3.93 billion in 2025 and is expected to reach USD 11.92 billion by 2033, growing at a CAGR of 15.4% from 2026 to 2033. Automated cell counters are instruments that count and analyze cells in medical diagnostics, pharmaceutical research, and food quality monitoring.

Key Market Trends & Insights

- North America automated cell counting market held the largest share of 37.92% of the global market in 2025.

- The automated cell counting industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the consumable and accessories segment held the largest market share in 2025.

- By application, the cell line development segment held the largest market share in 2025.

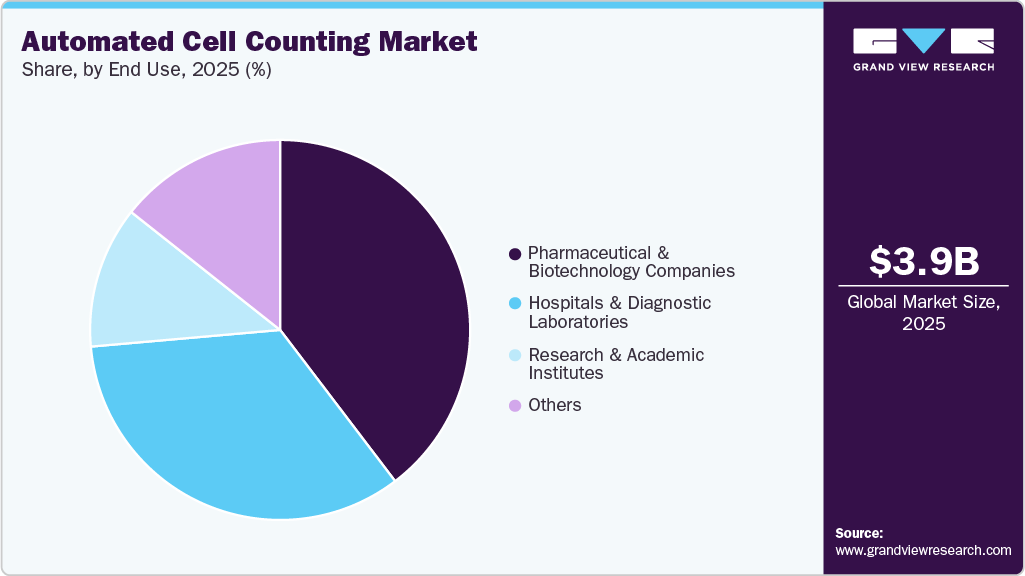

- By end use, the pharmaceutical and biotechnology companies segment held the largest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3.93 Billion

- 2033 Projected Market Size: USD 11.92 Billion

- CAGR (2026-2033): 15.4%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

They use modern techniques such as flow cytometry & digital imaging to analyze cells with great precision and consistency. The increased prevalence of chronic diseases, as well as the expansion of biopharma R&D, are major factors driving market growth.

Growing Demand for Accuracy, Efficiency, and Standardization in Cell Analysis

The shift from manual hemocytometers to automated cell counting systems is primarily driven by the need for higher accuracy, reproducibility, and operational efficiency in laboratories. Manual cell counting is time-consuming, labor-intensive, and prone to inter-operator variability, which becomes a significant limitation in high-volume research, clinical diagnostics, and biomanufacturing environments. Automated cell counters address these challenges by delivering faster results with consistent precision, enabling laboratories to meet increasing sample workloads without compromising data quality.

This demand is particularly strong in applications such as cancer research, immunology, stem-cell studies, and clinical hematology, where reliable cell concentration and viability data are critical for downstream analysis and decision-making. As laboratories face tighter timelines and higher expectations for data integrity, automation has become less of a convenience and more of a necessity, directly accelerating adoption of automated cell counting technologies across academic, clinical, and industrial settings.

Expansion of Biopharmaceutical Manufacturing and Cell-Based Therapies

Rapid growth in biopharmaceutical production and cell-based therapies is another major driver fueling the automated cell counting market. Cell and gene therapies, monoclonal antibodies, and vaccine development rely heavily on precise cell monitoring throughout upstream and downstream bioprocessing. Automated cell counters play a vital role in quality control, process optimization, and regulatory compliance by enabling frequent, standardized cell measurements during manufacturing workflows.

As biopharma companies scale production from research to commercial manufacturing, the need for robust, high-throughput, and GMP-compatible cell counting solutions intensifies. This trend not only boosts demand for advanced instruments but also drives recurring revenue from consumables and accessories used in routine process monitoring. With global investments in biomanufacturing capacity continuing to rise, automated cell counting systems are increasingly viewed as core infrastructure rather than auxiliary lab tools.

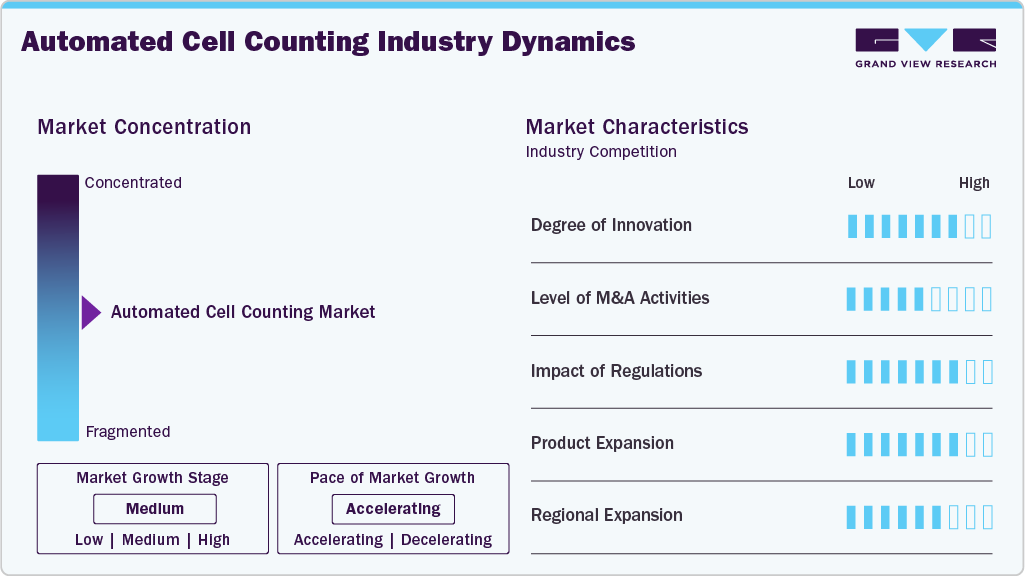

Market Concentration & Characteristics

Innovation in the automated cell counting industry is driven by advancements in imaging, artificial intelligence, fluorescence analysis, and high-throughput capabilities that improve accuracy, speed, and automation over traditional manual methods. Vendors are integrating AI and cloud connectivity into instruments to enable real-time data analytics, enhanced viability measurements, and support for complex samples, particularly for cell therapy and stem-cell research workflows. The advancement of smarter, multi-modal platforms has expanded applications in both clinical and research settings, as new portable and high-throughput devices are introduced to the market.

While the automated cell counting industry isn’t characterized by blockbuster mergers on the scale of some adjacent diagnostics sectors, strategic transactions and partnerships are evident among key life-science toolmakers. Established players such as Beckman Coulter (part of Danaher) and Thermo Fisher expand their portfolios through acquisitions and collaborations that integrate complementary technologies (e.g., analytical workflows and automation modules). Broader consolidation among lab automation and analytics firms continues to shape competitive dynamics and provides scale benefits in R&D, distribution, and cross-selling.

Regulation significantly affects the automated cell counting industry because devices are used in clinical diagnostics and biomanufacturing quality control. In the United States, systems must meet FDA requirements such as 510(k) clearance or equivalent pathways depending on risk classification, while in the EU, they must comply with the In Vitro Diagnostic Regulation (IVDR). These frameworks improve safety and performance standards but add validation, documentation, and compliance costs that can lengthen product development cycles and affect adoption rates, especially for novel or AI-enabled analytical features.

Manufacturers are broadening offerings beyond traditional cell counters into adjacent workflow solutions, including instruments capable of multi-parameter analysis, integrated consumables, and software platforms for data management. Growth in consumables and accessories also supports recurring revenue streams. Vendors are launching devices optimized for specialized applications such as cell therapy manufacturing QC and rapid hematology screening, while smaller, portable counters address point-of-care and distributed lab contexts.

North America remains the largest and most mature market, anchored by substantial biotech and clinical research infrastructure, robust funding, and early adoption of cutting-edge automation. Europe holds a solid share, underpinned by strong healthcare systems and funding initiatives that support advanced diagnostics. Asia-Pacific is the fastest growing region, with China, India, and Japan investing heavily in healthcare modernization, research labs and biopharmaceutical manufacturing capacity. Latin America and the Middle East/Africa are smaller but expanding as diagnostic and research capabilities evolve.

Product Insights

The consumables & accessoriessegment is expected to witness the largest share in 2025 and the fastest CAGR during the forecast period. The segment is largely driven by its inherently recurring nature and essential role in operational workflows. Consumables, such as reagents, assay kits, slides, microplates, and sample preparation tools, must be replaced frequently for each analysis, ensuring steady, repeat purchases from research, clinical, and biopharma labs worldwide. Their critical function in maintaining accuracy, reducing contamination risks and supporting high-throughput testing across applications like stem cell research, cancer studies and bioprocessing further cements this demand.

The instrumentssegment is expected to grow at a significant CAGR over the forecast period. Factors such as the expanding use of cell counting in research, diagnostics, and industrial applications are boosting the product demand & further drives the market growth. Cell counting instruments are progressively being used in numerous research areas such as cancer research, immunology, and neurology, indicating that the market segment has exponential development potential. The requirement and effectiveness of cell counting instruments will contribute to increased consumption of these instruments, hence, propelling the automated cell counting industry growth.

Application Insights

The cell line development application segment held 31.59% of the global market share in 2025, accounting for the largest proportion of the market. Cell line development is an essential component of research and biological medicine production. Cell line generation is used in the lab to assess cytotoxicity and drug metabolism, as well as to examine gene function in order to develop vaccines, antibodies, and cell treatments. Thus, it is likely to increase the demand for automated cell counting products and further boost the segment growth.

Stem cell research is expected to witness the fastest growth during the forecast period. The exponential growth is due to the increasing demand for mass manufacturing of human stem cells for therapeutic and research purposes. Stem cells are critical in areas including regenerative medicine, cancer treatment, and transplantation. Automated equipment makes it easier to precisely determine stem cell viability & nucleated cell concentration in cord blood and human bone marrow. Furthermore, features such as fluorescence imaging are becoming increasingly used to quantify GFP efficacy in stem cell transfection applications.

End Use Insights

The pharmaceutical & biotechnology companies segment dominated the global market share of 39.65% in 2025, The biopharma industry's rising emphasis on cell-based research & drug discovery is driving up the popularity of automated cell counters. These technologies are a must-have for preclinical lab testing of novel drug candidates and vaccinations. They provide high-throughput effectiveness, proliferation, & cytotoxicity screening studies for therapeutic efficacy and toxicity evaluation. Several prominent pharmaceutical companies are implementing automated methods to speed R&D programs and minimize medication development costs and time. Growth in biopharmaceutical R&D for innovative cell & gene therapy & regenerative medicines, which requires precision cell counts, is also driving the automated cell counting industry.

Hospitals & diagnostic laboratories segment is expected to witness significant growth during forecast period. The increasing prevalence of infectious and chronic illnesses such as cancer, HIV/AIDS, septicemia, influenza, measles, malaria, cholera, & vector-borne diseases such as chikungunya & polio are driving the global automated cell counting market. The increasing need for automated cell counting in the diagnosis and management of such fatal illnesses will drive the automated cell counting market. The World Health Organization (WHO) approximately 40.8 million individuals worldwide are living with HIV in 2025. As a result, increased infectious disease rates are predicted to significantly enhance segment growth.

Regional Insights

North America automated cell counting market accounted for the largest share of 37.92% in 2025. The significant share of North America can be attributed to several factors, such as, the availability of various major manufacturers of automated cell counting products in the region, advanced medical infrastructure, developed economies, significant players, and established supply channels. Furthermore, the incidence of diseases and the expanding elderly population have accelerated the race to produce innovative and efficacious remedies through the biopharmaceutical industry. This has increased demand for automated cell counters and is projected to continue generating revenue over the coming years.

U.S. Automated Cell Counting Market Trends

The U.S. accounted for the largest share of automated cell counting the automated cell counting market in North America in 2025. The U.S. possesses a strong research and development infrastructure that fosters innovation in life sciences and biotechnology. Moreover, a high concentration of leading biotech and pharmaceutical companies, such as Thermo Fisher Scientific Inc, Bio-Rad laboratories, Inc, Aglient Technologies, Inc. along with substantial investments in healthcare, contributes to a significant demand for advanced cell counting technologies.

Europe Automated Cell Counting Market Trends

The European automated cell counting market is propelled by expanding healthcare and biopharma sectors, rising prevalence of chronic diseases, and strong public research investment that fuels demand for precise, high-throughput cell analysis tools. Harmonized regulatory frameworks (e.g., IVDR/EMA guidance) and collaborative innovation between manufacturers and research institutions further encourage procurement of advanced automated counters in hospitals, academic labs, and industrial facilities across the region

Germany automated cell counting market is witnessing steady growth, supported by the country’s position as one of Europe’s largest life sciences hubs. Germany’s growth is driven by extensive pharmaceutical and biotechnology R&D investments, world-class research institutions, and a well-developed healthcare infrastructure that prioritizes state-of-the-art diagnostic automation. Government and industry funding for precision medicine and regenerative research also creates demand for sophisticated cell counting solutions across clinical and research applications.

Automated cell counting market in the UK benefits from strong life science research programs, significant public and private funding for laboratory automation, and widespread adoption of advanced diagnostic tools within the NHS and academic centers. Demand for automated cell counters is also tied to robust cancer, immunology and stem-cell research ecosystems that require reliable, high-throughput cell analysis.

Asia Pacific Automated Cell Counting Market Trends

Asia Pacific is expected to witness the fastest growth during forecast period. This region's exponential CAGR can be linked to the local presence of some clinical research & biopharmaceutical companies, as well as stem cell research activities. Furthermore, the region's market is being driven primarily by the region's expanding elderly population, which is especially sensitive to chronic diseases. This has resulted in an exceptional surge in the usage of these devices due to an increase in the volume of clinical tests performed annually for elderly patients. Such factors are fueling the expansion of the automated cell counting market.

Automated cell counting market in Japan accounted for the largest share in the APAC in 2025. The large share is due to its advanced technological infrastructure, strong emphasis on research and development, and a well-established healthcare sector. Moreover, the stringent regulatory framework, coupled with high standards, ensures the quality and reliability of automated cell-counting products, fostering trust among users. Collectively, these factors establish Japan's leadership in the automated cell counting market within the Asia Pacific.

MEA Automated Cell Counting Market Trends

In the Middle East, automated cell counting adoption is gradually rising as healthcare systems modernize and invest in research infrastructure. The expanding need for accurate diagnostic technologies to support growing chronic disease burdens, coupled with increased investment in laboratory automation and healthcare innovation, underpins steady market expansion across the region.

UAE automated cell counting market is growing due tocountry’s ambitions to become a regional life sciences and healthcare hub are driving demand for advanced automated cell counting systems. Government initiatives to strengthen healthcare delivery, expanding private hospital and diagnostic networks, and investments in biotechnology research facilities all support increased adoption of precision lab technologies that improve diagnostic capabilities and throughput

Automated cell counting market in Kuwait remains constrained by limited data availability. However, broader Gulf trends, including GCC-level forecasts, suggest that rising healthcare expenditure, public health modernization initiatives, and an increasing focus on diagnostic accuracy and laboratory automation are key factors supporting market growth. These general regional healthcare upgrades, along with the rising prevalence of chronic conditions, foster demand for automated analysis platforms similar to neighboring markets

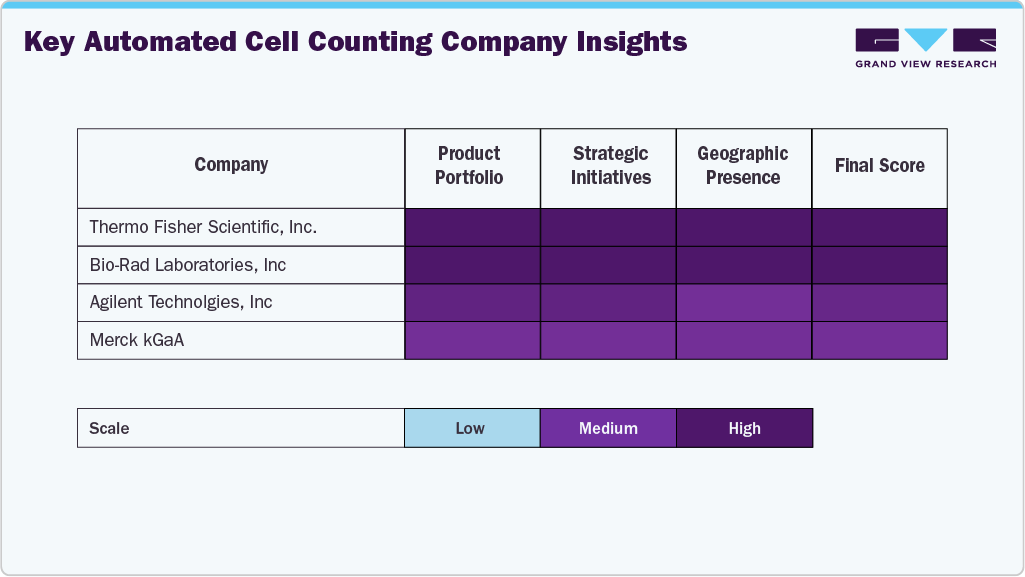

Key Automated Cell Counting Company Insights

In the automated cell counting market, Thermo Fisher Scientific, Bio-Rad Laboratories, Agilent Technologies, and Merck KGaA each occupy distinct competitive positions shaped by their portfolios and strategic priorities. Thermo Fisher Scientific is widely viewed as a market leader, often cited with the largest share thanks to its extensive global reach, strong installation base of Countess series instruments, and deep integration of software, consumables, and workflow solutions that appeal across academic, pharmaceutical, and biotech labs. Bio-Rad Laboratories holds a solid mid-tier position, leveraging its life-science and diagnostics capabilities to serve core research segments with reliable, user-friendly counters and expanding its offerings into quality control and biotechnology workflows.

Agilent Technologies, while slightly smaller in share relative to the leaders, competes through targeted analytical instruments and integrated solutions that fit broader laboratory automation strategies, reinforcing its footprint especially where combined analytics workflows are valued. Merck KGaA (MilliporeSigma) maintains relevance with a strong presence in Europe and established reagent and accessory ecosystems that support its cell counting devices, feeding demand in research and manufacturing contexts where reliability and flexible deployment are priorities. Collectively these companies shape a moderately concentrated competitive landscape, balancing scale and innovation against specialized offerings from niche players.

Key Automated Cell Counting Companies:

The following key companies have been profiled for this study on the automated cell counting market.

- Thermo Fischer Scientific Inc.

- Countstar, Inc.

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd

- Chemometec A/S

- Danaher

- Olympus Corporation

- MERCK KGaA

- Sysmex Corporation

- Agilent Technologies, Inc.

- Abbott

Recent Developments

-

In April 2025, Logos Biosystems announced the release of the LUNA-BX7 automated cell counter, which was designed for high-performance brightfield cell counting, making it the newest addition to the award-winning LUNA family of automated cell counters.

-

In October 2024, DeNovix announced the expansion of its CellDrop Automated Cell Counter portfolio with the commercial release of two new models, the CellDrop FLxi and CellDrop BFx. The newly introduced models featured higher-magnification optics designed for the quantification and viability assessment of small cells, including stem cells and yeast. These instruments were optimized for measuring cells in the 2-20 µm range and utilized simple mix-and-measure assays to enable faster, easier, and more reliable sample processing.

Automated Cell Counting Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4.37 billion

Revenue forecast in 2033

USD 11.92 billion

Growth rate

CAGR of 15.4% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico, Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fischer Scientific Inc.; Countstar Inc.; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd; Chemometec A/S; Danaher; Olympus Corporation; Merck KGaA; Sysmex Corporation; Agilent Technologies, Inc.; Abbott.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Automated Cell Counting Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, grand view research has segmented the global automated cell counting market report based on product, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Flow Cytometers

-

Image-based Cell Counters

-

Electrical Impendence Coulter Counters

-

-

Consumables & Accessories

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Blood Analysis

-

Stem Cell Research

-

Cell Line development

-

Biologics Production

-

Cell & Gene Therapy

-

-

Others

-

-

End Use Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Diagnostic laboratories

-

Research & Academic Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The consumables & accessories segment is expected to witness the largest share in 2025 and the fastest growth during the forecast period. Consumables and accessories are growing in popularity due to their high usage volume.

b. A few of the key market players include Thermo Fischer Scientific Inc., Countstar, Inc., Bio-Rad Laboratories, Inc., F. Hoffmann-La Roche Ltd, Chemometec A/S, Danaher, Olympus Corporation, Merck KGaA, Sysmex Corporation, and Agilent Technologies, Inc.,

b. The growing need for biologics in the prevention and treatment of chronic and infectious diseases, increased investment in the biotechnology & biopharmaceutical industries, and the development of advanced cell-based research are some of the factors driving market expansion.

b. The global automated cell counting market size was estimated at USD 3.93 billion in 2025 and is expected to reach USD 4.37 billion in 2026.

b. The global automated cell counting market is expected to grow at a compound annual growth rate of 15.41% from 2026 to 2033 to reach USD 11.92 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.