- Home

- »

- Biotechnology

- »

-

Flow Cytometry Market Size & Share, Industry Report, 2030GVR Report cover

![Flow Cytometry Market Size, Share & Trends Report]()

Flow Cytometry Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Reagents & Consumables, Software, Accessories, Services), By Technology, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-412-3

- Number of Report Pages: 166

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flow Cytometry Market Summary

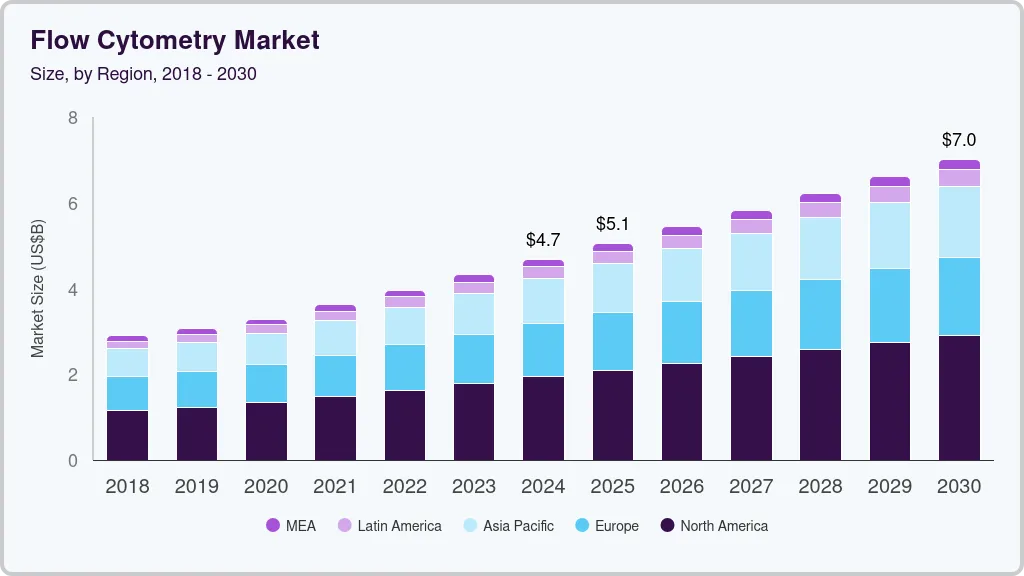

The global flow cytometry market size was estimated at USD 4,684.2 million in 2024 and is projected to reach USD 7,013.1 million by 2030, growing at a CAGR of 8.41% from 2025 to 2030. The increasing incidence of cancer, immunodeficiency disorders, and infectious diseases is a key factor propelling market growth.

Key Market Trends & Insights

- North America dominated the flow cytometry market with the largest revenue share of 41.35% in 2024.

- The flow cytometry market in the U.S. is expected to experience at a robust CAGR between 2024 and 2030

- By product, the instrument segment led the market with the largest revenue share of 35.30% in 2024.

- Based on technology, the cell-based segment led the market with the largest revenue share of 76.16% in 2024.

- Based on application, the clinical segment led the market with the largest revenue share of 45.34% in 2024.

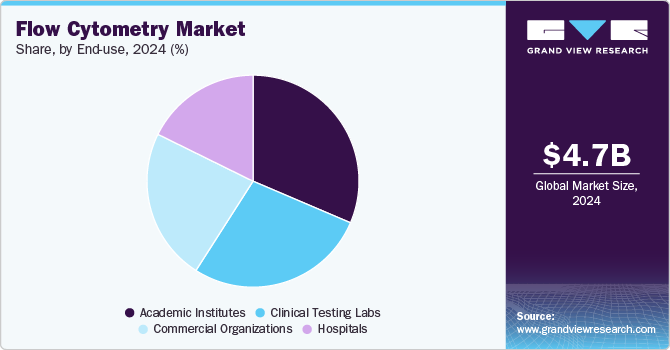

- Based on end use, the academic institutes segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4,684.2 Million

- 2030 Projected Market Size: USD 7,013.1 Million

- CAGR (2025-2030): 8.41%

- North America: Largest market in 2024

In addition, extensive research and development investments in biotechnology, life science, and biopharmaceutical research have contributed to a leveraged demand for flow cytometry instruments. For instance, in February 2023, Cytek Biosciences announced its plan to acquire imaging and flow cytometry business from DiaSorin with an aim to expand its market share in international market.

Flow cytometry plays a crucial role in diagnosing cancer and immunodeficiency diseases, and the increasing prevalence of these conditions is expected to drive market growth in the coming years. The adverse effects of chemotherapy and radiation therapy in cancer treatment have led physicians to favor autologous and allogeneic stem cell therapies, further boosting the demand for flow cytometry. According to the American Cancer Society, approximately 1.9 million new cancer cases were diagnosed in the U.S. in 2022, with nearly 600,000 deaths attributed to the disease. This rising burden underscores the need for advanced diagnostic tools like flow cytometry, which enables precise immune cell characterization and aids in treatment monitoring.

In addition to cancer diagnostics, flow cytometry is instrumental in identifying and characterizing immune cells in patients with Primary Immunodeficiency Diseases (PID). According to NCBI data from 2022, the global prevalence of PID ranges from 0.81 to 30.5 per 100,000 people. Technology is invaluable in detecting genetic defects associated with immune disorders and validating new genetic abnormalities. Moreover, flow cytometry is widely used to monitor immune responses following stem cell transplantation, making it an essential tool in organ transplantation procedures. The World Health Organization (WHO) estimates that approximately 50,000 stem cell transplants are performed globally each year, further driving the adoption of flow cytometry in clinical and research settings.

The increasing prevalence of hematological disorders is another major factor fueling the demand for flow cytometry. According to NCBI statistics, bleeding disorders affect approximately 1 in 1,000 individuals worldwide, with hemophilia A, hemophilia B, and Von Willebrand disease being the most common types. Flow cytometry provides critical insights into blood cell populations, aiding in the diagnosis and management of these conditions. Its ability to analyze complex cellular interactions in hematological malignancies and immune disorders has made it an indispensable tool in both diagnostic laboratories and research institutions. As the incidence of hematological and immune-related diseases continues to rise, the market for flow cytometry is expected to expand significantly.

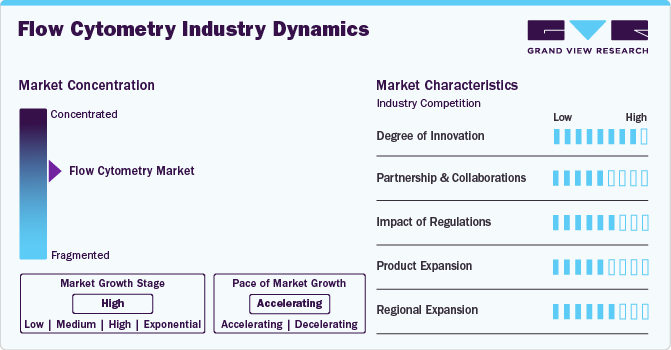

Market Concentration & Characteristics

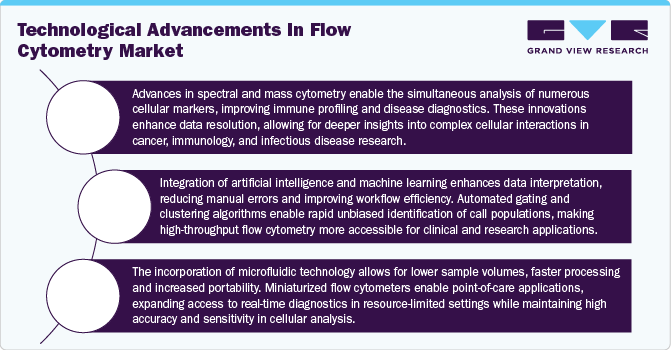

Market growth stage is high, and pace is accelerating. The market is characterized by a high degree of innovation owing to the rapid technological advancements. In addition, incorporation of automation and multi-processing technologies in flow cytometry are expected to have positive impact on its adoption during the forecast period.

The flow cytometry industry is experiencing rapid innovation, with advancements in spectral analysis, artificial intelligence-driven data processing, and microfluidic-based cytometry. These innovations enhance sensitivity, throughput, and automation, making the technology more accessible for clinical and research applications, including cancer diagnostics, immunology, and drug discovery. For instance, In October 2023, Sony Corporation launched the FP7000 spectral cell sorter, designed to facilitate high-speed, high parameter sorting with over 44 colors and streamlined workflows. This innovative system integrates patented spectral technology-based optics, advanced electronics, and fluidics.

Mergers and acquisitions in the flow cytometry industry are increasing as key players seek to expand their technological capabilities and market presence. Companies are acquiring firms specializing in advanced reagents, software, and automation solutions, enhancing product portfolios and strengthening their competitive edge in precision medicine and diagnostics.

Regulatory frameworks significantly influence the flow cytometry industry, ensuring product safety and efficacy. Compliance with FDA, CE, and other regulatory standards is essential for market entry. Stricter guidelines for clinical diagnostics, laboratory workflows, and data management impact product development, approval timelines, and adoption rates.

Continuous advancements in flow cytometry have led to the development of high-dimensional cytometers, single-cell analysis platforms, and AI-powered software solutions. Expanding product offerings to include multiplex assays, automated sample processing, and user-friendly interfaces is increasing adoption across research institutions, hospitals, and diagnostic laboratories worldwide.

The flow cytometry industry is expanding globally, with increasing adoption in emerging markets across Asia-Pacific, Latin America, and the Middle East. Government initiatives, growing healthcare infrastructure, and rising investment in biotechnology and clinical research are driving market penetration, making flow cytometry more accessible in developing regions.

Product Insights

The instrument segment led the market with the largest revenue share of 35.30% in 2024 with owing to higher penetration driven by technological developments. For instance, in June 2023, BD announced launch of an automated instrument which is designed to prepare samples for clinical diagnostics through flow cytometry, enabling the smoother processing and workflow. The progress in technology, leading to cost-effectiveness, improved accuracy, and portability, is expected to pave the way for future growth opportunities. In addition, focus of companies for development and manufacturing of instruments with rapid turnaround time are also estimated to have positive impact on the growth of instrument segment during the forecast period.

The software segment is expected to witness at a significant CAGR during the forecast period. In flow cytometry, software plays a crucial role in controlling and acquiring data from cytometers, analyzing information, and offering statistical insights. In research applications, the software is employed for cell acquisition and data analysis, while in clinical diagnosis, it aids in disease diagnosis through the analysis of patients' samples. The broad spectrum of applications is anticipated to propel the market in years to come. In addition, the introduction of new products by key companies is identified as a significant factor that is expected to fuel the growth of this segment over the forecast period. For instance, in February 2023, Agilent announced launch of NovoCyte Flow Cytometer System Software which encompasses updated regulatory compliances for biopharmaceutical and pharmaceutical manufacturing.

Technology Insights

Based on technology, the cell-based segment led the market with the largest revenue share of 76.16% in 2024. This segment plays a pivotal role in drug discovery, allowing researchers to analyze physiological cell characteristics and extract valuable biological information. The increasing adoption of multi-parameter flow cytometry, particularly in rare cell analysis, is expected to further drive demand in the coming years. This advanced technology is widely utilized in clinical studies, facilitating the examination of various cell types, including tumor cells in peripheral blood, endothelial cells, tumor stem cells, and hematopoietic progenitor cells. Beyond cancer research, cell-based flow cytometry is integral in understanding disease mechanisms and target identification, providing essential insights for precision medicine and therapeutic development. As research in oncology, immunology, and regenerative medicine continues to advance, the demand for sophisticated cell-based assays is anticipated to grow significantly.

The bead-based assays segment is expected to grow at a exponential CAGR over the forecast period, driven by advancements in molecular engineering and monoclonal antibody production. These assays are particularly useful in infectious disease research, where they facilitate rapid and precise detection of pathogens and immune responses. Unlike traditional cell-based assays, bead-based flow cytometry offers advantages such as cost-efficiency, minimal sample requirements, and faster turnaround times, making it a preferred choice for high-throughput screening applications. The technology employs indirect or sandwich immunoassay formats to accurately assess antibody levels in biological fluids, enhancing diagnostic and research capabilities. With continuous improvements in fluorescent bead technologies, automation, and multiplexing capabilities, bead-based assays are becoming increasingly versatile, enabling researchers to conduct simultaneous detection of multiple analytes in a single test. As the demand for rapid and reliable diagnostic solutions rises, particularly in infectious disease management and vaccine development, the bead-based assays segment is expected to experience significant market expansion.

Application Insights

Based on application, the clinical segment led the market with the largest revenue share of 45.34% in 2024, driven by expanding research and development (R&D) activities in cancer and infectious disease diagnostics, including ongoing efforts related to COVID-19. The increasing R&D investments in the biotechnology and pharmaceutical industries are creating a conducive environment for market expansion. Furthermore, strategic growth initiatives by key industry players and the introduction of innovative flow cytometry solutions for clinical applications are expected to fuel segment growth. For instance, in July 2023, Discovery Life Sciences launched novel flow cytometry clinical trial services, enhancing capabilities in genomics, proteomics, and molecular pathology. These advancements are strengthening the role of flow cytometry in clinical diagnostics, treatment monitoring, and personalized medicine, further propelling market demand.

The research segment is projected to grow at the fastest CAGR during the forecast period, due to the increasing adoption of flow cytometry in cell culture, disease research, and drug discovery. Over the years, flow cytometry has become an indispensable tool in biomedical research, enabling precise analysis of cell populations, immune responses, and disease mechanisms. The rising prevalence of cancer and hematologic disorders, along with the growing demand for novel therapies, has significantly increased the need for flow cytometry in preclinical and translational research. In addition, surging R&D investments in the pharmaceutical and biotechnology sectors are fostering innovation, driving further adoption of advanced flow cytometry techniques in drug development, immunology, and regenerative medicine. As the demand for high-throughput, high-resolution cellular analysis grows, the research segment is set to experience significant expansion in the coming years.

End-use Insights

Based on end use, the academic institutes segment accounted for the largest revenue share in 2024, driven by the extensive use of flow cytometry in cell biology and molecular diagnostics. This technology enables researchers to assess various cellular parameters, including physical properties, biomarker identification, and cell lineage determination using specific antibodies. It plays a crucial role in analyzing cell type, maturation stage, and functional characteristics, making it an essential tool in fields such as molecular biology, immunology, pathology, plant biology, and marine biology. With increasing emphasis on research and development activities, the segment is expected to witness significant growth over the forecast period, further solidifying the role of flow cytometry in academic and scientific research.

The clinical testing labs segment is projected to grow at the fastest CAGR during the forecast period, fueled by the rising demand for cost-effective diagnostic solutions for diseases like cancer and immunodeficiency disorders. Flow cytometry is widely utilized in clinical diagnostics, treatment monitoring, and therapeutic decision-making, particularly in oncology and immunology. The market’s expansion is also supported by an increasing number of industrial collaborations and strategic partnerships, aimed at improving accessibility to advanced flow cytometry services. For instance, in May 2023, BD India partnered with Sehgal Path Lab to establish a clinical flow cytometry center in Mumbai, enhancing diagnostic capabilities and expanding the reach of high-precision cellular analysis. These developments underscore the growing role of flow cytometry in clinical laboratories, further driving market growth.

Regional Insights

North America dominated the flow cytometry market with the largest revenue share of 41.35% in 2024. This strong market position is driven by the presence of a highly advanced healthcare system and a thriving pharmaceutical and biotechnology industry, particularly in the United States. The growing demand for flow cytometry solutions in clinical diagnostics, drug discovery, and biomedical research has significantly contributed to market expansion. Moreover, substantial R&D investments in oncology, immunology, and infectious diseases have further fueled the demand for flow cytometry instruments. Increased public-private partnerships supporting cancer research have played a pivotal role in boosting market growth. For example, in December 2023, AlleSense was commissioned to enhance cancer diagnostics using cutting-edge flow cytometry technologies, receiving an initial investment of USD 2.5 million.

U.S. Flow Cytometry Market Trends

The flow cytometry market in the U.S. is expected to experience at a robust CAGR between 2024 and 2030, driven by high cancer prevalence and extensive R&D initiatives aimed at developing novel therapies. The government's proactive funding initiatives and regulatory support for next-generation diagnostic technologies have created lucrative market opportunities. The adoption of automated flow cytometry platforms in clinical laboratories and hospitals is expected to further strengthen market expansion.

Europe Flow Cytometry Market Trends

The flow cytometry market in Europe is witnessing significant growth, largely due to rising demand in countries with strong biotechnology sectors, including Germany, the UK, and Italy. The COVID-19 pandemic also accelerated the adoption of flow cytometry technologies, as countries like Italy, France, the UK, and Germany ramped up vaccine development and infectious disease research. This trend has reinforced demand for high-throughput flow cytometry solutions across the region.

The UK flow cytometry market is expanding due to strategic collaborations between government bodies and private players, leading to the launch of innovative products. These partnerships are fostering the adoption of flow cytometry in clinical and research settings, boosting market penetration.

The flow cytometry market in France is projected to grow at a steady CAGR from 2024 to 2040, driven by the increasing acceptance of flow cytometry in academic and research institutions. In addition, artificial intelligence (AI) integration into flow cytometry workflows is expected to enhance automation and efficiency, driving further adoption.

The Germany flow cytometry market is set for substantial growth due to the strong presence of key players and their continuous strategic initiatives. The country’s leading role in pharmaceutical R&D, particularly in vaccine development during the COVID-19 pandemic, has led to a sustained demand for flow cytometry solutions in both clinical and research applications.

Asia Pacific Flow Cytometry Market Trends

The flow cytometry market in the Asia Pacific is expected to witness at a significant CAGR from 2025 to 2030, fueled by the expanding pharmaceutical and biotechnology sectors in emerging economies such as China and India. The rising burden of chronic diseases and the increasing use of flow cytometry devices in oncology, immunology, and infectious disease diagnostics are key growth drivers. Furthermore, continuous innovations in cancer and infectious disease research are expected to accelerate market expansion across the region.

The China flow cytometry market is expected to grow at a substantial CAGR from 2024 to 2030, as leading companies adopt both organic and inorganic growth strategies to maintain a competitive edge. Increasing government-funded R&D initiatives in precision medicine and immunotherapy are projected to drive demand for advanced flow cytometry instruments and reagents.

The flow cytometry market in Japan accounted for the largest market revenue share in Asia Pacific in 2024, primarily due to its strong R&D focus and continuous introduction of new technologies in flow cytometry applications. With increasing government and private investments in biomedical research, the demand for high-throughput flow cytometry solutions is rising across research institutions and pharmaceutical companies.

Latin America Flow Cytometry Market Trends

The flow cytometry market in Latin America is estimated to grow at a notable CAGR from 2024 to 2030, driven by rising public-private partnerships that support biomedical research and diagnostic advancements. The region’s aging population and increasing prevalence of chronic diseases are also contributing to market expansion.

The Brazil flow cytometry market is witnessing growth due to increased private and public investments in the pharmaceutical and biotechnology sectors. The country’s emphasis on expanding research infrastructure and enhancing diagnostic capabilities further supporting the demand for advanced flow cytometry solutions.

Middle East and Africa Flow Cytometry Market Trends

The flow cytometry market in the MEA is projected to grow at a steady CAGR from 2024 to 2030. However, factors such as limited investments in biotechnology, high costs of flow cytometry systems, and fewer R&D activities in the pharmaceutical and biotech industries may restrict market expansion. Despite these challenges, growing healthcare infrastructure and increased demand for localized testing are driving moderate growth.

The Saudi Arabia flow cytometry market is expected to grow at a significant CAGR over the forecast period, driven by an increasing prevalence of chronic diseases, rising demand for advanced diagnostic tools, and falling sequencing costs. As government and private sector investments in healthcare and research expand, the adoption of flow cytometry solutions in clinical laboratories and research institutions is expected to rise steadily.

Key Flow Cytometry Company Insights

Established players in the flow cytometry industry such as Danaher; BD; Sysmex Corp.; Agilent Technologies, Inc.; Apogee Flow Systems Ltd.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Stratedigm, Inc.; Miltenyi Biotec; Cytek Biosciences; Sony Group Corporation (Sony Biotechnology Inc.) are strategically positioning themselves for sustained growth. Their activities include continuous research and development initiatives, strategic partnerships and acquisitions, and a focus on expanding their product portfolios. By leveraging their experience and market presence, these players aim to maintain leadership positions and adapt to evolving industry trends in the competitive landscape of flow cytometry.

In the flow cytometry industry, emerging players are actively engaging in strategic activities to establish their presence. These activities include innovative product development, strategic collaborations, and market expansions. By focusing on such strategies, these players aim to capitalize on the growing demand for flow cytometry solutions.

Key Flow Cytometry Companies:

The following are the leading companies in the flow cytometry market. These companies collectively hold the largest market share and dictate industry trends.

- Danaher

- BD

- Sysmex Corporation

- Agilent Technologies, Inc.

- Apogee Flow Systems Ltd.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific, Inc.

- Stratedigm, Inc.

- Miltenyi Biotec

- Cytek Biosciences

- Sony Group Corporation (Sony Biotechnology Inc.)

Recent Developments

-

In January 2025, BD (Becton, Dickinson and Company) and Biosero, a developer of laboratory automation solutions, announced a collaboration to integrate robotic arms with BD's flow cytometry instruments. This partnership aims to automate manual processes in drug discovery and development, enhancing efficiency and throughput in laboratory workflows.

-

In March 2024, Beckman Coulter Life Sciences received 510(k) clearance from the FDA to distribute its DxFLEX Clinical Flow Cytometer in the U.S. This advancement makes high-complexity flow cytometry testing more accessible to laboratories without the need for additional expense.

-

In January 2024, Cytek Biosciences, Inc. agreed with the Centre for Genomic Regulation (CRG) and Pompeu Fabra University (UPF) to foster technological innovation and accelerate discoveries in the scientific community. The collaboration underscores the significant impact of Cytek's spectral flow cytometry technology, paving the way for expansion into new applications.

Flow Cytometry Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,058.8 million

Revenue forecast in 2030

USD 7,013.1 million

Growth rate

CAGR of 8.41% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Norway; Sweden; Denmark; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; UAE; South Africa; Saudi Arabia; Kuwait

Key companies profiled

Danaher; BD; Sysmex Corp.; Agilent Technologies, Inc.; Apogee Flow Systems Ltd.; Bio-Rad Laboratories, Inc.; Thermo Fisher Scientific, Inc.; Stratedigm, Inc.; DiaSorin S.p.A.; Miltenyi Biotec; Sony Biotechnology, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flow Cytometry Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global flow cytometry market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Cell Analyzers

-

Cell Sorters

-

-

Reagents & Consumables

-

Software

-

Accessories

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell-based

-

Bead-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Pharmaceutical

-

Drug Discovery

-

Stem Cell

-

In Vitro Toxicity

-

-

Apoptosis

-

Cell Sorting

-

Cell Cycle Analysis

-

Immunology

-

Cell Viability

-

Others

-

-

Industrial

-

Clinical

-

Cancer

-

Organ Transplantation

-

Immunodeficiency

-

Hematology

-

Autoimmune Disorders

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Organizations

-

Biotechnology Companies

-

Pharmaceutical Companies

-

CROs

-

-

Hospitals

-

Academic Institutes

-

Clinical Testing Labs

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global flow cytometry market size was estimated at USD 4,684.21 million in 2024 and is expected to reach USD 5,058.8 million in 2025.

b. The global flow cytometry market is expected to grow at a compound annual growth rate of 8.41% from 2025 to 2030 to reach USD 7,013.1 million by 2030.

b. North America dominated the flow cytometry market with a share of 41.20% in 2024. This is attributable to an established healthcare sector and supportive government policies for developing advanced technologies for molecular diagnostics in the region.

b. Some key players operating in the flow cytometry market include Danaher, BD, Sysmex Corp., Agilent Technologies, Inc., Apogee Flow Systems Ltd., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Stratedigm, Inc., DiaSorin S.p.A., Miltenyi Biotec, Sony Biotechnology, Inc.

b. Key factors driving the flow cytometry market growth include the rising R&D investments in the biotechnology sector and technological advancements in the field of flow cytometry for introducing new and improved analytical tools, such as microfluidic flow cytometry, for point-of-care testing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.