- Home

- »

- Next Generation Technologies

- »

-

Automated Material Handling Equipment Market Report, 2030GVR Report cover

![Automated Material Handling Equipment Market Size, Share & Trends Report]()

Automated Material Handling Equipment Market Size, Share & Trends Analysis Report By Product (Robots, AS/RS), By System Type, By Vertical (Automotive, E-Commerce), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-070-2

- Number of Pages: 204

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Technology

Market Size & Trends

The global automated material handling equipment market size was estimated at USD 61.04 billion in 2023 and is projected to grow at a CAGR of 9.7% from 2024 to 2030. The growing need for automation in various industries drives the market growth. Companies want to automate manufacturing processes to improve efficiency, reduce labor costs, and improve product quality. Material handling is a critical aspect of modern production systems, where the movement, storage, and protection of materials and products are essential for the efficient flow of operations.

This process is integral to the manufacturing, distribution, consumption, and disposal of goods and impacts the system's overall performance. A well-designed material handling system can reduce labor costs, minimize equipment expenses, and improve product quality. Through correct equipment selection, manufacturers can ensure the smooth flow of materials and products throughout the production process, increase the speed of production, reduce the risk of damage to materials and products, and improve the safety of workers. Therefore, material handling equipment is an essential investment for any manufacturing or production business seeking to streamline operations and optimize efficiency.

The automated material handling industry is expected to benefit from the increasing trend toward smart factories. With advancements in motion control, robots have become more agile and precise, allowing them to creatively manipulate workpieces or products and perform a wide range of tasks. Monitoring the manufacturing process, including picking, sorting, and conveying systems, is necessary to improve efficiency and reduce waste. Smart factories integrated with automated systems enable real-time monitoring of every process.

The AMH industry is driven by intuitive technologies such as cloud-based software, IoT, and machine learning, which enable real-time data monitoring and analysis, identifying inefficiencies and optimizing operations. Cloud-based software can monitor equipment performance and detect issues, while IoT sensors can track the movement of materials and products throughout the supply chain. As a result, the material handling industry is expected to continue growing as manufacturers seek to improve efficiency and reduce waste by adopting smart technologies. Machine Learning (ML) algorithms can also be used to optimize material flow, reduce bottlenecks, and enhance the system's productivity.

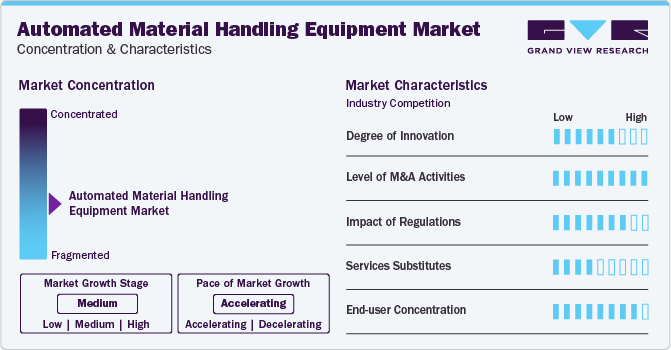

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. Material handling equipment is required in a warehouse or manufacturing plant for efficient product movement, stock location, order preparation, and localization. Manufacturing companies worldwide invest in new automated storage systems, retrieval systems, and other material handling equipment to improve their facilities, adopt advanced manufacturing techniques, and create new factories and warehouses to increase productivity and reduce labor costs. In addition, the development of artificial intelligence (AI) and automation has led to the emergence of new industry subsegments for Automated Material Handling (AMH) equipment, which are expanding quickly compared to conventional subsegments, such as conveyors and sortation systems, and posing severe difficulties for OEMs.

The AMH equipment industry is characterized by a high level of merger and acquisition (M&A) activity, reflecting the industry's rapid evolution. Established players are strategically acquiring startups to enhance their technological portfolios and gain a competitive edge. For instance, in March 2024, PR Industrial Srl and BlueBotics joined forces to introduce their first line of mobile robot solutions under the X-ACT brand. The partnership entails BlueBotics contributing its ANT navigation technology and fleet management software to power PR Industrial Srl's latest range of X-ACT mobile logistics robots. These robots are marketed under PR Industrial Srl's newly established business unit, known as Lifter Mobile Robotics.

The increasing government support in numerous countries in the form of FDIs is leading to increasing investments in the industrial sector. U.S. standard ANSI B56.5 defines the safety requirements for powered unmanned automatic guided industrial vehicles. The abovementioned standard is a guide to safety requirements for system suppliers, manufacturers, and users for the design, application, construction, operation, and maintenance of unmanned guided industrial vehicles and automated functions of manned industrial vehicles.

AMH equipment is an ideal substitute for manual forklifts, cranes, and conveyors; however, it requires a high initial investment. The threat of substitutes is currently low. There is increasing awareness regarding the benefits offered by AMH equipment compared to that of their substitutes. Buyers are deploying AMH equipment owing to the adoption of lean manufacturing practices that evaluate each process to improve efficiencies, increase accuracy, and eliminate waste throughout the facilities. Moreover, buyers are installing AMH equipment as they focus on increasing their operational efficiencies and decreasing labor costs.

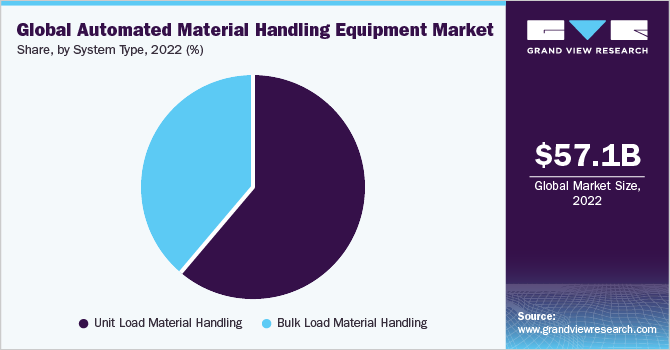

System Type Insights

The unit load material handling segment held the largest market revenue share in 2023. The unit load material handling equipment activity involves moving and storing a single entity, including pallets and containers. It carries a single load despite the individual items that make it up. Unit load equipment carriers are economical and quicker to transfer many items simultaneously compared to moving each item individually.

The bulk load material handling segment is estimated to grow significantly over the forecast period. Bulk load material handling priorities are increasing efficiency, reducing costs, and enhancing safety. Bulk load equipment carriers reduce manual labor and cost by eliminating the number of human laborers required to execute the assigned task. Inventory management is achieved with greater accuracy and control by ensuring no issues occur related to damage, misplaced items, and other problems.

Product Insights

The robots segment led the market in 2023 with a global revenue share of 24.2%. Integrating artificial intelligence (AI) and ML technologies in robotic systems is driving the growth of the robots segment. For instance, Third Wave Autonomation Reach forklifts use its Collaborative Autonomy Platform, which offers fleet management software with intelligent features and remote assistance capabilities. The platform incorporates ML and AI to help businesses enhance their forklift operations.

The warehouse management system segment is anticipated to showcase lucrative CAGR over the forecast period. Warehouse Management System (WMS) software provides a range of features and functionalities, such as inventory management, order processing, and shipping and receiving. With an effective WMS, paper use in warehousing can be significantly reduced by automating processes like counting, receiving, monitoring, and dispatching. For instance, as of March 2023, Maersk has improved its warehouse fulfillment process speed by introducing new software and scanning technology in WMS. According to Steve Belardi, who serves as the Vice President of Operations at Performance Team in the US, this has enabled them to meet the increasing demand for faster order fulfillment for mobile and store orders while improving accuracy.

Vertical Insights

The e-commerce segment held the largest market revenue share in 2023. The e-commerce industry is one of the fastest-growing sectors relying on Automated Material Handling (AMH) equipment to streamline warehousing and fulfillment operations. In addition, e-commerce has led to a significant increase in the demand for AMH equipment. These systems can handle large volumes of orders efficiently, reducing the need for manual labor. There is also a growing emphasis on workplace safety, and AMH equipment can significantly improve safety by reducing the risk of accidents and injuries. In March 2022, Swisslog Holding AG partnered with Berkshire Grey. The partnership aimed to deliver robotic solutions to e-commerce and retail customers and assist them in meeting the demands of consumers while addressing severe labor shortages.

The e-commerce segment is predicted to foresee significant growth in the forecast years. To ensure efficient and accurate handling of the goods, E-Commerce companies utilize a variety of AMH Equipment. By integrating these systems, E-Commerce providers can achieve end-to-end visibility and control over the entire supply chain, from product storage to final delivery. It can lead to better coordination, faster response times, and improved customer service. There is a trend toward using collaborative robots in E-Commerce warehouses. Unlike traditional industrial robots, cobots are designed to work alongside human workers, assisting them with tasks such as picking, packing, and sorting, thus helping to improve worker safety, reduce labor costs, and increase productivity.

Regional Insights

The automated material handling (AMH) equipment industry in North America is anticipated to witness significant growth over the forecast period. North America is a hub of technological innovation, driving the development of new and more advanced AMH equipment. Companies in the region are investing heavily in research and development to create more efficient, flexible, and intelligent systems. For instance, in March 2023, ABB announced the expansion of a manufacturing facility in Auburn Hills, Michigan, subsequently expanding the installation of AMH equipment. The expansion of the Auburn Hills facility is expected to create new job opportunities in the region, further strengthening ABB's contribution to the local economy.

U.S. Automated Material Handling Equipment Market Trends

Theautomated material handling equipment market in the U.S. is expected to grow at a CAGR of 10.5% from 2024 to 2030. The U.S. is the major producer of automated material handling equipment for warehouse automation, including fulfillment centers. The production of such equipment is rapidly increasing, fueled by advancements in technology and increased investments in automation. Advances in artificial intelligence (AI), machine learning, sensors, mobile networking technology, and vision technology have significantly enhanced the mobility, connectivity, and collaboration of automated material handling equipment.

The Canada automated material handling equipment market held a significant revenue share in the North America region. The Canada market is experiencing growth due to various factors. This includes the increasing adoption of automation in manufacturing, logistics, and warehousing industries, driven by the need to stay competitive, the boom in e-commerce, rising labor costs, emphasis on safety and productivity, and technological advancements.

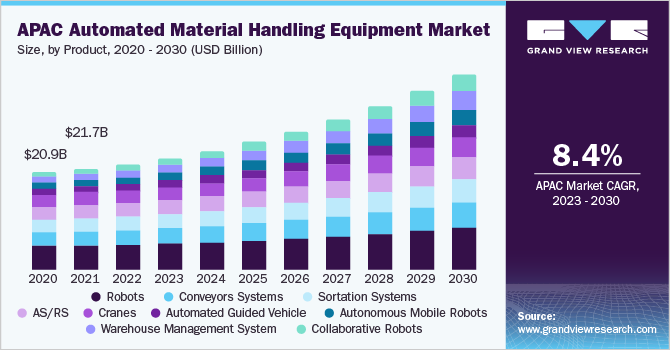

Asia Pacific Automated Material Handling Equipment Market Trends

The Asia Pacific automated material handling equipment market held the largest global revenue share of 39.3% in 2023. The market has been experiencing significant growth in recent years, attributed to several factors, including the increasing demand for automated material handling systems across various industries such as e-commerce, automotive, and food & beverage. Significant players such as Daifuku, Toyota Industries, and SSI Schaefer are also driving the market's growth in the Asia Pacific region. For instance, in July 2022, China-based JAKA Robotics successfully raised USD 150 million through a Series D funding round, which it plans to utilize to expand its global presence and conduct research and development activities to develop next-generation collaborative robots.

The automated material handling equipment market in India held a significant share in the Asia Pacific region. The warehousing sector in India is developing quickly and is progressing towards palletized loads, which can be stored at heights. The government's latest movement to give infrastructure status to the logistics sector has fetched much-needed support in buying equipment at cheaper costs and setting up infrastructure, further pushing the sales of warehousing equipment.

The China automated material handling equipment market held a significant share in the Asia Pacific region. China is a significant market for AMH equipment, with many companies investing in this technology to improve their manufacturing and logistics operations. For instance, in December 2021, Dematic, an American supplier of materials handling systems, software, and services, invested in a new plant base in Jinan, China. The project was anticipated to draw investments totaling roughly USD 50 million and had a planned area of 150,000 square meters. It was to start operating in the first quarter of 2023. The expansion would help the company scale its business and offer long-term growth benefits in China.

The automated material handling equipment market in Japan is anticipated to witness significant growth. Japan has been one of the prominent adopters of automated material handling equipment (AMHE) for several decades. The country has a highly developed manufacturing industry, and the adoption of AMHE technology has significantly improved the efficiency and productivity of manufacturing operations. The country's rapid economic growth and increasing industrialization have led to a rise in demand for efficient and automated logistics systems.

Europe Automated Material Handling Equipment Market Trends

The automated material handling equipment market in Europe is anticipated to witness a significant CAGR over the forecast period. Automated material handling equipment is gaining momentum in Europe due to the increasing demand for it from the manufacturing industry. The need for efficient and automated manufacturing, warehousing, and logistics processes has led to a growing demand for automated material handling solutions that can streamline operations, increase productivity, and reduce costs.

The UK automated material handling equipment market held a significant revenue share in the European region. The automated material handling equipment market in the UK is experiencing significant growth. The UK's exit from the European Union (EU), commonly known as Brexit, has resulted in changes in trade policies, customs procedures, and supply chain dynamics. To adapt to the post-Brexit landscape, many businesses in the UK invest in automated material handling equipment to optimize their supply chain operations, improve efficiency, and comply with new regulations.

The automated material handling equipment market in Germany is anticipated to witness significant growth over the forecast period. Germany's automated material handling equipment market is growing due to the increasing demand for automation and optimization of material handling processes in various industries such as automotive, e-commerce, food and beverage, pharmaceuticals, and logistics. Germany represented the highest growth rate in e-commerce turnover in the European region, which is expected to boost the market demand for AGV over the coming years.

Latin America Automated Material Handling Equipment Market Trends

The automated material handling equipment market in Latin America is witnessing a significant rise in the adoption of AMH equipment due to overall economic growth. As countries in the region continue to develop, there is a greater need for efficient logistics and supply chain management, which can be achieved through automated systems.

Middle East and Africa Automated Material Handling Equipment Market Trends

The automated material handling equipment market in the MEA is witnessing a significant adoption due to government investments in infrastructure development and modernization. As these efforts increase, there is a growing need for automated material-handling equipment to support these initiatives. The growing e-commerce market is also driving adoption in the region. Automated systems are essential for efficiently handling large orders generated by online shopping. The adoption of AMH equipment is also gaining prevalence in healthcare industries simultaneously.

Key Automated Material Handling Equipment Company Insights

Several notable companies focus on marketing strategies, such as expansions, mergers, acquisitions, contracts, partnerships, collaborations, agreements, and spur inventions. Companies are acquiring early automated material handling equipment suppliers with more extensive product lines. Market players are also diversifying their product portfolio with new product launches and developments. For instance, in March 2023, THiRARobotics Co., Ltd. announced the launch of its latest generation of autonomous mobile robots. These cutting-edge robots are designed to revolutionize logistics, warehousing, manufacturing, and 3PL operations. THiRARobotics’ new generation of autonomous mobile robots is equipped with advanced AI-powered navigation and perception capabilities, allowing them to navigate complex environments safely and efficiently without needing external infrastructure.

Key Automated Material Handling Equipment Companies:

The following are the leading companies in the automated material handling equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Daifuku Co., Ltd.

- KION GROUP AG

- Schaefer Systems International, Inc.

- Honeywell International Inc.

- Toyota Material Handling International

- Hyster-Yale Materials Handling, Inc.

- Jungheinrich AG

- Hanwha Group

- JBT

- KUKA AG

Recent Developments

-

In March 2024, OTTO Motors by Rockwell Automation, specializing in AMRs, unveiled its involvement in autonomous production logistics, a pioneering sector in manufacturing innovation. With the acquisition of OTTO Motors into its portfolio, Rockwell Automation broadened its material handling capabilities, offering a comprehensive solution for streamlining operations throughout entire facilities.

-

In February 2023, ArcBest Corporation announced the launch of autonomous reach trucks and forklifts that can also be operated remotely. These AMR units are integrated with software, enabling remote control by human operators. They offer mode settings that accommodate both autonomous and manual operations. Utilizing sensors and cameras, the units navigate warehouse floors to handle tasks such as pallet loading, stacking, and moving goods. Supervision of autonomous operation is facilitated by a teleoperator control center, ensuring efficient monitoring of the units.

-

In August 2023, ANYbotics AG expanded its footprint in Canada by appointing MicroWatt Controls as a reseller partner. This collaboration between ANYbotics AG and MicroWatt Controls highlights the growing need for industrial robotic inspection in the region, particularly within the chemical, oil & gas, energy, and mining sectors.

Automated Material Handling Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 65.74 billion

Revenue forecast in 2030

USD 114.45 billion

Growth Rate

CAGR of 9.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion, volume in thousand units, and CAGR from 2024 to 2030

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, system type, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; China; Japan; South Korea; Hong Kong; Taiwan; India; Thailand; Indonesia; Vietnam; Singapore; Malaysia; Australia; Mexico; Columbia; Chile; Argentina; Caribbean Region

Key companies profiled

Daifuku Co., Ltd.; KION GROUP AG; Schaefer Systems International, Inc.; Honeywell International Inc.; Toyota Material Handling International; Hyster-Yale Materials Handling, Inc.; Jungheinrich AG; Hanwha Group; JBT; KUKA AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

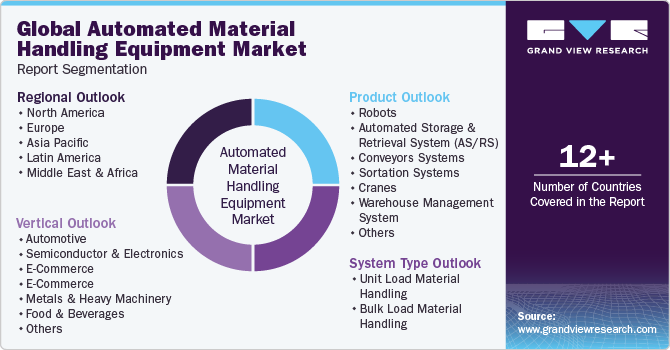

Global Automated Material Handling (AMH) Equipment Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automated material handling equipment market report based on product, system type, vertical, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Robots

-

Automated Storage and Retrieval System (AS/RS)

-

Unit Load

-

Mid & Mini Load

-

Vertical Lift Module (VLM)

-

Carousel

-

Shuttle

-

-

Conveyors Systems

-

Sortation Systems

-

Cranes

-

Warehouse Management System

-

Collaborative Robots

-

Autonomous Mobile Robots

-

Goods-to-Person Picking Robots

-

Self-driving Forklifts

-

Autonomous Inventory Robots

-

Unmanned Aerial Vehicles

-

-

Automated Guided Vehicle

-

Tow Vehicle

-

Unit Load Carrier

-

Pallet Truck

-

Forklift Truck

-

Hybrid Vehicles

-

Others

-

-

-

System Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Unit Load Material Handling

-

Bulk Load Material Handling

-

-

Vertical Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Semiconductor & Electronics

-

E-Commerce

-

E-Commerce

-

Metals & Heavy Machinery

-

Food & Beverages

-

Chemicals

-

3PL

-

Aviation

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

East Asia

-

China

-

Japan

-

South Korea

-

Hong Kong

-

Taiwan

-

-

India

-

Thailand

-

Indonesia

-

Vietnam

-

Singapore

-

Malaysia

-

Australia

-

-

Latin America

-

Mexico

-

Columbia

-

Chile

-

Argentina

-

Caribbean Region

-

-

Middle East and Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global automated material handling equipment market size was estimated at USD 61.04 billion in 2023 and is expected to reach USD 65.74 billion in 2024.

b. The global automated material handling (AMH) equipment market is expected to grow at a compound annual growth rate of 9.7% from 2024 to 2030 to reach USD 114.45 billion by 2030.

b. Asia Pacific dominated the AMH equipment market with a share of 39.3% in 2023. Significant players such as Daifuku, Toyota Industries, and SSI Schaefer are also driving the market's growth in the Asia Pacific region.

b. Some key players operating in the AMH equipment market include Daifuku, Kion, SSI Schaefer, Honeywell International, Toyota Material Handling, Hyster-Yale Material Handling, Jungheinrich, Hanwha, JBT, KUKA AG.

b. Key factors that are driving the AMH equipment market growth include increasing demand for automation and material handling equipment in various process industries and high labor cost.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."