- Home

- »

- Biotechnology

- »

-

Automated Nucleic Acid Extraction Market Size Report, 2033GVR Report cover

![Automated Nucleic Acid Extraction Market Size, Share & Trends Report]()

Automated Nucleic Acid Extraction Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Reagents & Consumables), By Technology (Magnetic Bead-based, Column-based), By Application, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-800-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automated Nucleic Acid Extraction Market Summary

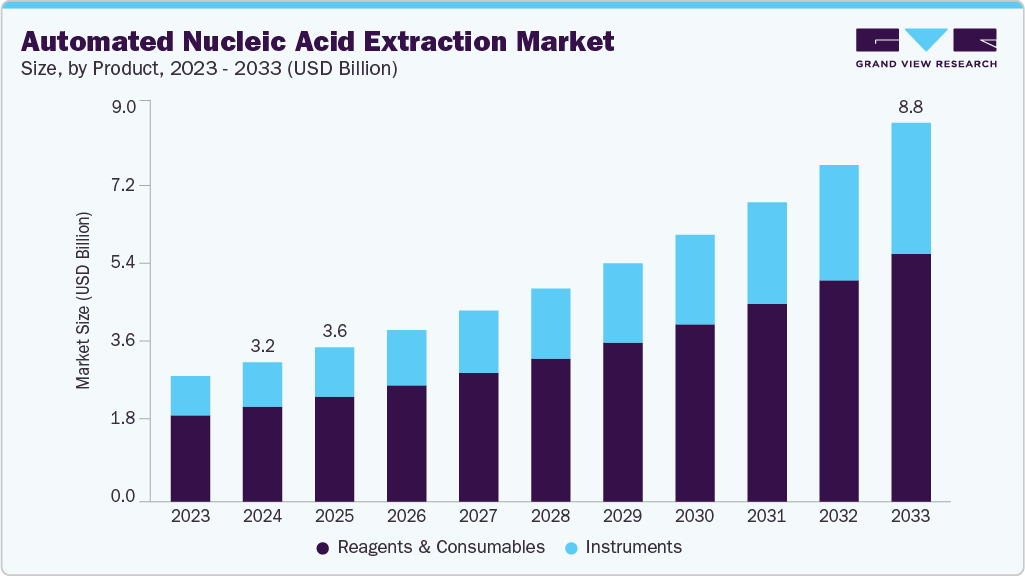

The global automated nucleic acid extraction market size was valued at USD 3.22 billion in 2024 and is expected to reach USD 8.77 billion by 2033, registering a CAGR of 11.89% from 2025 to 2033. Continuous advancements in extraction technologies, combined with the growing applications of genomics in precision medicine, infectious disease testing, and biotechnology research, are further driving market expansion.

Key Market Trends & Insights

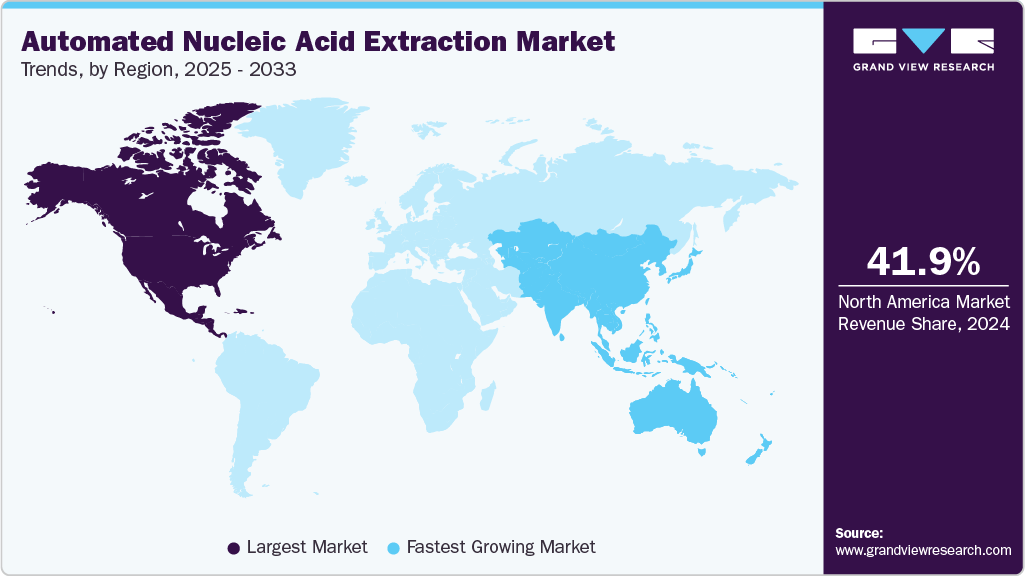

- The North America automated nucleic acid extraction market held the largest share of 41.91% of the global market in 2024.

- The automated nucleic acid extraction industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the reagents & consumables segment held the highest market share of 68.32% in 2024.

- Based on technology, the magnetic bead-based segment held the highest market share in 2024.

- By application, the DNA extraction segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.22 Billion

- 2033 Projected Market Size: USD 8.77 Billion

- CAGR (2025-2033): 11.89%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

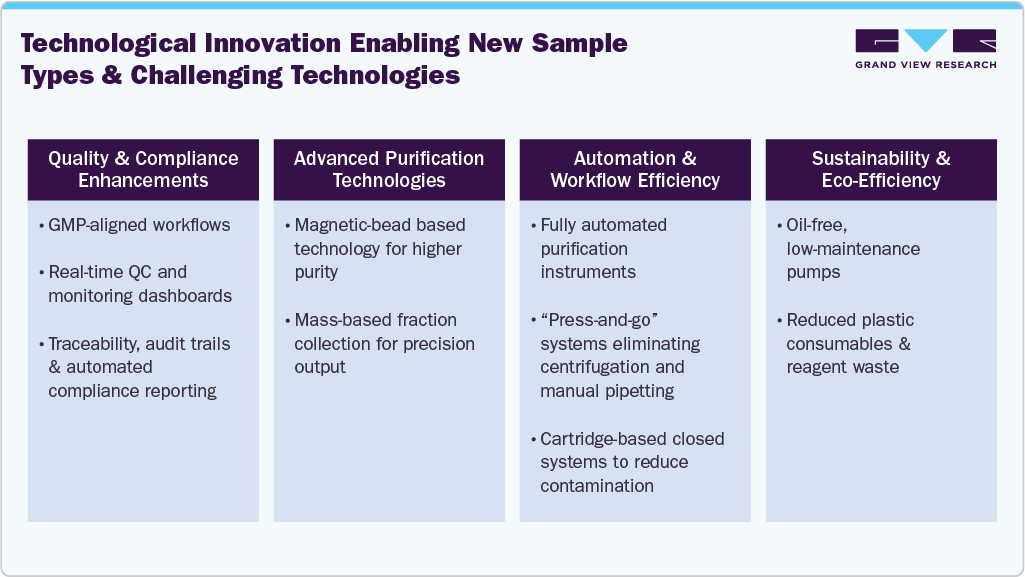

Technological innovation enabling new sample types and challenging technologies

Technological developments are stimulating the robust adoption of automated nucleic acid extraction systems by making it easier to process complex sample types, such as those with shallow volumes, clinical samples, FFPE tissues, and circulating cell-free nucleic acids. These developments will provide increased sensitivity, reproducibility, and throughput, while yielding high-quality DNA/RNA that is essential for diagnostics, precision medicine, and research.

Moreover, advanced automated solutions are now finely integrated into downstream technologies such as high-throughput PCR, NGS library preparation, and digital PCR, to lessen manual handling and improve turnaround times. Overall, as healthcare and research environments move towards automation, high-volume genomic testing, and precision oncology, automated nucleic acid extraction is increasingly essential to contemporary molecular technologies.

Rising Adoption of Genomics and Precision Medicine Driving Automation in Nucleic Acid Extraction

The increasing emphasis on genomics, precision medicine, and molecular diagnostics is catalyzing significant demand for automated systems for nucleic acid extraction. Automated nucleic acid extraction systems standardize extraction processes, minimize contamination, and enable high-throughput sample processing. As such, they are critical for technologies with a clinical-grade sample processing experience.

The growth of large-scale genomics and multi-omics initiatives is driving the automation of sample processing to manage increasing sample numbers efficiently. The traditional laborious approach is no longer sustainable enough to provide the pace, accuracy, or throughput that next-generation sequencing, liquid biopsy, and complex research projects require. Automated extraction systems can improve technologies, reduce labor dependency, and couple directly with sequencing and PCR platforms, solidifying their significance in the current life-science and personalized medicine landscape.

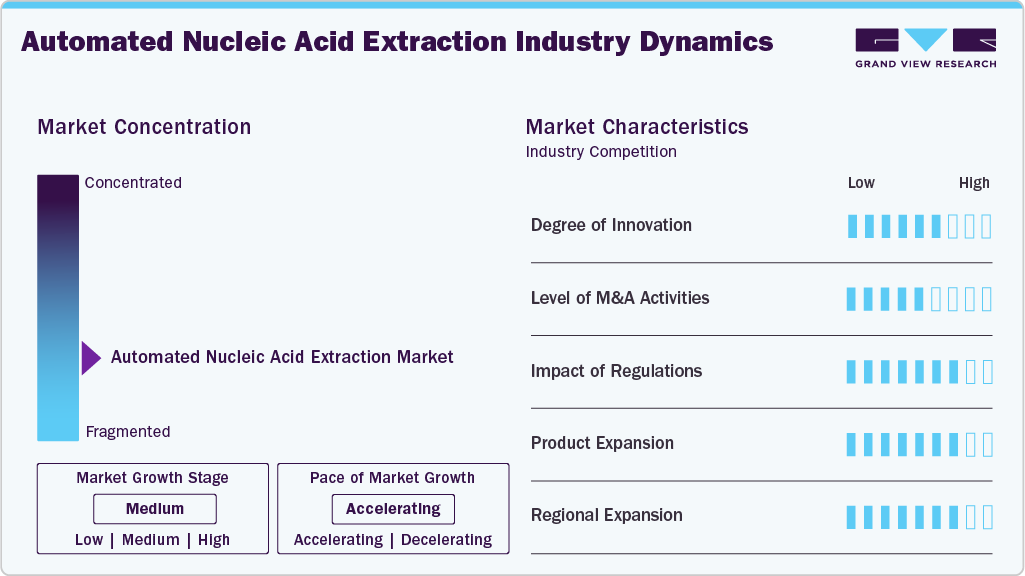

Market Concentration & Characteristics

The industry boasts a high level of innovation, owing to advanced robotic systems, AI-enabled protocol optimization, and improved technologies for magnetic-bead extraction and microfluidics, which enhance purity, yield, and efficiency. Current platforms integrate seamlessly with NGS systems and PCR, offering cloud-based technologies and LIMS compatibility that facilitate rapid, standardized, and scalable extraction. All these innovations support greater throughput, consistency, and improved performance in both clinical and research settings. For instance, in January 2023, QIAGEN launched the EZ2 Connect MDx platform in Europe and North America, expanding automated clinical sample-processing capabilities with CE-IVD certification, remote instrument management, and high-throughput DNA/RNA purification.

The level of M&A activity in the industry is moderate, driven by companies aiming to expand automation capabilities and build end-to-end molecular technology solutions. Leading players are acquiring technology innovators and reagent suppliers to strengthen portfolios, enhance high-throughput extraction capabilities, and meet growing demand in clinical diagnostics and genomics.

Regulatory bodies heavily influence the automated nucleic acid extraction industry, as systems intended for clinical use must comply with strict FDA, CE-IVDR, and CLIA requirements. Automated platforms that have been validated tend to be more trusted and accepted in clinical diagnostics and high-throughput genomic testing applications.

The industry is experiencing rapid expansion. Manufacturers have also introduced enhanced reagent kits, consumables, and more reliable and efficient software integrations for better technologies with their PCR, NGS, and Digital PCR systems. The ongoing product development cycle enables laboratories to expand their capacity, enhance processing efficiency, and develop higher-order molecular testing SNPs for clinical, research, and biopharmaceutical preparation work.

Companies are expanding their presence in high-growth regions such as the Asia-Pacific, Latin America, and the Middle East as the market continues to grow geographically. Investment in diagnostics and genomics is growing, and lab infrastructure is expanding, leading to an increased demand for automated extraction systems.

Product Insights

The reagents and consumables segment accounted for the largest share of the global market in 2024, due to the repetitive requirement of high-quality extraction kits, magnetic beads, buffers, and cartridges in repeated sample processing.

The instruments segment is expected to expand at the fastest rate during the forecast period, driven by the continued adoption of fully automated extraction platforms in clinical, research, and biopharmaceutical laboratories. New developments in robotics, microfluidics, and integrated technologies, plus demand for high-throughput molecular testing and precision.

Technology Insights

The magnetic bead-based segment accounted for the highest market share of 52.87% in 2024, primarily driven by its high efficiency and yield in processing a variety of sample types with a limited risk of contamination. This method is a common choice for automated formats due to its scalability, suitability for high-throughput technologies, and consistent results in clinical diagnostics, genomics, and biomanufacturing.

The column-based segment is expected to experience robust growth during the forecast period. Growing adoption in academic research, diagnostic labs, and smaller biopharma facilities continues to drive demand for column-based extraction solutions alongside advancements enhancing yield and purity.

Application Insights

The DNA extraction segment took the dominant position in 2024. This segment continues to retain the highest market share in the industry; however, the demand for genetic testing, cancer diagnostics, and personalized medicine will continue to drive growth in the volume of DNA extraction applications.

The RNA extraction segment is expected to experience robust growth during the forecast period. The expansion of RNA-focused diagnostics, vaccine development, and gene expression profiling is accelerating the adoption of automated RNA extraction technologies, positioning this segment for strong and sustained growth.

End Use Insights

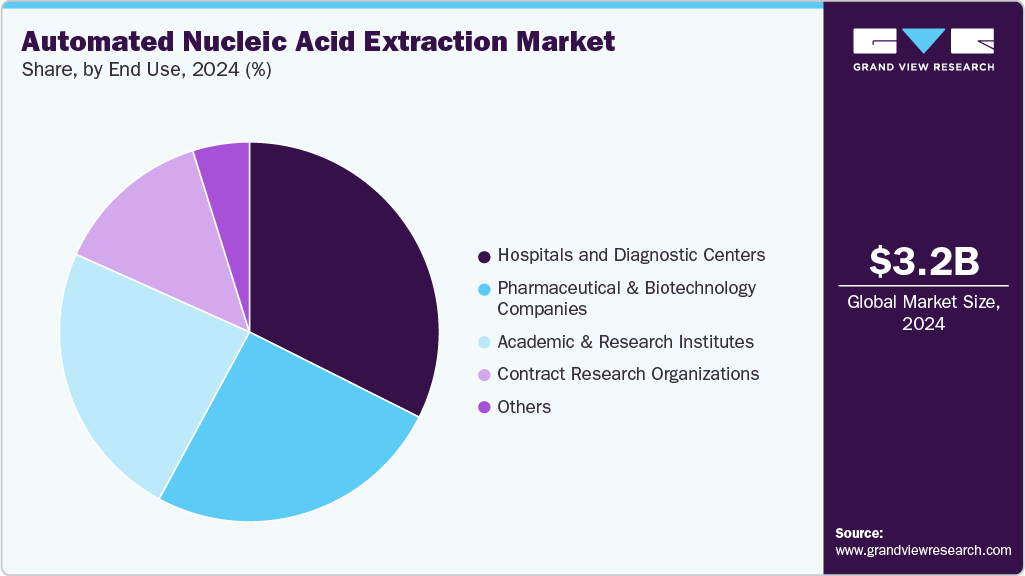

Hospitals and diagnostic centers accounted for the largest share of 32.41% in 2024. Increased patient volumes and the demand for results that are often faster, more accurate, and standardized will still stimulate strong demand from these facilities.

The segment of pharmaceutical and biotechnology companies is anticipated to experience the fastest CAGR during the entire forecast period. The demand is also boosted by the growing use of automated extraction systems to support high-throughput technologies, enhance sample quality, and accelerate R&D timelines.

Regional Insights

North America automated nucleic acid extraction industry dominated the global market and accounted for the largest revenue share of 41.91% in 2024. The region’s leadership is driven by advanced molecular diagnostics infrastructure, high adoption of automation in clinical and translational labs, and rising demand for high-throughput genomic technologies.

U.S Automated Nucleic Acid Extraction Market Trends

The automated nucleic acid extraction industry in the U.S. has experienced significant growth, driven by the increasing adoption of automated extraction systems across hospitals, diagnostic centers, and biotech facilities. Expanding applications in oncology, infectious disease testing, cell- and gene-therapy technologies, and forensic science continue to drive demand. The growing adoption of automation in CLIA-certified labs, government disease-preparedness programs, and biomanufacturing initiatives is expected to sustain strong growth momentum.

Europe Automated Nucleic Acid Extraction Market Trends

The automated nucleic acid extraction industry in Europe is expected to witness steady growth due to strong government funding, stringent regulatory standards that favor automated quality-controlled sample preparation, and rising investments in PCR- and NGS-based diagnostics. The area also benefits from academic-industry partnerships advancing automation in precision medicine and microbial genomics.

The UK automated nucleic acid extraction market is poised for solid growth driven by government-supported genomics programs, strong academic research hubs, and accelerated adoption of automated platforms in NHS molecular labs.

The automated nucleic acid extraction industry in Germany is supported by a robust biotechnology ecosystem, advanced clinical diagnostic laboratories, and government initiatives promoting digital health and automation in healthcare.

Asia Pacific Automated Nucleic Acid Extraction Market Trends

The automated nucleic acid extraction industry in Asia Pacific is anticipated to witness the fastest CAGR of 13.32% from 2025 to 2033. Increasing demand for automated extraction in oncology diagnostics, IVF/genomics labs, and pharmaceutical research strengthens the region’s growth trajectory.

China automated nucleic acid extraction industry is emerging as a dominant regional market, fueled by heavy public-sector investment, rapid expansion of genomics infrastructure, and fast-growing domestic automation manufacturers. National initiatives in synthetic biology, pandemic-preparedness infrastructure, and precision medicine continue to strengthen demand.

The automated nucleic acid extraction industry in Japan is expected to see strong growth driven by advanced healthcare systems, a high focus on aging-related diseases, and a national commitment to precision medicine. Automation in clinical labs, increasing adoption of digital PCR and NGS technologies, and partnerships between universities and industry players support market expansion.

Middle East & Africa Automated Nucleic Acid Extraction Market Trends

The automated nucleic acid extraction industry in the Middle East & Africa is projected to grow significantly, supported by the modernization of healthcare systems, rising burden of chronic and infectious diseases, and expansion of genomics and vaccine-manufacturing capabilities. GCC countries are adopting automated molecular testing technologies to support national public-health strategies, while growing academic and private-sector initiatives are enhancing market maturity across Africa.

Kuwait automated nucleic acid extraction market remains emerging but promising, fueled by expanding investments in precision medicine, infectious disease labs, and academic-industry research collaborations. Government diversification strategies and initiatives to upgrade clinical diagnostic capabilities are expected to gradually increase the adoption of automated nucleic-acid extraction systems.

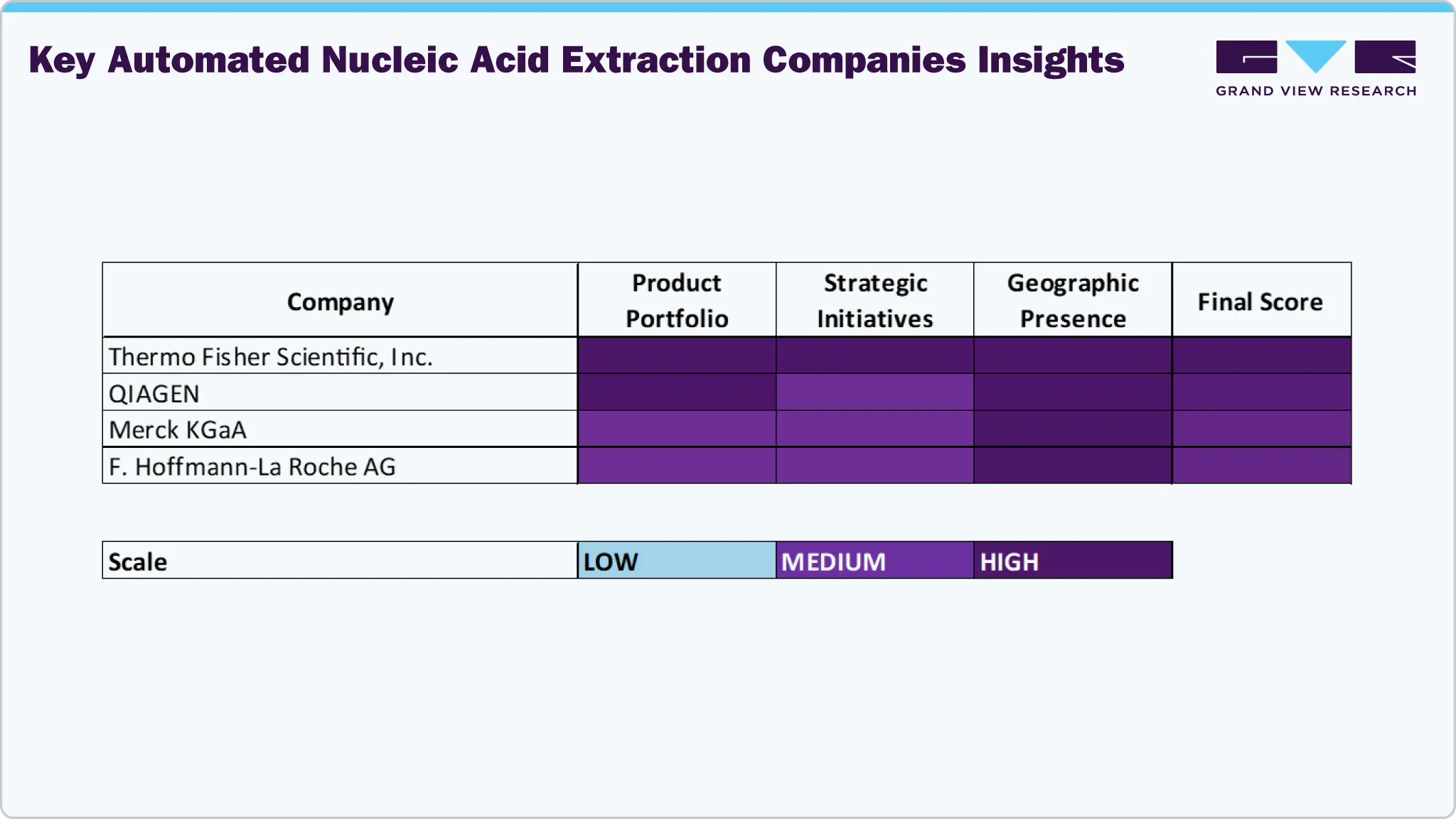

Key Automated Nucleic Acid Extraction Companies Insights

Key players operating in the automated nucleic acid extraction market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Automated Nucleic Acid Extraction Companies:

The following are the leading companies in the automated nucleic acid extraction market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Merck KGaA

- F. Hoffmann-La Roche AG

- Agilent Technologies

- Revvity, Inc.

- Promega Corporation

- Bio‑Rad Laboratories

- Takara Bio

- Zymo Research Corporation

Recent Developments

-

In June 2025, Agilent Technologies in the United States showcased its new Hybrid Multisampler and LC Single Quadrupole Mass Spectrometers at HPLC 2025 in Belgium, emphasizing enhanced analytical efficiency and performance.

-

In June 2024, Thermo Fisher Scientific in the United States launched the fully automated KingFisher PlasmidPro Maxi system, halving plasmid purification time and delivering high-purity yields with minimal manual intervention.

Automated Nucleic Acid Extraction Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.57 billion

Revenue forecast in 2033

USD 8.77 billion

Growth rate

CAGR of 11.89% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Thermo Fisher Scientific, Inc.; QIAGEN; Merck KGaAF. Hoffmann-La Roche AG; Agilent Technologies; Revvity, Inc.; Promega Corporation; Bio‑Rad Laboratories; Takara Bio; Zymo Research Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automated Nucleic Acid Extraction Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automated nucleic acid extraction market report on the basis of product, technology, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Reagents & Consumables

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Magnetic Bead-based

-

Column-based

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

DNA Extraction

-

Genomic DNA Extraction

-

Plasmid DNA Extraction

-

Others

-

-

RNA Extraction

-

mRNA Extraction

-

miRNA Extraction

-

Total RNA Extraction

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

Hospitals and Diagnostic Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.