- Home

- »

- Automotive & Transportation

- »

-

Automatic Emergency Braking Market Size Report, 2030GVR Report cover

![Automatic Emergency Braking Market Size, Share & Trends Report]()

Automatic Emergency Braking Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Low-speed, High-speed), By Technology (Crash Imminent Braking), By Brake (Disc), By Vehicle, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-165-8

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automatic Emergency Braking Market Trends

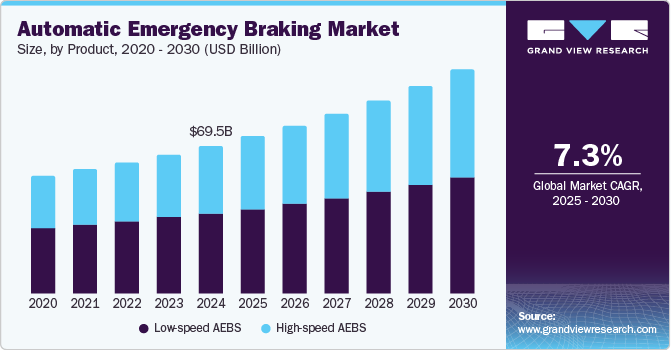

The global automatic emergency brakingmarket size was valued at USD 69.5 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2030. This market growth is driven by increasing awareness, and stringent government regulations regarding vehicle safety are compelling manufacturers to integrate AEB systems into their vehicles. In addition, the rising number of road accidents and fatalities has heightened the demand for advanced safety features, further boosting the adoption of AEB technology.

Technological advancements, such as the development of more sophisticated sensors and artificial intelligence, are enhancing the effectiveness and reliability of AEB systems, making them more attractive to consumers. Moreover, the growing trend of autonomous and semi-autonomous vehicles also contributes to the market’s expansion.

Regulations significantly impact the automatic emergency braking (AEB) market, driving innovation and adoption. For instance, the U.S. Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) finalized a rule requiring all passenger cars and light trucks to be equipped with AEB systems. This regulation, part of the Bipartisan Infrastructure Law, mandates that AEB systems must detect and react to imminent collisions with vehicles and pedestrians, even in low-light conditions.

Similarly, the European Union has implemented stringent safety standards under the General Safety Regulation, which requires new vehicles to be equipped with advanced safety features, including AEB. These regulations are designed to reduce road accidents and fatalities, compelling manufacturers to integrate AEB technology into their vehicles, thereby accelerating market growth and technological advancements.

Product Insights

The low-speed AEBS segment accounted for 54.5% of the total revenue generated in the global automatic emergency braking market in 2024, attributed to the increasing adoption of AEBS in urban environments, where low-speed collisions are more common. These systems effectively prevent accidents in congested traffic conditions, parking lots, and residential areas. The advancements in sensor technology and artificial intelligence have enhanced the accuracy and reliability of these systems, making them more appealing to both manufacturers and consumers.

The high-speed AEBS segment is expected to grow at a CAGR of 8.3% over the forecast period. The increasing emphasis on highway safety and the rising number of high-speed collisions drive this growth. The integration of advanced technologies, such as radar and lidar, has improved the performance of high-speed AEBS, enabling them to detect obstacles and initiate braking more effectively at higher speeds. Furthermore, the growing trend of autonomous and semi-autonomous vehicles, which rely heavily on high-speed AEBS for safe operation, is expected to fuel the demand for these systems.

Technology Insights

The Forward Collision Warning (FCW) segment dominated the global automatic emergency braking market with a revenue share of 36.8% in 2024, owing to its widespread adoption and effectiveness in enhancing vehicle safety. FCW systems use sensors, cameras, and radar to monitor the road ahead and detect potential collisions. When a threat is identified, the system alerts the driver, allowing them to take corrective action to avoid an accident. The increasing awareness of road safety among consumers and the implementation of stringent safety regulations by governments worldwide have significantly boosted the demand for FCW systems.

The Dynamic Brake Support (DBS) segment is projected to grow at the fastest rate with a CAGR of 7.8% over the forecast period, attributed to the increasing emphasis on advanced driver assistance systems (ADAS) and the rising number of high-speed collisions. The integration of advanced technologies, such as radar and lidar, has significantly improved the performance of DBS systems, enabling them to respond more effectively to potential threats.

Brake Insights

The disc segment emerged as the largest contributor to revenue in 2024, primarily due to its superior performance in emergency situations. Disc brakes offer rapid heat dissipation, which enhances braking efficiency and reduces stopping distances, making them an attractive option for manufacturers aiming to improve vehicle safety standards. In addition, the increasing adoption of ADAS in various vehicle categories has fueled the demand for disc brakes. The prevalence of lightweight materials and innovative designs in disc brake technology has further contributed to their dominance.

On the other hand, the drum segment is projected to experience steady growth over the forecast period from 2025 to 2030. While traditionally viewed as less efficient compared to disc brakes, drum brakes have found a niche market in smaller vehicles and commercial applications where cost-effectiveness is paramount. This segment is particularly appealing in budget-conscious markets, where manufacturers are seeking to balance safety with affordability. The resurgence of drum brakes can also be attributed to their design and materials advancements, which have improved their performance and durability.

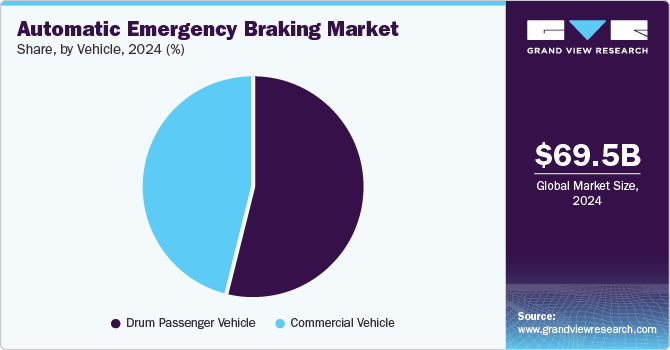

Vehicle Insights

The passenger vehicle segment dominated the global automatic emergency braking market in 2024, driven by heightened consumer awareness and stringent safety regulations. Automakers are increasingly integrating AEB systems as part of advanced driver assistance systems (ADAS), responding to rising demands for enhanced safety features. Technological sensors and artificial intelligence advancements have improved AEB effectiveness, boosting consumer confidence. Moreover, the growing popularity of electric and hybrid vehicles further solidifies this segment's leading position as AEB systems become standard in new models.

The commercial vehicle segment is anticipated to grow at a CAGR of 6.5% from 2025 to 2030. A heightened focus on fleet safety and regulatory mandates for advanced safety technologies fuels this growth. Fleet operators recognize the financial benefits of AEB systems, which can significantly reduce collision rates and related costs. The rise of e-commerce and increased demand for last-mile delivery also drive the need for safer commercial vehicles. As manufacturers develop AEB systems tailored for larger vehicles, the commercial segment is projected to expand significantly in the coming years.

Regional Insights

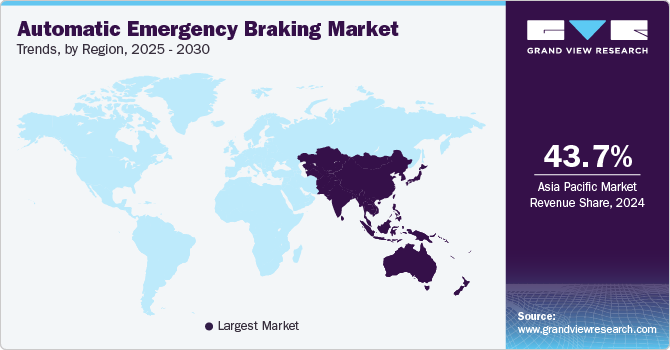

North America AEB market held a substantial share of the global market in 2024, largely due to the increasing demand for advanced safety features in vehicles and stringent regulations set by the National Highway Traffic Safety Administration (NHTSA).

U.S. Automatic Emergency Braking Market Trends

The U.S. dominated the North American AEB market in 2024. The Bipartisan Infrastructure Law mandates that all new cars and light trucks be equipped with AEB systems by 2029. This regulation is expected to boost the market significantly.

Asia Pacific Automatic Emergency Braking Market Trends

Asia Pacific dominated the global automatic emergency braking market with a revenue share of 43.7% in 2024, driven by the rapid expansion of the automotive industry and increasing consumer awareness about vehicle safety. Favorable government regulations and initiatives promoting ADAS in vehicles further support regional growth. For instance, Japan has mandated that all new and remodeled passenger cars be equipped with AEB systems, with existing models required to comply by December 2025. Similarly, South Korea has revised its vehicle safety regulations to mandate the inclusion of AEB in all passenger vehicles and trucks with a gross vehicle mass of 3.5 tons or less.

China Automatic Emergency Braking Market Trends

China accounted for a significant revenue share of the Asia Pacific automatic emergency braking market in 2024 attributed to the government’s strong emphasis on vehicle safety and the implementation of the China New Car Assessment Program (C-NCAP) 2024 protocols, which mandate the inclusion of AEB systems in new vehicles. Moreover, advancements in LiDAR and camera technologies have enhanced the effectiveness of AEB systems, further boosting their adoption.

Europe Automatic Emergency Braking Market Trends

Europe's Automatic Emergency Braking market is expected to grow steadily from 2025 to 2030, supported by stringent safety regulations and the European Union’s commitment to reducing traffic fatalities. The European Transport Safety Council estimates mandatory AEB systems could save thousands of lives annually. The EU’s General Safety Regulation, which includes mandatory AEB and other advanced safety features, is set to be fully implemented by 2024.

Key Automatic Emergency Braking Company Insights

Some of the key companies in the automatic emergency braking market include Robert Bosch GmbH, Continental Ag, Delphi Automotive LLP, ZF Friedrichshafen AG, Mobileye, Autolov Inc., Hyundai Mobis, Aisin Seiki Co., Ltd., and others.

-

Bosch’s AEB solutions are designed to prevent rear-end collisions and mitigate the severity of accidents by using advanced radar and camera technologies. The company’s systems are integrated into various vehicles, from passenger cars to commercial trucks.

-

Aisin Seiki Co., Ltd. offers a range of ADAS, including AEB technologies. The company’s AEB systems are designed to improve vehicle safety by detecting obstacles and applying the brakes to prevent collisions.

Key Automatic Emergency Braking Companies:

The following are the leading companies in the automatic emergency braking market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Continental Ag

- Delphi Automotive LLP

- ZF Friedrichshafen AG

- Mobileye

- Autolov Inc.

- Hyundai Mobis

- Aisin Seiki Co., Ltd.

- Hitachi Automotives Systems, Ltd.

- Mando Corporation

Recent Developments

-

In October 2024, Lynred unveiled its groundbreaking thermal imaging sensor, setting a new standard for compactness. This innovative technology is expected to enhance future automatic emergency braking systems significantly.

-

In July 2024, NIO Inc. released the Banyan 2.6.5 CN system for vehicles equipped with the NT 2.0 technology platform. This update features significant advancements in automatic emergency braking (AEB) functionality, leveraging artificial intelligence technology for improved performance.

-

In April 2024, the U.S. Department of Transportation's National Highway Traffic Safety Administration (NHTSA) mandated installing automatic emergency braking (AEB) systems, including pedestrian detection capabilities, in all new passenger cars and light trucks by September 2029.

Automatic Emergency Braking Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 74.0 billion

Revenue forecast in 2030

USD 105.4 billion

Growth rate

CAGR of 7.3% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, brake, vehicle, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Russia; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Robert Bosch GmbH; Continental Ag; Delphi Automotive LLP; ZF Friedrichshafen AG; Mobileye; Autolov Inc.; Hyundai Mobis; Aisin Seiki Co., Ltd.; Hitachi Automotives Systems, Ltd.; Mando Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automatic Emergency Braking Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automatic emergency braking market report based on product, technology, brake, vehicle, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Low-speed AEBS

-

High-speed AEBS

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Crash Imminent Braking

-

Dynamic Brake Support

-

Forward Collision Warning

-

Others

-

-

Brake Outlook (Revenue, USD Million, 2018 - 2030)

-

Disc

-

Drum

-

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Drum Passenger Vehicle

-

Commercial Vehicle

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.