- Home

- »

- Next Generation Technologies

- »

-

Automatic Identification & Data Capture Market Report, 2030GVR Report cover

![Automatic Identification And Data Capture Market Size, Share & Trends Report]()

Automatic Identification And Data Capture Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-976-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automatic Identification And Data Capture Market Summary

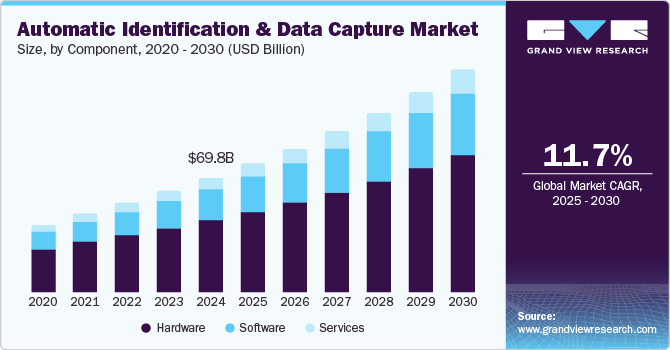

The global automatic identification and data capture market size was valued at USD 69.81 billion in 2024 and is projected to reach USD 136.86 billion by 2030, growing at a CAGR of 11.7% from 2025 to 2030. The constantly increasing need to manage data collection effectively and help businesses sort through large amounts of information is anticipated to be a major market driver.

Key Market Trends & Insights

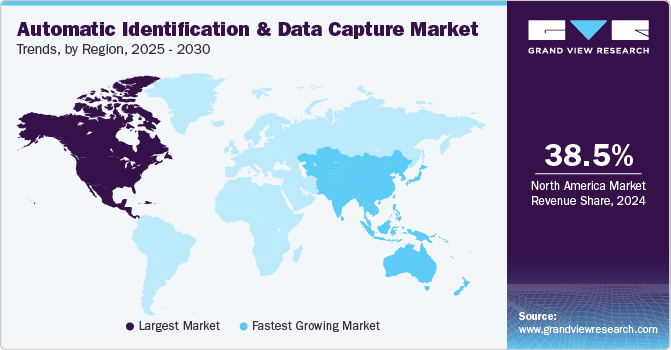

- North America accounted for the largest revenue share of 38.5% in the global market in 2024.

- The U.S. accounts for a dominant share of the regional market in 2024.

- Based on component, the hardware segment accounted for a dominant share of 63.0% in 2024.

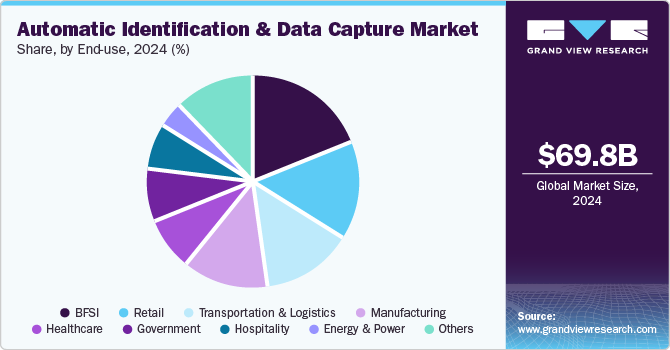

- Based on end-use, the BFSI segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 69.81 Billion

- 2030 Projected Market Size: USD 136.86 Billion

- CAGR (2025-2030): 11.7%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Automatic identification and data capture (AIDC) involves scanning, identifying, capturing, analyzing, recording, and storing data from a video, individual, audio, or picture without requiring manual entries. These systems are leveraged extensively to manage assets, delivery, inventory, security, and scan documents. The rapid expansion of the e-commerce sector globally, coupled with the increasing adoption of smartphones to scan QR codes, is expected to enable substantial advancements in the industry.

Globally, enterprises are undertaking significant investments in technological innovations that can ensure improved response times to address customer requirements effectively and enhance product and service quality. Biometrics solutions' growing importance and use present a significant growth avenue for this market. Increasing incidences of security breaches and transaction frauds have led enterprises to implement advanced identification and verification technologies. AIDC systems have become an indispensable part of the modern digital economy, as they support seamless information flow within and across organizational boundaries. Additionally, they enable the collection and analysis of data in real-time, aiding businesses to speed up their response to market changes, effectively manage their resources, and deliver high-value customer service. radiofrequency identification (RFID), barcodes, biometrics, smart cards, and speech and voice recognition are notable examples of AIDC solutions. These technologies have gained widespread acceptance across major retail, healthcare, and manufacturing industries due to their high accuracy, smooth functioning, and precision.

Factors such as the need to reduce manual data entry and capture errors, continued improvements in AIDC technology, and growing adoption of advanced AIDC systems are expected to drive market growth. Companies are leveraging strategies such as partnerships and acquisitions to launch innovative identification and data capture solutions catering to various industries. For instance, in September 2024, CYBRA Corporation, known for its tracking software Edgefinity IoT, announced its collaboration with CardWiz Technologies to provide advanced RFID offerings in the inventory tracking and asset management segment across Europe. Edgefinity IoT is extensively deployed for its capabilities, such as equipment location tracking in real-time, shipment auditing, inventory management, and safety enforcement. Similar initiatives by other organizations are expected to shape the industry positively in the coming years.

Component Insights

The hardware segment accounted for a dominant revenue share of 63.0% in 2024. The increasing demand for AIDC hardware devices such as RFID tags, scanners, barcode solutions, magnetic stripe cards, optical character recognition systems, biometric systems, and smart cards is expected to remain the primary segment driver. Constant improvements in design and technology have resulted in an increased pace of launch of new solutions. For instance, in May 2024, Hanwha Vision, which develops video surveillance systems and other vision solutions, announced the launch of a unique dual-lens Barcode Reader (BCR) camera to improve efficiency and minimize losses for logistics companies. The product offers video capture and barcode recognition capabilities in a single device and can track parcel barcodes at a speed of 2 meters per second on high-speed conveyors. Manufacturers are investing in research and development activities to improve the portability of these systems while ensuring higher efficiency and reliability, bringing competitive developments in the market.

The services segment is expected to advance at the fastest CAGR during the forecast period. Service providers in the industry offer comprehensive support to their customers, including installation, configuration, and long-term maintenance of AIDC systems. Additionally, they provide training and consulting services to enable organizations to effectively implement and utilize AIDC technologies in their operations. Service providers also offer technical support and troubleshooting assistance to ensure smooth functioning of these products and minimize disruptions in data capture processes. For instance, Cognex offers extensive documentation and training material for its offerings, such as In-Sight Vision Sensors, VisionPro, DataMan, Cognex Designer, and VisionPro Deep Learning. These resources improve employee performance and accelerate processes in enterprises.

End-use Insights

The BFSI segment accounted for the largest revenue share in the global market in 2024. This can be attributed to the increasing demand for technologies such as smart cards in the banking sector. These systems are widely implemented in financial organizations owing to their ability to conduct asset tracking, process transactions, and identify procedures securely. As governments globally aim to minimize the occurrence of security breaches and address cyber threats effectively in these institutions, the demand for barcoded documents, biometric authentication systems, and smart cards has grown significantly. In November 2022, Alogent, which provides specialized solutions to the BFSI industry, announced that the State Department Federal Credit Union had deployed its comprehensive enterprise check and payment processing solutions portfolio to streamline its remote deposit, teller capture, and back-office processing functions.

The retail segment is estimated to witness the fastest growth over the forecast period. The growing adoption of automatic identification & data capture technologies such as barcode & RFID tags in the areas of supply chain management, billing, and replenishment of orders in the retail value chain is expected to boost this segment’s contribution to the industry. With increasing urbanization and growing demand for various consumer goods, the retail business is witnessing continued expansion in multiple economies worldwide, aiding the adoption of AIDC technology in this sector. Manufacturers are developing complementary technologies while continuously improving conventional laser scanning capabilities to assist retail distribution centers in meeting new identification challenges and achieving their long-term objectives.

Regional Insights

North America accounted for the largest revenue share of 38.5% in the global market in 2024. This is on account of the increasing awareness and high adoption of AIDC devices and increased investments to introduce these technologies in high-potential industries such as retail, healthcare, and manufacturing. Furthermore, the widespread acceptance of advanced technology and the technological development of numerous industries are driving the regional market's growth. There is also a strong focus on ensuring security and improving efficiency in industrial processes, leading to the extensive use of advanced equipment such as barcode readers and biometric systems.

U.S. Automatic Identification And Data Capture Market Trends

The U.S. accounts for a dominant share of the regional market, aided by the rising need among industries to gather information regarding packaged or containerized items accurately and quickly. Additionally, government support to implement these solutions across different verticals, such as finance and law enforcement, has driven market growth in the economy. For instance, police departments, the Department of Motor Vehicles (DMV), and the Department of Licensing, among others, leverage various barcode symbologies to identify, track, and manage documents and resources and improve public communications.

Asia Pacific Automatic Identification And Data Capture Market Trends

Asia Pacific is expected to advance at the fastest CAGR from 2025 to 2030. Several major multinational retail and logistics firms are expanding their footprint in the Asia Pacific region to take advantage of the increased purchasing power and improved standards of living of the middle-income population. This has led to a significant regional expansion of the regional automatic identification and data capture business. Furthermore, the presence of various notable players such as Toshiba, Panasonic, and GoDEX International is expected to propel industry. Additionally, technological advances in the industrial sector in fast-growing nations such as China and India present further opportunities for AIDC companies to improve their solutions and services.

China accounts for a significant revenue share in the regional AIDC market on account of the rapid growth of industries, implementation of Industry 4.0, and the integration of advanced technologies in industrial processes. Additionally, the continued expansion of the e-commerce sector, owing to increasing consumer spending and changing buying behavior among Chinese citizens, has led to the increased use of AIDC systems such as barcode scanners. Their advanced features aid in real-time inventory tracking in logistics and warehousing applications.

Europe Automatic Identification And Data Capture Market Trends

Europe is anticipated to contribute substantially to the global market during the forecast period. The well-established industrial and manufacturing sectors in regional economies such as Germany, France, and the UK are expected to encourage manufacturers to launch innovative solutions in this market. Prominent AIDC devices being deployed by end-use industries include barcode and RFID scanners. These scanners can be integrated with a wide range of technologies, such as linear imagers, read linear, lasers, and area imagers, to expand their scope of application. Additionally, they enable businesses to track crucial information swiftly and precisely by providing real-time visibility in business performance and processes.

Germany accounted for a leading revenue share of the regional market in 2024, aided by the increased integration of technology in the manufacturing sector to streamline processes. AIDC tracks and identifies a wide range of products using computer systems. Enterprises are increasingly deploying AIDC technologies to monitor quality control, track inventory, and manage complex supply chains. Users can access and track the various stages involved in the production process, thus reducing the need for manual labor. Additionally, growing awareness among German enterprises regarding the advantages of combining AIDC with the Industrial Internet of Things (IIoT) is anticipated to create further growth avenues for the market.

Key Automatic Identification And Data Capture Company Insights

Key companies involved in the AIDC market include Cognex Corporation, Datalogic S.p.A., and Nordic ID, among others.

-

Cognex Corporation develops machine vision systems, sensors, and software in automated manufacturing processes. Major products offered by the company include the In-Sight vision system, the VisionPro vision software, and the DataMan range of handheld and fixed mount ID readers that can read 1D and 2D Data Matrix codes to identify and track items. The company has integrated deep learning software to improve its efficiency and solve complicated in-line inspection processes such as optical character recognition, defect detection, and assembly verification for its In-Sight solution. Besides hardware and software, Cognex offers training and maintenance support through documentation and other resources.

-

Datalogic S.p.A specializes in the development of automatic data capture and industrial automation offerings. The company manufactures and sells data collection mobile computers, bar code scanners, vision systems, sensors, and laser marking systems. Datalogic’s product portfolio includes on-counter/in-counter scanners/scales, presentation scanners, wearable scanners, industrial handheld scanners, self-shopping/store automation, and mobile computers. These products are deployed in airports, supermarkets, postal services, factories, and hospitals. The company has a strong presence in Europe, Asia-Pacific, the Americas, and the Middle East.

Key Automatic Identification And Data Capture Companies:

The following are the leading companies in the automatic identification and data capture market. These companies collectively hold the largest market share and dictate industry trends.

- NEC Corporation

- Cognex Corporation

- Datalogic S.p.A.

- Honeywell International Inc.

- Nordic ID Oyj

- Panasonic Holdings Corporation

- Radley, LLC

- SICK AG

- Toshiba Tec Corporation

- Zebra Technologies Corp.

Recent Developments

-

In May 2024, Datalogic announced the launch of the Magellan 900i imaging-based entry-level scanner that would replace the company’s GPS44XX series. The product features advanced reading capabilities on 2D and 1D barcodes, particularly when displayed on smartphones. The Magellan 900i provides a 30% boost in scanning performance compared to the GPS44XX range, offering an expanded Field of View (FoV) to read barcodes efficiently from different sources. The solution caters to the retail, manufacturing, healthcare, transportation, and logistics industries.

-

In March 2024, Cognex Corporation launched the 380 Modular Vision Tunnel, part of its Modular Vision Tunnel portfolio, leveraging the DataMan 380 barcode reader. The product provides high traceability and throughput owing to the use of the DataMan 380 barcode reader and an advanced system architecture. It has been designed to maximize depth of field, minimize footprint, and read the smallest codes, and offers a read rate of over 99% with four readers per tunnel.

Automatic Identification And Data Capture Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 78.56 billion

Revenue forecast in 2030

USD 136.86 billion

Growth rate

CAGR of 11.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; KSA; South Africa; UAE

Key companies profiled

NEC Corporation; Cognex Corporation; Datalogic S.p.A.; Honeywell International Inc.; Nordic ID Oyj; Panasonic Holdings Corporation; Radley, LLC; SICK AG; Toshiba Tec Corporation; Zebra Technologies Corp.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

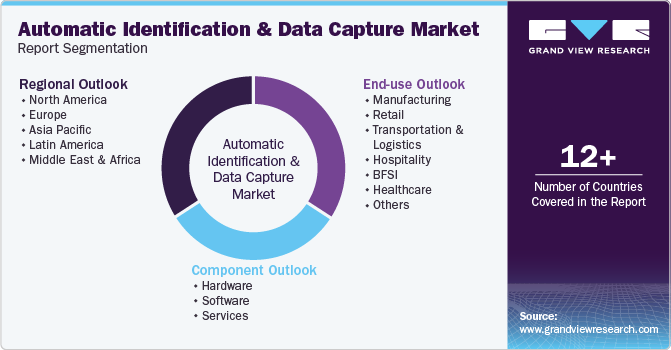

Global Automatic Identification And Data Capture Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global automatic identification and data capture market report based on component, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Hardware

-

RFID Reader

-

Barcode Scanner

-

Smart Cards

-

Optical Character Recognition Devices

-

Biometric Systems

-

Others

-

-

Software

-

Services

-

Integration & Installation Services

-

Support & Maintenance Services

-

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manufacturing

-

Retail

-

Transportation & Logistics

-

Hospitality

-

BFSI

-

Healthcare

-

Government

-

Energy & power

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.