- Home

- »

- Advanced Interior Materials

- »

-

Automotive Bushing Market Size, Industry Report, 2030GVR Report cover

![Automotive Bushing Market Size, Share & Trends Report]()

Automotive Bushing Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (HCV, LCV, Passenger), By Application (Suspension, Engine, Chassis, Interior, Exhaust, Transmission), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-439-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Bushing Market Summary

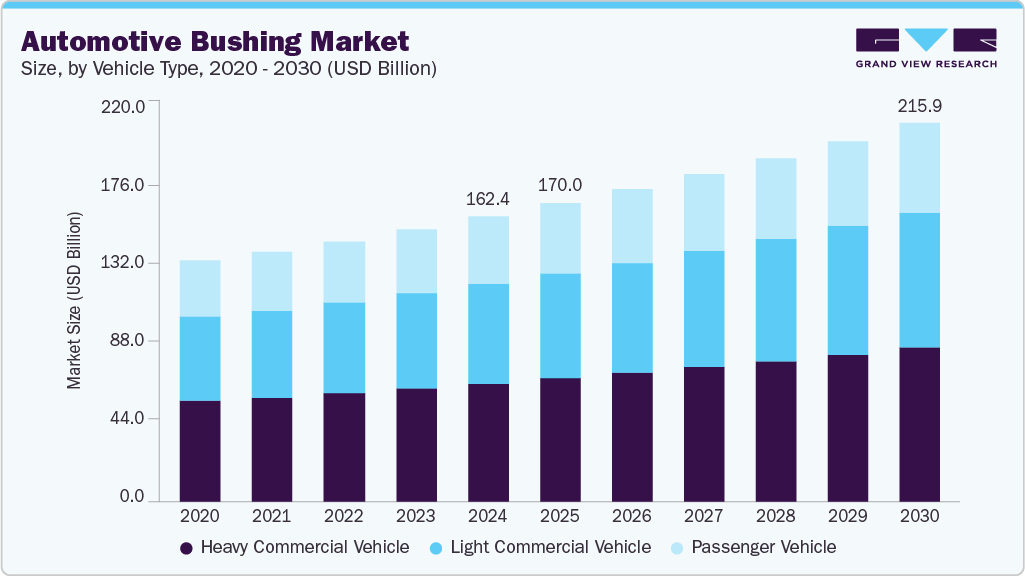

The global automotive bushing market size was estimated at USD 162.42 billion in 2024 and is projected to reach USD 215.98 billion by 2030, growing at a CAGR of 4.9% from 2025 to 2030. Increasing focus on vehicle safety and performance is a key driving factor that is encouraging the growth of the automotive bushings industry worldwide.

Key Market Trends & Insights

- The automotive bushing market in Asia Pacific dominated in 2024 with a revenue share of 60.3%.

- In 2024, China held the largest regional market share, driven by its massive automotive manufacturing sector and expanding vehicle production.

- By vehicle type, heavy commercial vehicle (HCV) segment dominated the market with a revenue share of 41.3% in 2024

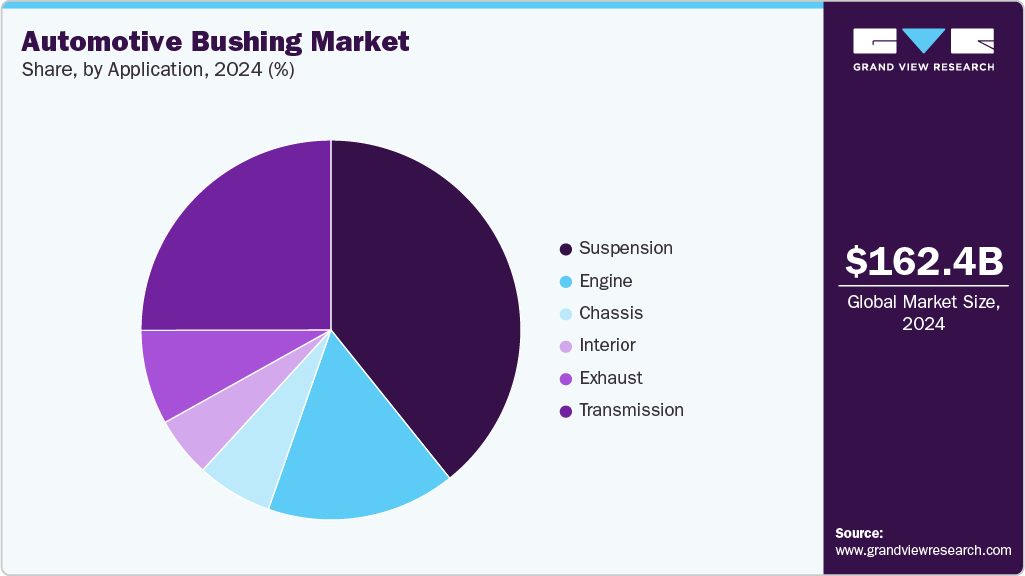

- By application, suspension segment accounted for the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 162.42 Billion

- 2030 Projected Market Size: USD 215.98 Billion

- CAGR (2025-2030): 4.9%

- Asia Pacific: Largest market in 2024

Automotive manufacturers and consumers emphasize enhanced vehicle handling, ride comfort, and safety features. This has propelled the demand for high-quality bushings-essential components across different automotive systems that help absorb shocks and reduce vibrations. Besides, improvements in the traditional bush designs and materials have further contributed to smoother driving experience and overall vehicle stability, leading to higher demand for advanced bushing solutions.Automotive bushings serve as critical components in a vehicle's suspension system, designed to reduce vibration, noise, and impact between metal parts. These bushings are typically made from a combination of rubber and metal, providing a cushion that absorbs shocks and minimizes the transmission of road imperfections to the vehicle's frame. By isolating different parts of the suspension system, bushings help maintain smooth and controlled handling, ensuring the ride remains comfortable and stable. The types of bushings can vary, including control arm bushings, sway bar bushings, and engine mount bushings, each serving a specific function within the vehicle's architecture.

Advancements in material science and increasing consumer demand for enhanced vehicle performance and comfort are major driving factors influencing the development and use of automotive bushings. As high-strength composites and synthetic elastomers become more prevalent, the use of bushings that offer improved durability, reduced noise, and better performance under various driving conditions is gaining traction. In addition, consumer expectations for a smooth, quiet, and responsive ride drive manufacturers to continually innovate and refine bushing technology to meet high standards of comfort and handling. Besides, the continuously growing vehicle manufacturing across different vehicle types and the growing significance of electric vehicles (EVs) are further encouraging the growth of certain bushings. For instance, the 9.6% growth in India’s automotive production (28 million units in FY 2023-24) boosts demand for automotive bushings, as every vehicle requires multiple bushings for suspension, engine mounts, and chassis systems. Similarly, growing vehicle production

However, one significant restraining factor is the cost of advanced bushing materials and manufacturing processes. While high-performance bushings can provide substantial benefits, their production can be more expensive than traditional rubber bushings. This increased cost can impact the vehicle's overall price, making it a consideration for manufacturers and consumers. Balancing performance and cost remains a challenge, as manufacturers must weigh the benefits of advanced bushings against their impact on vehicle affordability and market competitiveness.

Market Concentration & Characteristics

The market growth stage is low, and the pace of growth is accelerating. The automotive bushing market is experiencing moderate innovation, driven by the demand for lightweight and durable materials such as polyurethane and advanced composites, and the shift toward EVs requiring superior noise and vibration damping. However, innovations face challenges due to high R&D costs and slow adoption in budget vehicles, where cost sensitivity limits the integration of advanced solutions.

The automotive bushing industry is also characterized by moderate merger and acquisition (M&A) activity by the leading players. Suppliers are increasingly targeting emerging markets, including India and China, to capitalize on growing regional demand and cost-efficient manufacturing bases. For instance, in April 2025, NOVOSENSE and Continental expanded their partnership to include system-based chips and low-side switches. This collaboration aims to improve vehicle safety, efficiency, and reliability while strengthening their global supply chains.

The impact of regulations in the automotive bushing industry is moderate to high, driven by tightening global standards on noise, vibration, and harshness (NVH) control, emissions reduction, and material sustainability. Environmental and safety standards, such as emissions regulations and vehicle safety requirements, indirectly influence bushing design and materials. Regulations promoting lightweight vehicles and sustainability push manufacturers to innovate with eco-friendly materials.

The threat of substitutes is relatively moderate. Automotive bushings perform a specialized function in isolating vibrations and reducing noise between vehicle components. While alternative technologies like active suspension systems exist, they do not fully replace the need for bushing. Thus, substitutes pose a minimal immediate threat but could increase with future advancements in vehicle suspension technology.

The global automotive bushing market is moderately concentrated, with a few major companies leading the industry. These companies benefit from a strong brand reputation, wide distribution networks, and significant investments in research and development. Large automotive manufacturers and tier-1 suppliers are the main buyers, which increases the market’s concentration. To grow, companies focus on expanding their presence in different regions, especially in emerging markets like Asia-Pacific. They do this by forming partnerships, acquiring local businesses, and adapting their products to meet local regulations and customer needs.

Major Tier-1 suppliers, such as ContiTech Deutschland GmbH, Schaeffler AG, and many more, act as intermediaries between original equipment manufacturers (OEM) and bushing manufacturers, concentrating demand among fewer high-volume customers and leading to moderate end-use concentration.

Vehicle Type Insights

Heavy commercial vehicle (HCV) dominated the market with a revenue share of 41.3% in 2024 and is expected to grow significantly over the forecast period. Heavy commercial vehicles, including large trucks and buses, utilize automotive bushings in a more demanding context where durability and performance are of utmost importance. Bushings for such category vehicles are subjected to extreme loads and harsh driving conditions, including rough roads and high-speed travel. As a result, bushings for heavy commercial vehicles are designed to be exceptionally durable and resistant to wear and tear. They must also effectively manage vibrations and noise to enhance the driver’s comfort and vehicle stability. Innovations in bushing materials and designs, such as high-strength composites and advanced elastomers, are critical in addressing the unique challenges faced by heavy commercial vehicles, ensuring they can operate efficiently and reliably under severe conditions.

Light commercial vehicle type held the fastest growth in the automotive bushing market, registering a CAGR of 6.2% over the forecast period. In light commercial vehicles, such as delivery vans and small trucks, automotive bushings are essential for balancing load-bearing capacity with ride comfort. These vehicles often experience dynamic levels of stress and wear due to frequent stops, varying loads, and urban driving conditions. Consequently, bushings in light commercial vehicles need to be more robust to withstand the diverse demands of use while still providing adequate vibration damping and noise reduction. In 2024, the OICA correspondents' survey reported a global production of 20.90 million light commercial vehicles (LCV) units. This significant production volume further fuels the demand for automotive bushings, as light commercial vehicles require a wide range of bushings for suspension, steering, and engine components, contributing to market growth worldwide.

Application Insights

Based on application, the market is segmented into suspension, engine, chassis, interior, exhaust, and transmission. Among these, suspension accounted for the largest revenue share in 2024. In the automobile suspension system, automotive bushings are crucial for managing the interface between various components, including control arms, sway bars, and struts. These bushings provide a buffer that absorbs shocks and vibrations from the road, enhancing ride comfort and vehicle handling. By reducing the transfer of road imperfections and minimizing noise, bushings in the suspension system contribute significantly to the vehicle's overall stability and smoothness. In modern vehicles, advanced bushing materials and designs improve performance and durability, addressing the need for comfort and responsive handling in increasingly sophisticated suspension systems. Additionally, the growing demand for EVs has also contributed to the growing demand for suspension bushings.

The engine segment held the fastest growth in the automotive bushing market over the forecast period. Automotive bushings are used primarily in engine mounts to isolate engine vibrations and reduce the transfer of engine noise to the vehicle’s cabin. Engine mounts with high-quality bushings ensure the engine remains securely positioned while absorbing the vibrations and stresses generated during operation. This contributes to a quieter, more refined driving experience while protecting other vehicle components from undue stress. As automotive technology advances, including the introduction of electric and hybrid powertrains, the role of engine bushings is evolving. For instance, electric vehicles with different vibration characteristics than traditional internal combustion engines require specialized bushings to manage their powertrains' unique demands effectively.

Regional Insights

The automotive bushing market in North America is projected to grow at the fastest rate, with a CAGR of 5.4% during the forecast period. In North America, the consumption of automotive bushings is influenced by a strong focus on vehicle performance and consumer comfort. The U.S. automotive market, with its diverse range of vehicles from heavy-duty trucks to luxury sedans, drives demand for high-quality bushings that offer durability and enhanced ride quality. The popularity of pickup trucks and SUVs in North America has led to increased use of robust bushing designed to handle larger loads and off-road conditions. For example, the American automotive aftermarket industry frequently upgrades bushings to improve handling and comfort in performance vehicles and trucks, reflecting a consumer preference for high-performance enhancements and long-term durability.

U.S. Automotive Bushing Market Trends

In the North American automotive bushing market, the U.S. is projected to grow at the fastest rate over the forecast period. It also accounted for the largest regional revenue share in 2024. In the U.S., specific trends within the automotive bushing market focus on performance and customization. A strong aftermarket sector characterizes the U.S. automotive market. Consumers often seek to enhance their vehicles with upgraded bushings that improve handling, reduce noise, and extend component lifespan. This trend is evident in the popularity of aftermarket performance bushings for sports cars and trucks, designed to provide better control and comfort. Moreover, the rise of electric vehicles (EVs) in the U.S. market is driving demand for specialized bushings that address the unique characteristics of electric powertrains. Companies are developing advanced bushings to cater to the growing segment of EVs and hybrid vehicles, ensuring that they meet the specific needs of these new technologies.

Europe Automotive Bushing Market Trends

The automotive bushing market in Europe is expected to grow significantly over the forecast period. Europe, known for its emphasis on automotive engineering and environmental standards, is witnessing trends toward high-performance and eco-friendly automotive bushings. The production of 17.23 million units of motor vehicles in Europe in 2024, according to the OICA survey, directly impacts the automotive bushing market by driving demand for bushings used in various vehicle components, particularly in suspension and engine applications. The European market strongly emphasizes reducing vehicle emissions and improving fuel efficiency, leading to increased demand for lightweight and durable bushings. In addition, stringent noise and vibration regulations drive the adoption of advanced bushing materials that enhance comfort and compliance with environmental standards. Besides, the presence of key industry players including Continental AG and ZF Group also helps the market to perform significantly in the region.

Asia Pacific Automotive Bushing Market Trends

The automotive bushing market in Asia Pacific dominated in 2024 with a revenue share of 60.3% and is further expected to grow significantly over the forecast period. In the Asia Pacific region, the consumption of automotive bushings is experiencing significant growth due to the burgeoning automotive industry and increasing vehicle production rates. Countries such as China and India are the major drivers of this trend, with robust automotive manufacturing sectors and rising vehicle ownership. Expanding passenger and commercial vehicle segments in these markets have increased demand for advanced bushing technologies that improve riding comfort and vehicle performance.

In 2024, China held the largest regional market share, driven by its massive automotive manufacturing sector and expanding vehicle production. China's rising vehicle production, especially in electric vehicles (EVs), directly boosts demand for high-performance bushings critical for noise, vibration, and harshness (NVH) control. For example, in April 2024, according to the publication of the U.S. International Trade Commission, Chinese EV exports increased 1,016% from 2018 to 2023, to nearly 1.6 million EVs exported in 2023, boosting demand for automotive bushings, essential for vehicle suspension and vibration control. Increased EV production drives growth and innovation in the bushing market, as EVs require specialized, high-performance components. This export surge directly supports the expansion of China’s automotive bushing industry.

Key Companies & Market Share Insights

Some of the key players operating in the market are ContiTech Deutschland GmbH, Schaeffler AG, Powerflex USA, MEYLE AG, Vogelsang Fastener Solutions, Teknorot and others. Global companies focus on capacity expansion, signing partnership agreements with distributors, and various other operational strategies to gain an edge in the competitive market.

-

ContiTech Deutschland GmbH, a division of Continental AG, excels in the automotive sector with a diverse range of high-quality automotive bushing products. Specializing in vibration control and noise reduction, ContiTech’s bushings are designed to enhance vehicle performance and comfort. Their portfolio includes engine mountings, transmission mounts, and suspension bushings, all engineered to meet stringent OEM standards. Leveraging advanced materials and innovative technologies, ContiTech’s automotive bushings offer superior durability and performance, contributing to smoother rides and extended vehicle life.

-

Schaeffler AG is a global supplier of automotive components, including a comprehensive range of automotive bushings integral to their product lineup. Their automotive bushing portfolio encompasses engine, transmission, and suspension systems solutions, focusing on optimizing vehicle dynamics and reducing NVH (Noise, Vibration, and Harshness). With a strong emphasis on precision engineering, Schaeffler's products are designed to meet the demanding requirements of modern vehicles while enhancing overall driving comfort.

Key Automotive Bushing Companies:

The following are the leading companies in the automotive bushing market. These companies collectively hold the largest market share and dictate industry trends.

- Powerflex USA

- GYCX Factory

- MEYLE AG

- ContiTech Deutschland GmbH

- Vogelsang Fastener Solutions

- Schaeffler AG

- Teknorot

- Kesaria Rubber Industries Pvt. Ltd.

- Continental AG (Germany)

- Vibracoustic

Recent Developments

-

In September 2024, Continental AG introduced a new generation of hydraulic wheelset guiding bushings for train bogies, offering significantly improved pressure adaptation compared to conventional models.

-

In January 2024, Rheinmetall AG secured a significant new contract for engine components from a prominent, internationally operating vehicle manufacturer. The order comprises rocker arm bushings for various engine variants within the heavy transport sector.

-

In January 2024, Jiangyin Fangchen Auto Parts Co., Ltd. introduced its latest Suspension Bushing Sets designed for Mercedes-Benz, BMW, and Audi series vehicles.

Automotive Bushing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 170.03 billion

Revenue forecast in 2030

USD 215.98 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Saudi Arabia and South Africa

Key companies profiled

Powerflex USA, GYCX Factory, MEYLE AG, ContiTech Deutschland GmbH, Vogelsang Fastener Solutions, Schaeffler AG, Teknorot, Kesaria Rubber Industries Pvt. Ltd., Continental AG, and Vibracoustic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Bushing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive bushing market report based on vehicle type, application, and region:

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Heavy Commercial Vehicle

-

Light Commercial Vehicle

-

Passenger Vehicle

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Suspension

-

Engine

-

Chassis

-

Interior

-

Exhaust

-

Transmission

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive bushing market size was estimated at USD 155.24 billion in 2023 and is expected to reach USD 162.41 billion in 2024.

b. The global automotive bushing market is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030 to reach USD 215.98 billion by 2030.

b. Asia Pacific accounted for largest revenue share of 60.38% in 2023. The consumption of automotive bushings is experiencing significant growth due to the burgeoning automotive industry and increasing vehicle production rates

b. Some key players operating in the automotive bushing market include Powerflex USA, GYCX Factory, MEYLE AG, ContiTech Deutschland GmbH, Vogelsang Fastener Solutions, Schaeffler AG, Teknorot, Barberi Rubinetterie Industriali S.r.l., Xiamen Liangju Rubber Technology Co., Ltd., and Kesaria Rubber Industries Pvt. Ltd.

b. One major factor driving the demand for automotive bushings in the global market is the increasing focus on vehicle safety and performance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.