- Home

- »

- Advanced Interior Materials

- »

-

Automotive Composite Market Size, Industry Report, 2033GVR Report cover

![Automotive Composite Market Size, Share & Trends Report]()

Automotive Composite Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Polymer Matrix Composites, Metal Matrix Composites, Ceramic Matrix Composites), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-839-8

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Composite Market Summary

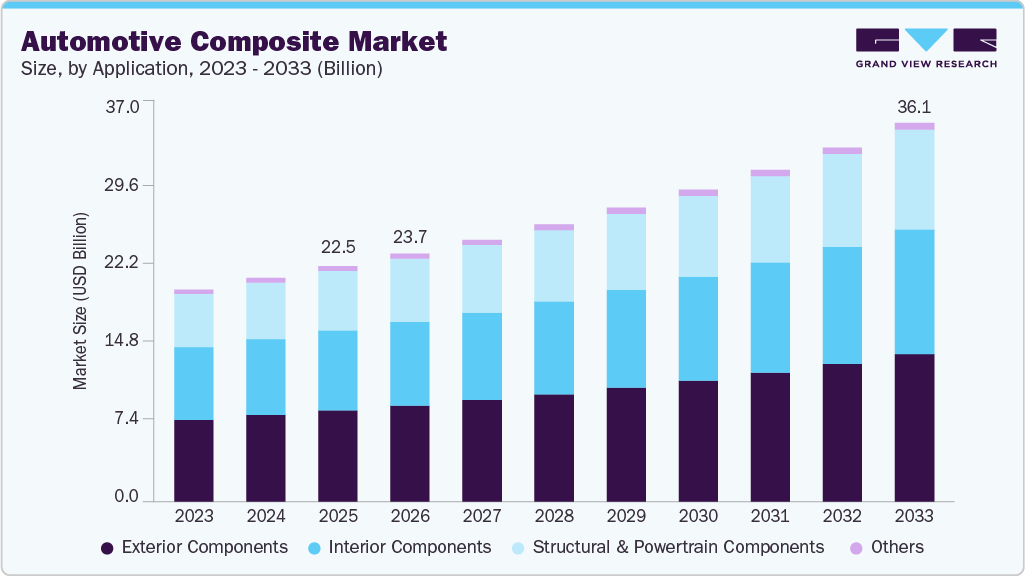

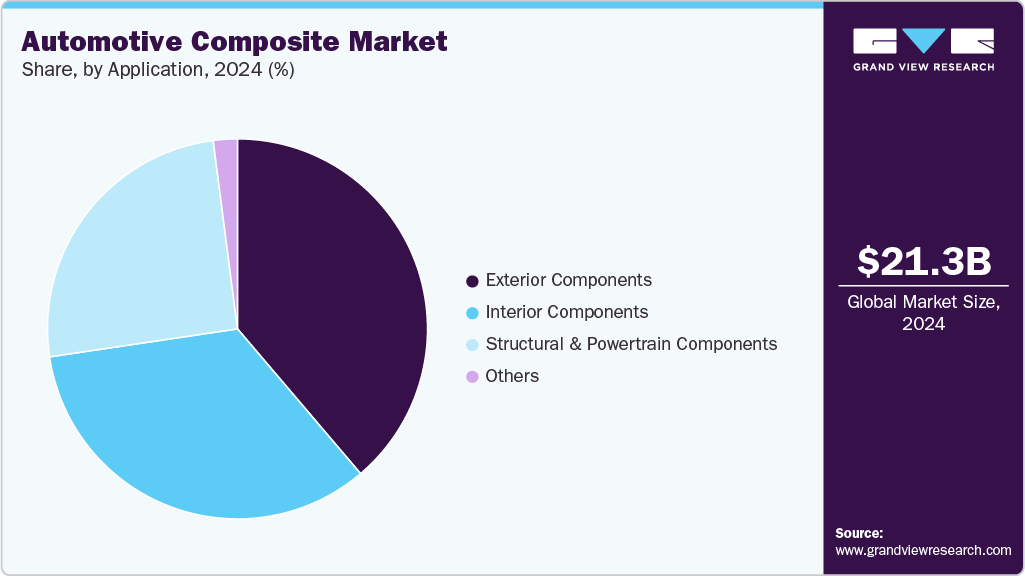

The global automotive composite market size was estimated at USD 21.33 billion in 2024 and is projected to reach USD 36.13 billion by 2033, growing at a CAGR of 6.1% from 2025 to 2033. Tightening global emission standards are pushing manufacturers to adopt materials and technologies that contribute to overall vehicular sustainability.

Key Market Trends & Insights

- Asia Pacific dominated the automotive composites market with the largest revenue share of 50.8% in 2024.

- The China automotive composite market is expected to grow during the forecast period.

- By product, the metal matrix composites segment is expected to grow at the fastest CAGR of 6.7% over the forecast period.

- By application, the structural & powertrain components segment is expected to grow at the fastest CAGR of 6.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 21.33 Billion

- 2033 Projected Market Size: USD 36.13 Billion

- CAGR (2025-2033): 6.1%

- Asia Pacific: Largest market in 2024

Composites help lower the overall emissions during both the production and operational phases of a vehicle's lifecycle. Governments and regulatory bodies are implementing policies that encourage the adoption of advanced materials in vehicles to meet environmental goals. This has led to an increased incorporation of composites in exterior body parts, under-the-hood components, and structural applications, thereby driving market growth across segments. As the global shift toward electric mobility accelerates, composites are playing a critical role in the design and engineering of electric and hybrid vehicles. Automakers are utilizing composite materials to offset the weight of heavy battery systems and improve driving range. Lightweight and durable composites not only enhance performance but also contribute to improved thermal management and design flexibility in EVs. This trend is expected to intensify as EV adoption grows worldwide, providing significant opportunities for composite manufacturers.

Technological progress in composite manufacturing processes, such as automated fiber placement, resin transfer molding, and 3D printing, is reducing production costs and cycle times. These advancements are making composites more commercially viable for high-volume automotive production. Additionally, innovations in hybrid composites and recyclable thermoplastic composites are improving material properties such as strength, impact resistance, and sustainability. These developments are expanding the application scope of composites from luxury and performance cars to mainstream passenger and commercial vehicles.

Market Concentration & Characteristics

The global automotive composites market is moderately concentrated, with several key players dominating the supply of advanced materials and components across regions. Companies such as Toray Industries, Hexcel Corporation, SGL Carbon, and Teijin Limited play leading roles through extensive R&D, vertically integrated operations, and strategic partnerships with automotive OEMs. The market is characterized by a high degree of innovation, as manufacturers continuously develop new resin systems, fiber reinforcements, and manufacturing techniques to meet evolving performance and sustainability demands. Technological advancements, such as fast-curing thermoset resins and high-volume production methods, are making composites increasingly suitable for large-scale automotive manufacturing, reducing the cost barrier traditionally associated with these materials.

Mergers and acquisitions are a recurring feature of the automotive composite industry, driven by the need to expand capabilities, integrate value chains, and enter new geographic territories. Regulatory frameworks, particularly those targeting vehicle emissions and recyclability, significantly influence material choices and design strategies. Composite materials benefit from these regulations due to their lightweight and energy-efficient properties. However, the availability of substitutes such as high-strength steel and aluminum alloys poses competitive pressure, especially in cost-sensitive segments. End-use concentration is notable in electric vehicles, performance vehicles, and high-end passenger cars. However, usage is gradually expanding into commercial vehicles and mid-range segments as cost-effectiveness improves and production scalability increases.

Product Insights

The polymer matrix composites segment dominated the market and accounted for the largest revenue share of 74.92% in 2024, driven by the growing demand for lightweight and durable materials in vehicle manufacturing. PMCs, which typically include thermoset and thermoplastic matrices reinforced with glass or carbon fibers, offer excellent mechanical strength, corrosion resistance, and design flexibility. These properties make them particularly valuable for applications such as body panels, bumpers, dashboards, and structural reinforcements. The ability of PMCs to reduce overall vehicle weight directly supports automakers in achieving improved fuel efficiency and lower emissions, aligning with global environmental regulations.

The metal matrix composites segment is expected to grow at the fastest CAGR of 6.7% over the forecast period, due to its superior mechanical properties and thermal performance. MMCs, which typically combine metals such as aluminum or magnesium with ceramic or metallic reinforcements, offer high strength-to-weight ratios, excellent wear resistance, and improved dimensional stability under thermal stress. These characteristics make them ideal for automotive components that operate under high mechanical loads or extreme temperatures, such as engine parts, brake systems, and drivetrain elements. As automakers pursue lighter and more durable materials to meet stringent efficiency and durability standards, MMCs present a compelling alternative to conventional metals.

Application Insights

Exterior components led the automotive composite industry, with a 38.78% share in 2024, driven by the increasing need for lightweight and aerodynamically efficient vehicle designs. Composite materials such as carbon fiber-reinforced polymers (CFRP) and glass fiber-reinforced plastics (GFRP) are widely used in body panels, bumpers, hoods, fenders, and roof systems due to their excellent strength-to-weight ratio. These materials help reduce overall vehicle weight, leading to improved fuel efficiency and reduced emissions.

The structural & powertrain components segment is expected to grow at the fastest CAGR of 6.6% over the forecast period. Advancements in composite manufacturing technologies such as high-pressure resin transfer molding (HP-RTM), compression molding, and thermoplastic composite processing are enabling the cost-effective mass production of structural and powertrain parts. These innovations are reducing cycle times and production costs, making composites a viable choice for a broader range of vehicle models. Additionally, regulatory mandates on vehicle emissions and crash safety performance are encouraging manufacturers to incorporate composite materials into structural zones that must absorb and distribute impact energy effectively.

Regional Insights

Asia Pacific dominated the automotive composite market with a 50.8% share in 2024, driven by the rapid expansion of the automotive manufacturing sector, particularly in countries such as India, Japan, South Korea, and Southeast Asian nations. The region’s cost-competitive production environment and rising demand for fuel-efficient vehicles support the adoption of lightweight composite materials. Moreover, increasing investments in electric vehicle (EV) infrastructure and the presence of global and regional automakers accelerating EV production are further contributing to the growth of composite usage across both structural and interior applications.

China Automotive Composite Market Trends

The China automotive composite market is expected to grow during the forecast period. In China, government policies promoting electric mobility and stringent regulations on fuel consumption and emissions are key drivers of the automotive composites market. The country is the world’s largest EV market, and automakers are increasingly using composite materials to reduce vehicle weight and extend battery range. Additionally, China’s "Made in China 2025" initiative encourages the development of advanced manufacturing technologies, including lightweight materials like carbon fiber composites, supporting both domestic innovation and international competitiveness in the automotive sector.

North America Automotive Composite Market Trends

In North America, the growth of the automotive composites industry is driven by strong demand for performance vehicles, increased adoption of electric vehicles, and a well-established automotive research and development ecosystem. Automakers are leveraging composites for structural applications to meet Corporate Average Fuel Economy (CAFE) standards and reduce vehicle emissions. The presence of major composite manufacturers, coupled with ongoing innovation in high-volume composite processing, supports the integration of advanced materials into mass-market vehicle platforms across the region.

The U.S. automotive composites industry’s growth is fueled by a combination of federal regulatory mandates for emissions reduction and the increasing production of high-performance and electric vehicles. Automakers are prioritizing lightweight construction techniques to enhance vehicle efficiency and range. The U.S. also benefits from strong technological capabilities and a well-developed supply chain for advanced composite materials, which supports the domestic production of structurally complex automotive components.

Europe Automotive Composite Market Trends

The rapid advancement of composite manufacturing technologies in Europe is a critical driver propelling market growth. Techniques such as automated fiber placement, resin transfer molding, and high-pressure resin infusion have become more efficient and cost-effective. These advancements have reduced production times and enabled high-volume manufacturing, making composites increasingly viable not only for luxury and sports vehicles but also for mass-market passenger cars. This shift is allowing European automakers to integrate composite components into a broader range of vehicle models.

Germany’s automotive composite market growth is driven by the country’s leadership in automotive engineering and innovation. The presence of premium and performance-focused automakers such as BMW, Audi, and Mercedes-Benz has encouraged early and extensive adoption of carbon fiber and hybrid composites. These materials are used in both structural parts and body panels to enhance vehicle performance, safety, and aesthetics. Additionally, Germany’s commitment to sustainability and e-mobility supports further integration of lightweight composite solutions.

Central & South America Automotive Composite Market Trends

In Central and South America, the automotive composites industry is influenced by the growing demand for cost-effective and fuel-efficient vehicles. Countries like Brazil and Argentina are witnessing increased vehicle production and exports, which is fostering interest in lightweight materials to improve overall vehicle efficiency. Though the market is still developing, local automakers are gradually exploring composite applications for non-structural parts and interiors to reduce manufacturing costs and meet regulatory standards.

Middle East & Africa Automotive Composite Market Trends

The automotive composites industry in the Middle East and Africa is gradually gaining momentum due to the region’s growing focus on local automotive manufacturing and diversification from oil-based economies. Countries like the UAE and South Africa are investing in advanced automotive technologies and sustainable transportation. Although the market is at a nascent stage, the need for durable, heat-resistant, and lightweight materials in vehicles operating in harsh climatic conditions is driving interest in composite solutions, particularly for commercial and utility vehicles.

Key Automotive Composite Company Insights

Some of the key players operating in the market include Solvay and Toray Industries, Inc.

-

Solvay is a Belgium-based global leader in advanced materials and specialty chemicals, with a strong presence in the automotive composites market. The company offers a broad portfolio of high-performance thermoplastic and thermoset composites, including carbon fiber-reinforced polymers and specialty resins. Solvay’s automotive composite materials are widely used in structural, powertrain, and interior components to reduce vehicle weight and improve energy efficiency. Their solutions support both internal combustion and electric vehicles, enabling compliance with stringent emission standards and sustainability goals.

-

Toray Industries, headquartered in Japan, is a leading manufacturer of carbon fiber and composite materials with a significant focus on automotive applications. The company’s product offerings include carbon fiber-reinforced plastics (CFRP), thermoplastic composites, and prepregs that are utilized in structural body parts, chassis components, and battery enclosures. Toray’s innovations are widely adopted by global automakers to achieve weight reduction, performance enhancement, and improved fuel economy.

SGL Carbon and Teijin Limited are some of the emerging participants in the automotive composite market.

-

SGL Carbon is a Germany-based company known for its expertise in carbon-based materials and solutions for the mobility and energy sectors. In the automotive composites market, SGL Carbon provides carbon fiber fabrics, non-crimp fabrics, and composite components that are integrated into structural vehicle parts, such as cross beams, roof segments, and battery housings. The company collaborates closely with OEMs to develop lightweight, durable components that meet modern vehicle design and safety requirements, particularly in electric and premium vehicle segments.

-

Teijin Limited, headquartered in Japan, is a diversified materials company with a strong foothold in the automotive composites space. The company specializes in carbon fiber, aramid fiber, and thermoplastic composite materials designed for use in structural, exterior, and interior vehicle components. Teijin’s advanced solutions support weight reduction, energy absorption, and thermal management, making them ideal for next-generation automotive platforms. The company also emphasizes sustainable manufacturing and recyclability in its composite product lines, aligning with the industry's shift toward eco-friendly materials.

Key Automotive Composite Companies:

The following are the leading companies in the automotive composite market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- Toray Industries, Inc.

- SGL Carbon

- Teijin Limited

- Hexcel Corporation

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.

- Johns Manville

- Gurit

- Plasan Carbon Composites

- TPI Composites

- GMS Composites

- IDI Composites International

- Revchem Composites

- Formaplex

- Owens Corning

Recent Developments

-

In October 2023, Toray Industries, Inc. introduced TORAYCA carbon fiber, an advanced lightweight material designed to enhance the performance of carbon-fiber-reinforced plastics. This innovation not only reduces weight across a range of applications but also supports environmental sustainability by improving overall efficiency. With its exceptional properties, TORAYCA is set to make a significant impact in industries like aerospace and automotive, contributing to improved fuel economy and lower carbon emissions.

Automotive Composite Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.46 billion

Revenue forecast in 2033

USD 36.13 billion

Growth rate

CAGR of 6.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2024

Forecast period

2025 - 2033

Report Updated

June 2025

Quantitative units

Revenue in USD million/billion, volume in Kilotons and CAGR from 2025 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; Morocco; South Africa

Key companies profiled

Solvay; Toray Industries, Inc.; SGL Carbon; Teijin Limited; Hexcel Corporation; Mitsubishi Chemical Carbon Fiber and Composites, Inc.; Johns Manville; Gurit; Plasan Carbon Composites; TPI Composites; GMS Composites; IDI Composites International; Revchem Composites; Formaplex; Owens Corning

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Composite Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive composite market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polymer Matrix Composites

-

Glass Fiber Reinforced Polymer Composite

-

Natural Fiber Reinforced Polymer Composite

-

Carbon Fiber Reinforced Polymer Composite

-

-

Metal Matrix Composites

-

Ceramic Matrix Composites

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Interior Components

-

Exterior Components

-

Structural & Powertrain Components

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Morocco

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.