- Home

- »

- Automotive & Transportation

- »

-

Automotive Digital Cockpit Market Size & Share Report, 2030GVR Report cover

![Automotive Digital Cockpit Market Size, Share & Trends Report]()

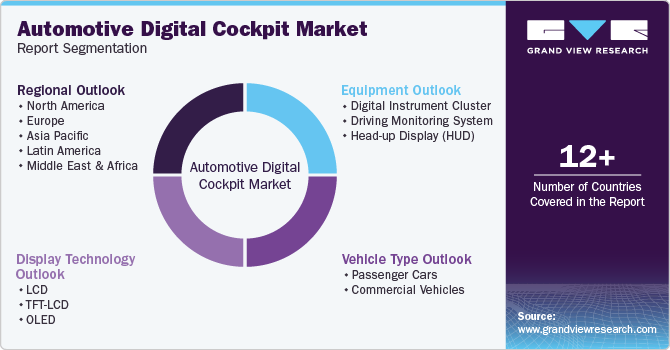

Automotive Digital Cockpit Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (Digital Instrument Cluster, Driving Monitoring System), By Display Technology, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-381-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Digital Cockpit Market Summary

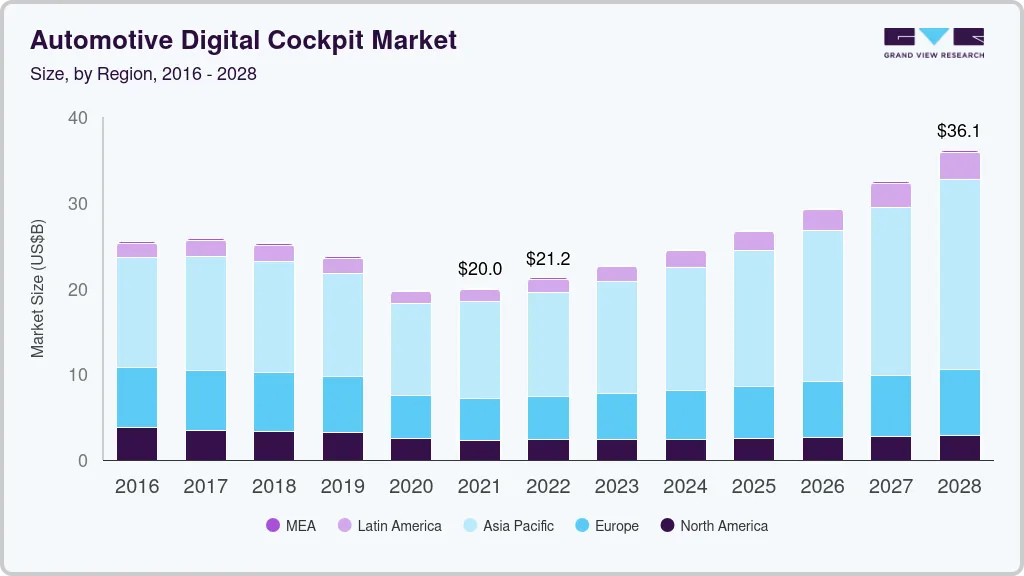

The global automotive digital cockpit market size was estimated at USD 24.56 billion in 2024 and is projected to reach USD 43.24 billion by 2030, growing at a CAGR of 10.1% from 2025 to 2030. Due to the increasing pace of urbanization and rising disposable income levels, growing sales of passenger cars and commercial vehicles have compelled manufacturers to launch vehicle models that integrate advanced digital cockpit solutions.

Key Market Trends & Insights

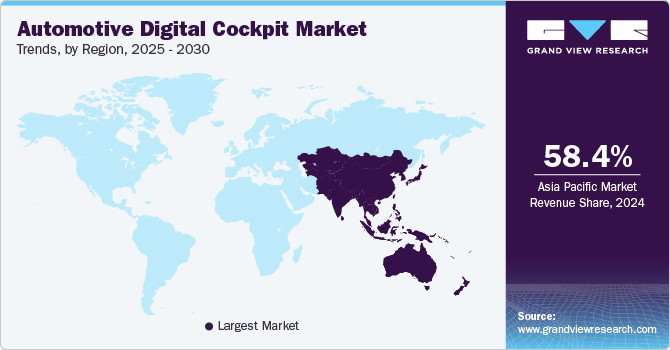

- Asia Pacific accounted for the largest revenue share of 58.4% in the global automotive digital cockpit market in 2024.

- China accounted for a leading revenue share in the regional market in 2024.

- By equipment, the digital instrument cluster segment accounted for the largest revenue share of 64.0% in 2024 and is expected to maintain its leading position in the coming years.

- By display technology, the TFT-LCD segment accounted for the largest revenue share in the global market in 2024.

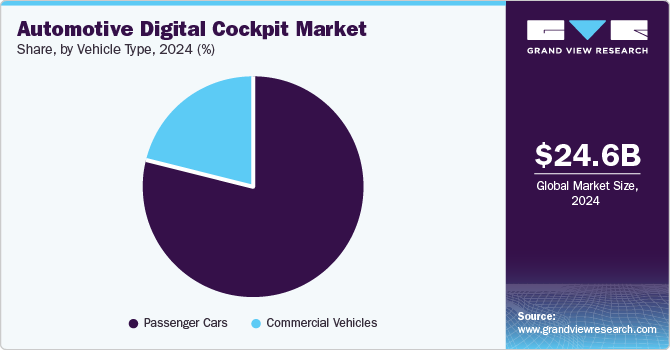

- By vehicle type, the passenger cars segment accounted for a dominant revenue share in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 24.56 Billion

- 2028 Projected Market Size: USD 43.24 Billion

- CAGR (2025-2030): 10.1%

- Asia Pacific: Largest market in 2024

According to data from the International Organization of Motor Vehicle Manufacturers (OICA), total sales of passenger cars and commercial vehicles globally crossed 92.7 million in 2023, which was a sharp increase from the sales figure of around 82.9 million in 2022. Increasing awareness and popularity of electric vehicles in developed markets is another notable factor that has driven the adoption of these systems in vehicles. Using a digital cockpit enables multiple displays to be seamlessly connected, with each display accessing data from a centralized source that enables synchronization. This ensures that information regarding various functions can be easily obtained, which helps optimize the driving experience.

Rising smartphone penetration and widespread proliferation of the Internet have resulted in the extensive adoption of vehicles with digital cockpit systems, as they enable drivers to utilize various smartphone features without taking their hands off the wheel. Smartphone integration features such as Android Auto and Apple CarPlay allow users to access applications such as phone, music, and calendar via the car’s dashboard in a safe manner that does not divert their focus from driving. Furthermore, the integration of AI to offer personalized experiences is expected to shape market growth during the forecast period, as automakers are leveraging this technology to customize the driving experience by understanding driver preferences and accordingly adjusting the cockpit display. For instance, Mercedes Benz, through its Mercedes-Benz User Experience (MBUX) infotainment system, integrates Advanced Driver Assistance Systems (ADAS), intelligent voice control, and a range of display solutions that help enhance interactions between the driver and the cockpit.

Innovations in display technology, artificial intelligence, and human-machine interfaces (HMIs) enable the development of more sophisticated and responsive digital cockpits, driving demand from both manufacturers and consumers. Constant developments in the AI space and the emergence of Generative AI are expected to boost market expansion in the coming years, with tech-based organizations looking to build upon the use cases of these technologies. For instance, in October 2024, Qualcomm announced a multi-year strategic partnership with Google to develop Generative AI-based digital cockpit solutions and software-defined vehicles (SDV). This collaboration would leverage the Snapdragon Digital Chassis and multiple in-vehicle technologies by Google, including Android Automotive OS and Google Cloud, to establish a standardized reference framework, enabling the creation of Gen AI-enabled in-car experiences.

Equipment Insights

The digital instrument cluster segment accounted for the largest revenue share of 64.0% in 2024 and is expected to maintain its leading position in the coming years. These systems are a collection of gauges and displays that provide drivers with real-time information about their vehicles. They have attained substantial popularity due to their ability to display information in a clear and concise manner, which helps enhance the overall driving experience. Digital instrument clusters offer a range of features that have driven their market demand. These include customizable displays that allow users to tailor the layout and information shown, such as speed, navigation, and multimedia controls, to their preferences. They also allow integration of various functions, including navigation, vehicle diagnostics, and driver assistance alerts, into a single display for convenience. Recent advancements have made it possible to support voice commands and touch interaction, enhancing usability while minimizing distractions.

The head-up display (HUD) segment is anticipated to advance at the fastest CAGR from 2025 to 2030. This component of the digital cockpit displays useful information directly in the line of sight of the driver, enabling them to monitor speed, understand routes, and be aware of warning signals that may otherwise be missed on secondary displays. A number of innovations have resulted in the substantial growth of this segment. For instance, modern HUDs increasingly utilize augmented reality (AR) to overlay navigation directions, speed limits, and hazard alerts onto the real-world view, making it easier for drivers to comprehend information without diverting their attention. Moreover, some HUDs offer 3D visuals that can enhance depth perception for navigation cues and other critical information, improving situational awareness. Another advancement has been the incorporation of eye tracking technologies, which can accurately detect where the driver is looking, adjusting displayed information accordingly to ensure that it remains relevant and in focus. In January 2022, at the CES 2022 event, Panasonic introduced its Augmented Reality HUD (AR HUD) 2.0 solution, which includes a patented eye tracking system (ETS). This technology identifies a driver’s height and head movement while driving and dynamically adjusts the images in the “eyebox,” enabling drivers to solely view clear and accurately positioned high-resolution icons and overlays.

Display Technology Insights

The TFT-LCD segment accounted for the largest revenue share in the global market in 2024, owing to the extensive usage of this display type in digital cockpits due to their versatility and performance. TFT (Thin-Film Transistor) LCDs can provide high-resolution displays, enabling crisp and clear visuals for information such as speed, navigation, and multimedia content. They offer excellent viewing angles, allowing drivers and passengers to see the display clearly from different positions in the vehicle. The technology further allows for quick response times, reducing motion blur and ensuring that dynamic information, such as navigation changes, is displayed smoothly. They can be easily integrated with various vehicle systems, including infotainment, navigation, and driver assistance technologies, providing a cohesive user experience. Thus, benefits such as improved safety, enhanced user experience, and support for modern aesthetics are important factors enabling segment expansion.

The OLED segment is anticipated to expand at the fastest CAGR during the forecast period, as this technology has gained significant traction in recent years due to its advantages over conventional LCDs. OLEDs provide deeper blacks and higher contrast ratios, enhancing visibility and readability of information in various lighting conditions. Additionally, OLED displays can produce a wide color gamut, resulting in vibrant colors that improve the overall aesthetic of the digital cockpit. These panels are generally thinner and lighter than LCDs, allowing for more flexible design options and reduced weight in the vehicle. Furthermore, the technology allows for flexible displays, enabling innovative designs such as curved screens that can enhance the cockpit's layout. Many display technology companies are developing OLED solutions and partnering with leading automakers to incorporate these products in newer vehicle models. For instance, in April 2023, Samsung Display signed an agreement with Ferrari at the former’s Asan campus in Korea to develop an OLED display that would be implemented in Ferrari’s next-generation models.

Vehicle Type Insights

The passenger cars segment accounted for a dominant revenue share in the global market in 2024, on account of the increasing sales of these vehicles and a steadily rising demand for digital cockpit systems by consumers. As per the OICA, more than 70% of global vehicle sales in 2023 came from passenger vehicles, aided by higher living standards and growing disposable income levels. Rapid emergence and developments in the autonomous vehicles space and the incorporation of connected features by leading manufacturers are expected to maintain this segment’s position as the leading end-user of digital cockpits in the coming years.

The commercial vehicles segment is expected to advance at a faster CAGR from 2025 to 2030, owing to the increasing integration of vehicle-to-vehicle communications technologies for fleet management. Digital cockpits in commercial vehicles transform how drivers interact with their vehicles, enhancing safety, efficiency, and overall usability. Digital displays provide real-time data on vehicle performance, fuel efficiency, navigation, and diagnostics, helping drivers make informed decisions. Many digital cockpits offer connectivity features that allow fleet managers to monitor vehicle performance, location, and driver behavior through integrated telematics. Moreover, integrating advanced driver-assistance systems enhances safety with features including lane departure warnings, adaptive cruise control, and collision avoidance alerts. Inbuilt communication systems enable drivers to stay connected with dispatchers, receive job updates, and manage logistics efficiently. These features ensure increased productivity and efficiency and smooth and seamless operations.

Regional Insights

Asia Pacific Automotive Digital Cockpit Market Trends

Asia Pacific accounted for the largest revenue share of 58.4% in the global automotive digital cockpit market in 2024. The increasing pace of vehicle sales in the region and the need for advanced vehicular technologies to improve passenger experience has compelled manufacturers to launch innovative solutions in this industry. Furthermore, the rapidly growing popularity of electric vehicles, particularly in economies such as India and China, has propelled market expansion in recent years. Rising consumer expectations for connectivity, personalization, and seamless integration with smartphones and other devices are pushing manufacturers to adopt digital cockpit systems. Additionally, intensifying competition among regional automakers to provide premium features in their vehicle models has compelled them to partner with organizations such as DENSO, Panasonic, and HYUNDAI MOBIS, all of which have a notable regional presence.

China accounted for a leading revenue share in the regional market in 2024. The fast pace of urbanization in the economy has significantly improved the living standards of citizens, leading to the rising demand for automobiles. Moreover, with the consistent push toward electric mobility by the Chinese government, there has been substantial growth in sales of EVs that incorporate head-up displays, voice assistants, and infotainment systems. According to a report by Canalys published in July 2024 , the proliferation rate of digital cockpits has increased steadily in the country, rising to 66% in 2023. This number is expected to reach 80% by 2025, enabled by a strong focus on software ecosystems and intelligent hardware integration. Artificial intelligence (AI) is also expected to play a vital role in this market, aiding constant advancements in driver monitoring and environmental feedback.

Europe Automotive Digital Cockpit Market Trends

Europe is anticipated to advance at a substantial CAGR during the forecast period because of the well-established automotive industry in regional economies such as Germany, the UK, and Spain. Moreover, ongoing technological advancements, rapidly evolving consumer preferences, and the shift toward electric and autonomous vehicles are expected to drive market advancements in the coming years. European manufacturers are integrating advanced technologies such as touchscreen displays, augmented reality, and voice recognition into digital cockpits, enhancing driver experience and functionality. Governments and technological leaders aim to accelerate the transformation of automotive AI and maintain the competitiveness of this sector in this region. Stricter regulations regarding safety and emissions in Europe are pushing automakers to innovate, with digital cockpits considered to be useful in providing essential information and controls that support compliance with these regulations.

Latin America Automotive Digital Cockpit Market Trends

The Latin America region is anticipated to advance at the fastest CAGR from 2025 to 2030. Economies such as Brazil and Mexico have seen large-scale development activities that have increased passenger and commercial vehicle sales. Consumer preferences in this region are rapidly shifting towards the adoption of connected vehicles owing to the increasing accessibility of advanced technologies and the growing presence of major digital cockpit solution providers. As a result, automotive manufacturers are introducing advanced models equipped with such systems. For instance, in November 2023, Citroën announced the launch of the C3 Aircross in Brazil, specifically developing the model for the South American market. It features a novel seven-seat configuration that offers convenience and flexibility, three driving modes, and specially tuned suspensions to ensure a smooth ride. The SUV includes a customizable 7-inch TFT digital dashboard and the Citroën Connect infotainment system with a 10-inch touchscreen equipped with Apple CarPlay and Android Auto.

Key Automotive Digital Cockpit Company Insights

Some of the major companies involved in the global automotive digital cockpit market include HYUNDAI MOBIS, Robert Bosch, and DENSO CORPORATION, among others.

-

HYUNDAI MOBIS, a subsidiary of the Hyundai Motor Group, is a South Korean automotive parts company primarily engaged in manufacturing automotive components and modules. It produces a wide range of automotive parts, including chassis, safety systems, and electronic parts and is also involved in the development of integrated modules, such as front-end modules and cockpit modules. The company invests heavily in developing technologies related to electric vehicles (EVs), autonomous driving, and connected car solutions. Much of its investment is directed towards research and development, particularly in areas including vehicle electrification and advanced driver-assistance systems (ADAS). HYUNDAI MOBIS has manufacturing plants and R&D centers globally, including locations in South Korea, the U.S., Europe, and China.

-

DENSO CORPORATION is a Japan-based global automotive parts manufacturer that develops and produces various products, including climate control systems, airbag systems, and spark plugs. DENSO also produces non-automotive components such as household heating equipment and industrial robots.

Key Automotive Digital Cockpit Companies:

The following are the leading companies in the automotive digital cockpit market. These companies collectively hold the largest market share and dictate industry trends.

- HYUNDAI MOBIS

- Robert Bosch GmbH

- Visteon Corporation

- Continental AG

- DENSO CORPORATION

- Panasonic Holdings Corporation

- Pioneer Corporation

- SAMSUNG

- FORVIA

- Garmin Ltd.

Recent Developments

-

In October 2024, HYUNDAI MOBIS announced the signing of a Business Cooperation Agreement with the German optoelectronics company ZEISS. This partnership would oversee the development of the ‘Holographic Windshield Display' at the former’s technical research centre located in Yongin, Gyeonggi-do. The Holographic HUD technology leverages the windshield as a transparent display to monitor a range of driving information and can also utilize infotainment features such as videos, music, and games simultaneously. The companies aim to begin mass production of this technology in 2027.

-

In September 2024, Garmin introduced the Garmin Dash Cam X series, which includes four models of high-quality dash cameras. The product range comprises the Garmin Dash Cam X110, X210, Mini 3, and the X310. These compact systems offer video resolutions of up to 4K Ultra High Definition (UHD) that can act as proof in cases of unexpected traffic incidents. The dashcam series is integrated with the ‘Garmin Clarity’ polarizer lens enhancement to reduce windshield glare, along with Garmin Clarity HDR optics that enable sharp details to be captured in both low light and very bright conditions.

Automotive Digital Cockpit Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.76 billion

Revenue forecast in 2030

USD 43.24 billion

Growth Rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, volume in units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, display technology, vehicle type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Germany, UK, Spain, China, Japan, India, Brazil, Mexico

Key companies profiled

HYUNDAI MOBIS; Robert Bosch GmbH; Visteon Corporation; Continental AG; DENSO CORPORATION; Panasonic Holdings Corporation; Pioneer Corporation; SAMSUNG; FORVIA; Garmin Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Digital Cockpit Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive digital cockpit market report based on equipment, display technology, vehicle type, and region:

-

Equipment Outlook (Volume, Units, Revenue, USD Billion, 2018 - 2030)

-

Digital Instrument Cluster

-

Driving Monitoring System

-

Head-up Display (HUD)

-

-

Display Technology Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

LCD

-

TFT-LCD

-

OLED

-

-

Vehicle Type Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Regional Outlook (Volume, Units; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.