- Home

- »

- Automotive & Transportation

- »

-

Automotive eCall Market Size, Share, Industry Report, 2030GVR Report cover

![Automotive eCall Market Size, Share & Trends Report]()

Automotive eCall Market (2025 - 2030) Size, Share & Trends Analysis Report Analysis By Propulsion Type, By Trigger Type, By Vehicle Type (Passenger Cars, Commercial Vehicles), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-612-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive eCall Market Summary

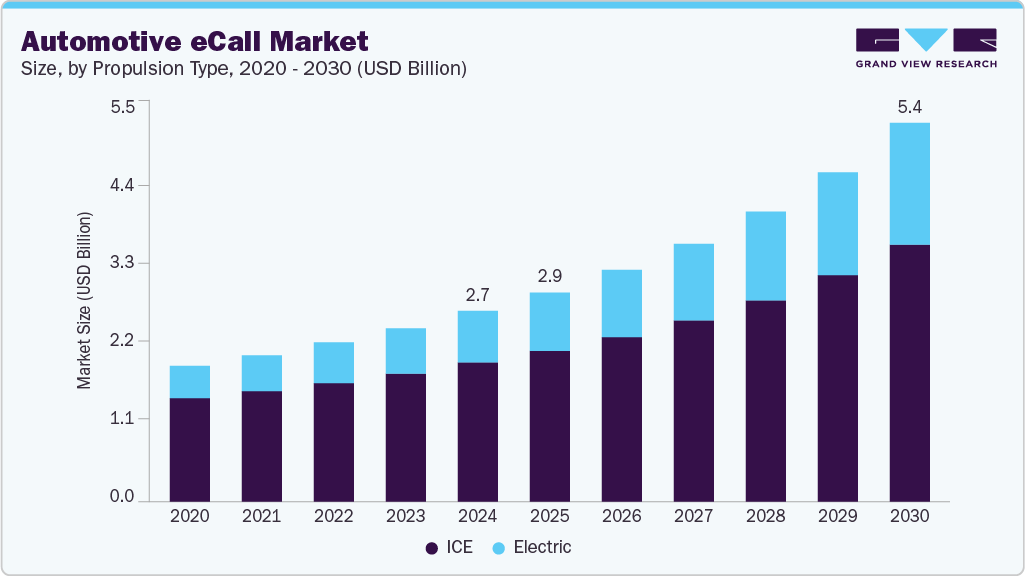

The global automotive eCall market size was estimated at USD 2.72 billion in 2024 and is projected to reach USD 5.39 billion by 2030, growing at a CAGR of 12.6% from 2025 to 2030. The automotive eCall market is driven by a mix of regulatory mandates, technological advancements, and changing consumer preferences for improved vehicle safety.

Key Market Trends & Insights

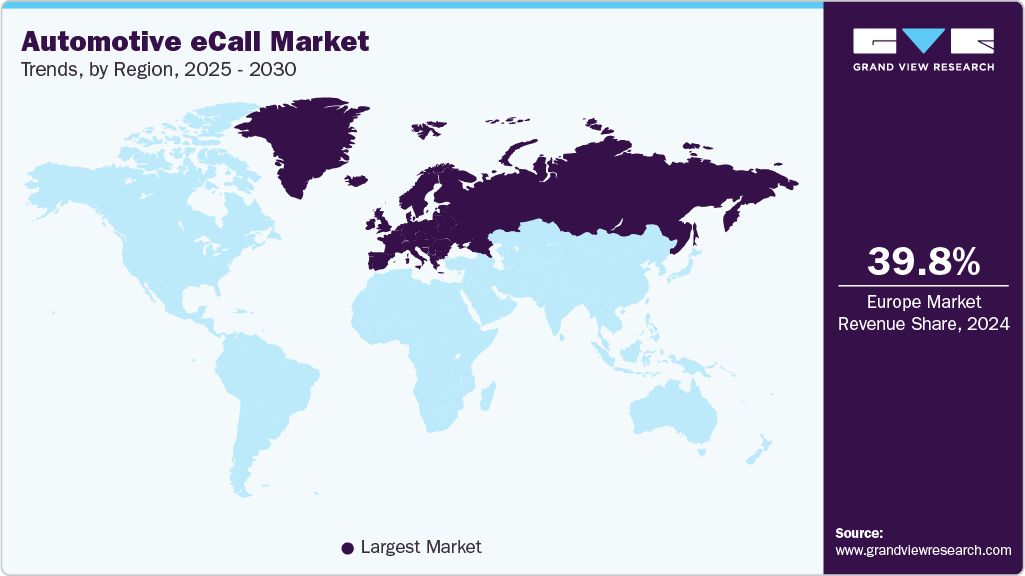

- Europe automotive eCall market dominated with a share of 39.8% of global revenue in 2024.

- Germany automotive eCall market is witnessing growh due to country’s strong automotive safety culture.

- By propulsion type, the ICE segment dominated the target market and accounted for the largest revenue share of 72.8% in 2024.

- By trigger type, the automatically initiated eCall segment dominated the automotive eCall market with a market share of 66.3%.

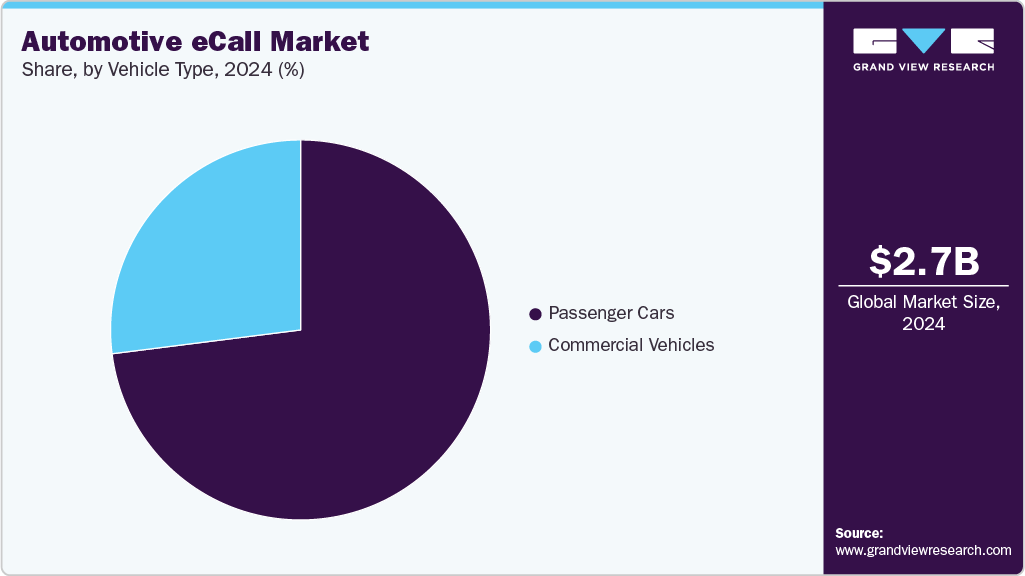

- By vehicle type, the passenger cars segment led the market and accounted with a share of 72.8% of the global revenue in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.72 Billion

- 2030 Projected Market Size: USD 5.39 Billion

- CAGR (2025-2030): 12.6%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

A key factor is the implementation of government regulations that require eCall systems in new vehicles. For instance, the European Union mandated that all new cars and light commercial vehicles sold from April 2018 onward must be equipped with the eCall system. Similar regulations exist or are being considered in Russia (under the ERA-GLONASS system), China, and Brazil. These mandates ensure consistent integration of eCall features across more vehicles, driving steady market demand. Another significant driver is the global focus on improving road safety. With rising rates of road accidents and fatalities, eCall systems have become an important safety solution. These systems automatically alert emergency services during a serious crash, transmitting the vehicle’s location and other key data, thereby drastically reducing response times. This capability can be life-saving, particularly in remote areas or during off-peak hours, and has gained strong support from public safety authorities and consumers alike.

Technological advancements are also fueling the growth of the eCall market. Improvements in telematics, global navigation satellite systems (GNSS), and mobile communication technologies-particularly the rollout of 4G and 5G-have enhanced the effectiveness and reliability of eCall systems. These technologies enable faster data transmission and more accurate location tracking, making the systems more valuable to both users and emergency responders. Additionally, as automotive technology evolve toward fully connected and autonomous vehicles, eCall becomes a foundational component of the broader intelligent transportation ecosystem.

The insurance industry further contributes to the market’s momentum by recognizing the value of eCall systems in reducing accident-related losses and verifying claims. Many insurers now offer incentives or discounts to policyholders whose vehicles are equipped with telematics-based safety systems, including eCall. This reinforces adoption, especially in markets where consumers are highly cost-conscious.

Despite strong growth prospects, the automotive eCall market faces several restraints that could hinder its widespread adoption and scalability. One of the primary challenges is the high cost of system integration, especially for manufacturers producing low-cost or economy vehicles. While premium and mid-range vehicles can absorb the additional cost of telematics hardware and connectivity services, budget models often operate on thinner profit margins, making it difficult for automakers to include eCall systems without impacting vehicle affordability.

Propulsion Type Insights

The ICE segment dominated the target market and accounted for the largest revenue share of 72.8% in 2024. Despite the growing shift toward electric vehicles (EVs), ICE-powered vehicles still represent the majority of vehicles on the road, especially in developing regions where EV adoption is slower. This larger base of ICE vehicles naturally results in higher integration of eCall systems within this segment. Another key reason for ICE dominance is the early implementation of eCall systems in traditional vehicle platforms. When regulations like the European Union's 2018 eCall mandate came into effect, most vehicles on the market were ICE-powered. As a result, automakers prioritized integrating eCall into ICE models to ensure regulatory compliance across their best-selling lines.

The electric motor segment in the automotive eCall market is expected to witness significant growth at a CAGR of 15.7% over the forecast period, driven by the rapid adoption of electric vehicles (EVs) and increasing regulatory alignment with safety and connectivity requirements. As governments across the globe implement stricter emission norms and incentivize the shift toward electrification, EV production is accelerating, particularly in regions like Europe, China, and North America. With this growing EV fleet comes a parallel demand for integrated safety features, including eCall systems.

Trigger Type Insights

The automatically initiated eCall (AIeC) segment dominated the automotive eCall market with a market share of 66.3%, primarily due to its superior safety advantages and regulatory backing. Unlike manually initiated systems, AIeC is designed to automatically trigger an emergency call to rescue services in the event of a serious collision, even if the vehicle occupants are unconscious or unable to respond. This critical capability has positioned AIeC as the preferred eCall configuration, especially under stringent safety regulations in regions like the European Union, where automatic activation is mandated for new vehicles. Moreover, the dominance of AIeC is supported by the increasing focus on reducing road fatalities and enhancing emergency response times.

The manually initiated eCall (MIeC) segment is expected to witness significant growth over the forecast period, driven by increasing consumer demand for flexible, user-controlled safety solutions and its growing adoption in regions where automatic eCall systems are not yet mandatory. Unlike AIeC, which activates only in the event of a severe crash, MIeC allows vehicle occupants to manually trigger an emergency call whenever they sense danger or need urgent assistance-such as during a medical emergency, witnessing an accident, or in case of vehicle breakdowns in unsafe areas. This user empowerment aspect makes MIeC particularly attractive in vehicles that prioritize driver autonomy and user experience. Additionally, emerging markets, where regulatory frameworks for automatic eCall are still evolving, often favor MIeC due to its lower integration cost and minimal dependence on advanced crash detection systems.

Vehicle Type Insights

The passenger cars segment led the market and accounted with a share of 72.8% of the global revenue in 2024, reflecting the widespread integration of eCall systems across this vehicle category. This dominance can be attributed to the high production volumes of passenger vehicles globally, as well as the implementation of regulatory mandates in regions such as the European Union, where all new passenger cars are required to be equipped with eCall functionality. In addition to regulatory influence, growing consumer awareness of vehicle safety and increasing expectations for connected features have encouraged automakers to embed eCall systems across a wide range of passenger car models.

The commercial vehicle segment is expected to witness the fastest growth over the forecast period. As commercial vehicles, including trucks, buses, and delivery vehicles, are increasingly being integrated with advanced safety and telematics systems, the demand for eCall technology is growing rapidly in this segment. Fleet management and operational efficiency are becoming key business priorities in logistics, transportation, and public services. The integration of eCall technology offers safety benefits and operational advantages, such as improved fleet tracking, real-time monitoring, and optimized response times in emergencies. This capability is essential for businesses that depend on their vehicles for critical operations, such as long-haul freight transportation and passenger transit.

Regional Insights

Europe automotive eCall market dominated with a share of 39.8% of global revenue in 2024, largely due to stringent regulatory mandates and widespread adoption of connected vehicle technologies. The region’s well-established telecommunications infrastructure and seamless integration between eCall systems and emergency services (such as 112-based PSAPs-Public Safety Answering Points) have also contributed to its dominance. Countries like Germany, France, and the UK are key markets, with automakers and technology providers continuously enhancing eCall functionalities, including Next-Generation eCall (NG eCall), which supports richer data transmission.

Germany automotive eCall market is witnessing growh due to country’s strong automotive safety culture, with consumers and manufacturers prioritizing advanced safety features. The integration of eCall with ADAS (Advanced Driver Assistance Systems) and crash sensors reinforces its necessity in modern vehicles. Additionally, Germany’s emergency services (PSAPs - Public Safety Answering Points) are fully equipped to handle eCall alerts, ensuring fast and accurate incident response. The country’s reliable mobile network coverage (including 4G/LTE and expanding 5G) supports seamless eCall functionality.

Asia Pacific Automotive eCall Market Trends

The Asia Pacific region is expected to witness significant growth with a CAGR of 14.3% in the automotive eCall market. Rising vehicle production and automotive sales in countries such as China, India, and Japan are contributing to the increased demand for advanced safety technologies, including eCall systems. In addition, growing consumer awareness of vehicle safety in the Asia Pacific region is a key factor influencing market growth. As consumers seek more advanced safety features, automakers are incorporating eCall systems into their vehicles to meet these demands.

China Automotive eCall Market is growing due to China's automotive sector is at the forefront of integrating advanced technologies such as electric vehicles (EVs) and autonomous driving systems. The adoption of eCall systems is increasingly seen as a critical component of these innovations, ensuring that vehicles are equipped with the necessary infrastructure to support emergency communication and enhance overall safety.

Automotive eCall Market in India is experiencing the growth due tothe India's expanding automotive industry, characterized by rising vehicle production and sales, is contributing to the demand for advanced safety technologies. As the market grows, automakers are increasingly focusing on integrating eCall systems to enhance vehicle safety and meet consumer expectations. Additionally, the development of next-generation telematics protocols and the increasing adoption of connected vehicle technologies are facilitating the integration of eCall systems. These advancements enable real-time communication between vehicles and emergency services, improving response times and overall road safety.

North America Automotive eCall Market Trends

The North American automotive eCall market is driven by several factors, which are influencing its rapid adoption and growth. One key driver is insurance incentives and safety benefits. Insurance companies are offering discounts to consumers who choose vehicles equipped with advanced safety technologies, such as eCall systems. This is due to eCall's role in reducing accident response times and, consequently, the severity of claims. As a result, many consumers are opting for vehicles with these systems to take advantage of the potential cost savings, thus boosting the demand for eCall-equipped cars.

U.S. Automotive eCall Market Trends

As autonomous vehicle technology advances in the U.S., the integration of eCall systems is becoming crucial. Autonomous vehicles rely heavily on connected technologies, and eCall is essential to ensure emergency communication in case of an incident. This growing trend toward autonomous driving increases demand for advanced safety technologies, including eCall.

Key Automotive eCall Company Insights

Some of the key players operating in the automotive eCall market include Continental AG, Telit Cinterion, Thales, Robert Bosch GmbH, DENSO CORPORATION, Infineon Technologies AG, among others. These companies are actively investing in research and development (R&D) to improve the performance, reliability, and responsiveness of automotive eCall systems. Key areas of innovation include enhancing system integration with telematics and vehicle connectivity platforms, as well as leveraging advanced technologies such as cloud-based communication and precise geolocation services. Additionally, these players are expanding their global manufacturing footprint and forming strategic partnerships to support the growing demand for eCall solutions across diverse regional automotive markets.

-

Continental AG is a German multinational automotive parts manufacturer headquartered in Hanover, Germany. The company operates globally and provides a wide range of products, including tires, braking systems, vehicle electronics, and powertrain components. The company develops and supplies systems that enable vehicles to contact emergency services in the event of a crash. These systems transmit data such as vehicle location and crash severity to support timely assistance. Continental integrates eCall functionality into its telematics control units, which support both automatic and manual call activation. Continental AG is also expanding its production infrastructure and engaging in industry partnerships to address the increasing demand for vehicle safety systems in global markets.

-

Visteon Corporation is a U.S.-based automotive electronics supplier specializing in digital cockpit and connectivity solutions. Visteon Corporation develops telematics control units (TCUs) that facilitate emergency call functionalities. These TCUs support both dedicated short-range communications (DSRC) and cellular vehicle-to-everything (C-V2X) standards, enabling vehicles to communicate with emergency services and other entities. TCUs are designed to integrate with various vehicle networks and operating systems, providing features such as over-the-air (OTA) software updates and high-precision positioning. These capabilities enhance the reliability and responsiveness of eCall systems.

Key Automotive eCall Companies:

The following are the leading companies in the automotive eCall market. These companies collectively hold the largest market share and dictate industry trends.

- Continental AG

- Robert Bosch GmbH

- Telit Cinterion

- Thales

- DENSO CORPORATION

- Infineon Technologies AG

- Valeo

- STMicroelectronics

- u-blox

- Visteon Corporation

Recent Developments

-

In March 2025, Telit Cinterion launched two new modules-the LE310 LTE Cat. 1 bis and the SL871K2 GNSS-targeted at compact, low-power IoT applications such as asset tracking, telematics, and wearables. The LE310 offers global LTE Cat. 1 bis connectivity in a small 15 x 18 mm form factor, optimized for space-constrained and battery-powered devices, and is available in regional and global variants. The SL871K2 GNSS module supports multiple satellite constellations (GPS, QZSS, GLONASS, BeiDou, and Galileo) and enables concurrent tracking with advanced features such as Assisted GNSS, 1PPS output, and TRAIM.

-

In January 2025, Infineon Technologies AG announced the commencement of construction for a new semiconductor backend production facility in Samut Prakan, Thailand, located south of Bangkok. This highly automated facility is scheduled to begin operations early in 2026. It is designed to enhance the company's manufacturing capabilities, particularly in response to the growing demand for power modules driven by global decarbonization and digitalization efforts. The investment, supported by the Thailand Board of Investment, is part of Infineon's strategy to diversify and optimize its manufacturing footprint, ensuring high efficiency, resilience, and quality in its production processes.

-

In April 2022, Robert Bosch GmbH expanded its eCall services by integrating them into eDriving’s Mentor app, in collaboration with U.S.-based technology firms Sfara and eDriving. This integration allows fleet drivers to access emergency assistance via their smartphones, even in vehicles lacking built-in eCall hardware. Sfara's collision detection technology enables the app to identify accidents or emergencies and automatically notify Bosch’s international emergency response centers, which operate in over 50 countries and support more than 20 languages.

Automotive eCall Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.98 billion

Revenue forecast in 2030

USD 5.39 billion

Growth rate

CAGR of 12.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Propulsion type, trigger type, vehicle type, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Continental AG; Robert Bosch GmbH; Telit Cinterion; Thales; DENSO CORPORATION; Infineon Technologies AG; Valeo; STMicroelectronics; u-blox; Visteon Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive eCall Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive eCall market report based on propulsion type, trigger type, vehicle type, and region.

-

Propulsion Type Outlook (Revenue, USD Million, 2018 - 2030)

-

ICE

-

Electric Motor

-

-

Trigger Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manually Initiated eCall (MIeC)

-

Automatically Initiated eCall (AIeC)

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive eCall market size was estimated at USD 2,716.7 million in 2024 and is expected to reach USD 2,978.6 million in 2025.

b. The global automotive eCall market is expected to grow at a compound annual growth rate of 12.6% from 2025 to 2030 to reach USD 5,388.8 million by 2030.

b. Europe dominated the automotive eCall market with 39.8% of the market share in 2024, driven by the European Union’s mandate requiring all new vehicles to be equipped with eCall systems since 2018. This regulatory push, combined with the region’s strong automotive manufacturing base, advanced digital infrastructure, and heightened focus on road safety, has significantly accelerated adoption.

b. Some key players operating in the automotive eCall market include Continental AG; Robert Bosch GmbH; Telit Cinterion; Thales; DENSO CORPORATION; Infineon Technologies AG; Valeo; STMicroelectronics; u-blox; and Visteon Corporation

b. Key factors driving the growth of the automotive eCall market include stringent government regulations mandating the installation of eCall systems in new vehicles. The increasing focus on vehicle and passenger safety, advancements in telematics and in-vehicle communication technologies, and rising awareness about the benefits of rapid emergency response are also contributing to market expansion. Additionally, growing vehicle production and the integration of connected car technologies are further fueling the demand for eCall systems globally.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.