- Home

- »

- Advanced Interior Materials

- »

-

Automotive Exterior Materials Market, Industry Report, 2030GVR Report cover

![Automotive Exterior Materials Market Size, Share & Trends Report]()

Automotive Exterior Materials Market (2024 - 2030) Size, Share & Trends Analysis By Product (Steel, Aluminum, Plastics, Glass Composites, Carbon Composites, Others), By Application, By Region And Segment Forecasts

- Report ID: GVR-1-68038-557-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Exterior Materials Market Summary

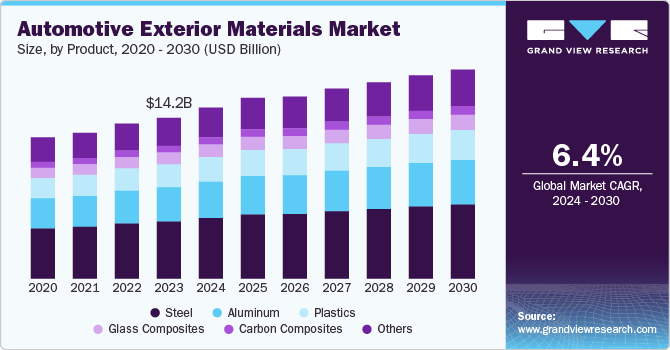

The global automotive exterior materials market size was estimated at USD 14.19 billion in 2023 and is projected to reach USD 21.91 billion by 2030, growing at a CAGR of 6.4% from 2024 to 2030. As automakers expand their operations into new regions, they are exposed to diverse environmental conditions, consumer preferences, and regulatory landscapes.

Key Market Trends & Insights

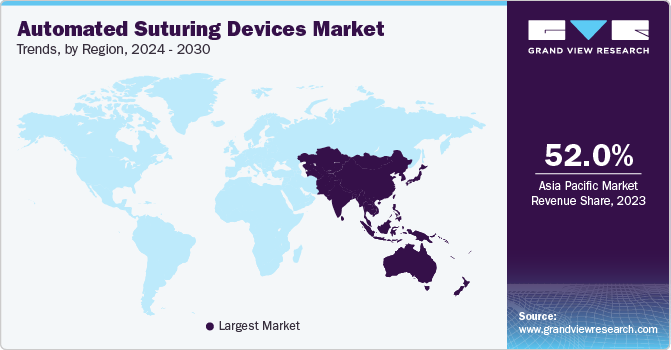

- Asia Pacific automotive exterior materials market accounted for the largest revenue share of 52.0% in 2023.

- The U.S. automotive exterior materials market is expected to witness significant growth over the forecast period.

- By product, the steel segment dominated the market and accounted for a revenue share of 34.5% in 2023.

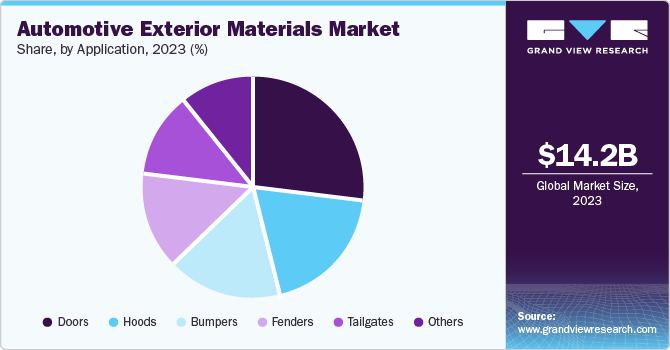

- By application, the doors segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.19 Billion

- 2030 Projected Market Size: USD 21.91 Billion

- CAGR (2024-2030): 6.4%

- Asia Pacific: Largest market in 2023

This necessitates using materials that meet varied requirements across different markets. The globalization of the automotive industry also plays an essential role in driving the automotive exterior materials market. Materials that offer superior impact resistance, corrosion resistance, and durability are crucial in ensuring vehicle safety and longevity. Advances in material science have led to the development of exterior materials that can absorb impact energy more effectively, reducing the severity of accidents. Additionally, materials with high resistance to environmental factors, such as UV radiation and extreme temperatures, are essential for maintaining vehicles' structural integrity and appearance over time. Safety remains a top priority for consumers and regulators, influencing the materials used in automotive exteriors.

EV manufacturers are exploring new materials to enhance vehicles' aesthetic appeal and functional performance. Materials that offer high impact resistance, weather resistance, and thermal management properties are in high demand. Additionally, the need to improve EVs' range and efficiency propels the use of lightweight and aerodynamic materials for exterior applications. The transition to EVs also requires materials supporting new design requirements, such as integrated sensors and cameras for autonomous driving technologies.

Product Insights

The steel segment dominated the market and accounted for a revenue share of 34.5% in 2023. Steel is preferred for automotive exteriors due to its cost-effectiveness and favorable strength-to-weight ratio. Traditional steel, high-strength steel (HSS), and advanced high-strength steel (AHSS) offer a balance between affordability and performance, making them ideal for mass production. Compared to other lightweight materials, steel's affordability makes it a go-to choice for automakers aiming to produce durable and economical vehicles. This cost advantage is particularly crucial in producing mid-range and budget vehicles.

The glass composites segment is expected to register a significant CAGR during the forecast period. Glass composites offer superior design flexibility, a significant advantage for automakers seeking to create innovative and attractive vehicle exteriors. The material's versatility allows for complex shapes and designs that are difficult to achieve with traditional materials. Additionally, glass composites are molded into smooth, high-quality finishes that enhance the vehicle's visual attraction. This flexibility in design and finish makes glass composites particularly valuable in producing components for premium and luxury vehicles, where the design is a key selling point.

Application Insights

The doors segment accounted for the largest market revenue share in 2023. Doors are critical structural components that protect occupants during side-impact collisions, among the most severe types of accidents. As a result, automakers are increasingly turning to high-strength materials such as advanced high-strength steel, aluminum, and composite materials to enhance the durability of doors. These materials provide superior energy absorption and resistance to deformation, which is essential for meeting stringent safety standards and ensuring passenger protection.

The fenders segment is anticipated to register the fastest CAGR over the forecast period. EV manufacturers are particularly focused on optimizing aerodynamics and reducing weight to maximize their vehicles' range and efficiency. Due to their lightweight and aerodynamic properties, fenders made from advanced materials such as thermoplastic polymers and composites are increasingly adopted in EVs. Additionally, the design flexibility of these materials allows for the integration of aerodynamic features directly into the fender design, further improving the vehicle's efficiency. As the EV market continues to expand, the demand for specialized fenders that meet the unique requirements of electric vehicles is expected to grow.

Regional Insights & Trends

The North America automotive exterior materials market is expected to witness significant growth over the forecast period. North America is headquartered by the world’s leading automotive manufacturers, such as General Motors, Ford, and Tesla. These companies are at the forefront of automotive innovation and continuously invest in developing new materials to enhance vehicle performance, safety, and aesthetics. The presence of these automotive giants drives the demand for advanced exterior materials as they pursue differentiation in a highly competitive market. Moreover, the ongoing collaborations between automakers and material science companies in the region further propel the innovation and adoption of new materials.

U.S. Automotive Exterior Materials Market Trends

The U.S. automotive exterior materials market is expected to witness significant growth over the forecast period. The development and use of high-strength materials in exterior components, including bumpers, fenders, and panels, are crucial to enhancing a vehicle’s durability. Manufacturers increasingly invest in materials that provide superior impact resistance and energy absorption during collisions. This focus on safety significantly drives the market, as automakers in North America strive to meet and exceed safety standards, ensuring that their vehicles offer maximum protection to occupants.

Asia Pacific Automotive Exterior Materials Market Trends

Asia Pacific automotive exterior materialsmarketaccounted for the largest revenue share of 52.0% in 2023. The region's aftermarket and repair industry is strong, with a significant demand for replacement exterior materials such as bumpers, fenders, and panels. This demand is driven by the large number of vehicles on the road, the frequency of accidents, and the consumer preference for maintaining their vehicles in top condition. The aftermarket segment plays a crucial role in the overall automotive exterior materials market, requiring materials that balance cost, quality, and performance. The strong presence of a well-established repair and aftermarket industry in Asia Pacific ensures a steady demand for exterior materials, contributing to the market's growth.

China automotive exterior materials market accounted for the largest revenue share in 2023. A strong consumer preference for premium vehicles with high customization characterizes the country's market. This trend drives the demand for high-quality exterior materials for unique finishes, colors, and textures. Consumers are increasingly looking for vehicles that extend, and automakers are responding by offering a wide range of exterior customization options. Materials that enable these customizations, while also providing durability and protection against environmental factors, are in high demand. The country's growing popularity of luxury and high-performance vehicles increases the need for premium exterior materials.

Europe Automotive Exterior Materials Market Trends

The Europe automotive exterior materials market is expected to witness significant growth over the forecast period. The region's automotive market is witnessing rapid adoption of electric vehicles (EVs), increased by government incentives, subsidies, and a strong consumer shift towards sustainable transportation. Countries such as Germany, Norway, and the Netherlands are leading in EV adoption, and this trend is driving the demand for lightweight advanced exterior materials that offer superior thermal and electrical insulation properties. EV manufacturers in Europe are particularly focused on optimizing the aerodynamics and weight of their vehicles to maximize battery efficiency and range, leading to an increased use of innovative materials in exterior applications.

The Germany automotive exterior materials market is expected to witness significant growth over the forecast period. The companies in Germany are known for their commitment to quality, innovation, and sustainability and play a crucial role in driving the demand for advanced exterior materials. The close collaboration between OEMs and material suppliers in Germany enables the development of new materials that meet the evolving needs of the automotive industry. Additionally, the presence of a strong automotive supply chain in the region, focusing on precision engineering and high-performance materials, is contributing to the growth of the automotive exterior materials market in Germany.

Key Automotive Exterior Materials Company Insight

Some key companies in the automotive exterior materialsmarket include Magna International Inc, IDEAL Automotive GmbH, Hayakawa Eastern Rubber Co., Ltd., Suminoe Textile Co., Ltd., and others.

-

Hayakawa Eastern Rubber Co., Ltd. is a specialized manufacturer and supplier of high-quality rubber and plastic components. The company offers a wide range of products, including rubber hoses, gaskets, seals, and vibration control components, primarily for the automotive, industrial machinery, and construction sectors.

-

Magna International Inc. is a leading global automotive supplier. The company offers an extensive product portfolio, which includes a wide range of automotive systems, assemblies, modules, and components. Magna's offerings encompass body exteriors and structures, power and vision technologies, seating systems, complete vehicle engineering, and contract manufacturing.

Key Automotive Exterior Materials Companies:

The following are the leading companies in the automotive exterior market. These companies collectively hold the largest market share and dictate industry trends.

- HAYAKAWA EASTERN RUBBER CO.,LTD

- IDEAL Automotive GmbH

- Kotobukiya Fronte Co., Ltd.

- SHANDONG EXCEEDING AUTO INTERIOR PARTS CO.,LTD

- Suminoe Textile Co., Ltd.

- HAYASHI TELEMPU CORPORATION

- Magna International Inc.

- Shanghai Shenda Co., Ltd.

- BOSHOKU CORPORATION

- KAP Ltd.

Recent Developments

-

In February 2024, KRAIBURG TPE has released new thermoplastic elastomer (TPE) products containing at least 73% recycled content. The new Recycling Content TPE for Automotive series is designed to address a variety of industrial applications. Here, KRAIBURG TPE also announced a contract with Tessi Supply, using the grades for inlay cases and floor mats.

-

In May 2024, LyondellBasell created a Lightweight Plastic Engine Hood with Chinese Tier I for the new energy vehicles of domestic automotive brands. The two companies unveiled the product during a launch ceremony at Chinaplas 2024 in Shanghai. The part's high rigidity ensures structural integrity and is prone to deformation due to humidity, temperature, and other conditions, meeting stringent dimensional requirements.

Automotive Exterior Materials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.06 billion

Revenue forecast in 2030

USD 21.91 billion

Growth Rate

CAGR of 6.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Argentina, Brazil, Saudi Arabia, and South Africa

Key companies profiled

HAYAKAWA EASTERN RUBBER CO.,LTD, IDEAL Automotive GmbH, Kotobukiya Fronte Co., Ltd., SHANDONG EXCEEDING AUTO INTERIOR PARTS CO.,LTD, Suminoe Textile Co., Ltd., HAYASHI TELEMPU CORPORATION, Magna International Inc., Shanghai Shenda Co., Ltd., BOSHOKU CORPORATION, KAP Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Exterior Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the automotive exterior materialsmarket report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Steel

-

Aluminum

-

Plastics

-

Glass Composites

-

Carbon Composites

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bumpers

-

Fenders

-

Doors

-

Hoods

-

Tailgates

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Latin America

-

Argentina

-

Brazil

-

-

The Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.