- Home

- »

- Advanced Interior Materials

- »

-

Automotive Metals Market Size, Share & Trends Report 2030GVR Report cover

![Automotive Metals Market Size, Share & Trends Report]()

Automotive Metals Market Size, Share & Trends Analysis Report By Product (Aluminum, Steel), By Application (Body Structure, Power Train), By Vehicle-type (Passenger, LCV, HCV), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-560-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Automotive Metals Market Size & Trends

The global automotive metals market size was estimated at USD 167.45 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030. Stringent regulations aimed at reducing carbon emissions from the automotive industry are driving the demand for lightweight metals like aluminum and magnesium in the forecast period.

Reducing a vehicle's weight by 10%, can improve its fuel economy by 6-8%. One way to achieve this is by replacing traditional steel and cast iron components with lightweight materials like aluminum and magnesium alloys and high-strength steel. By doing this, the weight of a vehicle's body and chassis can be reduced by up to 50%, which leads to lower fuel consumption.

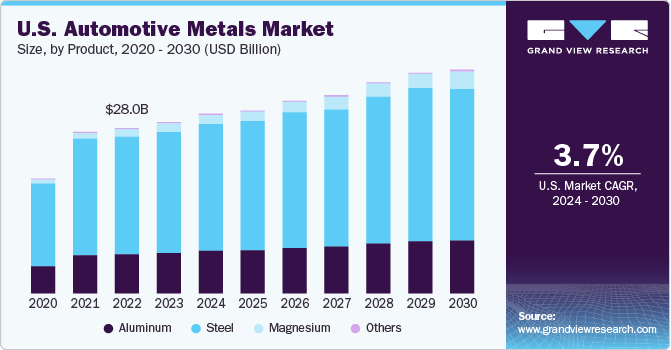

According to statistics for 2022, the U.S. is the second-largest vehicle manufacturer in the world. It has established manufacturing facilities that positively influence demand for automotive metals. Also, growth in lightweight vehicles is further aiding market growth. For instance, sales of lightweight vehicles increased by 13.6% on Y-o-Y basis, reaching 10.3 million units in the first eight months of 2023.

In the coming years, demand for metals is expected to rise further as a result of new emission regulations from the government. For instance, in April 2023, the EPA announced stricter environmental rules for light and medium-duty vehicles. The rules will apply to vehicles manufactured from 2027 to 2032, covering greenhouse gases and other pollutants, including ozone, nitrogen oxides, particulate matter, and carbon monoxide.

Also, state governments across the U.S. are pushing for increased adoption of electric vehicles (EVs). Starting from 2035, California plans to prohibit the sale of new vehicles that run on ICEs. The state is leading the nation toward EV adoption, with registrations for BEVs and PHEVs accounting for 24.4% of all light vehicles registered between January and June 2023. Additionally, 17 U.S. states will partially or fully adopt California's zero-emission vehicle (ZEV) regulations.

Market Concentration & Characteristics

The market comprises several manufacturers specializing in specific metals for the automotive industry. Major players in the industry are adopting expansion strategies and mergers & acquisitions to increase their customer base. These companies are establishing new facilities in emerging markets to facilitate their growth.

The sector is experiencing significant advancements in materials and technologies used to manufacture vehicle components. Strict fuel efficiency regulations have encouraged R&D to create lightweight and cost-effective materials for the automotive sector. Additionally, new technologies like 3D printing are now used to manufacture large metal parts.

Aluminum and magnesium are the fastest-growing metals in the automotive industry due to their lightweight properties, which make them ideal for constructing car components, body structure, power trains, and other parts. Manufacturers are actively researching and developing grades that can reduce car weight while maintaining cost-effectiveness in the steel segment. One such grade is AHSS, which is becoming increasingly popular in the automotive sector due to its ability to reduce car weight and greenhouse gas emissions.

Some of the key players in the market include ArcelorMittal SA, Voestalpine Steel Division, Magna International Inc., Alcoa Corporation, Hyundai Mobis, Schaeffler AG, Benteler International, Gestamp, Dana Limited, and GKN plc. These companies typically distribute their products directly to end-users through supply agreements. However, some companies also use third-party sources or distributors to supply their products in different economies. The metals are used to make vehicles for brands such as Volkswagen Group, Toyota Motors, Daimler, Ford Motors, BMW Group, General Motors, Nissan Motors, and Honda Motors.

Product Insights

Steel dominated the global market with a revenue share of over 70.0% in 2023. Affordability and superior properties of new steel grades, including advanced and ultra-high strength, are likely to positively impact their utilization in the automotive sector throughout the forecast period.

Aluminum’s penetration is exceeding over steel, owing to its characteristics such as lightweight and high recyclability. Further, it can absorb twice the crash energy as mild steel and reduces weight by up to 50%. Considering its rising demand, the aluminum content in an average car is expected to increase from 353 pounds in 2020 to 449 pounds in 2030, and in a light truck from 496 pounds in 2020 to 564 pounds in 2030.

Application Insights

The body structure segment held a revenue share of over 37.0% of the global market in 2023. Body structure comprises a frame, panels, doors, bonnet, and trunk closures. Typically, these components are made of steel to ensure strength and absorb crash energy. The segment is expected to see growth due to stringent safety regulations worldwide.

The use of steel in automotive suspension applications is anticipated to increase in the near future due to suspension requirements for high rigidity and strength. These systems experience high levels of vibrations and stress, making it crucial that suspension components, especially the spring, are made of materials that can withstand such conditions without damaging them.

Vehicle-type Insights

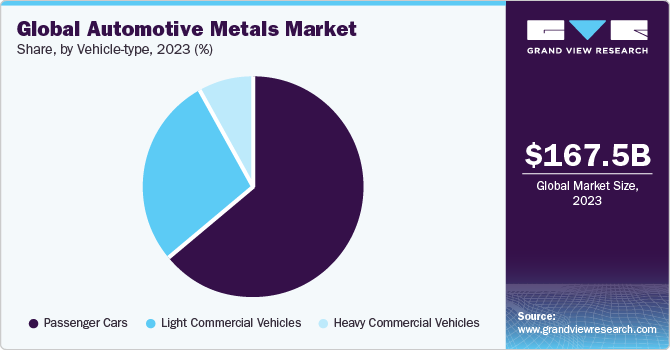

The passenger cars segment dominated the market with a revenue share of over 64.0% in 2023. The market has experienced an increase in customers who are set to invest in vehicles that offer aesthetic appeal and safety. Thus, manufacturers are investing in developing new and innovative cars with high-end appeal at a lower cost.

Light commercial vehicles (LCVs) are anticipated to grow at the fastest CAGR over the forecast period. Demand for LCVs is expected to be slightly impacted by the rising adoption of industrial and commercial transportation services. However, increasing urbanization, better road infrastructure, and supportive regulatory policies are expected to boost the demand for LCVs in the coming years.

Regional Insights

Asia Pacific held over 47.0% of the global market revenue in 2023. The automotive industry in the region is growing due to several critical factors, including government policies, consumer preferences, environmental regulations, and competition. Manufacturers continuously develop new designs and processes in response to changing consumer demand.

In terms of revenue, North America is expected to experience a CAGR of 3.2% over the forecast period. Expansion of the EV industry in the region is expected to boost segment growth. For example, in November 2022, BMW Group announced a USD 1.70 billion investment to produce EVs in the U.S. by 2030.

Key Companies & Market Share Insights

Some key players operating in the market include ArcelorMittal, Tata Steel, and Alcoa.

-

As of December 31, 2022, ArcelorMittal had approximately 15 % of the global market for automotive steel, according to its annual report.

-

India's Tata Steel is among the world's largest producers of steel for automobiles; in 2023, its production increased by 5% compared with the preceding year.

National Material Company (NMC) and Ternium are some of the emerging market participants.

-

NMC has six steel service centers and processing facilities in the U.S., and it ships over 1.4 million tons of steel annually.

-

Ternium started producing highly formable AHSS in 2016 to expand its presence in automotive and metal mechanic steel markets.

Key Automotive Metals Companies:

- Alcoa Corporation

- Allegheny Technologies

- ArcelorMittal

- China Steel Corporation

- Essar Steel

- Hyundai Steel Co., Ltd.

- Kaiser Aluminum

- Nippon Steel & Sumitomo Metal Corporation

- Novelis

- POSCO

- Tata Steel Limited.

- thyssenkrupp AG

- United States Steel Corporation

- voestalpine AG.

Recent Developments

-

In October 2023, POSCO completed the construction of an automotive steel plate plant in China. The plant is a joint venture between POSCO and HBIS, with an annual production capacity of 450,000 tons.

-

In April 2023, China based Valin ArcelorMittal Automotive Steel announced the commencement of manufacturing for its Phase II project. The project includes the installation of its another continuous galvanization line (CGL#2) having annual production capacity of 450,000 tons. With this addition, the company's total capacity will increase to 2 million tons annually.

Automotive Metals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 174.79 billion

Revenue forecast in 2030

USD 226.89 billion

Growth Rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and volume in kilotons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, vehicle-type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; U.K.; Spain; France; Italy; China; India; Japan; South Korea; Thailand; Brazil; Argentina; Morocco; South Africa

Key companies profiled

Alcoa Corporation; Allegheny Technologies; ArcelorMittal; China Steel Corporation; Essar Steel; Hyundai Steel Co., Ltd; Kaiser Aluminum; Nippon Steel & Sumitomo Metal Corporation; Novelis; POSCO; Tata Steel Limited; thyssenkrupp AG, United States Steel Corporation; voestalpine AG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Metals Market Report Segmentation

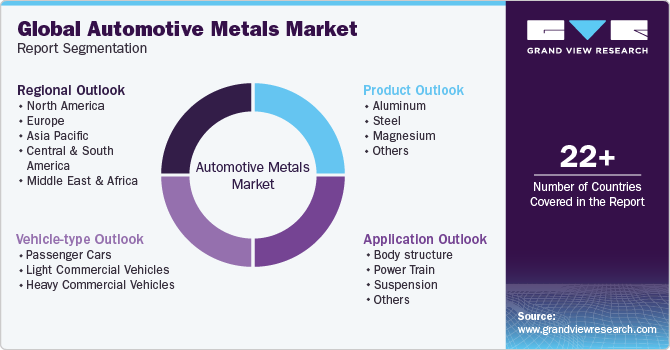

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global automotive metals market report based on product, application, vehicle-type, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Steel

-

Magnesium

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Body structure

-

Power train

-

Suspension

-

Others

-

-

Vehicle-type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Passenger cars

-

Light commercial vehicles

-

Heavy commercial vehicles

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Thailand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Morocco

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive metals market size was estimated at USD 167.45 billion in 2023 and is expected to reach USD 174.79 billion in 2024.

b. The global automotive metals market is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 to reach USD 226.89 billion by 2030

b. Based on the application, body structure dominated the market with a revenue share of over 37.0% in 2023. Ease of maintenance and repair of stamped metal parts and high recyclability as compared to plastics & composites are some of the major factors augmenting the demand for the metals in vehicle body structure

b. Some of the key vendors of the global automotive metals market are ArcelorMittal, POSCO, Tata Steel, and Alcoa among others.

b. The key factor that is driving the growth of the global automotive metals market is the growing efforts towards reducing carbon emission is propelling the demand for EVs, which is augmenting the consumption of lightweight metals in vehicle production.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."