- Home

- »

- Advanced Interior Materials

- »

-

Automotive Steel Market Size, Share, Industry Report, 2030GVR Report cover

![Automotive Steel Market Size, Share & Trends Report]()

Automotive Steel Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Passenger Vehicle, LCVs, HCVs), By Application (Body Structure, Power Train, Suspension), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-722-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Steel Market Summary

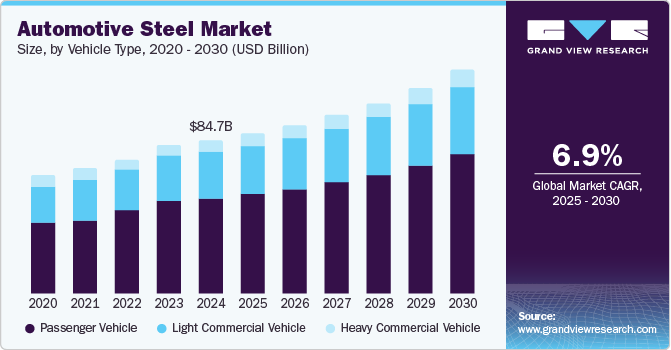

The global automotive steel market size was estimated at USD 84,699.6 million in 2024 and is projected to reach USD 123,414.3 million by 2030, growing at a CAGR of 6.5% from 2025 to 2030. The market growth can be attributed to the increasing vehicle production and sales and rising concerns about weight and fuel efficiency.

Key Market Trends & Insights

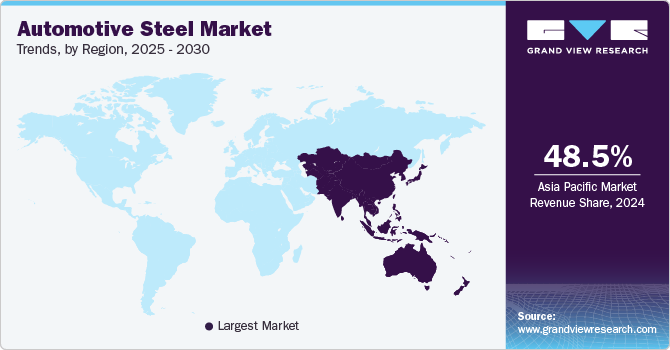

- In terms of region, Asia Pacific was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, passenger vehicle accounted for a revenue of USD 53,029.1 million in 2024.

- Heavy Commercial Vehicle is the most lucrative vehicle type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 84,699.6 Million

- 2030 Projected Market Size: USD 123,414.3 Million

- CAGR (2025-2030): 6.5%

- Asia Pacific: Largest market in 2024

In addition, stringent safety regulations and the demand for cost-effective materials enhance the appeal of automotive steel. Furthermore, the shift towards electric vehicles and innovations in steel alloys further propel this sector as manufacturers seek to reduce carbon emissions while improving vehicle performance and sustainability.

Automotive steel refers to the specialized steel used in the manufacturing of vehicles, designed to meet specific safety, performance, and weight requirements. The growing demand for high-strength steel (HSS) and advanced high-strength steel (AHSS) is a primary factor driving the automotive steel market. Manufacturers increasingly focus on lightweight vehicle designs that enhance fuel efficiency while ensuring safety. HSS and AHSS provide the necessary strength and rigidity, allowing for reduced vehicle weight without compromising structural integrity.

In addition, advancements in steel production technologies have improved the properties of automotive steel, making it suitable for various applications. Innovations such as hot stamping and laser welding enable the production of stronger, more formable, and corrosion-resistant steel grades. The introduction of third-generation AHSS combines high tensile strength with enhanced ductility, offering manufacturers greater design flexibility for complex geometries that improve passenger protection.

Furthermore, the rise of electric vehicles (EVs) further fuels the demand for automotive steel as manufacturers seek materials that offer durability and cost-effectiveness while reducing weight. Steel remains a preferred choice for chassis and safety components due to its high strength-to-weight ratio and recyclability. Moreover, sustainability considerations are increasingly influencing material selection in the automotive industry. Steel's recyclability positions it as a competitive option, aligning with manufacturers' goals to reduce environmental impact and promote circular economy principles through eco-friendly production processes.

Vehicle Type Insights

The passenger vehicle segment led the market and accounted for the largest revenue share of 62.6% in 2024. This growth can be attributed to the increasing demand for lightweight materials that enhance fuel efficiency and meet stringent safety standards. In addition, consumers prioritize eco-friendly vehicles, so manufacturers turn to advanced high-strength steel (AHSS) to reduce vehicle weight without compromising structural integrity. Furthermore, this shift aligns with regulatory pressures to reduce carbon emissions and supports the development of modern vehicle designs that cater to consumer preferences for performance and sustainability.

The heavy commercial vehicle segment is expected to grow at a CAGR of 7.6% over the forecast period, owing to the rising logistics and transportation industries, which require robust and durable materials. In addition, the demand for heavy-duty vehicles is increasing due to urbanization and the expansion of e-commerce, necessitating efficient transportation solutions. Furthermore, government initiatives promoting eco-friendly vehicles, including electric commercial vehicle incentives, encourage manufacturers to adopt advanced steel solutions. These developments aim to enhance vehicle performance while adhering to environmental regulations, driving this sector's demand for high-strength automotive steel.

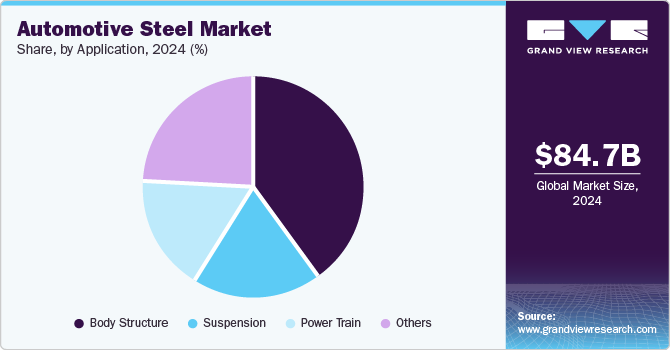

Application Insights

The body structure segment dominated the market and accounted for the largest revenue share of 39.8% in 2024, primarily driven by the increasing demand for advanced high-strength steel (AHSS). This material allows manufacturers to create lighter, more fuel-efficient vehicles while ensuring safety and structural integrity. In addition, stringent safety regulations further necessitate using robust materials that can effectively absorb crash energy. Furthermore, steel's high recyclability enhances its appeal, aligning with the automotive industry's shift toward sustainable practices.

The suspension application segment is expected to grow at a CAGR of 7.0% from 2025 to 2030, owing to the demand for automotive steel being propelled by the need for high-strength and rigidity components. Suspension systems are subjected to significant stress and vibrations, requiring materials that can withstand these conditions without compromising performance. Furthermore, as vehicle manufacturers focus on improving ride quality and handling, using advanced steel grades in suspension components is becoming increasingly prevalent. This trend supports the overall growth of the automotive steel market, as robust suspension systems are essential for vehicle safety and durability.

Regional Insights

The Asia Pacific automotive steel market dominated the global market and accounted for the largest revenue share of 48.5% in 2024. This growth can be attributed to the rising demand for electric and lightweight vehicles. As countries such as China and India ramp up automotive production, manufacturers are increasingly adopting advanced high-strength steel (AHSS) to enhance fuel efficiency and meet stringent safety standards. Furthermore, government initiatives to reduce carbon emissions further encourage the use of sustainable materials, making automotive steel a key component in the transition towards greener transportation solutions.

The automotive steel market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, driven by the rapid expansion of the electric vehicle (EV) sector. The government's strong support for EV production and increasing consumer preference for environmentally friendly vehicles drive demand for high-strength steel. In addition, advancements in steel manufacturing technologies enable the production of lighter and more durable materials, which are essential for improving vehicle performance and safety. This combination of factors positions China as a leader in the automotive steel market.

Europe Automotive Steel Market Trends

Europe automotive steel market is expected to grow at a CAGR of 7.8% over the forecast period, owing to stringent regulations to reduce carbon emissions and promote sustainability. In addition, the push for electric vehicles and lightweight materials has led manufacturers to adopt advanced high-strength steel solutions. Furthermore, government incentives and subsidies for EV production encourage automakers to invest in innovative steel technologies that enhance vehicle efficiency. This regulatory environment fosters a competitive landscape that propels the demand for automotive steel across European countries.

The automotive steel market in Germany dominated the European market and accounted for the largest revenue share in 2024, primarily driven by a strong focus on engineering excellence and innovation in vehicle design. As one of Europe's largest automotive producers, Germany emphasizes using advanced high-strength steel to create lightweight vehicles that meet rigorous safety standards while improving fuel efficiency. The country's commitment to sustainability and environmental responsibility further drives demand for innovative steel solutions, positioning Germany at the forefront of European automotive steel advancements.

North America Automotive Steel Market Trends

The North America automotive steel market is expected to grow significantly over the forecast period, driven by increasing investments in electric vehicle infrastructure and production. In addition, government policies promoting fuel efficiency and stricter emissions regulations compel manufacturers to utilize advanced high-strength steel in their designs. Furthermore, the rising consumer demand for lightweight vehicles with better performance and lower environmental impact also contributes to this trend.

The automotive steel market in the U.S. is expected to be driven by technological advancements and government initiatives aimed at promoting electric vehicles. In addition, the increasing focus on reducing greenhouse gas emissions drives manufacturers to explore lightweight materials such as advanced high-strength steel. Furthermore, substantial investments in EV infrastructure signal a shift towards sustainable transportation solutions, further enhancing the demand for automotive steel products that meet evolving consumer preferences and regulatory requirements. This dynamic landscape positions the U.S. as a key global automotive steel market player.

Key Automotive Steel Company Insights

Key companies in the global automotive steel industry include JSW, Nippon Steel Corporation, Nucor, and others. These companies adopt various strategies to enhance their competitive edge. These include investing in research and development to innovate advanced steel grades, improving production processes, and developing lightweight solutions. In addition, collaborations and partnerships with automotive manufacturers are also emphasized to create tailored steel products that meet specific vehicle requirements. Furthermore, companies focus on sustainability initiatives, such as enhancing recycling processes and reducing carbon emissions, aligning their operations with global environmental standards and consumer expectations for greener products.

-

Hyundai Steel manufactures hot and cold-rolled steel sheets, coated steel, and structural components designed to enhance vehicle performance and safety. Operating primarily in the automotive segment, the company focuses on developing innovative materials that meet the evolving demands of the automotive industry, particularly in lightweight vehicle manufacturing and sustainability.

-

JFE Steel Corporation produces high-strength steel, cold-rolled sheets, and coated steel, catering to the needs of automotive manufacturers seeking to improve fuel efficiency and safety. The company operates within the automotive segment, emphasizing the development of advanced materials that support lightweight construction and meet stringent safety standards, thereby contributing to the overall advancement of the automotive industry.

Key Automotive Steel Companies:

The following are the leading companies in the automotive steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- China BaoWu Steel Group Corporation Limited

- Hyundai Steel

- JFE Steel Corporation

- JSW

- Nippon Steel Corporation

- Nucor

- POSCO

- Tata Steel

- United States Steel Corporation

Recent Developments

-

In June 2024, Tata Steel Nederland introduced Zeremis Recycled, a new automotive steel featuring 30% recycled content aimed at helping customers meet their circularity goals. This initiative aimed at the rising demand for sustainable steel in the automotive, packaging, and construction industries. As part of its Green Steel Plan, Tata Steel aimed for significant CO2 reductions and enhanced sustainability, supporting immediate environmental benefits for its clients.

-

In September 2023, LISI AUTOMOTIVE partnered with ArcelorMittal to advance sustainability in the automotive industry through the development of XCarb recycled and renewably produced low-carbon-emissions automotive steel. This collaboration aimed to significantly reduce carbon footprints and improve product quality by integrating innovative steel solutions into manufacturing processes.

Automotive Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 88.4 billion

Revenue forecast in 2030

USD 123.4 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, China, India, Japan, South Korea, Germany, France, Italy, Brazil, Argentina

Key companies profiled

ArcelorMittal; China BaoWu Steel Group Corporation Limited; Hyundai Steel; JFE Steel Corporation; JSW; Nippon Steel Corporation; Nucor; POSCO; Tata Steel; United States Steel Corporation

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Steel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the automotive steel market report based on vehicle type, application, and region:

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicle

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Body Structure

-

Power Train

-

Suspension

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.