- Home

- »

- Automotive & Transportation

- »

-

Automotive Test Equipment Market Size, Share Report, 2033GVR Report cover

![Automotive Test Equipment Market Size, Share & Trends Report]()

Automotive Test Equipment Market (2026 - 2033) Size, Share & Trends Analysis Report By Product, By Vehicle (Passenger Vehicle, Light Commercial Vehicle), By Application Tools (Handheld Scan Tool, PC/Laptop-based Scan Tool), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-702-5

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Automotive Test Equipment Market Summary

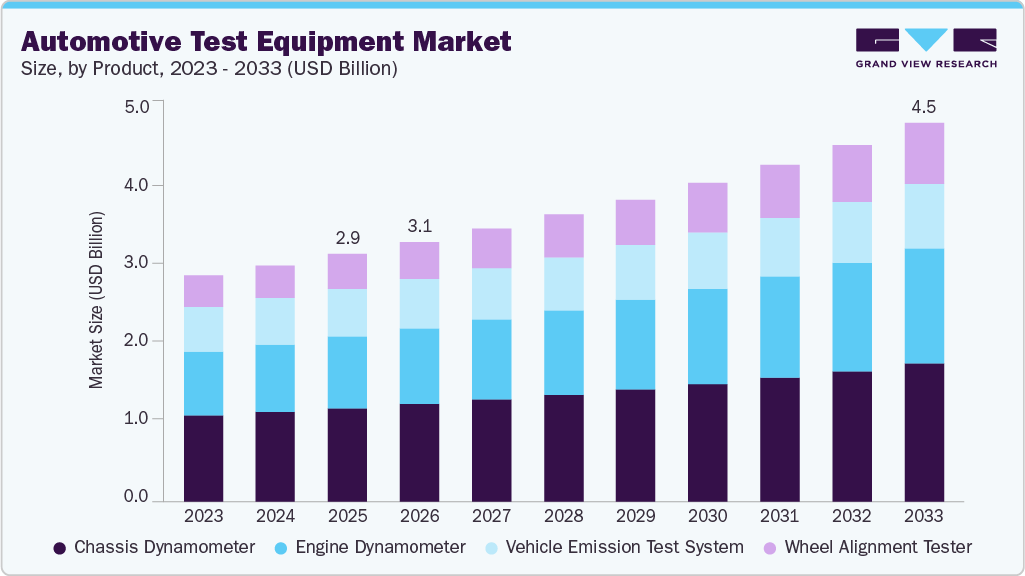

The global automotive test equipment market size was estimated at USD 2.92 billion in 2025, and is projected to reach USD 4.46 billion by 2033, growing at a CAGR of 5.5% from 2026 to 2033. Rising vehicle electrification, increasing software content, and tighter quality expectations across OEMs and suppliers are driving market growth.

Key Market Trends & Insights

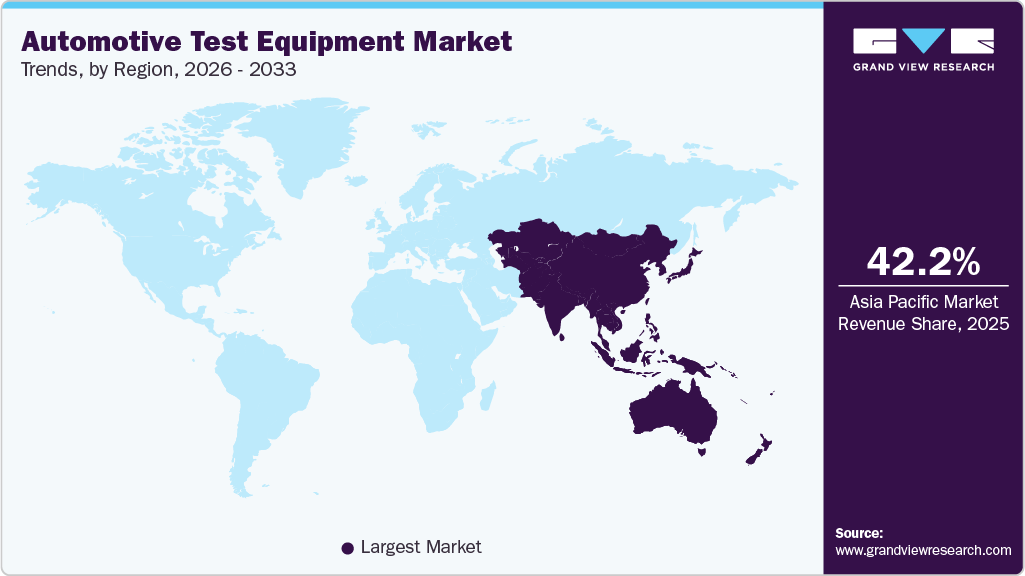

- Asia Pacific automotive test equipment industry accounted for a 42.2% share of the overall market in 2025.

- The automotive test equipment industry in the China held a dominant position in 2025.

- By product, the chassis dynamometer segment accounted for the largest share of 37.8.% in 2025.

- By vehicle, the passenger vehicle segment held the largest market share in 2025.

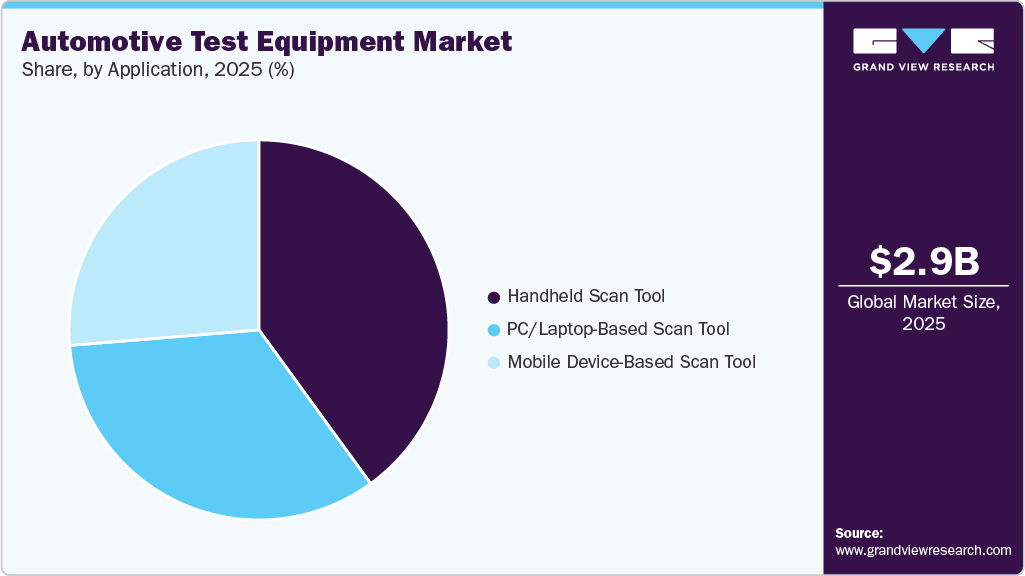

- By application tools, the handheld scan tool segment dominated the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 2.92 Billion

- 2033 Projected Market Size: USD 4.46 Billion

- CAGR (2026-2033): 5.5%

- Asia Pacific: Largest market in 2025

Higher model proliferation and shorter development cycles have necessitated broader validation coverage, resulting in increased volumes of functional, durability, and end-of-line testing across the powertrain, chassis, body electronics, and ADAS domains.The global automotive industry is witnessing a historic transformation as electric and hybrid vehicles rapidly gain traction across major markets. Governments worldwide are setting ambitious carbon neutrality targets and phasing out internal combustion engine (ICE) vehicles, prompting automakers to accelerate electrification strategies. For instance, the European Union plans to ban new petrol and diesel car sales by 2035, while countries like China and the U.S. are offering subsidies and tax credits for EV purchases.

This large-scale transition is not only reshaping vehicle architectures but also revolutionizing the entire supply chain from powertrain components to testing and validation systems. Unlike traditional vehicles, electric and hybrid vehicles require precise testing of high-voltage systems, energy efficiency, and battery management. As a result, automakers and suppliers are investing heavily in new categories of automotive test equipment designed to ensure safety, performance, and regulatory compliance. The shift toward electrification thus serves as a fundamental growth catalyst for the automotive test equipment ecosystem.

The regulatory environment is intensifying the need for advanced test equipment. Global safety and environmental standards for EVs and hybrids are evolving rapidly to address new risks such as battery fire hazards, high-voltage shock protection, and electromagnetic interference. Agencies like the United Nations Economic Commission for Europe (UNECE) and National Highway Traffic Safety Administration (NHTSA) have introduced specific testing protocols for EV safety, battery integrity, and emissions compliance from hybrid drivetrains (UNECE Regulation No. 100). Compliance with such stringent regulations compels OEMs and component suppliers to establish dedicated testing facilities equipped with specialized instruments for durability, vibration, crash, and electrical safety validation. As these standards become globally harmonized, even suppliers operating in smaller markets must upgrade their testing infrastructure. This ongoing regulatory alignment continues to drive growth in demand for automotive test equipment designed for electrified vehicle platforms.

The automotive industry is undergoing a major transformation with the rapid rise of autonomous driving technologies. Automakers and technology companies are investing heavily in developing vehicles capable of operating with minimal or no human input. Levels of autonomy have progressed from basic driver-assist features such as adaptive cruise control and lane-keeping (Level 1-2) to more advanced Level 3 and Level 4 systems capable of handling complex urban environments. For instance, Mercedes-Benz received approval in Germany and the U.S. for its Level 3 “Drive Pilot” system, marking a significant regulatory milestone. Similarly, Waymo and Cruise are advancing pilot operations for driverless robotaxis in cities like San Francisco and Phoenix. These technological advancements are fueling demand for sophisticated testing tools capable of validating AI algorithms, radar and LiDAR sensor accuracy, and vehicle-to-everything (V2X) communication systems creating a surge in demand for automotive test equipment.

The increasing technological sophistication of modern vehicles, particularly with the rise of electric, hybrid, and autonomous platforms, has significantly escalated the cost of testing and validation infrastructure. Automotive testing now requires advanced equipment such as dynamometers, HIL (Hardware-in-the-Loop) simulators, ADAS validation rigs, and environmental chambers capable of replicating diverse real-world conditions. These systems often integrate sensors, artificial intelligence, and cloud analytics, driving up both capital and operational expenses. For instance, validating autonomous driving functions demands high-resolution LiDAR calibration systems and complex simulation setups that can cost millions of dollars to deploy and maintain. Smaller automakers and Tier-2 suppliers often struggle to justify these investments, limiting the widespread adoption of high-end test platforms and creating disparities in technological readiness across the supply chain.

Product Insights

The chassis dynamometer segment accounted for the largest share of 37.8% in 2025. The growing emphasis on real-world vehicle performance, durability, and NVH (noise, vibration, harshness) is driving the adoption of chassis dynamometers. Rather than simply certifying vehicles under standard conditions, automakers and suppliers now demand test rigs that can replicate varied, repeatable on-road loads (such as towing, hills, extended high-speed runs) in a controlled lab environment. This capability reduces development time, enables precise tuning of powertrain, suspension, and NVH characteristics, and helps ensure that the finished vehicle behaves as expected in real-life conditions.

The wheel alignment tester segment is expected to grow at the fastest CAGR during the forecast period. The steady rise in global vehicle production and the rapid expansion of the automotive aftermarket service industry is fueling growth of the growth of wheel alignment testers in the automotive test equipment industry. With the increasing number of vehicles on the road, the need for regular maintenance, tire replacement, and wheel alignment services has grown substantially. Proper alignment is crucial for ensuring vehicle safety, driving stability, maximizing tire lifespan, and enhancing fuel efficiency.

Vehicle Insights

The passenger vehicle segment held the largest market share of 61.0% in 2025. The growing focus on vehicle safety, performance, and environmental compliance, coupled with evolving regulatory standards and rising consumer expectations, is driving the demand for automotive test equipment in passenger vehicles. Global vehicle production continues to expand, particularly in emerging markets, placing automakers under increasing pressure to design safer, more efficient, and lower-emission cars. Stringent norms such as Euro 7, CAFÉ standards, and BS VI have intensified the need for advanced testing technologies to ensure compliance and optimize vehicle performance. Automotive test systems play a crucial role in evaluating powertrain efficiency, emissions, and component durability under various operating conditions, enabling manufacturers to meet international quality standards.

The light commercial vehicle segment is expected to grow at a significant CAGR during the forecast period. The increasing demand for vehicle reliability, durability, and efficiency in logistics, delivery, and small-scale transport applications is driving the growth of automotive test equipment for light commercial vehicles (LCVs). The surge in e-commerce and last-mile delivery services has led to a significant rise in the production and utilization of LCVs worldwide. Fleet operators and manufacturers are focusing on minimizing downtime, improving operational efficiency, and ensuring compliance with emission and safety standards. This has accelerated the adoption of advanced testing systems to evaluate critical performance parameters such as engine health, braking efficiency, load endurance, and emission control.

Application Tools Insights

The handheld scan tool segment dominated the market in 2025. The rising demand for efficient and cost-effective maintenance solutions is driving the growth of the segment. Automotive workshops and fleet operators are under pressure to reduce vehicle downtime and service costs while maintaining high diagnostic accuracy. Handheld scan tools provide quick, on-site diagnostics without the need for large, stationary systems, allowing faster turnaround and improved service productivity. Their ease of use and affordability make them especially popular among small and mid-sized repair facilities.

The mobile device-based scan tool segment is projected to grow at the fastest CAGR of 6.8% over the forecast period. The expansion of the global automotive aftermarket and the increasing number of vehicles in operation are major factors driving the demand for portable and scalable diagnostic solutions. As vehicles age and require more frequent maintenance, the need for quick, reliable, and flexible diagnostic tools has become essential for both service providers and vehicle owners. Mobile device-based scan tools address this need by enabling real-time data access, cloud-based service history tracking, and compatibility across a wide range of vehicle models and systems.

Regional Insights

The North America automotive test equipment industry held a significant share in 2025. The demand in the region is driven by rapid electrification, as OEMs and suppliers accelerated investments in high-voltage battery, e-motor, and charging system validation. A major growth in drivers was the rising demand for ADAS and autonomous vehicle testing, prompting the expansion of sensor calibration, software-in-the-loop, and scenario simulation systems.

U.S. Automotive Test Equipment Market Trends

The U.S. automotive test equipment industry held a dominant position in 2025 due to the surge in electric vehicle production, leading to heightened demand for advanced battery cyclers, power analyzers, and high-voltage safety testing systems. The country witnessed significant modernization of proving grounds, where 5G connectivity and edge computing were introduced to enhance real-time testing and data transfer.

Europe Automotive Test Equipment Industry Trends

The Europe automotive test equipment industry was identified as a lucrative region in 2025. The European market is experiencing a strong transition toward AI-driven and digitalized testing solutions as manufacturers seek to reduce costs and shorten development cycles under strict EU regulations. Increasing focus on electrification, sustainability, and autonomous vehicle technologies is driving the need for intelligent test systems capable of managing complex validation tasks.

The UK automotive test equipment industry is expected to grow rapidly in the coming years due to growing focus on advanced vehicle diagnostics. Workshops and service centers are increasingly adopting multi-system diagnostic tools capable of handling diverse vehicle make and models to meet complex servicing needs.

The German automotive test equipment industry held a substantial market share in 2025. The growth in the country is attributed to the rising complexity of electric and hybrid powertrains, which require more integrated and precise validation systems. The country continues to strengthen its position as a global hub for advanced testing and certification, with a strong focus on multi-domain testing that combines mechanical, electrical, and environmental parameters.

Asia Pacific Automotive Test Equipment Industry Trends

The Asia Pacific automotive test equipment industry is anticipated to grow at a CAGR of 6.2% during the forecast period. The rapid advancement driven by the growing adoption of high-speed in-vehicle communication systems and digital testing technologies is fueling growth of the market in the region. The region’s automakers and component suppliers are increasingly investing in optical and Ethernet-based automotive testing solutions to support next-generation connected and software-defined vehicles.

The India automotive test equipment industry is expected to grow rapidly in the coming years, fueled by increasing investments in advanced testing infrastructure and vehicle validation facilities. The focus on enhancing safety, performance, and reliability standards is encouraging the development of modern test tracks and laboratories across the country.

The China automotive test equipment industry held a substantial market share in 2025. The market growth is primarily driven by the growing localization of R&D and testing capabilities. The increasing collaboration between international technology suppliers and domestic testing institutions is accelerating the development of advanced validation facilities.

Key Automotive Test Equipment Company Insights

Some of the key companies in the automotive test equipment industry include Robert Bosch GmbH, Siemens, Delphi Technologies (PHINIA Inc.), Continental AG, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Robert Bosch GmbH (Bosch) is a technology and services provider, offering innovative solutions that enhance automation, electrification, digitalization, and sustainability across industries. The company operates through key business sectors, including Mobility, Industrial Technology, Consumer Goods, and Energy and Building Technology. Its product portfolio encompasses sensor technology, software, and cross-domain connectivity solutions that integrate artificial intelligence for smarter, more efficient applications. The company specializes in advanced diagnostic tools, sensors, and software that enable precise testing and maintenance of vehicle systems.

-

Siemens AG is a technology company that delivers solutions across electrification, automation, and digitalization to drive industrial and societal advancement. The company operates through five primary segments: Digital Industries, Smart Infrastructure, Mobility, Siemens Healthineers, and Siemens Financial Services. Its diverse portfolio includes intelligent infrastructure systems, digital manufacturing technologies, smart mobility solutions, and medical and energy systems tailored to meet the complex needs of customers. The company focuses on providing digital simulation, automation, and testing solutions that enable efficient design validation and production optimization for vehicle systems.

Key Automotive Test Equipment Companies:

The following are the leading companies in the automotive test equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- Siemens

- Delphi Technologies (PHINIA Inc.)

- Continental AG

- Honeywell International Inc

- ABB

- Softing AG

- HORIBA

- SGS Société Générale de Surveillance SA

- Anthony Best Dynamics Limited.

Recent Developments

-

In September 2025, Siemens Digital Industries Software launched Tessent AnalogTest, a solution designed to automate analog circuit test generation and dramatically reduce development time. The software enables testing of analog components up to 100 times faster than conventional methods while maintaining high defect detection accuracy. By integrating automated design-for-test features and digital test patterns, it allows engineers to achieve over 90% defect coverage and significantly accelerate chip validation processes.

-

In December 2024, HORIBA partnered with Monolith AI to advance battery and powertrain testing using artificial intelligence. The collaboration allows Monolith AI to utilize HORIBA MIRA’s research data to improve its Anomaly Detector and Next Test Recommender tools, while integrating these capabilities into MIRA’s cloud-based development platform. This partnership aims to accelerate testing processes, reduce physical prototypes, and optimize system-level development for automotive manufacturers and suppliers.

Automotive Test Equipment Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 3.06 billion

Revenue forecast in 2033

USD 4.46 billion

Growth rate

CAGR of 5.5% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report vehicle

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

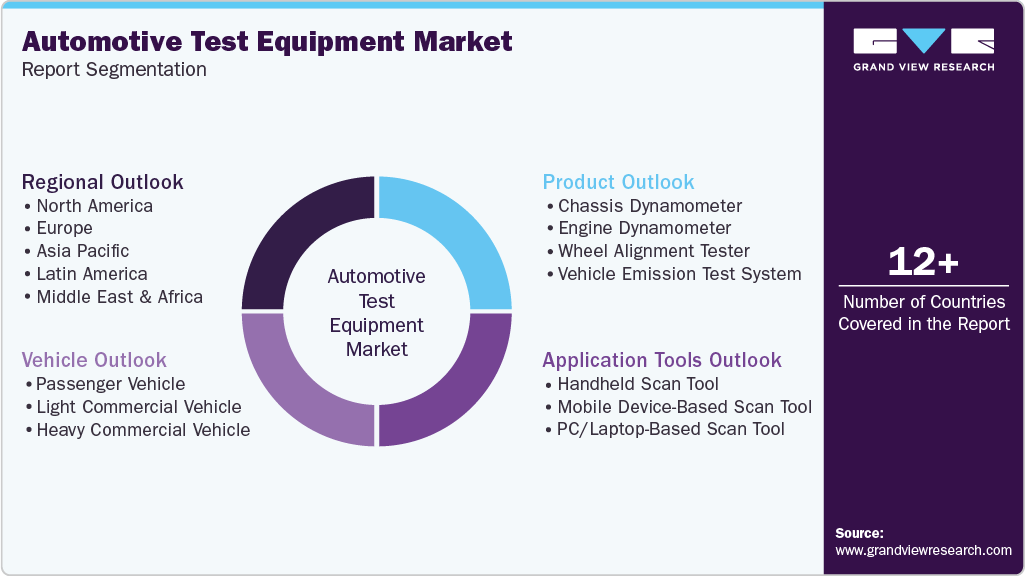

Product, vehicle, application tools, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Robert Bosch GmbH; Siemens; Delphi Technologies (PHINIA Inc.); Continental AG; Honeywell International Inc; ABB; Softing AG; HORIBA; SGS Société Générale de Surveillance SA; Anthony Best Dynamics Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Automotive Test Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global automotive test equipment market report based on product, vehicle, application tools, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Chassis Dynamometer

-

Engine Dynamometer

-

Wheel Alignment Tester

-

Vehicle Emission Test System

-

-

Vehicle Outlook (Revenue, USD Million, 2021 - 2033)

-

Passenger Vehicle

-

Light Commercial Vehicle

-

Heavy Commercial Vehicle

-

-

Application Tools Outlook (Revenue, USD Million, 2021 - 2033)

-

Handheld Scan Tool

-

Mobile Device-Based Scan Tool

-

PC/Laptop-Based Scan Tool

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global automotive test equipment market size was estimated at USD 2.92 billion in 2025 and is expected to reach USD 3.06 billion in 2026.

b. The global automotive test equipment market is expected to grow at a compound annual growth rate of 5.5% from 2026 to 2033 to reach USD 4.46 billion by 2033.

b. Asia Pacific dominated the automotive test equipment market with a share of 42.2% in 2025. The rapid advancement driven by the growing adoption of high-speed in-vehicle communication systems and digital testing technologies is fueling growth of the market in the region.

b. Some key players operating in the automotive test equipment market include Robert Bosch GmbH; Siemens; Delphi Technologies (PHINIA Inc.); Continental AG; Honeywell International Inc; ABB; Softing AG; HORIBA; SGS Société Générale de Surveillance SA; Anthony Best Dynamics Limited.

b. Rising vehicle electrification, increasing software content, and tighter quality expectations across OEMs and suppliers are driving the growth of the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.