- Home

- »

- Automotive & Transportation

- »

-

Automotive Transmission Market Share Report, 2021-2028GVR Report cover

![Automotive Transmission Market Size, Share & Trends Report]()

Automotive Transmission Market Size, Share & Trends Analysis Report By Transmission Type (Manual, Automatic), By Fuel Type (Gasoline, Diesel), By Vehicle Type (Passenger Cars, HCVs), By Region, And Segment Forecasts, 2021 - 2028

- Report ID: 978-1-68038-978-4

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2019

- Forecast Period: 2021 - 2025

- Industry: Technology

Report Overview

The global automotive transmission market size was valued at USD 152.32 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 5.2% from 2021 to 2028. The COVID-19 pandemic has negatively impacted the automobile industry, leading to sluggish growth of the automotive transmission market as a result of declined automotive sales or new requirements. On the other hand, technological advancements and the evolution of transmission systems as per performance requirements across several vehicle types, including Heavy Commercial Vehicles (HCVs) and passenger cars, are expected to drive the market growth over the forecast period. Automotive OEMs are adopting advanced systems, such as Automated Manual Transmission (AMT), with minimized fuel consumption and CO2 emissions without compromising on performance.

Rapid technological advancements in automotive transmission manufacturing are expected to boost the market growth. In addition, the increasing adoption of Continuously Variable Transmission (CVT) and Dual Clutch Transmission (DCT) technologies over manual and automatic systems, owing to the shift in demand for fuel-efficient products with increased performance, is anticipated to drive the market over the forecast period. Many auto manufacturers are introducing Intelligent Manual Transmission (IMT) that allows drivers to work the gears without clutch depressing.

Automobile component manufacturers in the industry are striving to provide cost-efficient solutions without compromising on vehicle performance. They are implementing numerous growth strategies to meet the increasing demand for transmission systems across the automobile industry. For instance, Aisin Seiki Co., Ltd. is focused on consolidating development and production capabilities for Toyota Motor Corp.’s manual transmission products under Aisin AI. Consolidating their capabilities will enable the companies to meet the worldwide demand and strengthen the competitiveness of their manual systems business.

Manufacturers in the industry are required to abide by stringent regulations. In August 2006, the National Highway Traffic Safety Administration (NHTSA) under the Federal Motor Vehicle Safety Standards (FMVSS) announced an agreement with the Association of International Automobile Manufacturers and Alliance of Automobile Manufacturers to make sure that every vehicle with automatic transmissions sold in the U.S. is equipped with brake transmission system interlocks.

The economy worldwide has witnessed a massive setback due to the COVID-19 pandemic, thus negatively impacting automobile production. The aftermath of COVID-19 has resulted in supply chain disruptions with several production facilities coming to a halt. Moreover, it has taken a toll on passenger and commercial vehicle sales, subsequently impacting the demand for automotive transmission. Europe was the leading regional market in the past, in terms of product sales; however, the adoption rate has recently witnessed a decline due to a dip in vehicle sales in the region. Europe will see mixed recovery cycles owing to the economic stimulus packages and local restrictions. According to the German Association of the Automotive Industry (VDA), in Europe, 5.1 million passenger cars were registered in the first half of 2020, which was 39% lesser than in 2019. Moreover, the sales for passenger vehicles in the U.S. were down by around 26% in 2020 compared to the previous year.

Transmission Type Insights

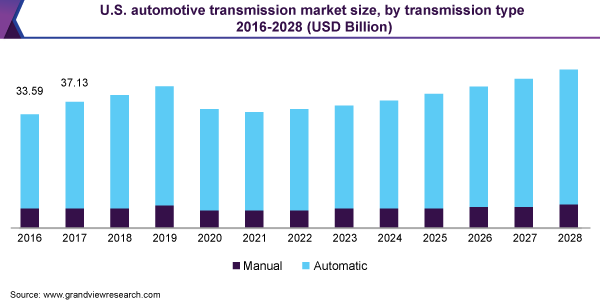

The manual type segment accounted for the largest revenue share of more than 50% in 2020. This growth is attributed to the price difference in vehicles with manual and automatic transmission variants. Consumers are inclined to opt for manual transmission owing to price sensitivity. Moreover, manual type also provides better mileage compared to its automatic variant as the gear shifting can be manually adjusted to deduce fuel consumption.

The automatic type segment is projected to register the fastest CAGR from 2021 to 2028. The growth can be attributed to the advancements in the automotive industry and improvements in automatic transmissions. Moreover, automatic types are easier to operate, efficient, and more powerful and accurate. The high price of these products may hamper their adoption in countries, such as India and Mexico. However, changing preferences and increasing consumer purchasing power in these countries are expected to support the segment growth over the forecast period.

Fuel Type Insights

The gasoline segment accounted for the largest revenue share of more than 55% in 2020. Gasoline cars comply with almost all emission regulations. They are efficient and emit lesser gas as compared to their diesel counterparts. The rising demand for gasoline across countries, such as the U.S., China, and India, is anticipated to drive the segment growth over the forecast period. According to the International Energy Agency (IEA), the gasoline demand is anticipated to increase over the next few years, due to the fast-growing markets in Asia, Central & South America, Africa, and the Middle East, which accounts for about 70% of the global demand growth in 2021.

The diesel segment is estimated to register a steady CAGR from 2021 to 2028. Diesel cars also have a significant demand owing to their high compression ratio, which allows better engine efficiency. A diesel engine is simpler than a gas engine as it does not require any associated electrical system and spark plugs. This engine type is widely adopted for use in cars and SUVs as it offers improved performance, similar to that of a gas engine, but with added gas mileage and reliability.

Vehicle Type Insights

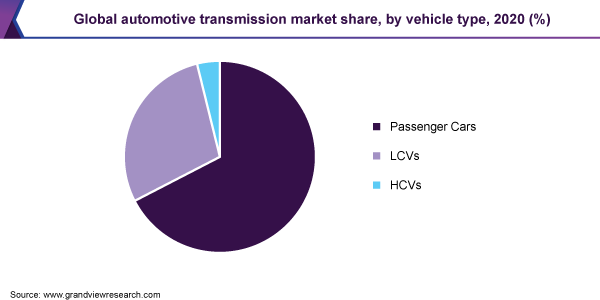

The passenger cars segment accounted for the largest revenue share of over 67% in 2020. Volatile fuel prices and the transportation infrastructure influence the demand for passenger cars. The global demand for passenger cars is expected to gain traction owing to the improving economic outlook in the U.S. and many developing markets, such as China and India.

Moreover, innovations in transmission technology in the passenger cars segment from 4-speed automatic transmissions to 8-speed and 9-speed automatic transmissions have led to enhancements in the overall comfort, driving experience, and fuel efficiency of these vehicles, which, in turn, augments the segment growth.

The HCVs segment is estimated to register the maximum CAGR of more than 8% from 2021 to 2028. Increasing manufacturing and infrastructure building activities have spurred the sales of HCVs. In addition, the growing number of HCVs in Europe has led the EU regulatory bodies and OEMs to enhance and improve the safety aspects of HCVs, thus driving their demand.

Regional Insights

Asia Pacific accounted for the largest revenue share of more than 31% in 2020 and is anticipated to continue its dominance growing at the fastest CAGR during the forecast period. The market growth is driven by the presence of several prominent automobile manufacturers and ancillaries in the region. Stringent regulations across Asia Pacific have encouraged companies to adopt efficient transmission systems. In addition, increasing automotive sales, especially in countries like China, India, Japan, and South Korea, are anticipated to have a positive impact on the regional market growth over the forecast period.

The markets in North America and Europe are expected to witness significant growth with the increasing penetration of electrified transmissions owing to the increasing focus on hybrid vehicles and their beneficial impact on fuel economy and emissions. In 2019, over 91% of passenger cars sold in the U.S. were Internal Combustion Engine (ICE) vehicles, while Electric Vehicles (EVs) accounted for the remaining 9%.

Key Companies & Market Share Insights

Most of the key companies focus on providing technologically driven and advanced products to enhance their product offerings in the market. The companies are also undertaking strategic initiatives, such as regional expansions, acquisitions, mergers, partnerships, and collaborations, to enhance their market share. Organic growth remains the key strategy for the overall industry with a significant focus on product launches. For instance, in April 2021, ZF Friedrichshafen AG announced the launch of the new 8-speed automatic transmission, ZF PowerLine, for medium-duty vehicles. The new ZF PowerLine provides higher efficiency than 9-speed and 10-speed transmission. Some of the prominent players in the global automotive transmission market include:

-

Aisin Seiki Co., Ltd.

-

Allison Transmission, Inc.

-

BorgWarner Inc.

-

Continental AG

-

Eaton Corporation PLC

-

Getrag

-

GKN PLC

-

Jatco Ltd.

-

Magna International, Inc.

-

ZF Friedrichshafen AG

Automotive Transmission Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 148.76 billion

Revenue forecast in 2028

USD 211.85 billion

Growth rate

CAGR of 5.2% from 2021 to 2028

Base year for estimation

2020

Historical data

2016 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD billion and CAGR from 2021 to 2028

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Transmission type, fuel type, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Rest of the World

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; Japan; India; South Korea

Key companies profiled

Aisin Seiki Co., Ltd.; Allison Transmission, Inc.; BorgWarner Inc.; Continental AG; Eaton Corporation PLC; Getrag; GKN PLC; Jatco Ltd.; Magna International, Inc.; ZF Friedrichshafen AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2028. For the purpose of this study, Grand View Research has segmented the global automotive transmission market report on the basis of transmission type, fuel type, vehicle type, and region:

-

Transmission Type Outlook (Revenue, USD Billion, 2016 - 2028)

-

Manual

-

Automatic

-

-

Fuel Type Outlook (Revenue, USD Billion, 2016 - 2028)

-

Gasoline

-

Diesel

-

Others

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2016 - 2028)

-

Passenger Cars

-

LCVs

-

HCVs

-

-

Regional Outlook (Revenue, USD Billion, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Rest of the World

-

Frequently Asked Questions About This Report

b. The global automotive transmission market size was estimated at USD 152.32 billion in 2020 and is expected to reach USD 148.76 billion in 2021.

b. The global automotive transmission market is expected to grow at a compound annual growth rate of 5.2% from 2021 to 2028 to reach USD 211.85 billion by 2028.

b. Asia Pacific accounted for the largest revenue share of more than 31% in 2020 and is anticipated to continue its dominance growing at the fastest CAGR during the forecast period in the automotive transmission market.

b. Some key players operating in the automotive transmission market include Allison Transmission Inc., Aisin Seiki Co., Ltd., Continental AG, BorgWarner Inc., Eaton Corporation PLC, GKN PLC, Getrag, Jatco Ltd., Magna International Inc., and ZF Friedrichshafen AG.

b. Key factors that are driving the automotive transmission market growth include stringent government standards associated with carbon emission and the growing number of commercial and passenger vehicles.

b. The manual type segment accounted for the largest revenue share of more than 50% in 2020 in the automotive transmission market.

b. The gasoline segment accounted for the largest revenue share of more than 55% in 2020 in the automotive transmission market.

b. The passenger cars segment accounted for the largest revenue share of over 67% in 2020 in the automotive transmission market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."