- Home

- »

- Next Generation Technologies

- »

-

Global Autonomous Finance Market Size & Share Report, 2030GVR Report cover

![Autonomous Finance Market Size, Share & Trends Report]()

Autonomous Finance Market (2022 - 2030) Size, Share & Trends Analysis Report By Solution (Auto-payments, Asset Management), By End-use (Banks, Financial Institutions, Healthcare), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-016-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Finance Market Summary

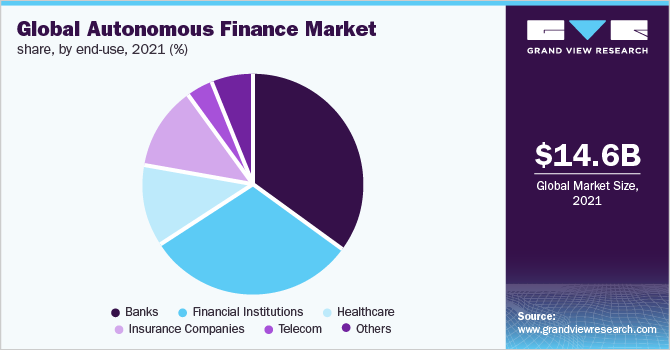

The global autonomous finance market was valued at USD 14.57 billion in 2021 and is anticipated to reach USD 56.93 billion by 2030, growing at a CAGR of 16.8% from 2022 to 2030. Autonomous finance leaders are increasingly leaning towards autonomous finance solutions because they can enhance business processes, functions, and workflows through automation, leveraging self-learning software.

Key Market Trends & Insights

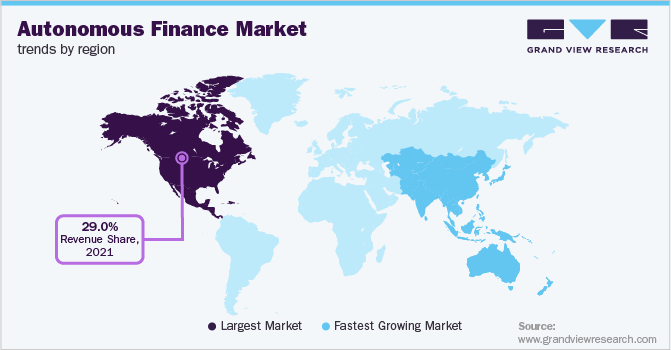

- North America dominated the autonomous finance market in 2021 and accounted for more than 29.0% of revenue.

- Asia Pacific is expected to emerge as the fastest-growing market during the forecast period.

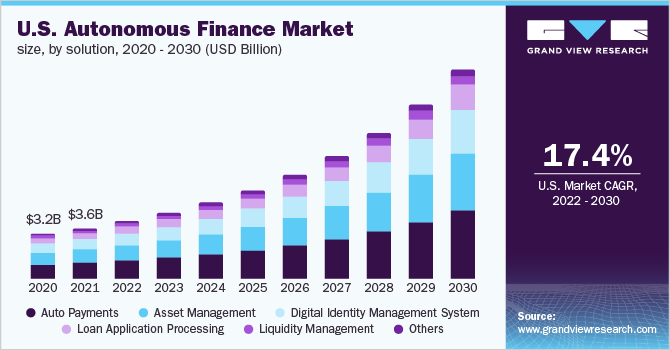

- By solution, the auto payments segment dominated the market in 2021, accounting for a revenue share of more than 30.0%.

- By end-use, the banks segment dominated the market in 2021 and accounted for a global revenue share of more than 35.0%.

Market Size & Forecast

- 2021 Market Size: USD 14.57 Billion

- 2030 Projected Market Size: USD 56.93 Billion

- CAGR (2022-2030): 16.8%

- North America: Largest market in 2021

- Asia Pacific: Fastest growing market

The growth of autonomous finance operations can be attributed to various benefits provided to businesses, including cost-efficiency, reduction in system downtime, real-time data analytics & reporting, and scalability in operations without hiring additional staff. Technological development and automation through technologies such as Artificial Intelligence (AI), cloud services, and Robotic Process Automation (RPA) are being leveraged to develop digital processes and enhance the customer experience in obtaining digital and autonomous financial services.The technological capabilities of autonomous finance fintech companies are expected to provide a first-mover advantage to early adopters. According to receeve GmbH, a debt recovery and collection platform, 89.0% of finance leaders within the BFSI industry believe that companies that adopt autonomous finance operations early would gain a significant competitive advantage over their peers. Autonomous finance is already being incorporated into various financial operations such as accounting, asset management, loan application processing, and liquidity management. The autonomous finance market is expected to grow as companies align to improve technology capabilities and customer experience.

Banks and financial institutions have raised investments in technologies such as Robotic Process Automation (RPA), blockchain, data analytics, and Artificial Intelligence (AI) to automate business processes. Global banks, including Barclays, Goldman Sachs, and Moelis, have resorted to automation of back-end processes to drive efficiency, reduce workload, and use employees efficiently for core functions.

Additionally, changing customer preferences for digital and omnichannel financial services accelerated during the pandemic. The primary factor causing this transition was the ability to access financial services remotely. The rise in digitization and the need for businesses to align with customers emerging needs are expected to drive market growth.

The changing customer preferences for real-time financial services are a primary driver for the growth of autonomous finance operations. Financial services providers are thus compelled to adapt to the latest customer needs. For instance, World pay Group, a payment processing company, allowed merchants to accept payments in cryptocurrency from consumers either online or in person. Ubiquitous payment methods such as digital wallets are a prominent illustration of the acceptance of digital payments. Moreover, innovation-driven through emerging technologies such as blockchain-based autonomous decentralized finance is expected to contribute to the autonomous finance market growth.

Data security and privacy concerns are increasingly threatening the autonomous finance market. Major challenges plaguing several customers include digital theft, cybercrime, and identity safety concerns. However, regulators seek transparency and competition in the digital financial services industry while ensuring customer protection. The data security and privacy concerns are expected to be tackled and thus reduced during the forecast period.

COVID-19 Impact Analysis

The Financial Services Industry (FSI) encountered significant changes due to COVID-19. As automation emerged as a key trend, the popularity of digital platforms significantly expanded throughout the pandemic, and consumers of all age groups preferred digital transactions while interacting with businesses. Although Robotic Process Automation (RPA) was already being used significantly in FSIs, the additional need to enable a remote workforce drove automation and is expected to play a more significant role in the FSI.

The COVID-19 outbreak compelled people to use digital services and phone transactions to avoid the usage of cash and the associated risk of infection. Additionally, autonomous finance fintech companies also provided customers the ability to earn passive income through staking digital assets such as cryptocurrencies leading to rising awareness and a growing customer base.

Solution Insights

The auto payments segment dominated the market in 2021, accounting for a revenue share of more than 30.0%. A high penetration rate of smartphones has observed a rising preference for mobile banking and digital payments. Additionally, the Internet of Things (IoT) has led to a rise in connected devices enabling innovative payments. WORLDLINE, a digital payments company, reported 38.5 billion connected devices in 2020. Prevailing semi-autonomous payments and continuous innovation in the payments industry are expected to contribute to segment growth.

The asset management segment is anticipated to register significant growth during the forecast period. Autonomous asset management uses algorithms for automated asset and portfolio management. The ability of autonomous asset management to emulate human decision-making capabilities while sourcing the best execution rates for trades is the primary factor for segment growth. Autonomous software can also be used for stock analysis and forecasting. Users also benefit from reduced costs due to the elimination of intermediaries such as brokers.

End-use Insights

The banks segment dominated the market in 2021 and accounted for a global revenue share of more than 35.0%. The pandemic outbreak witnessed banks resorting to collaborations to incorporate automation capabilities. Digitization of banking functions helps save critical time from manual activities. For instance, in August 2021, Arab National Bank partnered with RPA technology provider Automation Anywhere to automate back-end functions and saved over 40,000 manual work hours. The transforming business models and the rise in digital banks are expected to contribute to segment growth.

The financial institutions segment is anticipated to register the fastest growth during the forecast period. Financial firms are rapidly digitizing all services, including retail offerings, payment platforms, and wealth and capital management processes. Virtual channels like mobile banking, chat support, contact centers, email communications, and internet catalogs are replacing physical branches to enhance customer service, which automation has made possible. The benefits provided by autonomous finance to financial institutions are driving the growth of the segment.

Regional Insights

North America dominated the autonomous finance market in 2021 and accounted for more than 29.0% of revenue. The North American region is characterized by an ecosystem encouraging the early adoption of innovative technology, including autonomous finance. Governments emphasize enabling a digital and sustainable finance infrastructure and driving purposeful governance.

Companies in the U.S. are collaborating to enhance digital capabilities. For instance, in February 2022, U.S. Bank partnered with Microsoft Corporation to improve its technology infrastructure and selected Microsoft Azure as the primary provider of cloud services to operate its applications.

Asia Pacific is expected to emerge as the fastest-growing market during the forecast period. The Asia Pacific regional market's growth can be attributed to the presence of many Internet of Things (IoT) based services and companies in the region. The region has favorable demographics with a high percentage of a young population.

The rising use of advanced technologies, such as artificial intelligence and machine learning, for the services such as asset management, digital identity authentication, and back-office procedures in several firms is anticipated to drive market growth in the region. The market opportunities are also expected to attract global investments in the region.

Key Companies & Market Share Insights

The autonomous finance market is characterized as a fragmented market. Prominent market players are pursuing strategies, such as research & development initiatives, expansion, strategic partnerships & joint ventures, and mergers & acquisitions to gain a competitive edge in the market. The strategic initiatives also represent an effort to add to the product offerings and innovation. Additionally, market players seek to gain market share due to the demand for fully automated solutions.

Vendors are offering autonomous solutions to enhance the customers' experience across the world. For instance, in January 2022, Roots Automation introduced a new SaaS platform for injury claims. The newly launched insurance technology solution automates data extraction and helps streamline insurance workflow and claim operations. Such initiatives and product launches by key market players drive the market's growth. Some of the prominent players in the global autonomous finance market include:

-

Signzy Technologies Private Limited

-

Roots Automation

-

ReGov Technologies Sdn Bhd

-

Fennech Financial

-

Auditoria.AI

-

High Radius Corporation

-

Oracle Corporation

-

NICE

-

Vic.ai

-

Viral Gains

Autonomous Finance Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 16.48 billion

Revenue forecast in 2030

USD 56.93 billion

Growth rate

CAGR of 16.8% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Solution, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil

Key companies profiled

Signzy Technologies Private Limited; Roots Automation; ReGov Technologies Sdn Bhd; Fennech Financial; Auditoria.AI; High Radius Corporation; Oracle Corporation; NICE; Vic.ai; Viral Gains

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Finance Market SegmentationThe report forecasts revenue growth at global, regional, and country levels providing an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global autonomous finance market report based on solution, end-use, and region:

-

Solution Outlook (Revenue, USD Billion, 2017 - 2030)

-

Asset Management

-

Auto Payments

-

Digital Identity Management System

-

Liquidity Management

-

Loan Application Processing

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Banks

-

Financial Institutions

-

Healthcare

-

Insurance Companies

-

Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global autonomous finance market size was estimated at USD 14.57 billion in 2021 and is expected to reach USD 16.48 billion in 2022.

b. The global autonomous finance market is expected to grow at a compound annual growth rate of 16.8% from 2022 to 2030 to reach USD 56.93 billion by 2030.

b. North America dominated the autonomous finance market with a share of 29.3% in 2021. The North American region is characterized by an ecosystem encouraging the early adoption of innovative technology, including autonomous finance.

b. Some key players operating in the autonomous finance market include Signzy Technologies Private Limited; Roots Automation; ReGov Technologies Sdn Bhd; Fennech Financial; Auditoria.AI; HighRadius Corporation; Oracle Corporation; NICE; Vic.ai; ViralGains.

b. Key factors that are driving the market growth include a rise in digital transactions and an increase in customer demand for a frictionless and real-time experience.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.