- Home

- »

- Automotive & Transportation

- »

-

Autonomous Forklift Market Size, Industry Report, 2030GVR Report cover

![Autonomous Forklift Market Size, Share & Trends Report]()

Autonomous Forklift Market (2025 - 2030) Size, Share & Trends Analysis Report By Forklift Type (Pallet Jacks, Reach Trucks), By Navigation Technology (LiDAR, Vision-Guided), By Load Capacity, By Autonomy, By Application, By End User, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-583-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Forklift Market Size & Trends

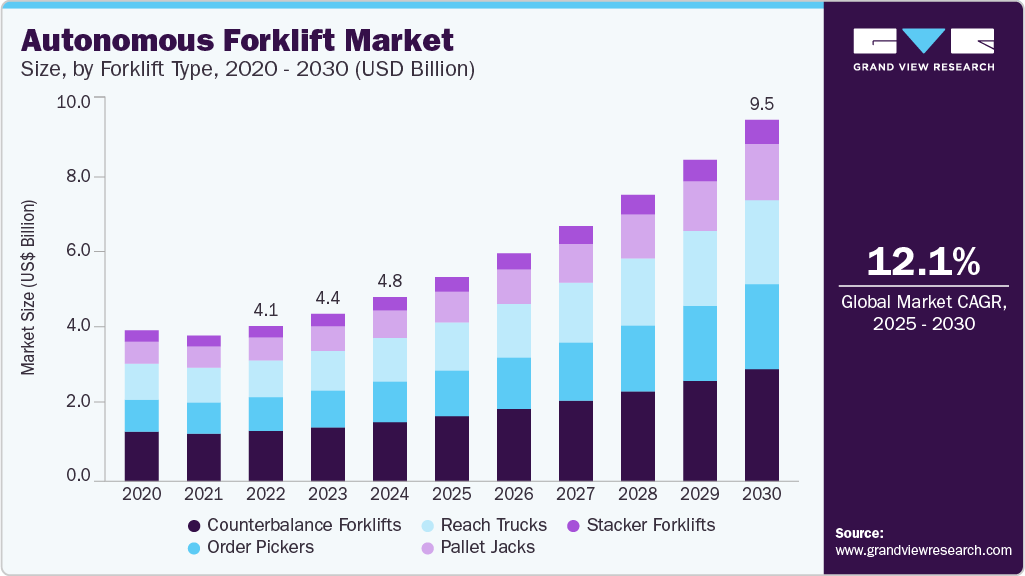

The global autonomous forklift market size is estimated at USD 4.84 billion in 2024 and is projected to reach USD 9.49 billion by 2030, growing at a CAGR of 12.1% from 2025 to 2030. The autonomous forklift market is gaining momentum, driven by growing labor shortages in warehousing and manufacturing, increasing demand for faster fulfillment in e-commerce, and a rising focus on industrial safety and regulatory compliance.

Key Highlights:

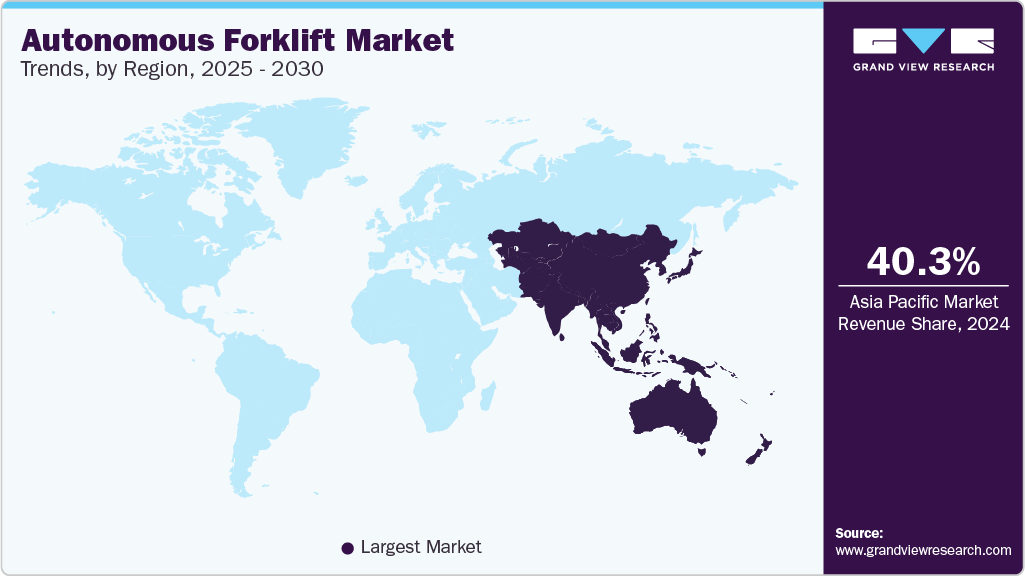

- The Asia Pacific autonomous forklift market accounted for 40.3% of the global share in 2024.

- The China autonomous forklift market held a substantial market share in 2024.

- In terms of forklift type, the counterbalance forklifts segment accounted for the largest share of 32.1% in 2024.

- In terms of navigation technology, the light detection and ranging (LiDAR) segment accounted for the largest share in 2024.

- In terms of application, the warehouse automation segment accounted for the largest share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.84 Billion

- 2030 Projected Market Size: USD 9.49 Billion

- CAGR (2025-2030): 12.1%

- Asia Pacific: Largest market in 2024

The need to address these challenges is pushing businesses to adopt autonomous forklifts to improve operational efficiency and reduce risks. However, high initial investment costs for autonomous forklift systems, including hardware, software, and integration, remain a key challenge. The integration of autonomous forklifts with smart warehousing solutions and IoT platforms presents a major growth opportunity for the market.

The growing labor shortages in warehousing and manufacturing are a significant driver for the autonomous forklift market. The American Staffing Association forecasts that warehouse and transportation job openings will reach 1.7 million by 2024, with this number expected to rise to 2.1 million by 2030, driven by high recruitment times and turnover. This gap between available talent and required expertise further exacerbates the labor shortfall. According to the U.S. Bureau of Labor Statistics, the warehousing industry currently faces a shortage of over 35,000 workers. To combat this challenge, automation has emerged as a strategic solution. For instance, in August 2024, Holman Logistics deployed autonomous high-reach forklifts from Third Wave Automation at its Spanaway facility. It utilizes AI-powered technology to improve efficiency and safety in warehousing and distribution tasks.

The increasing demand for faster fulfillment in e-commerce is a key driver for the autonomous forklift market. According to the India Brand Equity Foundation (IBEF), India’s e-commerce industry, valued at USD 125 billion in 2024, is projected to grow to USD 345 billion by 2030, reflecting a compound annual growth rate (CAGR) of 15%. In the U.S., according to the Census Bureau of the Department of Commerce, total e-commerce sales for 2024 are estimated to increase by 8.1%, accounting for 16.1% of total retail sales, compared to 15.3% in 2023. To keep up with these demands, major retailers, including Walmart are investing heavily in autonomous forklifts. For instance, in July 2024, Walmart announced plans to invest up to USD 200 million in autonomous forklifts, including the purchase of "FoxBots" from Fox Robotics. This investment is part of Walmart's broader automation initiative to improve warehouse efficiency and reduce labor costs, with staged deployments of the technology across multiple U.S. distribution centers.

In North America, regulations including OSHA (Occupational Safety and Health Administration) standards and ANSI (American National Standards Institute) guidelines for powered industrial trucks, are pushing companies to adopt autonomous technologies that improve safety. In the European Union, the Machinery Directive (2006/42/EC) and ISO 3691-4:2023, which is being developed to replace EN 1525, reflect safety requirements for modern driverless trucks. In the Asia-Pacific region, regulations such as China's Safety Production Law require companies to improve safety measures, further driving the demand for advanced autonomous forklifts that enhance safety while also ensuring compliance. As these standards become more stringent, companies will continue to invest in autonomous forklift solutions to meet compliance while improving operational efficiency.

Automation offers long-term savings, but the high initial capital expenditure may deter smaller businesses from adopting these solutions, despite the potential benefits in efficiency and labor cost reduction. High initial investment costs for autonomous forklift systems, including hardware, software, and integration, remain a significant challenge for many companies. These systems typically require an upfront investment of anywhere between ~USD 100,000 to USD 200,000 per unit, depending on the complexity of the technology and the required features. Additional costs for software licenses, integration with existing warehouse management systems, and ongoing maintenance can increase the overall expense.

Forklift Type Insights

The counterbalance forklifts segment accounted for the largest share of 32.1% in 2024. Factors such as the increasing demand for efficient material handling, the growing focus on warehouse automation, and the need to address labor shortages. Major companies are focusing on integrating advanced technologies such as AI, sensors, and automation to improve forklift performance. For instance, in January 2024, Jingsong Robot Co. introduced the X-FMR, an automated counterbalance forklift designed for warehouse use. The forklift autonomously identifies, lifts, transports, and stacks cargo, improving workflow efficiency by up to 70%.

The order pickers segment is projected to grow at the fastest CAGR from 2025 to 2030, driven by several key factors, including the increasing demand for faster and more accurate order fulfillment, especially within e-commerce and omnichannel retail, and the growing need for space optimization in warehouses. Also, labor shortages and the push to minimize human error in high-demand environments continue to fuel the adoption of autonomous order pickers.

Navigation Technology Insights

The light detection and ranging (LiDAR) segment accounted for the largest share in 2024, driven by factors such as the increasing adoption of autonomous vehicles, the need for accurate environmental sensing, and the growing demand for enhanced safety in warehouse operations. LiDAR technology plays a crucial role in enabling autonomous forklifts to navigate complex environments with precision. In September 2022, Toyota Material Handling Japan (TMHJ), a division of Toyota Industries Corporation, developed an autonomous lift truck featuring AI-based technology and 3D LiDAR. The truck is capable of recognizing truck and load positions, generating automated travel routes for loading operations, even in situations where the truck's stopping location and load position are not fixed.

The vision-guided segment is projected to grow at a significant CAGR during the forecast period, driven by the factors including the rising adoption of affordable 2D and 3D camera systems in warehouse automation, particularly in densely packed environments where LiDAR may struggle. The segment benefits from increased demand in the food & beverage sector, where changing SKU profiles and narrow aisles require flexible navigation. Companies such as Seegrid and Jungheinrich are also actively deploying vision-guided autonomous forklifts for case picking and pallet handling in dynamic retail warehouses.

Load Capacity Insights

The 1.5 to 3 tons segment accounted for the largest share in 2024, driven by increasing demand for versatile and efficient forklifts in medium-sized warehouse and manufacturing operations. These forklifts offer the perfect balance between lifting capacity and maneuverability, making them ideal for managing a wide variety of loads in sectors such as retail, e-commerce, and automotive. Their ability to navigate tight spaces while offering higher lifting capabilities has made them increasingly popular for high-density storage environments.

The less than 1.5 tons segment is expected to register a notable CAGR from 2025 to 2030, driven by factors such as the growing need for compact forklifts in confined spaces, advancements in battery technology providing longer operational hours, increased adoption of autonomous solutions for smaller-scale operations, and the rise of e-commerce and retail, where fast, efficient order picking is crucial. Pallet jacks and order pickers in this category are seeing increased demand for tasks in small-to-medium-sized warehouses and retail environments.

Autonomy Insights

The semi-autonomous segment accounted for the largest share in 2024, driven its ability to balance cost-effectiveness with increased operational efficiency. Many businesses prefer semi-autonomous forklifts as they offer enhanced productivity without the full investment required for fully autonomous systems. The segment holds a large share as it offers a more accessible entry point for companies transitioning toward automation, providing a scalable solution that enhances workflow without requiring significant upfront capital expenditure.

The fully autonomous segment is expected to register a notable CAGR from 2025 to 2030. Factors such as the increasing demand for warehouse automation, advancements in AI and sensor technology, and the need for enhanced operational efficiency are supporting the segment growth. Companies are increasingly adopting fully autonomous solutions to reduce labor costs, improve safety, and optimize material handling processes. For instance, in February 2024, ArcBest launched its Vaux Smart Autonomy line, featuring fully automated electric forklifts and reach trucks for distribution centers and manufacturing facilities. The new forklifts, part of ArcBest’s Vaux Freight Movement System, operate in autonomous, remote, or manual modes.

Application Insights

The warehouse automation segment accounted for the largest share in 2024, driven increasing demand for operational efficiency, labor cost reduction, and the need for enhanced safety in warehouse environments. The rise of e-commerce and the pressure to streamline supply chain operations have accelerated the adoption of automated solutions. In February 2024, ArcBest announced to launched Vaux Smart Autonomy, featuring reach trucks and autonomous forklifts that can also be operated remotely. The technology integrates sensors, cameras, and a teleoperator control center, enhancing warehouse operations and supporting the growth of complex supply chains.

The automated loading & unloading systems segment is expected to register a notable CAGR from 2025 to 2030, fueled by the increasing need for efficiency in warehouse operations, labor shortages, and the rising demand for faster supply chain operations. These systems help optimize loading and unloading tasks, reduce human error, and improve overall throughput in distribution centers. For instance, in April 2022, Gideon Bros, a Croatia-based company, launched the "Trey" autonomous forklift designed for truck trailer loading and unloading operations. The Trey forklift uses vision guidance to autonomously load and unload full pallets, significantly reducing the time required for loading dock workers by over 80%.

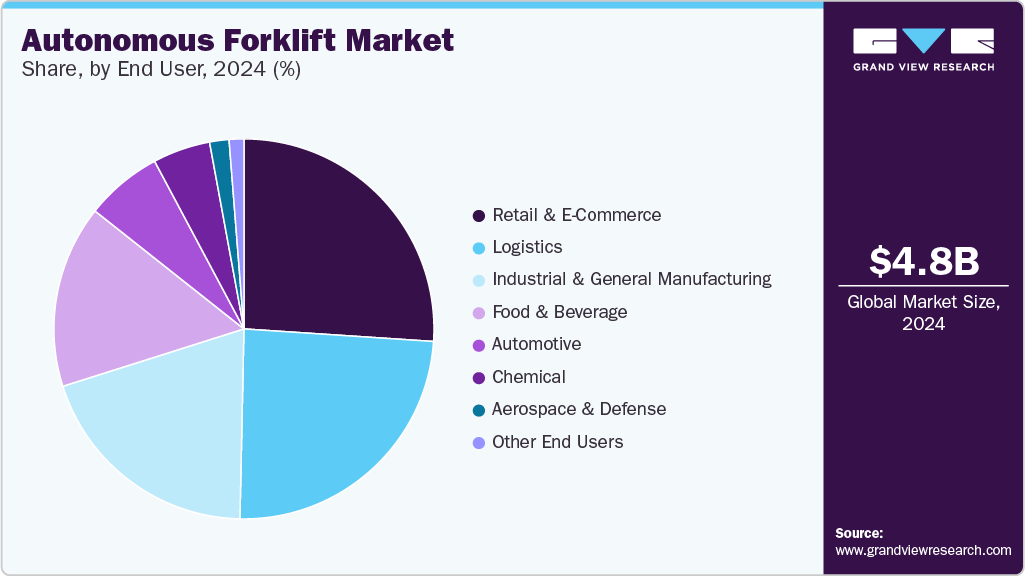

End User Insights

The logistics segment accounted for the largest share in 2024. Factors such as the increasing demand for faster order fulfillment, growing e-commerce, the need for labor cost reduction, and advancements in automation technology. The logistics sector includes activities such as warehousing, transportation, inventory management, and last-mile delivery. Autonomous forklifts, particularly counterbalance forklifts and reach trucks, are most commonly used in logistics due to its ability to handle heavy loads and operate efficiently in confined spaces. The growing focus on reducing operational costs has further fueled the adoption of autonomous forklifts, providing a cost-effective solution to enhance warehouse productivity and streamline operations.

The retail & e-commerce segment is expected to register a notable CAGR from 2025 to 2030, owing to the increasing demand for fast and accurate order fulfillment, the rise of direct-to-consumer (DTC) models, the growth of omnichannel retail strategies, and the need for more efficient supply chain management. The surge in online shopping, coupled with the push for faster delivery times, has heightened the need for warehouse automation, particularly autonomous forklifts. Retailers are adopting these technologies to streamline operations, reduce labor costs, and improve inventory management.

Regional Insights

The Asia Pacific autonomous forklift market accounted for 40.3% of the global share in 2024, driven by rising demand for efficient logistics operations, rapid advancements in automation technology, and strong government support for industrial automation. In Japan, the government's focus on enhancing labor productivity through Industry 4.0 initiatives has greatly contributed to the widespread adoption of autonomous forklifts in manufacturing and logistics. Similarly, China’s government has introduced numerous initiatives to encourage the development and deployment of robotics and automation, further fueling the market growth in the region. These efforts, along with the increasing pressure on businesses to streamline operations and reduce costs, have accelerated the adoption of autonomous forklifts across key industries in the Asia Pacific region.

Countries in this region are increasingly adopting smart warehouse solutions, aiming to enhance productivity and efficiency. In January 2024, Coca-Cola launched five new autonomous forklifts (AGVs) at its regional beverage concentrate plant in Singapore, in collaboration with XSQUARE Technologies, a leader in intelligent warehouse automation solutions in the Asia Pacific. This initiative is part of Coca-Cola’s digital transformation strategy to build supply chain resilience and enhance plant capacity for future growth.

The China autonomous forklift market held a substantial market share in 2024. The market in China is experiencing rapid growth, driven by factors such as the increasing demand for operational efficiency, government support for Industry 4.0, the growth of e-commerce, and the need for enhanced labor productivity. Companies including JD Logistics and Alibaba are adopting autonomous forklift technologies to streamline warehouse operations, improve order fulfillment, and reduce labor costs, accelerating market growth.

Autonomous forklift market in Japan held a significant share in 2024. In Japan, the autonomous forklift market is influenced by the increasing need for automation in response to labor shortages, the government’s push for Industry 4.0 technologies, and the growing demand for operational efficiency in logistics. Additionally, Japan's aging population and workforce challenges have accelerated the adoption of autonomous systems to reduce reliance on human labor. In March 2024, Mitsubishi Logisnext completed a demonstration of automated truck loading using AGVs, leading to the start of full-scale operations with Konoike Transport in Japan, aiming to address forklift operator shortages and reduce truck dwell times.

India autonomous forklift market held a significant share in 2024.According to the IBEF, the Indian logistics industry is experiencing rapid growth, driven by factors including the booming e-commerce market and advancements in logistics technology. In India, the logistics sector is expected to account for 14.4% of the GDP, with a projected market value increase from USD 250 billion in 2021 to USD 380 billion by 2025, growing at a rate of 10% to 12% annually. The sector’s expansion is supported by government and industry initiatives to reduce logistics and supply chain costs. These efforts are expected to drive the adoption of automated solutions, such as autonomous forklifts, to improve efficiency, reduce labor costs, and enhance operational productivity, thereby playing a crucial role in the continued growth of the market.

Europe Autonomous Forklift Market Trends

The Europe Autonomous Forklift industry was identified as a lucrative region in 2024. The European Autonomous Forklift market is witnessing significant transformation, driven by region’s strong focus on warehouse automation to improve efficiency and reduce operational costs, increased labor shortages, particularly in sectors reliant on manual material handling, and the growing emphasis on sustainability and reducing carbon emissions in logistics operations. Moreover, the European Union's initiatives to advance Industry 4.0 technologies, along with the region’s commitment to adopting green logistics practices, are propelling the market forward.

The European market for warehouse automation is witnessing increased demand as companies strive for enhanced efficiency and automation in material handling systems. In October 2024, KION Group AG partnered with Eurofork S.p.A. to distribute Eurofork’s E4CUBE pallet shuttle system through KION’s Industrial Trucks & Services sales network in the EMEA region. This partnership between KION Group AG and Eurofork S.p.A. further strengthens the market’s growth, emphasizing the growing shift towards automated solutions in material handling and warehouse operations across the EMEA region.

Germany Autonomous Forklift market is being shaped by country’s strong e-commerce growth, technological advancements, and increasing demand for automation in warehousing and distribution centers. Germany’s robust regulatory environment, which encourages digital transformation and automation in industries such as logistics, plays a key role in supporting the adoption of autonomous forklifts.According to the Waredock Estonia OÜ report,Germany, as Europe's largest economy and a leading digital retail market, is experiencing significant growth in online shopping, driven by technological innovation and changing consumer behavior. The e-commerce market is projected to grow from USD 58.4 billion in 2023 to USD 88.4 billion by 2028, with a CAGR of 8.29%. This surge in e-commerce will increase the demand for faster, more efficient logistics, leading to greater adoption of automation solutions including autonomous forklifts to streamline warehouse operations, reduce human labor costs, and improve the overall efficiency of the supply chain.

Autonomous Forklift market in the UK is growing rapidly, driven by key factors such as the expanding e-commerce sector, labor shortages, and technological advancements. Leading companies like KION Group and Mitsubishi Logisnext are expanding their automated solutions, integrating autonomous forklifts in various industries. The demand for counterbalance forklifts and reach trucks is high, as these products efficiently handle heavy loads and navigate tight spaces.

North America Autonomous Forklift Market Trends

The North America autonomous forklift industry was identified as a lucrative region in 2024. The autonomous forklift market in North America is being driven by factors such as the growing e-commerce sector, increasing demand for operational efficiency, and advancements in automation technology. Major players in the region, such as KION North America, Fox Robotics, and Toyota Material Handling, are heavily investing in autonomous solutions to meet the growing demand for more efficient and cost-effective warehouse operations. For instance, in May 2024, KION North America and Fox Robotics announced a non-exclusive partnership where KION NA will manufacture and assemble FoxBot autonomous trailer loader/unloaders at its Summerville, South Carolina facility. This collaboration is expected to scale Fox Robotics' supply chain and enhance its autonomous solutions offering in the U.S. market, further driving the adoption of automation in logistics and material handling.

Mexico autonomous forklift market is benefiting from rapid industrialization, particularly in the manufacturing, automotive, and logistics sectors. Companies like Grupo Bimbo and Nestlé Mexico have started incorporating automation technologies to boost productivity and minimize operational expenses. The shortage of skilled labor and rising labor costs are pushing industries to adopt autonomous forklifts to maintain efficiency. In 2024, the Mexican government introduced tax incentives for businesses adopting automation technologies, further accelerating the adoption of autonomous forklifts.

U.S. Autonomous Forklift Market Trends

The U.S. Autonomous Forklift industry held a dominant position in 2024. The Autonomous Forklift market in the U.S. is witnessing significant transformation, driven by driven by several key factors such as the increasing demand for warehouse automation, labor shortages, and advancements in robotics and artificial intelligence (AI). Companies are increasingly adopting autonomous forklifts to enhance productivity, reduce operational costs, and improve safety within distribution centers. The market is also supported by OSHA safety standards for workplace automation and ANSI's B56.5 regulations for industrial trucks, ensuring compliance and safety, and promoting wider adoption of autonomous forklifts. Additionally, the rise of e-commerce, particularly in retail sectors, has led to an increasing need for more efficient and scalable material handling solutions. In April 2024, Fox Robotics entered into a multi-year agreement with Walmart. The program will deploy 19 additional FoxBot autonomous forklifts across Walmart’s distribution centers, with potential for further expansion.

Key Autonomous Forklift Company Insights

Some of the key players operating in the market include Toyota Industries Corporation, KION Group AG, Hyster-Yale Materials Handling, Inc., and Jungheinrich AG,

-

Toyota Industries Corp. founded in 1926 and headquartered in Kariya, Japan, Toyota Industries Corporation is a global leader in manufacturing forklifts and material handling equipment. The company offers a wide range of autonomous forklifts, warehouse automation solutions, and logistics services. Toyota’s product portfolio includes both electric and automated guided vehicles (AGVs), which are deployed across industries such as automotive, manufacturing, retail, and logistics. Popular automated forklift products include the Toyota 8FBE Series (electric counterbalance trucks) and Toyota Automated Forklifts (AGVs).

-

KION Group AG, founded in 2006 and headquartered in Wiesbaden, Germany, KION Group AG is a leading manufacturer of industrial trucks and supply chain solutions. The company specializes in autonomous forklifts, automated guided vehicles (AGVs), and warehouse automation systems. KION Group’s product portfolio includes brands including Linde, STILL, and Baoli, offering a range of solutions for industries including automotive, retail, logistics, and manufacturing. Some of the automated forklift products include the Linde K Series and STILL Automated order pickers.

Key Autonomous Forklift Companies:

The following are the leading companies in the autonomous forklift market. These companies collectively hold the largest market share and dictate industry trends.

- Toyota Industries Corporation

- Seegrid Corporation

- KION Group AG

- AGILOX Services GmbH

- Jungheinrich AG

- Hyster-Yale Materials Handling, Inc.

- Mitsubishi Logisnext Co., Ltd.

- Oceaneering International, Inc.

- Crown Equipment Corporation

- SSI Schäfer Group

Recent Developments

-

In January 2025, Cyngn raised approximately USD 33 million to accelerate the production and deployment of its DriveMod Tuggers and DriveMod Forklifts. This funding will enable Cyngn to scale its growth, commercialize autonomous vehicle technologies, and meet rising demand in industries like automotive, heavy machinery, and logistics.

-

In July 2024, GreyOrange expanded its Certified Ranger Network with new autonomous forklifts capable of handling multiple pallets and trolleys, improving operational efficiency. Powered by the GreyMatter platform, these robots support heavy payloads up to 3000 kg, marking a market-first in autonomous material handling solutions.

-

In July 2024, Toyota Material Handling Japan and Fujitsu jointly launched Japan’s first AI-based cloud service for evaluating forklift driving safety, offering automated detection of unsafe operations and generating operator-specific safety scorecards to enhance warehouse safety and efficiency.

-

In February 2024, Seegrid unveiled its Lift CR1 autonomous lift truck at MODEX '24, featuring a 15’ lift height and a 4,000lb payload capacity, providing flexible, scalable automation solutions for warehousing, manufacturing, and logistics operations.

-

In August 2023, Cyngn signed a pre-order agreement with Arauco for 100 AI-powered autonomous electric forklifts, marking a significant milestone in Cyngn’s DriveMod Forklift initiative. The agreement aims to enhance Arauco’s operational efficiency, safety, and sustainability, with deliveries expected to start in 2024.

Autonomous Forklift Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.36 billion

Revenue Forecast in 2030

USD 9.49 billion

Growth rate

CAGR of 12.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Forklift type, navigation technology, load capacity, autonomy, application, end user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Toyota Industries Corporation; Hyster-Yale Materials Handling, Inc.; Mitsubishi Logisnext Co., Ltd.; Seegrid Corporation; KION Group AG; Jungheinrich AG; Crown Equipment Corporation; SSI Schäfer Group; AGILOX Services GmbH; Oceaneering International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Forklift Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global autonomous forklift market report based on forklift type, navigation technology, load capacity, autonomy level, application, end user, and region.

-

Forklift Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pallet Jacks

-

Counterbalance Forklifts

-

Reach Trucks

-

Order Pickers

-

Stacker Forklifts

-

-

Navigation Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

LiDAR

-

Vision-Guided

-

SLAM (Simultaneous Localization and Mapping)

-

Magnetic-Guided

-

Geofencing

-

Other Navigation Technologies

-

-

Load Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 1.5 Tons

-

1.5 to 3 Tons

-

Above 3 Tons

-

-

Autonomy Outlook (Revenue, USD Million, 2018 - 2030)

-

Semi-Autonomous

-

Fully Autonomous

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Warehouse Automation

-

Material Handling

-

Logistics & Freight Automation

-

Cold Storage and Temperature-Controlled Environment

-

Automated Loading & Unloading Systems

-

Other Applications

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Industrial & General Manufacturing

-

Logistics

-

Chemical

-

Food & Beverage

-

Retail & E-Commerce

-

Automotive

-

Aerospace & Defense

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous forklift market size was estimated at USD 4.84 billion in 2024 and is expected to reach USD 5.36 billion in 2030.

b. The global autonomous forklift market is expected to grow at a compound annual growth rate of 12.1% from 2025 to 2030 to reach USD 9.49 billion by 2030.

b. Asia Pacific dominated the autonomous forklift market with a share of 40.3% in 2024. This is attributable to the rising demand for efficient logistics operations, rapid advancements in automation technology, and strong government support for industrial automation.

b. Some key players operating in the autonomous forklift market include Toyota Industries Corporation, KION Group AG, Jungheinrich AG, Hyster-Yale Materials Handling, Inc., Mitsubishi Logisnext Co., Ltd., Seegrid Corporation, AGILOX Services GmbH, Oceaneering International, Inc., Crown Equipment Corporation, SSI Schäfer Group

b. Key factors that are driving the market growth include growing labor shortages in warehousing and manufacturing, increasing demand for faster fulfillment in e-commerce, and a rising focus on industrial safety and regulatory compliance. The need to address these challenges is pushing businesses to adopt autonomous forklifts to improve operational efficiency and reduce risks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.