- Home

- »

- Next Generation Technologies

- »

-

Autonomous Last Mile Delivery Market, Industry Report, 2030GVR Report cover

![Autonomous Last Mile Delivery Market Size, Share & Trends Report]()

Autonomous Last Mile Delivery Market (2025 - 2030) Size, Share & Trends Analysis Report By Platform (Ground Delivery Vehicle, Aerial Delivery Drones), By Solution, By Range, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-204-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Last Mile Delivery Market Summary

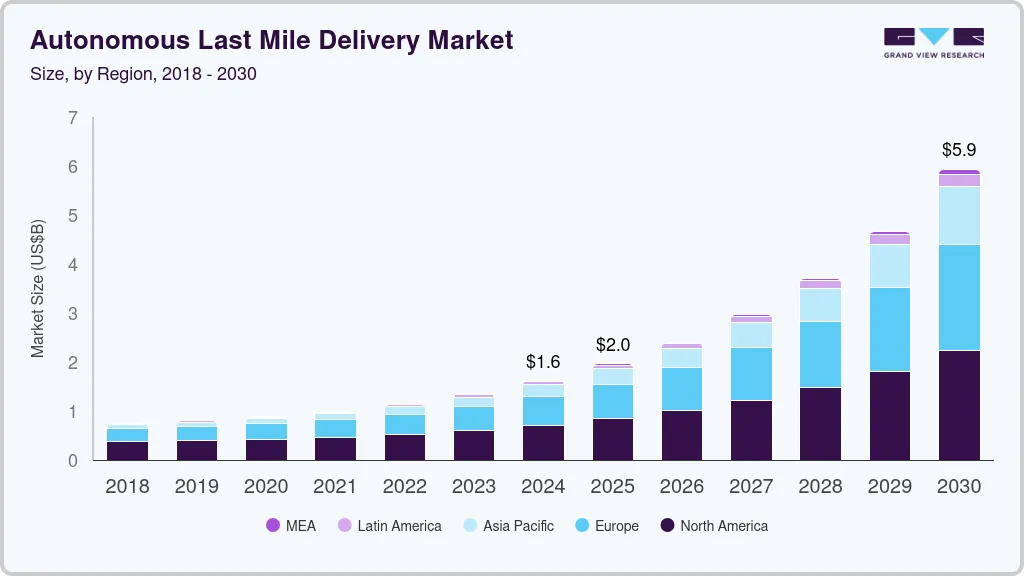

The global autonomous last mile delivery market size was estimated at USD 1,615.4 million in 2024 and is projected to reach USD 5,930.2 million by 2030, growing at a CAGR of 24.8% from 2025 to 2030. The market growth is primarily driven by the increasing demand for operational efficiency in logistics.

Key Market Trends & Insights

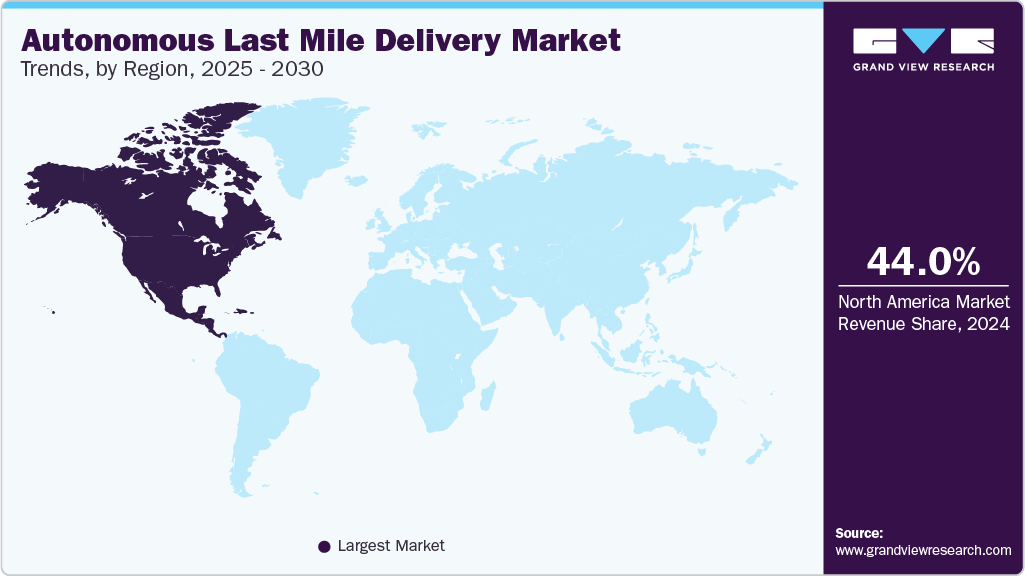

- North America dominated the market with a share of 44% in 2024.

- The autonomous last mile delivery market in the U.S. dominated the North American market with a share of over 89% in 2024.

- In terms of platform, the ground delivery vehicles segment dominated with a revenue market share of over 82% in 2024.

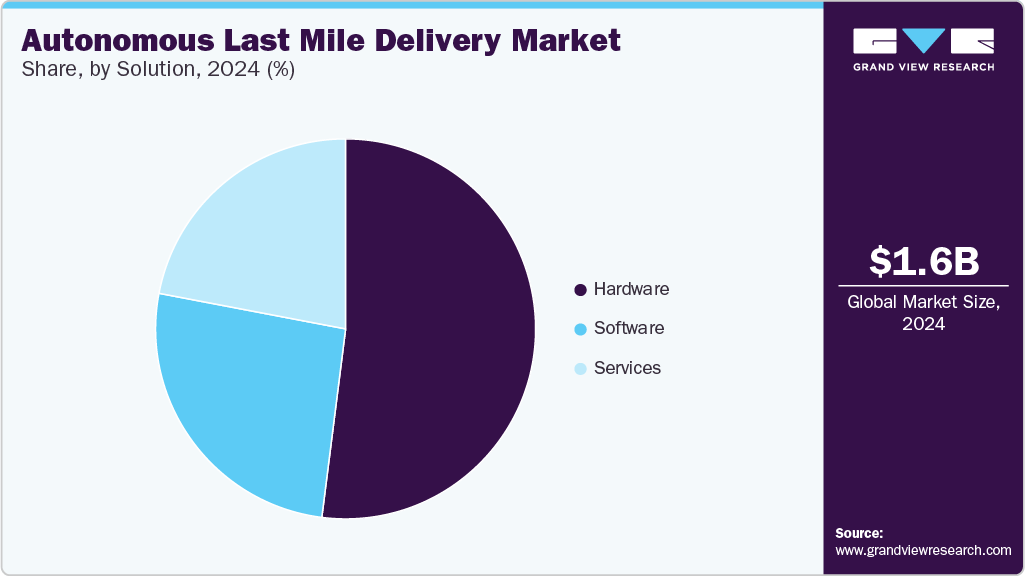

- In terms of solution, the hardware segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1,615.4 Million

- 2030 Projected Market Size: USD 5,930.2 Million

- CAGR (2025-2030): 24.8%

- North America: Largest market in 2024

Companies are investing in automation technologies like robotics, artificial intelligence (AI), and machine learning to streamline delivery processes, reduce delivery costs, and improve delivery speed and accuracy. This shift towards automation is further accelerated by the desire for precision and consistency in last-mile delivery, which is expected to fuel market expansion in the coming years.

The shift towards Industry 4.0 is a major driver of the autonomous last mile delivery industry. This revolution is characterized by integrating IT with operational technology, enabling real-time monitoring, improved decision-making, and highly efficient production systems. As manufacturers adopt smart factory solutions, there is a growing demand for automation services to help businesses transition to fully connected and intelligent systems. This trend towards smart manufacturing continues to accelerate the growth of the autonomous last mile delivery industry.

In addition, integrating AI and machine learning into industrial automation systems is emerging as another major trend. AI helps optimize processes by analyzing vast amounts of data to make intelligent decisions autonomously, while machine learning enables systems to improve based on real-time feedback and historical data continuously. These technologies are being applied to tasks such as quality control, predictive maintenance, and process optimization. As AI and machine learning continue to advance, their integration into automation is expected to become more impactful, enabling smarter and more efficient production environments, thereby further driving market growth.

Furthermore, predictive maintenance is rapidly gaining traction as a trend within the industry. By utilizing sensors and IoT devices, companies can monitor the health of machinery in real-time and predict when equipment will require maintenance, thus preventing unplanned downtime. This trend is enabled by advanced data analytics, which can forecast potential failures before they occur, saving costs on repairs and extending the life of equipment. As industries aim to reduce maintenance-related disruptions and costs, predictive maintenance is increasingly becoming a crucial element of their automation strategies, playing a significant role in market growth.

Moreover, virtualization of control systems is a growing trend in industrial automation, where traditional hardware-based control systems are replaced with software-based solutions running on virtualized platforms. This allows for more flexible, scalable, and cost-effective management of industrial automation processes. Virtualization enables manufacturers to simulate, monitor, and control automation processes from a centralized location, without the need for extensive physical infrastructure. With the growing need for more efficient resource management and quicker adaptation to changing demands, virtualization is becoming an essential element of the modern autonomous last mile delivery industry, which is expected to further fuel the market in the coming years.

Platform Insights

The ground delivery vehicles segment dominated with a revenue market share of over 82% in 2024, owing to its widespread application across high-load industrial processes that require efficient heat dissipation. Water-cooled systems are preferred in industries such as power generation, petrochemicals, and manufacturing, where continuous, large-scale cooling is essential. These systems offer higher heat transfer efficiency than air-based systems and can handle greater thermal loads with relatively compact equipment. The availability of water resources and established infrastructure in key industrial regions is further driving segmental growth.

The aerial delivery drones segment is expected to witness the highest CAGR of over 28% from 2025 to 2030, driven by increasing demand for energy-efficient and environmentally sustainable cooling solutions. Hybrid cooling systems combine the benefits of both wet and dry cooling technologies, allowing facilities to switch between modes based on ambient conditions, water availability, and energy costs. This flexibility makes hybrid systems particularly attractive in regions facing water scarcity or stringent environmental regulations. Industries such as data centers, pharmaceuticals, and electronics manufacturing are adopting hybrid systems to optimize performance while minimizing water and energy consumption, which is further driving the segmental growth.

Range Insights

The short range (<20 kilometers) segment accounted for the largest market share in 2024, owing to its suitability for urban and suburban deliveries, where traffic congestion and delivery density make autonomous solutions more efficient. Robots and drones can navigate these areas effectively, reducing delivery times and costs. In addition, there is an increasing trend towards integrating autonomous delivery systems with smart city infrastructure, allowing for real-time traffic data utilization and optimized routing. This integration enhances the efficiency and reliability of short-range deliveries.

The long range (>20 kilometers) segment is expected to witness the highest CAGR from 2025 to 2030, owing to advancements in autonomous truck and drone technology, enabling deliveries over greater distances. This expansion is driven by the need for efficient and affordable parcel transportation over long distances, especially in rural and intercity areas. There's a growing emphasis on developing hybrid delivery models that combine autonomous ground vehicles for long-distance transport with drones for final delivery, optimizing efficiency and reducing costs. These factors are expected to drive the segmental growth in the coming years.

End Use Insights

The food & beverages segment accounted for the largest market share in 2024, owing to the increasing demand for fast, efficient, and contactless delivery solutions. Autonomous vehicles can operate around the clock, reducing delivery time and helping businesses meet the growing demand for instant gratification. There is a trend towards integrating temperature-controlled delivery systems within autonomous vehicles, ensuring the quality and safety of perishable items during transit. Furthermore, partnerships between food delivery platforms and autonomous vehicle providers are becoming more common, expanding service coverage and efficiency.

The retail segment is expected to witness the highest CAGR from 2025 to 2030. Retailers leverage autonomous systems to streamline their supply chains and reduce operational costs. Moreover, there is a growing trend towards implementing autonomous delivery systems in urban fulfillment centers, allowing for rapid last-mile deliveries. Retailers also explore using autonomous lockers and pickup points, providing customers with flexible delivery options. These factors are expected to drive the segmental growth in the coming years.

Solution Insights

The hardware segment accounted for the largest market share in 2024, driven by advancements in robotics, AI, and sensor technologies, enhancing the efficiency and reliability of autonomous delivery vehicles. Integrating high-resolution cameras, LiDAR, and advanced motion sensors enables precise navigation and obstacle detection. In addition, developing durable and energy-efficient battery systems extends operational hours, making autonomous delivery more viable for businesses and thereby driving the segmental growth.

The services segment is expected to witness the highest CAGR from 2025 to 2030, owing to the increasing adoption of the Robot-as-a-Service (RaaS) model, allowing businesses to lease autonomous delivery systems without significant upfront investment. This model is particularly attractive to SMEs seeking to enhance delivery efficiency without the financial burden of purchasing expensive equipment. Furthermore, there's a shift towards subscription-based service models, offering businesses flexible and scalable solutions. These models provide access to the latest technology and maintenance services, ensuring optimal performance of autonomous delivery systems. These factors are expected to drive segmental growth in the coming years.

Regional Insights

North America dominated the market with a share of 44% in 2024, driven by significant investments from both the government and private sectors. The U.S. government's funding for drone and autonomous vehicle upgrades, coupled with private companies' deployments, accelerates market growth. Moreover, advancements in AI, robotics, and sensor technologies enhance the efficiency and reliability of autonomous delivery systems, making them increasingly viable for urban and suburban logistics, which is further driving the regional growth.

U.S. Autonomous Last Mile Delivery Market Trends

The autonomous last mile delivery market in the U.S. dominated the North American market with a share of over 89% in 2024. Companies are pioneering autonomous trucking and delivery solutions, benefiting from favorable regulations in states such as Texas. Furthermore, partnerships with major retailers and logistics providers, such as Uber Freight and Walmart, facilitate real-world testing and deployment, accelerating the adoption of autonomous delivery technologies and driving market expansion.

Europe Autonomous Last Mile Delivery Market Trends

The autonomous last mile delivery market in Europe is expected to grow at a CAGR of over 25% from 2025 to 2030. Regulatory frameworks that support autonomous vehicle testing and deployment, combined with a strong emphasis on reducing carbon emissions, encourage logistics companies to invest in electric and autonomous delivery vehicles. Collaborations between tech startups and established logistics firms further enhance the development and deployment of these technologies across Europe.

The UK autonomous last mile delivery market is expected to grow at a significant rate in the coming years. The UK is witnessing a surge in autonomous delivery initiatives, spurred by advancements in AI and robotics. Companies are developing autonomous vehicles tailored for urban environments, aiming to alleviate congestion and reduce delivery times. Government support through innovation grants and regulatory frameworks that facilitate the testing and deployment of autonomous vehicles further bolsters market growth.

The autonomous last mile delivery market in Germany is driven by the country’s strong automotive industry and emphasis on technological innovation. Collaborations between automotive giants and tech startups focus on developing autonomous delivery vehicles that integrate seamlessly with existing logistics networks. In addition, Germany's commitment to sustainability and reducing emissions encourages the deployment of electric and autonomous delivery solutions in urban areas.

Asia Pacific Autonomous Last Mile Delivery Market Trends

The autonomous last mile delivery market in Asia Pacific is expected to grow at the highest CAGR of over 30% from 2025 to 2030, owing to rapid urbanization, technological advancements, and supportive government policies. Companies are deploying autonomous delivery vehicles and drones to meet the rising demand for e-commerce and food delivery services. The region's aging population and labor shortages are further driving the adoption of autonomous delivery solutions to maintain efficient logistics operations.

Japan autonomous last mile delivery market is gaining traction, driven by the government support for the development and deployment of autonomous delivery vehicles through deregulation and innovation grants. Companies are investing in electric and autonomous delivery vehicles to address urban congestion and environmental concerns, particularly in densely populated cities such as Tokyo and Osaka, further driving the market growth.

The autonomous last mile delivery market in China is rapidly expanding, driven by the country’s rapid urbanization and booming e-commerce sector. Government policies that support innovation in logistics and transportation, coupled with advancements in AI and robotics, further boost the growth of autonomous delivery technologies in the country.

Key Autonomous Last Mile Delivery Company Insights

Some key players operating in the market are Siemens AG and Rockwell Automation, Inc., among others.

-

Siemens AG is a global player in autonomous last mile delivery, with a long-established presence in the market. The company offers a comprehensive range of automation solutions, including digitalization, control systems, robotics, and IoT technologies. The company’s flagship platform, Siemens Digital Industries, integrates automation and software to optimize production efficiency and sustainability. Its services span across industries such as manufacturing, energy, automotive, and infrastructure, positioning the company as a key player driving digital transformation and smart factory solutions worldwide.

-

Rockwell Automation Inc. is renowned for its control systems, automation software, and industrial IoT solutions. The company is focused on enabling smart manufacturing, optimizing production efficiency, and improving safety across a wide range of industries, including automotive, food and beverage, and energy. Rockwell’s FactoryTalk platform helps businesses automate and monitor operations with advanced data analytics and AI, empowering industries to maximize performance and minimize downtime.

Yokogawa Electric Corporation and Omron Corporation are some of the emerging market participants.

-

Yokogawa Electric Corporation is a well-established company in industrial automation, recognized for its focus on providing innovative solutions for processing industries. The company enhances efficiency and reduces operational costs by integrating advanced technologies such as AI, IoT, and sophisticated control systems. The company’s OpreX automation suite is designed to help industries such as oil and gas, chemicals, and energy optimize their operations and stay competitive in a rapidly evolving digital landscape.

-

Omron Corporation is a global provider of industrial automation solutions, known for its expertise in robotics, control systems, and sensors. The company focuses on improving operational efficiency, safety, and quality through automation products that serve industries such as automotive, electronics, and manufacturing. The company’s ongoing advancements in smart automation and AI integration allow it to continuously meet the evolving needs of businesses.

Key Autonomous Last Mile Delivery Companies:

The following are the leading companies in the autonomous last mile delivery market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Group Holding Ltd.

- Amazon, Inc.

- Drone Delivery Canada Corp.

- Flytrex Inc.

- JD.com, Inc.

- Kiwi Campus (Kiwibot)

- Nuro, Inc.

- Refraction AI

- Shenzhen Yiqing Innovation Technology Co., Ltd. (Unity Drive Innovation)

- Starship Technologies

- TeleRetail

- Udelv Inc.

- Wing Aviation LLC

- A2Z Drone Delivery, LLC

Recent Developments

-

In May 2025, Amazon, Inc. unveiled seven new robots at its innovative delivery station in Dortmund, Germany, designed to accelerate and improve the safety of package handling and delivery operations.

-

In October 2024, Wing Aviation LLC and Serve Robotics announced a pilot partnership to expand autonomous food delivery by combining Serve’s AI-powered sidewalk delivery robots with Wing’s drone fleet.

-

In September 2023, Flytrex launched its Autonomous Pickup system, enabling a fully autonomous drone delivery process from order placement to pickup and delivery directly to customers’ yards. This innovation uses a drop-off wire for drones to pick up orders from restaurants and retailers without human intervention, significantly reducing delivery times to about five minutes after order readiness.

Autonomous Last Mile Delivery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,962.7 million

Revenue forecast in 2030

USD 5,930.2 million

Growth rate

CAGR of 24.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, solution, range, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Australia; Japan; India; South Korea; Brazil; South Africa; Saudi Arabia; UAE

Key companies profiled

Alibaba Group Holding Ltd.; Amazon, Inc.; Drone Delivery Canada Corp.; Flytrex Inc.; JD.com, Inc.; Kiwi Campus (Kiwibot); Nuro, Inc.; Refraction AI; Shenzhen Yiqing Innovation Technology Co., Ltd. (Unity Drive Innovation); Starship Technologies; TeleRetail; Udelv Inc.; Wing Aviation LLC; A2Z Drone Delivery, LLC.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Last Mile Delivery Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global autonomous last mile delivery market report based on platform, solution, range, and end use,and region:

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Ground Delivery Vehicles

-

Delivery Bots

-

Self-driving Vans & Trucks

-

-

Aerial Delivery Drones

-

Fixed-Wing

-

Rotary-Wing

-

Hybrid

-

-

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Short Range (<20 Kilometers)

-

Long Range (>20 Kilometers)

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverages

-

Retail

-

Healthcare

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global autonomous last mile delivery market size was estimated at USD 1,615.4 million in 2024 and is expected to reach USD 1,962.7 million in 2025.

b. The global autonomous last mile delivery market is expected to grow at a compound annual growth rate of 24.8% from 2025 to 2030 to reach USD 5,930.2 million by 2030.

b. North America dominated the autonomous last mile delivery market with a share of over 44% in 2024. The growth is attributed to the continuous efforts being made in the U.S. and Canada for the development of next-generation drone and ground delivery vehicle technologies.

b. Some key players operating in the autonomous last mile delivery market include; Alibaba, Amazon.Com, Inc., Drone Delivery Canada, Flytrex, JD.com, Kiwi Campus (Kiwibot), Nuro, Refraction AI, Robby Technologies, Shenzhen Yiqing Innovation Technology Co., Ltd., Starship Technologies, TeleRetail, Udelv Inc., Unsupervised AI, Wing Aviation LLC.

b. The increasing demand for cost-effective and faster delivery services has led to the development of autonomous last mile delivery services. The rising e-commerce sector has escalated the demand for quick delivery of packages, which has supplemented the growth of the autonomous last mile delivery market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.