- Home

- »

- Automotive & Transportation

- »

-

Autonomous Tractors Market Size, Industry Report, 2030GVR Report cover

![Autonomous Tractors Market Size, Share & Trends Report]()

Autonomous Tractors Market (2024 - 2030) Size, Share & Trends Analysis Report By Power Output, By Automation, By Application, By Farming Type (Field Farming, Horticulture, Dairy Farming & Livestock Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-353-3

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Autonomous Tractors Market Summary

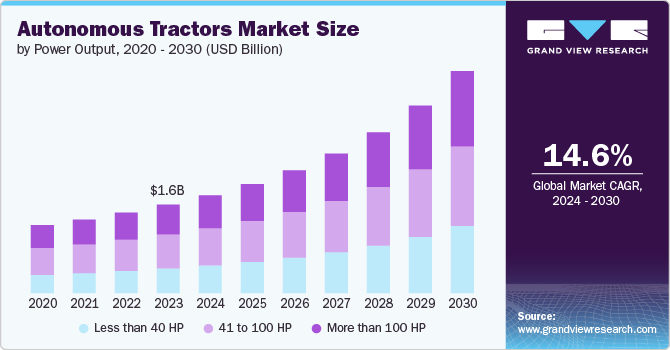

The global autonomous tractors market size was estimated at USD 1.68 billion in 2023 and is expected to reach USD 4.22 billion by 2030, growing at a CAGR of 14.6% from 2024 to 2030. The market for autonomous tractors is experiencing significant growth driven by a convergence of technological advancements, agricultural trends, economic factors, and environmental considerations.

Key Market Trends & Insights

- North America accounted for the largest revenue share of 38.2% in 2023.

- The Asia-Pacific region is experiencing a rising demand for autonomous tractors in agriculture.

- Based on automation, the partially autonomous segment dominated the market with a revenue share of 63.5% in 2023.

- Based on the power output, the 41 to 100 hp segment had the largest market share of 38.4% in 2023.

- Based on the application, the harvesting segment held the largest market share of 38.1% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.68 Billion

- 2030 Projected Market Size: USD 4.22 billion

- CAGR (2024-2030): 14.6%

- North America: Largest market in 2023

One of the primary drivers of autonomous tractor adoption is the global shortage of skilled agricultural labor. Many farming regions are facing difficulties in finding and retaining qualified workers. Autonomous tractors offer a solution by reducing the reliance on human operators, thereby mitigating the impact of labor scarcity. These machines can operate autonomously for extended periods, performing tasks with precision and consistency, which not only addresses labor shortages but also enhances overall farm productivity.In addition, the trend towards larger farm sizes is another factor driving the demand for autonomous tractors. As agricultural operations scale up to meet growing food demand, there is a need for machinery that can efficiently cover expansive areas. Autonomous tractors excel in this regard, as they can operate continuously without human fatigue and manage large-scale operations effectively. This scalability enhances productivity and allows farmers to maximize their yields while minimizing operational costs over vast agricultural lands.

Technological advancements play a crucial role in the development and adoption of autonomous tractors. Recent innovations in artificial intelligence, machine learning, GPS technology, and sensors have significantly enhanced the capabilities of these machines. AI algorithms enable autonomous tractors to navigate fields, detect obstacles, and make real-time adjustments in operations. GPS systems provide precise positioning data, allowing for accurate field mapping and targeted application of inputs such as fertilizers and pesticides. Such technological sophistication improves operational efficiency, reduces input wastage, and optimizes resource management on farms.

However, the target market faces several significant restraints that could slow down its widespread adoption and integration into agricultural practices worldwide. One of the foremost challenges is the high initial costs associated with autonomous tractor technology. Implementing autonomous systems requires substantial investment in advanced sensors, GPS equipment, artificial intelligence software, and integration with existing farm management systems. For many farmers, especially those operating smaller or medium-sized farms, these upfront costs can be prohibitive. The return on investment (ROI) must be carefully assessed against potential long-term savings in labor, efficiency gains, and reduced input costs to justify such expenditures.

Power Output Insights

Based on the power output, the autonomous tractors market is segmented into less than 40 hp, 41 to 100 hp, and more than 100 hp. The 41 to 100 hp segment had the largest market share of 38.4% in 2023. Autonomous tractors in the 41 to 100 hp range have gained prominence in the agriculture sector primarily due to their practicality and cost-effectiveness. These tractors offer a versatile solution for a variety of tasks essential to dairy operations, such as feeding, manure management, and field maintenance, such as planting and spraying. Their medium-sized horsepower makes them suitable for navigating the terrain typically found on dairy farms, including smaller fields and pasture lands. This adaptability allows farmers to efficiently manage their operations throughout the year without the need for multiple specialized machines.

The less than 40 hp segment registered the highest CAGR of 16.0% over the forecast period. Their compact size, technological advancements, and suitability for diverse farm sizes and tasks contribute to their growing popularity and market growth over the forecast period. Smaller autonomous tractors are increasingly favored for their agility and maneuverability in smaller fields and confined spaces, which are common in diverse agricultural settings. Their compact size allows them to navigate more efficiently through narrow rows and tighter spaces compared to larger machinery.

Automation Insights

On the basis of automation, the market is bifurcated into partially autonomous and fully autonomous. The partially autonomous segment dominated the market with a revenue share of 63.5% in 2023. Partially autonomous tractors have gained broader acceptance among users, such as farmers and agricultural businesses, due to their perceived reliability and familiarity. Users might find comfort in the ability to intervene when necessary, maintaining control over operations. In addition, partial autonomy represents a more cost-effective option for buyers compared to fully autonomous systems. These tractors may offer significant operational benefits at a lower initial investment or ongoing maintenance cost, aligning better with budget constraints.

The fully autonomous segment is anticipated to register the highest CAGR of 15.9% over the forecast period in the target market. Advances in technology, such as improvements in artificial intelligence, sensor technology, and connectivity, are likely driving the growth of fully autonomous tractors. These innovations enable tractors to perform complex tasks autonomously, reducing the need for human intervention. Fully autonomous tractors leverage AI algorithms and machine learning models to interpret data from various sensors (such as cameras, LiDAR, and radar) and make real-time decisions. These technologies enable tractors to perceive their environment, identify obstacles, and adjust their actions accordingly without human intervention.

Application Insights

Based on the application, the autonomous tractors market is segmented into tillage, harvesting, planting & seeding, and others. The harvesting segment held the largest market share of 38.1% in 2023. Harvesting is a critical phase in agriculture that occurs within a relatively short window of time. During this period, there is typically high demand for efficient and timely harvesting to maximize crop yield and quality. Autonomous tractors equipped for harvesting tasks can operate continuously, if needed, without fatigue or human limitations, ensuring that harvesting operations are completed within optimal timeframes.

The planting & seeding segment registered the highest CAGR of 16.9% over the forecast period. There is a growing trend towards precision agriculture practices, where farmers aim to optimize inputs such as seeds, fertilizers, and pesticides based on specific field conditions. Autonomous planting and seeding equipment can precisely control and adjust these inputs according to real-time data and analytics, thereby improving crop yield, quality, and resource utilization. This capability has driven increased adoption of autonomous solutions in the planting & seeding segment.

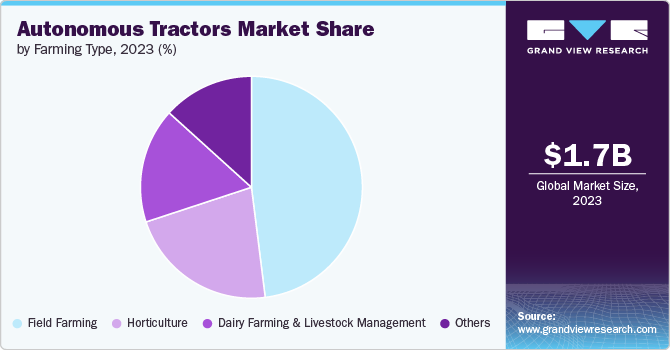

Farming Type Insights

On the basis of farming type, the market is segmented into field farming, horticulture, dairy farming & livestock monitoring. The field farming segment dominated the market with a revenue share of 48.4% in 2023. Field farming encompasses a wide range of agricultural activities such as plowing, tillage, cultivation, and general field maintenance. These tasks are fundamental to crop production and cover large areas of agricultural land, making them crucial targets for automation to enhance efficiency and productivity. In additionn, autonomous tractors bring substantial improvements in operational efficiency to field farming tasks. They can operate continuously for extended periods without fatigue, maintaining consistent speeds and precision in tasks such as seedbed preparation, weed control, and soil management. This consistency and efficiency translate into time savings and better utilization of resources for farmers.

The others segments, including forestry and controlled environment farms, registered the highest CAGR of 14.8% over the forecast period. Forestry and controlled environment farms have unique operational requirements that benefit significantly from autonomous technology. In forestry, autonomous tractors are used for tasks such as tree planting, thinning, and harvesting, where precision and environmental considerations are crucial. Controlled environment farms, including greenhouse and indoor vertical farming operations, utilize autonomous tractors for tasks such as seedling management, crop maintenance, and harvesting in controlled environments. Moreover, autonomous tractors offer enhanced efficiency and precision in forestry and controlled environment farming operations. In forestry, for example, autonomous systems can navigate rugged terrain and perform tasks with minimal environmental impact, improving productivity and sustainability. In controlled environment farms, autonomous tractors can operate in confined spaces with precision, optimizing resource use and maximizing crop yields.

Regional Insights

North America accounted for the largest revenue share of 38.2% in 2023 and is expected to continue its dominance over the forecast period. North America has been an early adopter and leader in the development and deployment of precision agriculture technologies, including autonomous tractors. This early adoption has created a mature ecosystem of technology providers, service providers, and supportive industries that contribute to the growth and dominance of the autonomous tractors market in the region. In addition, the agricultural landscape in North America is characterized by extensive, large-scale farms that benefit significantly from the adoption of autonomous tractors. These farms cover vast areas of land, making efficiency and labor optimization crucial factors in farm management. Autonomous tractors enable farmers in North America to operate more efficiently, cover larger areas of land, and reduce the dependency on manual labor, which is increasingly scarce and costly.

U.S. Autonomous Tractors Market Trends

The U.S. is home to some of the world's leading agricultural machinery manufacturers and technology companies. These companies have been at the forefront of developing and advancing autonomous tractor technologies. Investments in research and development (R&D) have led to the creation of sophisticated autonomous systems that can navigate fields, perform precise operations, and integrate with farm management software. This technological prowess has given companies in the U.S. a competitive edge in the global autonomous tractors market.

Asia Pacific Autonomous Tractors Market Trends

The Asia-Pacific region is experiencing a rising demand for autonomous tractors in agriculture, driven by several key factors that are shaping the agricultural landscape and technological adoption in the region. Many countries in the Asia Pacific, including China, Japan, Australia, and India, are witnessing a rapid transition towards mechanized farming practices. This shift is driven by the need to improve productivity, reduce labor dependency, and address challenges related to an aging agricultural workforce. Autonomous tractors represent a significant advancement in farm mechanization by offering capabilities to operate autonomously, thereby enhancing efficiency and scalability in agricultural operations.

Europe Autonomous Tractors Market Trends

Europe has a well-established regulatory framework that supports innovation and technology adoption in agriculture. Regulations related to agricultural machinery safety, emissions standards, and data privacy are well-defined, providing clarity and assurance to farmers and manufacturers investing in autonomous tractors. Regulatory support and incentives from national governments and the European Union encourage the adoption of autonomous technologies as part of efforts to modernize agriculture and achieve sustainability goals. In addition, European countries have ambitious environmental sustainability goals, including reducing greenhouse gas emissions, improving soil health, and promoting biodiversity in agriculture. Autonomous tractors contribute to these goals by enabling precision farming practices that minimize the use of agrochemicals, optimize water and energy efficiency, and promote sustainable land management practices. This alignment with sustainability objectives reinforces the demand for autonomous tractors among European farmers and policymakers.

Key Autonomous Tractors Company Insights

Some of the key companies operating in the autonomous tractors market include Deere & Company, AGCO Corporation, among others.

-

Deere & Company is one of the leading U.S.-based companies that specializes in manufacturing agricultural machinery, drivetrains, heavy equipment, diesel engines, forestry machinery, and lawn care equipment. The company operates through four business segments, namely, production & precision farming, small agriculture & turf, construction & forestry, and financial services. The production & precision farming segment focuses on developing and manufacturing advanced agricultural machinery, including tractors, combines, harvesters, tillage equipment, soil preparation, seeding, crop care, and more with precision technologies. This segment integrates GPS, telematics, and data analytics to optimize farming operations such as planting, seeding, spraying, and harvesting. The company serves its customers in over 100 countries with administrative and sales offices in Argentina, Australia, Brazil, Canada, China, France, Germany, India, Italy, Mexico, Poland, Singapore, Sweden, South Africa, Spain, Ukraine, the UK, and the U.S.

Monarch Tractor and YANMAR HOLDINGS CO., LTD. are some of the emerging market companies in the target market.

-

Monarch Tractor is a company that specializes in manufacturing electric autonomous tractors designed for sustainable agriculture. These tractors are equipped with advanced technologies such as AI, machine learning, and sensor fusion to enhance precision farming practices. Monarch Tractor aims to reduce the environmental impact of agriculture by offering zero-emission, quiet operation alternatives to traditional diesel-powered tractors. It targets both small and large-scale farms, focusing on innovation and sustainability in the agricultural machinery sector. The company has secured licensing agreements with tractor manufacturer Case New Holland and others to expand its technology to various regions and crops.

Key Autonomous Tractors Companies:

The following are the leading companies in the autonomous tractors market. These companies collectively hold the largest market share and dictate industry trends.

- John Deere (Deere & Company)

- CNH Industrial

- AGCO Corporation

- Kubota Corporation

- Claas KGaA mbH

- Yanmar Co., Ltd.

- Mahindra & Mahindra

- SDF Group

- TYM Corporation

- Monarch Tractor

Recent Developments

-

In February 2024, Deere & Company introduced its latest range of four-track tractors with high hp, which includes a top model boasting 830 horsepower. The 2025 lineup features new models, including the 9RX 710, the 9RX 770, and the 9RX 830, equipped with upgraded engines, hydraulic systems, and technology packages, along with updated cabs. To support farmers in preparing their equipment and farms for autonomous operations, the MY25 8 Series and 9 Series tractors will offer an autonomous-ready option. This feature enables farmers to transition to fully autonomous operation seamlessly, aligning with their farm's specific readiness.

-

In October 2023, Monarch Tractor expanded its operations into Europe, marking a significant milestone in its global growth strategy. This move signifies Monarch Tractor's commitment to global growth and its confidence in meeting farmers' evolving needs for sustainable and efficient agricultural solutions. It positions Monarch Tractor as an emerging player in the European agricultural technology sector and sets the stage for further expansion and innovation in the future.

Autonomous Tractors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.86 billion

Revenue forecast in 2030

USD 4.22 billion

Growth rate

CAGR of 14.6% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Power output, automation, application, farming type, region

Regional scope

North America; Europe, Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Deere & Company; CNH Industrial; AGCO Corporation; Kubota Corporation; Claas KGaA mbH; Yanmar Co., Ltd.; Mahindra & Mahindra; SDF Group; TYM Corporation; Monarch Tractor

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Autonomous Tractors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global autonomous tractors market report based on power output, automation, application, farming type, and region:

-

Power Output Outlook (Revenue, USD Million, 2017 - 2030)

-

Less than 40 HP

-

41 to 100 HP

-

More than 100 HP

-

-

Automation Outlook (Revenue, USD Million, 2017 - 2030)

-

Partially Autonomous

-

Fully Autonomous

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Tillage

-

Harvesting

-

Planting & Seeding

-

Others

-

-

Farming Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Field Farming

-

Horticulture

-

Dairy Farming & Livestock Management

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous tractors market size was estimated at USD 1.68 billion in 2023 and is expected to reach USD 1.86 billion in 2024.

b. The global autonomous tractors market is expected to grow at a compound annual growth rate of 14.6% from 2024 to 2030 to reach USD 4.22 billion by 2030.

b. The partially autonomous segment claimed the largest market share of 63.5% in 2023 in the agricultural autonomous tractors market, driven by cost-effectiveness, flexibility, safety enhancements, regulatory alignment, and industry innovation. Partially autonomous tractors offer a balance between automation and human control. Farmers appreciate the ability to operate the tractor autonomously for routine tasks such as plowing, seeding, or spraying, while still retaining the option to intervene manually when needed.

b. Some of the prominent players in the autonomous tractors market are Deere & Company, CNH Industrial, AGCO Corporation, Kubota Corporation, Claas KGaA mbH, Yanmar Co., Ltd., Mahindra & Mahindra, SDF Group, TYM Corporation, Monarch Tractor.

b. The agricultural autonomous tractors market is primarily driven by increasing demand for sustainable and efficient farming practices, as well as the need to address labor shortages in agriculture. Additionally, technological advancements in areas like GPS, computer vision, and artificial intelligence are enabling more capable autonomous tractors that can boost farm productivity and profits while reducing costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.