- Home

- »

- Automotive & Transportation

- »

-

Autonomous Vehicle Market Size And Share Report, 2030GVR Report cover

![Autonomous Vehicle Market Size, Share & Trends Report]()

Autonomous Vehicle Market Size, Share & Trends Analysis Report By Vehicle Type, By Level of Autonomy, By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-401-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Autonomous Vehicle Market Size & Trends

The global autonomous vehicle market size was valued at USD 42.37 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 21.9% from 2023 to 2030. Advancements in AI, connectivity, and sensor capabilities are crucial for the market's growth, enabling vehicles to make more informed decisions and navigate complex environments efficiently. These technological strides enhance vehicle safety and reliability and also expand the scope of autonomous applications across industries, from logistics and transportation to ridesharing and delivery services. The cost-efficiency brought about by these advancements makes autonomous solutions more appealing to businesses seeking innovative and competitive edge offerings, ultimately propelling the market's expansion and adoption.

The growth in delivery demands driven by the growth of e-commerce necessitates faster and more effective logistics solutions. Autonomous vehicles, encompassing drones and self-driving delivery vans, present the potential to optimize last-mile delivery processes, addressing the increasing need for rapid and dependable shipments. These vehicles promise optimized routes, reduced operational costs, and quicker delivery times, aligning with the goals of e-commerce companies aiming to meet customer expectations for faster shipping. As e-commerce expands its reach, the need for innovative logistics solutions amplifies, fueling investment and research into autonomous technologies ultimately accelerating the advancement and adoption of autonomous vehicles within the e-commerce supply chain.

Industries adopting self-driving transport demonstrate a willingness to embrace innovative technology. As these industries experience the benefits of increased efficiency, reduced costs, and enhanced safety brought by autonomous transport, it encourages further adoption and investment in autonomous vehicle technology across various sectors. For instance, in September 2023, Volvo Autonomous Solutions (V.A.S.), a Sweden-based company that offers autonomous transport solutions, and Boliden, a Swedish Mining company, are teaming up for a long-term partnership to introduce self-driving transport solutions in Boliden's operations. They'll work on various projects, starting with using autonomous transport at Boliden's Garpenberg site in Sweden.

Vehicle Type Insights

The passenger vehicle segment dominated the market with a share of 71.4% in 2022. There's a growing interest among consumers for more convenient, safe, and efficient transportation options. Autonomous vehicles offer the promise of hands-free and stress-free commuting, appealing to individuals seeking a more relaxed and productive travel experience. Continuous advancements in autonomous vehicle technology, including improved sensors, AI algorithms, and connectivity, have made significant strides in making autonomous passenger vehicles more feasible and reliable. These advancements instill confidence in the safety and performance of these vehicles, further driving consumer interest.

The commercial vehicle segment is also witnessing substantial growth. Various industries, including commercial transportation, logistics, and delivery services, are increasingly recognizing the benefits of autonomous technology in enhancing their operations. The potential to streamline commercial logistics, optimize supply chains, and meet growing customer demands drives the adoption of autonomous solutions in commercial fleets. A growing ecosystem of technology developers, manufacturers, and investors is dedicated to advancing autonomous systems for commercial use. Continuous innovation and investment in this sector will drive the development and deployment of more sophisticated autonomous commercial vehicles.

Application Insights

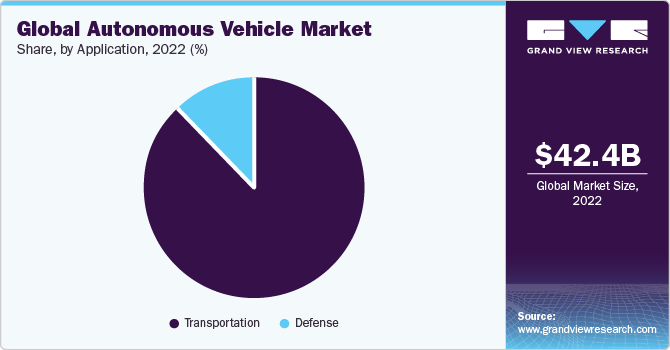

The transportation segment dominated the market with a revenue share of 87.7% in 2022 because of its immense potential for innovation and efficiency. Autonomous technology holds the promise of transforming the movement of goods and people by providing safer and more efficient transportation solutions, and revolutionizing traditional methods of travel and logistics. Industries such as logistics, shipping, and ridesharing are embracing autonomous vehicles to optimize operations, reduce costs, and meet increasing demands for reliable transport. This sector's emphasis on improved logistics, enhanced safety, and cost-effectiveness drives the dominance of autonomous vehicles in the transportation industry.

The growth of the defense segment within the market is given by the increasing focus on developing unmanned military systems. Governments worldwide are aiming to enhance national security and reduce risks to human personnel in conflict zones. These vehicles offer advantages such as reconnaissance, logistics support, and even combat capabilities, making them essential for modern defense strategies. The demand for reliable, high-tech autonomous solutions continues to grow as nations seek to bolster their military capabilities with advanced and unmanned systems.

Level of Autonomy Insights

The Level 1 segment dominated the market with a revenue share of 47.1% in 2022. Basic driver assistance features such as adaptive cruise control or lane-keeping assistance, known as Level 1 autonomy, lead the autonomous market due to their ease of use and extensive integration in contemporary vehicles. These systems offer essential safety and convenience without necessitating substantial infrastructure modifications or incurring high expenses. Moreover, the widespread inclusion of Level 1 autonomy as standard or optional features across different car models by automakers enhances accessibility for consumers, further solidifying their prevalence in the market.

The Level 4 & 5 segment is poised for significant growth in the autonomous vehicle market. Level 4 & 5 segment in autonomous vehicles represent higher degrees of automation, enabling vehicles to operate without human intervention. The rising interest and in these levels are mainly due to technological advancements in sensors, artificial intelligence, and computing power which ensures safety and more reliable self-driving capabilities. Moreover, industries, and consumers are recognizing the potential benefits such as increased safety, efficiency and convenience, which fuels the growth of these higher-level autonomous vehicles.

Regional Insights

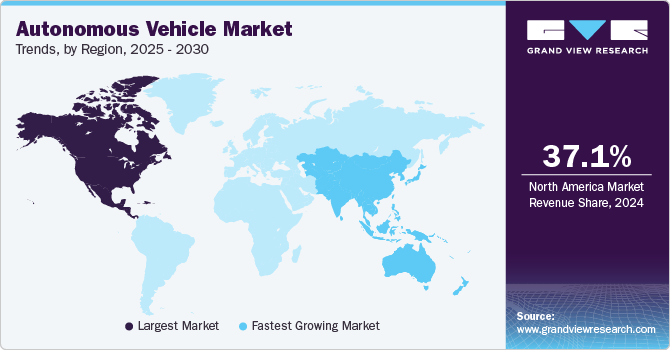

North America dominated the market with a share of over 38.0% in 2022. North America’s extensive infrastructure, particularly in certain areas such as California’s Silicon Valley, provides an ideal testing ground for autonomous vehicles and other technologies. This well-established infrastructure and supportive ecosystem contribute significantly to the advancement and adoption of autonomous systems. The region’s population is generally receptive to innovative technologies, creating a substantial market for autonomous vehicles, drones, and other autonomous systems. This consumer demand and acceptance drive further development in the field.

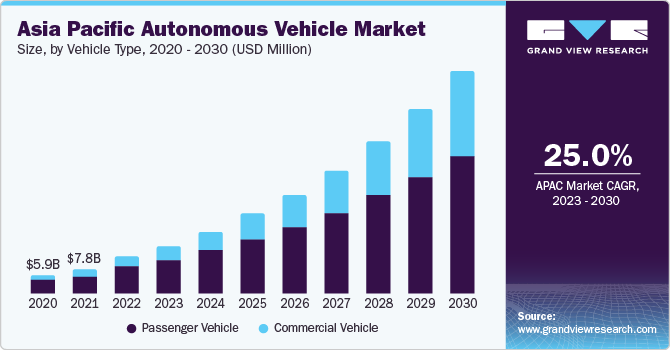

Asia-Pacific region is expected to grow with the fastest CAGR of 25.0% from 2023 to 2030. Countries in Asia Pacific, such as China, Japan, and South Korea have densely populated cities facing transportation challenges. Autonomous vehicles are seen as a solution to address congestion, improve mobility, and enhance transportation efficiency in these urban centers. Moreover, Asia Pacific’s emphasis on electric and connected vehicles aligns with autonomous vehicle trajectory. The region’s focus on clean energy has driven the interest in autonomous technologies, leading to growing market for these vehicles.

Key Companies & Market Share Insights

The market is marked by intense competition, with a small number of global competitors holding substantial market share. The primary emphasis is on creating innovative products and fostering collaboration among the key industry participants. For instance, in July 2023, Volkswagen, a German-based Automobile manufacturer, plans to initiate trials of self-driving vehicles in Austin, Texas, shifting away from Argo AI. The German auto manufacturer intends to introduce roughly 10 ID Buzz electric vans, equipped with autonomous systems developed alongside Mobileye, into the city by the end of 2023.

In another instance, In August 2023, Pony.ai, a U.S.-based software company, partnered with Toyota Motor (China) Investment Co., Ltd. and GAC Toyota Motor Co., Ltd. to create a joint venture aimed at advancing fully driverless robotaxis for mass production and deployment. This initiative combines Pony.ai's autonomous driving tech, Toyota's branded electric vehicles, and GTMC's production expertise. Together, they'll offer safe and convenient robotaxi services, propelling the industry towards commercialized autonomous mobility.

Key Autonomous Vehicle Companies:

- AB Volvo

- Bayerische Motoren Werke AG

- Ford Motor Company

- General Motors

- Hyundai Motor Group

- Mercedes-Benz AG

- Renault SA

- Tesla, Inc

- Toyota Motor Corporation

- Volkswagen Group

Autonomous Vehicle Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 53.71 billion

Revenue forecast in 2030

USD 214.32 billion

Growth rate

CAGR of 21.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Market revenue in USD million/billion, CAGR from 2023 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments Covered

Vehicle type, level of autonomy, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; KSA; UAE; South Africa

Key companies profiled

AB Volvo; Bayerische Motoren Werke AG; Ford Motor Company; General Motors; Hyundai Motor Group; Mercedes-Benz AG; Renault SA; Tesla,Inc; Toyota Motor Corporation; Volkswagen Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Global Autonomous Vehicle Market Report Segmentation

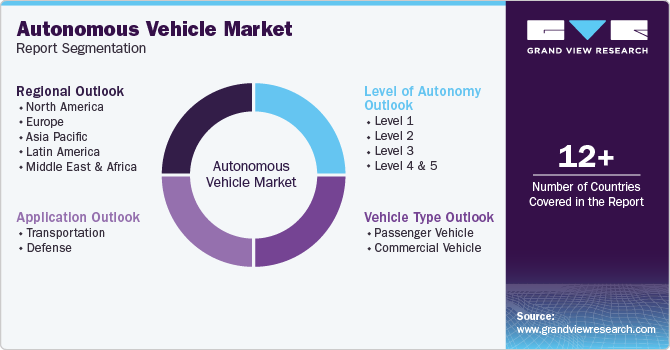

This report forecasts revenue growth on global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global Autonomous Vehicle report based on vehicle type, level of autonomy, application, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Passenger Vehicle

-

Commercial Vehicle

-

-

Level of Autonomy Outlook (Revenue, USD Million, 2017 - 2030)

-

Level 1

-

Level 2

-

Level 3

-

Level 4 & 5

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Transportation

-

Industrial

-

Commercial

-

Personal

-

-

Defense

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global autonomous vehicles market size was estimated at USD 42.37 billion in 2022 and is expected to reach USD 53.71 billion in 2023.

b. The global autonomous vehicles market is expected to grow at a compound annual growth rate of 21.9% from 2023 to 2030 to reach USD 214.32 billion by 2030.

b. North America dominated the autonomous vehicles market with a share of 38.0% in 2022. This is attributable to advanced infrastructure, particularly evident in regions such as California's Silicon Valley, which serves as an ideal testing ground for autonomous vehicles.

b. Some key players operating in the autonomous vehicles market include AB Volvo; Bayerische Motoren Werke AG; Ford Motor Company; General Motors; Hyundai Motor Group; Mercedes-Benz AG; Renault SA; Tesla, Inc; Toyota Motor Corporation; and Volkswagen Group

b. Key factors that are driving the autonomous vehicles market growth include the rising need for road safety, environmental impact due to traditional vehicles, and increased energy savings by autonomous vehicles.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."