- Home

- »

- Next Generation Technologies

- »

-

Aviation IoT Market Size, Share And Growth Report, 2030GVR Report cover

![Aviation IoT Market Size, Share & Trends Report]()

Aviation IoT Market Size, Share & Trends Analysis Report By End-use (Airline Operators, Airport), By Component (Hardware, Service), By Application (Aircraft Operations, Asset Management), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-323-5

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global aviation IoT market size was valued at USD 6.88 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 23.3% from 2023 to 2030. The growing trend of air travel with an emphasis on passenger experience is anticipated to drive market growth. Moreover, the significant strain on airlines and airport resources caused by the high volume of travelers is expected to increase the demand for internet of things (IoT) solutions in aviation to efficiently streamline and help automate avionic processes. For instance, IoT helps air traffic controllers regulate air traffic on the runway with real-time data and analytics for smooth and timely takeoffs and landings. Furthermore, the trend of digitization in the aviation industry is expected to drive the demand for internet of things in aviation.

Smart airports are utilizing IoT technology to create a digital ecosystem for automated check-in, baggage handling, and flight bookings. Moreover, IoT technology allows significant cost savings for airline operators in routine maintenance cycles by providing real-time aircraft health monitoring and threat analysis. This, in turn, is expected to increase the demand for IoT technology in the aviation industry. During the COVID-19 outbreak, various industries were shut down briefly and lockdowns were imposed to reduce the spread of the virus, which, in turn, impacted business operations across regions. There was also a shutdown of commercial flights and airports around the world.

However, the demand for IoT technology is anticipated to have increased during the pandemic as aircraft required regular maintenance as they were forced to stay in airport hangers for long periods. The technology is significant in aircraft Maintenance, Repair, And Overhaul (MRO) processes as it offers significant data to operators and enables remote diagnostic capabilities. This, in turn, brought more demand to the market around the world. Moreover, the technological developments in Machine Learning (ML) and Artificial Intelligence (AI) are anticipated to drive the expansion of this industry. These technologies can be used for several applications associated with the aviation industry.

For instance, facial recognition in assistance with AI is used for ensuring security, efficiency, and precision while validating the information of passengers. This is consequently aiding in reducing the wait times associated with the check-in procedures while strengthening the biometric airport screening processes. The growing preference for automation systems in the aviation industry is another key factor contributing to the market growth. IoT can particularly help the aviation industry in enhancing MRO services and reducing downtime. The ability to predict the malfunctioning component and reduce equipment downtime using advanced predictive software is allowing airlines to increase their revenues. Continued deployment of advanced technologies by service providers and the provisioning of customized solutions are also offering lucrative growth opportunities to the market.

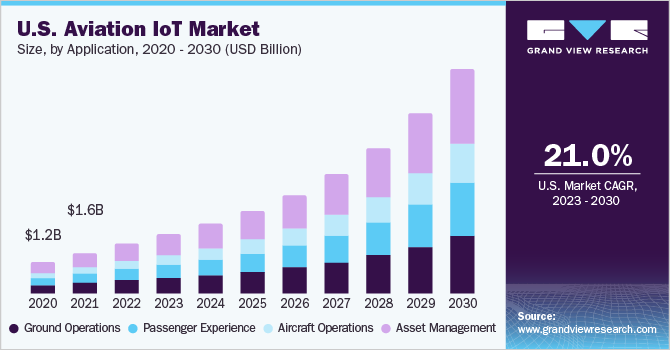

Application Insights

The asset management segment accounted for a significant revenue share of more than 30.0% in 2022. The aviation industry deals with several expensive assets that can potentially lead to higher operating costs. At this juncture, the increasing fleet size in line with the growing passenger traffic is highlighting the importance of asset management and tracing to achieve higher operational efficiency. Aviation asset management provides various solutions to improve the overall productivity of crew and fleet operations, which, in turn, is anticipated the drive the segment growth.

The passenger experience segment is anticipated to account for the fastest growth rate of around 25% during the forecast period. The growth of this segment can be attributed to the trend of using technology to increase flyer experience. Similarly, technologies, such as NFC and Wi-Fi, are deployed to enhance the passenger experience by offering network connectivity and device connectivity. Moreover, access to various information and infotainment systems can potentially enhance the travel experience and eliminate the unnecessary confusion that passengers encounter during travel.

End-Use Insights

The airport segment accounted for a significant revenue share of over 35% in 2022. It is also expected to emerge as the fastest-growing segment over the forecast period in line with the growing popularity of the smart airport concept across various regions. IoT can potentially open opportunities for the incumbents of the aviation industry to offer solutions for passenger traffic monitoring, baggage handling, and facilities management, and subsequently improve the overall operational flow and efficiency of the airport. The partnerships that are materializing between IoT service providers and airport operators are anticipated to create significant growth opportunities for the segment over the forecast period. The airline operators segment is anticipated to grow at a significant CAGR over the forecast period.

The segment is growing steadily as airlines are focusing on generating ancillary revenues. IoT can play an important role in providing access to various real-time data to airlines and in improving the in-flight cabin experience for passengers. The proliferation of smartphones is driving the demand for in-flight internet connectivity and personalized entertainment solutions, thereby opening opportunities for airlines to generate considerable ancillary revenues. The growing adoption of intelligent baggage monitoring and advanced cabin climate control solutions to enhance the overall passenger experience is also contributing to the growth of the segment.

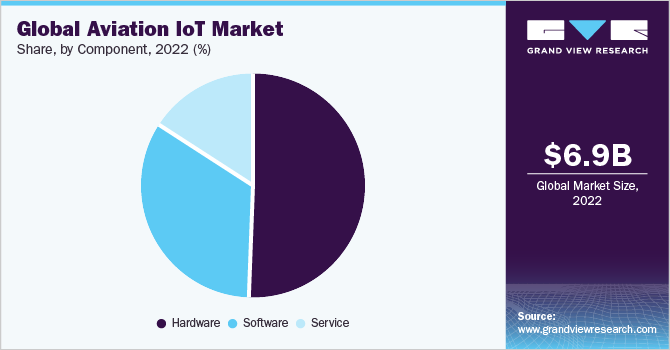

Component Insights

The hardware segment accounted for the largest revenue share of over 50% in 2022. The factors attributing to the share of this segment involve the increasing use of sensors, actuators, gateways, and other devices in aircraft and airports to collect and analyze data in real-timeto help make efficient decisions. Moreover, the trend of safety and efficiency in the aviation industry is expected to increase the demand for IoT hardware as it can help monitor and automate a few repetitive tasks. Thus, the hardware component segment is expected to be a vital segment in the industry.

The software segment is expected to grow at a significant CAGR over the forecast period. The segment growth can be credited to the growing trend of data visualization in aviation. Aviation IoT software is in demand as it helps in large amounts of data collection to help in decision-making related to air traffic control, baggage tracking, maintenance, and more. Moreover, the segment is expected to grow as developers are creating software that is compatible with a wide range of IoT hardware devices installed in airplanes and airports across the world.

Regional Insights

North America accounted for the largest revenue share of around 35% in 2022. The established aviation industry in the U.S. and Canada is allowing the region to be a lucrative market to implement sophisticated technologies. North America is home to major Original Equipment Manufacturers (OEM), such as The Boeing Company and Textron Inc., and hence, it has been an early adopter of advanced technologies. Moreover, the continued rollout of sophisticated aviation infrastructure in the U.S. to enhance the passenger experience also bodes well for the growth of the North America region.

Asia Pacific is estimated to grow at the highest CAGR of over 25% during the forecast period. The growth can be attributed to the rising air traffic in the region, increasing investments in smart airport architecture, and the expansion of airline operations in the region. Developing countries, such as India, and other Southeast Asian countries have witnessed a significant rise in domestic air travel due to the emergence of low-cost airlines. This, in turn, is expected to drive the regional market as airlines use IoT for safety compliance and enhance passenger experience.

Key Companies & Market Share Insights

Key players use strategies, such as partnerships, acquisitions, ventures, innovations, R&D, and geographical expansions, to solidify their industry position. Companies are also focusing on improving their product offerings to better suit the changing needs of users to stay competitive. For instance, in March 2023, Honeywell International, Inc. partnered with Lufthansa Technik to develop a digital platform named AVIATAR that is aimed at increasing customer experience in aviation analytics. Some of the prominent players operating in the global aviation IoT market are:

-

Honeywell International, Inc.

-

Tata Communication

-

Cisco Systems, Inc.

-

Huawei Technologies Co. Ltd.

-

IBM Corp.

-

Aeris Communication

-

Microsoft Corp.

-

Tech Mahindra Ltd.

-

Wind River Systems, Inc.

-

SAP SE

Recent Developments

- In June 2021, Honeywell expanded its agreement with SmartSky to provide Honeywell customers with the best and most extensive in-flight connectivity services.Additionally, Honeywell provides safety solutions that allow for direct data connection communications between pilots and air traffic controllers using L-band satellite networks.

Aviation IoT Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.33 billion

Revenue forecast in 2030

USD 36.20 billion

Growth rate

CAGR of 23.3% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, component, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; China; India; Australia; South Korea; Thailand; Brazil; Mexico; South Africa; UAE

Key companies profiled

Honeywell International, Inc.; Tata Communications Ltd.; Cisco Systems, Inc.; Huawei Technologies Co. Ltd.; IBM Corp.; Aeris Communication; Microsoft Corp.; Tech Mahindra Limited; Wind River Systems, Inc.; SAP SE

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aviation IoT Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the aviation IoT market based on application, end-use, component, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ground Operations

-

Passenger Experience

-

Aircraft Operations

-

Asset Management

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Airport

-

Airline Operators

-

MRO

-

Aircraft OEM

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

- Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

- Asia Pacific

-

China

-

Australia

-

India

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global aviation IoT market size was estimated at USD 6.88 billion in 2022 and is expected to reach USD 8.33 billion in 2023.

b. The global aviation IoT market is expected to grow at a compound annual growth rate of 23.3% from 2023 to 2030 to reach USD 36.20 billion by 2028.

b. North America dominated the aviation IoT market with a share of 34.2% in 2020. This is attributable to the established aviation industry in the U.S. and Canada is allowing the region to be a lucrative market to implement sophisticated technologies.

b. Some key players operating in the aviation IoT market include Honeywell International, Inc., Tata Communication, Cisco Systems, Inc., Huawei Technologies Co. Ltd., SITAONAIR.

b. Key factors that are driving the aviation IoT market growth include the exponential growth in air passenger traffic, strong emphasis on enhancing passenger experience, and growing preference for smart airport architecture.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."