- Home

- »

- Next Generation Technologies

- »

-

B2B E-commerce Marketplaces By Power Tools & Accessories Market, 2030GVR Report cover

![B2B E-commerce Marketplaces By Power Tools & Accessories Market Size, Share & Trends Report]()

B2B E-commerce Marketplaces By Power Tools & Accessories Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Product (Drill, Saws, Wrenches, Grinders, Sanders, Others), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-631-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

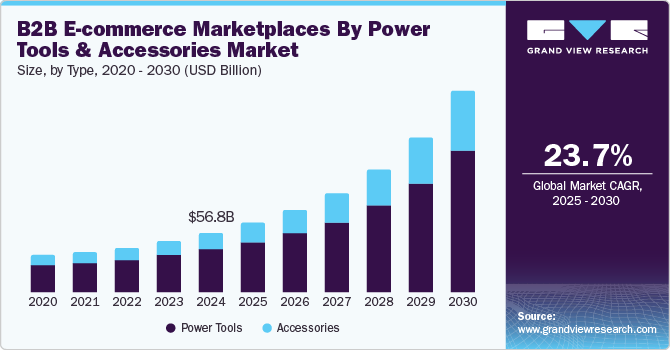

The global B2B e-commerce marketplaces by power tools & accessories market size was valued at USD 56.84 billion in 2024 and is projected to grow at a CAGR of 23.7% from 2025 to 2030. The rise of digitalization has led many businesses to adopt online platforms for purchasing and selling power tools, enhancing operational efficiency. Third-party e-commerce websites provide advantages such as bulk discounts, price transparency, and easy product comparisons, which appeal to buyers. In addition, the COVID-19 pandemic accelerated this trend as companies sought alternative sales channels amidst physical retail restrictions, resulting in increased buyer and seller participation in these digital marketplaces.

In addition, the expansion of internet access in developing regions enables more small and medium-sized enterprises to participate in online transactions. According to the International Telecommunication Union (ITU), around 67% of the global population, or 5.4 billion people, are now online, reflecting a 4.7% growth since 2022. The growing demand for innovative power tools equipped with advanced technologies is likely to draw a wider customer base. As manufacturers increasingly adopt Product Information Management (PIM) systems, they are able to provide detailed product information that enhances the buyer experience and supports informed purchasing decisions.

Moreover, the competitive landscape within this industry is evolving as major players implement innovative strategies to capture market share. Companies are focusing on improving distribution channels and enhancing customer engagement through personalized services. The introduction of flexible pricing models and self-service capabilities on e-commerce platforms is expected to cater effectively to B2B customers' needs. As businesses prioritize convenience and efficiency in their purchasing processes, the B2B e-commerce marketplaces in the power tools & accessories industry are well-positioned for continued expansion.

Type Insights

The power tools segment dominated the market with a revenue share of 72.3% in 2024. This dominance can be attributed to the increasing demand for efficient and versatile tools across various industries, including construction, manufacturing, and maintenance. Businesses are increasingly opting for power tools due to their ability to enhance productivity and reduce labor costs. The convenience offered by online marketplaces allows buyers to access a wide range of products and compare prices, further solidifying the power tools segment's leading position in the market.

The accessories segment is projected to grow at the highest CAGR during the forecast period, driven by the growing awareness of the importance of high-quality accessories that complement power tools, enhancing their performance and longevity. As industries continue to adopt advanced technologies, there is a rising demand for specialized accessories tailored to specific applications. The rising trend of customization in toolkits, along with the growing popularity of cordless options, serves as a significant factor driving the growth of this segment within the B2B e-commerce marketplaces by the power tools & accessories industry. For instance, in 2024, Bosch Power Tools unveiled a new range of products that enhanced its existing lineup of cordless 18V tools while also introducing hand tools for various trades.

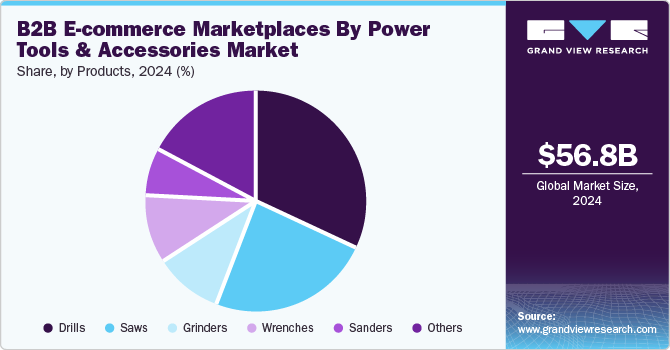

Products Insights

The drills segment dominated the market with the largest share in 2024. This trend is primarily due to the widespread application of drills in various sectors, including construction, woodworking, and automotive repair, where precision and efficiency are paramount. Drills are essential for tasks such as drilling holes, driving screws, and fastening materials, making them indispensable tools for professionals. As businesses seek tools that can handle diverse tasks effectively, drills equipped with advanced features such as variable speed settings, torque control, and ergonomic designs are becoming essential.

The wrenches segment is expected to grow at a significant CAGR over the forecast period, driven by innovations such as cordless and air wrenches that offer enhanced functionality and ease of use. For instance, in 2023, Snap-on launched the CT9038 18V 3/8" Drive MonsterLithium Cordless Impact Wrench, designed to enhance productivity for professional technicians. These modern wrenches provide greater torque and efficiency while reducing user fatigue, making them increasingly popular among professionals in automotive and industrial applications. The growing trend toward automation and mechanization in various industries is also contributing to the demand for advanced wrench solutions. As businesses prioritize efficiency and performance, the availability of high-quality wrenches through B2B e-commerce marketplaces in the power tools & accessories industry is likely to engage more buyers.

Regional Insights

The North America B2B e-commerce marketplaces by power tools & accessories market is experiencing significant growth, driven by a surge in construction and infrastructure development activities across the region. This growth is fueled by increasing investments in both residential and commercial projects, leading to heightened demand for power tools and accessories. The convenience of online purchasing through established platforms allows businesses to access a broad range of products efficiently, facilitating quick comparisons and informed purchasing decisions.

U.S. B2B E-commerce Marketplaces By Power Tools & Accessories Market Trends

The U.S. B2B e-commerce marketplaces by power tools & accessories market dominated the regional market in 2024. The U.S. market benefits from a robust e-commerce infrastructure and a large number of established players, such as Amazon and eBay, which cater to diverse customer needs with extensive product offerings. The strong preference for online shopping among businesses has been amplified by the COVID-19 pandemic, which prompted many companies to explore digital channels for procurement.

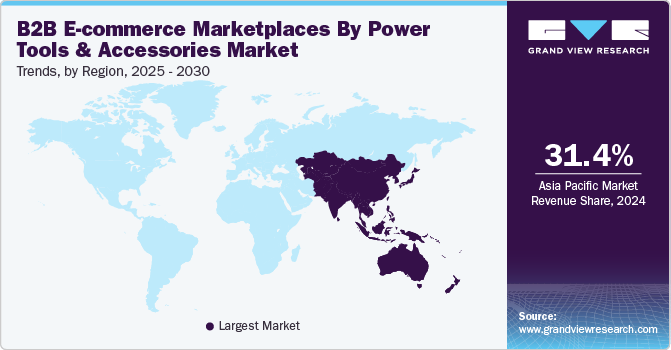

Asia Pacific B2B E-commerce Marketplaces By Power Tools & Accessories Market Trends

The Asia Pacific B2B e-commerce marketplaces by power tools & accessories market dominated the global market with a revenue share of 31.4% in 2024, This growth can be attributed to rapid industrialization and urbanization across the region, which is significantly increasing the demand for construction and manufacturing activities. In addition, the proliferation of internet access and mobile technology has facilitated the rise of online marketplaces, allowing businesses to easily source tools and accessories at competitive prices.

The China B2B e-commerce marketplaces by power tools & accessories market dominated the regional market in 2024. The country's robust manufacturing base and extensive supply chains have positioned it as a power tool production and distribution hub. The increasing adoption of e-commerce platforms among Chinese businesses has transformed traditional procurement processes, enabling companies to streamline their purchasing through online channels. As a result, China's market is characterized by a diverse range of products and competitive pricing, making it a favorable destination for buyers looking for power tools and accessories.

Europe B2B E-commerce Marketplaces By Power Tools & Accessories Market Trends

The Europe B2B e-commerce marketplaces by power tools & accessories market is expected to witness significant growth due to increasing demand for power tools driven by ongoing construction and renovation projects across countries such as Germany, the UK, and France. These nations are investing heavily in infrastructure development, leading to a heightened need for high-quality tools and accessories. The shift toward digital procurement methods allows businesses to access a wide range of products through online marketplaces, facilitating efficient comparisons and informed purchasing decisions.

Key B2B E-commerce Marketplaces By Power Tools & Accessories Company Insights

-

The B2B e-commerce marketplaces by power tools & accessories market include several notable companies providing various products and services to business customers. W.W. Grainger, Inc. offers extensive Maintenance, Repair, and Operations (MRO) supplies catering to various industrial needs. Snap-on Business Solutions Inc. focuses on high-quality automotive tools and diagnostic equipment, serving professionals across multiple sectors. Fastenal Company specializes in industrial and construction supplies, emphasizing rapid delivery to meet customer demands. MSC Industrial Direct Co., Inc. provides a diverse range of metalworking products and valuable inventory management services. Collectively, these companies significantly influence the landscape of the B2B e-commerce marketplaces by power tools and accessories industry.

-

W.W. Grainger, Inc., is a supplier of MRO products, serving a diverse range of industries through its extensive online platform. The company offers a wide selection of tools, safety equipment, and industrial supplies, enabling businesses to manage their procurement processes efficiently. Grainger's commitment to customer service is reflected in its robust e-commerce capabilities, which provide users with easy access to product information and purchasing options.

-

Snap-on Business Solutions Inc. specializes in providing high-quality tools and diagnostic equipment primarily for the automotive sector. The company offers a comprehensive range of products, including hand tools, power tools, and advanced diagnostic software tailored for automotive repair and maintenance professionals. Snap-on's innovative solutions are designed to improve efficiency and productivity for its customers, who include vehicle dealerships and repair centers. With a strong focus on e-commerce, Snap-on allows users to purchase products directly online, further solidifying its presence in the B2B e-commerce marketplaces by the power tools and accessories industry.

Key B2B E-commerce Marketplaces By Power Tools & Accessories Companies:

The following are the leading companies in the B2B E-commerce marketplaces by power tools & accessories market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon.com Inc.

- Alibaba.com

- W.W. Grainger, Inc.

- eBay Inc.

- Snap-on Business Solutions Inc.

- Home Depot

- Walmart

- Thomas Publishing Company.

- Fastenal Company

- MSC Industrial Direct Co., Inc.

Recent Development

-

In September 2024, Amazon Business introduced several new features aimed at enhancing the B2B purchasing experience. These include a personalized hosted product catalog, an inventory restocking service, and integration with SAP Ariba for streamlined procurement processes. These updates are designed to improve efficiency for business customers and foster increased commerce on the platform.

-

In April 2024, Bosch Power Tools Division launched an upgraded e-commerce site, BoschTools.com, designed to enhance the B2B purchasing experience. The new platform features a Trade Hub that categorizes tools and accessories by industry, a Bosch E-Repair service for easy product repairs, and improved navigation for searching tools based on materials. Customers can purchase products directly from linked sites such as Amazon and Lowe’s or locate local authorized dealers.

B2B E-commerce Marketplaces By Power Tools & Accessories Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 66.24 billion

Revenue forecast in 2030

USD 191.93 billion

Growth rate

CAGR of 23.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, products, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Amazon.com Inc.; Alibaba.com; W.W. Grainger, Inc.; eBay Inc.; Snap-on Business Solutions, Inc.; Home Depot; Walmart; Thomas Publishing Company.; Fastenal Company; MSC Industrial Direct Co., Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global B2B E-commerce Marketplaces By Power Tools & Accessories Market Report Segmentation

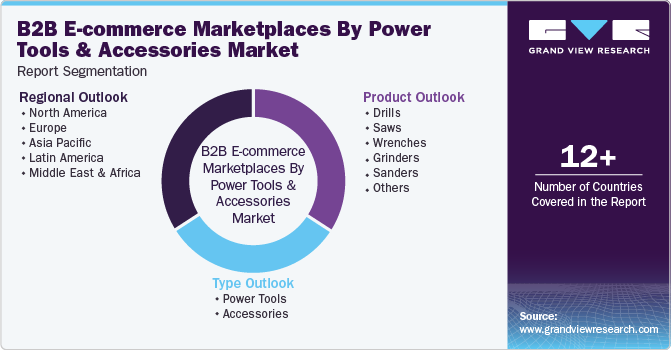

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global B2B e-commerce marketplaces by power tools & accessories market report based on type, products, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Tools

-

Accessories

-

-

Products Outlook (Revenue, USD Million, 2018 - 2030)

-

Drills

-

Saws

-

Wrenches

-

Grinders

-

Sanders

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.