- Home

- »

- Advanced Interior Materials

- »

-

Power Tools Market Size And Share, Industry Report, 2033GVR Report cover

![Power Tools Market Size, Share & Trends Report]()

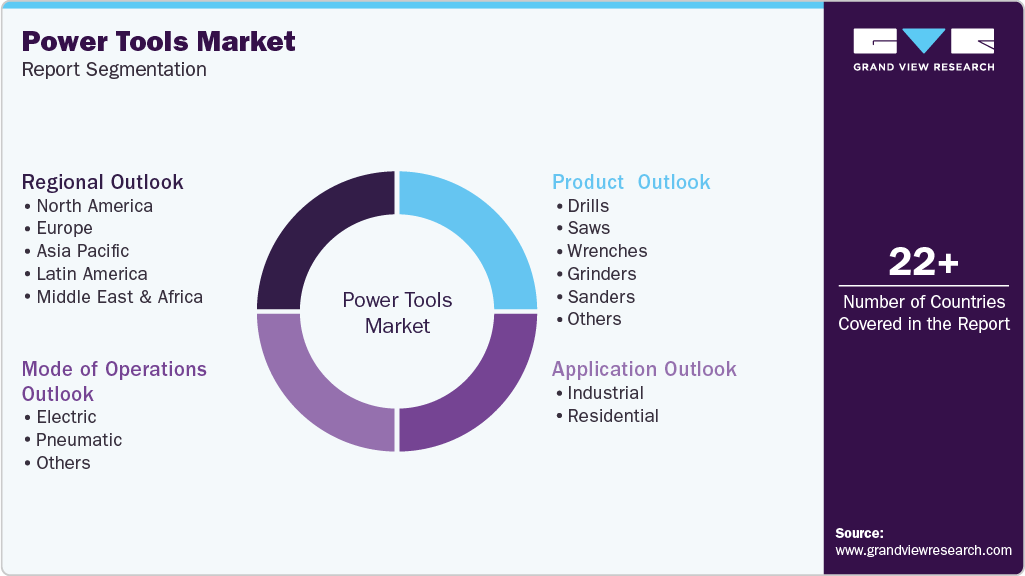

Power Tools Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Drills, Saws, Wrenches, Grinders, Sanders, Others), By Mode of Operation (Electric, Pneumatic, Others), By Application (Industrial, Residential), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-760-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Tools Market Summary

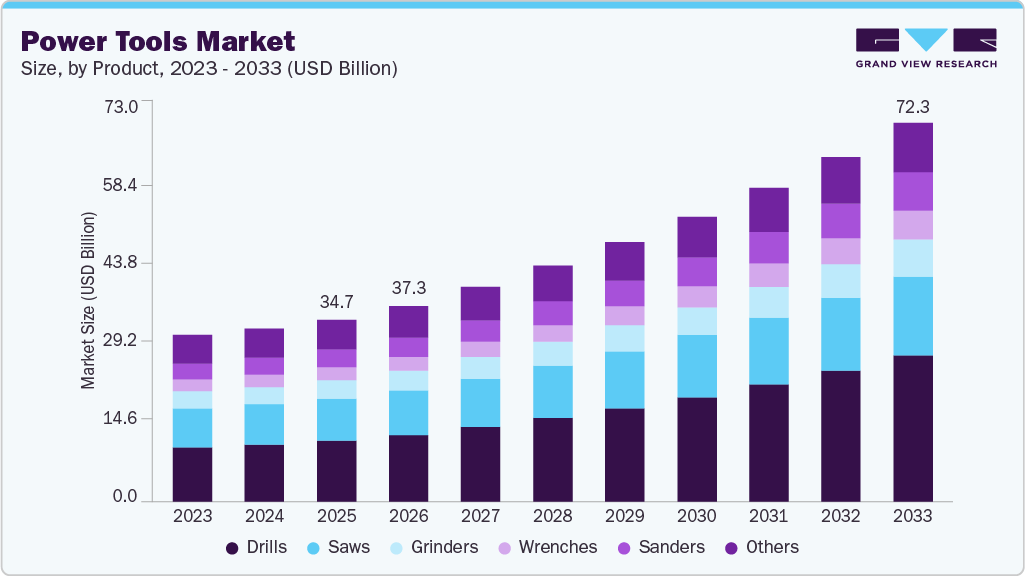

The global power tools market size was estimated at USD 34.71 billion in 2025 and is expected to reach USD 72.27 billion by 2033, growing at a CAGR of 9.9% from 2026 to 2033. As governments across the globe are undertaking infrastructure development projects, the demand for power tools used in construction activities is anticipated to grow in the coming years.

Key Market Trends & Insights

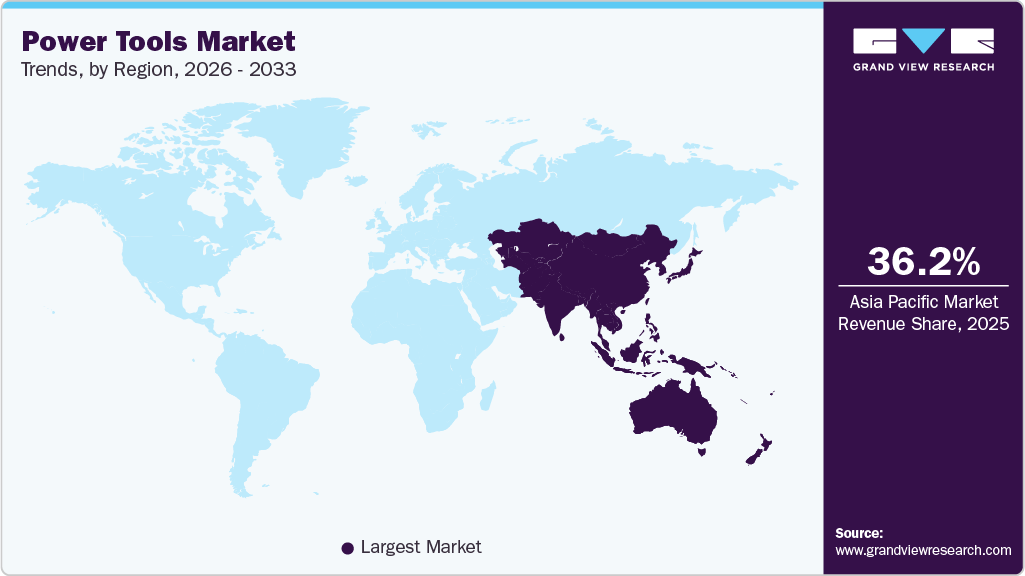

- Asia Pacific dominated the power tools market with the largest revenue share of 36.2% in 2025.

- By product, drills segment is expected to grow at the fastest CAGR of 11.9% over the forecast period.

- By mode of operation, electric segment is expected to grow at the fastest CAGR of 10.5% from 2026 to 2033.

- By application, residential segment is expected to grow at the fastest CAGR of 11.0% over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 34.71 Billion

- 2033 Projected Market Size: USD 72.27 Billion

- CAGR (2026-2033): 9.9%

- Asia Pacific: Largest market in 2025

Such initiatives are expected to lead to aggressive investments in non-residential construction projects and subsequently drive the demand for power tools over the forecast period. The U.S. power tools market dominated the market and accounted for a market share of 86.6% in 2025. The demand for power tools in the U.S. has been increasing steadily over the past few years, driven by factors such as the growth in the construction industry, the popularity of DIY projects, and the increasing adoption of power tools in industrial and manufacturing settings. Overall, it seems that the demand for power tools in the US is expected to continue growing in the coming years, driven by a range of factors across various industries and consumer segments.

The popularity of cordless power tools is growing noticeably amongst consumers. Battery-operated, cordless power tools, such as crimpers, hammer drills, impact drivers, impact wrenches, and circular saws, are used in construction, repair, and maintenance applications, as well as in sanding, metalworking, and welding, among other tasks, and are being widely adopted across several end-use industries. Power tools powered by lithium-ion batteries are significantly gaining traction and are expected to replace power tools operating on conventional batteries, such as nickel-cadmium (Ni-Cd) batteries and nickel-metal hydride (Ni-MH) batteries.

Technological advancements are influencing the growth of the market. Companies are introducing technologically advanced products to enhance the efficiency of their products. For instance, the Flexvolt battery offered by Dewalt automatically switches battery voltage depending on the tool you attached to it. An automatic switch of voltage helps in manually adjusting the power before using different corded power tools.

In addition to technological innovations, the increasing adoption of cordless tools that provide easy mobility and no external power source is driving market growth. The growing demand from household applications and the revival of industries in the near future is expected to upkeep the market growth over the forecast period.

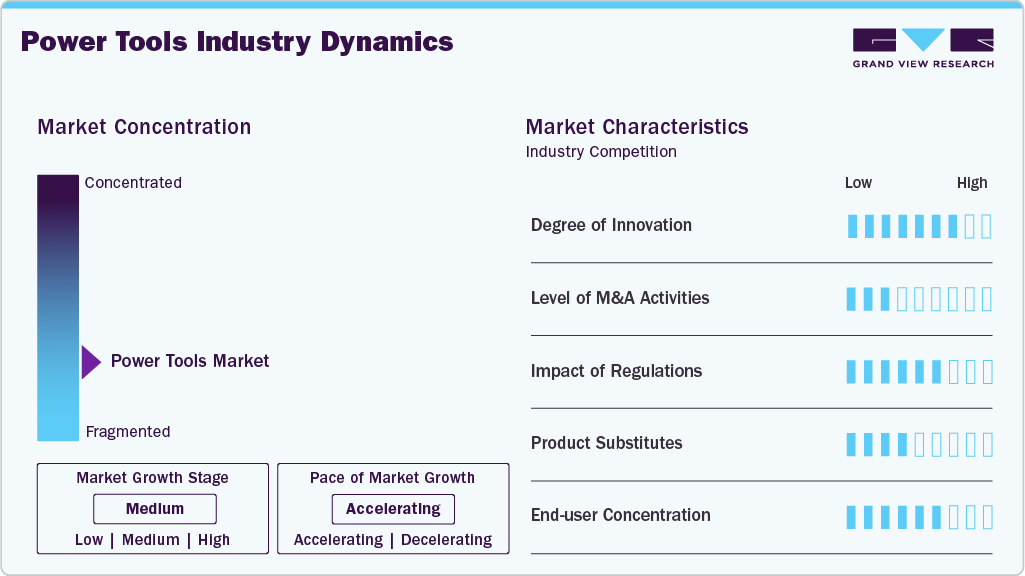

Market Concentration & Characteristics

The power tools market has seen significant innovation driven by advancements in battery technology, smart connectivity, and ergonomic design. Cordless tools, powered by high-capacity lithium-ion batteries, now offer comparable performance to corded versions, enabling greater mobility and convenience. Integration of IoT features, such as Bluetooth-enabled diagnostics and tool tracking, enhances user efficiency and reduces downtime. Additionally, manufacturers are focusing on sustainability by developing energy-efficient motors and recyclable components, catering to both professional tradespeople and DIY consumers seeking reliable, high-performance tools.

The threat of substitutes in the power tools market remains moderate, primarily influenced by the availability of manual tools and outsourcing services. While manual tools are less efficient and labor-intensive, they may appeal to budget-conscious or infrequent users. In addition, some consumers may opt to hire professionals instead of investing in expensive power tools, particularly for specialized tasks. However, the increasing affordability, versatility, and user-friendliness of modern power tools continue to mitigate these threats, especially as DIY culture and home improvement trends gain traction.

Product Insights

The drills segment dominated the market in 2025 with a revenue share of 33.4% and is expected to continue leading over the forecast period. Drills are easy to use, cheaper as compared to other power tools, and are commonly used in industrial and household applications. Drills are also prominently used as a basic repair and maintenance tool, thus, driving segmental growth. Apart from drills, the product segment is bifurcated into saws, wrenches, grinders, sanders, and others.

The wrenches segment is anticipated to grow significantly at a CAGR of 11.2% during the forecast period. Compared to traditional wrenches, power wrenches save a lot of time and manual effort in fastening. Wrenches are prominently used in production plants to improve work efficiency. The automation of production facilities is a major contributor to the growth of the segment.

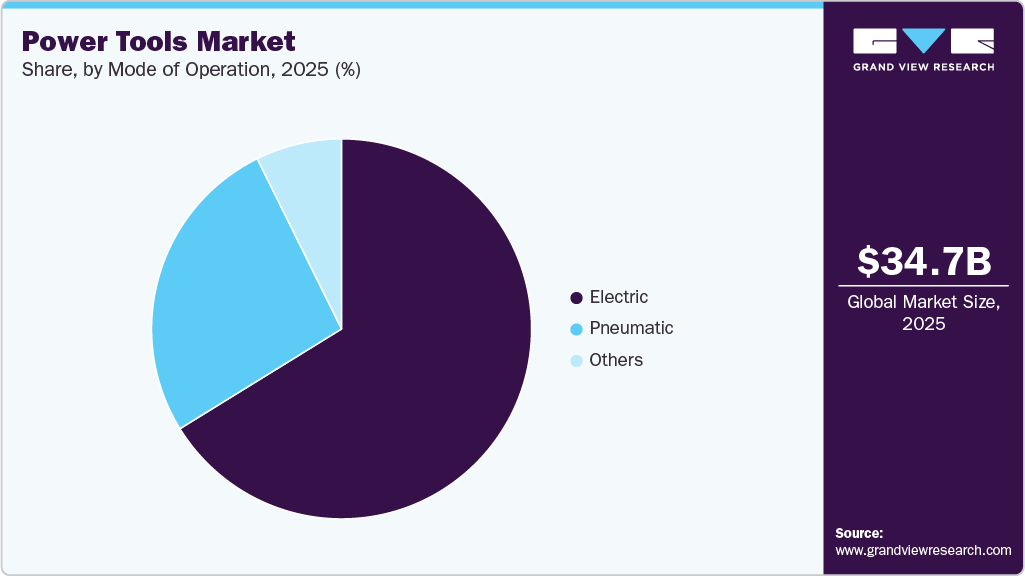

Mode of Operation Insights

The electric mode of operation segment accounted for the largest revenue share of 66.3% in 2025. The demand for electric power tools is increasing due to their convenience, efficiency, safety, durability, technological advancements, and cost-effectiveness. As more people take up DIY projects and home renovations, and as industries such as construction and manufacturing continue to grow, the demand for electric power tools is expected to continue to rise.

The pneumatic mode of operation segment is expected to grow significantly at a CAGR of 9.2% over the forecast period. The market demand for pneumatic power tools is increasing due to their high power and torque, durability, cost-effectiveness, safety, and versatility. As industries such as automotive, construction, and manufacturing continue to grow, the market demand for pneumatic power tools is expected to continue to rise.

Application Insights

The industrial application segment held the largest revenue share of 61.8% in 2025. Industrial applications include the use of tools in industries such as automotive, construction, aerospace, and logistics. Increased technological innovation and adoption of advanced technologies among these industries is the crucial factor for the dominance of industrial applications over the residential segment. The Automotive and construction industries have the highest adoption of power tools, thus driving the growth of the industrial segment.

The residential application segment is projected to witness the fastest CAGR of 11.0% during the forecast period. The growth is primarily attributed to the growing trend of DIY culture. The availability of user-friendly and easy-to-operate power tools is the vital reason for the considerable growth rate of household applications. Renovation and remodeling of construction projects are growing, leading to increased utilization of the product in the residential sector.

Regional Insights

Asia Pacific held the largest market share of 36.2% in 2025. Due to the flourishing automotive industry in countries such as India and China, the region is projected to witness the fastest CAGR over the forecast period. Increasing disposable income and growing construction & infrastructure development activities are major factors influencing the growth.Low production costs and availability of cheap labor are leading multinational companies to set up their production facilities in developing countries, such as China and India. Moreover, government efforts to boost local production, support manufacturers, and reduce the import of goods and become self-sufficient are expected to boost the industrial sectors and further fuel the growth of power tools over the forecast period.

China Power Tools Market Trends

The power tools market in China is growing due to rising government investments in infrastructure projects, including railway construction, data centers, and ongoing Belt and Road initiatives, which are expected to drive the demand for power tools in the coming years. In addition, the Chinese government’s initiatives to boost the manufacturing sector are expected to fuel the demand for tools in industrial sectors. China’s goal to reduce dependence on foreign technology and promote Chinese manufacturers is expected to boost the manufacturing and industrial sectors of China, thereby increasing the requirement for power tools, further fueling the market growth.

Europe Power Tools Market Trends

The Europe power tools market is primarily driven by the region’s strong industrial and manufacturing base, ongoing construction and infrastructure development, and the rising adoption of cordless, energy-efficient, and technologically advanced tools such as those featuring brushless motors and smart connectivity. Growth is further supported by expanding DIY and home-improvement activities, increased ergonomics and productivity requirements across professional sectors, and the rapid expansion of e-commerce channels that enhance product accessibility.

Germany power tools market is witnessing growth driven by the country’sautomotive industry in Germany is one of the largest in Europe in terms of revenue and volume, owing to the specific and innovative nature of country-based car manufacturers and suppliers. Similarly, Germany is one of the major markets in Europe for manufacturers of aerospace owing to growing innovation, competence, and technological support offered by key players. This is expected to maintain the demand for power tools in aerospace and automotive industries.

North America Power Tools Market Trends

North America is expected to meet around one-third of the global operational fleet requirements, resulting in an increased demand for airframe and other aircraft parts over the forecast period. Furthermore, commercial aircraft are expected to witness the highest demand over the forecast period owing to the increasing passenger and freight traffic. Since the commercial aircraft manufacturing industry in Asia is relatively small, large number of aircraft are imported from North America. This is expected to boost market growth in North America.

The demand for power tools in U.S. is increasing owing to the flourishing aerospace, construction, and automotive industries. The U.S. has a huge production of aerospace owing to the presence of manufacturing facilities of all major industry players. The major manufacturers of aerospace & defense products in the country are Boeing, Lockheed Martin, and Airbus.

Latin America Power Tools Market Trends

The emerging economies, such as Argentina, Brazil, and Peru, are witnessing population growth coupled with rapid urbanization. These factors are triggering the construction of residential and commercial units in Latin America, fueling the demand for power tools in the region.A rise in the development of single-family houses in Latin America is also contributing to the growth of the residential construction market. The rising percentage of single parents is anticipated to drive the demand for single-family housing units in Latin America from 2026 to 2033.

Middle East & Africa Power Tools Market Trends

The demand for power tools is largely driven by the oil and gas industry in the Middle East, which plays an important role in contributing to its economy. Power tools are used in the exploration, drilling, and production activities of the oil and gas industry. Moreover, countries in the Middle East are also focusing on industrialization and diversifying their economies to reduce their reliance on the petroleum sector. This is expected to boost the manufacturing sector of the Middle East, including electronics and automotive, increasing the demand for tools and equipment and thereby fueling the demand for power tools.

Key Power Tools Company Insights

Some of the key players operating in market include Atlas Copco and Hitachi Koki Co., Ltd.

-

Atlas Copco AB is a manufacturer of power equipment, compressors, and industrial machines.

-

Koki Holdings Co., Ltd. is involved in manufacturing and selling power tools. Major brands under the company include HIKOKI, Metabo HPT, and Metabo.

Stanley Black & Decker & Hilti Corporation are some of the emerging market participants in Power Tools market.

-

Stanley Black & Decker offers hand and power tools with related accessories, fastening systems and products, services, and equipment for various industries such as oil & gas and infrastructure, security systems, and healthcare solutions

-

Hilti Corporation is a technology company focused on product development and manufacturing, logistics, sales, and servicing of technological equipment.

Key Power Tools Companies:

The following are the leading companies in the power tools market. These companies collectively hold the largest market share and dictate industry trends.

- Makita Corporation

- Robert Bosch Group

- Stanley Black & Decker

- Techtronic Industries Co., Ltd.

- Emerson Electric Co.

- Atlas Copco

- Hilti Corporation

- Ingersoll Rand, Inc.

- Hitachi Koki Co., Ltd.

- Apex Tool Group, LLC

Recent Developments

-

In June 2023, DEWALT, a brand of Stanley Black & Decker, launched its two new seal-headed ratchets. The products protect against automotive solvents and oils. In addition, these are generally used in the electrical, mechanical, MRO services, and automotive sectors.

-

In March 2023, the company launched its new product GBH 18V-22 Professional. The product is compact and lightweight, which offers superior safety and protection. Furthermore, it is optimized for overhead installation work, thus, fitting seamlessly on a rotary hammer.

Power Tools Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 37.28 billion

Revenue forecast in 2033

USD 72.27 billion

Growth rate

CAGR of 9.9% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mode of operation, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; Brazil; Mexico

Key companies profiled

Makita Corporation; Robert Bosch Group; Stanley Black & Decker; Techtronic Industries Co., Ltd.; Emerson Electric Co.; Atlas Copco; Hilti Corporation; Ingersoll Rand, Inc.; Hitachi Koki Co., Ltd., Apex Tool Group, LLC

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global power tools market report based on product, mode of operation, application, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Drills

-

Saws

-

Wrenches

-

Grinders

-

Sanders

-

Others

-

-

Mode of Operations Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric

-

Pneumatic

-

Others

-

-

Applications Outlook (Revenue, USD Million, 2021 - 2033)

-

Industrial

-

Residential

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. Industrial segment dominated the power tools market with a share of 61.8% in 2025. This is attributable to growing adoption of power tools in the manufacturing and production facilities across the globe.

b. Some of the key players operating in the Power Tools market include Emerson Electric, Co.; Hilti Corporation; Ingersoll-Rand PLC; Koki Holdings Co., Ltd.; Makita Corporation; Robert Bosch; Stanley Black & Decker; Techtronic Industries

b. Key factors that are driving the market growth include rising demand from automotive & construction industry, increasing trend of DIY in household applications, and increasing automation in industries.

b. The global power tools market size was estimated at USD 34.71 billion in 2025 and is expected to reach USD 37.28 billion in 2026.

b. The power tools market is expected to grow at a compound annual growth rate of 9.9% from 2026 to 2033 to reach USD 72.27 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.