- Home

- »

- Beauty & Personal Care

- »

-

Baby Diapers Market Size And Share, Industry Report, 2030GVR Report cover

![Baby Diapers Market Size, Share & Trends Report]()

Baby Diapers Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Non-Disposable Diapers, Disposable Diapers), By Type (Open Diapers, Closed Diapers), By Size (New Born, Small), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-664-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Baby Diapers Market Summary

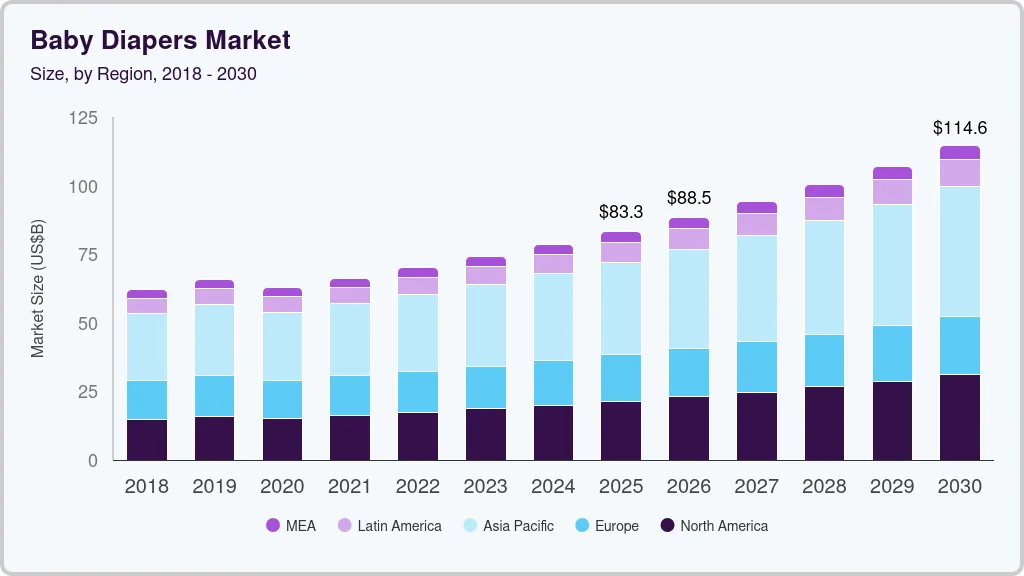

The global baby diapers market size was estimated at USD 78.54 billion in 2024 and is projected to reach USD 114.59 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. A steady rise in the global birth rate, especially in emerging economies, significantly drives the baby diapers market by increasing the number of infants requiring diaper products.

Key Market Trends & Insights

- The baby diapers market in North America accounted for a market share of around 45% in 2024

- The baby diapers market in the U.S. accounted for a market share of around 83% in 2024

- The Asia Pacific baby diapers market is expected to grow a CAGR of 7.1% from 2025 to 2030.

- Based on product, disposable diapers accounted for a market share of around 79% in 2024.

- In terms of type, open baby diapers accounted for a share of over 53% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 78.54 billion

- 2030 Projected Market Size: USD 114.59 billion

- CAGR (2025-2030): 6.6%

- U.S.: Largest market in 2024

As birth rates grow, particularly in regions such as Asia-Pacific, Africa, and Latin America, the demand for essential baby care products like diapers rises accordingly. In these regions, where disposable income is also gradually increasing, parents are opting for convenient, hygienic, and high-quality diaper options, thus expanding the market. The growing population of infants directly correlates with higher diaper consumption, driving both production and sales across various diaper brands and categories.

As more families migrate to urban areas and an increasing number of mothers join the workforce, disposable diapers have become an essential solution for busy parents seeking convenience and hygiene. Urban living often involves fast-paced, time-constrained lifestyles, making disposable diapers a practical choice for working parents who may not have the time or resources to regularly wash cloth diapers. These diapers offer ease of use, with no need for frequent laundering or additional time-consuming care, providing a cleaner, more hygienic option for babies. The convenience of easily accessible, ready-to-use diapers also aligns well with the growing trend of dual-income households, further driving the demand in urban markets.

Continuous advancements in diaper technology, including the development of more absorbent materials, eco-friendly options, and innovative features like wetness indicators, have significantly driven demand for new and improved diaper products. These innovations offer enhanced comfort, better performance, and environmental sustainability, appealing to modern parents who seek both convenience and responsibility, thus fueling the growth of the market.

In August 2023, Huggies launched a first-of-its-kind diaper aimed at combating nappy rash. The new product features a unique formulation that includes a moisture-locking layer designed to keep babies’ skin dry and prevent irritation. This innovation is designed to provide long-lasting protection against nappy rash, a common issue for infants, by combining advanced absorbency with skin-friendly ingredients. The launch underscores Huggies' commitment to both comfort and health, catering to parents seeking effective, gentle solutions for their babies’ skin.

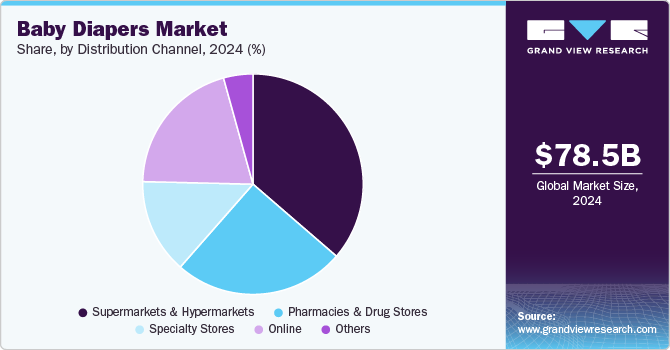

The growth of e-commerce and improvements in distribution channels have significantly contributed to the expansion of the diaper market. The rise of online shopping platforms has made it increasingly convenient for parents to purchase diapers, often in bulk, at competitive prices, offering greater affordability and ease of access. Online retailers, alongside supermarkets and pharmacies, have expanded their presence, ensuring that diapers are readily available across multiple channels. This increased accessibility has allowed consumers to find their preferred products with minimal effort, further driving market growth.

Product Insights

Disposable diapers accounted for a market share of around 79% in 2024. Disposable diapers offer significant advantages over cloth alternatives, including ease of use, superior absorbency, and the ability to be discarded after use, reducing the time and effort required for cleaning and maintenance. Their widespread adoption is also fueled by advancements in diaper technology, which has led to thinner, more absorbent designs that keep babies dry and comfortable for longer periods. Additionally, disposable diapers are preferred by parents for their effectiveness in preventing leaks, especially during nighttime, and the increasing availability of eco-friendly disposable options has helped address environmental concerns. The combination of these factors ensures the continued dominance of disposable diapers in the market.

The demand for non-disposable diapers is expected to grow at CAGR of 8.7% from 2025 to 2030. Non-disposable diapers, such as cloth diapers, are seen as an eco-friendly alternative to disposable ones, as they can be reused multiple times, reducing waste and environmental impact. Parents are also attracted to the long-term cost savings, as cloth diapers, although a higher initial investment, do not require frequent repurchasing like disposables. Furthermore, advancements in cloth diaper technology, such as improved absorbent materials and easier washing methods, have made them more appealing. One company offering non-disposable baby diapers is BumGenius, which is known for its high-quality, reusable cloth diapers designed to provide comfort, performance, and sustainability for both parents and babies.

Type Insights

Open baby diapers accounted for a share of over 53% in 2024. The dominance of open (taped) baby diapers among consumers is driven by their ease of use, affordability, secure fit, and adaptability for babies of various shapes and sizes. Taped diapers feature adjustable side tabs that allow parents to customize the fit, ensuring a snug and comfortable wear for infants, especially during the early stages when babies are more active and prone to movement. This design provides a more flexible and secure fastening compared to pull-up diapers, making it easier to change babies, particularly for younger infants who are unable to stand or walk. The availability of advanced features like improved absorbency, leak protection, and skin-friendly materials in taped diapers further contributes to their popularity, making them a preferred choice for many parents seeking reliability and comfort.

The demand for closed baby diapers is expected to grow at CAGR of 7.5% from 2025 to 2030. The increasing growth of closed baby diapers, such as pull-up or pants diapers, among consumers is driven by their convenience, and enhanced mobility for babies and toddlers. These diapers are designed to be pulled up and down like regular underwear, making them ideal for active infants and toddlers who are beginning to walk and explore. They offer greater comfort and independence, as they can be easily changed without needing to remove the child’s clothes. This shift is also influenced by the growing preference for diapers that support potty training, as pull-ups help toddlers become more familiar with the concept of using the toilet.

Size Insights

Large size baby diapers accounted for a share of around 41% in 2024. Larger sizes, typically designed for older infants and toddlers, offer a better value per unit, making them an attractive option for parents looking to reduce frequent purchases. Additionally, as babies grow, the frequency of diaper changes decreases, and parents prefer larger sizes that provide longer wear time, reducing the need for constant replacements. The shift towards bulk purchasing for better value is also influenced by busy parents seeking practical solutions for their children’s needs. Moreover, advancements in diaper technology, such as improved absorbency and comfort in larger sizes, further support the preference for these products among parents.

Medium size baby diapers is expected to grow at CAGR of 9.5% from 2025 to 2030. The increasing growth of medium-size baby diapers among consumers is driven by the transition phase between newborn and toddler stages, where babies experience fluctuating growth patterns. Medium-sized diapers are often preferred for infants who are growing rapidly, but not yet large enough for larger sizes, offering a more comfortable and secure fit than smaller diapers. This size also caters to parents who want a balance between cost-efficiency and performance, as medium-size diapers tend to be more affordable than larger ones, while still providing longer use compared to newborn sizes.

Distribution Channel Insights

Sales through supermarkets & hypermarkets accounted for a market share of over 36% in 2024. The segment remains a dominant distribution channel, driven by the convenience and accessibility these retail formats offer. Parents prefer purchasing baby diapers in bulk from these stores due to competitive pricing, regular promotions, and the ability to compare different brands and product types in one location. Supermarkets and hypermarkets also benefit from high foot traffic, particularly in urban areas, making them a key point of sale for baby care products. Major supermarkets and hypermarkets contributing to the sale of baby diapers include Walmart, Costco, Target, Carrefour, and Tesco, which all provide a wide range of diaper options to cater to diverse consumer preferences.

Baby diapers online sales is expected to grow at a CAGR of 8.4% from 2025 to 2030. The growth of the baby diaper market through online channels has been significant, driven by the convenience, wide selection, and competitive pricing offered to consumers. With an increasing number of parents preferring to shop online for baby products, e-commerce platforms provide easy access to various diaper brands, including premium and eco-friendly options. The rise of online shopping has also led to the growth of subscription services, which offer regular deliveries of diapers, saving time and effort for parents. The ongoing digital transformation and the growth of mobile shopping apps have further boosted sales, enabling consumers to compare products, read reviews, and make informed purchasing decisions. This shift to online channels is particularly notable in regions like North America and Europe, where convenience and value are key drivers for growth in the baby diaper market.

Regional Insights

The baby diapers market in North Americaaccounted for a market share of around 45% in 2024 in the global market.Consumers are increasingly demanding diapers that offer superior absorbency, comfort, and skin protection, prompting manufacturers to innovate with advanced materials and eco-friendly options. Additionally, the rise of e-commerce and online retail channels has improved the accessibility of various diaper brands, further fueling market expansion. With an increasing number of parents opting for natural and organic diaper alternatives, the market is also witnessing a shift toward sustainable solutions.

U.S. Baby Diapers Market Trends

The baby diapers market in the U.S. accounted for a market share of around 83% in 2024 in the North American market. The availability of a large number of companies in the U.S. significantly drives the baby diaper market by fostering intense competition, innovation, and variety in product offerings. Leading players such as Procter & Gamble (Pampers), Kimberly-Clark (Huggies), and Unicharm are continuously innovating to meet diverse consumer demands for high-quality, comfortable, and skin-friendly diapers. Alongside these giants, numerous regional and private-label brands contribute to the market, offering cost-effective alternatives and promoting accessibility across various income groups. The robust presence of both multinational and smaller companies ensures that consumers benefit from a wide range of choices in terms of price, features, and availability, further boosting the market's growth.

Europe Baby Diapers Market Trends

The baby diapers market in Europe accounted for revenue share of around 22% of global revenue in 2024. Parents in the region are increasingly prioritizing diapers that offer superior comfort, enhanced absorption, and sustainability, fueling innovation among manufacturers. The adoption of biodegradable and reusable diapers is gaining traction, supported by stringent environmental regulations and heightened consumer awareness of sustainability. Additionally, advanced distribution channels, including e-commerce platforms, are playing a pivotal role in market expansion. Major countries operating in this market include Germany, France, the United Kingdom, Italy, and Spain, with these nations contributing significantly to the overall market revenue.

Asia Pacific Baby Diapers Market Trends

The Asia Pacific baby diapers market is expected to grow a CAGR of 7.1% from 2025 to 2030. The market is experiencing significant growth, driven by rising birth rates, increased urbanization, and growing awareness of infant hygiene across emerging economies. The market benefits from innovations in diaper materials, improved absorption technologies, and eco-friendly options catering to environmentally conscious consumers. Countries such as China, India, and Indonesia are key contributors to market expansion due to their large populations and increasing disposable incomes. Major companies operating in this market include Procter & Gamble, Kimberly-Clark Corporation, Unicharm Corporation, Kao Corporation, and Hengan International Group.

Key Baby Diapers Company Insights

The baby diapers market is highly competitive, characterized by the presence of global giants like Procter & Gamble (Pampers), Kimberly-Clark (Huggies), and Unicharm (MamyPoko), which dominate with strong brand recognition and extensive distribution networks. Regional players such as Nobel Hygiene and Ontex cater to cost-sensitive markets with affordable alternatives. The competition is intensifying due to rising consumer demand for eco-friendly and biodegradable diapers, driving innovation. Private label brands, particularly in North America and Europe, are also gaining traction due to their cost-effectiveness. Companies focus on product differentiation through features like better absorbency, comfort, and skin-friendly materials, along with aggressive marketing and e-commerce expansion strategies.

Key Baby Diapers Companies:

The following are the leading companies in the baby diapers market. These companies collectively hold the largest market share and dictate industry trends.

- The Procter & Gamble Company (P&G)

- Kimberly-Clark Corporation

- Hengan International

- Unicharm Corporation

- Johnson & Johnson

- First Quality Enterprises

- Ontex Group

- The Hain Celestial Group, Inc.

- The Honest Company, Inc.

- Essity AB

Recent Developments

-

In May 2024, Procter & Gamble brand Pampers introduced the new Swaddlers 360° Diapers, combining the trusted softness and skin protection of Swaddlers with an innovative pull-on waistband design for easier diaper changes. The new product is designed to simplify the diapering experience for parents, particularly during active baby stages when conventional diaper changes can be challenging. With a focus on comfort and practicality, Pampers continues to address parental needs by enhancing convenience without compromising the quality and protection for which Swaddlers are renowned. This launch highlights Pampers' commitment to innovation in the baby care segment.

-

In May 2024, Kimberly-Clark's Huggies brand launched the Skin Essentials Diaper, designed to address common causes of diaper rash and promote healthier skin for babies. These diapers feature advanced technologies to manage moisture effectively and reduce friction, the two leading causes of rash. The introduction underscores Huggies' commitment to prioritizing baby skin health while offering parents innovative solutions for diapering challenges. This product launch highlights the brand's continued focus on comfort, protection, and addressing key concerns in baby care.

Baby Diapers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 83.31 billion

Revenue forecast in 2030

USD 114.59 billion

Growth Rate (Revenue)

CAGR of 6.6% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, size, distribution channel, region.

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; and South Africa

Key companies profiled

The Procter & Gamble Company (P&G); Kimberly-Clark Corporation; Hengan International; Unicharm Corporation; Johnson & Johnson; First Quality Enterprises; Ontex Group; The Hain Celestial Group, Inc.; The Honest Company, Inc.; and Essity AB

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Baby Diapers Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global baby diapers market report based on product, type, size, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Non-Disposable Diapers

-

Disposable Diapers

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Open Diapers (Taped)

-

Closed Diapers ( Pull-up or Pants)

-

-

Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

New Born

-

Small

-

Medium

-

Large

-

Extra Large

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Pharmacies & Drug Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global baby diapers market size was estimated at USD 78.54 billion in 2024 and is expected to reach USD 83.31 billion in 2025.

b. The global baby diapers market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 114.59 billion by 2030.

b. Asia Pacific dominated the baby diapers market with a share of 40% in 2024. The high affordability and purchasing power of consumers in the region has enabled them to buy highly effective baby products, irrespective of their prices. The demand for natural and organic products has been rising in China, Australia and India due to which companies have been focusing on natural ingredients, performance enhancement, and aesthetic improvement to appeal to modern parents.

b. Some key players operating in the baby diapers market include Procter & Gamble (P&G), Kimberly-Clark Corporation, Hengan International , Unicharm Corporation, Johnson & Johnson, The Hain Celestial Group, Inc., and The Honest Company, Inc.

b. The shifting inclination for high-quality and eco-friendly baby products is the major factor boosting the demand for biodegradable diapers across the globe. . In addition, manufacturers are focusing on developing bio-ingredients-based baby diapers, which is also anticipated to propel the market growth over the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.