- Home

- »

- Consumer F&B

- »

-

Bacon Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Bacon Market Size, Share & Trends Report]()

Bacon Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Regular, Ready-to-Eat), By Distribution Channel (Foodservice, Retail), By Region (North America, Europe), And Segment Forecasts

- Report ID: GVR-4-68040-337-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bacon Market Summary

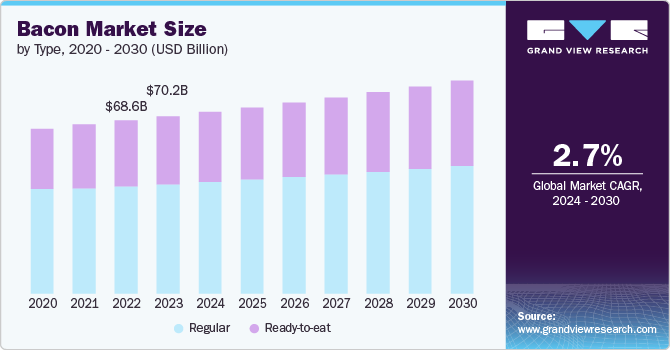

The global bacon market size was estimated at USD 70,201.7 million in 2023 and is projected to reach USD 84,404.7 million by 2030, growing at a CAGR of 2.7% from 2024 to 2030. This can be attributed to the growing consumer awareness & acceptance of convenience meat products, increasing demand for meat protein, the introduction of innovative product variants, and expansion of menu options by foodservice outlets.

Key Market Trends & Insights

- Europe was the largest revenue generating market in 2023.

- The market in the U.S. accounted for a notable revenue share in 2023.

- By type, the regular bacon segment accounted for a revenue share of 61.8% in 2023.

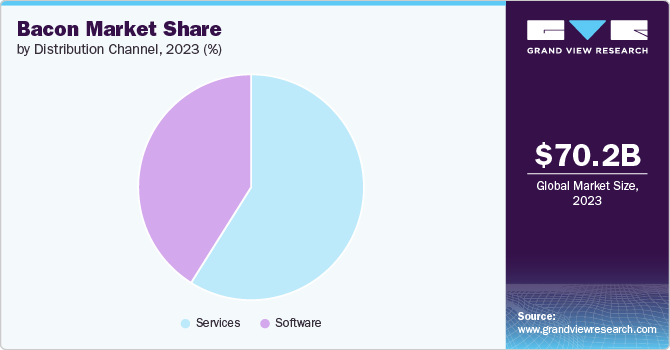

- By distribution channel, the distribution of bacon through the food service channel accounted for a revenue share of 58.4% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 70,201.7 Million

- 2030 Projected Market Size: USD 84,404.7 Million

- CAGR (2024-2030): 2.7%

- Europe: Largest market in 2023

A significant factor contributing to the growth of the market is the rising acceptance and awareness of convenience meat products among consumers. There is an increasing shift towards convenience meat products that offer enhanced taste, quality, and longer shelf life. Bacon fits into this trend as a versatile ingredient that can be used in various dishes, making it popular among consumers seeking convenient yet flavorful food options. Convenience Chasers, a segment of shoppers identified in the Midan Marketing Meat Consumer Segmentation 2.0 study, comprised 39% of meat buyers in fall 2020, marking a 9% increase from the original study conducted in early 2019. This rise, coupled with the enduring trend of consumers preferring to eat meals at home (with 82% of meals being prepared at home as of January 2022), has prompted many shoppers to pay closer attention to the convenient meat options available in stores.

Moreover, the escalating demand for Ready-to-Eat (RTE) and Ready-to-Cook (RTC) food, especially among the expanding working population with hectic lifestyles, is a significant driver of the market. Consumers are looking for quick and easy meal solutions, leading to a rise in the consumption of RTE and RTC products such bacon.

The increasing demand for meat protein is a significant driver of the market’s growth. According to an article by Redefine Meat Ltd., global meat consumption is projected to be between 460M to 570M by 2050. The overall rise in demand for meat protein globally is benefiting the market, given its popularity as a flavorful meat product. Bacon is a highly versatile ingredient that finds its way into a diverse array of dishes, ranging from traditional breakfast items such as eggs and pancakes to more unconventional pairings in salads, sandwiches, and even desserts. Its savory, salty flavor profile and crispy texture makes it a sought-after ingredient for enhancing the taste of various recipes across different cuisines and meal types. In June 2024, Hormel Foods launched four new bacon toppings products made from 100% bacon. The new offerings include cherrywood and pecanwood real bacon crumbles, single serve bacon bits, and single serve bacon bits. These products cater to the increasing consumer demand for bacon as an ingredient and flavor enhancer, providing options that align with current food trends.

The bacon market has been experiencing significant growth driven by the introduction of innovative product variants that cater to evolving consumer preferences and tastes. Manufacturers in the bacon industry have been focusing on creating unique and differentiated offerings such as low-calorie and gluten-free bacon to capture market share and meet the demands of a diverse consumer base. For instance, in March 2024, Hormel Black Label launched a new limited-time flavor offering called Hormel Black Label Ranch Bacon, combining the savory smokiness of bacon with the rich taste of ranch in a single bite.

Furthermore, the expansion of menu options by foodservice outlets has been a significant driver of growth in the market. As consumers increasingly seek convenience and variety in their dining choices, food establishments have responded by incorporating bacon into a wide range of dishes, thereby boosting demand for this popular meat product. In January 2024, Wendy’s introduced a new Breakfast Burrito, a convenient and satisfying breakfast choice tailored for hectic mornings.

Type Insights

Regular bacon accounted for a revenue share of 61.8% in 2023. Regular bacon’s versatility in the kitchen has driven its popularity. Chefs and food enthusiasts continually experiment with bacon in various dishes, expanding its appeal beyond traditional uses. Moreover, regular bacon allows for personal customization in terms of doneness and crispness. Consumers can cook it to their preferred level of crispness or tenderness, leading to a rise in its demand. In October 2023, Daily’s Premium Meats, announced the launch of a new product called Steak Cut Bacon for National Pork Month. This innovative product is designed to cater to the increasing demand for thick-cut bacon.

Ready-to-eat bacon is expected to witness a significant CAGR from 2024 to 2030. The combination of convenience, health considerations, and taste innovations is anticipated to drive the popularity of RTE bacon among consumers. In February 2024, Applegate Farms LLC, a subsidiary of Hormel Foods, introduced a new shelf-stable bacon offering called Applegate Naturals Fully Cooked Sunday Bacon. This fully cooked bacon is made from humanely raised pork, minimally processed, and contains no artificial ingredients. It is designed to provide consumers with a convenient and quick bacon option that can be enjoyed in just three minutes in the microwave. Furthermore, marketing strategies that highlight the ease of incorporating ready-to-eat bacon into various dishes, along with the development of innovative packaging that maintains product freshness, is further expected to stimulate consumer interest and demand.

Distribution Channel Insights

The distribution of bacon through the food service channel accounted for a revenue share of 58.4% in 2023. The increasing demand for ready-to-eat and ready-to-cook meat products among consumers of all age groups is a major factor contributing to this channel of distribution. As consumers seek convenient ordering options, quick-service restaurants, and other food service operators are also focusing on incorporating bacon into their menus to cater to this demand. The popularity of bacon in various dishes such as pizza, breakfast sandwiches, appetizers, and hamburgers also drives its distribution through food service channels. For instance, in January 2024, Burger King introduced a new limited edition burger on its menu called the Candied Bacon Whopper.

The distribution of bacon through retail channels is expected to grow at a significant CAGR from 2024 to 2030. The distribution of bacon through the retail channel is primarily driven by factors such as rising consumer demand for convenient & ready-to-eat food options and the availability of a wide variety of bacon flavors and types in retail outlets cater to the diverse preferences of consumers. For instance, Godshall’s introduced its new Smoked Beef Bacon to Costco stores in Washington State. This product, made with high-quality U.S.-sourced beef and wood-smoked with a blend of hickory and applewood, offers an authentic flavor profile. Additionally, the increasing trend of health-conscious consumers looking for specific types of bacon, such as low-calorie or gluten-free options, has led to retailers stocking a range of products to meet these demands. Moreover, the strategic placement and promotion of bacon products in supermarkets/hypermarkets and specialty stores play a crucial role in driving sales through the retail channel.

Regional Insights

In 2023, the market in North America captured a revenue share of 25.1%. Rising consumer awareness and acceptance regarding the convenience of meat products, especially for breakfast options such bacon, contribute to the market’s expansion. For instance, in May 2024, North Country Smokehouse unveiled a new addition to their product line - the Organic Applewood Smoked Bacon Crumbles. This innovative offering is now available for purchase at Hannaford Supermarkets, marking the beginning of a series of new bacon crumble products from the company.

U.S. Bacon Market Trends

The market in the U.S. accounted for a notable revenue share in 2023. The popularity of bacon in various food items such as hamburgers, breakfast sandwiches and pizza, appetizers, and is contributing to the market growth. Moreover, the rising trend of out-home consumption through quick-service restaurants has led to marketing strategies aimed at expanding consumer bases, particularly in the breakfast segment where bacon plays a significant role. In January 2024, Wendy’s has introduced a new Breakfast Burrito in the U.S., which contains two freshly cracked eggs and six strips of oven-baked, applewood-smoked bacon.

Europe Bacon Market Trends

The market in Europe is primarily driven by increasing per capita consumption of pork. Pork is a widely consumed red meat in the region, with various cured or preserved pork products such as bacon being popular choices. The growing demand for processed meat products, supported by the rising consumption of pork across countries such as the UK, Italy, Germany, and others, is fueling the demand for bacon in Europe. Additionally, tariff reductions from free trade agreements are stimulating the demand for EU pork, further boosting the market in the region. According to the Food and Agriculture Organization of the United Nations (2023), the per capita pork consumption in Europe was 35kg.

Asia Pacific Bacon Market Trends

Asia Pacific market is expected to grow with a CAGR of 3.2% from 2024 to 2030. The growth in the region is closely tied to changing dietary preferences. As economies in the region continue to grow, there is a shift towards more Westernized diets, leading to an increased demand for bacon as a popular breakfast and cooking ingredient. Moreover, the rising urbanization and expanding retail sector, including supermarkets and hypermarkets, are providing easier access to bacon products for consumers across various demographics. Additionally, marketing strategies by key players in the market to promote product awareness and availability are also contributing to the market’s growth in the Asia-Pacific region.

Key Bacon Company Insights

Key market players such as Hormel Foods Corporation; Tyson Foods Inc.; Kraft Heinz Company; WH Group Limited Fresh Mark Inc.; and Karro Food Group Limited among others contribute significantly to the innovation and growth of the market by utilizing tactics such as forging partnerships, making agreements, and expanding production capacity.

Key Bacon Companies:

The following are the leading companies in the bacon market. These companies collectively hold the largest market share and dictate industry trends.

- Hormel Foods Corporation

- Tyson Foods Inc.

- The Kraft Heinz Company

- WH Group Limited

- Fresh Mark Inc.

- Karro Food Group Limited

- The Oscar Mayer Company

- Niman Ranch

- Tonnies Lebensmittel GmbH & Co. KG

- Farmland Foods, Inc.

Recent Developments

-

In April 2024, Applegate Farms LLC introduced a new product to its lineup - the APPLEGATE NATURALS Fully Cooked SUNDAY BACON. This addition helped expand the range of offerings under its APPLEGATE bacon brand.

-

In January 2024, Tyson Foods Inc. opened a cutting-edge bacon manufacturing facility valued at USD 355 million in Kentucky. This expansive 400,000-square-foot establishment is dedicated exclusively to the production of bacon and is projected to turn out approximately 2 million pounds of bacon each week.

-

In January 2024, North Country Smokehouse launched a new Organic Applewood Smoked Uncured Canadian Bacon. This bacon is organic, certified humane, and hand-trimmed by the company’s butchers. The bacon is free of nitrites, growth hormones, nitrates, and antibiotics and is available at Whole Foods Market in New England.

Bacon Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 71.97 billion

Revenue forecast in 2030

USD 84.40 billion

Growth rate

CAGR of 2.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Hormel Foods Corporation; Tyson Foods Inc.; Kraft Heinz Company; WH Group Limited; Fresh Mark Inc.; and Karro Food Group Limited; Oscar Mayer Company; Niman Ranch; Tonnies Lebensmittel GmbH & Co. KG; Farmland Foods; Inc.

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Bacon Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bacon market report based on type, distribution, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Regular

-

Ready-to-eat

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Retail

-

Hypermarkets & Supermarkets

-

Independent Grocery Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bacon market size was estimated at USD 70.20 billion in 2023 and is expected to reach USD 71.97 billion in 2024

b. The global bacon market is expected to grow at a compounded growth rate of 6.9% from 2024 to 2030 to reach USD 84.40 billion by 2030.

b. In 2023, the bacon market in Europe captured a revenue share of 30.1%.The market in Europe is boosted by the growing per capita consumption of pork and the popularity of processed pork products such as bacon. This increase is supported by tariff reductions from free trade agreements enhancing the demand for EU pork.

b. Some key players operating in the market include Hormel Foods Corporation; Tyson Foods Inc.; Kraft Heinz Company; WH Group Limited; Fresh Mark Inc.; and Karro Food Group Limited; Oscar Mayer Company; Niman Ranch; Tonnies Lebensmittel GmbH & Co. KG; and Farmland Foods, Inc.

b. The growth can be attributed to the growing consumer awareness & acceptance of convenience meat products, increasing demand for meat protein, introduction of innovative product variants and expansion of menu options by foodservice outlets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.