- Home

- »

- Alcohol & Tobacco

- »

-

Baijiu Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![Baijiu Market Size, Share & Trends Report]()

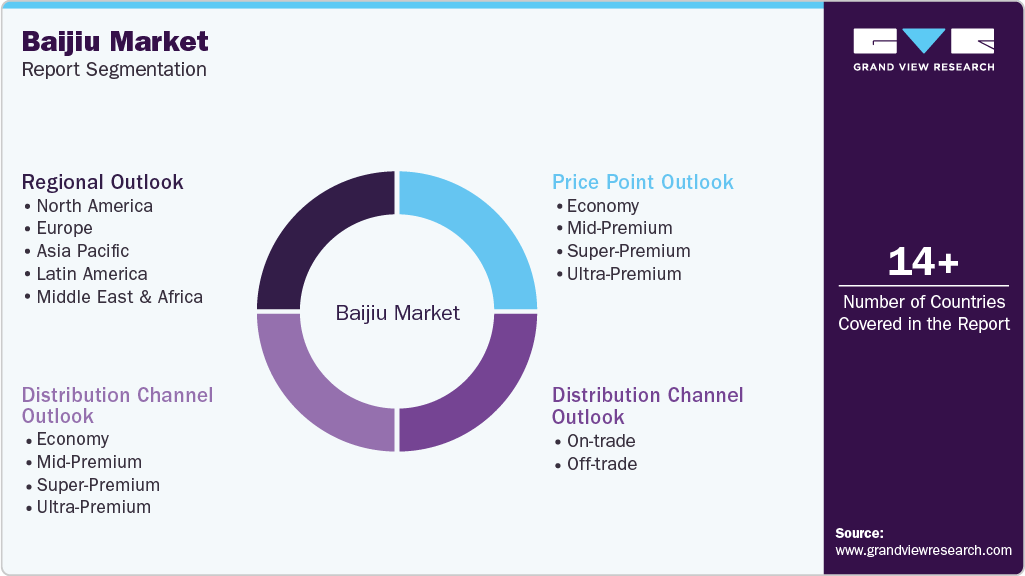

Baijiu Market (2025 - 2033) Size, Share & Trends Analysis Report By Price Point (Economy, Mid-Premium, Super-Premium, Ultra-Premium), By Distribution Channel (On-Trade, Off-Trade), By Price Point - Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-806-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Baijiu Market Summary

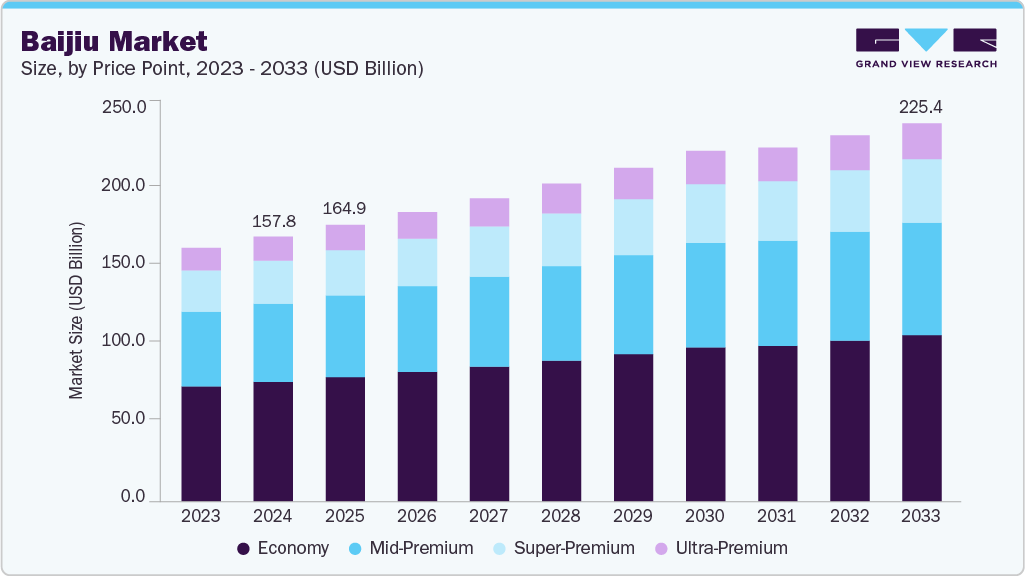

The global baijiu market size was estimated at USD 157.78 billion in 2024 and is projected to reach USD 225.41 billion by 2033, growing at a CAGR of 4.0% from 2025 to 2033. The market is deeply rooted in China's cultural and traditional heritage, where it remains an integral part of festivals, weddings, and business banquets.

Key Market Trends & Insights

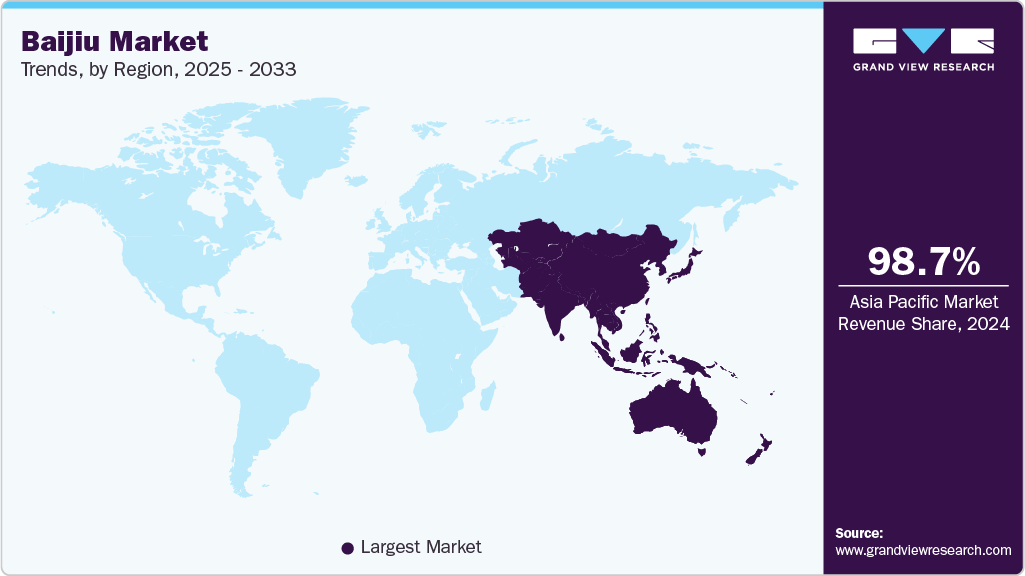

- Asia Pacific dominated the Baijiu Market with the largest revenue share of 53.2% in 2024.

- The Market in China is expected to grow at the highest CAGR of 6.5% from 2025 to 2033 in terms of revenue.

- By application, the agriculture segment dominated the global Baijiu Market with the largest revenue share of 83.9% in 2024

Market Size & Forecast

- 2024 Market Size: USD 157.78 Billion

- 2033 Projected Market Size: USD 225.41 Billion

- CAGR (2025-2033): 4.0%

- Asia Pacific: Largest market in 2024

The category is also witnessing a clear shift toward premiumization, with consumers increasingly favoring high-end and collectible brands, such as Moutai and Wuliangye, driven by rising incomes and traditional gifting practices. Also, strong regional brand heritage and local loyalty reinforce consumer attachment, as many distilleries hold long-standing reputations and dominate their respective provincial markets.Baijiu manufacturers are increasingly expanding into global markets by catering to overseas Chinese communities, who already have a cultural familiarity with the spirit, and gradually introducing it to mainstream Western drinkers through cocktail bars, mixologists, and trendy hotel menus. For example, brands like Ming River have positioned themselves in the U.S. and Europe by promoting Baijiu in cocktails and educating consumers about how to drink it. Meanwhile, major Chinese distilleries are entering distribution channeling partnerships with global distributors and hotel chains to place baijiu in duty-free shops and high-end venues, thereby boosting awareness and availability abroad.

Manufacturers are also actively modernizing their portfolios to attract younger consumers through product innovation and contemporary branding. This includes developing flavored, lower-alcohol, and cocktail-friendly variants that are easier to consume and more suitable for social settings. Modern packaging with sleek, minimalist designs and digital-first marketing, including e-commerce, social media, and influencer collaborations, is helping to refresh baijiu’s traditional image, making it more relevant to a younger audience that values lifestyle and experience over heritage alone.

For instance, in October 2025, Wuliangye launched a 29% ABV product line called Crush On, targeting millennials with fruit-infused, ready-to-drink options and stylish packaging. Other brands, such as Moutai and Jiangxiaobai, are experimenting with baijiu-based cocktails and flavored liqueurs to bridge the gap between traditional and modern drinking cultures.

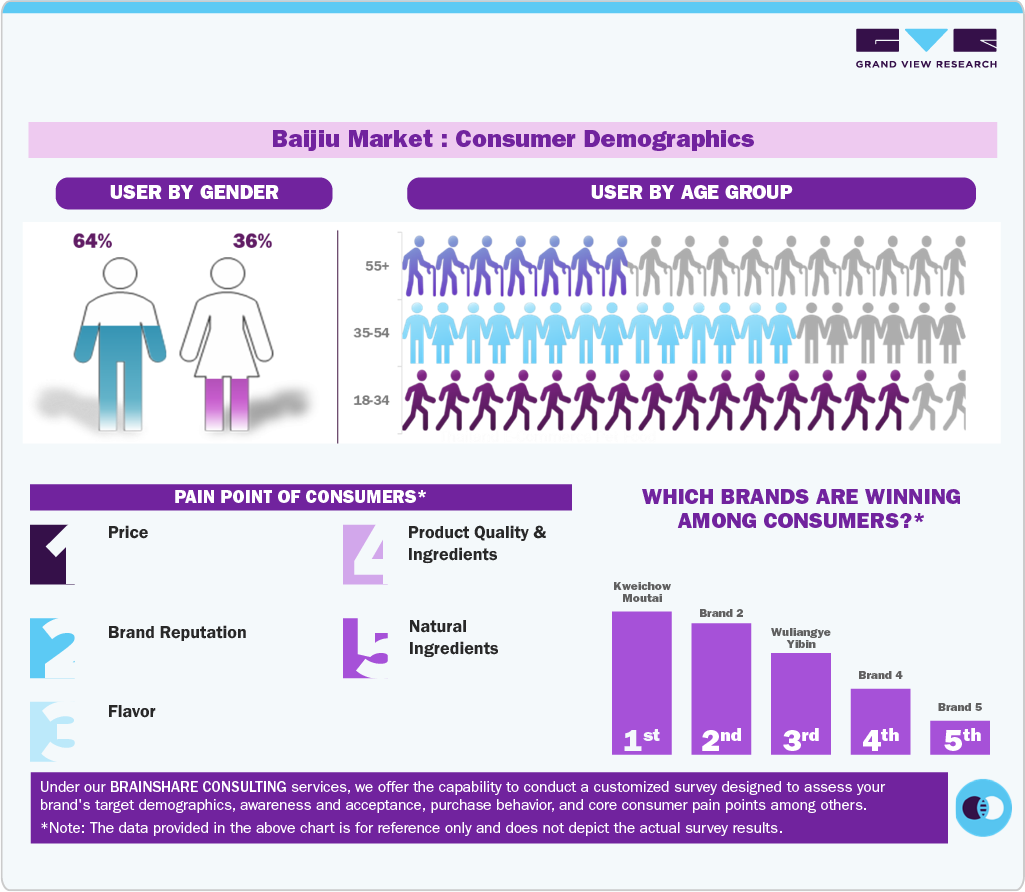

Consumer Insights

Consumer insights reveal that the global baijiu industry is fundamentally bifurcated, driven by drastically different motivations in its primary and secondary markets. Within China, where consumption generates major share of worldwide revenue, baijiu is intertwined with cultural ritual, status, and celebratory gifting; key consumers are often older, affluent males for whom the spirit’s high proof and complex fermentation profile signify prestige and history.

However, these specific usage contexts create significant barriers for international adoption, where consumers perceive the product as overly potent, lacking mixability, and unfamiliar in aroma compared to established Western spirits. Successful global insights therefore, focus acutely on overcoming this sensory hurdle through education, primarily targeting the growing segment of curious, wealthy consumers in North America and Europe who prioritize authenticity and deep historical narratives in their drinking habits.

To bridge this gap, modern consumer insights suggest that global expansion must rely heavily on repositioning baijiu as a diverse category, moving away from its monolithic perception as simply a high-proof spirit. Strategic success is achieved by segmenting the market: introducing lighter aroma styles (such as rice or light aroma Baijiu) as approachable bases for craft cocktails, thereby appealing directly to younger urban demographics and professional mixologists seeking exotic ingredients.

Furthermore, international consumers respond strongly to insights focused on provenance and terroir, necessitating premiumization strategies that emphasize the centuries-old production processes and traits that align baijiu with high-end spirits like single malt whisky or mezcal.

Price Point Insights

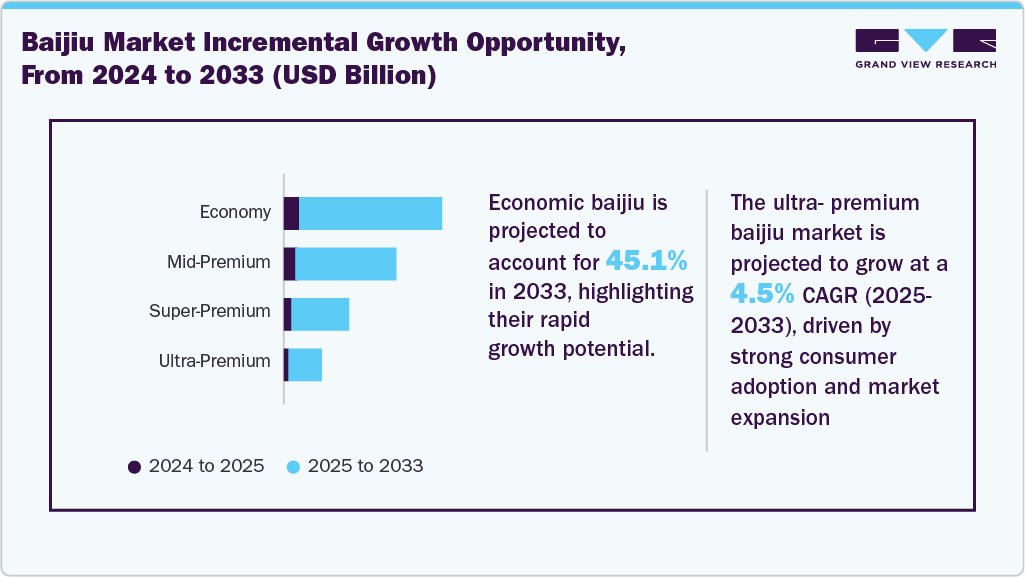

The economic baijiu segment led the market with the largest revenue share of 45.1% in 2024, primarilydue to its affordability, high consumption frequency, and widespread accessibility. This price range majorly caters to a broad consumer base, including middle- and lower-income groups. It is commonly consumed during daily meals, family gatherings, festivals, and business banquets, where large quantities are typically served. This segment also plays a crucial role in introducing baijiu to international markets, especially among overseas Chinese communities, where lower-priced options make it easier for new consumers to experience the spirit without a significant financial commitment. For instance, Erguotou, a popular Beijing-based Baijiu brand, is sold at low prices, enjoys high domestic and international consumption, and serves as an entry point for consumers before they explore mid- or premium-tier offerings.

The ultra-premium baijiu is anticipated to witness at the fastest CAGR of 4.5% from 2025 to 2033,due to status-driven consumption, gifting culture, and investment appeal. Wealthier consumers in China and abroad are increasingly viewing ultra-premium baijiu not just as a drink, but as a symbol of prestige, social status, and refined taste, particularly during business banquets, luxury events, and special celebrations. The gifting culture further drives demand, as limited-edition and collectible bottles are highly sought after for corporate or personal gifting. In addition, some ultra-premium Baijiu brands, like Kweichow Moutai, have become investment-like assets, with certain aged bottles appreciating over time, making them attractive to collectors.

Distribution Channel Insights

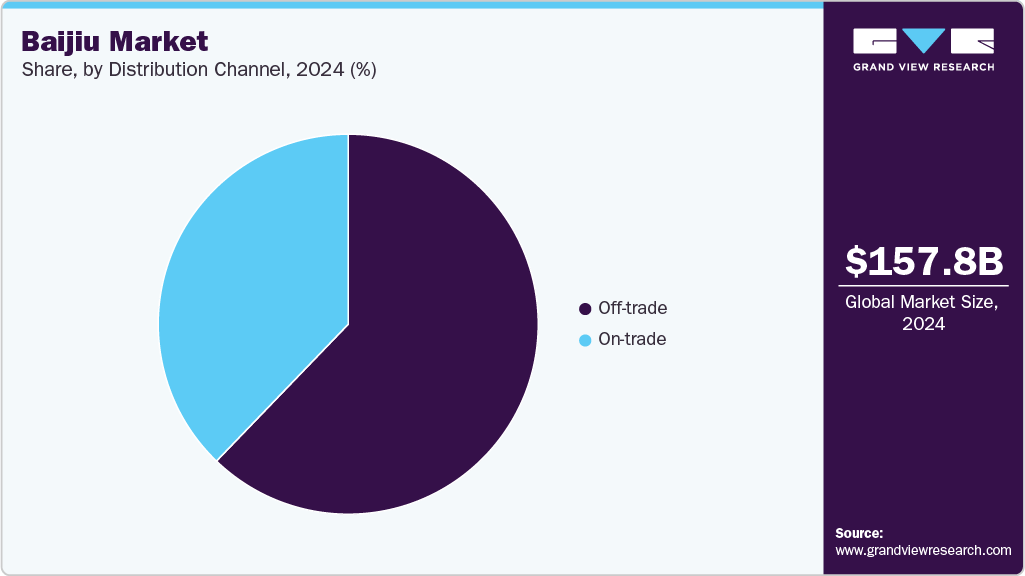

The off-trade segment led the market with the largest revenue share of 62.2% in 2024.The off-trade channel comprises supermarkets, hypermarkets, convenience stores, and e-commerce platforms, such as JD.com and Tmall. The market is expanding due to its wide accessibility, convenience, and cost-effectiveness. Consumers often prefer purchasing Baijiu from these channels for home consumption, gifts, or social occasions, where buying in bulk or at competitive prices is easier than in on-trade venues like bars or restaurants. The rise of e-commerce and online grocery platforms has further accelerated this trend, making it easier for domestic and international consumers to purchase Baijiu without geographic constraints. For instance, during the “June 18 shopping festival,” Baijiu sales on JD.com rose by 40%, while sales of Baijiu on Meituan Instant Shopping soared tenfold, highlighting the growing demand for off-trade channels in Baijiu distribution.

The on-trade segment is expected to grow at the fastest CAGR of 3.8% from 2025 to 2033. Younger and urban consumers seek social and experiential drinking occasions, preferring to enjoy Baijiu in premium settings where it can be paired with meals or crafted into cocktails. On-trade venues also serve as educational platforms, where mixologists and sommeliers introduce Baijiu’s flavors, aromas, and drinking culture to new audiences, especially in international markets. In addition, the rise of lifestyle dining, high-end bars, and cocktail culture boosts on-trade visibility, helping traditional brands modernize their image and attract aspirational consumers.

Regional Insights

The baijiu market in North America is expected to grow at a substantial CAGR of 6.8% from 2025 to 2033. In North America, Baijiu producers increasingly focus on brand innovation and consumer education to make the spirit more appealing to Western audiences. Companies are reformulating products to suit local palates, offering tasting sessions, cocktail-friendly variants, and marketing collaborations with Western brands and influencers. At the same time, efforts to educate consumers about Baijiu’s unique flavor profiles and cultural significance, through events, mixologist-led tastings, and experiential promotions, are helping overcome initial unfamiliarity and build acceptance. For example, Wuliangye, one of China’s most renowned Baijiu producers, has actively promoted its products in the United States. In June 2024, the company launched marketing campaigns targeting American consumers, including collaborations with U.S.-based bars and restaurants to introduce Baijiu-based cocktails, aiming to familiarize American palates with Baijiu’s unique flavor profile and increase its presence in the U.S. spirits market.

Asia Pacific Baijiu Market Trends

Asia Pacific dominated the baijiu market with the largest revenue share of 98.7% in 2024. The Asia-Pacific market is evolving with a strong focus on premium investment value, youth-driven innovation, and regional market expansion. In APAC, Baijiu has become a major stored liquor investment. According to the 2024 AIFIAN report , nearly 50% of all stored liquor investments in the region are in Baijiu, reflecting its deep cultural value and investor confidence in its long-term appreciation potential. At the same time, distillers are modernizing to attract younger consumers by launching lower-alcohol, fruit-flavored, and stylishly packaged Baijiu variants, supported by influencer-led and digital marketing campaigns. Moreover, growing urbanization and rising incomes in Tier-2 and Tier-3 cities across China and Southeast Asia are driving greater demand for mid-range and premium Baijiu, as consumers seek products that combine traditional heritage with contemporary appeal.

The baijiu market in China accounted for the largest market revenue share of 93.6% in Asia Pacific in 2024. Culturally, Baijiu remains an indispensable element in the Chinese social fabric, central to business banquets, family gatherings, and gifting rituals, where its role as a symbol of respect and hospitality is paramount. Rising disposable incomes across China further fuel the premiumization trend, enabling consumers to invest in more expensive and prestigious brands as a display of wealth and taste. Moreover, aggressive brand building, innovative marketing strategies, and product differentiation, including single-grain expressions and artistic packaging, are actively cultivating new usage occasions and attracting a broader consumer base, marrying tradition with modern lifestyle aspirations.

Moreover, consumers are increasingly gravitating towards high-end, aged, and distinctively branded Baijiu, driven by a desire for superior quality, craftsmanship, and status symbol association. Simultaneously, there's a growing appeal among younger demographics for more diverse and accessible options, including lower-alcohol variants, innovative flavor profiles, and products that offer a modern twist on traditional spirits. This evolving landscape is further influenced by the expanded reach and convenience of e-commerce platforms, which facilitate wider product discovery and cater to changing consumer purchasing habits beyond traditional retail.

Europe Baijiu Market Trends

The baijiu market in Europe is anticipated to grow at the fastest CAGR during the forecast period, driven by premiumization, cultural exchange, and cocktail innovation. Chinese producers are positioning Baijiu as a luxury spirit through high-end packaging, limited-edition releases, and collaborations with European mixologists to craft Baijiu-based cocktails suited to local tastes. Growing participation in international spirits fairs, tasting events, and cultural showcases is helping increase awareness among European consumers who value craftsmanship and heritage. For instance, in May 2025, Fenjiu, one of China’s leading Baijiu brands, expanded its European footprint by showcasing its products in Milan during the “Chinese Brands Going Global Worldwide Tour”, promoting its rich brewing tradition and refined flavor profile to appeal to premium spirit enthusiasts.

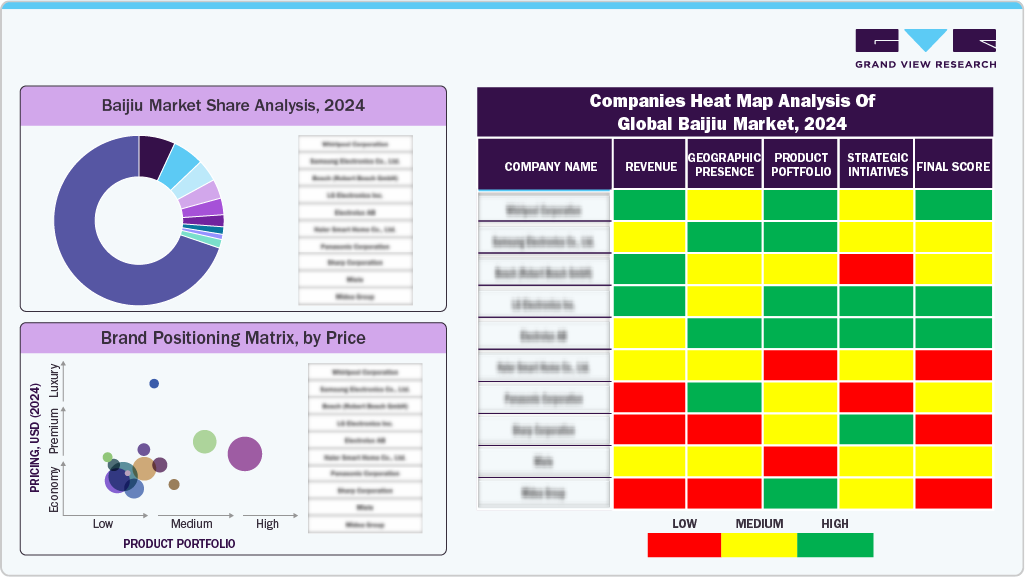

Key Baijiu Company Insights

Leading players in the baijiu industry include Kweichow Moutai Co., Ltd., Wuliangye Yibin Co., Ltd., and Luzhou Laojiao Co., Ltd. The global baijiu industry remains highly competitive, with leading players focusing on expanding their distribution across both online and offline channels to enhance accessibility. Companies are increasingly investing in product innovation, modern distillation techniques, and flavor diversification to appeal to younger and international consumers. The market is further driven by rising demand for premium and ultra-premium Baijiu, growing cultural exports, and the integration of Baijiu-based cocktails in global hospitality and bar settings.

Key Baijiu Companies:

The following are the leading companies in the baijiu market. These companies collectively hold the largest Market share and dictate industry trends.

- Kweichow Moutai Co., Ltd.

- Wuliangye Yibin Co., Ltd.

- Luzhou Laojiao Co., Ltd.

- Yanghe Distillery Co., Ltd.

- Jiannanchun Group Co., Ltd.

- Gujinggong Liquor Co., Ltd.

- Shui Jing Fang Co., Ltd.

- Shede Spirits Co., Ltd.

- Ming River Baijiu

- Jiangxiaobai

Recent Developments

-

In August 2025, Chinese liquor giants such as Wuliangye and Yanghe have launched new low-alcohol Baijiu products (around 26%–33.8% ABV) to attract younger, health-conscious consumers. These launches feature trendy packaging, celebrity endorsements, and digital marketing strategies designed to resonate with Gen Z and millennials. The move comes amid declining demand for traditional high-proof spirits, with companies positioning low-alcohol offerings as a new growth engine to modernize China’s Baijiu industry.

-

In September 2024, Shede Spirits officially launched its dual-brand Tuopai and Shede in Malaysia at a high-profile event in Kuala Lumpur. This marks a significant step in Shede's international expansion strategy, with Malaysia being the first overseas market the company has actively cultivated. The event, themed "Sharing Chinese Wisdom with the World," was attended by approximately 300 guests, including industry leaders and cultural figures. Shede's President, Tang Hui, emphasized the company's commitment to global growth, highlighting Malaysia's role as a model market in Shede's global strategy.

Baijiu Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 164.87 billion

Revenue Forecast in 2033

USD 225.41 billion

Growth rate

CAGR of 4.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, Volume in million 9-liter cases, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Price point, distribution channel, price point – distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Kweichow Moutai Co., Ltd.; Wuliangye Yibin Co., Ltd.; Luzhou Laojiao Co., Ltd.; Yanghe Distillery Co., Ltd.; Jiannanchun Group Co., Ltd.; Gujinggong Liquor Co., Ltd.; Shui Jing Fang Co., Ltd.; Shede Spirits Co., Ltd.; Ming River Baijiu; Jiangxiaobai

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Baijiu Market Report Segmentation

This report forecasts revenue growth at regional levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global baijiu market report based on the price point, distribution channel, price point-distribution channel, and region.

-

Price Point Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

Economy

-

Mid-Premium

-

Super-Premium

-

Ultra-Premium

-

-

Distribution Channel Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

On-trade

-

Off-trade

-

-

Price Point – Distribution Channel Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

Economy

-

On-trade

-

Off-trade

-

-

Mid-Premium

-

On-trade

-

Off-trade

-

-

Super-Premium

-

On-trade

-

Off-trade

-

-

Ultra-Premium

-

On-trade

-

Off-trade

-

-

-

Regional Outlook (Volume, Million 9-Liter Cases; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global baijiu market was estimated at USD 157.78 billion in 2024 and is expected to reach USD 164.87 billion in 2025.

b. The global baijiu market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2033 to reach USD 225.41 billion by 2033.

b. The Asia Pacific baijiu market accounted for a share of around 98.7% in 2024. The Asia-Pacific Baijiu market is evolving with a strong focus on premium investment value, youth-driven innovation, and regional market expansion.

b. Some of the key players in the U.S. baijiu market is - Kweichow Moutai Co., Ltd.; Wuliangye Yibin Co., Ltd.; Luzhou Laojiao Co., Ltd.; Yanghe Distillery Co., Ltd.; Jiannanchun Group Co., Ltd.; Gujinggong Liquor Co., Ltd.; Shui Jing Fang Co., Ltd.; Shede Spirits Co., Ltd.; Ming River Baijiu; Jiangxiaobai

b. The market is influenced by its deep cultural and traditional roots in China, where it remains an integral part of festivals, weddings, and business banquets. The category is also witnessing a clear shift toward premiumization, with consumers increasingly favoring high-end and collectible brands such as Moutai and Wuliangye, driven by rising incomes and gifting traditions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.