- Home

- »

- Food Safety & Processing

- »

-

Bakery Processing Equipment Market Size Report, 2030GVR Report cover

![Bakery Processing Equipment Market Size, Share & Trends Report]()

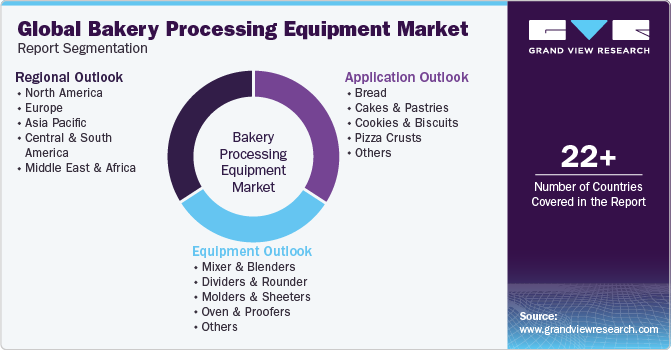

Bakery Processing Equipment Market Size, Share & Trends Analysis Report By Equipment (Mixer & Blenders,Dividers & Rounder), By Application (Bread, Cakes & Pastries), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-795-7

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Bakery Processing Equipment Market Trends

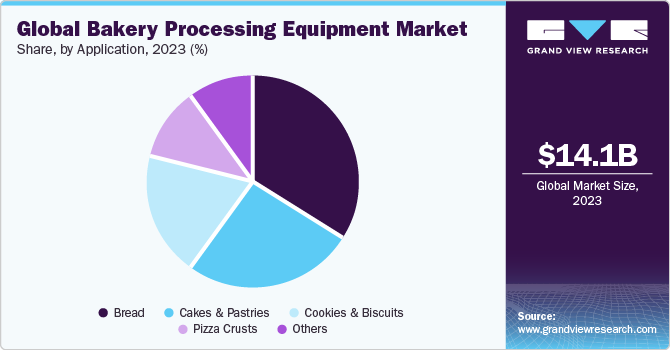

The global bakery processing equipment market size was estimated at USD 14,057.4 million in 2023 and is projected to grow at a CAGR of 6.7% from 2024 to 2030. Growing demand for packaged food products, including ready-to-eat food products & snacks, owing to their convenience and shelf life, is anticipated to drive the market demand for bakery processing equipment over the forecast period.

Changing consumer lifestyles and tastes have compelled food manufacturers to introduce new products. However, these product launches focus on catering to the changing demand for taste, flavor, and nutrients, thus increasing production complexity. This is anticipated to drive the demand for advanced bakery processing equipment that can handle various ingredients and perform several functions across the production line.

Bakery manufacturers are increasingly focusing on enhancing their production efficiency owing to the increasing energy and labor costs and the growing raw material cost of food ingredients. Hence, to secure higher profits, bakery manufacturers are incorporating technologically advanced bakery processing equipment. Due to this factor the demand for advanced automated bakery processing machines that ensure improved efficiency and minimum wastage of food ingredients is anticipated to grow in coming years.

Equipment automation provides an increased throughput rate by minimizing the degree of manual operation requirements. It increases the flexibility of equipment, which can easily facilitate on-the-fly changes to the product. Automation ensures minimum human intervention, which assists in reducing labor costs. Thus, to automate the manufacturing processes in the bakery, demand for automated bakery processing equipment is expected to show a positive trend over the coming years. High demand for bakery processing equipment is driven by their ability to enhance operational efficiency, offer versatility, ensure product quality and consistency, and meet the increasing consumer demand for bakery products.

The growing consumer preference for high-quality equipment, ongoing product advancements, and strengthened government regulations are projected to boost bakery processing equipment industry growth. Furthermore, the rising prominence of commercials with appealing promotional content and the availability of diverse flavors in processed food are expected to boost their popularity, fueling the demand for bakery processing equipment.

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements. Moreover, the companies are further adopting various organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market. For instance, in July 2022, John Bean Technologies Corporation announced the acquisition of Alco-food-machines, a producer of manufacturing lines and food processing solutions. This acquisition was made as part of the company's efforts to diversify its products in the convenience meal and plant-based protein technology sectors.

The market is also characterized by a high degree of product innovation and the incorporation of new technologies to optimize machine effectiveness, which results in the development of high-quality bakery processing equipment. For example, in August 2022, at the International Baking Industry Exposition in Las Vegas, MECATHERM and ABI introduced M-Care, a new intuitive predictive maintenance solution for industrial bakeries & pastry and condiments producers to better optimize their industrial performance.

Various certifications, regulations, and standards enforced by multiple organizations, such as the Food and Drug Administration (FDA), and the Food Safety and Standard Authority of India (FSSAI) plays vital roles in the market. New entrants are looking for more significant opportunities in the global market for bakery processing equipment, as growing urbanization and the rising demand for bakery products among the population have benefitted market growth.

The market is slightly fragmented, with a few major players such as Ali Group S.r.l., Bühler AG, and GEA Group Aktiengesellschaft dominating it and some smaller companies competing in space. The key players' strategies most often involve acquisitions and regional expansion.

Equipment Insights

Based on equipment, the oven & proofers segment led the market with the largest revenue share of 33.1% in 2023, on account of the extensive use of these equipment for baking and the rising demand for baked goods. In addition, the market is expected to be further driven by the introduction of low-energy consumption ovens. Ovens are the most important processing step in the baking industry, as both heat and transfer phenomena occur simultaneously inside them, triggering biochemical and physiochemical changes in the product. In addition, the equipment forms a crucial kill step that prevents pathogens from blooming within the product. Furthermore, baking in the oven imparts final characteristics, such as color, aroma, texture, flavor, and shelf life, to products.

The molders & sheeters segment is anticipated to witness at the fastest CAGR over the forecast period. In this equipment, dough pieces are sheeted or gradually flattened through a series of rollers in preparation for final molding. Dough sheeters have variable speeds, so that different operating rates can be adapted to different dough types. These equipment are generally comprised of 2-3 sets of roller heads between which the dough piece is pressed to gradually flatten the dough piece. Though dough sheeters are a bit higher than other commercial kitchen equipment prices, they are expected to witness significant growth in demand over the coming years.

Application Insights

Based on application, the bread segment led the market with the largest revenue share of 34.1% in 2023. High demand for bread across North America and Europe due to the dietary habits of regional consumers is a prominent driver of market growth. In addition, the high demand for bread in traditional and rapidly emerging economies, such as India and China, is expected to grow at a steady CAGR over the forecast period. Moreover, the vast array of bread types, from whole wheat to white, and specialty breads such as sourdough bread, requires versatile bakery processing equipment. Manufacturers are investing in equipment that can handle a range of dough types and baking processes to meet this diversity, which will likely drive the demand for market growth.

The pizza crusts segment is anticipated to witness at the fastest CAGR over the forecast period, as consumers are seeking high-quality pizza crusts. In addition to that, consumers are increasingly looking for pizzas with healthier, organic, or gluten-free options, pushing bakeries and pizza manufacturers to innovate and diversify their crust offerings. This necessitates advanced bakery processing equipment that can handle various dough types and baking processes. Furthermore, the growing food service industry, including the fast-food chains, is expanding significantly, which will further create demand for pizza crusts.

Regional Insights

The bakery processing equipment market in North America is characterized by the rising demand for convenience foods among consumers due to increasing disposable income and busy lifestyles. Bakery products are an important segment of convenience foods, and with the growing demand for convenience goods, the demand for bakery products is anticipated to witness growth in coming years.

U.S. Bakery Processing Equipment Market Trends

The bakery processing equipment market in U.S. accounted for more than 77.8% of the regional revenue share in 2023. The market is driven by the expansion of bakery product varieties. With the growing interest in diverse bakery products, the bakery owners are incorporating technologically advanced bakery processing equipment.

Europe Bakery Processing Equipment Market Trends

The bakery processing equipment market in Europe is anticipated to grow at the fastest CAGR during the forecast period. Europe is characterized by integrating advanced technologies within bakery machinery, including automation and energy-efficient machines. These innovations meet the demands for large-scale production and food quality in bakery processes, boosting efficiency and reducing workforce expenses.

The Germany bakery processing equipment market accounted for more than 25% of the regional revenue in 2023. Germany is well known for its high-quality bakery products across the globe. To maintain the competitive edge bakery owners in Germany are investing to equip their bakeries with technologically advanced equipment.

The bakery processing equipment market in UK is expected to grow at the significant CAGR during the forecast period, due to the growing demand for convenience foods. Bakery products offer quick and easy meal solutions for people with busy lifestyles. Further, as these bakery items generally have a longer shelf life, their demand remains high in the UK.

Asia Pacific Bakery Processing Equipment Market Trends

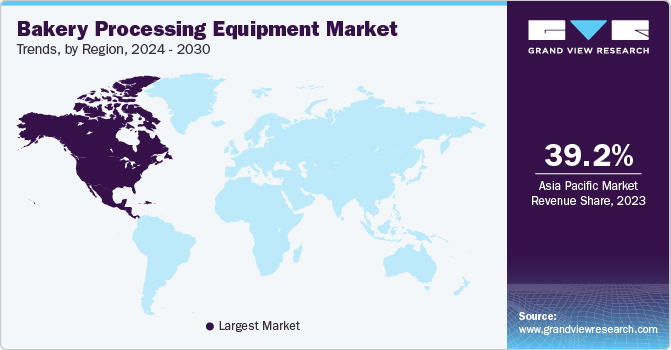

Asia Pacific dominated the market with the largest revenue share of 39.2% in 2023, owing to the growing globalization of food trends. In addition, factors like population growth, rising disposable income, and changing lifestyles also propel the demand for convenience food items, thereby driving the demand for bakery product.

The bakery processing equipment market in China held over 38.2% of the Asia Pacific market and is anticipated to witness at the fastest CAGR over the forecast period, due to the growing demand for a variety of breads to cater to specific dietary preferences. It involves bread such as high-fiber, gluten-free, and whole-grain bakery products. The high quantity and consistent production of such a variety of breads, along with the different types of bakery products, is likely to drive the demand for bakery processing equipment.

The Indian bakery processing equipment market is anticipated to grow at the substantial CAGR over the forecast period, due to the changing dietary and lifestyle preferences. Increasing disposable income, rising awareness about the different types of bakery products, and availability of bakery products through different retail channels are driving the demand for bakery products. To cater to the rising demand for bakery products, the requirement for processing equipment will likely remain high over the forecast period.

Central & South America Bakery Processing Equipment Market Trends

The bakery processing equipment market in Central & South America is expected to witness at a significant CAGR over the forecast period, owing to the rising middle-class population and rising disposable income. Further, increased demand for gluten-free nutritional bakery food items drives the demand for bakery products. To cater to the growing demand for bakery products, the bakery processing equipment demand is likely to remain high in the coming years.

The Brazil Bakery processing equipment market is projected to grow at the fastest CAGR of 7.5% over the forecast period, owing to rapid urbanization changing lifestyle patterns and rising demand for various bakery products in the country.

Middle East & Africa Bakery Processing Equipment Market Trends

The bakery processing equipment market in Middle East and Africa have a wide-ranging population characterized by diverse dietary habits and cultural impacts on cuisine. This diversity fuels the requirement for bakery items that resonate with regional flavors and align with global tastes, highlighting the importance of adaptable bakery processing machinery.

The South Africa bakery processing equipment market is projected to grow at the fastest CAGR of 6.6% over the forecast period. The market is experiencing growth driven by the increasing demand for convenience food products and the expanding food service industry.

Key Bakery Processing Equipment Company Insights

Some of the key players operating in the market include Ali Group S.r.l., Bühler AG, Baker Perkins Limited, and GEA Group Aktiengesellschaft.

-

Ali Group S.r.l provides complete turnkey solutions for food service equipment. The company offers the industry's most extensive product mix of hot and cold food service equipment. Its diverse product range covers cooking, refrigeration, bakery, coffee, and other food preparation solutions. The company has a presence in more than 150 countries, with its 110+ brands, which deliver a complete spectrum of equipment. Across the globe, it has more than 74 manufacturing sites and 141 sales and service offices

-

Bühler AG. The company has a presence in more than 140 countries, with 30 manufacturing sites, 100 service stations, and 25 application centers. Its business is divided into three segments: food, feed & confectionary, process technologies, and advanced materials. The company has more than 100 years of experience in offering solutions for baked goods. In addition to that, the company also provides digital, training and maintenance services to help the bakery owners to remain up to date on product & technologies

Global Bakery Solutions and Koenig Maschinen GmbH are some of the emerging market participants in the market.

-

Global Bakery Solutions offers products involving bread & bun handling, intelligent pan conveyors, high-speed mixers, ambient spiral cooling systems, and bread & bun product loading. The company offers solutions to handle different types of food processing processes, including baking, cooling, product handling, packaging, and basket handling

-

Koenig Maschinen GmbH company offers solutions for food processes such as mixing & lifting, baking, cooling & freezing, scoring, and dividing & lifting. In the baking segment, the company has been providing tunnel ovens used to manufacture flat breads and traditional pizza baking

Key Bakery Processing Equipment Companies:

The following are the leading companies in the bakery processing equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Ali Group S.r.l.

- Baker Perkins Limited

- Bühler AG

- GEA Group Aktiengesellschaft

- The Middleby Corporation

- Markel Food Group

- JBT Corporation

- Heat & Control, Inc.

- RHEON Automatic Machinery Co., Ltd.

- Anko Food Machine Co., Ltd.

- Gemini Bakery Equipment Company

- Global Bakery Solutions

- Koenig Maschinen GmbH

- FRITSCH

- Benier Nederland B.V.

Recent Developments

-

In October 2023, Rademaker, a prominent player in the baking equipment sector, entered into an exclusive collaboration with Form & Frys Maskinteknik, a Danish company known for its expertise in machinery designed for folding, forming, and filling pastries and other baked products. Through this strategic alliance, is likely to help the Rademaker to expand its presence in Europe and North American continent

-

In February 2023, The Middleby Corporation announced the acquisition of Escher Mixers, which is a manufacturer and designer of technologically advanced spiral and planetary mixers for the baking industry

-

In July 2022, The Middleby Corporation acquired Colussi Ermes, an automated washing solution provider for the food processing industry. Its washing solutions are in demand owing to the use of a technology that reduces labor demands, water and energy consumption and operates in a small footprint

Bakery Processing Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 14,764.3 million

Revenue forecast in 2030

USD 21,780.6 million

Growth rate

CAGR of 6.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

June 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; South Korea; India; Australia; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Ali Group S.r.l.; Baker Perkins Limited; Bühler AG; GEA Group Aktiengesellschaft; The Middleby Corporation; Markel Food Group; JBT Corporation; Heat & Control, Inc.; RHEON Automatic Machinery Co., Ltd.; Anko Food Machine Co., Ltd.; Gemini Bakery Equipment Company; Global Bakery Solutions; Koenig Maschinen GmbH; FRITSCH; Benier Nederland B.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bakery Processing Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the bakery processing equipment market report based on equipment, application, and region.

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Mixer & Blenders

-

Dividers & Rounder

-

Molders & Sheeters

-

Oven & Proofers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bread

-

Cakes & Pastries

-

Cookies & Biscuits

-

Pizza Crusts

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global bakery processing equipment market size was estimated at USD 14,057.4 million in 2023 and is expected to be USD 14,764.3 million in 2024.

b. The global bakery processing equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 21,780.6 million by 2030.

b. Asia Pacific region dominated the market and accounted for 39.2% share in 2023. A favorable regulatory environment, a surge in housing demand, rapid infrastructure development, and the renovation of buildings for improved energy performance are fueling the construction sector growth.

b. Some of the key players operating in the bakery processing equipment market include Ali Group S.r.l., Baker Perkins Limited, Bühler AG, GEA Group Aktiengesellschaft, The Middleby Corporation, Markel Food Group, JBT Corporation, Heat & Control, Inc., RHEON Automatic Machinery Co., Ltd., Anko Food Machine Co., Ltd., Gemini Bakery Equipment Company, Global Bakery Solutions, Koenig Maschinen GmbH, FRITSCH, Benier Nederland B.V.

b. The market is driven by the increasing demand for convenience foods, expansion of food processing industry, innovation & technological advancements in bakery processing machinery, and growing demand for different bakery product varieties.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."