- Home

- »

- Advanced Interior Materials

- »

-

Bamboo Construction Materials Market Size Report, 2033GVR Report cover

![Bamboo Construction Materials Market Size, Share & Trends Report]()

Bamboo Construction Materials Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Bamboo Lumber & Panels, Bamboo Flooring), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-805-5

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bamboo Construction Materials Market Summary

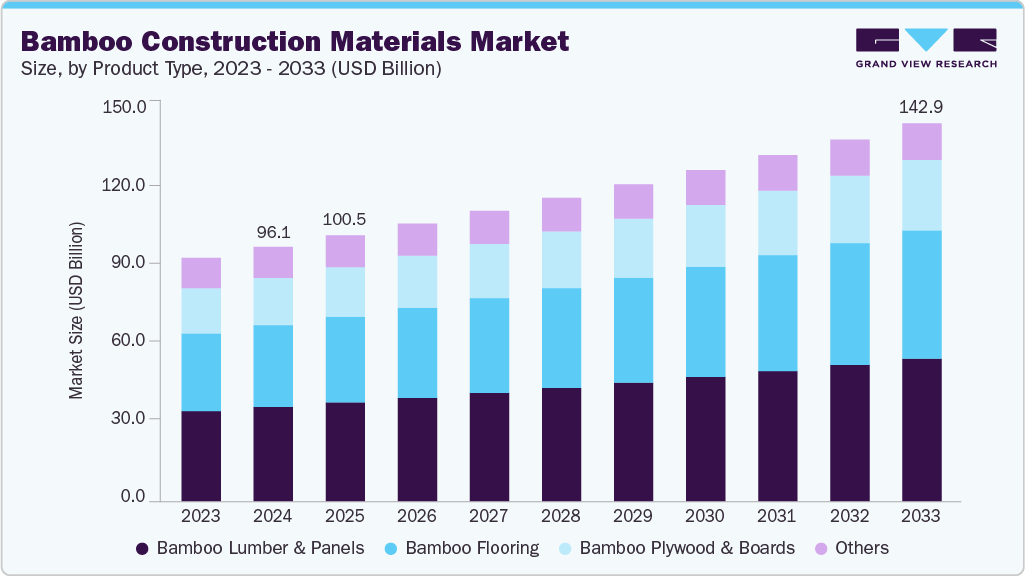

The global bamboo construction materials market size was estimated at USD 96.14 billion in 2024 and is expected to reach USD 142.87 billion by 2033, expanding at a CAGR of 4.5% from 2025 to 2033. The growing emphasis on sustainable construction practices is one of the primary factors driving the global bamboo construction materials market.

Key Market Trends & Insights

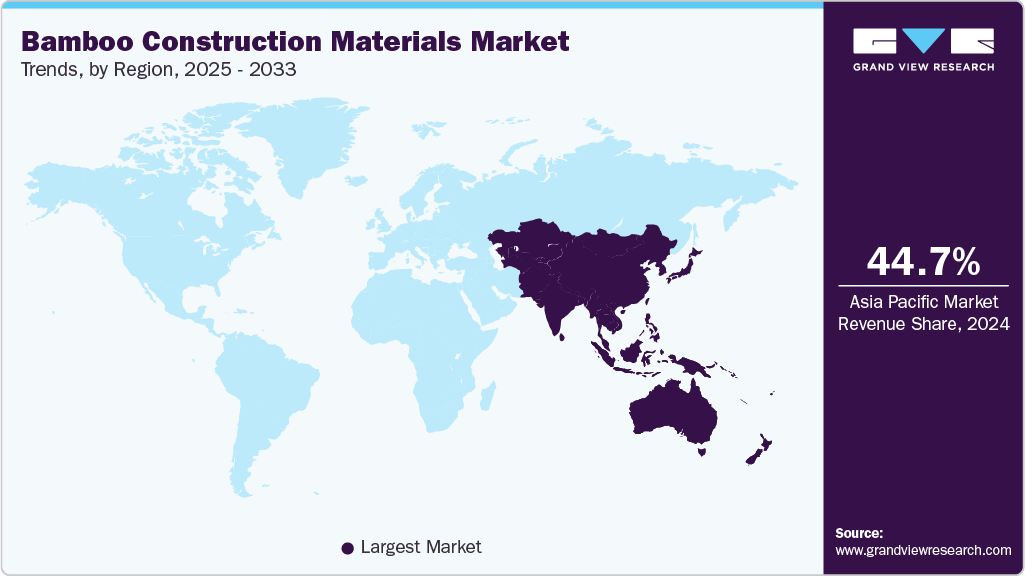

- Asia Pacific dominated the bamboo construction materials market with the largest revenue share of 44.7% in 2024.

- By product type, bamboo flooring segment is expected to grow at fastest CAGR of 5.1% over the forecast period.

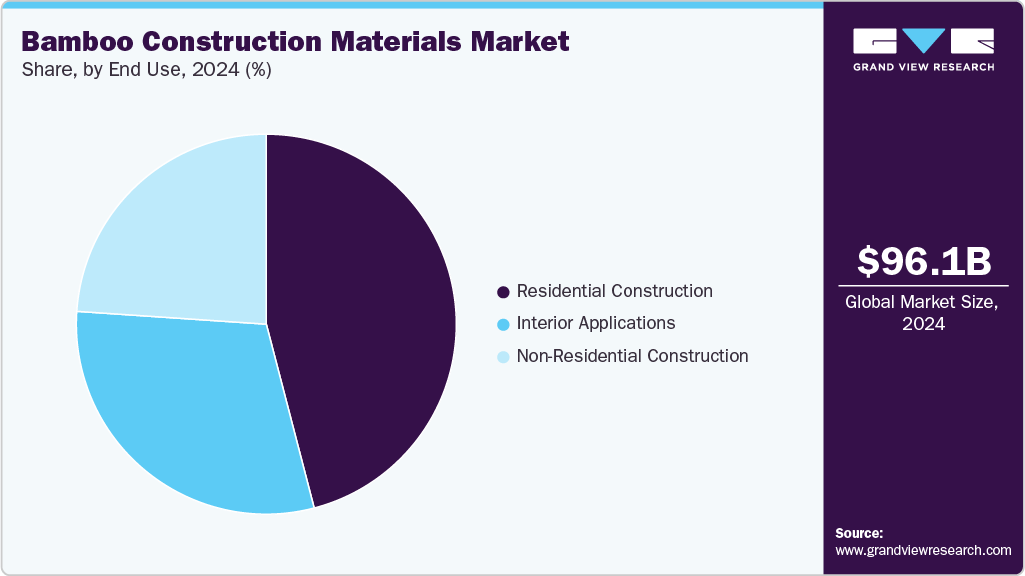

- By end use, interior applications segment is expected to grow at fastest CAGR of 5.0% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 96.14 Billion

- 2033 Projected Market Size: USD 142.87 Billion

- CAGR (2025-2033): 4.5%

- North America: Largest market in 2024

With increasing awareness about climate change and the depletion of non-renewable resources, bamboo has emerged as an eco-friendly alternative to conventional building materials such as steel, concrete, and timber. Its rapid renewability, high carbon sequestration capacity, and low environmental footprint make it a preferred choice for green buildings and eco-conscious projects. Governments and international organizations are also promoting bamboo-based materials through green building certifications and sustainability initiatives, further accelerating market adoption.Technological advancements in bamboo processing and treatment have significantly enhanced its structural strength, durability, and resistance to environmental factors, thereby boosting its suitability for modern construction. Innovations in engineered bamboo products-such as laminated bamboo lumber, bamboo composites, and cross-laminated bamboo panels-are expanding the scope of applications in Residential Construction, commercial, and infrastructure projects. These advancements have addressed earlier limitations related to termite attacks, moisture absorption, and inconsistent quality, positioning bamboo as a viable structural material comparable to traditional timber and steel in terms of performance and longevity.

Rising urbanization and infrastructure development, particularly in Asia-Pacific and Latin America, are also propelling the demand for bamboo construction materials. Countries such as China, India, Indonesia, and Vietnam have abundant bamboo resources and are integrating bamboo into affordable housing projects and rural infrastructure due to its cost-effectiveness and local availability. Moreover, growing demand for aesthetically appealing and culturally significant building designs has led to a surge in the use of bamboo in resorts, pavilions, and eco-tourism facilities, thereby contributing to the overall market expansion.

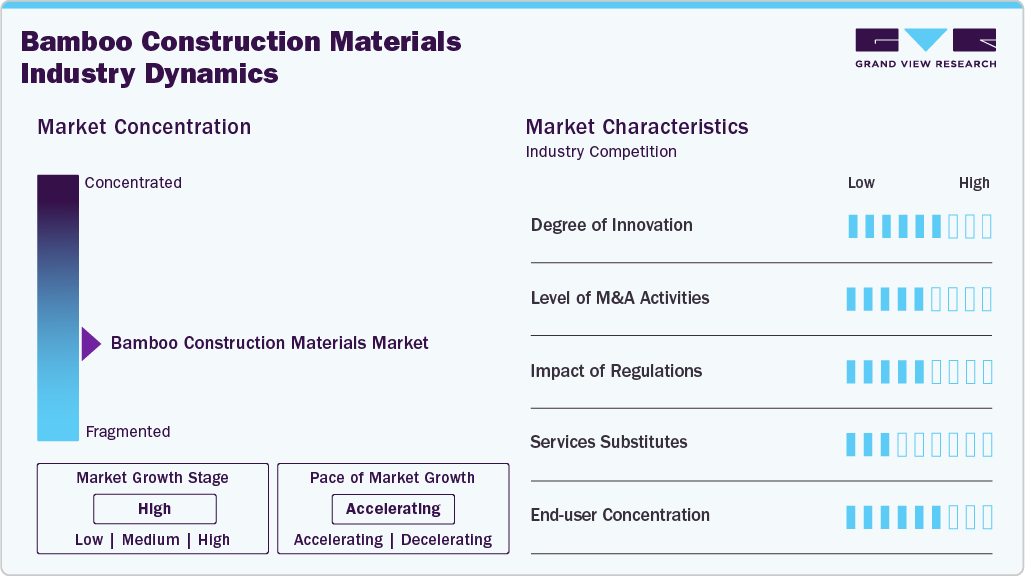

Market Concentration & Characteristics

The global bamboo construction materials market is moderately fragmented, with a mix of regional manufacturers, local artisans, and emerging industrial-scale producers. The degree of innovation in the market is increasing, driven by advancements in engineered bamboo products such as laminated bamboo lumber and structural composites that enhance durability, consistency, and load-bearing capacity. Research collaborations between construction technology firms and academic institutions are fostering innovation in treatment, preservation, and processing techniques. However, the industry still faces challenges in scaling standardized production processes globally. Mergers and collaborations are relatively limited but gradually increasing as companies seek to consolidate their supply chains and expand international distribution networks to cater to the growing demand for sustainable construction materials.

Regulatory frameworks have a significant impact on the market, as sustainability standards, green building certifications, and national construction codes increasingly recognize bamboo as a legitimate and sustainable material. These policies encourage broader acceptance and investment in bamboo-based solutions. While substitutes such as timber, steel, and recycled composites exist, bamboo’s eco-friendly and renewable nature gives it a distinct advantage in sustainability-driven projects. End-user concentration is relatively diverse, encompassing Residential Construction, commercial, and public infrastructure developers who prioritize low-carbon and aesthetic design solutions. The market is expected to evolve toward greater consolidation and technological sophistication as global demand for sustainable construction intensifies and regulatory alignment improves across regions.

Product Type Insights

Bamboo lumber & panels segment led the market and accounted for the largest revenue share of 37.0% in 2024, driven by the rising adoption of engineered bamboo products as sustainable alternatives to conventional timber and plywood. Advances in manufacturing technologies such as cross-lamination, resin infusion, and heat treatment have improved bamboo’s structural stability, strength, and resistance to warping. These properties make bamboo panels suitable for use in structural frameworks, furniture, and decorative surfaces. In addition, increasing environmental regulations promoting renewable construction materials are encouraging builders to choose bamboo-based panels for green building certifications.

Bamboo flooring segment is expected to grow at fastest CAGR of 5.1% over the forecast period, driven by the increasing consumer preference for natural, renewable, and visually appealing flooring solutions. Bamboo offers the aesthetic appeal of hardwood with superior sustainability and affordability, making it attractive for residential and commercial interiors. Technological innovations in strand-woven bamboo flooring have significantly enhanced its hardness, durability, and moisture resistance, allowing it to compete effectively with premium wood species. The rise in eco-conscious home renovation trends, especially in North America and Europe, has further accelerated demand.

End Use Insights

Residential construction segment dominated the market and accounted for the largest revenue share of 45.9% in 2024, driven by the growing demand for sustainable and energy-efficient housing solutions. Homeowners and developers are increasingly turning to bamboo as a cost-effective and renewable material for flooring, roofing, wall panels, and framing applications. Its high tensile strength and natural insulation properties make it suitable for both tropical and temperate climates. Government-backed initiatives promoting green housing and carbon-neutral developments are also supporting bamboo adoption in new residential projects.

Interior applications segment is expected to grow at fastest CAGR of 5.0% over the forecast period, driven by the growing integration of bamboo in modern architectural and design projects for its versatility and aesthetic value. Bamboo’s natural texture, color variety, and design flexibility make it a preferred material for wall claddings, ceiling panels, furniture, and decorative elements. Increasing trends in sustainable interior design, coupled with demand for biophilic and minimalist aesthetics, are fueling the segment’s growth. Manufacturers are offering a wider range of treated and laminated bamboo products tailored for interior use, ensuring resistance to humidity and pests.

Regional Insights

Asia Pacific Bamboo Construction Materials Market Trends

Asia Pacific dominated the global bamboo construction materials market and held 44.7% revenue market share in 2024, due to abundant bamboo resources, supportive government policies, and rising infrastructure development. Countries such as China, India, Indonesia, and Vietnam actively promote bamboo as a sustainable alternative to timber for affordable housing and rural development projects. The rapid pace of urbanization, coupled with low-cost production and labor advantages, further strengthens regional growth. Investments in bamboo treatment technologies and engineered bamboo innovations enhance structural integrity and expand usage in commercial and residential construction projects. Growing export potential and international collaborations are also driving market expansion across the region.

China is a leading producer and consumer of bamboo construction materials, driven by its rich bamboo reserves and strong government initiatives promoting green construction. The country’s push toward carbon neutrality by 2060 has accelerated the use of renewable materials such as bamboo in public infrastructure and housing projects. Continuous innovation in engineered bamboo products and large-scale manufacturing capabilities have made China a global hub for sustainable material exports. Moreover, the integration of bamboo in eco-tourism, landscaping, and prefabricated structures is gaining popularity. Domestic demand is further supported by favorable policies encouraging local communities to cultivate and process bamboo for value-added construction applications.

North America Bamboo Construction Materials Market Trends

The North America bamboo construction materials market is driven by a growing commitment to sustainable building practices and green certifications such as LEED and WELL. Rising environmental awareness among consumers and builders is encouraging the adoption of renewable and low-carbon materials. Advances in engineered bamboo technologies, including laminated and cross-laminated panels, have expanded applications in Residential Construction and commercial architecture. The region’s emphasis on sustainable urban development and net-zero construction is fostering greater use of bamboo in interior design, flooring, and structural components. Additionally, the increasing collaboration between U.S. and Canadian firms with Asian suppliers supports market growth through knowledge transfer and improved material availability.

U.S. Bamboo Construction Materials Market Trends

In the U.S., the market is driven by the rapid integration of bamboo products into sustainable and modular construction systems. Growing federal and state-level initiatives promoting eco-friendly infrastructure and carbon-neutral building materials are strengthening the market. The rising trend of using natural and aesthetic materials in home remodeling and commercial design also fuels demand. Furthermore, the availability of imported engineered bamboo products from Asia and technological advancements in local manufacturing have improved accessibility and quality. The U.S. green construction industry’s focus on circular economy models and material recycling provides an additional boost to the adoption of bamboo-based solutions.

Europe Bamboo Construction Materials Market Trends

The Europe bamboo construction materials market is driven by strict environmental regulations, increasing demand for sustainable materials, and the European Green Deal initiatives. Growing emphasis on reducing construction-related emissions is prompting architects and developers to incorporate bamboo in sustainable building designs. Technological innovations, such as bamboo-reinforced composites and hybrid materials, are enhancing performance and durability under European climate conditions. The expanding eco-tourism and hospitality sectors are also using bamboo in interior and outdoor architectural applications. Moreover, collaborations with Asian manufacturers are enabling European firms to access high-quality engineered bamboo products for large-scale projects.

In Germany, the bamboo construction materials market is propelled by strong sustainability policies, innovative architecture trends, and high consumer awareness regarding eco-friendly materials. The country’s advanced engineering capabilities are facilitating the use of bamboo in high-performance composites, furniture, and modular structures. Support from government-backed initiatives focused on green construction and energy-efficient buildings further strengthens market growth. Increasing demand for biobased materials in both Residential Construction and commercial sectors complements Germany’s goal of reducing dependence on traditional timber and concrete. In addition, research institutions and design firms are exploring bamboo’s potential in circular economy models and climate-resilient architecture.

Latin America Bamboo Construction Materials Market Trends

The Latin America bamboo construction materials market is driven by the region’s abundant bamboo availability and the growing trend of sustainable housing initiatives. Governments in countries such as Colombia, Ecuador, and Brazil are encouraging bamboo cultivation and usage for low-cost, resilient housing solutions. Rising eco-tourism and sustainable resort projects are also creating new opportunities for bamboo-based construction. Moreover, bamboo’s natural resilience to seismic activity makes it a favorable material in earthquake-prone areas. Increasing community-level manufacturing, coupled with international funding for sustainable development, further boosts regional market growth and adoption across rural and urban sectors.

Middle East & Africa Bamboo Construction Materials Market Trends

The Middle East & Africa market is witnessing growing interest in bamboo construction materials due to increasing sustainability awareness and diversification of building materials. Rapid urbanization and a rising focus on green infrastructure projects are encouraging the adoption of eco-friendly materials such as bamboo for landscaping, interiors, and modular housing. In regions facing resource scarcity, bamboo offers a lightweight, renewable, and cost-effective alternative to traditional materials. Support from global organizations promoting sustainable development and carbon-neutral construction is also accelerating market penetration. Furthermore, tourism-oriented projects, especially in Africa, are integrating bamboo structures to enhance eco-aesthetic appeal and reduce environmental impact.

Key Bamboo Construction Material Company Insights

Some of the key players operating in market include Smith & Fong Co., Inc., Dasso Group

-

Smith & Fong Co., Inc. specializes in sustainable bamboo architectural materials under its brand Plyboo. The company produces bamboo panels, flooring, wall systems, and acoustic panels designed for both commercial and Residential Construction use. Smith & Fong focuses on innovation, offering environmentally responsible products that combine aesthetic appeal with high structural integrity, certified by third-party sustainability programs.

-

Dasso Group is a pioneer in engineered bamboo technology, known for its patented fusion bamboo products. The company offers outdoor decking, cladding, and structural materials that are resistant to weathering, decay, and pests. Dasso’s advanced thermal and resin treatment processes enhance the material’s strength and longevity, positioning it as a sustainable alternative to tropical hardwoods in global construction markets.

Bamboo Australia Pty Ltd., Teragren LLC are some of the emerging market participants in bamboo construction materials market.

-

Bamboo Australia Pty Ltd. is a leading producer and distributor of raw and processed bamboo products. The company provides construction-grade bamboo poles, laminated boards, and custom-processed materials for architectural and landscaping projects. It emphasizes environmental sustainability through eco-friendly cultivation practices and supports the growing demand for renewable materials.

-

Teragren LLC manufactures high-quality bamboo building materials with a focus on environmental responsibility and superior craftsmanship. Its product portfolio includes bamboo flooring, countertops, panels, and veneer sheets designed for sustainable construction and interior applications.

Key Bamboo Construction Material Companies:

The following are the leading companies in the bamboo construction materials market. These companies collectively hold the largest market share and dictate industry trends.

- MOSO International B.V.

- Smith & Fong Co., Inc.

- Dasso Group

- Bamboo Australia Pty Ltd.

- Teragren LLC

- Plyboo (Smith & Fong’s brand)

- Bamboo Revolution

- Xiamen Yusheng Bamboo Products Co., Ltd.

- Guangxi Fenglin Wood Industry Group

Recent Developments

-

In August 2025, Veribambu introduced its outdoor anti-slip bamboo decking series, developed for exterior applications including gardens, patios, balconies, and commercial outdoor environments. Crafted from high-strength natural bamboo, the decking is specially treated to enhance weather resistance and surface grip, offering improved durability and safety performance in outdoor conditions.

Bamboo Construction Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 100.47 billion

Revenue forecast in 2033

USD 142.87 billion

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End Use, product type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

MOSO International B.V.; Smith & Fong Co., Inc.; Dasso Group; Bamboo Australia Pty Ltd.; Teragren LLC; Plyboo; Bamboo Revolution; Xiamen Yusheng Bamboo Products Co., Ltd.; Guangxi Fenglin Wood Industry Group

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bamboo Construction Materials Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global bamboo construction materials market report based on product type, end use, and region.

-

Product Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Bamboo Lumber & Panels

-

Bamboo Flooring

-

Bamboo Plywood & Boards

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential Construction

-

Non-Residential Construction

-

Interior Applications

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global bamboo construction materials market size was estimated at USD 96.14 billion in 2024 and is expected to reach USD 100.47 billion in 2025.

b. The global bamboo construction materials market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2033 to reach USD 142.87 billion by 2033.

b. Bamboo lumber & panels segment led the market and accounted for the largest revenue share of 37.0% in 2024, driven by the rising adoption of engineered bamboo products as sustainable alternatives to conventional timber and plywood.

b. Some of key players in the bamboo construction materials market are MOSO International B.V., Smith & Fong Co., Inc., Dasso Group, Bamboo Australia Pty Ltd., Teragren LLC, Plyboo, Bamboo Revolution, Xiamen Yusheng Bamboo Products Co., Ltd., and Guangxi Fenglin Wood Industry Group.

b. The key factors driving the bamboo construction materials market include growing demand for sustainable and renewable building materials, advancements in engineered bamboo technologies, supportive government regulations promoting green construction, and rising adoption of eco-friendly design practices across residential and commercial projects.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.