- Home

- »

- Petrochemicals

- »

-

Base Oil Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Base Oil Market Size, Share & Trends Report]()

Base Oil Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Group I, Group II, Group III, Group IV, Group V), By Application (Automotive Oils, Process Oils, Industrial Oils, Metalworking Fluids), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-097-2

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Base Oil Market Summary

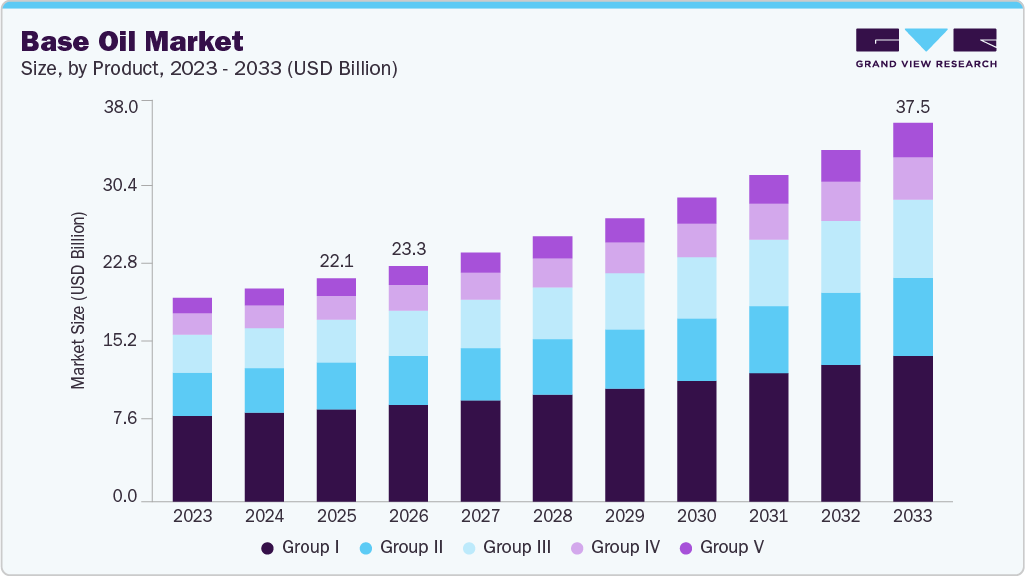

The global base oil market size was estimated at USD 22.11 billion in 2025 and is projected to reach USD 37.49 billion by 2033, growing at a CAGR of 7.0% from 2026 to 2033. The industry is being propelled by the sustained growth of the automotive and industrial sectors.

Key Market Trends & Insights

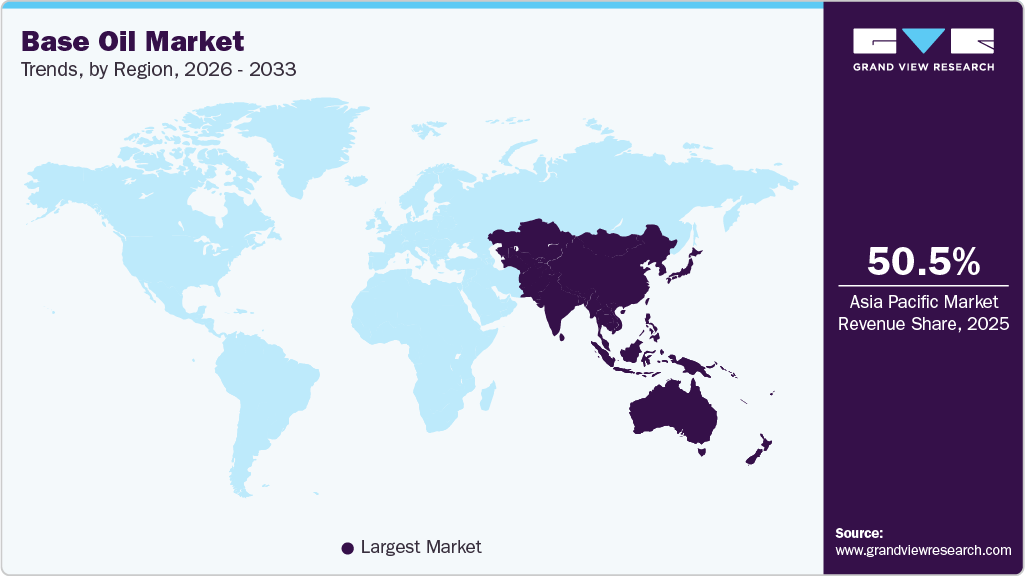

- Asia Pacific dominated the base oil market with the largest revenue share of 50.5% in 2025.

- Group V base oil is expected to grow at the fastest CAGR of 8.8% from 2026 to 2033.

- By application, the automotive oils segment is expected to grow at the fastest CAGR of 7.4% from 2026 to 2033 in terms of revenue.

Market Size & Forecast

- 2025 Market Size: USD 22.11 Billion

- 2033 Projected Market Size: USD 37.49 Billion

- CAGR (2026-2033): 7.0%

- Asia Pacific: Largest Market in 2025

Rising vehicle production, coupled with increased mechanization across manufacturing, construction, and heavy industries, is driving higher lubricant consumption, thereby fueling demand for base oils worldwide. Technological innovation in lubricant formulations is serving as a key market driver. The development of high-performance, synthetic base oils, designed to improve engine efficiency, reduce emissions, and extend equipment life, is encouraging adoption by OEMs and lubricant manufacturers, thereby reinforcing global base oil demand.

The global base oil industry offers growth potential as the adoption of synthetic and high-performance lubricants increases, driven by fuel efficiency and emission standards. Emerging economies, particularly in the Asia-Pacific and Latin America, provide untapped markets supported by industrialization and infrastructure development, creating avenues for market expansion and strategic investments.

Market Concentration & Characteristics

The global base oil market is moderately concentrated, dominated by a mix of large multinational producers and regional players. Key companies such as ExxonMobil, Shell, Chevron, and Sinopec hold significant market share, leveraging integrated refining capabilities, strong distribution networks, and long-term contracts with lubricant manufacturers to maintain market leadership.

The market is characterized by high capital intensity, stringent quality standards, and growing demand for synthetic and specialty base oils. Factors such as regulatory compliance, technological innovation, and raw material availability shape competitiveness, while global market growth is driven by the automotive, industrial, and infrastructure sectors.

Product Insights

Group I product dominated the market with a revenue share of 41.4% in 2025, due to its cost-effectiveness and wide availability. Their established supply chains and compatibility with conventional lubricants make them a preferred choice for automotive and industrial applications in price-sensitive markets.

Group V base oils are the fastest-growing segment with the projected revenue CAGR of 8.8% during the forecast period, driven by rising demand for high-performance and specialty lubricants. Their superior properties, including enhanced thermal stability and low volatility, support advanced automotive engines and industrial machinery, boosting adoption across developed and emerging markets.

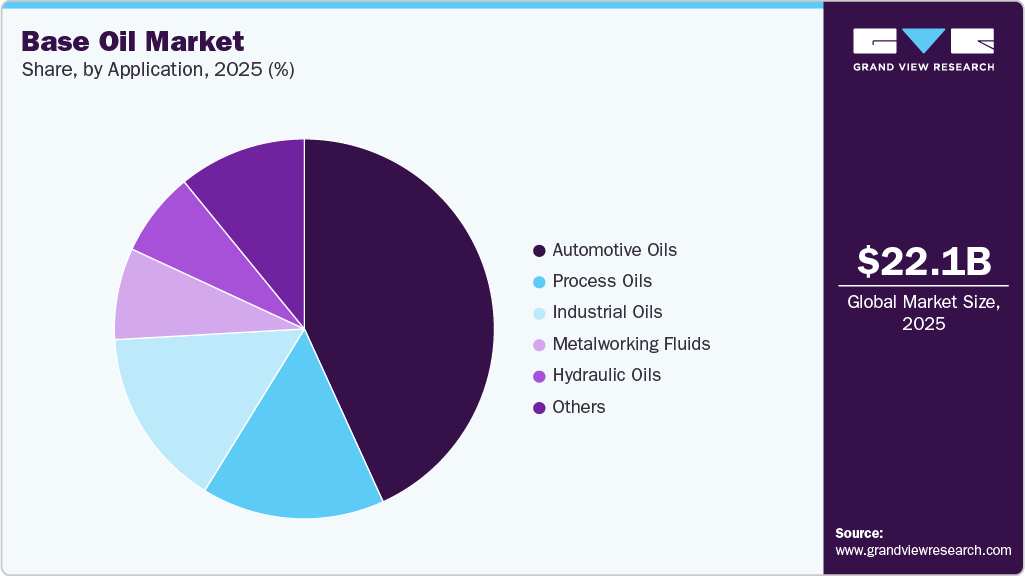

Application Insights

The automotive oils application dominated the market with a revenue share of 43.2% in 2025, fueled by increasing vehicle production and replacement demand. Their critical role in engine protection, efficiency, and performance ensures sustained consumption across passenger vehicles, commercial fleets, and industrial machinery.

Process oils are a significant growing segment with an expected CAGR revenue of 7.1% during the forecast period, driven by expanding industrial and manufacturing activities. Applications in rubber, plastics, and specialty chemicals, along with rising demand for high-quality process oils, are accelerating adoption in both developed and emerging markets.

Regional Insights

The Asia Pacific base oil industry region dominated the market with a revenue share of 50.5% in 2025, driven by rapid industrialization, expanding automotive production, and growing infrastructure projects. Rising demand in countries like China and India, coupled with increasing lubricant consumption, reinforces the region’s leading market position.

China Base Oil Market Trends

The China base oil industry is fueled by rapid automotive production, industrial expansion, and rising demand for high-performance lubricants. Strategic domestic production and strong import-export activities further strengthen market growth.

Europe Base Oil Market Trends

The base oil industry in Europe is supported by stringent emission standards and the shift toward high-performance lubricants. Growing automotive and industrial sectors, particularly in Germany and France, drive steady demand for synthetic and specialty base oils.

The Germany base oil industry drives European demand for base oils through its strong automotive manufacturing, industrial machinery, and chemical sectors. The focus on performance lubricants and sustainability supports steady market growth.

North America Base Oil Market Trends

The base oil industry in North America maintains a strong market due to established automotive and industrial sectors, technological adoption in lubricant formulations, and growing replacement demand, with the U.S. being the largest contributor.

The U.S. base oil industry is driven by high automotive and industrial consumption, technological advancements in synthetic and specialty oils, and stringent environmental standards, maintaining its leadership position in North America.

Latin America Base Oil Market Trends

The base oil industry in Latin America is witnessing significant growth, driven by industrialization, rising vehicle sales, and infrastructure development in countries such as Brazil and Mexico, which are boosting base oil demand across automotive and industrial applications.

Middle East & Africa Base Oil Market Trends

The base oil industry in the Middle East & Africa market benefits from robust activity across the industrial, construction, and energy sectors. Increasing lubricant requirements in oil refining, petrochemicals, and heavy machinery support base oil consumption across the region.

Key Base Oil Company Insights

The global market is fragmented, with leading players actively pursuing mergers, acquisitions, and partnerships to expand production capacity and strengthen market presence. Ongoing investments in innovation and scale-driven strategies are reinforcing their competitive positioning worldwide.

-

CNOOC Limited is a leading Chinese energy company with a growing presence in the market. Leveraging its integrated upstream and downstream operations, the company supplies high-quality base oils to meet rising demand in automotive and industrial lubricants across Asia-Pacific and emerging markets.

-

Petro-Canada Lubricants Inc., a subsidiary of Suncor Energy, is a key North American player in the market. The company focuses on high-performance and synthetic base oils, serving automotive, industrial, and specialty lubricant segments, supported by robust R&D and a strong distribution network.

Key Base Oil Companies:

The following key companies have been profiled for this study on the base oil market.

- CNOOC Limited

- PetroCanada Lubricants Inc.

- Petroleum & Chemical Corp. (SINOPEC)

- PETRONAS Lubricants International

- PT Pertamina (Persero)

- PetroChina Co., Ltd

- Exxon Mobil Corporation

- Abu Dhabi National Oil Company

- Chevron Corporation

- Shell plc

- Indian Oil Corporation Ltd

- BP p.l.c

- Saudi Arabian Oil Co.

- Sepahan Oil

- Bahrain Lube Base Oil Company

- LUKOIL

- SK Lubricants Co., Ltd.

- H&R OWS Chemie GmbH & Co. KG

- Bharat Petroleum Corporation Limited

- GS Caltex Corporation

- Neste

- Repsol

Recent Developments

- In January 2026, Saudi Aramco and Luberef signed a memorandum of understanding to explore the development of a new base oil plant at the Jazan Refinery in Saudi Arabia, aimed at expanding Group III+ base oil production capacity.

Base Oil Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 23.31 billion

Revenue forecast in 2033

USD 37.49 billion

Growth rate

CAGR of 7.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; Thailand; Malaysia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies Listed

CNOOC Limited; PetroCanada Lubricants Inc.; Petroleum & Chemical Corp. (SINOPEC), PETRONAS Lubricants International; PT Pertamina (Persero); PetroChina Co., Ltd; Exxon Mobil Corporation; Abu Dhabi National Oil Company; Chevron Corporation, Shell plc; Indian Oil Corporation Ltd; BP p.l.c; Saudi Arabian Oil Co.; Sepahan Oil; Bahrain Lube Base Oil Company; LUKOIL; SK Lubricants Co., Ltd.; H&R OWS Chemie GmbH & Co. KG; Bharat Petroleum Corporation Limited; GS Caltex Corporation; Neste; Repsol

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

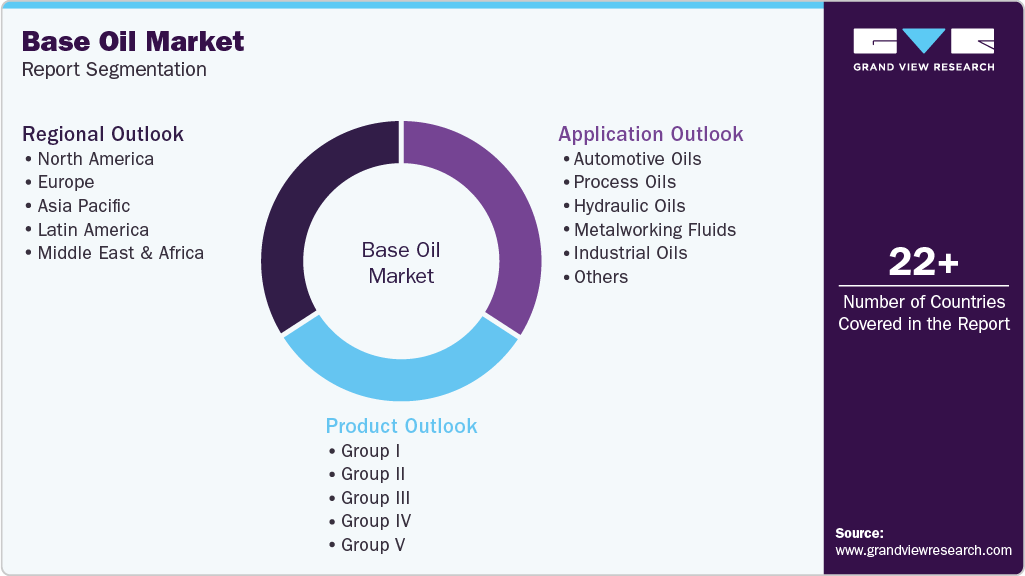

Global Base Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global base oil market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Group I

-

Group II

-

Group III

-

Group IV

-

Group V

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

Automotive Oils

-

Process Oils

-

Hydraulic Oils

-

Metalworking Fluids

-

Industrial Oils

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Thailand

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global base oil market is being propelled by the sustained growth of the automotive and industrial sectors. Rising vehicle production, coupled with increasing mechanization in manufacturing, construction, and heavy industries, is driving higher consumption of lubricants, thereby fueling demand for base oils worldwide

b. Some key players operating in the base oil market include ExxonMobil, Chevron Corp., British Petroleum PLC, Royal Dutch Shell, Sepahan Oil Company, LukOil, Saudi Aramco, S-Oil Corp., Indian Oil Corp. Ltd., Total, Motul, Repsol, Gulf Oil UAE, Petrobras, and Tupras.

b. The global base oil market size was valued at USD 22.11 billion in 2025 and is expected to reach USD 23.31 billion in 2026.

b. The global base oil market is expected to grow at a compound annual growth rate of 7.0% from 2026 to 2033 to reach USD 37.49 billion by 2033.

b. Asia Pacific region dominated the market with a revenue share of 50.5% in 2025, driven by rapid industrialization, expanding automotive production, and growing infrastructure projects. Rising demand in countries like China and India, coupled with increasing lubricant consumption, reinforces the region’s leading market position

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.