- Home

- »

- Beauty & Personal Care

- »

-

Bath Salts Market Size And Share, Industry Report, 2033GVR Report cover

![Bath Salts Market Size, Share & Trends Report]()

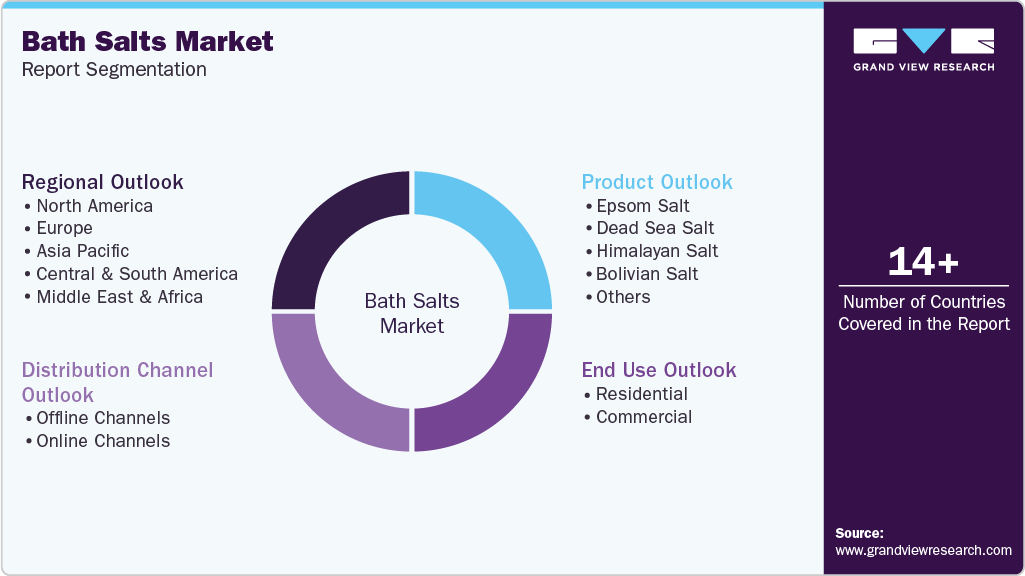

Bath Salts Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Epsom Salt, Dead Sea Salt, Himalayan Salt, Bolivian Salt), By End Use (Residential, Commercial), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-622-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bath Salts Market Summary

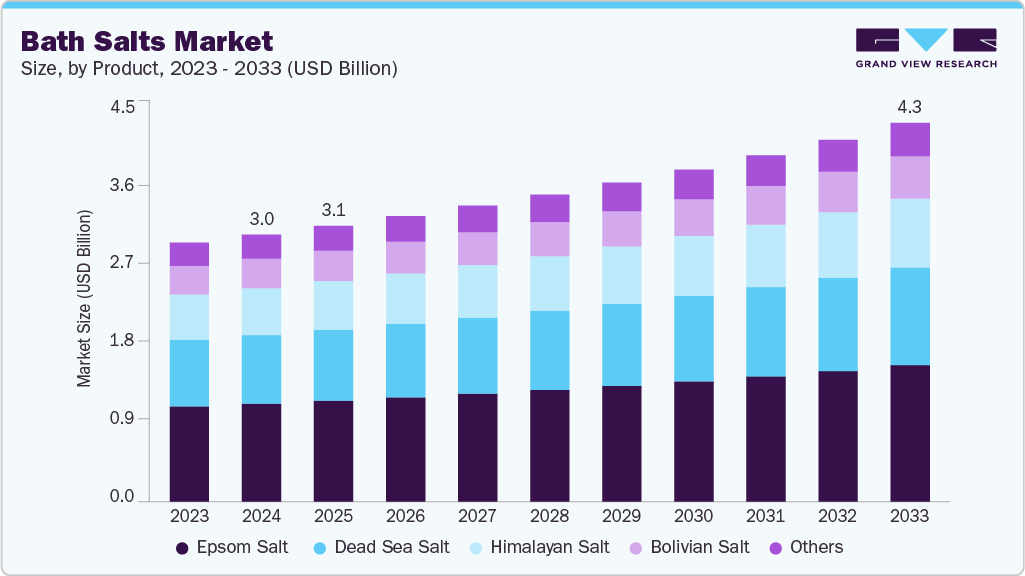

The global bath salts market size was estimated at USD 3.02 billion in 2024 and is projected to reach USD 4.28 billion by 2033, growing at a CAGR of 4.0% from 2025 to 2033. As consumers increasingly prioritize relaxation, stress relief, and skin health, bath salts have transitioned from niche therapeutic products to mainstream wellness essentials.

Key Market Trends & Insights

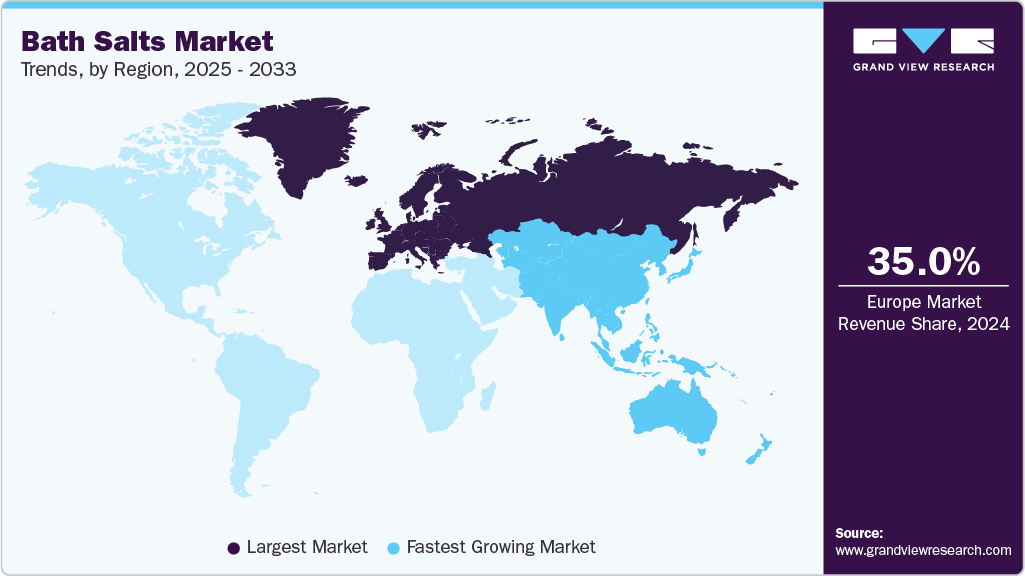

- Europe's bath salts market held the largest share of 35% of the global market in 2024.

- The bath salts industry in Europe is expected to grow steadily over the forecast period.

- By product segment, Epsom Salt held the highest market share of 36.68% in 2024.

- Based on the distribution channel, the offline channel held the largest market share in 2024.

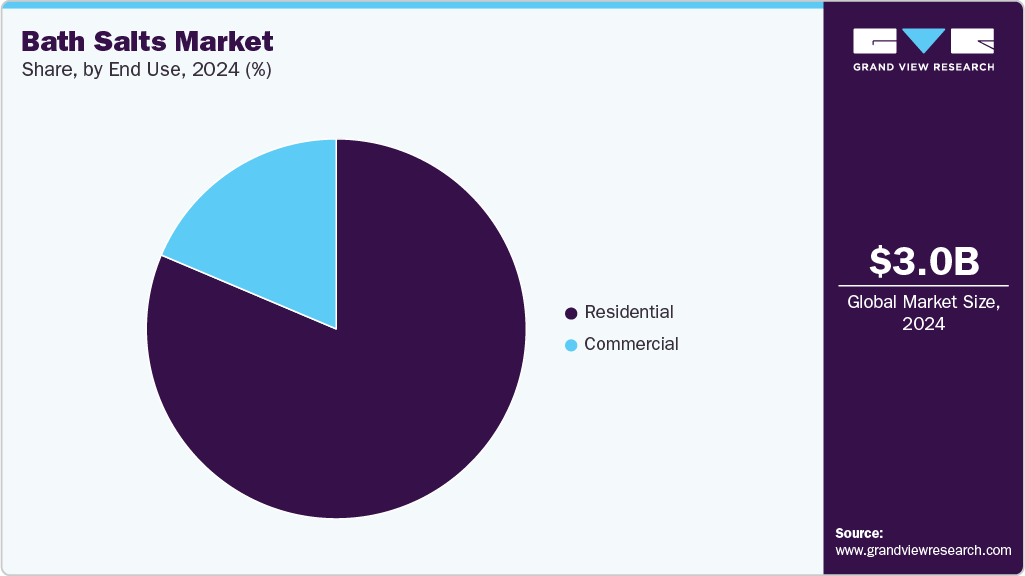

- By end use, the residential segment accounted for the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.02 Billion

- 2033 Projected Market Size: USD 4.28 Billion

- CAGR (2025-2033): 4.0%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

This trend is particularly noticeable in regions such as North America, Europe, and the rapidly developing Asia-Pacific markets, including China, India, Japan, and Southeast Asia. Rising disposable incomes and expanding middle-class populations in these regions are fueling increased purchases not only of premium bath salts but also of natural and organic variants, reflecting a growing preference for clean, sustainable ingredients. Consumers are more informed and selective, associating high-quality bath salts with luxury self-care rituals, mental wellness, and rejuvenation.Modern buyers, especially millennials and Gen Z, view bath salts not just as bath additives but as integral components of their lifestyle and self-care routines. Influenced heavily by social media wellness trends and influencer endorsements, these consumers seek products that combine efficacy, sensory experience (such as fragrance and texture), and aesthetic appeal. Bath salts have thus become a form of personal indulgence and home spa experience, often chosen to complement curated bathroom décor and wellness spaces. This demographic also values transparency in sourcing, sustainability, and cruelty-free certifications, driving brands to innovate in packaging and ingredient disclosure.

In response to this surging demand, both established global brands and new market entrants are broadening their product lines to capture diverse consumer needs. Premium players such as Dr Teal’s, Lush, and Neal’s Yard Remedies continue to lead by offering specialized bath salts infused with essential oils, minerals like Epsom or Dead Sea salts, and botanicals targeted at specific wellness outcomes like muscle relaxation or detoxification. Meanwhile, mid-tier and value brands, including Target’s Up & Up and smaller indie brands, provide affordable yet high-quality options that appeal to design-conscious and health-aware buyers. In addition, artisanal and craft bath salt producers are gaining traction by emphasizing hand-crafted blends, exotic ingredients, and eco-friendly packaging to attract niche wellness consumers.

E-commerce has significantly transformed the bath salts industry by expanding product availability and consumer choice on a global scale. Online retailers are enhancing the shopping experience through virtual consultations, detailed product demonstrations, and subscription models that promote customer engagement and loyalty. Informative platforms such as YouTube, wellness blogs, and community forums play a crucial role in shaping consumer preferences by providing expert reviews, self-care tutorials, and influencer endorsements. Consequently, bath salts are increasingly marketed not just as practical wellness products but as aspirational lifestyle accessories that embody relaxation, mindfulness, and holistic well-being.

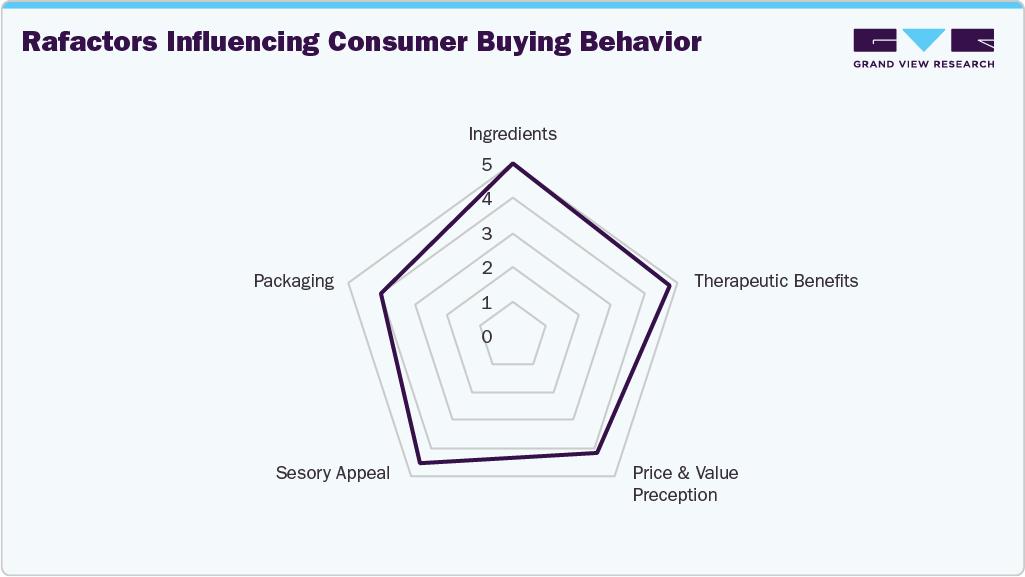

Consumer Insights

Consumers typically seek bath salts made from high-quality, natural ingredients such as Epsom salt, Dead Sea salt, Himalayan pink salt, or mineral-rich blends that promise therapeutic benefits like muscle relaxation, detoxification, and skin nourishment. The purity and source of these minerals greatly influence purchasing decisions, as buyers associate authentic, sustainably sourced ingredients with efficacy and safety. Alongside ingredient quality, the texture, fragrance, and appearance of bath salts, such as fine grains, coarse crystals, or infused botanicals, also play a crucial role in consumer appeal, as many view bath salts as both a sensory experience and a wellness ritual. For example, some users prefer calming lavender-scented salts for relaxation, while others may opt for invigorating eucalyptus blends to refresh the senses.

Brand reputation significantly affects consumer trust and loyalty in the bath salts industry. Established brands with a history of quality and transparency are often favored, especially by buyers seeking reliable, safe products for sensitive skin or therapeutic use. Premium brands leverage their heritage, clinical endorsements, or unique formulations to justify higher price points, appealing to customers looking for luxury or specialty items. Price remains a critical factor, with consumers balancing cost against perceived benefits and quality. While some buyers prefer affordable, everyday bath salts for routine use, others are willing to invest more in artisanal, organic, or limited-edition blends. Promotions, sample packs, and subscription options can reduce purchase barriers and encourage trial.

Usage occasions also influence preferences, with consumers selecting bath salts for daily relaxation, post-workout recovery, skincare benefits, or gift-giving. Durability concerns extend to packaging, with demand growing for eco-friendly, resealable containers that preserve product freshness and align with sustainability values. Social influences such as recommendations from wellness experts, dermatologists, and peer reviews impact purchase decisions, as do emerging trends around mindfulness, clean beauty, and self-care rituals. Consumers increasingly seek products that reflect their lifestyle choices, whether that means cruelty-free certification, vegan formulas, or ethically sourced minerals. Bath salts that combine effective ingredients with appealing aesthetics, such as colored crystals or botanical additions, often attract buyers looking for both functional and decorative value.

Product Insights

The epsom salt segment led the market with the largest revenue share of 36.68% in 2024. Epsom Salt is popular among users seeking natural relief from muscle aches, stress, and inflammation, driving consistent demand. In addition, its versatility across personal care, wellness, and bath salt segments contributes to broad market appeal. The product’s accessibility, affordability, and presence in both offline retail and online platforms further support its strong market position.

The himalayan salts segment is projected to grow at the fastest CAGR of 4.4% over the forecast period, driven by increasing consumer preference for natural and mineral-rich products that promote wellness and relaxation. Their unique pink color and high mineral content, including magnesium, calcium, and potassium, appeal to health-conscious buyers seeking therapeutic benefits such as detoxification, improved skin health, and muscle relaxation. In addition, the rising trend of spa culture and at-home self-care rituals worldwide boosts demand for premium bath salts like Himalayan salts.

Distribution Channel Insights

The offline sales segment led the market with the largest revenue share of 66.90% in 2024. Shoppers often prefer purchasing bath salts in supermarkets, specialty wellness stores, and pharmacies where they can assess product quality firsthand and receive personalized advice from store staff. Established brick-and-mortar retail networks provide broad accessibility, especially in markets where digital penetration is limited or consumers prefer in-person shopping for health and beauty products. Moreover, in-store promotions, product sampling, and curated displays help drive impulse buying and brand loyalty.

The online segment is projected to grow at the fastest CAGR of 4.4% over the forecast period. E-commerce platforms offer a broad selection of bath salt products, including specialized and artisanal varieties, which attract wellness-focused buyers seeking unique formulations. The convenience of shopping from home, combined with features such as customer reviews, product recommendations, and detailed ingredient information, enhances purchasing confidence.

End Use Insights

The residential segment led the market with the largest revenue share of 81.36% in 2024. Bath salts are widely used by individuals seeking relaxation, stress relief, and skin care benefits within the comfort of their own homes, making residential demand a key driver. The increasing popularity of home spa experiences, coupled with heightened awareness of the therapeutic properties of bath salts, has encouraged more frequent and diverse usage among households globally.

The commercial segment is projected to grow at the fastest CAGR of 5.8% over the forecast period. Increasing consumer demand for luxury spa treatments, hotel amenities, and therapeutic services has prompted commercial establishments to incorporate high-quality bath salts into their offerings to enhance customer experience and differentiate their brands. Moreover, the rise of health and wellness tourism is fueling investment in commercial bath salt products by resorts, wellness centers, and fitness clubs. As businesses seek to capitalize on growing consumer interest in holistic self-care, the commercial sector’s adoption of bath salts is expected to accelerate, supported by innovations in product formulations and bulk purchasing advantages.

Regional Insights

North America dominated the bath salts market with the largest revenue share of 31.95% in 2024. The widespread popularity of spa treatments, natural remedies, and at-home relaxation rituals has fueled consistent growth. In addition, the presence of well-established retail networks, including specialty stores and online platforms, ensures easy accessibility to a diverse range of bath salt products. Innovation in product formulations, such as organic and mineral-rich variants, along with active marketing campaigns, has further boosted consumer interest.

U.S. Bath Salts Market Trends

The bath salts market in the U.S. accounted for the largest revenue share of 85% in North America in 2024. Growing awareness of wellness and self-care practices has driven widespread adoption of bath salts for relaxation, muscle relief, and skin care. The U.S. market benefits from extensive distribution channels, including specialty wellness retailers, pharmacies, and e-commerce platforms, making products highly accessible to consumers. In addition, innovation in product offerings, such as organic and scented varieties, caters to diverse preferences, further boosting demand.

Europe Bath Salts Market Trends

The bath salts market in Europe is anticipated to grow at a significant CAGR during the forecast period. The region’s long-standing tradition of spa culture and wellness rituals has cultivated a deep appreciation for bath salts as essential components of relaxation and therapeutic routines. European consumers increasingly prioritize high-quality, sustainably sourced ingredients, which has encouraged manufacturers to innovate with mineral-rich and eco-friendly formulations.

Asia Pacific Bath Salts Market Trends

The bath salts market in Asia Pacific is projected to grow at the fastest CAGR of 4.7% from 2025 to 2033. Rapid urbanization, rising disposable incomes, and expanding middle-class populations are fueling demand for luxury and natural bath products. In addition, growing spa and wellness tourism industries in countries like Japan, China, and India are boosting commercial and residential consumption of bath salts.

Key Bath Salts Company Insights

The global bath salts industry features a mix of established manufacturers and emerging brands that introduce innovative formulations and cater to evolving consumer preferences. Leading companies focus on product quality, natural and organic ingredients, and wellness benefits to address the growing demand for self-care and therapeutic products. By partnering with major retail chains, specialty stores, and spas, and expanding their presence on e-commerce platforms, these players ensure broad market reach and accessibility.

In addition, strategic collaborations and flexible production capabilities enable key market participants to develop specialized bath salts such as mineral-rich, scented, or eco-friendly variants and efficiently target niche segments and emerging markets worldwide.

Key Bath Salts Companies:

The following are the leading companies in the bath salts market. These companies collectively hold the largest market share and dictate industry trends.

- PDC Brands.

- Dead Sea Ltd.

- SAN FRANCISCO SALT CO

- Enviromedica.

- Bathorium.

- The Midwest Sea Salt Company Inc.

- Better Bath Better Body LLC

- Yareli Bath & Beauty.

- SaltWorks

- The Seaweed Bath Co.

Recent Developments

-

In September 2023, SaltWorks expanded its Ultra Epsom product range by launching a eucalyptus-scented Epsom salt. Made in the U.S. with premium magnesium sulfate and pure eucalyptus essential oil, this new option is designed to relax muscles, soothe the skin, and provide refreshing aromatherapy benefits. It is certified OU Kosher and comes in 2- and 5-pound resealable bags. The eucalyptus version complements the brand’s existing lavender and unscented selections, offering customers additional choices for a high-quality, spa-like bathing experience at home.

-

In May 2023, Saint Jane Beauty introduced its Deep Sleep Bath Salts, a product crafted to encourage relaxation while nourishing the skin. The blend includes sea salts and magnesium to ease muscle tension, along with peptides and hyaluronic acid for added hydration. Complemented by calming floral extracts such as lavender, jasmine, evening primrose, and sacred lotus, the soak offers a soothing experience. In user trials, participants reported feeling more relaxed, noticing softer skin, and experiencing muscle relief after regular use. Available at Sephora, the bath salts are designed to enhance nighttime self-care rituals.

Bath Salts Market Report Scope:

Report Attribute

Details

Market size value in 2025

USD 3.12 billion

Revenue forecast in 2033

USD 4.28 billion

Growth rate

CAGR of 4.0% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; South Africa

Key companies profiled

PDC Brands.; Dead Sea Ltd.; SAN FRANCISCO SALT CO; Enviromedica.; Bathorium; The Midwest Sea Salt Company Inc.; Better Bath Better Body LLC; Yareli Bath & Beauty.; SaltWorks; and The Seaweed Bath Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bath Salts Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bath salts market report based on product, distribution channel, end use, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Epsom Salt

-

Dead Sea Salt

-

Himalayan Salt

-

Bolivian Salt

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline Channels

-

Supermarkets/Hypermarkets

-

Specialty Stores (beauty/wellness shops)

-

Pharmacies/Drug Stores

-

-

Online Channels

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bath salts market was estimated at USD 3.02 billion in 2024 and is expected to reach USD 3.12 billion in 2025.

b. The global bath salts market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2030 to reach USD 4.28 billion by 2030.

b. Epsom Salt held the highest market share of 36.68% in 2024 due to its widespread use in wellness, skincare, and therapeutic bath products. Its affordability, ease of availability, and perceived health benefits significantly boosted consumer demand.

b. Some of the key players operating in the bath salts market include PDC Brands., Dead Sea Ltd., SAN FRANCISCO SALT CO, Enviromedica., Bathorium. , The Midwest Sea Salt Company Inc., Better Bath Better Body LLC, Yareli Bath & Beauty., SaltWorks, The Seaweed Bath Co.

b. Growth of the global bath salts market is primarily driven by increasing consumer inclination toward wellness and self-care routines, with rising demand for relaxing, therapeutic, and aromatherapy-infused bathing products enhancing market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.