- Home

- »

- Next Generation Technologies

- »

-

Battery Testing, Inspection, And Certification Market Report, 2033GVR Report cover

![Battery Testing, Inspection, And Certification Market Size, Share & Trends Report]()

Battery Testing, Inspection, And Certification Market (2025 - 2033) Size, Share & Trends Analysis Report By Service Type, By Standard and Certification Type, By Sourcing Type, By Battery Type, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-459-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Battery Testing, Inspection, And Certification Market Summary

The global battery testing, inspection, and certification market size was valued at USD 9,277.7 million in 2024 and is projected to reach USD 55,351.8 million by 2033, growing at a CAGR of 22.2% from 2025 to 2033. The growth is driven by the increasing adoption of battery-powered technologies across various sectors, including automotive, consumer electronics, and renewable energy.

Key Market Trends & Insights

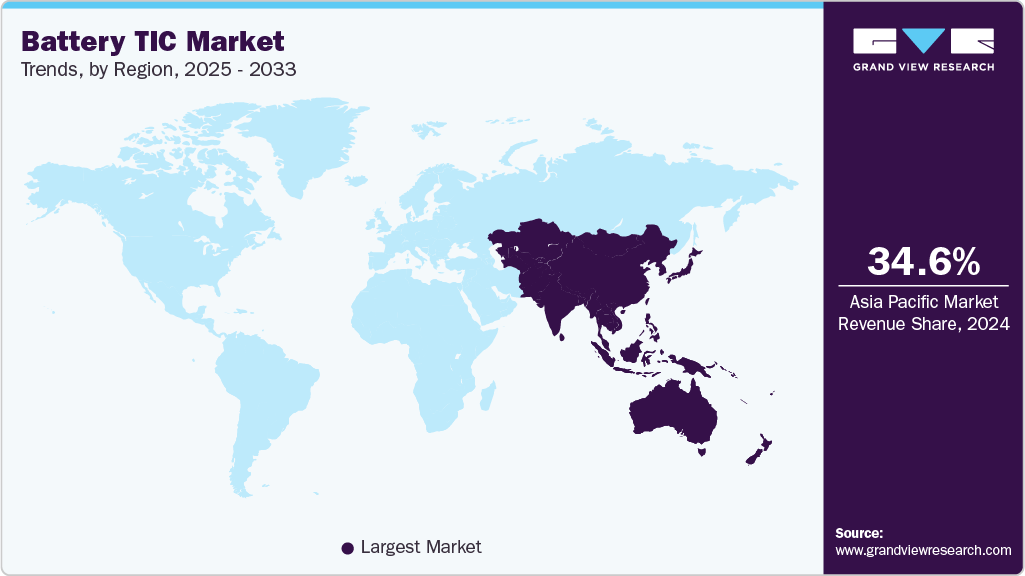

- Asia Pacific dominated the global battery testing, inspection, and certification (TIC) market with the largest revenue share of 34.6% in 2024.

- The battery TIC market in China led the Asia Pacific market and held the largest revenue share in 2024.

- By service type, the testing segment led the market, holding the largest revenue share of 71.3% in 2024.

- By application, the electric vehicles segment held the dominant position in the market and accounted for the leading revenue share of 37.6% in 2024.

- By application, the consumer electronics segment is expected to grow at the fastest CAGR of 24.1% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 9,277.7 Million

- 2033 Projected Market Size: USD 55,351.8 Million

- CAGR (2025-2033): 22.2%

- Asia Pacific: Largest market in 2024

As the demand for high-performance and safe batteries escalates, rigorous testing and certification processes become paramount. Battery TIC services ensure that batteries meet regulatory standards and performance criteria, addressing safety concerns and enhancing reliability. The rapid expansion of electric vehicles (EVs) and the rising prevalence of renewable energy storage solutions are key factors propelling market growth.Additionally, advancements in battery technologies, such as solid-state and lithium-sulfur batteries, necessitate specialized testing to validate their performance and safety. Governments and regulatory bodies are also implementing stricter standards and regulations, further boosting the demand for TIC services. The market is characterized by a competitive landscape with numerous players offering various services, from performance testing to compliance certification. This growth trajectory is expected to continue as industries seek to innovate and ensure the reliability of their battery systems, driving investment and advancements in the battery TIC sector.

The increasing global adoption of EVs and the expanding use of energy storage systems (ESS) are significantly driving the growth and development of the battery TIC market. Lithium-ion batteries are favored due to their superior energy density and extended lifespan, making them well-suited for EVs and ESS. As the prevalence of EVs and ESS continues to rise, so does the demand for rigorous testing and certification of these batteries to ensure they comply with safety and performance standards. This growing need for assurance is fueling the expansion of the TIC market.

Service Type Insights

The testing segment led the market in 2024, accounting for over 71.3% of global revenue. This high share is attributed to the escalating demand for rigorous battery performance, safety, and reliability evaluation across various applications, including EVs and ESS. As battery technologies advance and regulatory standards become more stringent, comprehensive testing becomes essential to ensure compliance and optimal performance. The rise in battery-related incidents and the need for high-quality assurance further drive the demand for specialized testing services. This focus on thorough assessment to meet safety standards and enhance battery lifespan highlights the significant role of the testing segment in the TIC market.

The certification segment is expected to grow at the highest CAGR during the forecast period. As electric vehicles and energy storage systems grow more complex, a demand for verified safety and performance is rising. Certification ensures these technologies meet evolving technical and regulatory standards. The global expansion of testing facilities supports localized certification needs across key regions. Companies are pursuing partnerships and acquisitions to strengthen their technical capabilities and service reach. Certification has become essential for product validation, market access, and customer confidence. This trend reinforces the strategic role of certification in the battery industry's growth.

Standard And Certification Type Insights

The safety testing segment accounted for the largest market revenue share in 2024, due to the critical importance of safety in battery technology, particularly with the widespread adoption of EVs and ESS. As these technologies become more prevalent, stringent safety standards are essential to mitigate risks and ensure reliable operation. The increasing complexity of battery systems and heightened regulatory scrutiny drive the demand for comprehensive safety testing and certification. Ensuring compliance with rigorous safety standards helps prevent accidents and failures, making this segment a key focus for the industry and a significant contributor to market revenue.

The performance testing segment is expected to grow at the highest CAGR over the forecast period. As battery technologies advance, there is an increasing demand for batteries that deliver superior performance in terms of efficiency, energy density, and longevity. The push for innovation in battery materials and design necessitates comprehensive performance testing to validate new technologies. This focus on optimizing battery performance and meeting evolving industry requirements is propelling the rapid growth of the performance testing segment.

Sourcing Type Insights

The in-house segment accounted for the largest market revenue share in 2024. Companies increasingly prefer in-house testing and certification to maintain greater control over the quality and consistency of their battery products. In-house facilities allow for more efficient testing processes, quicker turnaround times, and the ability to tailor testing procedures to specific product requirements. Additionally, in-house sourcing reduces dependency on external providers and enhances confidentiality, which is crucial for proprietary technologies. As battery technology advances and regulatory requirements become more stringent, the demand for in-house testing and certification solutions is expected to remain strong, contributing to this segment’s leading market share.

The outsourced segment is expected to grow at the highest CAGR over the forecast period. As battery technologies become more complex and global regulatory requirements intensify, many companies increasingly turn to specialized third-party providers for TIC. Outsourcing offers access to advanced technologies and expertise that might only be available in some places, reducing the need for substantial capital investment in testing infrastructure. Additionally, third-party providers can offer scalability and flexibility, accommodating fluctuating demand and evolving industry standards more efficiently.

Battery Type Insights

The lithium-ion segment accounted for the largest market revenue share in 2024. This dominance is primarily due to the widespread use of lithium-ion batteries across various applications, including EVs, consumer electronics, and ESS. Their high energy density, long lifespan, and reliability make them the preferred choice for many industries. As demand for these batteries grows, so does the need for rigorous testing and certification to ensure safety and performance standards are met. The significant market share of lithium-ion batteries reflects their critical role in powering modern technologies and the corresponding emphasis on comprehensive TIC services to support their deployment.

The lead-acid segment is expected to grow at the highest CAGR over the forecast period. Lead-acid batteries, known for their reliability and cost-effectiveness, are increasingly being used in various applications, including backup power systems, automotive, and renewable energy storage. Their established technology and recycling capabilities make them a sustainable choice as industries seek affordable and environmentally friendly solutions. Additionally, advancements in lead-acid battery technology, such as improved performance and longer life cycles, further fuel their adoption.

Application Insights

The Electric Vehicles (EVs) segment accounted for the largest market revenue share in 2024 due to the rapid growth of the electric vehicle industry, driven by increasing consumer demand, government incentives, and a global shift towards sustainable transportation solutions. EVs rely heavily on advanced battery technologies, making rigorous testing and certification crucial to ensure safety, performance, and compliance with regulatory standards. As EV adoption continues to rise, the emphasis on battery reliability and safety becomes more critical, further driving the demand for comprehensive TIC services.

The consumer electronics segment is expected to grow at the highest CAGR over the forecast period. The rapid advancement in consumer electronics, including smartphones, tablets, laptops, and wearable devices, necessitates high-performance batteries with enhanced energy density and longer life cycles. As these devices become more integral to daily life, the demand for reliable and safe battery solutions escalates. Additionally, the continuous innovation and introduction of new consumer electronics products drive the need for stringent testing and certification to ensure compliance with safety standards and optimal performance.

Regional Insights

North America led the Aerospace Testing industry with a revenue share of over 28.5% in 2024, driven by government incentives and regulatory frameworks aimed at promoting clean energy and reducing carbon emissions, accelerating the demand for high-performance and safe battery solutions. Additionally, substantial investments in battery technology innovation and the expansion of manufacturing capabilities by major industry players in the U.S. and Canada are enhancing the region’s capacity for battery TIC.

U.S. Battery Testing, Inspection, And Certification Market Trends

The U.S. Aerospace Testing industry is expected to grow significantly in 2024 as the growing adoption of light electric vehicles (LEVs) and energy storage systems (ESS) is creating fresh demand for advanced battery testing, inspection, and certification in the U.S. Battery testing, once centered on traditional EVs, is now expanding to include LEV and ESS modules, with a strong focus on current, voltage, safety, and overall performance. To keep pace, U.S. laboratories are enhancing their local testing capabilities, aiming to meet regulatory standards more efficiently and accelerate certification timelines, thereby minimizing delays and improving market readiness. For instance, in April 2025, SGS, a Swiss multinational Testing, Inspection, and Certification (TIC) company, expanded its Suwanee lab in Georgia to strengthen battery testing services for light electric vehicles and energy storage systems. The facility now supports testing up to 100V and 1200A, enhancing regional capacity and compliance for residential, commercial, and industrial applications.

Europe Battery Testing, Inspection, And Certification Market Trends

The battery TIC market in Europe is expected to grow significantly over the forecast period. The European Union's ambitious climate goals and stringent regulations are accelerating the adoption of EVs and renewable energy storage solutions, which require advanced battery technologies. Additionally, significant investments in battery manufacturing and research, particularly in countries like Germany, France, and Sweden, are fostering innovation and enhancing the region's battery testing, inspection, and certification capabilities.

Asia Pacific Battery Testing, Inspection, And Certification Market Trends

The Battery TIC industry in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period due to the region's significant role as a major hub for battery manufacturing and innovation. Countries like China, Japan, and South Korea are leading producers of advanced batteries used in EVs, consumer electronics, and energy storage systems.

The rapid growth in these sectors, combined with increasing investments in battery technology and stringent regulatory standards, drives high demand for TIC services. Additionally, the region's expansive industrial base and robust infrastructure support the large-scale adoption and rigorous testing of battery technologies, further contributing to its dominant market share.

Key Battery Testing, Inspection, And Certification Company Insights

Some key companies in the TIC industry are UL LLC, SGS SA, DEKRA, and TUV SUD.

-

DEKRA is a provider of testing, inspection, and certification for Space Exploration, initially established with a focus on vehicle safety. Over time, it has broadened its scope to deliver comprehensive safety, security, and sustainability solutions across multiple industries, including aerospace. In the aerospace Space Exploration Sector, DEKRA applies its deep expertise to conduct thorough testing and certification processes that meet strict safety regulations, helping manufacturers and operators ensure the reliability of their products.

-

SGS is in testing, inspection, and certification (TIC), providing accurate and dependable services that support organizations in achieving quality, compliance, and sustainability goals. With expertise across diverse industries, SGS ensures trust and transparency in every engagement. The company also offers specialized brands along with training and consultancy solutions. Its worldwide network and independent testing capabilities significantly enhance safety and performance. SGS empowers businesses to operate with confidence and efficiency.

Key Battery Testing, Inspection, And Certification Companies:

The following are the leading companies in the battery testing, inspection, and certification market. These companies collectively hold the largest market share and dictate industry trends.

- UL LLC

- SGS SA

- Intertek Group plc

- TÜV NORD GROUP

- Bureau Veritas

- DEKRA

- Eurofins Scientific

- TÜV Rheinland

- TÜV SÜD

Recent Developments

-

In April 2025, UL released the fifth edition of its ANSI/CAN/UL 9540A battery safety standard, incorporating updates to accommodate new storage chemistries like sodium-ion. The revised standard enhances testing procedures for advanced battery energy storage systems (BESS) applications, including rooftop and open-garage installations. It also provides more precise guidelines for evaluating thermal runaway risks, reflecting input from industry experts, regulators, and fire safety professionals.

-

In March 2025, SGS increased the size of its battery testing lab in Suwanee, Georgia, by 20%, enhancing its ability to certify batteries for light electric vehicles (LEVs) and energy storage systems (ESSs). This expansion allows for quicker and more efficient testing, helping manufacturers meet rising demand in Georgia’s EV and battery sector. The upgraded facility now provides full certification and testing services for modules up to 100V and 1200A, ensuring alignment with major international standards.

-

In June 2024, the global expert organization DEKRA commenced construction of a new battery test center in Klettwitz, Germany. This cutting-edge facility will provide comprehensive battery testing services, including validation testing, support during development, and final certification testing. The center will conduct a wide range of tests, encompassing mechanical, performance, and environmental assessments, as well as abuse tests where batteries are exposed to conditions far exceeding their typical usage.

-

In May 2024, UL LLC acquired BatterieIngenieure, a German company specializing in battery testing and simulation. This acquisition expands UL LLC’s capabilities in the battery technology sector, enhancing its expertise in testing and evaluating advanced battery systems. Integrating BatterieIngenieure into UL Solutions strengthens the company’s global reach and technical proficiency in battery testing.

Battery Testing, Inspection, And Certification Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11,164.4 million

Revenue forecast in 2033

USD 55351.8 million

Growth rate

CAGR of 22.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Report updated

June 2025

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, standard and certification type, sourcing type, battery type, application, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

UL LLC; SGS SA; Intertek Group plc; TÜV NORD GROUP; Bureau Veritas; DEKRA; DNV GL; Eurofins Scientific; TÜV Rheinland; TÜV SÜD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Battery Testing, Inspection, And Certification Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global battery testing, inspection, and certification market report based on service type, standard and certification type, sourcing type, battery type, application, and region.

-

Service Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Testing

-

Inspection

-

Certification

-

-

Standard and Certification Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Safety Testing

-

EMC Testing

-

Performance Testing

-

Others

-

-

Sourcing Type Outlook (Revenue, USD Million, 2021 - 2033)

-

In-house

-

Outsourced

-

-

Battery Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Lithium-ion

-

Lead-Acid

-

Nickel-Metal-Hydride

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Electric Vehicles (EVs)

-

ICE Vehicles

-

Consumer Electronics

-

Industrial Equipment

-

Medical Devices

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

- Brazil

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global battery testing, inspection, and certification market size was estimated at USD 9.28 billion in 2024 and is expected to reach USD 11.16 billion in 2025.

b. The global battery testing, inspection, and certification market is expected to grow at a compound annual growth rate of 22.2% from 2025 to 2033 to reach USD 55.37 billion by 2033.

b. Asia Pacific dominated the battery TIC market with a share of 34.6% in 2024. This high share is primarily due to the region's significant role as a major hub for battery manufacturing and innovation. Countries like China, Japan, and South Korea are leading producers of advanced batteries used in EVs, consumer electronics, and energy storage systems.

b. Some key players operating in the battery TIC market include UL LLC, SGS SA, Intertek Group plc, TÜV NORD GROUP, Bureau Veritas, DEKRA, DNV GL, Eurofins Scientific, TÜV Rheinland, TÜV SÜD

b. Key factors that are driving the battery TIC market growth include EV adoption fuels demand for battery testing and safety standards, stricter regulations propel battery inspection and certification, and rising energy storage needs drive battery quality assurance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.