- Home

- »

- Beauty & Personal Care

- »

-

Beauty and Personal Care Products Market Report, 2030GVR Report cover

![Beauty And Personal Care Products Market Size, Share & Trend Report]()

Beauty And Personal Care Products Market Size, Share & Trend Analysis Report By Type (Conventional, Organic), By Product (Skin Care, Hair Care, Color Cosmetics, Fragrance), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-563-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Market Size & Trends

The global beauty and personal care products market size was estimated at USD 557.24 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.7% from 2024 to 2030. One of the primary factors driving market expansion is the rising consciousness of consumers about their appearance. Beauty and personal care products such as skin care, color cosmetics, and hair care are becoming an integral part of daily grooming among millennials. The introduction of cosmetics with natural, non-toxic, and organic ingredients has also been boosting the market growth.

The easy availability of these cosmetic items through various sales channels such as specialty stores, pharmacies, and beauty salons has contributed to the growth of the market in terms of value sales. In addition, the increasing focus of male consumers on skin care and grooming to enhance their physical appearance and take better care of their skin is anticipated to offer strong opportunities for growth. Increasing investments in the research and development of new and effective offerings also bode well for market growth.

Rising consumer awareness about using cosmetics that are vegan, organic, natural, and, at the same time, good for the planet has encouraged manufacturers to launch new offerings and expand their footprint. For instance, in June 2021, SO'BiO étic, a socially responsible French beauty company, launched its organic beauty line in the U.S., to supply eco-friendly and healthy beauty items. The company’s products do not contain glycol, parabens, silicones, nanoparticles, PEG, or chemical filters.

Various chemicals used as ingredients in beauty and personal care products can have adverse side effects on the skin. Similarly, long-term and extensive use of haircare commodities containing harsh chemicals can lead to numerous hair problems such as hair fall, premature greying, and dry and lackluster hair. Growing consumer awareness regarding the probable side effects of using such products is one of the major factors limiting the growth of conventional beauty and personal care products.

Consumer trends have been shaping the market for beauty and personal care products over the years. Ongoing trends influencing the market include sustainability, natural and organic ingredients, health, and convenience. The growing consumer preference for natural, organic, vegan beauty and personal care products to avoid the harmful effects of synthetic and rough chemicals is boosting the market growth. Consumers are replacing conventional beauty and personal care products with clean labeled and environment-friendly products.

The primary consumer demographic propelling the trend is composed of Millennials and Gen Z, who exhibit heightened enthusiasm for organic and natural beauty products in comparison to the general consumer base. According to a blog by ESW in July 2022, within this age group, 43% of consumers express a preference for natural skincare, surpassing 31% of the overall consumer population in the U.S.

The COVID-19 pandemic has also had a significant impact on the growth of the market. The pandemic disrupted the production as well as supply of beauty and personal care items. The situation was exacerbated by strict restrictions on movement, as well as social distancing and stay-home policies. Demand for new orders from retailers came to a standstill as major markets were under lockdown and commodity sales took a major hit, both through online and offline channels.

Market Concentration & Characteristics

In the beauty and personal care products market, product innovation is a driving force, characterized by a strong focus on natural, sustainable, and clean formulations. Companies are investing in developing products that incorporate natural and organic ingredients, responding to consumer demand for safer, environmentally friendly options. Additionally, there is a notable emphasis on incorporating advanced technologies, such as biotechnology and nanotechnology, to create more effective and targeted skincare solutions.

Merger and acquisition activities in the beauty and personal care products market have been prominent, with major players strategically acquiring and integrating companies to diversify their product portfolios and expand their market reach. Companies are seeking acquisitions of niche brands specializing in natural and organic products, as well as startups focused on innovative technologies to gain a competitive edge. Additionally, there is a trend of vertical integration, where companies acquire or merge with suppliers to ensure a seamless and efficient supply chain.

Regulations in the beauty and personal care products market are designed to ensure consumer safety and product efficacy. Government agencies such as the Food and Drug Administration (FDA) in the United States and the European Commission in the European Union oversee the industry, setting guidelines for product ingredients, labeling, and advertising. Regulations govern the use of certain ingredients to ensure they are safe for consumer use, with restrictions on substances known to be harmful or potentially allergenic. Furthermore, labeling regulations mandate clear and accurate information regarding product contents, usage instructions, and warnings.

Substitutes in the beauty and personal care products market encompass a broad spectrum of options, including natural ingredients often used in home-made remedies and do-it-yourself (DIY) beauty treatments. This trend has gained momentum owing to the growing consumer interest in clean, organic, and sustainable alternatives. Additionally, the rise of independent brands and small-scale manufacturers specializing in handmade, natural, and artisanal beauty products presents a substitute for mass-produced items.

Type Insights

The conventional beauty and personal care market accounted for the largest revenue share of 84.6% in 2023. Low prices of the conventional type compared to organic variants and their easy availability through various distribution channels across the globe have driven segment growth so far. However, conventional cosmetics frequently contain a high percentage of petroleum-based ingredients, which is not only harmful to the skin when not properly refined but also required extensive mining, which can endanger wildlife and soils. This could hamper segment growth.

The organic beauty and personal care products market is expected to grow at a CAGR of 8.8% from 2024 to 2030. These cosmetics are formulated by using organically sourced ingredients and are safe for the skin, cruelty-free, and aid in the protection of the environment and biodiversity. Rising consumer awareness regarding the benefits associated with the use of organic cosmetics is expected to drive its adoption among consumers globally. This, in addition to a rising number of players offering clean and organic beauty and personal care products, is likely to boost the segment over the forecast period.

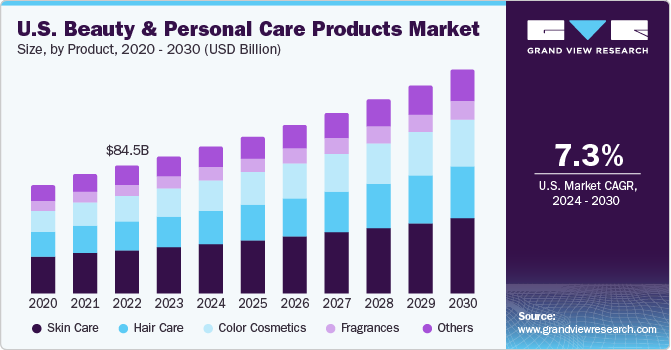

Product Insights

The skincare market accounted for a revenue share of 33.7% of the beauty and personal care products industry in 2023. This is attributable to the rising popularity of cosmetics containing natural and organic ingredients such as herbs, plant extracts, and fruit extracts. Skincare products can have numerous benefits and functions, such as rejuvenating and protecting the skin, treating wrinkles and signs of aging, reducing the occurrence of acne, lightening spots, and keeping the skin healthy and young. These benefits continue to propel the growth of the skincare segment.

The haircare products market is expected to grow at a CAGR of over 8.1% from 2024 to 2030. Haircare products are used to solve various hair problems like frizzy hair, split ends, hair fall, dandruff, and dry or itchy scalp. The availability of a wide range of haircare products, such as shampoo, conditioner, hair gel, hair wax, hair serum, hair oil, and hair colorants, in different formats and for various customer requirements will drive segment growth over the forecast period.

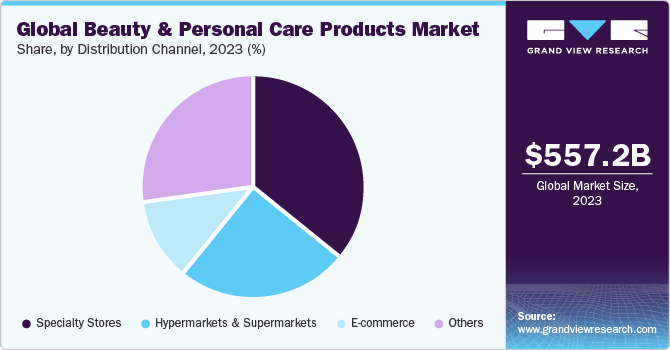

Distribution Channel Insights

The sales of beauty and personal care products through specialty stores hold the revenue share of 35.6% in 2023, driven by the growing presence of such stores around the globe. These stores have been focusing on offering natural and chemical-free beauty and personal care products to pique customer interest and allow them to choose from numerous brands and variants before making a purchase. Additionally, the presence of store associates that help customers select the right cosmetics for their needs and provide adequate knowledge about the ingredients has been boosting the growth of this segment.

Supermarkets and hypermarkets have become popular for the purchase of beauty and personal care products as they offer a wide range of items under a single roof and are located near residential areas for convenient and easy accessibility. The sales of beauty and personal care products through e-commerce channel is projected to grow at a CAGR of 10.3% from 2024 to 2030. Rising internet penetration and target marketing by companies to reach a wider audience has fueled segment growth. In addition, heavy discounts and offers provided by online platforms will boost the sale of beauty and personal care items through this segment.

Regional Insights

The Asia Pacific beauty and personal care products market dominated the global market with a revenue share of 39.3% in 2023, and is expected to grow at a CAGR of nearly 9% from 2024 to 2030. This is attributable to the rising number of working women in countries such as China and India and their growing interest and spending capacity for beauty and personal care products. Moreover, the rising young population in these countries with access to the internet is expected to offer immense opportunities for the growth of the regional market over the forecast years.

Australia Beauty and Personal Care Products Market

There is a notable emphasis on natural and organic products, driven by increasing consumer awareness of ingredients, sustainability, and environmental impact. Additionally, the trend towards clean beauty and skincare, which involves the use of products free from potentially harmful chemicals, is gaining traction in the beauty & personal care products market in Australia. Furthermore, the rise of e-commerce and digital channels has expanded consumer access to a wide range of beauty and personal care products, fueling market growth. The Australian market is projected to grow at a CAGR of around 8.5% from 2024 to 2030.

Europe beauty and personal care products market

The growth of the beauty and personal care products market in Europe is fueled by the growing inclination of consumers toward natural and vegan cosmetics, especially in the UK, France, and Germany. The European market is projected to grow at a CAGR of 6.2% from 2024 to 2030.

In North America, consumers are willing to pay a high price for cosmetics that enhance their physical appearance, and this is especially true for consumers in the U.S. and Canada. The higher spending power of consumers in these regions and the presence of leading players will drive the regional markets. The beauty and personal care products market in Canada is expected to grow at a CAGR of 8.7% from 2024 to 2030. According to the International Trade Administration, the recovery of the beauty and personal care industry in Canada presents a significant opportunity for cosmetic product exporters from the U.S. The growing desire for natural or organic, cruelty-free, and non-animal-tested cosmetic products is an ongoing product trend in beauty products.

Due to consumer preferences, the Canadian skincare market now comprises about 40% of organic and ethically derived goods. Emerging market trends have fostered the expansion of cosmetic items in Canada. In addition to using technology to improve marketing methods, this includes producing products to appeal to the age, gender, and ethnicity of consumers. The popularity of beauty products has also been aided by the use of innovative, environmentally friendly packaging and design.

Key Beauty And Personal Care Products Company Insights

There are a host of international and domestic players in this market and they have been focusing on strategies such as innovation and the launch of natural, organic, and vegan beauty and personal care products in the retail space.

Key Beauty And Personal Care Products Companies:

The following are the leading companies in the beauty and personal care products market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these beauty and personal care products companies are analyzed to map the supply network.

- Unilever

- Estée Lauder

- Shiseido

- Revlon

- Procter & Gamble

- L'Oréal S.A.

- Coty Inc.

- Kao Corporation

- AVON PRODUCTS, INC

- ORIFLAME COSMETICS S.A.

Recent Developments

-

In September 2023, L’Oréal Groupe agreed to make a minority investment in Shinehigh Innovation, an innovative biotech company based in China, to forge a lasting partnership to jointly develop novel and environmentally sustainable beauty solutions.

-

In April 2023, Pacifica launched a new body care line called Wake Up Beautiful, featuring retinoid and mushroom body products to renew skin. The collection includes a body serum and lotion, both formulated with sustainable and eco-friendly ingredients. The product contains mushrooms to promote skin hydration.

-

In February 2023, Shiseido Co., Ltd., in collaboration with Shoppers Stop Ltd.'s Global SS Beauty Brands, introduced its makeup brand, NARS Cosmetics, to the Indian market. The strategic plan includes the opening of 14 stores in New Delhi and Mumbai throughout 2023, along with the promotion of NARS products through Sephora outlets.

-

In February 2023, Neon Hippie, a mushroom-based skin care brand, launched in the U.S. with its 7 Shroom Complex featuring chaga, reishi, shiitake, tremella, trametes versicolor, cordyceps, and coprinus. The product line includes seven items and is available at select Neiman Marcus stores and online.

-

In January 2023, Shroom Skincare launched its first product, Mycelium Glow Brightening Serum, which combines mushroom extracts and vitamin C to rejuvenate and moisturize the skin. The serum offers a range of benefits, including protection from environmental damage, reduction of inflammation, and improvement in the appearance of aging and uneven skin tone. The product contains maitake, reishi, chaga, and cordyceps mushroom extracts, each providing different skin benefits.

Beauty and Personal Care Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 599.15 billion

Revenue forecast in 2030

USD 937.13 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Actuals Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type; product; distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Australia & New Zealand, Brazil, Argentina, South Africa, UAE

Key companies profiled

Unilever; The Estée Lauder Companies Inc.; Shiseido; MacAndrews & Forbes (Revlon); L’Oréal S.A.; Coty Inc.;Procter & Gamble;Kao Corporation;Oriflame Cosmetics S.A.; Avon Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Beauty And Personal Care Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global beauty and personal care products market report on the basis of type, product, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion; 2018 - 2030)

-

Conventional

-

Organic

-

-

Product Outlook (Revenue, USD Billion; 2018 - 2030)

-

Skin Care

-

Face Skin Care

-

Face Creams & Moisturizers

-

Cleansers & Face Wash

-

Sunscreen/Sun Care

-

Others (Masks, Serum, Scrub, etc.)

-

-

Body Skin Care

-

Body Washes & Shower Gels

-

Hair Removal Products

-

Creams & Moisturizers

-

Body Sunscreen/Sun Care

-

Others (Serum, Body Scrub, Oils, etc.)

-

-

-

Hair Care

-

Shampoo

-

Conditioner

-

Oils

-

Serums

-

Others (Hair Masks, Peels, Etc.)

-

-

Color Cosmetics

-

Fragrances

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion; 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global beauty and personal care products market size was estimated at USD 518.6 billion in 2022 and is expected to reach USD 557.24 billion in 2023.

b. The global beauty and personal care products market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 973.13 billion by 2030.

b. The Asia Pacific dominated the beauty and personal care products market with a share of 39% in 2022. This is attributable to the rising number of working women population in countries such as China and India and their rising interest in spending on beauty and personal care products.

b. Some of the key players operating in the beauty and personal care products market include Unilever; The Estée Lauder Companies Inc.; Shiseido; MacAndrews & Forbes (Revlon); L’Oréal S.A.; Coty Inc.; Procter & Gamble; Kao Corporation; Oriflame Cosmetics S.A.; Avon Products, Inc.

b. One of the primary factors driving beauty and personal care products market expansion is the rising number of appearance-conscious consumers globally. Additionally, beauty and personal care products such as skincare, color cosmetics, hair care, and others are becoming an integral part of grooming among millennials.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."