- Home

- »

- Homecare & Decor

- »

-

Global Bedroom Furniture Market Size Report 2020-2027GVR Report cover

![Bedroom Furniture Market Size, Share & Trends Report]()

Bedroom Furniture Market Size, Share & Trends Analysis Report By Product (Beds, Wardrobe & Storage, Dressers & Mirrors, Night Stands), By Distribution Channel, By Region, And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-713-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Consumer Goods

Report Overview

The global bedroom furniture market size was valued at USD 220.6 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 4.5% from 2020 to 2027. Shifting consumer preference towards high-end furniture products owing to technological advancements in the home furnishing industry is a key factor driving the market for bedroom furniture. In addition, the prevalence of the mini-housing boom across the globe is paving way for greater demand for bedroom furniture. Increasing per capita income of consumers, particularly in the developing nations, easy access to digital tools, and adoption of newer lifestyle trends, have revamped the traditional households into modern luxury residential dwellings.

Increased attention towards gaining trending bedroom styles has influenced major bedroom renovation projects inducing minimalist appeal for the serene and calming environment of bedrooms with functional furniture. For instance, the Culla Collection by Article, a Canada-based furniture company, offers a single-drawer nightstand, bed frame, and three-drawer dresser, which is made from veneered American white oak. In addition, the rising adoption of four-poster beds as a need to accommodate bigger mattresses is gaining traction in the market. These modern four-poster beds also feature a clean and simple style, which stands out without overwhelming the space.

According to the American Housing Survey by the Harvard Joint Center for Housing Studies, the home improvement industry size was valued at USD 383.3 billion in 2017. Moreover, the increasing wave of millennials buying homes, particularly older homes, which require more refurbishment, is boosting the market growth. According to studies by HomeAdvisor, millennials are investing in a greater number of home improvement projects each year compared to other age groups.

Increased splurge on real estate investment is helping drive the furniture industry, thereby increasing demand for bedroom furniture. According to the Global Real Estate report published by HSBC, real estate was valued at USD 228 trillion in 2016, which grew by 5% from 2015. The growing need for new houses as a result of the growing population across regions is also expected to boost the market growth.

According to the National Association of Home Builders (NAHB), the number of single-family permits in the U.S. has increased by 8.4% in 2018. Thus, rising developments in the residential household category are expected to drive the need for residential furniture, thereby resulting in the rise in the demand for bedroom furniture.

Product Insights

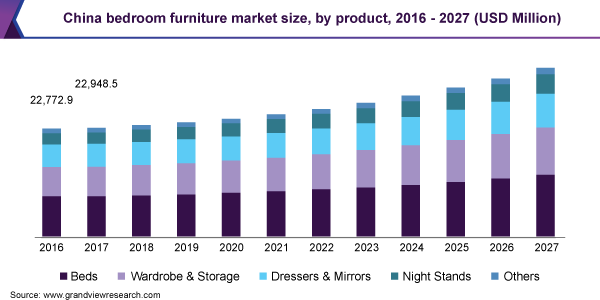

In terms of revenue, beds dominated the market with a share of 37.1% in 2019. This is attributed to the rising construction of residential households, along with rapid urbanization in developing nations, including India, China, and Brazil. Increasing support by the government of these countries is also boosting the growth of residential housing, thereby propelling demand for beds among bedroom furniture products. For instance, the government of India offers housing loans and reconstruction loans to the citizens at low-interest rates. In addition, government initiatives such as Pradhan Mantri Awas Yojana and National Urban Housing Fund to provide residential housing at an affordable rate in India are expected to drive the demand for bedroom furniture products over the forecast period.

Wardrobe and storage products are expected to expand at the fastest CAGR of 5.1% from 2020 to 2027. Increasing inclination toward the light, stylish, and comfortable walk-in closet designs or free-standing wardrobes has resulted in an important element of creating modern bedroom interiors. The growing trend of sliding wardrobes as a simple and stylish way of adding functional storage and maximizing the space of the closet has been increasing the demand for this bedroom furniture. A high preference for space-saving fixtures is drawing more attention to closet drawers, which are replacing bedroom dressers, thereby leaving more space in the bedroom. This scenario is likely to propel the demand for wardrobes and storage furniture over the forecast period.

Distribution Channel Insights

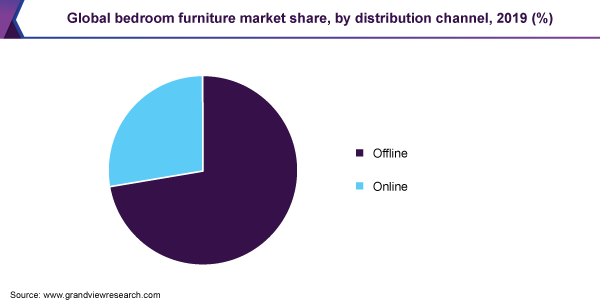

In terms of revenue, offline distribution channels dominated the market with a share of 72.5% in 2019. This is attributed to higher demand for household furniture in the industry as a result of rising in the real estate sector, which has drawn a demand for flexible and sustainable furniture. The dominance of retail stores has created intense competition in the market with major producers, such as Inter IKEA Systems B.V.; Williams-Sonoma Inc.; La-Z-Boy Incorporated; and Raymour & Flanigan Furniture, across the globe. These stores help consumers to visualize their home and set of furniture as a result of the home environment created in the store.

In addition, increasing focus by these furniture manufacturers on sustainability factors is helping draw the attention of consumers through proper product assortment in these stores. For instance, CRATE & BARREL provide FSC certified, reclaimed, and sustainable pieces of furniture produced with high-end designs. Moreover, the availability of the furniture segment in hypermarkets or supermarket stores has increased the sales of bedroom furniture from offline stores in the market.

The online distribution channel is expected to expand at the fastest CAGR of 4.7% from 2020 to 2027. This is attributed to the increasing number of companies catering to consumers via their respective website portals and third-party online retailers. Access to a large number of brands and their offerings, the ability to compare prices, and ease of availing discounts and coupons have popularized the online mode of purchasing bedroom furniture among consumers. An increasing number of online shoppers is likely to offer potential opportunities for furniture brands to cater to the large customer base.

For instance, the U.K. is emerging as a regional e-commerce center, which is driven by a large population and people with a high standard of living. With the rapid growth in retail e-commerce as compared to brick and mortar business models, companies are increasingly showcasing their bedroom furniture through online channels.

Regional Insights

Asia Pacific dominated the market for bedroom furniture with a share of 38.7% in 2019 and is anticipated to witness the fastest growth over the forecast period. This is attributed to the growing real estate sector in developing countries, such as China and India, which increases the consumers’ need to invest in furnishing activities and add an aesthetic look to the bedroom environment as a cause of remodeling. Moreover, an increasing share of millennials in the furniture market is bound to invest in various modern bedroom furniture products owing to customization and space-saving features. A large population in the region is boosting the real estate development, thereby increasing the adoption of various bedroom furniture, such as nightstands, dressers, and beds.

North America is expected to expand at a CAGR of 4.6% from 2020 to 2027. The steady growth of new furniture sales in regard to the rising development of residential construction in the U.S., Canada, and Mexico is generating greater demand for household bedroom furniture. According to the National Association of Realtors, existing-home sales growth is forecasted at 4% for the residential property market in 2018.

Moreover, the rising traction of sustainable furniture across U.S. households is projecting the growth of eco-friendly furniture products for bedrooms. According to the National Association of Home Builders, green residential construction for single-family has incurred a growth of 2% from 2005, to 23% in 2013. Therefore, consumers are highly focused on building a green environment inside their houses, thereby driving demand for sustainable bedroom furniture products.

Key Companies & Market Share Insights

The market has been characterized by intense competition. Companies are focusing on expanding their product lines and are adopting innovative technologies in order to meet consumer demand for custom furniture products. For instance, in August 2019, Malouf launched a new bedroom furniture line, including two complete designer beds, two headboards, and two bases available in five fabric options of five colors. Some of the prominent players in the bedroom furniture market include:

-

Bed Bath & Beyond Inc.

-

Williams-Sonoma, Inc.

-

Target Corporation

-

Wayfair Inc.

-

Home Depot, Inc.

-

Ashley Furniture Industries, Inc.

-

Heritage Home Group

-

La-Z-Boy

-

Mattress Firm Inc.

-

Herman Miller, Inc.

Bedroom Furniture Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 226.6 billion

Revenue forecast in 2027

USD 313.6 billion

Growth Rate

CAGR of 4.5% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; U.K.; Germany; China; India; Brazil

Key companies profiled

Bed Bath & Beyond Inc.; Williams-Sonoma, Inc.; Target Corporation; Wayfair Inc.; Home Depot, Inc.; Ashley Furniture Industries, Inc.; Heritage Home Group; La-Z-Boy; Mattress Firm Inc.; Herman Miller, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global bedroom furniture market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2027)

-

Beds

-

Wardrobe & Storage

-

Dressers & Mirrors

-

Night Stands

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global bedroom furniture market size was estimated at USD 220.64 billion in 2019 and is expected to reach USD 226.56 billion in 2020.

b. The global bedroom furniture market is expected to grow at a compound annual growth rate of 4.5% from 2020 to 2027 to reach USD 313.58 billion by 2027.

b. Asia Pacific dominated the bedroom furniture market with a share of 38.7% in 2019. This is attributable to growing real estate sector in developing countries such as China and India increases the consumers’ need to invest in furnishing activities.

b. Some key players operating in the bedroom furniture market include Bed Bath & Beyond Inc., Williams-Sonoma, Inc., Target Corporation, Wayfair Inc., Home Depot, Inc., Ashley Furniture Industries, Inc., Heritage Home Group, La-Z-Boy, Mattress Firm Inc., and Herman Miller, Inc.

b. Key factors that are driving the market growth include shifting consumer preference towards high end furniture products owing to technological advancements in the home furnishing industry is a key driving factor for the bedroom furniture market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."