- Home

- »

- Homecare & Decor

- »

-

Bedroom Linen Market Size & Share, Industry Report, 2030GVR Report cover

![Bedroom Linen Market Size, Share & Trends Report]()

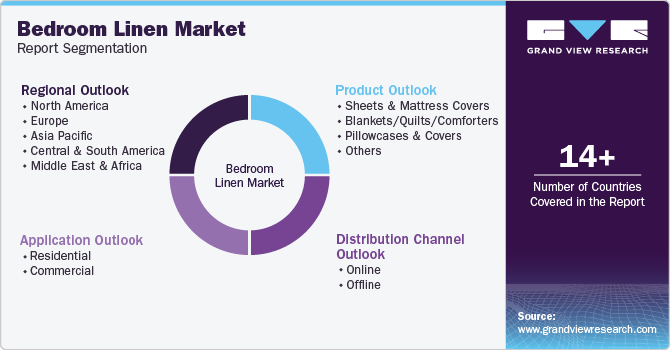

Bedroom Linen Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Sheets & Mattress Covers, Blankets, Pillowcases & Covers), By Application (Residential, Commercial), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-018-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bedroom Linen Market Summary

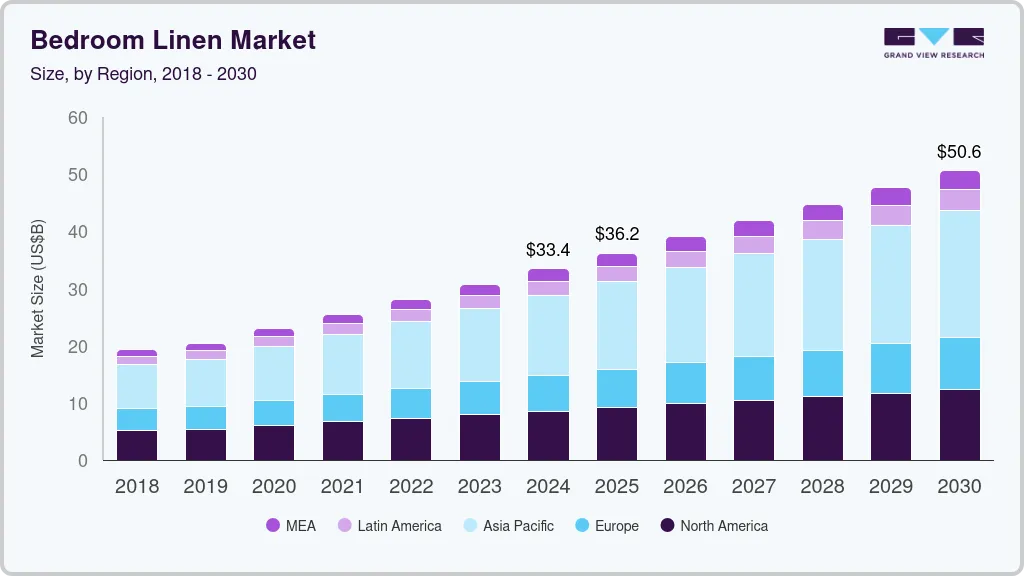

The global bedroom linen market size was estimated at USD 33.42 billion in 2024 and is projected to reach USD 50.56 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. The increasing interest in home décor and renovation projects has significantly boosted demand for bedroom linens as consumers seek to refresh or update their bedroom aesthetics.

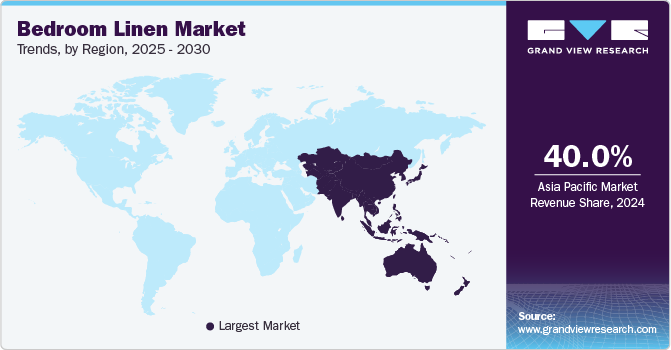

- The Asia Pacific bedroom linen market accounted for revenue share of around 40% of global revenue in 2024.

- By product, sheets & mattress covers accounted for a market share of around 43% in 2024.

- By application, commercial application accounted for a share of around 52% in 2024.

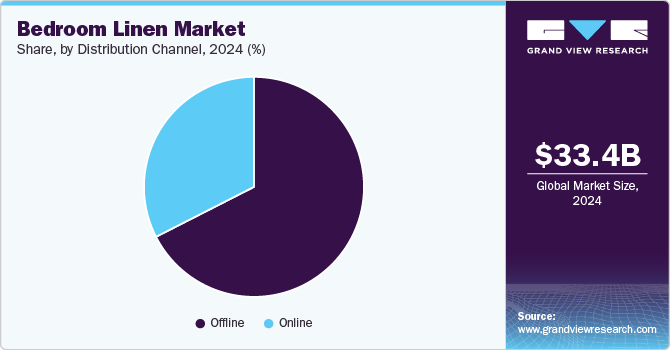

- By distribution channel, Offline sales accounted for a market share of around 67% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 33.42 Billion

- 2030 Projected Market Size: USD 50.56 Billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2022

As more people invest in creating personalized, stylish, and comfortable living spaces, bedroom linens such as sheets, comforters, pillowcases, and duvet covers have become essential elements of interior design. Homeowners are looking for linens that not only complement their décor but also enhance the overall ambiance of their bedrooms. This trend has led to a higher preference for bedding in various colors, patterns, and textures that align with current design trends, such as minimalist, modern, or bohemian styles.The growing hospitality sector, including hotels, resorts, and vacation rentals, has a substantial impact on the demand for bedroom linens, as these establishments prioritize providing guests with a comfortable and luxurious experience. For instance, according to Lodging Econometrics, in 2024, in the U.S., there are around 6,065 hotels under construction, 2,041 hotels for renovations, and around 661 hotels will open by the end of 2024. As the competition in the hospitality industry intensifies, hotels and resorts are increasingly investing in high-quality, durable, and stylish bed linens to enhance their guest experience and meet rising customer expectations. The need for frequent linen replacements due to high usage, along with the desire to maintain high standards of cleanliness and hygiene, further drives demand.

Consumers are increasingly prioritizing comfort and quality when it comes to bedroom linens, leading to a growing preference for high-quality fabrics such as cotton, linen, and silk, which are considered essential for a restful night's sleep. This shift is also driven by a heightened awareness of health and hygiene, as people recognize the importance of maintaining clean and fresh bedding. As a result, there is a rising demand for bed linens that not only offer superior comfort but are also easy to care for, antimicrobial, and durable. These fabrics contribute to better sleep quality while addressing hygiene concerns, with consumers seeking bedding that promotes both comfort and cleanliness.

Key players in the bedroom linen industry are constantly innovating to meet evolving consumer preferences for comfort, style, and sustainability. Many brands are introducing advanced fabrics, such as temperature-regulating linens that adapt to body heat for a more comfortable sleep, and moisture-wicking materials that keep the bed dry throughout the night. In addition, eco-conscious innovations have led to the development of organic, sustainable bedding made from materials such as organic cotton, bamboo, and hemp, appealing to environmentally aware consumers. Customization options are also growing, with companies offering personalized linens, including monogrammed pillowcases and duvet covers, allowing customers to create unique, tailored bedroom aesthetics. Furthermore, advancements in antimicrobial treatments and allergen-free fabrics are addressing health-conscious consumers' demand for hygienic and hypoallergenic bedding. These innovations are enhancing the overall value proposition of bedroom linens, driving consumer interest and market growth.

Product Insights

Sheets & mattress covers accounted for a market share of around 43% in 2024. Sheets are a fundamental part of daily sleep routines, and consumers prioritize materials that offer softness, breathability, and durability, such as cotton, linen, and bamboo. The growing demand for hypoallergenic and moisture-wicking fabrics has also contributed to their popularity, as consumers seek products that promote a healthy and comfortable sleep environment. Mattress covers, on the other hand, are increasingly sought after for their protective qualities, helping to extend the lifespan of mattresses by guarding against spills, allergens, dust mites, and stains. As consumers become more aware of the impact of sleep on overall well-being, the demand for high-quality, functional, and comfortable sheets and mattress covers continues to rise, with many opting for eco-friendly, sustainable options to align with growing environmental concerns.

The demand for blankets/quilts/comforters is expected to grow at CAGR of 7.6 % from 2025 to 2030. The rise in awareness about the importance of sleep quality has contributed to the demand for premium comforters and blankets made from natural materials such as down, wool, and cotton, as well as hypoallergenic options for sensitive sleepers. According to Sleephealth.org, more than half (55%) of Americans view getting a good night's sleep as a top priority. In addition, the expanding trend of home décor personalization has led to a wider variety of designs, colors, and patterns being offered to match different interior themes, favoring the market growth.

Application Insights

Commercial application accounted for a share of around 52% in 2024. Premium bed linens, including sheets, comforters, duvets, and pillowcases, are essential in maintaining luxury standards and contributing to a comfortable and restful stay. The demand for commercial-grade bedroom linens has risen as establishments recognize the importance of offering superior comfort to attract and retain customers, with many opting for linens made from high-thread-count cotton, bamboo, and other soft, breathable materials. In addition to the hospitality sector, other commercial establishments such as hospitals, nursing homes, and spas also rely on high-quality bedroom linen for patient care, wellness services, and overall comfort. The growing focus on sustainability has also influenced commercial purchases, with eco-conscious businesses opting for organic or environmentally friendly bedding options to align with green initiatives.

The demand for bedroom linen in residential application is expected to grow at CAGR of 7.3% from 2025 to 2030. Consumers are investing more in high-quality bedding materials such as cotton, linen, and bamboo to enhance their sleep experience and create cozy, stylish bedroom environments. The demand for products such as luxury sheets, comforters, duvet covers, and pillowcases has surged as people seek to elevate their living spaces with comfortable, durable, and visually appealing items. In addition, the rise in home renovation trends and greater awareness of the importance of quality sleep has fueled this demand. Spending on home improvements and maintenance is projected to rise from USD 472 billion USD USD 477 billion by the third quarter in 2024, reflecting a modest increase of 1.2%, according to the latest Leading Indicator of Remodeling Activity report from the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University.

Distribution Channel Insights

Offline sales accounted for a market share of around 67% in 2024. Traditional brick-and-mortar stores such as department stores, home goods retailers, and specialty bedding shops remain popular destinations for customers who prefer a hands-on shopping experience. In addition, these stores often provide personalized customer service, allowing shoppers to receive expert advice on fabric types, care instructions, and product recommendations. The ability to immediately take home products without waiting for delivery also adds to the appeal of offline shopping. Major retailers such as Bed Bath & Beyond, Macy's, and Target continue to be key players in the offline bedroom linen industry, offering an extensive range of products that cater to diverse consumer needs across various price points.

Bedroom linen online sales is expected to grow at a CAGR of 7.9% from 2025 to 2030. The growing sales of bedroom linen through online platforms is a significant trend reshaping the market, driven by the increasing preference for the convenience of e-commerce and the ability to access a wide variety of products from the comfort of home. Consumers are attracted by the ease of browsing extensive collections, reading customer reviews, and comparing prices across different brands without visiting physical stores. For instance, according to the Provoke Fall 2024/ Winter 2025 Survey, conducted in collaboration with Furniture Today in 2024, the primary reasons for purchasing online include better prices (27%), free delivery (25%), a broader selection of products (19%), and a quicker shopping experience (16%). In addition, online platforms offer personalized shopping experiences, allowing customers to select bedding based on their specific preferences for material, design, size, and even eco-friendliness.

Regional Insights

The North America bedroom linen market accounted for a market share of around 28% in 2024 in the global market. Consumers in the U.S. and Canada are investing more in high-quality bedding products such as sheets, comforters, duvets, and pillowcases, with a growing preference for premium materials such as Egyptian cotton, linen, and bamboo. The demand for innovative features, including temperature-regulating, hypoallergenic, and moisture-wicking fabrics, is on the rise, particularly as more consumers prioritize sleep quality and overall well-being. Sustainability has become a key trend, with eco-friendly, organic, and sustainably sourced bedding gaining popularity among environmentally conscious buyers. The market is further boosted by a strong inclination toward home improvement and interior design, leading to a vibrant and competitive landscape in the North American bedroom linen sector.

U.S. Bedroom Linen Market Trends

The U.S. bedroom linen market accounted for a market share of around 60% in 2024 in the North American market. Consumers are seeking a diverse range of bedding options, from affordable sheets and comforters to luxurious, high-end linens crafted from premium materials such as Egyptian cotton, silk, and linen. Innovations in fabric technologies, such as temperature-regulating, hypoallergenic, and moisture-wicking fabrics, are also gaining popularity. Major brands in the U.S. bedroom linen market include Bed Bath & Beyond, Target, Macy's, Brooklinen, and Parachute, all of which offer a wide variety of products that cater to different consumer needs and price points.

Asia Pacific Bedroom Linen Market Trends

The Asia Pacific bedroom linen market accounted for revenue share of around 40% of global revenue in 2024. The region is home to major textile manufacturing hubs such as China, India, and Pakistan, which contribute significantly to the production and supply of bedroom linens, making it a key player in both domestic and global markets. In addition, the expanding middle class in countries such as China and India is leading to higher demand for quality home textiles, including premium bedding sets, sheets, and pillowcases. Consumer preferences in the region are shifting toward modern and innovative designs, with an increasing focus on eco-friendly and sustainable materials, such as organic cotton and bamboo. The rise of e-commerce and digital shopping platforms further enhances accessibility, allowing consumers across the region to easily access a wide range of bedroom linen option, favoring the bedroom linen industry growth.

Europe Bedroom Linen Market Trends

The Europe bedroom linen market is expected to grow a CAGR of 7.2% from 2025 to 2030. The market is characterized by a wide variety of offerings, ranging from premium luxury linens made of Egyptian cotton and linen to more affordable yet durable options made of microfiber and cotton blends. Leading brands such as IKEA, H&M Home, Zara Home, and John Lewis dominate the European market by offering diverse collections that cater to different consumer preferences in terms of design, material, and price. The growing trend towards sustainability has led to a rise in eco-friendly and organic bedding options, with consumers increasingly opting for linens made from organic cotton, bamboo, and recycled materials. The European bedroom linen industry is also benefiting from innovations in fabric technologies, including the development of moisture-wicking temperature-regulating, and hypoallergenic bedding, appealing to consumers seeking both comfort and functionality.

Key Bedroom Linen Company Insights

The competitive landscape in the bedroom linen market is characterized by the presence of both well-established global brands and local manufacturers, each vying for market share by offering a wide range of high-quality products such as bed sheets, comforters, pillowcases, and duvet covers. Leading players such as Bed Bath & Beyond, IKEA, and Tempur Sealy International, Inc. dominate the market with a broad selection of designs, materials, and price points to cater to varying consumer preferences. In addition, luxury bedding brands target the high-end segment with premium products made from high-quality materials such as Egyptian cotton, silk, and linen. The market is also witnessing the rise of sustainable and eco-conscious brands, such as Boll & Branch and Parachute, which emphasize the use of organic and ethically sourced materials. As a result, innovation in fabric quality, design, sustainability, and customer experience plays a critical role in shaping the competitive dynamics of the bedroom linen market.

Key Bedroom Linen Companies:

The following are the leading companies in the bedroom linen market. These companies collectively hold the largest market share and dictate industry trends.

- Serta Simmons Bedding, LLC

- Bed Bath & Beyond Inc.

- Tempur Sealy International, Inc.

- Pacific Coast Feather Company

- Acton & Acton Ltd.

- Beaumont & Brown Ltd.

- Boll & Branch LLC

- Crane and Canopy Inc.

- American Textile Co.

- Trident Ltd.

Recent Developments

-

In October 2024, Serta Simmons Bedding has introduced its all-new Tuft & Needle mattress collection, aimed at offering a premium sleep experience with innovative design and enhanced comfort. The collection is designed to meet the needs of a diverse range of customers by combining cutting-edge technology with high-quality materials, ensuring durability and support. With a focus on affordability, simplicity, and convenience, the Tuft & Needle mattresses are set to compete in the growing direct-to-consumer market, making luxury sleep products more accessible. The launch reflects Serta Simmons' continued commitment to expanding its portfolio and providing customers with top-notch sleep solutions that align with evolving preferences for comfort, quality, and value.

-

In September 2024, Bed Bath & Beyond Inc. has launched a global licensing program, beginning with its renowned Bed Bath & Beyond brand, marking a significant expansion of its retail presence worldwide. This initiative aims to leverage the brand's strong recognition and customer loyalty to create new product categories and partnerships in various regions. Through the licensing program, Beyond Inc. intends to collaborate with global manufacturers and retailers to offer Bed Bath & Beyond-branded products in key international markets, extending its reach beyond traditional retail channels. The move is expected to strengthen the brand’s position in the home goods market, tapping into new opportunities and enhancing its growth in the global marketplace.

Bedroom Linen Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 36.17 billion

Revenue forecast in 2030

USD 50.56 billion

Growth rate (Revenue)

CAGR of 6.9% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region.

Regional scope

North America; Europe; Asia Pacific; Central & South America; & Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Brazil; and South Africa

Key companies profiled

Serta Simmons Bedding, LLC; Bed Bath & Beyond Inc.; Tempur Sealy International, Inc.; Pacific Coast Feather Company; Acton & Acton Ltd.; Beaumont & Brown Ltd.; Boll & Branch LLC; Crane and Canopy Inc.; American Textile Co.; Trident Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bedroom Linen Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the bedroom linen market report on the basis of product, application, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sheets & Mattress Covers

-

Blankets/Quilts/Comforters

-

Pillowcases & Covers

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bedroom linen market was estimated at USD 33.42 billion in 2024 and is expected to reach USD 36.17 billion in 2024.

b. The global bedroom linen market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 50.56 billion by 2030.

b. Asia Pacific region dominated the bedroom linen market with a share of around 38% in 2024. This is owing to the booming hospitality and housing sector in this regional market.

b. Some key players operating in the bedroom linen market include Serta Simmons Bedding, LLC; Bed Bath & Beyond Inc.; Tempur Sealy International, Inc; Pacific Coast Feather Company; Acton & Acton Ltd; Beaumont & Brown Ltd; Boll & Branch LLC; Crane and Canopy Inc.; American Textile Co; Trident Limited

b. Key factors that are driving the bedroom linen market growth include the boom in housing, as well as the hospitality sector, is a major factor contributing to the growth of this market. Moreover, the growing inclination towards spending on home furnishing products is also a reason propelling this market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.