- Home

- »

- Alcohol & Tobacco

- »

-

Beer Market Size, Share And Trends, Industry Report, 2030GVR Report cover

![Beer Market Size, Share & Trends Report]()

Beer Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ale, Lager, Stout), By Packaging, By Production, By Distribution Channel (On-Trade, Off-Trade), By Region, And Segment Forecasts

- Report ID: 978-1-68038-663-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Beer Market Summary

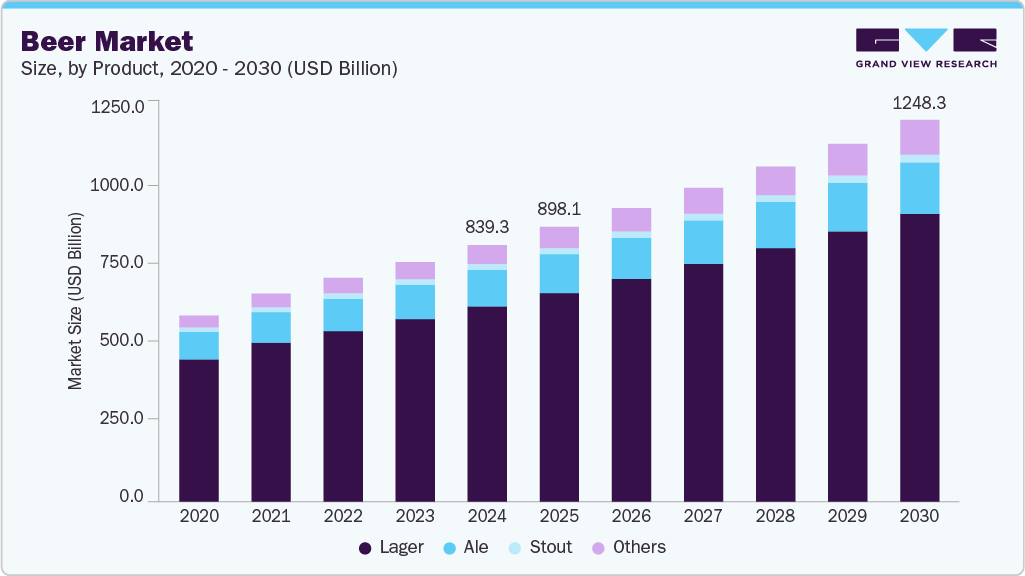

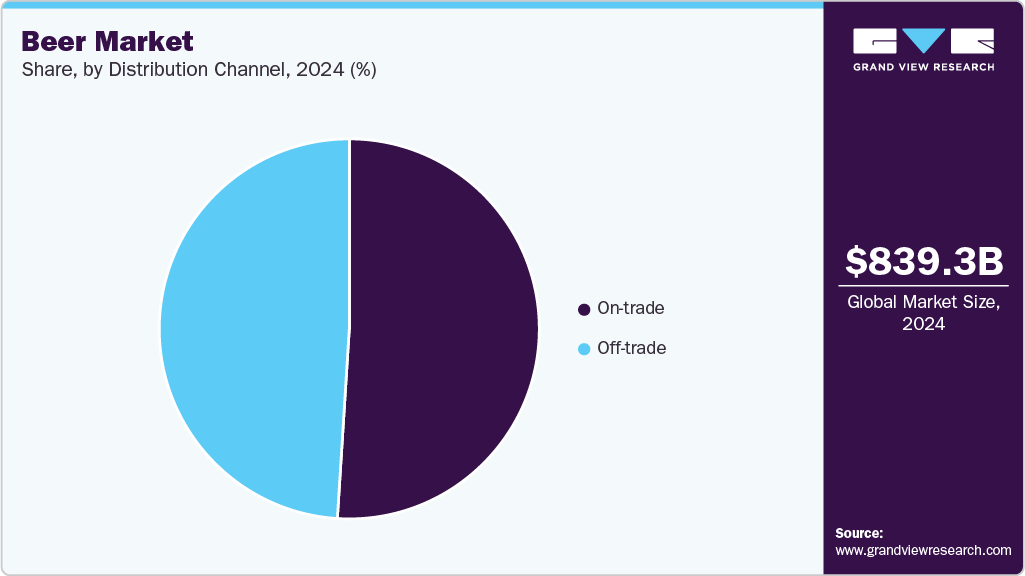

The global beer market size was estimated at USD 839.31 billion in 2024 and is projected to reach USD 1,248.3 billion by 2030, growing at a CAGR of 6.8% from 2025 to 2030. Beer consumption patterns have shifted dramatically, with declining consumption in traditional drinking countries and high gains in emerging markets and places where wine and spirits were traditionally consumed.

Key Market Trends & Insights

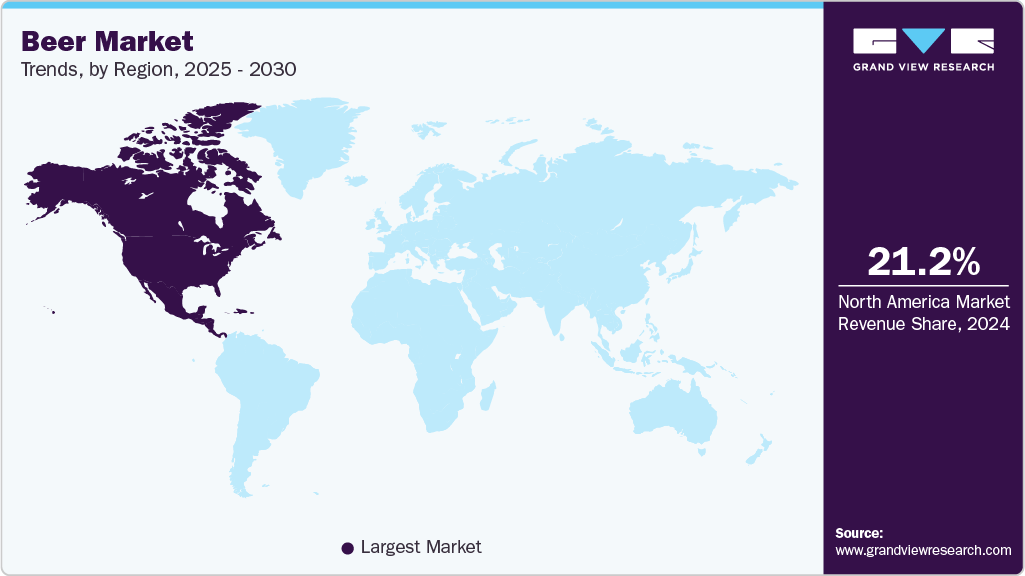

- The North America beer market accounted for a revenue share of 21.2% in 2024.

- The beer market in the U.S. is expected to grow at a CAGR of 6.6% from 2025 to 2030.

- By product, lager beer segment accounted for a revenue share of 76.1% in 2024.

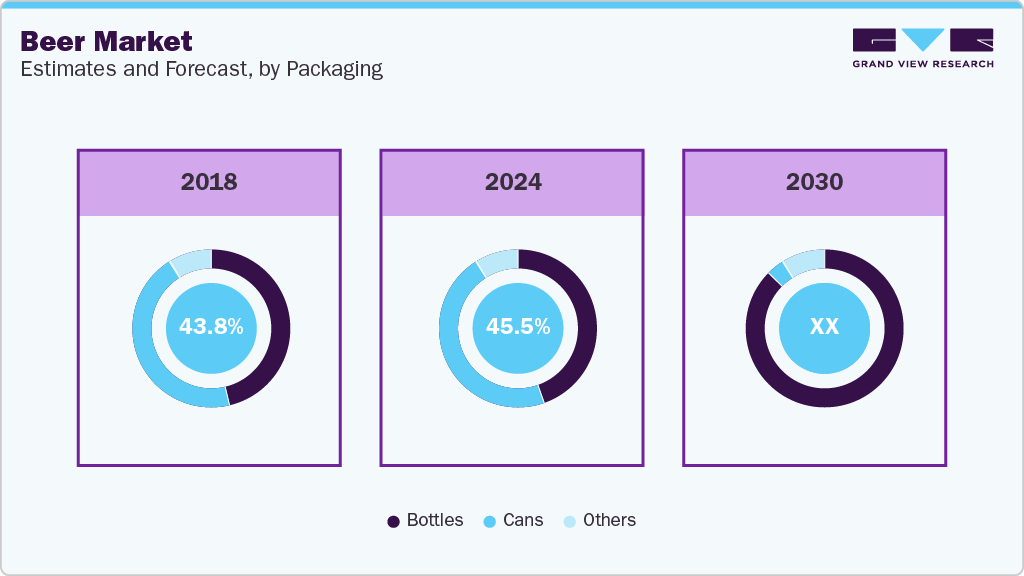

- By packaging, bottled beer segment accounted for a revenue share of 45.7% in 2024.

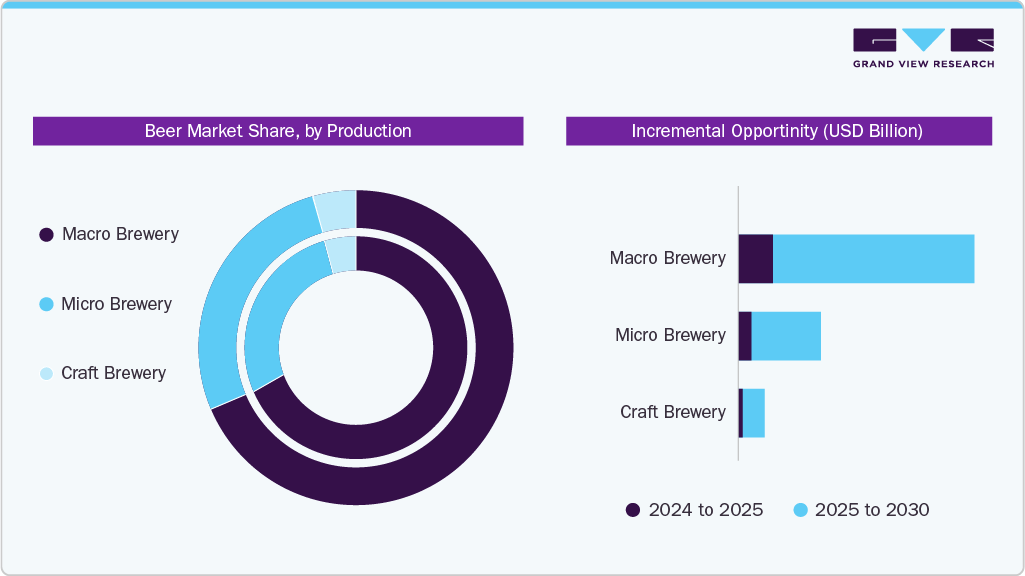

- By production, macro brewery segment accounted for a revenue share of 67.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 839.31 Billion

- 2030 Projected Market Size: USD 1,248.3 Billion

- CAGR (2025-2030): 6.8%

- North America: Largest market in 2024

These changes have resulted in the convergence of global alcoholic beverage consumption habits and a rapid rise in beer sales. Consumers’ lifestyles, notably drinking habits, changed as a result of the COVID-19 pandemic and the subsequent lockdowns. The lockdowns negatively impacted alcohol sales at bars, pubs, restaurants, and nightclubs. However, at-home alcohol consumption grew, and sales in retail and online stores increased significantly. Breweries are well-known for their experimental and innovative brewing methods. They consistently push the limits of brewing ingredients, methods, and styles, developing exciting new flavors that capture the interest of beer enthusiasts. Furthermore, small-scale production settings such as microbreweries have enabled draught beer brewers to adapt quickly to shifting consumer tastes. These allow companies to brew seasonal or limited-edition beers that help spark interest and increase demand.

The industry is seeing an enormous surge in demand for craft beer. Young drinkers prefer craft beer as it offers a variety of styles and taste profiles. Artisanal beer is becoming increasingly popular. Craft breweries are known for their frequent experimentation with different ingredients to give a distinct flavor. For example, Miami Brewing Company makes unique brews with exotic tropical fruits found in South Florida and the Redlands.

Growing beverage consumption has sparked fierce competition among beer brands, creating new flavors and increased consumption. Craft beers are gaining popularity because they offer a variety of flavors in addition to those given by macro breweries. Craft beers with unique ingredients and innovative flavors that combine salty, fruity, and tart flavors are gaining popularity among millennials worldwide. Some large brewers are also taking action in response to shifting customer needs.

Additionally, increased availability and improved distribution channels are making beer more accessible than ever. Supermarkets, online retailers, and specialty beer shops are expanding their selections through beer clubs and e-commerce platforms. This enhanced accessibility, combined with growing familiarity, encourages more consumers to switch.

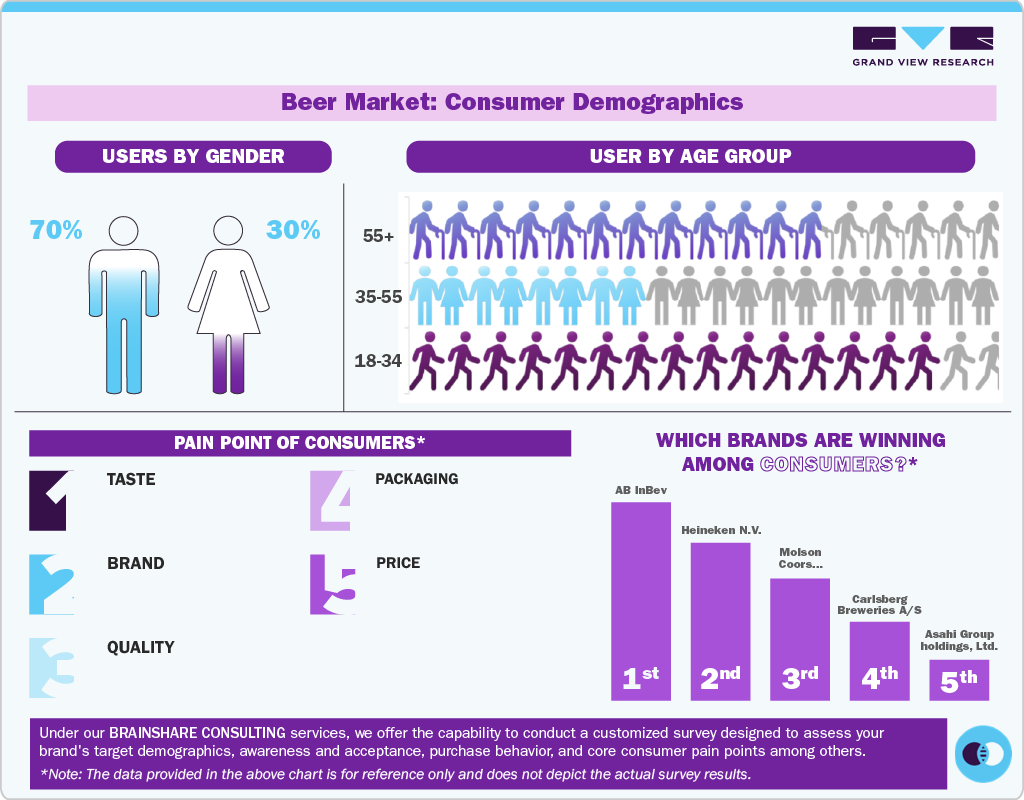

Consumer Insights

The global beer market presents a spectrum of opportunities across various sectors, driven by shifting consumer preferences, technological advancements, and evolving regulatory landscapes. One prominent avenue lies in craft beer production, which has witnessed exponential growth in recent years. Craft breweries, characterized by their emphasis on quality, flavor innovation, and local sourcing, continue to capture a significant market share. This segment offers opportunities not only for brewers but also for suppliers of specialized ingredients, equipment manufacturers, and distributors catering to the unique needs of craft brewers.

Breweries prioritize flavor and quality of beer. They usually use premium ingredients and conventional brewing techniques, which produce distinctive and varied flavor profiles. The emphasis on quality and diversity has resulted in customers seeking alternatives to standardized, mass-produced beers. Breweries also prioritize high-quality and innovative recipe development. They aim to offer innovative beer offerings and attract a wide range of consumers.

The increased demand for locally produced beer has led to the subsequent expansion of breweries. The major focus of the breweries is to target local communities. They offer a sense of connection and authenticity to the region in which the brewery operates and draught beer is produced. Customers who value the beer's history and connection to the community will find resonance in this focus on regional identity and culture. Local breweries have elevated the culture of beer consumption and understanding while also broadening the range for potential customers.

In recent years, the beer market has witnessed a notable shift in consumer trends and preferences, influenced by various factors ranging from health consciousness to cultural shifts. One significant trend is the rising demand for craft beer. Consumers are increasingly drawn to unique, artisanal brews that offer diverse flavors and higher quality ingredients compared to mass-produced alternatives. Craft breweries have capitalized on this demand by experimenting with innovative recipes and brewing techniques, appealing to a more discerning consumer base that values authenticity and craftsmanship.

According to the same article, there is a growing preference for local beers, as consumers seek out unique, regional offerings. Breweries are also adopting digital marketing strategies to reach these consumers and build brand loyalty. The craft beer movement continues to gain momentum, with premiumization reshaping the industry. Consumers are willing to pay more for high-quality, artisanal beers that offer unique flavors and experiences. Cold IPAs remain in high demand.

Moreover, beer manufacturers have recognized the potential of music festivals as a lucrative marketing opportunity. Many beer companies sponsor festivals, allowing them to showcase their products through branded bars and experiential marketing activities. These initiatives increase brand visibility and create memorable experiences for attendees, associating beer with positive emotions and enjoyment.

The beer market presents opportunities for diversification beyond traditional brewing. Collaborations with other industries, such as food, hospitality, and entertainment, can create unique experiences for consumers and expand revenue streams. Brewpubs, taprooms, and beer tourism are thriving sectors that capitalize on experiential consumption, offering consumers a chance to engage with the brewing process firsthand and savor unique brews in immersive environments.

Product Insights

Lager beer accounted for a revenue share of 76.1% in 2024. The demand for lager beer is increasing due to its light, crisp taste and lower alcohol content, which appeal to a broad range of consumers, including younger drinkers and those seeking more sessionable options. Its refreshing profile makes it ideal for social settings and casual occasions, driving popularity across global markets. Additionally, the rise of craft breweries producing innovative lager styles and the growing preference for milder, easy-to-drink beverages have further fueled its demand.

Ale beer is expected to grow at a CAGR of 5.8% from 2025 to 2030. There has been a noticeable shift in consumer preferences toward craft and artisanal beverages, including ale beers. Ale beers offer a wide range of flavors, including malty, fruity, and hoppy profiles. The complexity and depth of flavors attract beer enthusiasts who appreciate different taste experiences. Consumers increasingly seek unique and flavorful options, which has led to a rise in demand for specialty and craft ales. In March 2024, Bell's Brewery introduced its seasonal beer, Oberon Ale, a wheat ale known for its appealing 5.8% ABV and citrusy, velvety taste. This beer has gained significant popularity and attracts numerous fans to Kalamazoo, Michigan, every year for its release celebration on Oberon Day.

Packaging Insights

Bottled beer accounted for a revenue share of 45.7% in 2024. Consumer preference plays a key role in driving the choice of packaging material for beer. Many consumers prefer the traditional feel and experience of drinking beer from glass bottles, contributing to their continued popularity in the market. In August 2021, Beer Alien conducted a taste test where 151 participants tasted beer and completed a questionnaire. The participants knew whether the beer was packaged in bottles or cans. According to the results, 61.29% of the participants preferred beer from a bottle, 11.29% from a can, and 27.42% thought both tasted the same. These results suggest that the bottled or canned beer packaging played a significant role in the participants' preferences. It appears that beer drinkers have a preconceived preference for beer packaging types.

The canned beer market is expected to grow at a CAGR of 7.2% from 2025 to 2030. Consumer preferences play a crucial role in driving the packaging choices made by breweries. The shift toward cans can be attributed to changing consumer preferences, with many beer drinkers prefer canned beer over other packaging options. Cans are often perceived as more convenient, portable, and easier to recycle than glass bottles. In March 2024, Lone Wolf introduced two of its drinks, Lone Wolf Alpha and Lone Wolf Mavrick, in cans. The company believes that cans enhance the taste of the beverage and maintain carbonation better than bottles, thus improving the overall drinking experience.

Production Insights

Macro brewery accounted for a revenue share of 67.2% in 2024. Macro breweries cater to a wide consumer base globally, producing beers that are generally more uniform in flavor profile and consistent in quality. This mass-production approach allows them to meet the high demand for beer across various markets. Anheuser-Busch InBev is one of the largest and most well-known macro breweries with a significant international presence. It is a multinational beer and brewing holdings company based in Leuven, Belgium. The company owns a portfolio of well-known beer brands, such as Budweiser, Stella Artois, and Corona.

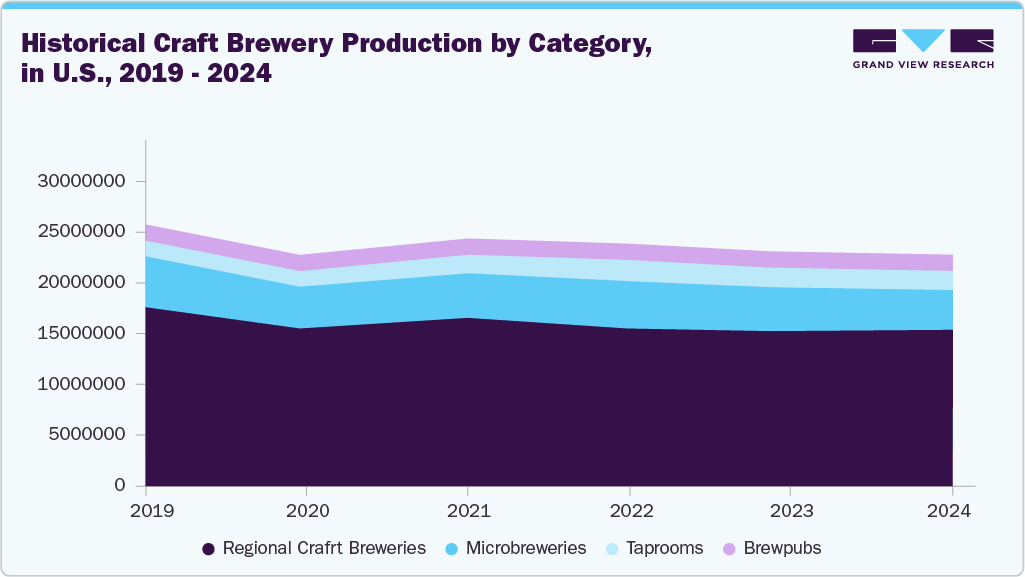

The craft brewery market is expected to grow at a CAGR of 8.2% from 2025 to 2030. Craft breweries have become destinations for both locals and tourists seeking unique experiences. The rise of beer tourism, including brewery tours, tastings, and beer festivals, has contributed to the growth of the sector. Visitors not only get to enjoy the beer but also learn about the brewing process, meet the brewers, and experience the culture of the area. Moreover, craft breweries prioritize consumer engagement through taprooms, events, and social media interactions. This direct interaction with consumers helps build a loyal customer base that values the authenticity and artistry behind craft beer production.

Distribution Channel Insights

Sales of beer through on-trade channels accounted for a revenue share of 50.9% in 2024. The on-trade distribution channel includes bars, clubs, restaurants, hotels, and wineries. Consumers often seek unique and diverse beer options when they visit bars, restaurants, or pubs, leading to a demand for a variety of craft beers and specialty brews in on-trade establishments. Furthermore, on-trade locations provide consumers with an experience beyond just the beverage itself. Factors such as ambiance, social interactions, and food pairings contribute to the appeal of on-trade channels for beer consumption. Many on-trade establishments emphasize local or regional beer offerings to support small breweries and encourage consumers to experience unique flavors specific to certain areas. This is anticipated to boost the growth of this distribution channel.

Sales of beer through off-trade channels are expected to grow with a CAGR of 5.8% from 2025 to 2030. The growing popularity of craft beers has led to an increase in demand for these products through off-trade channels. Specialty beer shops catering to this trend offer a wide range of craft beers that are not readily available in supermarkets or other general retail stores. This niche market segment has created opportunities for both independent retailers and larger chains looking to expand their product offerings in response to evolving consumer preferences.

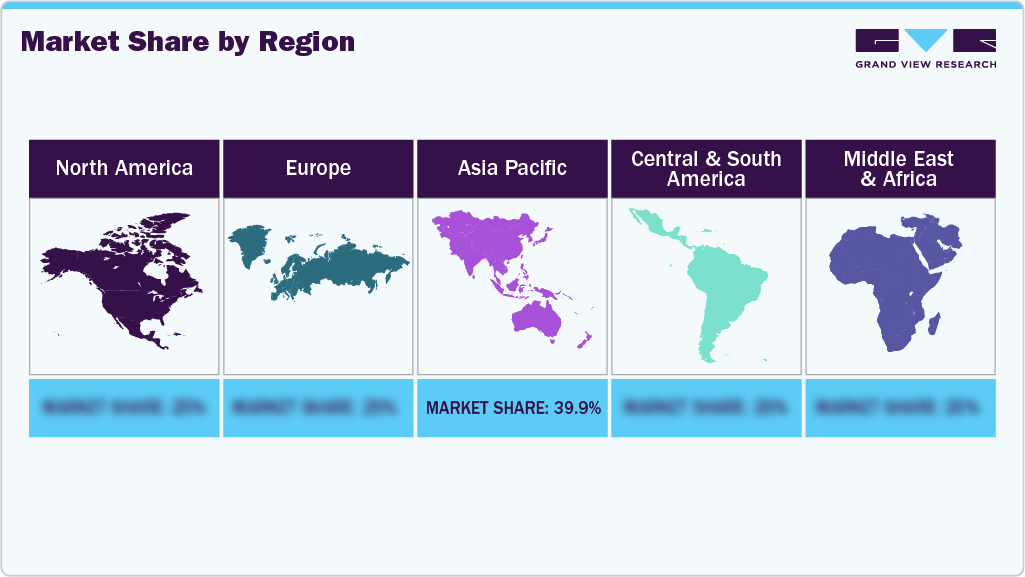

Regional Insights

The North America beer market accounted for a revenue share of 21.2% in 2024. The beer market among Americans. is growing due to a strong craft beer culture, increasing demand for premium and flavored brews, and evolving consumer tastes. Americans prefer unique, small-batch, and locally brewed beers that offer distinct flavors and quality. Health-conscious trends have also driven interest in low-alcohol and organic beer options. Additionally, beer remains a popular choice for social gatherings and sporting events, sustaining its broad appeal across demographics.

U.S. Beer Market Trends

The beer market in the U.S. is expected to grow at a CAGR of 6.6% from 2025 to 2030. The beer market in the U.S. has been experiencing significant growth, with a surge in the number of craft breweries entering the market. This trend is driven by the market’s promising growth potential and consumer readiness to explore new and distinctive beer varieties. Two leading states in this regard are California and Colorado, which host a substantial number of craft breweries within their borders. According to the California Craft Brewers Association, as of January 2024, California leads the nation with over 1,100 operational craft breweries, surpassing all other states in brewery numbers.

Asia Pacific Beer Market Trends

The Asia Pacific beer market is expected to grow at a CAGR of 7.1% from 2025 to 2030. The significant changes in the social lifestyle of the working population have played a major role in driving the growth of the beer market in Asia Pacific. As disposable incomes rise, there is a higher demand for premium and expensive beers among consumers. This shift has led to an increased interest in beers, with social media, regional events, and advertising campaigns contributing to its rising demand.

The beer market in China is expected to grow at a CAGR of 6.4% from 2025 to 2030. The market is increasing due to rising disposable incomes, urbanization, and shifting consumer preferences toward premium and craft beer options. Younger consumers are driving demand for diverse flavors and higher-quality brews, while international brands and local craft breweries are expanding their presence. Additionally, beer is increasingly associated with socializing and modern lifestyles, further boosting its popularity across urban centers in China.

Europe Beer Market Trends

The Europe beer market is expected to grow at a CAGR of 6.7% from 2025 to 2030.A key driver of the European beer market is the rise in new product offerings by beer brands. Introducing innovative products such as flavored and crafted beers has attracted consumers looking for unique drinking experiences. Breweries are constantly developing new flavors and styles to cater to diverse tastes. For instance, in March 2024, Krombacher Brewery, a prominent brewing group in Germany, announced that it would roll out its Starnberger Hell beer across various European countries and regions. This specialty beer, crafted in the authentic Bavarian lager style, is set to be launched in countries like France, Italy, the UK, and South-East Europe.

The beer products market in Germany is expected to grow at a CAGR of 5.3% from 2025 to 2030. Germany has a diverse brewery landscape with a wide range of breweries producing various beer styles. From traditional family-owned breweries to large-scale commercial operations, the variety of offerings caters to different consumer preferences and contributes to the overall growth of the market. Moreover, in recent years, there has been a rise in craft breweries and innovative beer styles in Germany. This trend appeals to consumers looking for unique flavors and experiences beyond traditional brews, driving competition and creativity within the market. In March 2023, a German brewery, Neuzeller Klosterbrau, introduced the world’s first instant beer powder. This innovative product offers a convenient and portable way to enjoy beer without needing traditional liquid form.

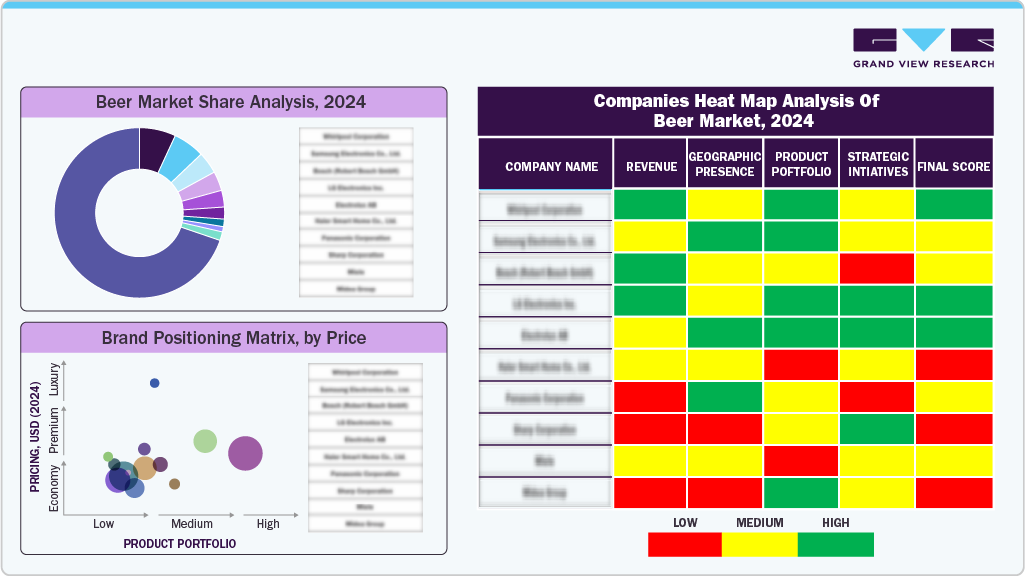

Key Beer Company Insights

The beer market is characterized by the presence of several key companies with well-established brand recognition and extensive distribution networks.

Leading players have developed broad product portfolios and achieved significant penetration across mainstream retail channels. These companies continuously introduce new flavors and formats to appeal to a wide range of consumers, supported by strategic marketing initiatives and investments in production and distribution capabilities that enhance their competitive positioning.

Alongside the major participants, the market includes numerous smaller craft and regional brands contributing to product innovation and category diversification. The growing segment of wine producers is also influencing the market dynamics by bridging the gap between functional beverages and alcoholic drinks.

Overall, the beer market remains competitive, with companies focusing on innovation, expanded retail presence, and targeted marketing to respond to evolving consumer preferences and sustain growth.

Key Beer Companies:

The following are the leading companies in the beer market. These companies collectively hold the largest market share and dictate industry trends.

- AB InBev

- Heineken N.V.

- Carlsberg Breweries A/S

- Molson Coors Beverage Company

- Asahi Group Holdings, Ltd.

- Diageo

- China Resources Beer (Holdings) Company Limited

- Boston Beer Co.

- Kirin Holdings Company, Limited.

- Beijing Yanjing Beer Group Corporation

Recent Developments

-

In January 2025, Anheuser-Busch launched Michelob ULTRA Zero, an alcohol-free beer. Targeting health-conscious and active consumers, this new brew offers just 29 calories—about half that of many leading non-alcoholic beers—while maintaining the refreshing taste associated with the Michelob ULTRA brand. With 0% alcohol by volume, Michelob ULTRA Zero is designed for those seeking a flavorful, guilt-free beer that fits a balanced lifestyle and a variety of social occasions.

-

In April 2024, Kirin Brewery launched a new standard-priced beer brand called Harekaze. This introduction marks a significant milestone for the company as it is its first new beer in 17 years.

-

In April 2024, Molson Coors Beverage Company announced the introduction of Madrí Excepcional, a premium European-style lager, to Canada in spring. The beer, developed in collaboration with La Sagra brewery, is aimed at urban trendsetters and offers a light golden color, a smooth taste profile, and a short bitter finish. With its 4.6% ABV, the beer embodies the essence of contemporary Madrid and aims to provide Canadians with a taste of premium Spanish flavor without the need for travel.

Beer Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 898.1 billion

Revenue forecast in 2030

USD 1,248.3 billion

Growth rate (Revenue)

CAGR of 6.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, production, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

AB InBev; Heineken N.V.; Carlsberg Breweries A/S; Molson Coors Beverage Company; Asahi Group Holdings, Ltd.; Diageo; China Resources Beer (Holdings) Company Limited; Boston Beer Co.; Kirin Holdings Company Limited; Beijing Yanjing Beer Group Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beer Market Report Segmentation

This report forecasts revenue growth at the global, regional and country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the beer market report based on product, packaging, production, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ale

-

Lager

-

Stout

-

Others

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Cans

-

Others

-

-

Production Outlook (Revenue, USD Million, 2018 - 2030)

-

Macro Brewery

-

Micro Brewery

-

Craft Brewery

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global beer market size was estimated at USD 839.31 billion in 2024 and is expected to reach USD 898.14 billion in 2025.

b. The global beer market is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030, reaching USD 1,248.3 billion by 2030.

b. The Asia Pacific dominated the beer market with a share of 35.5% in 2024. This is attributable to China being the largest country in the region consuming beer.

b. Some key players operating in the beer market include Anheuser-Busch InBev; Heineken; Carlsberg Breweries A/S; Molson Coors Beverage Company; ASAHI GROUP HOLDINGS, LTD.; Diageo; Sierra Nevada Brewing Co.; UNITED BREWERIES LTD.; Oettinger Brauerei; China Resources Beer (Holdings) Company Limited

b. Health-conscious consumers are increasingly turning to low-alcohol and non-alcoholic beers, reshaping the global beer market. The rise in wellness trends has led to the development of new product lines, such as low-calorie and low-carb beers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.