- Home

- »

- Plastics, Polymers & Resins

- »

-

Beer Packaging Market Size & Share, Industry Report, 2030GVR Report cover

![Beer Packaging Market Size, Share & Trends Report]()

Beer Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Glass, Plastic, Metal), By Product (Bottles, Cans, Kegs), By End Use (Breweries, Restaurants & Bars, Liquor Stores), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-597-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Beer Packaging Market Summary

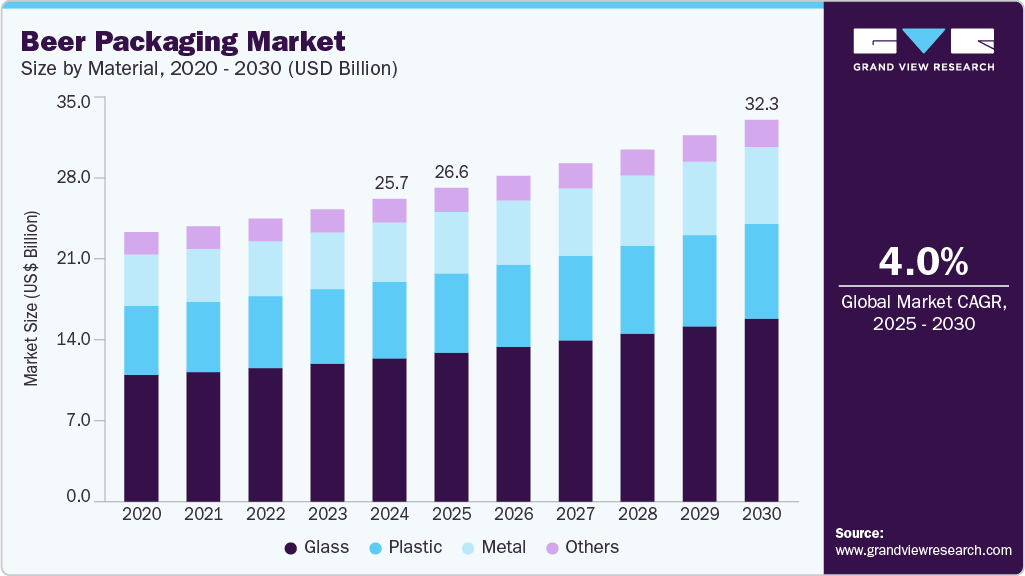

The global beer packaging market size was estimated at USD 25.66 billion in 2024 and is projected to reach USD 32.36 billion by 2030, growing at a CAGR of 4.0% from 2025 to 2030. Rising global beer consumption, especially craft and premium varieties, is driving demand for innovative and sustainable packaging.

Key Market Trends & Insights

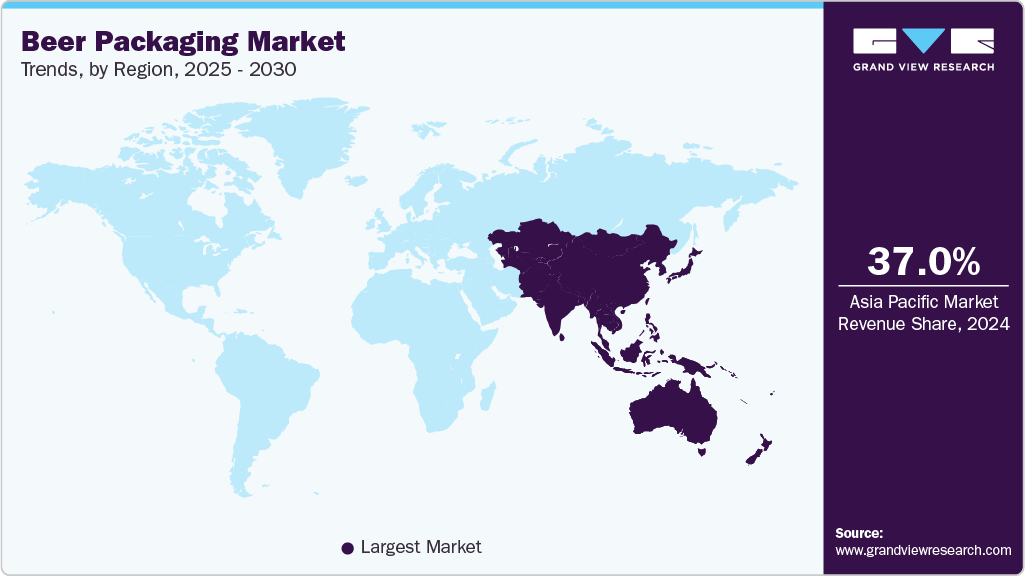

- Asia Pacific dominated the beer packaging market and accounted for the largest revenue share of over 37.0% in 2024.

- The China beer packaging market is expected to grow over the forecast period.

- By material, the glass material segment recorded the largest revenue share of over 47.0% in 2024.

- By product, the bottles segment recorded the largest revenue share of over 51.0% in 2024.

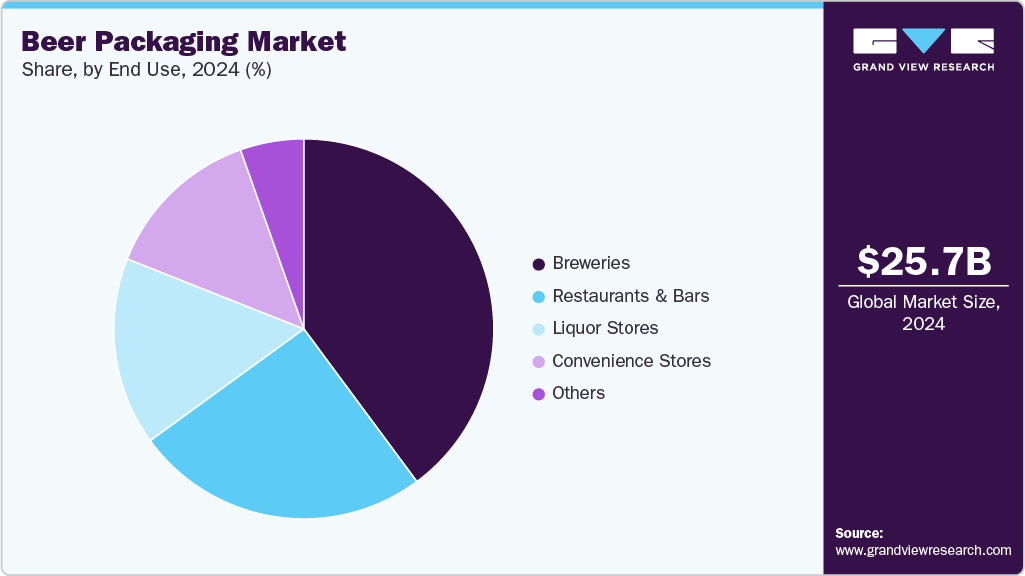

- By end use, the breweries segment recorded the largest market share of over 39.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 25.66 Billion

- 2030 Projected Market Size: USD 32.36 Billion

- CAGR (2025-2030): 4.0%

- Asia Pacific: Largest market in 2024

Additionally, increasing focus on product shelf life and branding is boosting the adoption of advanced packaging solutions. The beer packaging industry’s growth is primarily driven by rising global beer consumption, particularly in emerging economies. As countries such as China, India, Brazil, and Vietnam experience rising disposable incomes, urbanization, and shifting consumer preferences toward Western lifestyles, beer consumption has increased significantly. This uptick drives demand for innovative, functional, and region-specific packaging solutions such as cans, glass bottles, PET bottles, and kegs. For example, in India, the growing preference for craft and premium beers is pushing packaging companies to offer sleek, attractive, and differentiated packaging formats to support brand visibility and appeal.

The surge in demand for sustainable and eco-friendly packaging solutions is also contributing to the growth of the beer packaging market. Consumers, particularly Millennials and Gen Z, are increasingly favoring brands that adopt green practices. As a result, breweries and packaging manufacturers are shifting toward recyclable materials, lightweight designs, and reduced plastic usage. For instance, companies such as Carlsberg have developed fiber-based "Green Fibre Bottle" prototypes, while others are exploring biodegradable labels and eco-friendly inks. This sustainability push is not only a response to environmental concerns but also helps brands comply with tightening regulations on packaging waste in regions such as the EU and North America.

The rise of e-commerce and direct-to-consumer alcohol delivery services has also become a crucial growth factor. These platforms require durable, tamper-evident, and visually appealing packaging that can withstand shipping while enhancing brand experience. As online sales of alcoholic beverages expand, especially post-COVID-19, there’s increasing pressure on packaging manufacturers to innovate with formats that are both transport-friendly and shelf-ready.

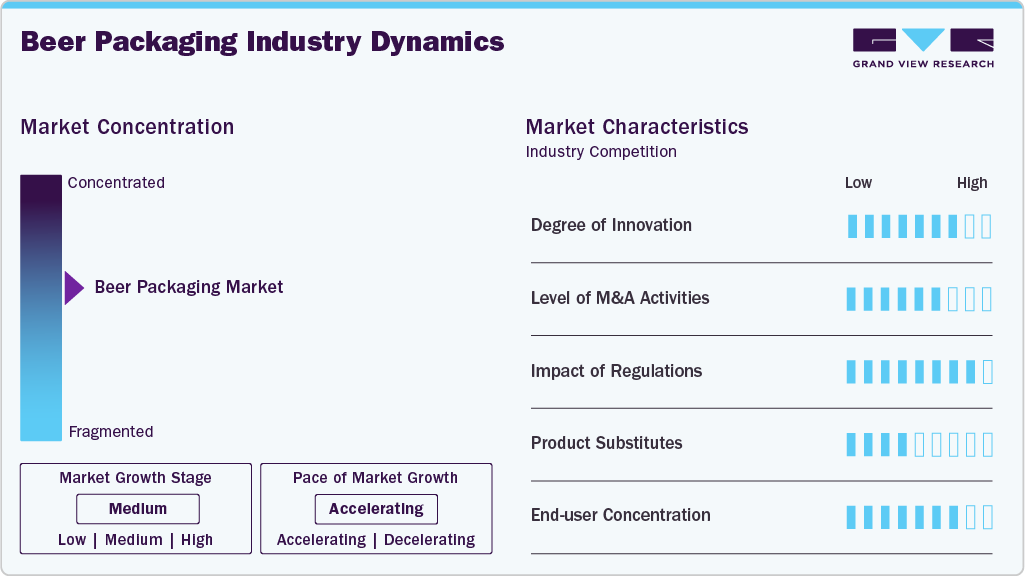

Market Concentration & Characteristics

The beer packaging industry operates under stringent regulations related to safety, labeling, recycling, and materials usage. Governments across regions enforce laws that govern permissible packaging materials, recycling mandates, and health-related labeling (alcohol content warnings). These regulations vary significantly by geography, requiring packaging companies to customize solutions for compliance in each market. For instance, returnable glass bottles are commonly used in Germany due to deposit laws, while in the U.S., aluminum cans dominate due to cost efficiency and ease of recycling.

Sustainability is central to the beer packaging market, with rising demand for lightweight, recyclable, and biodegradable packaging solutions. Environmental concerns and consumer awareness are pushing brands to minimize plastic usage and carbon footprint through sustainable designs and materials. Companies are adopting eco-friendly alternatives such as molded fiber packaging, paper-based multipacks, and refillable containers.

For instance, in June 2022, Carlsberg Group launched its largest-ever trial of a new Fibre Bottle, a bio-based and fully recyclable beer bottle, placing 8,000 units in the hands of consumers across eight Western European markets, including Denmark, Sweden, Norway, Finland, the UK, Poland, Germany, and France. The bottle features a sustainably sourced wood fibre outer shell with insulating properties that can keep beer colder longer, and a plant-based polyethylene furanoate (PEF) polymer lining developed by Carlsberg’s partner Avantium. This pilot aims to gather consumer feedback to refine the bottle design and accelerate Carlsberg’s ambition to commercialize this innovative packaging, which could reduce carbon emissions by up to 80% compared to traditional single-use glass bottles.

Material Insights

The glass material segment recorded the largest revenue share of over 47.0% in 2024. Glass remains a traditional and premium packaging material in the beer industry, particularly for bottled beers. It is inert, non-permeable, and preserves the flavor and carbonation of beer effectively. Craft brewers and premium brands widely use glass packaging to reflect authenticity and quality. The growing demand for premium, craft, and specialty beers is a major driver for glass packaging. Additionally, glass is 100% recyclable without loss of quality, aligning with sustainability trends and influencing eco-conscious consumer preferences and regulatory support.

The metal segment is expected to grow at the fastest CAGR of 4.5% during the forecast period. Metal, particularly aluminum cans, is a dominant packaging format in the beer industry. Cans are lightweight, easily stackable, and protect beer from light and oxygen exposure. They are widely used across both mainstream and craft beer brands due to their portability and fast chilling properties. The growth of canned beer, especially among younger consumers and for outdoor events, is a key driver. Sustainability is also pushing this segment forward, as aluminum is highly recyclable and has a lower carbon footprint over its lifecycle.

Product Insights

The bottles segment recorded the largest revenue share of over 51.0% in 2024. Bottles, particularly glass bottles, have been a traditional packaging format for beer for decades. They are often associated with premium and craft beer due to their aesthetic appeal and ability to preserve taste by offering good barrier properties against oxygen. Bottled beers are typically favored in on-premise consumption settings such as restaurants and bars due to their upscale image and recyclable nature. The demand for bottled beer is driven by premiumization trends in the beer market, increasing demand for craft and artisanal beer, and consumer perception of glass as a more sustainable and quality-preserving material.

The cans segment is expected to grow at the fastest CAGR of 4.5% during the forecast period. Aluminum cans have grown rapidly in popularity due to their lightweight nature, high recyclability, and lower shipping costs. Cans are especially prevalent in retail and off-premise consumption settings. They offer excellent protection against light and oxygen, preserving beer freshness and allowing for easy branding with 360-degree printing. Cans are driven by their convenience, portability, and eco-friendliness due to their high recyclability. The growing popularity of ready-to-drink formats and expanding e-commerce channels also favors canned beer.

End Use Insights

The breweries segment recorded the largest market share of over 39.0% in 2024. Breweries are the primary consumers of beer packaging as they handle the production and bottling or canning of beer. Packaging for this segment ranges from glass bottles and aluminum cans to kegs and multipacks. The branding and labeling requirements are also a significant concern for breweries, as they directly influence consumer perception and shelf visibility. Increasing craft beer consumption, the rise of microbreweries, and innovation in sustainable packaging drive packaging demand in this segment.

The restaurants & bars segment is projected to grow at the fastest CAGR of 4.5% during the forecast period. Restaurants and bars utilize beer packaging primarily in the form of bottles, cans, and kegs for direct consumption. The aesthetic and functional aspects of the packaging are critical, especially for premium or specialty brews served in upscale venues. Growth in social dining culture, urban nightlife trends, and the popularity of beer pairings with gourmet food fuel demand.

Region Insights

Asia Pacific dominated the beer packaging market and accounted for the largest revenue share of over 37.0% in 2024 and is projected to grow at the fastest CAGR of 4.6% during the forecast period. The Asia Pacific region dominates the global market due to its massive population base and rapidly expanding middle class with increasing disposable income. Countries such as China, India, and Southeast Asian nations are experiencing significant urbanization and westernization of drinking habits, driving unprecedented demand for packaged beer. Additionally, the rise of craft beer culture and premium beer segments in major cities across the region has created demand for innovative packaging solutions that emphasize brand differentiation and sustainability.

China Beer Packaging Market Trends

The China beer packaging market is expected to grow over the forecast period. China stands as the world's largest beer market by volume, making it the primary driver of beer packaging demand globally. The country's massive urbanization process has transformed drinking patterns, with urban consumers increasingly preferring packaged beer over traditional bulk or draft options. Major international brewing companies such as AB InBev, Heineken, and Carlsberg have established significant manufacturing and packaging operations in China to serve both domestic demand and regional export markets. The rise of domestic premium brands such as Tsingtao Brewery Co.,Ltd. and Snow Beer has also driven innovation in packaging design and materials, with companies investing heavily in distinctive bottle shapes, premium labeling, and sustainable packaging solutions to appeal to increasingly sophisticated Chinese consumers.

North America Beer Packaging Market Trends

North America represents a mature but evolving beer packaging industry characterized by premiumization trends and strong consumer preferences for sustainable packaging solutions. The region's well-established craft beer industry, with thousands of microbreweries and craft producers, drives demand for diverse packaging formats and customized solutions that help smaller brands compete with established players. The regulatory environment in North America strongly supports sustainable packaging initiatives, with various states and provinces implementing bottle deposit programs and recycling mandates that influence packaging material selection. The region's sophisticated cold chain distribution networks and modern retail infrastructure support premium packaging formats. At the same time, the growing popularity of hard seltzers and flavored alcoholic beverages has created new packaging requirements that emphasize freshness and brand differentiation.

The beer packaging industry in the U.S. is primarily driven by its intense competition between major national brands and a thriving craft beer sector that demands diverse packaging solutions. The craft beer revolution has fundamentally transformed packaging requirements, with over 9,000 craft breweries requiring smaller batch packaging capabilities, unique bottle shapes, and customized labeling solutions that help differentiate their products in crowded retail environments.

Europe Beer Packaging Market Trends

Europe’s beer packaging industry is shaped by stringent environmental regulations, a strong craft beer culture, and a preference for traditional glass bottles. Germany, the largest beer market in Europe, maintains a strong attachment to glass bottles due to cultural heritage and recycling infrastructure. However, cans are gaining traction among younger consumers and at festivals such as Oktoberfest, where convenience is key. The EU’s Single-Use Plastics Directive is pushing breweries to adopt more sustainable options, such as reusable bottles and biodegradable six-pack rings.

Countries such as the UK and Belgium are seeing a rise in canned craft beers, with brands such as BrewDog leading the shift toward eco-friendly aluminum packaging. Meanwhile, Eastern European markets, such as Poland and the Czech Republic, continue to favor glass bottles but are gradually embracing cans for export-oriented brands. The growing trend of home beer delivery services during the COVID-19 pandemic also accelerated demand for durable and lightweight packaging formats across the region.

Key Beer Packaging Company Insights

The beer packaging industry is characterized by intense competition among global and regional players. Key competitors include major packaging companies such as Ball Corporation, Crown Holdings, Amcor plc, Westrock Company, and Ardagh Group, alongside smaller niche firms catering to localized and artisanal brands. The market sees constant innovation in packaging formats, such as cans, bottles, and kegs, as well as in sustainable materials and digital labeling technologies. Companies compete on cost efficiency, product differentiation, environmental compliance, and partnerships with breweries, creating a dynamic and fragmented competitive landscape.

-

In March 2025, CANPACK partnered with United Breweries Limited (UBL), part of the Heineken Group, to launch Kingfisher Lemon Masala and Mango Berry Twist, flavored beers inspired by Indian street food. Aimed at Gen Z, CANPACK provided 330ml recyclable aluminum cans with vibrant, culturally inspired designs that align with the values of sustainability, innovation, and individuality. The collaboration highlights CANPACK’s advanced printing and manufacturing capabilities, enhancing shelf appeal and supporting UBL’s push for adventurous, modern flavor experiences.

-

In January 2025, Ardagh Glass Packaging enhanced its 12-oz Heritage glass beer bottle collection with two new additions: an amber glass bottle featuring a twist-off closure and a flint (clear) glass bottle with a pry-off closure. These new bottles offer craft brewers greater branding flexibility with a wider label area and a shorter, lighter design compared to traditional long-neck bottles, improving transport efficiency.

Key Beer Packaging Companies:

The following are the leading companies in the beer packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Ardagh Group

- Amcor plc

- ALPLA

- Berry Global Inc.

- Smurfit Westrock

- TricorBraun

- Crown Holdings, Inc.

- CANPACK

- WestRock Company

- AGI glaspac

- Gamer Packaging

- P. Wilkinson Containers Ltd.

- INOXCVA

- THIELMANN

- Ball Corporation

Beer Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.61 billion

Revenue forecast in 2030

USD 32.36 billion

Growth rate

CAGR of 4.0% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, product, end use, region

States scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Key companies profiled

Ardagh Group; Amcor plc; ALPLA; Berry Global Inc.; Smurfit Westrock; TricorBraun; Crown Holdings, Inc.; CANPACK; WestRock Company; AGI glaspac; Gamer Packaging; P. Wilkinson Containers Ltd.; INOXCVA; THIELMANN; Ball Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beer Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global beer packaging market report based on material, product, end use, and region:

-

Material Outlook (Revenue, USD Million 2018 - 2030)

-

Glass

-

Plastic

-

Metal

-

Others

-

-

Product Outlook (Revenue, USD Million 2018 - 2030)

-

Bottles

-

Cans

-

Kegs

-

Others

-

-

End Use Outlook (Revenue, USD Million 2018 - 2030)

-

Breweries

-

Restaurants & Bars

-

Convenient Stores

-

Liquor Stores

-

Others

-

-

Region Outlook (Revenue, USD Million 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global beer packaging market was estimated at around USD 25.66 billion in the year 2024 and is expected to reach around USD 26.61 billion in 2025.

b. The global beer packaging market is expected to grow at a compound annual growth rate of 4.0% from 2025 to 2030 to reach around USD 32.36 Billion by 2030.

b. Breweries emerged as the dominating end use segment in the beer packaging market due to their large-scale production and consistent demand for customized, branded packaging. This enables cost-efficient bulk procurement and reinforces brand identity.

b. The key players in the beer packaging market include Ardagh Group; Amcor plc; ALPLA; Berry Global Inc.; Smurfit Westrock; TricorBraun; Crown Holdings, Inc.; CANPACK; WestRock Company; AGI glaspac; Gamer Packaging; P. Wilkinson Containers Ltd.; INOXCVA; THIELMANN; and Ball Corporation.

b. The beer packaging market is driven by rising global beer consumption and increasing demand for sustainable, convenient, and visually appealing packaging. Growth in craft breweries and premium product offerings further boosts market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.