- Home

- »

- Power Generation & Storage

- »

-

Behind-the-Meter Energy Storage Market Size Report, 2033GVR Report cover

![Behind-the-Meter Energy Storage Market Size, Share & Trends Report]()

Behind-the-Meter Energy Storage Market (2025 - 2033) Size, Share & Trends Analysis Report By Battery Type (Lithium-ion Batteries, Lead-acid Batteries, Others), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-794-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Behind-the-Meter Energy Storage Market Summary

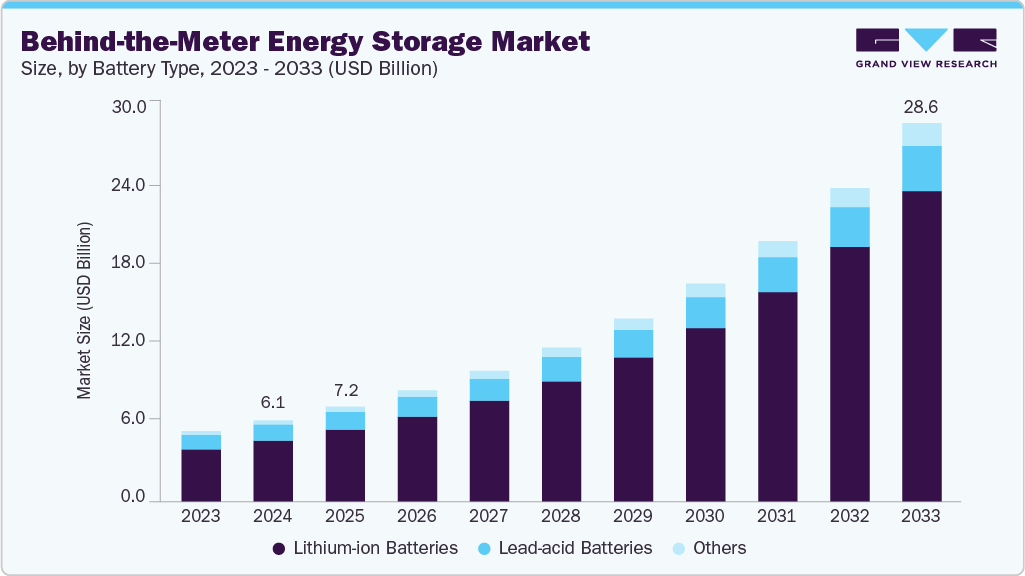

The global behind-the-meter energy storage market size was valued at USD 6.12 billion in 2024 and is projected to reach USD 28.59 billion by 2033, growing at a CAGR of 18.9% from 2025 to 2033. Growth in the market is largely driven by the increasing need for decentralized power solutions, enhanced grid resilience, and demand-side energy management.

Key Market Trends & Insights

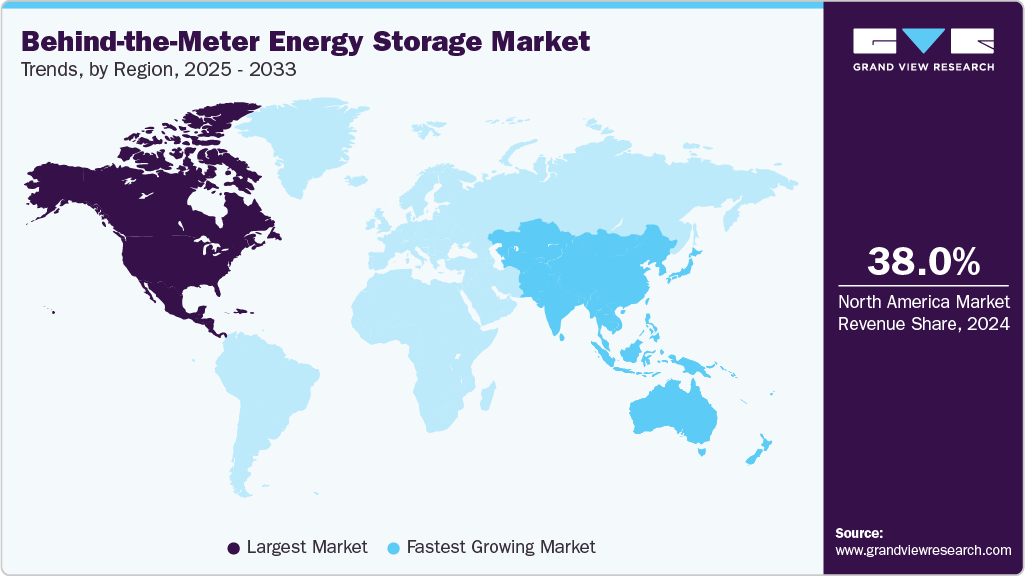

- North America behind-the-meter (BTM) energy storage market held the largest share of 38% of the global market in 2024.

- The behind-the-meter energy storage market in the U.S. is expected to grow significantly over the forecast period.

- By battery type, lithium-ion batteries held the highest market share of 75% in 2024.

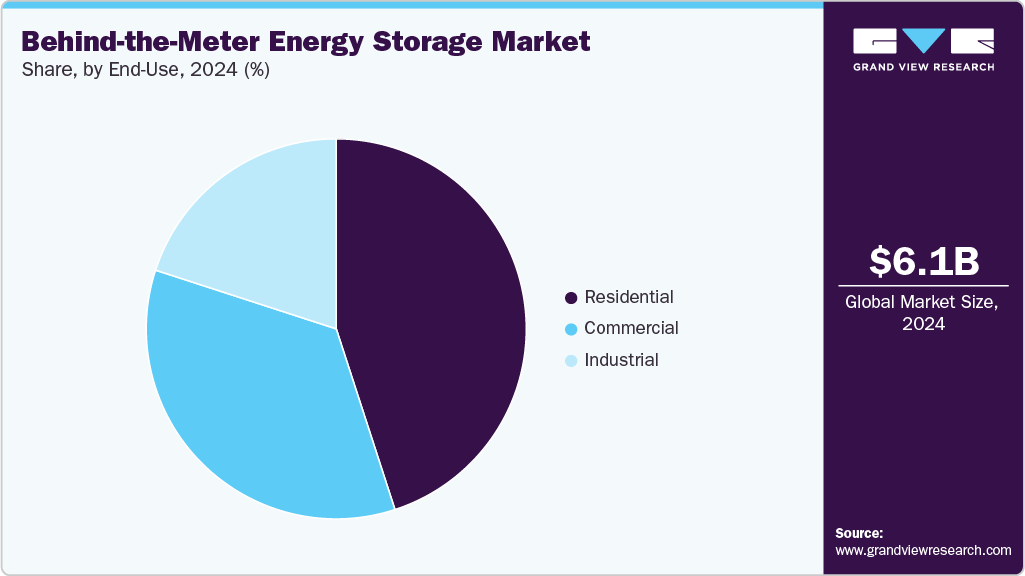

- Based on the end-use, the residential segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.12 Billion

- 2033 Projected Market Size: USD 28.59 Billion

- CAGR (2025-2033): 18.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Behind-the-meter energy storage systems enable end-users including commercial, industrial, and residential consumers, to store electricity for self-consumption, load shifting, and backup power. This capability reduces energy bills and peak demand charges and enhances reliability and energy independence. The growing penetration of renewable energy sources, particularly rooftop solar, with declining lithium-ion battery costs and improved energy management software, has accelerated global adoption. Moreover, the shift toward electrification and the emergence of prosumer models further fuel demand for BTM solutions across developed and emerging economies.In North America, the market benefits from robust policy support, evolving grid infrastructure, and the rapid adoption of distributed renewable generation. The United States leads regional deployment with strong participation from commercial and industrial sectors seeking to mitigate high electricity costs and demand charges. State-level incentives, such as California’s Self-Generation Incentive Program (SGIP) and New York’s NYSERDA storage initiatives, have catalyzed installations, while growing corporate sustainability commitments continue to boost adoption. Canada is also witnessing rising interest in BTM systems as utilities expand distributed energy resource (DER) integration and support customer-owned storage projects.

Europe is another significant market, propelled by the continent’s stringent decarbonization targets and supportive regulatory frameworks promoting energy self-sufficiency. Countries like Germany, the United Kingdom, and Italy are at the forefront of deploying BTM storage with solar PV for residential and small business users. Time-of-use pricing models and grid flexibility needs have driven installations, particularly in regions with high renewable penetration. The European Union’s clean energy package and ongoing advancements in smart grid technologies are expected to enhance BTM adoption further. Partnerships between utilities, energy aggregators, and technology providers foster the development of virtual power plants (VPPs), establishing Europe as a key growth hub for the global behind-the-meter energy storage market.

Drivers, Opportunities & Restraints

The global behind-the-meter energy storage market is primarily driven by the rising demand for decentralized energy solutions and increasing consumer focus on energy independence and cost optimization. With growing renewable energy penetration, especially rooftop solar, consumers are adopting BTM storage systems to manage self-consumption, peak shaving, and backup power needs. Supportive government policies, net-metering regulations, and incentives for adopting distributed energy resources (DER) are accelerating installations across residential, commercial, and industrial sectors. Additionally, falling lithium-ion battery prices and advancements in energy management software and smart inverters have made BTM systems more economically viable. Growing concerns over grid reliability, power outages, and fluctuating electricity tariffs further strengthen market growth globally.

Opportunities in the BTM energy storage market are expanding as technological innovation and digitalization transform the distributed energy ecosystem. Integrating renewable generation, smart meters, and virtual power plant (VPP) platforms enables real-time energy optimization and participation in demand response programs. Emerging business models such as energy-as-a-service and peer-to-peer energy trading offer new revenue streams for consumers and aggregators. In addition, the growing electrification of transport and heating sectors presents a case for BTM storage deployment alongside EV charging infrastructure. Developing economies with rising urbanization and unstable grids, particularly in Asia-Pacific and Latin America, offer untapped potential for cost-effective BTM storage solutions that enhance energy access and grid flexibility.

However, the market faces several restraints, including high initial investment costs and limited awareness among residential and small business users. The economic payback period for BTM systems remains a concern in regions with low electricity tariffs or limited policy support. Technical challenges related to system integration, interoperability with grid standards, and cybersecurity risks also hinder large-scale adoption. Moreover, evolving regulatory frameworks, lack of standardized compensation mechanisms for grid services, and competition from alternative storage technologies such as community-scale batteries and grid-tied solutions, pose challenges to market growth. Addressing these barriers through supportive regulations, financing mechanisms, and technological standardization will be key to unlocking the full potential of the behind-the-meter energy storage market.

Battery Type Insights

The lithium-ion batteries segment held the largest revenue share of around 75% in 2024, dominating the battery type segment in the global behind-the-meter (BTM) Energy Storage market. This dominance is driven by lithium-ion’s superior energy density, high efficiency, long lifecycle, and rapid response capabilities, key attributes for commercial, industrial, and residential storage applications. The technology’s flexibility to support peak shaving, demand response, and renewable energy integration has made it the preferred choice for BTM installations worldwide. Continuous innovation in lithium-ion chemistry and battery management systems (BMS) further enhances performance, safety, and cost-effectiveness, solidifying its position as the industry benchmark for distributed energy storage solutions.

Declining battery costs, large-scale manufacturing expansion, and increased deployment of distributed renewable systems such as rooftop solar PV further support the segment’s growth. Government incentives, time-of-use tariff structures, and corporate sustainability goals also accelerate adoption across key markets, including the U.S., China, Germany, and Japan. As consumers and utilities seek flexible, reliable, and decentralized energy solutions, lithium-ion batteries remain central to enabling grid resilience and energy independence. Their scalability across small residential systems to large commercial facilities ensures continued market leadership in the global BTM energy storage landscape.

End Use Insights

The residential segment held the largest market share of approximately 45% in 2024 within the global behind-the-meter (BTM) Energy Storage market. This dominance is primarily attributed to the rapid adoption of residential solar-plus-storage systems, driven by the increasing focus on energy independence, rising electricity costs, and the growing availability of net-metering and time-of-use tariff programs. Homeowners are increasingly deploying BTM energy storage systems to store excess solar energy, enhance self-consumption, and ensure reliable backup power during outages. Lithium-ion battery systems have become the preferred choice for residential users due to their compact design, long cycle life, and integration compatibility with rooftop solar and smart home energy management systems.

The segment’s growth is further reinforced by government incentives, tax credits, and subsidy programs promoting distributed renewable generation and household-level energy resilience. Advancements in digital energy management platforms and declining battery prices have made residential BTM systems more accessible and cost-effective. In regions such as North America, Europe, and Asia-Pacific, the increasing frequency of power outages, coupled with expanding prosumer energy models, is propelling residential storage adoption. As consumers prioritize sustainable and self-sufficient energy solutions, the residential segment will remain a key growth driver in the global BTM energy storage market.

Regional Insights

North America held the largest share of approximately 38% in the global BTM Energy Storage market in 2024, driven by strong policy support, advanced grid infrastructure, and the rapid integration of renewable energy sources. The United States leads the market with substantial investments enabled by the Inflation Reduction Act (IRA), offering tax credits and incentives for residential, commercial, and industrial storage systems. Utilities and corporations increasingly deploy storage to improve grid stability, manage peak demand, and achieve decarbonization targets. Canada also contributes through provincial energy storage programs and growing investment in clean energy projects, strengthening North America’s position as the leading regional market.

Falling lithium-ion battery costs, expanding solar-plus-storage adoption, and advancements in energy management systems are accelerating market growth. Increasing electricity prices and frequent grid interruptions are prompting residential and commercial users to invest in BTM storage for backup power and energy cost optimization. Strategic collaborations between technology providers, utilities, and government agencies further enhance deployment, ensuring North America maintains its leadership in the global market over the forecast period.

U.S. Behind-the-Meter Energy Storage Market Trends

The United States is the largest single-country market for BTM energy storage, benefiting from federal and state-level incentives, corporate renewable energy commitments, and the growing integration of distributed solar. Incentives under the Inflation Reduction Act, renewable portfolio standards, and funding for long-duration storage projects have created a favorable environment for rapid deployment. Utilities leverage BTM systems for grid stabilization, peak load management, and ancillary services. At the same time, industrial and commercial users adopt storage to improve energy efficiency and reliability. Technological innovation, hybrid storage solutions, and infrastructure expansion further support market growth. With abundant renewable energy resources and strong policy backing, the U.S. will remain a leading and dynamic market throughout the forecast period.

Europe Behind-the-Meter Energy Storage Market Trends

Europe accounted for approximately an 18% share of the global BTM energy storage market in 2024, supported by ambitious decarbonization goals, strict emission regulations, and strong investment in distributed storage solutions. Countries such as Germany, France, the Netherlands, and the UK actively deploy BTM systems to integrate intermittent renewable energy, stabilize grids, and provide ancillary services. Policy incentives, subsidies, research funding, and mature electricity infrastructure create a favorable residential, commercial, and utility-scale adoption environment. Europe’s focus on sustainable energy transition, energy security, and smart grid modernization continues to drive market expansion and maintain its competitive position globally.

Asia-Pacific Behind-the-Meter Energy Storage Market Trends

The Asia-Pacific region is emerging as a high-growth market, contributing roughly a 30% share in 2024, fueled by rapid urbanization, industrialization, and large-scale renewable energy deployment. Countries including China, Japan, India, and South Korea invest heavily in BTM storage to improve grid stability and optimize renewable energy utilization. Government incentives, infrastructure expansion, and research programs accelerate deployment across residential, commercial, and industrial sectors. Rising electricity demand, energy security needs, and corporate sustainability initiatives further support market growth, positioning Asia-Pacific as a critical contributor to the global BTM energy storage landscape.

Latin America Behind-the-Meter Energy Storage Market Trends

Latin America held around 7% share in 2024, driven by abundant renewable energy resources, particularly in Brazil, Mexico, and Argentina. Investment in distributed and large-scale storage systems helps balance variable generation from solar and wind projects. Regional energy programs, government incentives, and international collaborations encourage BTM adoption across commercial, industrial, and residential applications. Growing electricity demand and energy access challenges in some areas further support market expansion, indicating steady growth potential in the region over the forecast period.

Middle East & Africa Behind-the-Meter Energy Storage Market Trends

The Middle East & Africa (MEA) region accounted for roughly 7% share in 2024, with the gradual adoption of BTM energy storage driven by energy diversification goals and renewable integration initiatives. Key economies such as the UAE, Saudi Arabia, South Africa, and Egypt are investing in distributed storage solutions to enhance grid reliability and support industrial and residential energy needs. Sub-Saharan Africa is leveraging smaller-scale and off-grid storage projects to improve energy access. Policy support, international funding, and public-private collaborations are expected to drive steady adoption, positioning the MEA region for consistent BTM energy storage market growth.

Key Behind-the-Meter Energy Storage Company Insights

Some of the key players operating in the global behind-the-meter energy storage market include Tesla, Inc., LG Energy Solution Ltd., BYD Company Ltd., Sonnen GmbH, Enphase Energy, Inc., Schneider Electric SE, Siemens AG, Panasonic Holdings Corporation, ABB Ltd., and Samsung SDI Co., Ltd. These companies focus on advancing residential, commercial, and industrial energy storage solutions, emphasizing innovations in lithium-ion battery technologies, intelligent energy management systems, and solar-plus storage integration.

Key Behind-the-Meter Energy Storage Companies:

The following are the leading companies in the behind-the-meter energy storage market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- BYD Company Ltd.

- Enphase Energy, Inc.

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co., Ltd.

- Schneider Electric SE

- Siemens AG

- Sonnen GmbH

- Tesla, Inc.

Recent Developments

-

In June 2025, Tesla, Inc. announced the deployment of an advanced behind-the-meter (BTM) energy storage project in California, featuring its latest Powerwall 3 and Powerpack systems. The installation, designed for both residential and commercial applications, aims to enhance local grid reliability and optimize solar energy self-consumption. The project integrates Tesla’s AI-driven energy management platform, enabling real-time monitoring, demand response participation, and backup power during outages.

Behind-the-Meter Energy Storage Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.16 billion

Revenue forecast in 2033

USD 28.59 billion

Growth rate

CAGR of 18.9% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD Million, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Battery Type, End Use, and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Tesla, Inc.; LG Energy Solution Ltd.; BYD Company Ltd.; Sonnen GmbH; Enphase Energy, Inc.; Schneider Electric SE; Siemens AG; Panasonic Holdings Corporation; ABB Ltd.; Samsung SDI Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

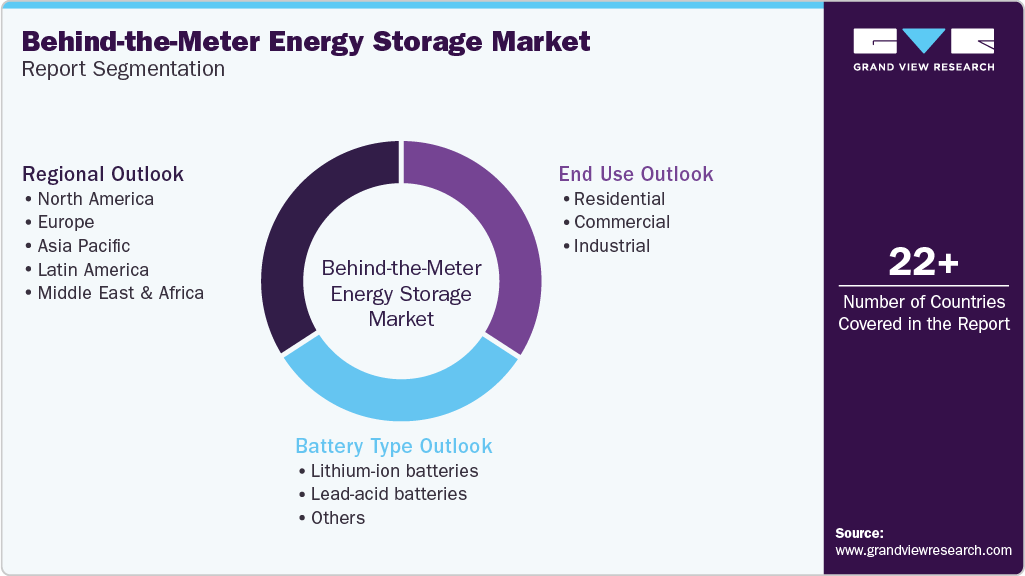

Global Behind-the-Meter Energy Storage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global behind-the-meter energy storage market report on the basis of battery type, end use and region:

-

Battery Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Lithium-ion batteries

-

Lead-acid batteries

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global behind-the-meter energy storage market size was estimated at USD 6.12 billion in 2024 and is expected to reach USD 7.16 billion in 2025.

b. The global behind-the-meter energy storage market is expected to grow at a compound annual growth rate of 18.9% from 2025 to 2033 to reach USD 28.59 billion by 2033.

b. Based on the battery type segment, lithium-ion batteries held the largest revenue share of more than 75% in 2024.

b. Some of the key players operating in the BTM energy storage market include Tesla, Inc., LG Energy Solution Ltd., BYD Company Ltd., Sonnen GmbH, Enphase Energy, Inc., Schneider Electric SE, Siemens AG, Panasonic Holdings Corporation, ABB Ltd., and Samsung SDI Co., Ltd.

b. The Behind-the-Meter (BTM) energy storage market is primarily driven by the growing need for long-duration, scalable energy storage solutions to support the integration of intermittent renewable energy sources such as solar and wind.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.