- Home

- »

- Clothing, Footwear & Accessories

- »

-

Belts And Wallets Market Size, Share & Trends Report, 2030GVR Report cover

![Belts And Wallets Market Size, Share & Trends Report]()

Belts And Wallets Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Wallets, Belts), By Material (Leather, Non-Leather) By End-User, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-040-7

- Number of Report Pages: 95

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Belts And Wallets Market Summary

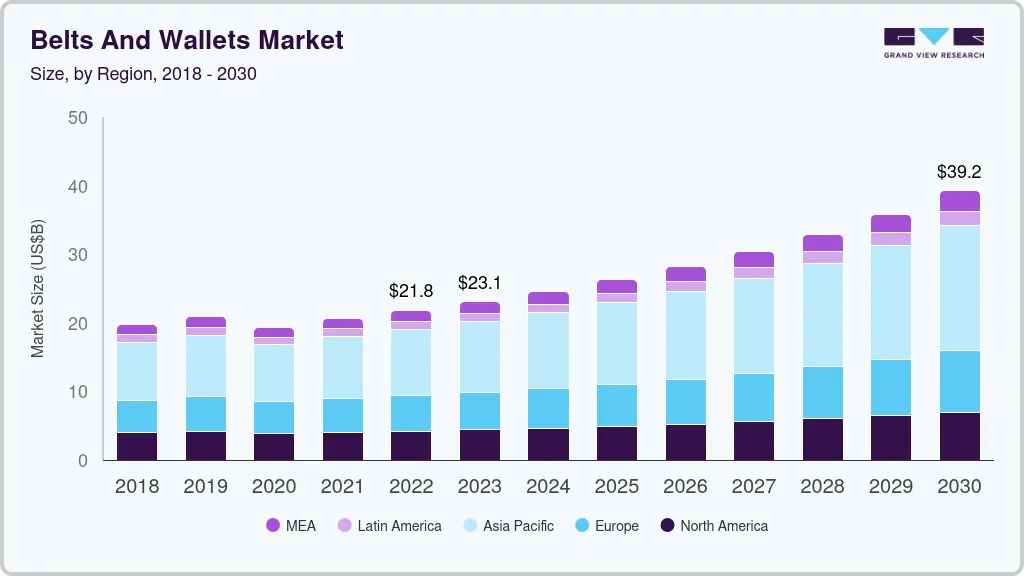

The global belts and wallets market size was estimated at USD 21,797.3 million in 2022 and is projected to reach USD 39,237.5 million by 2030, growing at a CAGR of 7.6% from 2023 to 2030. The market is mainly driven by the growing fashion trend coupled with the rising adoption of belts and wallets in the corporate population across the globe.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2022.

- In terms of segment, wallets accounted for a revenue of USD 21,797.3 million in 2022.

- Wallets is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 21,797.3 Million

- 2030 Projected Market Size: USD 39,237.5 Million

- CAGR (2023-2030): 7.6%

- Asia Pacific: Largest market in 2022

Particularly among millennials belts and wallets have become more significant as a fashion statement. Moreover, the rising demand for leather belts and wallets among the young generation is further projected to provide ample opportunities for market growth over the forecast period.

The COVID-19 pandemic has had a significant effect on the belts and wallets industry. Due to retail closures brought on by lockdown and quarantine rules, the sales during the COVID-19 pandemic significantly decreased. The pandemic also had an impact on offline sales of belts and wallets in several infected nations, including China and India, due to social exclusion and stay-at-home rules. Also, the ongoing pandemic has encouraged people to budget their money better and avoid making frivolous expenditures.

Additionally, it is anticipated that the rising demand for belts and wallets among working women globally would create a number of chances for market expansion. The World Bank estimates that in 2021, women will make up 39.3% of the global labor force. Also, the population's growing demand for trendy belts and wallets is anticipated to support the market expansion during the prognosis period.

Manufacturers in the sustainable sector may find attractive business prospects as a result of the increase in demand for leather goods like belts and wallets. The industry has a tremendous chance for expansion as a result of the growing consumer awareness of sustainable and cruelty-free products. Recently, vegan leather and accessories from cruelty-free sources have become more fashionable, especially with the global millennial population.

Considering the consumer requirement for highly durable and sleek leather accessories, leather wallets, and pouches are widely used for everyday uses. Materials like nylon or plastic are hard and can cause discomfort, but leather is smooth even when folded, which makes it more comfortable to keep in the pocket.

Additionally, the rising security concerns regarding contactless card technology, which uses radio-frequency identification (RFID), have birthed the concept of RFID technology wallets. This technology is becoming increasingly popular among consumers. Brands such as Buffway, Travando, and Himi offer RIFD-enabled leather wallets that allow tracking of import belongings including credit cards, debit cards, and passports as well as prevent identity theft by using RFID-blocking technology.

Product Insights

The belts segment dominated the market among products in 2022, accounting for 58.1% of global sales. The considerable demand for belts among working professionals, youth, and ladies is the key factor driving the market. Also, it is anticipated that throughout the forecast period, women's rising demand for fashionable, comfortable, and fancy belts would positively affect the belts market sector.

The wallet segment is anticipated to expand significantly with a CAGR of 6.1% from 2023 to 2030. A wallet is considered to be a daily use product by both men and women to keep one’s personal belongings, money, and small travel documents that need to be protected from theft, damage, or weather exposure. Moreover, the concept of RFID technology wallets was born in response to the growing security issues surrounding contactless card technology, which uses RFID. Therefore, RFID-based wallets are further projected to provide ample growth opportunities to the market growth.

Material Insights

Among materials, the leather segment led the market and accounted for a 72.8% share of the global revenue in 2022. The demand for exclusive leather for making a variety of products including belts and wallets significantly drives the growth of the global market. The increasing population and the rising income levels of consumers are some of the key factors that drive the demand for leather wallets and belts.

Consumers' growing fashion consciousness has been a major driver in boosting product demand, and this has led many firms to diversify their product offerings. Affordable and smaller producers have also been gaining importance in the leather belts and wallets business, in addition to well-known names and brands. Leather goods lend a trendy and sophisticated look for consumers who not only lay emphasis on the material and design of the apparel but are also aware of its role in fashion and setting trends.

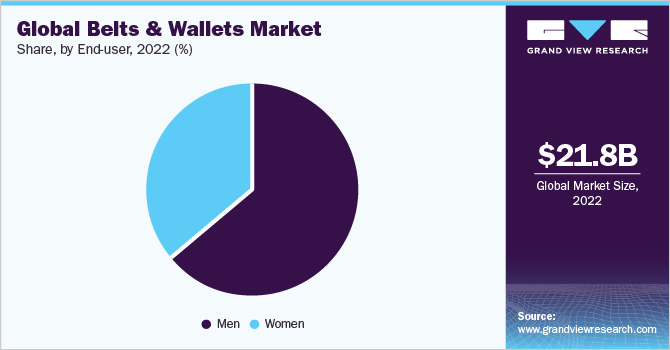

End-user Insights

Among end-users, the men segment led the market and accounted for a 64.1% share of the global revenue in 2022. The market is primarily driven by men's major wallet and belt usage trends as well as the widespread use of belts and wallets by men in professional occupations. Moreover, the availability of various product designs and categories in the main belts and wallets segment further contributed to the largest market share. Continuously evolving personal grooming as well as fashion habits among men and their subsequent demand for comfort wear, has been driving the growth of belts among men.

The women segment is anticipated at a CAGR of 7.4% from 2023 to 2030. One of the key factors influencing the market's expansion is the rising demand for belts and wallets among women working professionals and the rising popularity of these accessories among women in general. Also, it is anticipated that a rise in the number of women pursuing higher education will result in an increase in their participation in the labor force. The buying power of women on luxury and distinctive styles, including leather accessories like belts and wallets is likely to eventually expand as a result that is likely to have a favorable effect on the market.

Distribution Channel Insights

Offline distribution channels, which accounted for 72.0% of global revenue in 2022, dominated the market. Locating belts and wallets in physical retail establishments that offer a selection of brands and models is one of the most common distribution techniques. Before making a purchase, customers can choose from a large selection of brands at these establishments. Supermarkets typically provide discounts and other advantages to draw in customers and boost product sales. They act as distribution centers for parent companies and offer a large range of brands in one area. Due to the wide range of products available and ease of use, offline distribution had the largest market share.

The online distribution channel is expected to witness the fastest growth in the forecast period. E-commerce retail channels play a significant role in the distribution of belts and wallets as a considerable amount of the market revenue is generated through these channels. Customers no longer need to physically visit retail locations to browse through millions of products thanks to online sales platforms. One of the key consumer groups propelling the expansion of online merchants has been millennials.

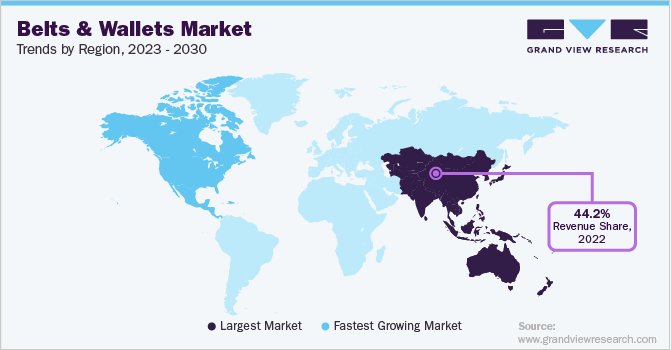

Regional Insights

Asia Pacific dominated the market for belts and wallets and accounted for a 44.2% share of the global revenue in 2022. The presence of a large working population in China and India further supported the market growth in the region. Led by countries such as China and India, the Asia Pacific belts and wallets market is driven by the increasing demand for premium and luxury products in these countries. China has traditionally been the largest manufacturer of finished leather products including belts and wallets worldwide. The sheer scale of leather production in China makes it possible for brands to achieve economies of scale with a high degree of technical knowledge.

North America is projected at a CAGR of 6.6% over the forecast period. The growing popularity of leather goods belts with increasing online purchases in the region is expected to drive the North America belts and wallets market. The leather belts and wallets industry has witnessed significant growth in recent years owing to the rising demand from emerging markets, such as consumer spending in the U.S. and Canada.

Key Companies & Market Share Insights

Due to the fact that some of the participants in this market are among the top producers of goods, such as various types of belts and wallets, there is fierce competition among them. Both regional and global marketplaces for these companies' products have sizable consumer bases. These market participants also benefit from strong and sizable distribution networks that enable them to reach a wider customer base. Some of the prominent players in the global belts and wallets market include:

-

Tommy Hilfiger licensing, LLC (PVH)

-

Aditya Birla Group

-

PUMA SE

-

Titan Company

-

Marshall Wallet (ABC INTERNATIONAL)

-

LEVI STRAUSS & CO.

-

Guccio Gucci S.p.A. (KERING)

-

Burberry PLC

-

Diesel Fashion India Reliance Pvt.Ltd

-

Ralph Lauren Corp.

Belts And Wallets Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 23.08 billion

Revenue forecast in 2030

USD 39.24 billion

Growth rate

CAGR of 7.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; U.K.; France; China; Japan; India; Brazil: South Africa

Key companies profiled

Tommy Hilfiger Licensing, LLC (PVH); Aditya Birla Group; PUMA SE; Titan Company; Marshall Wallet (ABC INTERNATIONAL); LEVI STRAUSS & CO.; Guccio Gucci S.p.A. (KERING); Burberry PLC; Diesel Fashion India Reliance Pvt. Ltd; Ralph Lauren Corp.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Belts And Wallets Market Segmentation

This report forecasts growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the global belts and wallets market report based on product, material, end-user, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Wallets

-

Belts

-

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Leather

-

Non-Leather

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global belts and wallets market size was estimated at USD 21.80 billion in 2022 and is expected to reach USD 23.08 billion in 2023.

b. The global belts and wallets market is expected to grow at a compound annual growth rate of 7.6% from 2023 to 2030 to reach USD 39.28 billion by 2030.

b. Asia Pacific dominated the belts and wallets market with a share of 44.2% in 2022.Led by countries such as China and India, the Asia Pacific belts and wallets market is driven by the increasing demand for premium and luxury products in these countries.

b. Some key players operating in the belts and wallets market include Tommy Hilfiger licensing, LLC (PVH), Aditya Birla Group, PUMA SE, Titan Company, Marshall Wallet (ABC INTERNATIONAL), LEVI STRAUSS & CO., Guccio Gucci S.p.A. (KERING), Burberry PLC, Diesel Fashion India Reliance Pvt. Ltd, and Ralph Lauren Corp.

b. Key factors that are driving the belts and wallets market growth include growing fashion trend coupled with the rising adoption of belts and wallets in the corporate population across the globe. Particularly among millennials belts and wallets have become more significant as a fashion statement.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.