- Home

- »

- Medical Devices

- »

-

Benign Prostatic Hyperplasia Treatment Device Market Report 2033GVR Report cover

![Benign Prostatic Hyperplasia Treatment Device Market Size, Share & Trends Report]()

Benign Prostatic Hyperplasia Treatment Device Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Resectoscopes, Urology Laser), By Treatment, By Procedure, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-119-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Benign Prostatic Hyperplasia Treatment Device Market Summary

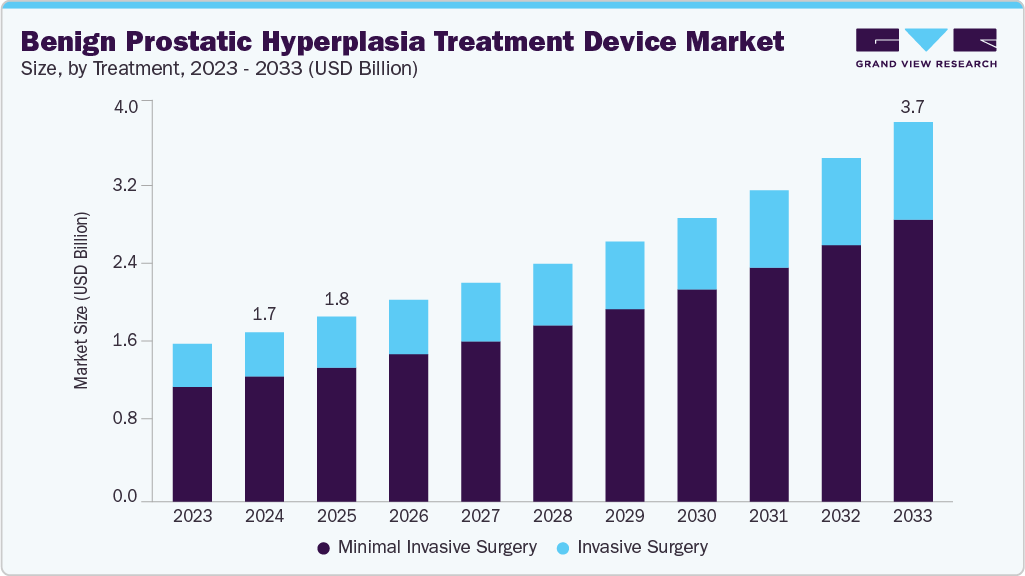

The global benign prostatic hyperplasia treatment device market size was estimated at USD 1.67 billion in 2024 and is projected to reach USD 3.71 billion by 2033, growing at a CAGR of 9.40% from 2025 to 2033. The growing aging population is a key market driver for benign prostatic hyperplasia (BPH) treatment devices, as BPH incidence increases with age.

Key Market Trends & Insights

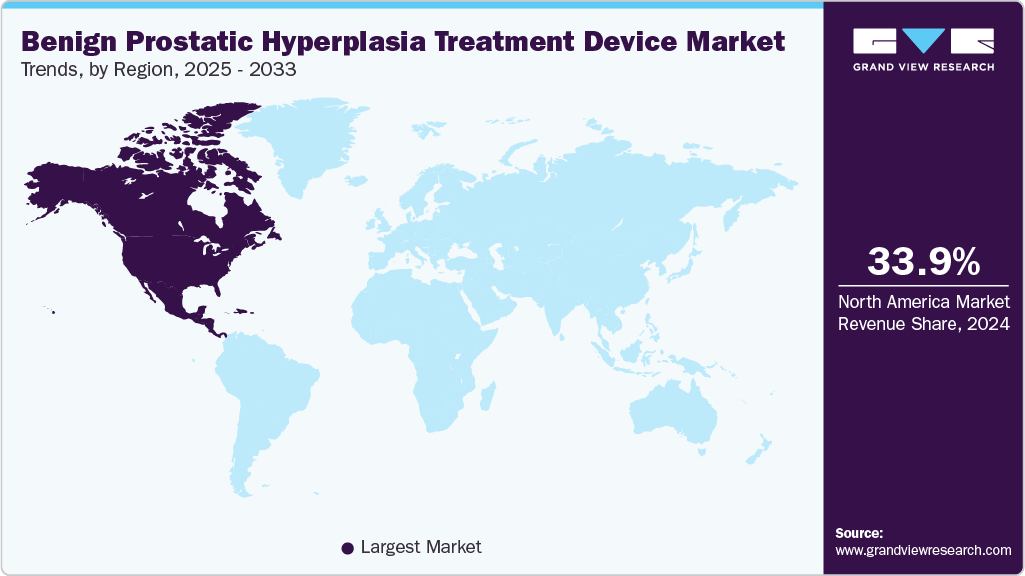

- North America dominated the benign prostatic hyperplasia (BPH) treatment device market with the largest revenue share of 33.87% in 2024.

- The benign prostatic hyperplasia (BPH) treatment device market in the U.S. accounted for the largest market revenue share in North America in 2024.

- By treatment, the minimally invasive surgery segment dominated the market in 2024.

- By procedure, the transurethral resection of the prostate (TURP) segment led the market with the largest revenue share of 25.03% in 2024.

- By product, the resectoscopes segment led the market with the largest revenue share of 21.68% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.67 Billion

- 2033 Projected Market Size: USD 3.71 Billion

- CAGR (2025-2033): 9.40%

- North America: Largest market in 2024

Rising cases of lower urinary tract symptoms (LUTS) and other urological conditions are also fueling demand for effective treatments. There is a strong shift toward minimally invasive procedures, which offer shorter recovery times, fewer postoperative complications, and improved patient outcomes compared to traditional surgery. Advances in BPH treatment technology are expanding options for both patients and physicians. In addition, increased awareness and earlier diagnosis of BPH are contributing to the global adoption of advanced treatment devices.

The prostate grows larger because of benign prostatic hyperplasia (BPH). Due to aging, the majority of the male population experiences prostate-related issues such as BPH. A sudden urge to urinate and difficulties urinating are symptoms associated with benign prostatic hyperplasia. The treatment options include medication, surgery, and minimally invasive procedures. The market for devices used to treat benign prostatic hyperplasia is expanding at an accelerated rate, driven by the increasing elderly population.

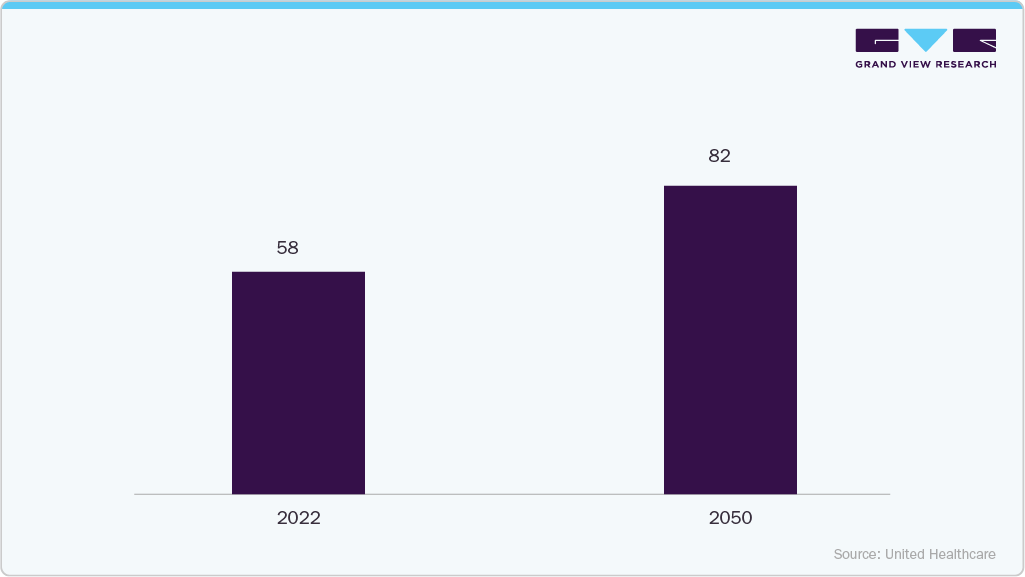

The increasing elderly male population is contributing to greater demand for benign prostatic hyperplasia (BPH) treatment devices. With advancing age, the prevalence of prostate enlargement and lower urinary tract symptoms rises, leading to a preference for advanced and minimally invasive therapies. Innovations, including laser systems, prostatic urethral lifts, and water vapor ablation technology, are gaining popularity. Enhanced awareness, improved diagnostic rates, and expanded access to healthcare services further accelerate market growth. UnitedHealthcare projects that the number of Americans aged 65 and older will increase from 58 million in 2022 to 82 million by 2050.

The market is expected to grow due to increasing demand for minimally invasive procedures and ongoing innovations in novel BPH treatment devices. Minimally invasive surgeries are primarily performed as outpatient procedures under minimal anesthesia, resulting in a faster recovery compared to traditional open surgeries. Furthermore, the widespread adoption of robot-assisted surgical methods, combined with favorable reimbursement options, is actively accelerating market growth.

For instance, in May 2023, Teleflex Incorporated announced new research findings that conclusively demonstrate the long-term efficacy of the prostatic urethral lift procedure with the UroLift System. Data indicate that this system has fewer complications compared to other established minimally invasive procedures for BPH. The UroLift System has become the leading minimally invasive treatment for benign prostatic hyperplasia, adopted by doctors in the U.S. Collectively, these compelling factors are expected to increase market demand in the coming years.

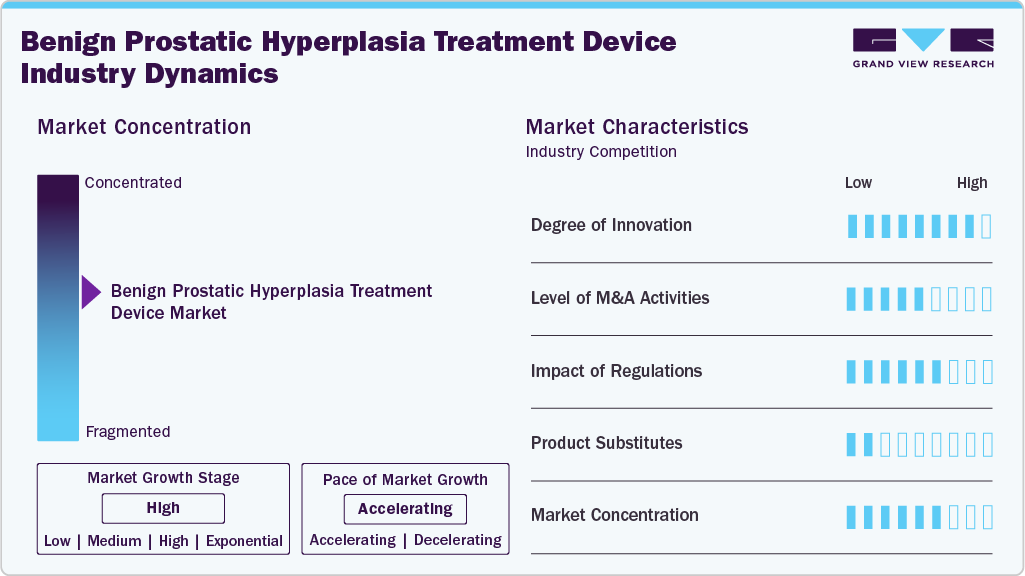

Market Concentration & Characteristics

The benign prostatic hyperplasia (BPH) treatment device industry is experiencing rapid growth, driven by technological advancements, strong demand in established healthcare settings, and increasing adoption in outpatient and home care environments.

The BPH treatment devices market is experiencing significant innovation, particularly in minimally invasive technologies such as laser therapy, prostatic urethral lifts, and thermal ablation systems. These advancements aim to improve patient outcomes by enabling faster recovery, reducing complications, and increasing long-term efficacy, which is driving market adoption. In August 2025, Apollo Prostate Institute introduced South India’s first water vapour thermotherapy for BPH, demonstrating the ongoing introduction of advanced solutions and the impact of new technologies on treatment options.

The benign prostatic hyperplasia (BPH) treatment device industry has experienced a moderate yet rising level of mergers and acquisitions as companies seek to expand their product portfolios. Strategic collaborations enable firms to enhance product offerings, gain regulatory advantages, and strengthen their presence in high-growth regions. This consolidation trend supports faster innovation and broader clinical adoption of advanced BPH therapies.

The stringent regulatory standards have a significant impact on the BPH treatment devices market by ensuring safety, efficacy, and clinical performance before commercialization. While longer approval timelines can slow product launches, supportive reimbursement and clear regulatory pathways in key regions help accelerate the adoption of innovative technologies.

Treatment Insights

Minimal invasive surgery held the largest market share in 2024. Compared to open surgery, minimally invasive procedures offer effective treatment with fewer risks and a quicker recovery time. Significant improvements and advances have been made in the field of minimally invasive surgery recently, with a focus on enhancing patient outcomes and minimizing invasiveness. For instance, in February 2025, Olympus announced a key milestone for its iTind device with expanded availability across major APAC markets, reinforcing access to minimally invasive treatment options for benign prostatic hyperplasia (BPH). This strategic expansion aims to address the rising demand for non-permanent, tissue-sparing therapies that improve symptoms while preserving quality of life. Such product launches are anticipated to support the segment growth in the coming years.

Invasive surgical procedures for benign prostatic hyperplasia are experiencing significant growth as more patients progress to advanced stages of the condition, where medications provide limited or temporary relief. Many individuals seek longer-lasting outcomes and more effective symptom reduction, leading to increased adoption of surgical treatments. Improved clinical success rates, reduced complication profiles, and wider availability of skilled urologic specialists are further accelerating this shift. As a result, the demand for advanced surgical devices and technologies continues to rise to meet the growing clinical need.

Procedure Insights

The Transurethral Resection of the Prostate (TURP) segment held the largest market share in 2024. The surgical treatment known as TURP is used to treat moderate to severe BPH. For many years, TURP has been a common surgical procedure used to treat BPH, and it has a demonstrated track record of successfully reducing urinary symptoms. Although it is an invasive procedure that can involve a hospital stay, there are risks and adverse effects that could occur, including retrograde ejaculation, bleeding, and infection.

For instance, as per the reports published by Mayo Clinic in 2024, men with moderate to severe urinary issues who do not receive a cure from medicines are typically thought to be candidates for TURP. TURP often produces rapid symptom relief. Within a few days, most men experience a significant increase in urine flow. Sometimes, maximum medical care is required to relieve symptoms, especially years later.

The Robot-Assisted Laparoscopic Prostatectomy (RASP) segment is expected to grow at the highest CAGR during the forecast period. The robotic system enhances a surgeon's flexibility and accuracy, allowing for delicate movements and precise dissection. Smaller incisions are used during robot-assisted laparoscopic prostatectomy than during open surgery, which results in less pain, scarring, and blood loss. The reports published by The Harvard Gazette, in March 2024, stated that robot-associated prostate surgery requires shorter hospital stays and has fewer complications, such as blood clots and UTI infections, compared to traditional open surgery procedures. Thus, such advantages are anticipated to drive the segment growth over the forecast period.

Product Insights

The resectoscopes segment held the largest market share in 2024. Resectoscopes are specialized types of endoscopes used for procedures on the bladder, uterus, prostate, or urethra. TURP surgery uses a resectoscope, an advanced surgical device used for the treatment of medium to severe BPH. Although TURP with a resectoscope remains the gold standard for treating BPH, several minimally invasive options are available. These include water vapor therapy, microwave therapy, and laser therapy. These alternatives aim to lower the procedure's invasiveness and could shorten recovery periods. Resectoscopes have transformed the field of urology by allowing surgeons to carry out complicated surgeries with less trauma to patients and shorter recovery times than with open surgery.

The urology laser segment is expected to grow at the highest CAGR during the forecast period. The increasing research and development of manufacturing facilities for laser systems used in BPH treatments drives the segment's growth. Due to their accuracy and lower risk of complications compared to other open surgeries for BPH, urology lasers have become a favorable option among patients and medical professionals. The article published in Urology Times in July 2023 demonstrated the advancements in HoLEP treatment for benign prostatic hyperplasia. The pulse-modulated holmium lasers enabled surgeons to perform outpatient surgery for BPH.

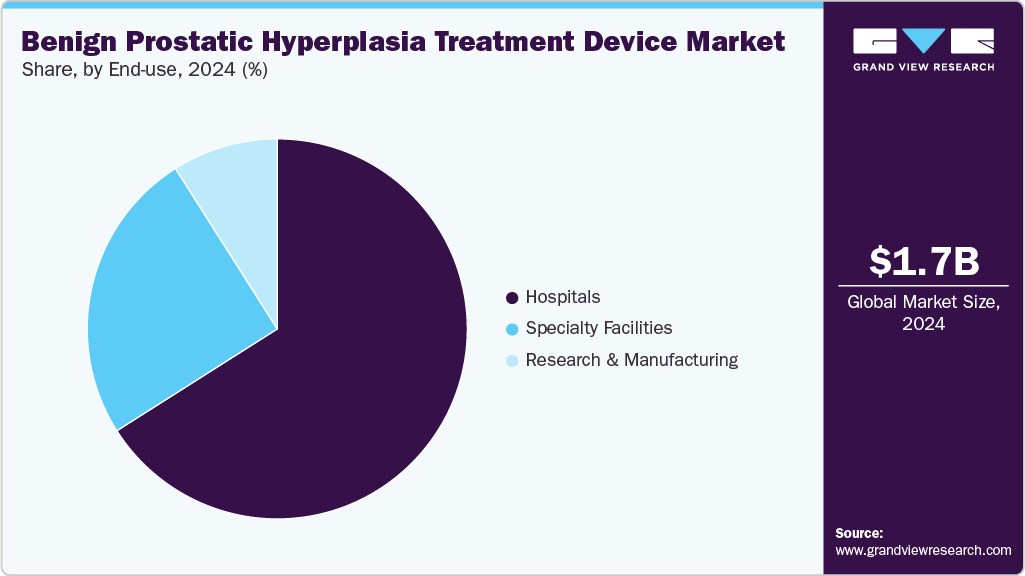

End-use Insights

The hospitals segment held the largest market share in 2024. The rise in urology-related disorders and the increasing prevalence of BPH treatments drive segment growth. For the diagnosis and treatment of BPH, hospitals play a crucial role. They serve as the primary site for handling BPH patients since they frequently have access to cutting-edge medical technology and a staff of trained healthcare specialists. Hospitals can undertake surgical procedures like TURP or HoLEP when BPH symptoms are severe or other therapies have been unsuccessful.

Specialty facilities are experiencing significant growth, which is directly driving the market for benign prostatic hyperplasia (BPH) treatment devices. With advanced infrastructure and skilled urologists, these dedicated centers can perform minimally invasive procedures more efficiently, improving patient outcomes and accessibility. As the number of specialty urology facilities increases, procedural volumes rise, driving demand for innovative and high-performance devices for BPH treatment.

Regional Insights

North America dominated the benign prostatic hyperplasia (BPH) treatment device market in 2024, owing to the presence of key manufacturers such as Urologix, LLC, Boston Scientific Corporation, Dornier MedTech, and Olympus America in the region. Furthermore, the rising prevalence of urological disorders and the increasing demand for minimally invasive surgical procedures are driving market growth. Also, increasing incidences of diabetes and obesity lead to the risk of BPH disorders in men, which boosts the BPH devices industry growth.

U.S. Benign Prostatic Hyperplasia Treatment Device Market Trends

The benign prostatic hyperplasia (BPH) treatment device market in the U.S. is expanding steadily, driven by a large and aging male population with a high prevalence of urinary disorders. There is increasing adoption of minimally invasive procedures, including laser therapies, prostatic urethral lifts, and water vapor ablation, due to their effectiveness, shorter recovery times, and reduced complication rates. Advanced healthcare infrastructure, widespread access to specialty urology centers, and high patient awareness support early diagnosis and treatment. Favorable reimbursement policies and strong clinical adoption of innovative devices further bolster market growth. Ongoing technological advancements and growing demand for outpatient procedures are shaping the market toward more patient-centric, efficient BPH treatment solutions.

Europe Benign Prostatic Hyperplasia Treatment Device Market Trends

The benign prostatic hyperplasia (BPH) treatment device market in Europe is experiencing significant growth, driven by an increasing geriatric male population and rising incidence of prostate-related disorders. Furthermore, the availability of urologists across Europe is anticipated to drive the regional market growth. According to the British Association of Urological Surgeons (BAUS), in 2022/23, there were a total of 666,042 finished consultant episodes (FCEs) under the care of urologists in England. Of these, 497,713 FCEs (74.7%) involved male patients, while 168,263 FCEs (25.3%) involved female patients.

The UK BPH treatment device market is driven by growing awareness, early diagnosis, and increasing preference for minimally invasive procedures. In addition, continuous technological advancements are further accelerating market growth and device adoption.

Asia Pacific Benign Prostatic Hyperplasia Treatment Device Market Trends

The benign prostatic hyperplasia (BPH) treatment device market in the Asia Pacific is experiencing significant growth due to a rapidly increasing demand for minimally invasive procedures, as patients prefer faster recovery times and reduced hospitalization compared to traditional surgeries. Countries like Japan, China, and South Korea are leading the adoption of advanced technologies, including laser therapy and prostate implants, while emerging markets in Southeast Asia are catching up with improvements in healthcare infrastructure. Growing awareness of prostate health and improving access to urology specialists are further accelerating market uptake. Although cost constraints and uneven reimbursement remain challenges, the region offers strong growth potential driven by technological advancement and expanding healthcare investment.

India benign prostatic hyperplasia treatment device marketis growing rapidly, driven by a large and expanding geriatric male population along with the rising incidence of prostate-related disorders. The increasing adoption of minimally invasive procedures, such as laser-based therapies, is supported by the expansion of specialty urology centers and improved access to advanced medical technologies. Growing patient awareness about treatment options, coupled with shorter recovery times compared to traditional surgeries, is encouraging a shift toward device-based therapies. In addition, government initiatives to modernize healthcare infrastructure and the increasing popularity of medical tourism are further driving market growth. Despite growth opportunities, cost sensitivity and varied reimbursement coverage remain key challenges in broader adoption. Overall, the market is evolving toward modern, efficient, and patient-friendly BPH treatment solutions.

Middle East And Africa Benign Prostatic Hyperplasia Treatment Device Market Trends

The benign prostatic hyperplasia (BPH) treatment device market in the MEA is experiencing significant growth, driven by advancements in healthcare infrastructure and greater availability of urology specialists. Countries in the Gulf region, in particular, are investing in modern medical technologies, such as laser therapy and prostatic urethral implants, to enhance treatment outcomes. Growing awareness of prostate health and men’s willingness to seek early medical intervention are contributing to higher treatment uptake. The disparities in healthcare accessibility and reimbursement limitations in low-income regions continue to affect market penetration. Overall, the market is moving toward technologically advanced, patient-centric treatment solutions.

Key Benign Prostatic Hyperplasia Treatment Device Company Insights

Some of the players operating in the market include KARL STORZ, Boston Scientific Corporation, Olympus America, Dornier MedTech, biolitec Holding GmbH & Co KG, Cook, Teleflex Incorporated, Urotronic, Coloplast Group, and PROCEPT BioRobotics Corporation, among others. Key players are focusing on the launch of innovative medical devices, implementing growth strategies, driving technological advancements, and securing product approvals.

Key Benign Prostatic Hyperplasia Treatment Device Companies:

The following are the leading companies in the benign prostatic hyperplasia (BPH) treatment device market. These companies collectively hold the largest market share and dictate industry trends.

- KARL STORZ

- Boston Scientific Corporation

- Olympus America

- Dornier MedTech.

- biolitec Holding GmbH & Co KG

- Cook

- Teleflex Incorporated.

- Urotronic.

- Coloplast Group

- PROCEPT BioRobotics Corporation

Recent Development

-

In February 2025, Olympus announced a key milestone for its iTind device with expanded availability across major APAC markets, reinforcing access to minimally invasive treatment options for benign prostatic hyperplasia (BPH). This strategic expansion aims to address the rising demand for non-permanent, tissue-sparing therapies that improve symptoms while preserving quality of life. By expanding its presence in high-growth regions, Olympus enhances its competitive position and facilitates more effective care pathways for aging male populations.

-

In April 2025, Rivermark Medical, a medical device company specializing in urology and dedicated to advancing BPH treatment with innovative and simplified solutions, announced the enrollment of the first patient in its RAPID III clinical study. RAPID III is a multicenter, prospective, randomized pivotal trial aimed at assessing the safety and efficacy of the FloStent System in men suffering from lower urinary tract symptoms associated with BPH

-

In August 2025, ProVerum, a Dublin-based medtech firm, secured USD 80 million in new funding led by MVM Partners, with participation from investors including OrbiMed and the Ireland Strategic Investment Fund. The Series B financing will support the development and advancement of ProVerum’s ProVee System, a device designed to treat benign prostatic hyperplasia (BPH).

Benign Prostatic Hyperplasia Treatment Device Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.81 billion

Revenue forecast in 2033

USD 3.71 billion

Growth rate

CAGR of 9.40% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Segments covered

Treatment, procedure, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway, Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Report coverage

Revenue, competitive landscape, growth factors, and trends

Key companies profiled

KARL STORZ; Boston Scientific Corporation; Olympus America; Dornier MedTech; biolitec Holding GmbH & Co KG; Cook; Teleflex Incorporated; Urotronic; Coloplast Group; PROCEPT BioRobotics Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Benign Prostatic Hyperplasia Treatment Device Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global benign prostatic hyperplasia (BPH) treatment device market report based on treatment, procedure, product, end-use, and region:

-

Treatment Outlook (Revenue, USD Million, 2021 - 2033)

-

Minimal Invasive Surgery

-

Invasive Surgery

-

-

Procedure Outlook (Revenue, USD Million, 2021 - 2033)

-

Transurethral Resection of the Prostate

-

Prostate Laser Surgery

-

Transurethral Microwave Thermotherapy

-

Transurethral Needle Ablation of the Prostate

-

Prostatic Urethral Lift

-

Water Vapor Therapy

-

Robot-Assisted Laparoscopic Prostatectomy

-

Aquablation Therapy

-

Prostatic Artery Embolization

-

Open Prostatectomy

-

Bipolar Enucleation of Prostate

-

Transurethral Incision of the Prostate

-

High-Intensity Focused Ultrasound

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Resectoscopes

-

Urology Laser

-

Radiofrequency Ablation

-

Electrodes

-

Catheters

-

Prostatic Stents

-

Implants

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Facilities

-

Research and Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global benign prostatic hyperplasia treatment device market size was estimated at USD 1.67 billion in 2024 and is expected to reach USD 1.81 billion in 2024.

b. The global benign prostatic hyperplasia treatment devices market is expected to grow at a compound annual growth rate of 9.40% from 2025 to 2033 to reach USD 3.71 billion by 2033.

b. North America dominated the BPH treatment device market, accounting for a 33.87% share in 2024, due to the presence of key manufacturers in the region. Furthermore, the rising prevalence of urological disorders and increasing demand for minimally invasive surgical procedures are driving the growth of the benign prostatic hyperplasia (BPH) treatment device market in this region.

b. Some key players operating in the BPH treatment devices market include KARL STORZ, Boston Scientific Corporation, Olympus America, Dornier MedTech, biolitec Holding GmbH & Co KG, Cook, Teleflex Incorporated, Urotronic, Coloplast Group, and PROCEPT BioRobotics Corporation.

b. The market for BPH treatment devices has been driven by factors such as rising patient awareness of available treatment options, the increasing prevalence of urological disorders, and technological advancements. Advances in BPH treatment technology are expanding options for both patients and physicians. Additionally, increased awareness and earlier diagnosis of BPH are contributing to the global adoption of advanced treatment devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.