- Home

- »

- Medical Devices

- »

-

Endoscopes Market Size, Share And Growth Report, 2030GVR Report cover

![Endoscopes Market Size, Share & Trends Report]()

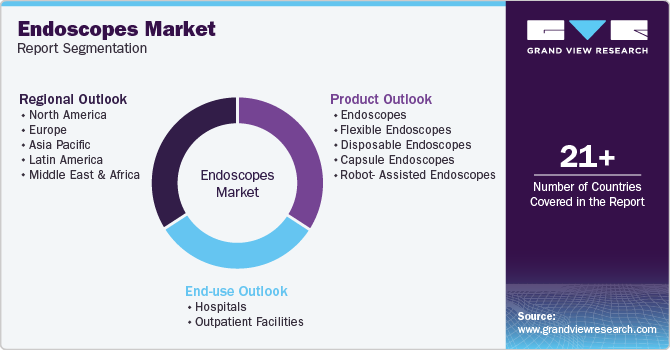

Endoscopes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Rigid Endoscopes, Flexible Endoscopes, Disposable Endoscopes, Capsule Endoscopes), By End-use (Outpatient Facilities, Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-550-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endoscopes Market Summary

The global endoscopes market size was estimated at USD 25.08 billion in 2024 and is projected to reach USD 33.45 billion by 2030, growing at a CAGR of 4.88% from 2025 to 2030. Increasing awareness regarding earlier detection of diseases through minimally invasive surgical procedures, the adoption of various distribution strategies, and the growing prevalence of chronic disorders are some of the major factors driving market growth.

Key Market Trends & Insights

- North America endoscopes market accounted for the largest revenue share of 40.9% in 2024.

- The endoscopes market in the U.S. held the largest share in 2024.

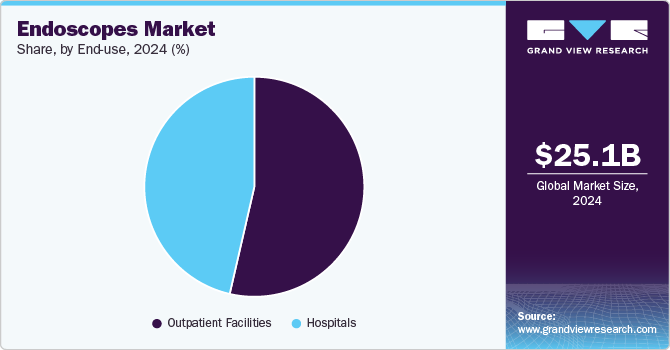

- By end use, the outpatient facilities’ segment dominated the market in 2024.

- By product, the reusable endoscopes segment dominated the market with revenue share of 87.4% in 2024.

- By product, disposable endoscopes segment is expected to witness fastest CAGR growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 25.08 Billion

- 2030 Projected Market Size: USD 33.45 Billion

- CAGR (2025-2030): 4.88%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, favorable reimbursement policies and rising FDA approvals for endoscopes are expected to boost the market's growth. For instance, in April 2021, Endotherapeutics Pty Ltd., a leading medical device distributor, partnered with Cook Medical, a medical device company, to distribute Cook Medical OHNS Portfolio in Australia.

The increasing prevalence of cancer and cancer-related mortality globally is one of the factors expected to drive the market. For instance, according to the Cancer Progress Report 2023 released by the American Cancer Society, in 2023, around 1,958,310 new cancer cases were diagnosed in the U.S., and 609,820 individuals died due to it. Projections indicate that by 2040, the number of new cancer cases could reach 2.3 million. As the prevalence of cancer rises globally, there is a growing need for effective diagnostic and treatment procedures. Endoscopes play a crucial role in offering minimally invasive options to accurately diagnose, stage, and treat various forms of cancer. Thus, such factors boost market growth.

Furthermore, endoscopic procedures have been primarily adopted to diagnose and treat functional gastrointestinal disorders. This disorder can affect any part of the gastrointestinal tract, including the stomach, esophagus, and intestines. The growing prevalence of functional gastrointestinal disorders, such as irritable bowel syndrome (IBS), functional constipation, or functional dyspepsia, is also expected to accelerate product adoption and boost market growth over the forecast period. For instance, in 2021, a multinational study published in the Gastroenterology journal on 33 countries reported that, globally, over 40% of persons have functional gastrointestinal disorders.

Technological advancements significantly impacted the field of disposable endoscopic devices, driving innovation and improving patient care. These advancements have led to developing more advanced and sophisticated disposable endoscopes, offering enhanced imaging capabilities, improved maneuverability, and ease of use. For instance, in September 2024, Olympus Corporation received U.S. FDA 510(k) approval for its CADDIE computer-aided detection (CADe) device, a cloud-based AI technology developed to help gastroenterologists during colonoscopy procedures to detect colorectal polyps.

Many players in the market are increasingly investing in developing new products and continuously improving existing products. For instance, in October 2023, Foresight Group (Foresight), an investment company, announced a USD 6.61 million investment along with USD 1.65 million from Clydesdale Bank in Clearview Endoscopy Limited. This company repairs, services, and maintains flexible endoscopes and offers its services to customers across Ireland and the UK.

The miniaturization of components created smaller and more flexible endoscopes, enabling easier access to narrow & complex anatomical structures. Moreover, advancements in materials and manufacturing techniques led to the production of disposable endoscopes that are cost-effective, reliable, & safe for patients. Thus, such factors are anticipated to boost the market growth over the forecast period.

Moreover, with new technologies and methods being developed and introduced regularly, the endoscope market is expected to grow significantly over the forecast period. For instance, the application of AI in many gastroenterology fields is becoming more widespread, especially in endoscopic image processing.

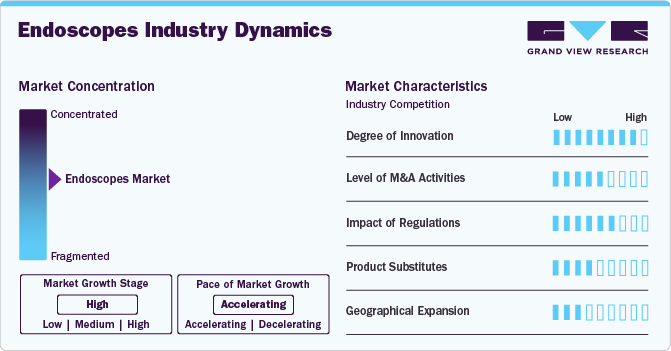

Market Concentration & Characteristics

The global endoscopes market is characterized by a high degree of innovation, owing to growing research activities, rising investments, and approvals from governments and regulatory bodies to improve healthcare infrastructure and advance research in the endoscopy field. For instance, in May 2021, Pentax Medical and Jiangsu Vedkang Medical Science and Technology entered a multiyear joint venture to codevelop disposable therapeutic products in the flexible endoscopy space. Under this joint venture, Pentax Medical would offer its sales & distribution network, and Jiangsu Vedkang would utilize its production and R&D capabilities.

The endoscopes market is characterized by medium merger and acquisition activity. Market players, such as Olympus Corp., Ethicon US, LLC, Fujifilm Holdings Corp., Boston Scientific Corp., Karl Storz GmbH & Co., KG, Stryker, and Medtronic, are involved in mergers and acquisitions. Through M&A activity, these companies can expand their geographic reach and enter new territories. For instance, in December 2022, Olympus Corporation signed an agreement to acquire Odin Vision, a London-based cloud-AI endoscopy company, to enhance patient care by transforming procedural and clinical workflows.

Companies actively invest substantial resources in clinical trials and regulatory submissions to obtain regulatory approval for pipeline products. This may result in increasing the cost of developing novel endoscopic technologies. For instance, the European Union (EU) has recently imposed laws and guidelines that can affect Endoscopists and patients. The new regulations raise the requirement for clinical trials and observational studies for both new and existing endoscopic device uses to assure therapeutic benefit and minimize patient damage.

A wide range of product substitutes are available, as endoscopic devices is a rapidly evolving field in healthcare. For instance, the conventional endoscope can be replaced by an innovative capsule endoscopy technology. Three technological developments have been necessary for the development of the capsule endoscope are powerful, compact camera systems that are only a few millimeters in size, wireless technology that allows camera images to be transmitted in real-time, and sensor or actuator systems that allow intuitive control of the capsule inside the body.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising funding creates more opportunities for market players to enter new regions. For instance, in September 2024, Olympus Latin America launched the EVIS X1 endoscopy system in Brazil. It includes two compatible gastrointestinal endoscopes, a CF-HQ1100DL/I colonovideoscope, and a GIF-1100 gastrointestinal videoscope.

End-use Insights

By end use, the outpatient facilities’ segment dominated the market in 2024 and accounted for the largest revenue share of 53.6%. Outpatient facilities play a vital role in the endoscope market by providing convenient & efficient diagnostic and therapeutic procedures. The increasing popularity of endoscopes in outpatient settings can be attributed to their numerous advantages. One significant advantage of endoscopes in outpatient facilities is their cost-effectiveness. These single-use devices eliminate the need for reprocessing, saving valuable time and resources for cleaning, sterilizing, & maintaining reusable endoscopes. This streamlined approach improves workflow efficiency, reduces turnaround time, and enhances patient throughput.

Hospitals segment in endoscopes market is anticipated to register a significant growth over the forecast period. The growing number of healthcare centers, such as hospitals, oncology specialty clinics, and cancer centers, is increasing the need for endoscopy devices, which is expected to drive market growth. The number of endoscopies being performed in hospitals is growing with the increase in hospital facilities. The number of hospitals is increasing in most countries, including the U.S., Canada, the UK, Italy, Spain, China, India, Thailand, Japan, Brazil, Argentina, South Africa, and the UAE. According to American Hospital Association, there are 6,120 hospitals in the U.S. in 2024. Similarly, in 2021, there were 1,300 hospitals in Canada. The European Union has around 15,000 hospitals. Moreover, the UK has 1148 hospitals as of August 2023.

Product Insights

By product, the reusable endoscopes segment dominated the market with revenue share of 87.4% in 2024. The reusable endoscopes segment comprises of rigid endoscopes, flexible endoscopes, capsule endoscopes, and robot-assisted endoscopes. The segment’s growth is driven by the rising occurrence of chronic diseases impacting internal body systems and the superior benefits of flexible endoscopes compared to other devices. There is a growing awareness of the importance of early diagnosis in conditions such as Inflammatory Bowel Diseases (IBD), stomach & colon cancers, respiratory infections, and tumors, leading to a higher demand for flexible endoscopes for diagnostic purposes. Furthermore, key players are developing and launching new products to strengthen their market position. For instance, in May 2023, Air Water, Inc. and Keio University developed an ultra-fine rigid endoscope employing its Graded-Index Plastic Optical Fiber (GI-POF) technology.

Disposable endoscopes segment is expected to witness fastest CAGR growth during the forecast period. The growing adoption of minimally invasive surgeries and product approvals are expected to boost the global market over the forecast period. Key advantages include high patient acceptance rates, reduced pain, cost-effectiveness, and lower chances of complications. NIH data from January 2023 indicates an increasing trend of ambulatory minimally invasive procedures in the U.S., which raises the demand for disposable endoscopes in these settings. In addition, the demand for disposable endoscopes in hospitals & diagnostic centers and the rising use of single-use endoscopy devices in ENT, bronchoscopy, & dentistry procedures are expected to drive market growth over the forecast period.

Regional Insights

North America endoscopes market accounted for the largest revenue share of 40.9% in 2024. The market is fueled by rapid technological advancements, leading to the development of new and innovative endoscopic devices. These technological breakthroughs have improved the adoption of endoscopes. For instance, in October 2022, OMNIVISION, a prominent developer of semiconductor solutions, collaborated with AdaptivEndo, a technology disruptor in single-use endoscopes, to create a flexible and unified platform. This platform is designed to use single-use and hybrid endoscopes in various medical fields, including gynecology, gastroenterology, urology, and advanced endoscopic surgery.

U.S. Endoscopes Market Trends

The endoscopes market in the U.S. held the largest share in 2024. An advanced healthcare infrastructure, high investments by market players and hospitals promoting the use of novel endoscopy equipment, and favorable reimbursement policies are among the factors expected to drive market growth in the U.S. For instance, in June 2021, EvoEndo raised USD 10.1 million to promote the use of unsedated transnasal endoscopy for patients and physicians.

Europe Endoscopes Market Trends

Europe endoscopes market is anticipated to register considerable growth during the forecast period. Technological advancements and the adoption of various strategies by market players drive market growth. Moreover, the number of diseases that require endoscopy is increasing, propelling the market growth. For instance, in Italy, the prevalence of cancer is also growing. According to the Associazione Italiana Di Oncologia Medica (AIOM) 2021 cancer estimates, there were 233,200 cases of colorectal cancer in women and 280,300 in men in 2021.

France endoscopes market is anticipated to register a considerable growth rate during the forecast period. The growing geriatric population and the increasing prevalence of cancer propel the market for endoscopes in France. As per an article published in March 2023, around 26% of the total population were over 60. The growing number of elderly individuals who are susceptible to various diseases, including cancer, GI disorders, respiratory issues, and cardiovascular conditions, drives the demand for endoscopy procedures for diagnosis & treatment. The rising preference for minimally invasive surgeries and the growing emphasis on early cancer detection are among the factors anticipated to impact the market positively..

UK endoscopes market is anticipated to register a considerable growth rate during the forecast period. The growing awareness of and preference among physicians & patients for improving post-procedure outcomes and reducing the risk of cross-contamination is driving the demand for disposable endoscopes. Moreover, the increasing number of patients suffering from chronic diseases that require minimally invasive surgical procedures for diagnosis & treatment is contributing to market growth. For instance, according to the Migration Observatory, the population of the UK is projected to increase from 67 million in 2021 to 77 million in 2046.

Asia Pacific Endoscopes Market Trends

Asia Pacific is anticipated to be the fastest-growing region in the endoscopes market. Changes in lifestyle & demographics and a growing geriatric population suffering from chronic diseases, such as cancer, ophthalmic diseases, & GI disorders, are factors driving the market. Technological advancements in Asia Pacific’s healthcare industry are likely to further drive market growth. Moreover, increasing awareness about the advantages of minimally invasive surgeries over open surgeries and the rising prevalence of chronic diseases are expected to provide growth opportunities in this region.

China endoscopes market held the significant share in 2024. the endoscope market in China is driven by increasing demand for minimally invasive procedures, the growing presence of trained endoscopists for a broad range of applications, the development of surgical devices to increase indications of endoscopic surgeries, and product advancements. In addition, the demand for disposable endoscopes in China is surging due to the failure of standard cleaning and disinfection processes, as per the study published in the American Journal of Infection Control. The study reported positive bacterial tests for Pseudomonas aeruginosa culture in contaminated pancreatic and biliary endoscopes, even after multiple cleaning and disinfection attempts.

Thailand endoscopes market is anticipated to register a significant growth during the forecast period. Factors such as favorable initiatives undertaken by government and private players fuel the market growth. Experimental cancer screening programs, including the Colorectal Cancer (CRC) screening program in Thailand, are expected to increase the demand for endoscopy surgeries. These programs aim to detect and treat cancer at early stages, leading to a rise in endoscopic procedures.

Latin America Endoscopes Market Trends

Latin America endoscopes market is anticipated to register considerable growth during the forecast period. The region witnesses a high burden of infections and acute diseases. Disposable endoscopes have demonstrated their effectiveness in preventing cross-contamination and reducing procedure costs, leading to a growing demand among healthcare professionals prioritizing preventive healthcare measures for infection control. This is expected to drive the market over the forecast period.

Mexico endoscopes market is anticipated to register a considerable growth during the forecast period. The increasing prevalence of cervical cancer among women in Mexico is expected to drive the market. Cervical cancer is the second-most commonly occurring cancer among women in Mexico. According to the HPV Information Center, 2023, approximately 9,439 new cases of cervical cancer are estimated to be diagnosed each year, with about 4,335 women dying due to this disease. Increasing disposable income, technological advancements in endoscopes, and growing demand for minimally invasive surgeries are key factors promoting market growth.

Middle East & Africa Endoscopes Market Trends

MEA endoscopes market is anticipated to register the fastest growth during the forecast period. Advancements in healthcare infrastructure, growing healthcare expenditures, and increasing awareness of available diagnostic and therapeutic solutions are driving the regional market's growth. Other factors contributing to the regional market's growth include the rapid economic development, growing geriatric population, and rising government healthcare investments, which are projected to attract foreign investments in this region.

The endoscopes market in UAE is experiencing rapid growth during the forecast period. Increase in geriatric population & cancer prevalence and a favorable reimbursement environment drive the demand for endoscopy devices. Health Authority-Abu Dhabi (HAAD) has provided recommendations for treatment of colorectal cancer, which is expected to drive demand for endoscopies. Moreover, changing reforms by HAAD are anticipated to affect market growth.

Key Endoscopes Company Insights

Key participants in the endoscopes market are focusing on devising innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, mergers & acquisitions, and geographical expansions.

Key Endoscopes Companies:

The following are the leading companies in the endoscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S

- STERIS plc.

Recent Developments

-

In November 2023, Olympus Corporation (Olympus), launched EVIS X1, its next-generation endoscopy system in China. This endoscopy system has been demonstrated at the 6th annual China International Import Expo that was held in Shanghai from November 5th -10th.

-

In March 2023, AIG Hospitals in Hyderabad launched a Center of Excellence (CoE) in collaboration with Boston Scientific. This collaboration aims to enhance healthcare services by providing advanced treatment options and expertise in various medical fields.

-

In January 2023, FUJIFILM India has launched FushKnife, a diathermic slitter and ClutchCutter, a rotatable forceps. The products were introduced at the 63rd Annual Conference of Indian Society of Gastroenterology-ISGCON in Jaipur.

Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 26.36 billion

Revenue forecast in 2030

USD 33.45 billion

Growth Rate

CAGR of 4.88% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Boston Scientific Corporation; PENTAX Medical (Hoya Corporation); FUJIFILM Holdings Corporation; Karl Storz GmbH & Co. KG; Stryker; Medtronic; Ambu A/S; STERIS plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopes Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the global endoscopes market report on the basis of product, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Endoscopes

-

Reusable Endoscopes

-

Rigid Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Pharyngoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

-

-

Flexible Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Pharyngoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

Colonoscope

-

-

-

Capsule Endoscopes

-

Robot- Assisted Endoscopes

-

-

Disposable Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

Colonoscope

-

-

-

Capsule Endoscopes

-

Robot- Assisted Endoscopes

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopes market size was estimated at USD 25.08 billion in 2024 and is expected to reach USD 26.36 billion in 2025.

b. The global endoscopes market is expected to grow at a compound annual growth rate of 4.88% from 2025 to 2030 to reach USD 33.45 billion by 2030.

b. Reusable endoscopes segment dominated the market with revenue share of 87.3%. The segment’s growth is driven by the rising occurrence of chronic diseases impacting internal body systems and the superior benefits of flexible endoscopes compared to other devices.

b. Some key players operating in the endoscopes market include Fujifilm Holdings Corporation; Olympus Corporation LLC; Stryker Corporation; Ethicon Endo-Surgery; Richard Wolf GmbH; Karl Storz; and Boston Scientific Corporation.

b. Key factors that are driving the endoscopes market growth include an increasing geriatric population; a growing preference for minimally invasive surgeries; and a rise in incidences of cancer, gastrointestinal diseases, and other chronic diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.