- Home

- »

- Drilling & Extraction Equipments

- »

-

Bentonite Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Bentonite Market Size, Share & Trends Report]()

Bentonite Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Sodium Bentonite, Calcium Bentonite), By Application (Foundry Sands, Civil Engineering, Cat Litter, Drilling Mud), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-314-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2025

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bentonite Market Summary

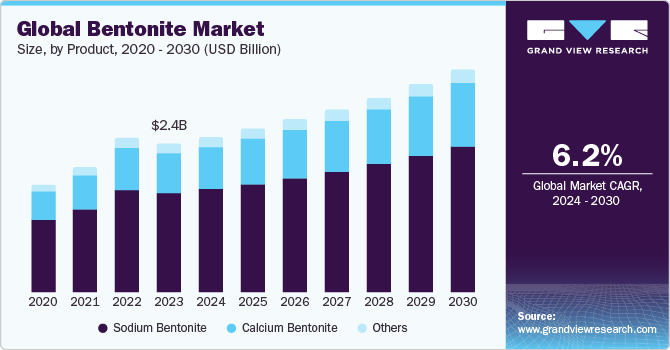

The global bentonite market size was estimated at USD 2.44 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030.Bentonite's unique properties, including its ability to absorb water and expand, make it invaluable in applications like drilling muds, foundry sands, and sealants in various industries such as construction, oil and gas, pharmaceuticals, and cosmetics.

Key Market Trends & Insights

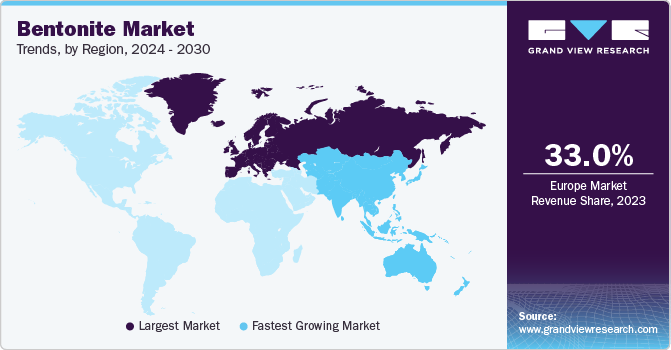

- Europe dominated the global bentonite market with the highest revenue share in 2023.

- By product, sodium bentonite held the largest revenue share of over 65% in 2023.

- By application, drilling mud segment is anticipated to register a revenue CAGR of 6.3% over the forecast period.

- The cat litter segment has also emerged as another dominant application of bentonite, driven by the growing demand for high-quality cat litter products.

Market Size & Forecast

- 2023 Market Size: USD 2.44 Billion

- 2030 Projected Market Size: USD 3.65 Billion

- CAGR (2024-2030): 6.2%

- Europe: Largest market in 2023

Bentonite is extracted via open-pit mining or underground mining methods. It further undergoes processing, which involves drying, milling, and sometimes chemical treatment to enhance its properties for specific applications. However, the manufacturing process of bentonite can raise environmental concerns due to disturbance of land, energy consumption during processing, and potential chemical usage.

The U.S. is a major player in global bentonite market, boasting abundant reserves concentrated in states such as Montana, South Dakota, and Wyoming. In particular, Wyoming has the country's largest bentonite deposits, making it a hub for production. Favorable geological conditions and well-established mining infrastructure bolster the industry's prominence. This strategic blend of resources, infrastructure, and technological prowess solidifies the country’s pivotal role in global bentonite market.

The global bentonite market continues to be driven by increasing industrial applications across diverse sectors. One significant driver is rising demand for bentonite in construction activities worldwide. Bentonite's ability to swell and form a tight seal makes it crucial in applications such as tunnelling, foundation building, and landfill liners. According to World Bank, by 2040, world's population is expected to increase by nearly 2 billion people, a 25% rise. This growth will be accompanied by a continued shift from rural to urban areas, resulting in a 46% increase in urban population. Consequently, there will be a significant need for infrastructure development to support growing urban centers.

However, it faces challenges due to environmental concerns and regulatory restrictions. Mining and processing of bentonite can have environmental impacts, leading to stringent regulations governing its extraction and use. For instance, regulations concerning waste management and water pollution control can impact operational practices and increase compliance costs for bentonite manufacturers.

Emerging economies offer significant growth opportunities, driven by infrastructure development and increasing urbanization. Countries in Asia Pacific, particularly China and India, are witnessing robust demand for bentonite in construction and industrial applications. For instance, in budget 2023-2024, Government of India allocated INR 16,000 crore (USD 1953.3 million) to a new initiative, called, “Sustainable Cities of Tomorrow” to transform multiple cities by improving their infrastructure and mobility, as well as by ensuring their urban sustainability. The expansion of residential, commercial, and industrial sectors due to sustainable economic growth in the region is expected to boost construction activities, thereby driving bentonite market over the forecast period.

Bentonite Price Trends

Bentonite prices experienced significant fluctuations in 2022. Initially, the market witnessed an increase in prices due to rising demand for high-grade bentonite, as it is costly due to its enhanced characteristics. Also, Europe being a major consumer of bentonite was largely affected with the surge in prices, as it also faced the repercussions due to Russia-Ukraine war impacting raw material availability and supply chain. Additionally, changes in regulations and implementation of stringent mandates by local governments to regulate trade of bentonite on an international level to preserve diminishing reserves also impacted prices.

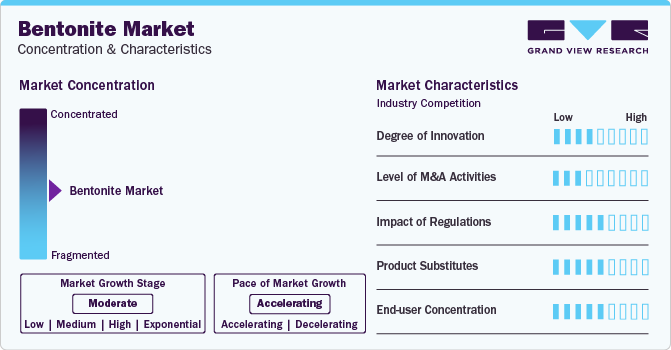

Market Concentration & Characteristics

Bentonite market is at a moderate stage of growth, with an accelerated pace, and is characterized by a fragmented structure, with presence of a diverse array of medium and small-scale enterprises operating across various regions. Intense competition prevails within the industry, as these entities primarily cater to local demand for bentonite products.

The market displays a moderate level of innovation, primarily focused on refining manufacturing processes to produce superior-quality bentonite. Companies are increasingly investing in research and development endeavors to integrate advanced technological solutions into their production processes, aiming to enhance efficiency and meet evolving customer demands.

It has witnessed moderately high levels of merger and acquisition activity, as major industry players seek to consolidate their market share. Industry players are particularly targeting small-scale firms that aim to streamline operations and gain significant regional market presence through acquisitions.

Regulatory scrutiny also plays a prominent role in shaping the bentonite market environment, with regulatory norms focusing on enhancing mining procedures, production standards and ensuring worker safety in facilities. In recent times, there has been a notable shift in perception regarding mining waste, with increasing recognition of its potential for recycling through appropriate disposal methods. This shift aligns with broader sustainability goals, emphasizing importance of adopting eco-friendly practices within bentonite industry.

Product Insights

Sodium bentonite held the largest revenue share of over 65% in 2023. Sodium bentonite segment is experiencing significant growth due to expanding applications of this versatile mineral across various industries. Surge in demand for sodium bentonite can be attributed to its widespread use in oil and gas industry. Sodium bentonite is a crucial component in drilling fluids, where it acts as a viscosifier, suspending agent, and lubricant, enhancing efficiency and safety of drilling operations.

Growing construction industry, particularly in developing economies, has also fueled demand for sodium bentonite. Sodium bentonite is used as a sealant, binder, and absorbent in various construction applications, such as in the production of concrete, asphalt, and geosynthetic clay liners, which are essential for infrastructure development.

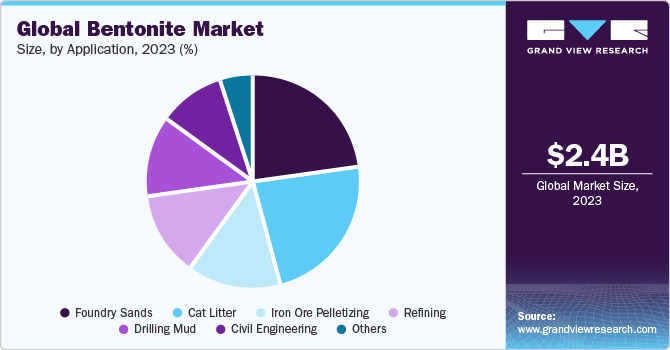

Application Insights

Drilling mud segment is anticipated to register a revenue CAGR of 6.3% over the forecast period. Foundry Sands sector led the market and accounted for more than 23.0% share of global revenue in 2023. his growth can be attributed to increasing demand for bentonite in the production of high-quality metal castings across various industries. Bentonite is a crucial component in preparation of molding sand used in manufacturing of iron, steel, and non-ferrous castings. The unique properties of foundry sand bentonite, such as its strong flow ability and thermal stability, make it an essential binder that helps produce superior quality green sand molds.

As the global construction, automotive, and machinery industries continue to expand, particularly in emerging economies, demand for high-quality metal castings has surged, driving the growth of foundry sands segment, and thus bentonite industry.

Cat litter segment has also emerged as another dominant application of bentonite, driven by growing demand for high-quality cat litter products. Increasing adoption of cats as pets has fueled demand for bentonite cat litter. Its unique properties, such as its high absorption rate, odor lock formula, and excellent clumping ability, make it an essential component in cat litter products.

Moreover, growing trend of pet humanization, where pet owners prioritize their pets' hygiene and care, has contributed to rising demand for bentonite cat litter. Pet owners are now more aware of importance of maintaining their pets' health and hygiene and are willing to invest in such products further boosting the bentonite market.

Regional Insights

North America held a significant revenue share in the global market, owing to presence of the U.S. Region's leading producers, such as the U.S. and Canada, contribute significantly to global supply of bentonite, particularly high-quality sodium bentonite. This coupled with growing demand from various end use industries, including oil & gas, construction, and agriculture, has solidified North America's position as a major player in the industry

U.S. Bentonite Market Trends

The U.S. bentonite market is one of the largest in North America. Its large-scale drilling activities, driven by increasing demand for energy resources, have fueled demand for bentonite in drilling mud applications. The growing construction industry and the expanding agricultural sector in the U.S. have further bolstered demand for bentonite in the country.

Europe Bentonite Market Trends

Europe dominated the market and accounted for the largest revenue share, over 33.0%, in 2023. Turkey held over 18% revenue share of the overall Europe bentonite market. It is attributed to advanced mining technologies, stringent quality standards, and a strong emphasis on sustainable practices. The region benefits from extensive deposits of high-quality bentonite, particularly in countries such as Greece, Germany, and Italy, which bolster production capabilities.

Asia Pacific Bentonite Market Trends

Asia Pacific accounted for second-largest share of global revenue in 2023 and is projected to witness fastest growth from 2024 to 2030. It is driven by the region's established agriculture, automotive, and construction industries. Rapid urbanization, population growth, and rising living standards in countries like China and India have fueled demand for bentonite across various applications, including iron ore pelletizing, drilling fluids, and soil treatment.

In India bentonite market, growing agricultural sector, coupled with increasing use of bentonite as a soil conditioner and fertilizer additive, has been a key driver of demand. Additionally, expansion of construction and automotive industries in India has further boosted consumption of bentonite in applications such as drilling fluids, foundry sands, and specialty products. Presence of large-scale bentonite deposits in the country, as well as availability of cost-effective labor and resources, have made it an attractive hub for bentonite production and consumption in Asia Pacific.

Central & South America Bentonite Market

Growth of the market is positively influenced by growing infrastructure development, particularly in countries such as Brazil and Mexico, which is expected to drive demand for bentonite in construction applications. In addition, region's oil & gas industry is expected to drive demand for bentonite in drilling fluids, refining, and other applications. Imerys, Ashapura Group, and Minerals Technologies, Inc. have established a strong presence in region through their high-quality products and effective marketing strategies.

Middle East & Africa Bentonite Market

Countries in the region are developing at a fast pace owing to ongoing industrialization and urbanization. It is driven by increasing demand from various industries such as construction, oil and gas, and agriculture. The region's growing infrastructure development, particularly in countries like UAE, and Saudi Arabia, is expected to drive demand for bentonite in construction applications.

Key Bentonite Company Insights

Some of the key players operating in the market include Ashapura Group and Clariant AG .

-

Ashapura Minechem Limited, part of Ashapura Group, leads as India’s largest bentonite mine owner and exporter, ranking globally in the top five. It possesses over 60 million tons of sodium and calcium bentonite reserves nationwide, with extensive activation, milling, and processing facilities across India. It has R&D, global technology integration, and a robust shipping infrastructure. It also maintains a wholly owned subsidiary and offices in UAE and China, enhancing its international reach and operational footprint.

-

Clariant's Adsorbents business operates 28 production sites globally, converting raw bentonite clay into consistent quality products tailored for various industrial applications. Its focus is on transforming natural raw materials into reliable products through drying, milling, and classification to meet quality standards of bentonite before delivery to customers.

Key Bentonite Companies:

The following are the leading companies in the bentonite market. These companies collectively hold the largest market share and dictate industry trends.

- Ashapura Group

- Bentonite Performance Minerals LLC.

- Black Hills Bentonite, LLC

- Cimbar Performance Minerals Inc.

- Clariant AG

- Imerys

- Kunimine Industries Co. Ltd

- Minerals Technologies Inc.

- Pacific Bentonite Ltd.

- Wyo-Ben Inc.

Recent Developments

-

In January 2024, GHCL Limited signed an MoU worth USD ~413 million for investments in Gujarat, India. A total investment of around USD 113 million out of the USD 413 million has been allocated for mining bentonite and sands in Saurashtra region of Gujarat. Bentonite and sand are part of overburden found during lignite mining. Bentonite will be marketed to various industries, primarily for use as a raw material in fertilizers, foundries, cosmetics, and pharmaceuticals, among others.

-

In April 2023, Phoslock Environmental Technologies, a leading global environmental technology corporation specializing in application of bentonite to mitigate excessive nutrient levels in water bodies resulting from agricultural runoff, industrial discharges, and sewage treatment processes, is seeking to extend its operational footprint in Casper.

-

In November 2022, Bentoproduct, a Bosnian enterprise specializing in manufacturing of bentonite-based products, initiated a takeover proposal for Nemetali, a domestic mining company. Further, Securities Commission of Bosnia and Herzegovina's Serb Republic has granted approval for this bid.

Bentonite Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.54 billion

Revenue forecast in 2030

USD 3.65 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; Russia; Italy; Turkey; China; India; Japan; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Ashapura Group; Bentonite Performance Minerals LLC.; Black Hills Bentonite, LLC; Cimbar Performance Minerals Inc.; Clariant AG; Imerys; Kunimine Industries Co. Ltd; Minerals Technologies Inc.; Pacific Bentonite Ltd.; Wyo-Ben Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bentonite Market Report Segmentation

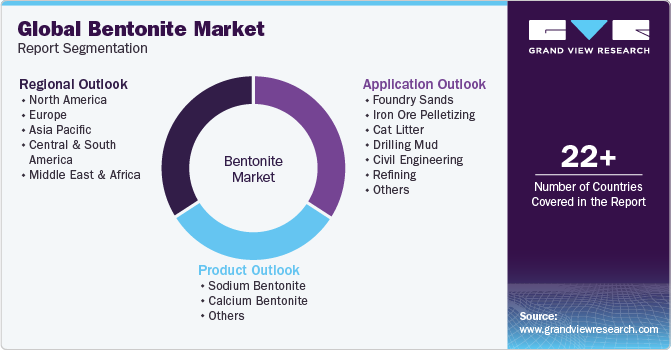

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global bentonite market report on the basis of product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Sodium Bentonite

-

Calcium Bentonite

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Foundry Sands

-

Iron Ore Pelletizing

-

Cat Litter

-

Drilling Mud

-

Civil Engineering

-

Refining

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

Italy

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The bentonite market size was estimated at USD 2.44 billion in 2023 and is expected to reach USD 2.54 billion in 2024.

b. The bentonite market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 3.65 billion by 2030.

b. Based on product, sodium bentonite dominated the bentonite market with a share of over 65.0% in 2023, owing to the extensive use of sodium bentonite in end-use applications such as drilling mud, foundry sands, iron ore pelletizing, among others.

b. Some of the key players operating in the bentonite market include Ashapura Group, Bentonite Performance Minerals LLC., Black Hills Bentonite, LLC, Cimbar Performance Minerals Inc., Clariant AG, Imerys, and Kunimine Industries Co. Ltd.

b. The key factors that are driving the bentonite market include the rising demand for bentonite in construction activities worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.