- Home

- »

- Organic Chemicals

- »

-

Benzyl Chloride Market Size & Share, Industry Report, 2030GVR Report cover

![Benzyl Chloride Market Size, Share & Trends Report]()

Benzyl Chloride Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Benzyl Alcohol, Benzyl Cyanide, Benzyl Quaternary Ammonium Compounds), By Application (Pharmaceutical, Agriculture, Paints & Coatings), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-514-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Benzyl Chloride Market Summary

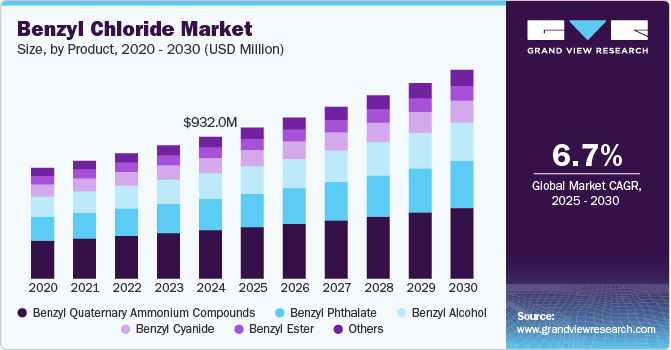

The global benzyl chloride market size was estimated at USD 932.0 million in 2024 and is projected to reach USD 1372.8 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. Benzyl chloride, also known as α-chlorotoluene, is a versatile organic compound with the formula C6H5CH2Cl.

Key Market Trends & Insights

- Asia-Pacific dominated the benzyl chloride market for largest revenue share of 49.9% in 2024.

- North America represents a mature market for benzyl chloride, with significant demand stemming from the pharmaceutical and paints and coatings industries.

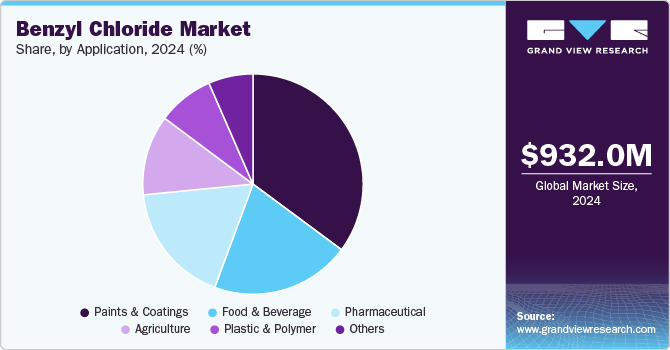

- Based on application, the paints and coatings segment dominated the market with a market share of 35.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 932.0 Million

- 2030 Projected Market Size: USD 1372.8 Million

- CAGR (2025-2030): 6.7%

It is a colorless liquid widely used as a chemical building block in various industries. Industrially, benzyl chloride is produced through the gas-phase photochemical reaction of toluene with chlorine. Its reactivity and utility make it a critical component in the synthesis of numerous products, including benzyl alcohol, benzyl esters, and other derivatives.

The demand for benzyl chloride has been steadily increasing due to its extensive applications in diverse industries. , One of the primary drivers of this growth is its use in the production of benzyl alcohol which accounts for approximately 50% of the global benzyl chloride market

Benzyl alcohol is widely used to manufacture paints, coatings, and personal care products, which are experiencing heightened demand due to expanding infrastructure projects and consumer preferences. Additionally, benzyl chloride is a key intermediate in the production of agrochemicals, pharmaceuticals, and dyes, further contributing to its rising demand.

Despite its growing demand, the benzyl chloride market faces challenges such as fluctuating raw material prices and environmental concerns associated with its production and use. For instance, the North American market experienced a decline in late 2024 due to oversupply, reduced agrochemical demand, and cheaper imports.

However, these challenges also present opportunities for innovation, such as developing more sustainable production methods and exploring alternative applications. As industries continue to evolve, benzyl chloride's versatility ensures its relevance in meeting the needs of emerging markets and technologies.

Drivers, Opportunities & Restraints

The benzyl chloride market is experiencing growth due to several key drivers. One of the primary factors is its extensive use in the production of benzyl alcohol, which accounts for 50% of the global benzyl chloride market. Benzyl alcohol is widely utilized in industries such as paints, coatings, and personal care products, all of which are seeing increased demand due to expanding infrastructure projects and consumer preferences. Additionally, benzyl chloride is a critical intermediate in the synthesis of agrochemicals, pharmaceuticals, and dyes, further driving its demand. The growing pharmaceutical industry, in particular, relies on benzyl chloride for the production of active pharmaceutical ingredients (APIs), which is a significant contributor to market expansion.

The benzyl chloride market presents several opportunities for growth. One notable opportunity lies in the increasing demand for sustainable and eco-friendly production methods. As environmental concerns grow, companies are exploring innovative ways to reduce the environmental impact of benzyl chloride production, which could open new avenues for market expansion.

Additionally, the rising demand for agrochemicals in developing regions, driven by the need for higher agricultural productivity, provides a significant growth opportunity. The market is also poised to benefit from advancements in chemical synthesis technologies, which could enhance the efficiency and cost-effectiveness of benzyl chloride production.

Despite its growth potential, the benzyl chloride market faces several restraints. One major challenge is fluctuating raw material prices, which can impact production costs and profitability. Additionally, environmental concerns associated with the production and use of benzyl chloride pose significant challenges. Regulatory restrictions and the need for compliance with environmental standards can increase operational costs for manufacturers Furthermore, oversupply in certain regions, such as North America, coupled with reduced demand for agrochemicals and competition from cheaper imports, has led to market slowdowns in recent years.

Application Insights

The paints and coatings segment dominated the market with a market share of 35.2% in 2024, during the forecast period. In the paints and coatings industry, benzyl chloride is primarily used to manufacture benzyl alcohol, which serves as a solvent and stabilizer in paint formulations. Benzyl alcohol improves the viscosity, drying time, and durability of paints and coatings, making it an indispensable ingredient in this sector. This application is particularly important in infrastructure development, automotive manufacturing, and home improvement projects, all of which are driving the demand for high-quality paints and coatings globally.

Benzyl chloride finds limited but significant applications in the food and beverage industry, primarily as a chemical intermediate in producing flavoring agents and preservatives. It synthesizes benzyl esters, which impart fruity flavors and aromas in food products. Additionally, benzyl chloride-derived compounds are utilized as antimicrobial agents in food preservation. However, its use in this sector is subject to stringent safety regulations to ensure compliance with food-grade standards.

Regional Insights

The Asia-Pacific region dominates the global benzyl chloride market due to its robust industrial base and growing demand across key sectors such as pharmaceuticals, agrochemicals, and paints and coatings. Countries like China and India are major contributors, driven by their expanding manufacturing industries and increasing investments in infrastructure. However, the market in APAC faced challenges in late 2024, including a bearish trend caused by oversupply, reduced feedstock toluene costs, and subdued demand from the agrochemical and polymer sectors

China Benzyl Chloride Market Trends

China benzyl chloride market is growing due to the country's robust chemical industry and its role as a global manufacturing hub make it a critical market for benzyl chloride and its derivatives.

North America Benzyl Chloride Market Trends

North America represents a mature market for benzyl chloride, with significant demand stemming from the pharmaceutical and paints and coatings industries. The region benefits from advanced manufacturing capabilities and a strong focus on research and development, particularly in the pharmaceutical sector. However, the market experienced a slowdown in late 2024 due to oversupply and reduced demand for agrochemicals, coupled with competition from cheaper imports

Europe Benzyl Chloride Market Trends

Europe is a significant market for benzyl chloride, driven by its applications in pharmaceuticals, agrochemicals, and specialty chemicals. The region's stringent environmental regulations have encouraged the adoption of sustainable production practices, which could present opportunities for innovation in the benzyl chloride market. Additionally, the demand for benzyl chloride in the paints and coatings industry is supported by the region's focus on infrastructure development and automotive manufacturing. While the market in Europe is relatively stable, fluctuations in raw material prices and regulatory compliance costs remain key challenges for manufacturers.

Latin America Benzyl Chloride Market Trends

In Latin America, the benzyl chloride market is primarily driven by the agricultural sector, where it is used in the production of agrochemicals such as pesticides and herbicides. The region's reliance on agriculture for economic growth ensures a steady demand for benzyl chloride derivatives. .

Middle East & Africa Benzyl Chloride Market Trends

The Middle East and Africa (MEA) region is witnessing growing demand for benzyl chloride in the paints and coatings industry, fueled by increasing construction activities and infrastructure development. However, both regions face challenges such as limited industrial capacity and dependence on imports, which could hinder market growth. Despite these obstacles, the rising demand for agrochemicals and infrastructure projects presents significant growth opportunities in these regions.

Key Benzyl Chloride Company Insights

Some of the key players operating in the market include Lanxess AG, Valtris Specialty Chemicals.

-

Lanxess AG, headquartered in Cologne, Germany, is a leading specialty chemicals company with a strong presence in the benzyl chloride market. The company operates globally, providing high-quality chemical intermediates, additives, and specialty chemicals for various industries. Lanxess is known for its focus on innovation, sustainability, and advanced manufacturing processes.

-

Valtris Specialty Chemicals, based in the United States, is a prominent player in the benzyl chloride market. The company specializes in the production of specialty chemicals and intermediates, serving a wide range of industries, including pharmaceuticals, plastics, and coatings.

Key Benzyl Chloride Companies:

The following are the leading companies in the benzyl chloride market. These companies collectively hold the largest market share and dictate industry trends.

- Kemin Industries, Inc.

- Lanxess AG

- Valtris Specialty Chemicals

- Shanghai Xinglu Chemical Technology Co., Ltd.

- Nippon Light Metal Holdings Co., Ltd.

- Hubei Phoenix Chemical Company Limited

- Benzo Chem Industries Pvt. Ltd.

- Charkit Chemical Company LLC

- KLJ Group

- Danyang Wanlong Chemical Co., Ltd.

- LBB Specialties

Recent Developments

-

In May 2023, LANXESS recently doubled its production capacity for high-purity benzyl alcohol at its Kalama, Washington, USA site. This expansion was achieved through technical upgrades and is aimed at supporting the increasing demand for benzyl alcohol in the Americas. Benzyl alcohol is widely used in applications such as pharmaceuticals, personal care products, and coatings.

Benzyl Chloride Market Report Scope

Report Attribute

Details

Market size in 2025

USD 993.0 million

Revenue forecast in 2030

USD 1372.8 million

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Kemin Industries, Inc.; Lanxess AG; Valtris Specialty Chemicals; Shanghai Xinglu Chemical Technology Co., Ltd.; Nippon Light Metal Holdings Co. Ltd.; Hubei Phoenix Chemical Company Limited; Benzo Chem Industries Pvt. Ltd.; Charkit Chemical Company LLC; KLJ Group Danyang Wanlong Chemical Co., Ltd.; LBB Specialties

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Benzyl Chloride Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global benzyl chloride market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Benzyl Alcohol

-

Benzyl Cyanide

-

Benzyl Quaternary Ammonium Compounds

-

Benzyl Phthalate

-

Benzyl Ester

-

Others

-

-

Application Oil Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

Pharmaceutical

-

Agriculture

-

Paints & Coatings

-

Food and Beverage

-

Plastic and Polymer

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global benzyl chloride market size was estimated at USD 932.0 million in 2024 and is expected to reach USD 1372.8 million in 2025.

b. The global benzyl chloride market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 1372.8 million by 2030.

b. Asia Pacific dominated the benzyl chloride market with a share of 46.9% in 2024. The Asia-Pacific region dominates the global benzyl chloride market due to its robust industrial base and growing demand across key sectors such as pharmaceuticals, agrochemicals, and paints and coatings.

b. Some key players operating in the benzyl chloride market include Kemin Industries, Inc., Lanxess AG, Valtris Specialty Chemicals, Shanghai Xinglu Chemical Technology Co., Ltd., Nippon Light Metal Holdings Co., Ltd., Hubei Phoenix Chemical Company Limited, Benzo Chem Industries Pvt. Ltd., Charkit Chemical Company LLC, KLJ Group Danyang Wanlong Chemical Co., Ltd., LBB Specialties

b. The benzyl chloride market is widely used in industries such as pharmaceuticals, personal care, and paints and coatings, driving the demand for benzyl chloride as a precursor.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.