- Home

- »

- Consumer F&B

- »

-

Beverage Flavoring System Market, Industry Report, 2030GVR Report cover

![Beverage Flavoring System Market Size, Share & Trends Report]()

Beverage Flavoring System Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Flavoring Agents, Flavoring Carriers), By Beverage, By Flavor, By Form, By Origin, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-306-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Beverage Flavoring System Market Trends

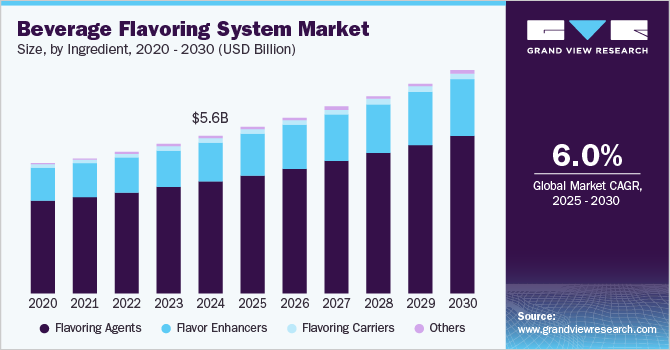

The global beverage flavoring system market size was valued at USD 5.60 billion in 2024 and is expected to expand at a CAGR of 6.0% from 2025 to 2030. The increasing demand for innovative and exotic flavors in beverages is a significant driver, as consumers seek unique and diverse taste experiences. The rising health consciousness among consumers has led to a growing preference for natural and organic flavoring systems, driving market growth. Additionally, the expansion of the beverage industry, including the rapid growth of functional and fortified drinks, has boosted the demand for advanced flavoring systems.

Technological advancements in flavor extraction and formulation have enabled manufacturers to develop more sophisticated and customized flavor profiles, catering to the evolving preferences of consumers. The influence of social media and global food trends has also played a crucial role in shaping consumer tastes and preferences, further fueling market growth. Increasing experiments for unusual combinations to create evolved tastes and appearances boost the beverage flavoring systems' market. Particularly in the non-alcoholic section, the mocktail range, including fruity, floral, sour, and spicy flavors, is gaining demand across meals to complement exquisite dishes. Furthermore, the increasing disposable incomes and urbanization in emerging economies have led to higher spending on premium and flavored beverages.

A flavoring system refers to the combination of varied ingredients such as flavoring agents, flavor carriers, flavor enhancers, preservatives, emulsifiers, and stabilizers. These ingredients enhance the flavor or taste of alcoholic and non-alcoholic beverages. The increasing awareness among manufacturers about the various ingredients and their respective functionalities is driving the market.

The demand for drinks that can complement or satisfy the need for well-being is projected to create potential demand in efforts to boost immunity against coronavirus. These drinks consist of ingredients that contribute to a healthy lifestyle. Holistic product solutions that promote long-term benefits for mental, physical, and emotional well-being are estimated to exhibit potential growth over the forecast period from 2025 to 2030.

The continuously rising stress levels of people across the globe are boosting demand for drinks that can provide relief or boost the mind and mood, which is projected to create potential growth in the near future. Relaxation drinks use ingredients such as botanicals, adaptogens, CBD, and L-theanine. The calming effect of these drinks on the body and mind is estimated to create potential opportunities over the forecast period.

Ingredients Insights

Flavoring agents dominated the market with the largest revenue share of 71.2% in 2024. Flavoring agents are essential in the beverage industry, providing the desired taste and aroma to enhance the overall consumer experience. The increasing demand for diverse and exotic flavors in beverages has driven the widespread use of flavoring agents. Additionally, the rising health consciousness among consumers has led to the development of natural and organic flavoring agents, which are perceived as healthier alternatives to synthetic options. The expansion of the beverage industry, including functional and fortified drinks, has also boosted the demand for advanced flavoring agents that cater to specific health benefits and dietary preferences. Technological advancements in flavor extraction and formulation have enabled manufacturers to create more sophisticated and customized flavor profiles, further driving market growth.

Flavoring carriers are expected to grow at a CAGR of 6.4% over the forecast period, owing to the increasing demand for efficient and versatile carriers that can enhance the stability and delivery of flavors in beverages. Flavoring carriers play a crucial role in preserving the integrity of flavor compounds during processing and storage, ensuring consistent taste and quality. The shift towards natural and clean-label products has led to the development of innovative carriers made from natural and organic ingredients, which align with consumer preferences for healthier and more sustainable options. Technological advancements in encapsulation and delivery systems have also contributed to the growth of this segment, enabling more precise and effective flavor release. Additionally, the expanding beverage industry, including functional and fortified drinks, has boosted the demand for advanced flavoring carriers that cater to specific health benefits and dietary needs.

Beverage Insights

Non-alcoholic beverages dominated the market with the largest revenue share in 2024, owing to the increasing consumer preference for healthier and functional beverages. The wide range of products under the non-alcoholic segments, such as energy drinks, flavored milk, flavored water, mocktails, and juices, are contributing to the dominating share of the segment. The increasing varieties of aforementioned product types under non-alcoholic beverages are further supporting the maximum revenue share of the segment in the market for beverage flavoring systems.

The benefits associated with non-alcoholic beverages over alcoholics are another major factor supporting segmental growth. These beverages can promote post-exercise recovery, rehydrate the body, improve cardiovascular health, reduce the risk of osteoporosis, improve copper metabolism, promote better sleep, and reduce anxiety and stress, among others. The rising awareness about the health benefits associated with non-alcoholic beverages, especially among the young population, is contributing to the growth of the segment. Moreover, the increasing number of health freaks across the globe supports the demand for energy drinks and sports drinks.

Alcoholicbeverages are expected to grow at the fastest CAGR of 6.3% over the forecast period. The increasing consumer interest in premium and craft alcoholic beverages, such as artisanal beers, specialty cocktails, and flavored spirits, has driven demand for advanced and diverse flavoring systems. The trend towards innovative and exotic flavors in alcoholic beverages is also gaining momentum, with consumers seeking unique taste experiences. Additionally, the rise of social drinking and the influence of social media in promoting new and trendy alcoholic beverages have further boosted market growth. Technological advancements in flavor extraction and infusion have enabled manufacturers to create sophisticated and customized flavor profiles, catering to the evolving preferences of consumers.

Flavor Insights

The chocolate and browns segment dominated the market with the largest revenue share in 2024. Chocolate and brown flavors are immensely popular in a wide range of beverages, including coffee, hot chocolate, milkshakes, and alcoholic drinks like chocolate liqueurs and stouts. Chocolate flavors' rich and indulgent taste appeals to a broad consumer base, making them a favorite choice in the beverage industry. Additionally, the trend toward premium and artisanal beverages has further boosted the demand for high-quality chocolate and brown flavors. These flavors are often associated with comfort and indulgence, which resonates with consumers seeking a luxurious and satisfying beverage experience.

The herbs & botanicals segment is expected to grow at the fastest CAGR over the forecast period. Herbs and botanicals are highly valued for their perceived health benefits and natural flavor profiles, which appeal to health-conscious consumers seeking beverages with added functional benefits. The rising wellness and holistic living trend have further boosted the demand for these natural flavoring agents. Additionally, the expanding variety of beverages, such as teas, infusions, flavored waters, and functional drinks, has increased the utilization of herbs and botanicals to create unique and appealing flavor combinations. Technological advancements in extraction and formulation methods have also enhanced the quality and potency of these flavoring agents, contributing to their growing popularity.

Form Insights

Liquid dominated the market with the largest revenue share in 2024. The segment growth is attributed to the versatility and ease of use of liquid flavoring agents in various beverage formulations. Liquid flavorings are widely used in a range of beverages, such as soft drinks, juices, dairy products, and alcoholic beverages, providing consistent and uniform flavor distribution. The ability to easily blend and mix liquid flavorings with other ingredients makes them a preferred choice for beverage manufacturers. Additionally, liquid flavorings often have a longer shelf life and better stability compared to other forms, ensuring that the desired flavor profile is maintained throughout the product's shelf life. The continuous innovation in liquid flavor formulations, including natural and organic options, caters to the growing consumer demand for healthier and more diverse flavors.

Dry is expected to grow at a significant CAGR over the forecast period. Dry flavoring agents, such as powders and granules, offer significant advantages in terms of stability, shelf life, and ease of transportation. They are particularly favored in the production of instant beverages, powdered drink mixes, and other dry beverage applications where moisture content needs to be minimized. Additionally, dry flavorings are versatile and can be easily reconstituted, providing manufacturers with flexibility in product formulation. The increasing demand for on-the-go beverage solutions and the convenience of using dry flavoring agents have further boosted their popularity.

Origin Insights

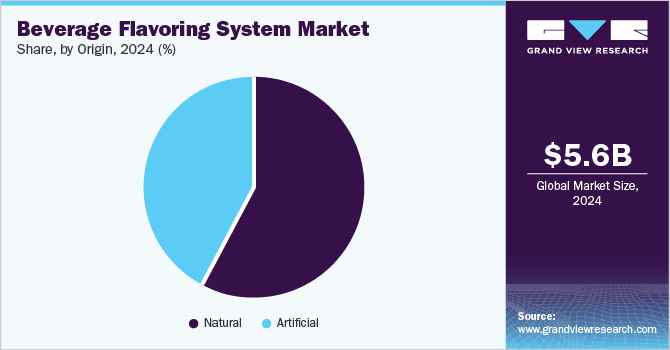

Natural dominated the market with the largest revenue share in 2024. Consumers increasingly seek beverages containing natural and organic ingredients, avoiding artificial additives and preservatives. This trend towards health-conscious and sustainable consumption has driven manufacturers to develop and use natural flavoring systems that align with these preferences. Additionally, the rise of functional and fortified beverages, which often emphasize the use of natural ingredients, has further supported the dominance of the natural segment.

The artificial segment is expected to grow at a significant CAGR over the forecast period. Artificial flavoring agents offer consistency, stability, and cost-effectiveness, making them a preferred choice for many beverage manufacturers. These flavorings can be precisely formulated to achieve specific taste profiles, ensuring a consistent flavor experience for consumers. The ability to replicate natural flavors at a lower cost is particularly attractive to manufacturers looking to maintain product affordability while delivering desirable flavors. Additionally, the versatility of artificial flavorings allows for their use in a wide range of beverages, including sodas, energy drinks, and flavored waters.

Regional Insights

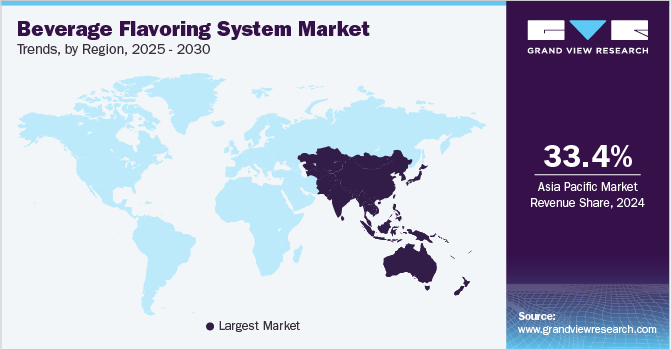

Asia Pacific beverage flavoring system industry dominated the global industry with the largest revenue share of 33.4% in 2024. The region's diverse and growing consumer base, coupled with increasing disposable incomes, has significantly boosted the demand for various flavored beverages. The influence of cultural preferences for unique and traditional flavors has also played a crucial role in shaping the market dynamics. The rapid urbanization and expanding middle class in countries such as China, India, and Japan have also contributed to the rising demand for innovative and exotic beverage flavors. The thriving food and beverage industry in the region, supported by a robust retail infrastructure and the growing popularity of e-commerce, has made flavored beverages more accessible to consumers. Furthermore, technological advancements in flavor extraction and formulation have enabled manufacturers to cater to the evolving tastes and preferences of the Asia Pacific consumer base

North America Beverage Flavoring System Market Trends

The North American beverage flavoring system industry held a considerable share in 2024. The region's dynamic food and beverage industry, coupled with a strong focus on health and wellness, has led to the development of a wide range of natural and functional flavoring agents. Consumers in North America are increasingly seeking beverages that offer unique taste experiences and health benefits, driving the demand for advanced flavoring systems. .

The U.S. beverage flavoring system industry is expected to grow significantly over the forecast period. The country’s growth is attributed to the combination of health trends, technological innovation, and consumer demand for unique taste experiences. The rise of health-conscious lifestyles has significantly influenced the market, with consumers seeking beverages that are not only flavorful but also offer functional benefits.

Europe Beverage Flavoring System Market Trends

Europe beverage flavoring system industry is expected to grow at a significant CAGR of 6.0% over the forecast period. European consumers are highly conscious of the health and environmental impact of the products they consume, leading to a significant demand for natural flavoring agents. The region's rich culinary heritage and diverse taste preferences also drive the development of innovative and exotic flavors.

Key Beverage Flavoring System Company Insights

The beverage flavoring system market is large and fragmented worldwide, which has increased the competition between players. The market is fragmented across varied small- and medium-sized players. Flavor manufacturers are adopting new technologies, particularly to manufacture natural and synthetic flavors for better stability and efficient flavor production. The extraction of flavors from source ingredients is a complex procedure. Hence, manufacturers are adopting various advanced methods such as biotechnology, encapsulation, and emulsion to increase the effectiveness of the flavors. These enable them to meet the global demand for various flavors.

The market is highly competitive as flavor manufacturers are focusing more on distribution and supply chain strategies. The flavor manufacturers have also been keeping track of emerging trends in the beverage industry, which is helping them to cope with the future demands of their customers. The continuously changing preference of the consumers about taste and flavor is the key aspect for the flavor manufacturers. For instance, International Flavors and Fragrance (IFF) is expanding its core product line with beverage solutions having citrus and other natural flavors. The company’s citrus flavor is its key product line in the entire product portfolio. IFF is focused on introducing new and innovative citrus flavors for the food and beverage industry.

Along with that, the presence of a huge customer base in the Asia Pacific countries like China and India and the high percentage of the youth population, which is more likely to invest in alcoholic and non-alcoholic beverages is attracting leading manufacturers in the region. In February 2019, the Switzerland-based company Givaudan opened a state-of-the-art flavor manufacturing facility in Pune, India, to strengthen its footprint in the Asia Pacific flavors market.

-

ADM is a global leader in agricultural processing and food ingredient solutions. In the beverage flavoring system industry, ADM provides a wide range of flavoring agents, carriers, and enhancers that cater to both alcoholic and non-alcoholic beverages. The company's innovative solutions include flavor systems for beer and malt-based beverages, colas and carbonated soft drinks, and fermented drinks like cider and kombucha.

-

Givaudan is a leading global flavor and fragrance company, renowned for its expertise in creating unique and high-quality flavor solutions. In the beverage flavoring system market, Givaudan offers a diverse range of natural and natural-identical flavoring agents that cater to various beverage categories, including juices, energy drinks, teas, and alcoholic beverages.

Key Beverage Flavoring System Companies:

The following are the leading companies in the beverage flavoring system market. These companies collectively hold the largest market share and dictate industry trends.

- ADM

- Givaudan

- Sensient Technologies Corporation

- Kerry Group plc.

- International Flavors & Fragrances Inc.

- dsm-firmenich

- Takasago International Corporation

- Flavorcan International Inc.

- Tate & Lyle

- Döhler GmbH

Recent Developments

-

In May 2023, FlavorSum, a prominent North American flavor producer, launched the “Choose Your Flavor Adventure” platform, an innovative tool designed to assist food and beverage formulators. Accessible via desktop and mobile devices, the platform supports the product development cycle and addresses formulation challenges, reaffirming FlavorSum’s commitment to enhancing innovation in the industry.

Beverage Flavoring System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.92 billion

Revenue forecast in 2030

USD 7.93 billion

Growth Rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredients, beverage, flavor, form, origin, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain China, Japan, India, Australia, Brazil, South Africa

Key companies profiled

ADM; Givaudan; Sensient Technologies Corporation; Kerry Group plc. ; International Flavors & Fragrances Inc.; dsm-firmenich; Takasago International Corporation; Flavorcan International Inc.; Tate & Lyle; Döhler GmbH

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Beverage Flavoring System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global beverage flavoring system market report based on ingredients, beverage, flavor, form, origin, and region:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2028)

-

Flavoring Agents

-

Flavoring Carriers

-

Flavor Enhancers

-

Others

-

-

Beverage Outlook (Revenue, USD Million, 2018 - 2030)

-

Alcoholic

-

Non-alcoholic

-

Dairy

-

Juices

-

Carbonated Soft Drinks

-

Functional Drinks

-

Others

-

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Chocolate and Browns

-

Dairy

-

Herbs & Botanicals

-

Fruits & Vegetables

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry

-

Liquid

-

-

Origin Outlook (Revenue, USD Million, 2018 - 2030)

-

Artificial

-

Natural

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.