- Home

- »

- Next Generation Technologies

- »

-

BFSI Crisis Management Market Size & Share Report, 2030GVR Report cover

![BFSI Crisis Management Market Size, Share & Trends Report]()

BFSI Crisis Management Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By Enterprise Size, By Application, By End-Users, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-986-9

- Number of Report Pages: 182

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global BFSI crisis management market size was valued at USD 11.24 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 18.5% from 2023 to 2030. Factors such as the growth in the digitization of banks and financial services and the remote working culture leading to more cybercrimes are driving the demand for banking, financial services and insurance (BFSI) crisis management. Furthermore, the introduction of cybercrime policies, initiatives, and regulations by the governments for the BFSI sector and crisis management solution providers is boosting the demand for crisis management services worldwide. The COVID-19 pandemic had a positive impact on the crisis management market. Financial institutions were investing in crisis management services even before the pandemic.

However, the pandemic boosted the adoption of crisis management solutions as more companies witnessed numerous incidents and demanded crisis management teams and plan to recover from this crisis and continue their businesses. The increase in COVID-19 cases globally slowed the growth of the economy, which resulted in the shutting down of companies due to result of partial or total lockdowns. However, financial services, banking, and insurance continued to operate despite the pandemic. Due to this reason, BFSI firms required an instant crisis management plan for disaster recovery and business continuity to keep their services operational during the pandemic.

Crisis management is a service that offers solutions for risk assessments, crisis notification alerts, crisis tracking dashboards, business continuity and disaster recovery plans, and risk and compliance management solutions. There was a rise in the global usage and adoption of online and digitalized financial services as a result of the COVID-19 outbreak and the following lockdown.

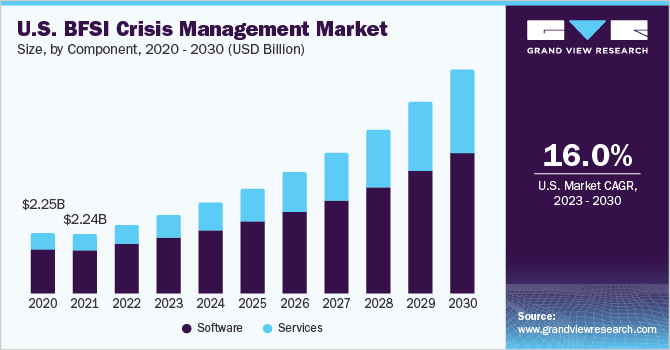

Component Insights

Based on components, the market is categorized into software and services. The software segment dominated the market with a share of 72.2% in 2022 owing to the fact that the crisis management software enables the key stakeholders to stay informed, assist the crisis teams to coordinate response activities and put important documentation in the hands of all employees with the help of a simple and effective cloud platform.

The services segment is projected to register the highest CAGR of 22.8% over the forecast period. The growth of the services segment can be attributed to the increased focus of technology companies on the development of technology as a service (TaaS).

Deployment Insights

The cloud segment dominated the market with a revenue share of 57.8% in 2022 and is projected to register the highest CAGR of 20.8% over the forecast period. There is significant growth in the cloud segment as the cloud provides a high level of backup and redundancy at a minimal cost. In terms of deployment, the market is divided into on-premise and cloud.

For BFSI firms, maintaining the privacy and security of the data is crucial. Quick response time for delivering and receiving messages is another big concern for banks and financial institutions. Therefore, an on-premise solution provides low latency to the users because of few or no external dependencies, which cuts short the feedback loop time i.e. time to receive and deliver messages between two individuals.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of 59.6% in 2022. This is attributed to the trend of adopting the multi-cloud and hybrid cloud strategy among large enterprises as they are deploying workloads on multiple public clouds while also storing some data on the private cloud. Based on enterprise size, the market is divided into small and medium, and large enterprises.

The small and medium enterprises segment is projected to expand at the highest CAGR of 20.4% over the forecast period. This segment is expected to give high returns as to overcome the pandemic's effects and business shocks, small and medium firms require a crisis management plan and team. Furthermore, SMEs lack experience in managing crises, as they are new in business as compared to large industries.

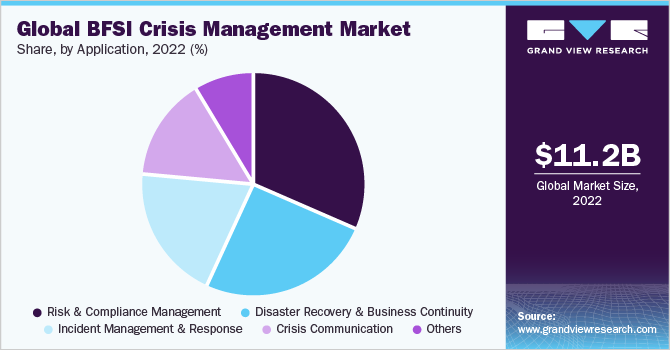

Application Insights

The risk and compliance segment accounted for the largest revenue share of over 31.4% in 2022. This growth is due to the rise in cloud-based technology trends in the risk and compliance management industry as account decentralization and cloud computing challenges are at the forefront of regulation strategy. According to a study by Cloud Security Alliance in 2022, it was found that 91% of financial service businesses were using the cloud or were expected to be moving there within the next nine months. Based on application, the market is segmented into risk and compliance management, disaster recovery & business continuity, incident management & response, crisis communication, and others.

The crisis communication segment is projected to register the highest CAGR of 20.5% in the forecast period. This segment is expected to grow in the future owing to the usage of SaaS, as BCI’s Emergency & Communications Report 2023 stated that 78.2% of companies who utilized SaaS easily activated their emergency and crisis communication plans within 30 minutes.

End-user Insights

The banks segment accounted for the largest revenue share of 53.2 % in 2022 as they largely adopt digital platforms and networked solutions. Furthermore, market participants are offering crisis management solutions in this sector in order to monitor and reduce business risks, identify fraud, and enhance event and document management. By end user, the market is divided into banks, insurance companies, and financial service providers.

The financial service providers segment is expected to expand at the highest CAGR of 20.2% over the forecast period. This is owing to the increase in the number of investments in fintech in the Asia Pacific region. In February 2022, according to a report by S&P Global Market in Intelligence, 2022, fintech in the Asia Pacific received USD 15.6 billion in private funding.

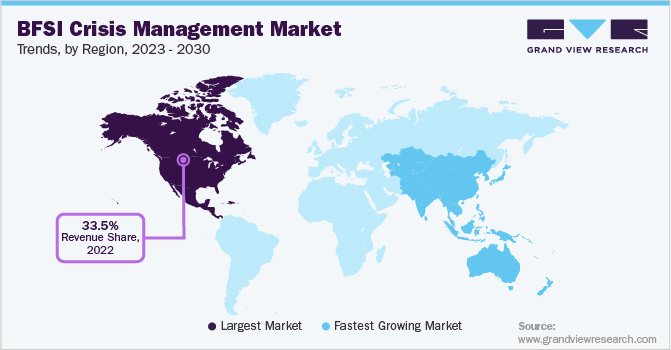

Regional Insights

North America dominated the market with a share of 33.5% in 2022 owing to the presence of prominent crisis management services and software providers. North America is likely to witness significant growth owing to the increasing adoption of cloud-based solutions and the COVID-19 pandemic.

The market in the Asia Pacific is projected to register the highest CAGR of 20.5% over the forecast period. This is owing to the increase in fintech deals in the region, according to a report by S&P Global Market in Intelligence in 2022, fintech in Asia Pacific closed 754 deals, which was an increase of 81% and 49% from 2020 and 2019, respectively.

Key Companies & Market Share Insights

The competitive landscape of the BFSI crisis management market is fragmented, featuring several global as well as regional players. The key participants are entering into strategic collaborations, partnerships, and mergers & acquisitions to expand their business footprint and survive the highly competitive environment. Moreover, service providers are investing considerably in research & development activities to incorporate new technologies in their offerings and develop advanced solutions to gain a competitive advantage over other market players.

In February 2022, MetricStream announced its collaboration with the Value Reporting Foundation, which maintains the SASB standards. This collaboration helped MetricStream integrate cost-effective, industry-specific, and decision-useful SASB standards for its services. Some prominent players in the global BFSI crisis management market include:

-

NCC Group

-

Noggin

-

LogicGate, Inc.

-

MetricStream Inc.

-

4C Strategies

-

IBM

-

CURA Software Solutions

-

Everbridge

-

Konexus

-

SAS Institute Inc

-

Deloitte

-

RQA Europe Ltd.

BFSI Crisis Management Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.18 billion

Revenue forecast in 2030

USD 43.31 billion

Growth rate

CAGR of 18.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; China; India; Japan; Brazil; Mexico

Key companies profiled

4C Strategies; LogicGate, Inc.; MetricStream; CURA; Everbridge; Konexus; SAS Institute Inc; Deloitte Touche Tohmatsu Limited; RQA Europe Ltd.; IBM; NCC Group; Noggin

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global BFSI Crisis Management Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global BFSI crisis management market report based on component, deployment, enterprise size, application, end-user, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Risk & Compliance Management

-

Disaster Recovery & Business Continuity

-

Incident Management & Response

-

Crisis Communication

-

Others

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Banks

-

Insurance Companies

-

Financial Services Providers

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global BFSI crisis management market size was projected at USD 11.24 billion in 2022 and is witnessed to the value of USD 13.18 billion in 2023

b. The global BFSI crisis management market is estimated to grow at a CAGR of 18.5% from 2023 to 2030 and reach USD 43.31 billion by 2030

b. North America dominated the BFSI crisis management with a share of 33.5% in 2022. This is attributable to the presence of prominent crisis management services and software providers.

b. Some key players operating in the BFSI crisis management market are 4C Strategies, LogicGate, Inc., MetricStream, CURA, Everbridge, Konexus, SAS Institute Inc, Deloitte Touche Tohmatsu Limited, RQA Europe Ltd., IBM, NCC Group, and Noggin.

b. Key factors driving the market growth include the growth in digitization of banks & financial institutions and a remote working culture which results in more cybercrimes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.