- Home

- »

- Network Security

- »

-

Big Data Security Market Size, Share & Growth Report, 2030GVR Report cover

![Big Data Security Market Size, Share & Trends Report]()

Big Data Security Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment (On-premises, Cloud), By Enterprise Size, By End-use (BFSI, Telecom), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-423-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Big Data Security Market Summary

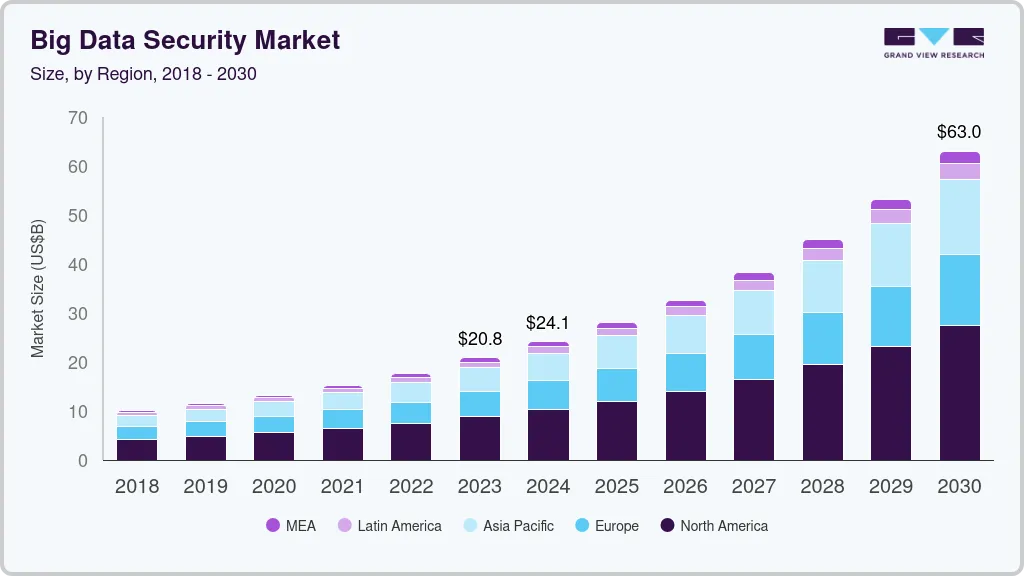

The global big data security market size was estimated at USD 20.82 billion in 2023 and is projected to reach USD 62.97 billion by 2030, growing at a CAGR of 17.3% from 2024 to 2030. Several key factors primarily drive the market, such as the exponential growth of data generation by organizations and the increasing complexity of data environments have heightened the need for robust security measures.

Key Market Trends & Insights

- North America held the major share of over 42% of the big data security market in 2023.

- The big data security market in the U.S. is expected to grow significantly from 2024 to 2030.

- Based on component, the software segment accounted for the largest market share of 78% in 2023.

- Based on deployment, the cloud segment dominated the market in 2023.

- Based on enteprise size, the large enterprises segment accounted for the largest share of 72% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 20.82 Billion

- 2030 Projected Market Size: USD 62.97 Billion

- CAGR (2024-2030): 13.6%

- North America: Largest market in 2023

Additionally, the rising frequency and sophistication of cyberattacks, including data breaches and ransomware, necessitate advanced security solutions to safeguard sensitive information. Stringent regulatory requirements and compliance standards, such as the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA), compel organizations to implement comprehensive data security strategies. Furthermore, the growing adoption of cloud computing and the Internet of Things (IoT) introduces new security challenges. It expands the attack surface, driving demand for specialized big data security solutions.As organizations collect and process vast volumes of data from diverse sources, the need for sophisticated security measures intensifies to protect this asset from unauthorized access and breaches. The growing complexity arises from integrating various data types, storage systems, and processing technologies, which complicates maintaining data integrity and confidentiality. Consequently, organizations require advanced security solutions to address these multifaceted challenges, propelling the demand for big data security technologies and services.

The rising frequency and sophistication of cyberattacks, including data breaches and ransomware, substantially drive the big data Security market. As cybercriminals employ increasingly advanced techniques to exploit vulnerabilities and target sensitive data, organizations face heightened risks to their information assets. This evolving threat landscape necessitates deploying sophisticated security solutions to detect, prevent, and respond to complex attacks. The growing prevalence of data breaches and ransomware incidents underscores the critical need for robust big data security measures to mitigate these threats and protect valuable data resources effectively. As a result, the demand for advanced security technologies and services in the big data sector continues to escalate.

Component Insights

The software segment accounted for the largest market share, over 78%, in the big data security market in 2023. The adoption of big data security software is driven by several critical factors. Organizations increasingly seek advanced software solutions to protect their vast and complex data environments from sophisticated cyber threats. The need for real-time threat detection, comprehensive data encryption, and effective access controls propels the demand for software that offers these capabilities. Additionally, the integration of artificial intelligence and machine learning within security software enhances its ability to identify and respond to emerging threats, further driving adoption.

The services segment is anticipated to grow at the fastest CAGR over the forecast period. Different considerations influence the adoption of big data security services. Organizations often require specialized expertise and support to address the multifaceted challenges of securing their data environments. Services such as security assessments, incident response, and compliance management provide essential support in navigating complex regulatory requirements and mitigating risks. The need for ongoing monitoring, management, and consultation drives organizations to engage with service providers that offer tailored solutions and expert guidance, thereby fostering the growth of the big data security services market.

Deployment Insights

The cloud segment accounted for the largest market share in 2023. The benefits of scalability, flexibility, and cost-efficiency primarily drive the adoption of big data security solutions over the cloud. Cloud-based big data security solutions allow organizations to scale their security measures with data growth without significant capital investment in hardware. Leveraging cloud service providers' infrastructure and expertise in managing and securing data offers a compelling advantage. Additionally, the cloud provides integrated tools and services that simplify the implementation of comprehensive security protocols, making it easier for organizations to address emerging threats and comply with regulatory requirements.

The on-premises segment is anticipated to expand at a compound annual growth rate of over 16% during the forecast period. The adoption of big data security solutions on-premises is driven by control, customization, and compliance considerations. Organizations with susceptible data or those subject to stringent regulatory requirements often prefer on-premises solutions to maintain greater control over their security infrastructure. On-premises deployments offer the ability to customize security measures to fit specific organizational needs and ensure that data remains within the organization's direct control, thereby addressing data sovereignty and compliance concerns. This preference for on-premises solutions is often influenced by the desire for complete oversight and tailored security configurations that align with the organization's unique requirements.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of over 72% in 2023. Large enterprises' adoption of big data security is primarily driven by the need to protect extensive and complex data environments. Large enterprises handle vast volumes of sensitive and valuable information across multiple departments and geographic locations, necessitating sophisticated security measures to safeguard against advanced cyber threats. Additionally, these organizations are often subject to rigorous regulatory requirements and compliance standards, which mandate robust security solutions to ensure data protection and avoid significant financial and reputational risks. The scale and complexity of their operations further compels large enterprises to invest in comprehensive big data security solutions that provide advanced threat detection, data encryption, and incident response capabilities.

The small & medium enterprises (SMEs) segment is anticipated to expand at the fastest CAGR during the forecast period. SMEs are driven to adopt big data security solutions by cost-effectiveness and ease of implementation. While SMEs may not handle data on the same scale as large enterprises, they still face significant risks from cyber threats and data breaches. To address these concerns, SMEs seek security solutions that balance affordability and effectiveness. Cloud-based security solutions and managed services are particularly appealing to SMEs due to their scalability and lower upfront costs, enabling these businesses to implement robust security measures without requiring extensive in-house resources. Additionally, SMEs increasingly recognize the importance of protecting customer data and maintaining compliance with regulatory requirements, further driving their adoption of big data security solutions.

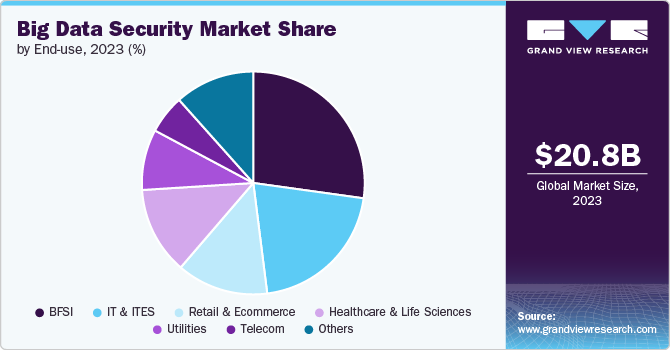

End-use Insights

The BFSI segment accounted for the largest market share of over 27% in 2023 in the big data security market. In the BFSI sector, the adoption of big data security is driven by the critical need to protect sensitive financial information and ensure regulatory compliance. Financial institutions handle vast amounts of personal and transactional data that are prime targets for cyberattacks and fraud. The stringent regulatory frameworks governing the BFSI sector, such as the Payment Card Industry Data Security Standard (PCI DSS) and the General Data Protection Regulation (GDPR), necessitate advanced security measures to safeguard data integrity and confidentiality. Consequently, BFSI organizations invest heavily in big data security solutions to mitigate risks, prevent financial losses, and maintain trust with clients.

The IT & ITES segment is anticipated to grow at the highest CAGR during the forecast period. In the Information Technology and IT-enabled Services (ITES) sector, the adoption of big data security is primarily influenced by the need to secure client data and maintain service reliability. IT and ITES firms often manage and process substantial volumes of data on behalf of their clients, which requires robust security measures to protect against data breaches and cyber threats. The sector's focus on maintaining high service availability and compliance with industry standards drives the demand for sophisticated security solutions that handle complex and dynamic data environments. Additionally, as IT and ITES providers offer solutions to diverse industries, they must adhere to various regulatory requirements, further driving the need for comprehensive big data security measures.

Regional Insights

North America held the major share of over 42% of the big data security market in 2023. The big data security market in North America is experiencing several key trends. The region's advanced technological infrastructure and high concentration of data-centric industries drive the adoption of cutting-edge security solutions. Increased regulatory scrutiny, particularly around data protection laws such as the California Consumer Privacy Act (CCPA) and the evolving landscape of federal regulations, is prompting organizations to invest in comprehensive big data security measures. Additionally, the rise of sophisticated cyber threats and a focus on protecting sensitive financial and personal data contribute to the growing demand for advanced security technologies and services.

U.S. Big Data Security Market Trends

The big data security market in the U.S. is expected to grow significantly from 2024 to 2030. In the U.S., big data security market trends strongly emphasize innovation and technology adoption. The U.S. is a leader in developing and implementing advanced security solutions, including artificial intelligence and machine learning for threat detection and response. The growing complexity of data environments and the high frequency of cyberattacks drive organizations to adopt robust security frameworks. Furthermore, significant investments in cybersecurity infrastructure and a proactive regulatory environment underscore the country's commitment to addressing evolving data security challenges.

Europe Big Data Security Market Trends

The big data security market in Europe is growing significantly at a CAGR of over 16% from 2024 to 2030. The big data security market in Europe is largely shaped by stringent regulatory requirements, particularly under the General Data Protection Regulation (GDPR). European organizations are prioritizing compliance and data privacy, leading to increased investment in security solutions that meet rigorous standards. The region also sees a rise in collaboration between public and private sectors to address cybersecurity threats and enhance data protection measures. As data protection concerns remain paramount, European businesses increasingly adopt advanced security technologies to safeguard against breaches and ensure regulatory compliance.

Asia Pacific Big Data Security Market Trends

The big data security market in Asia Pacific is growing significantly at a CAGR of over 18% from 2024 to 2030. In the Asia Pacific region, the big data security market is characterized by rapid growth driven by increasing data generation and adoption of digital technologies. Expanding e-commerce, financial services, and cloud computing in emerging markets fuels the demand for robust security solutions. Additionally, governments in the region are implementing stricter data protection regulations and investing in cybersecurity infrastructure to address rising cyber threats. As organizations across the Asia Pacific navigate a complex and evolving security landscape, there is a growing emphasis on scalable and adaptable Big Data security solutions to protect sensitive information and support business growth.

Key Big Data Security Company Insights

Key players operating in the big data security market include Amazon Web Services, Inc., Broadcom, IBM, McAfee, LLC, Microsoft, Oracle, Palo Alto Networks, SAS Institute Inc., Splunk Inc., and Trend Micro Incorporated. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Splunk Inc., a leader in cybersecurity and observability, unveiled new security innovations designed to enhance threat detection and security operations across diverse data sources. These developments include Splunk Enterprise 8.0, which equips security teams with the tools needed to proactively mitigate risks. Additionally, the introduction of a new Federated Analytics feature allows for the analysis of data at its source, facilitating more effective threat hunting and frequent threat detection.

-

In April 2024, Trend Micro Incorporated, a global firm in cybersecurity, announced the integration of AI-driven cyber risk management capabilities across its flagship platform, Trend Vision One. This comprehensive solution integrates over ten industry technology categories into a unified offering, enabling security, cloud, and IT operations teams to manage risk proactively. As a result, the platform simplifies the management of the entire cyber risk lifecycle, encompassing discovery, prioritization, risk assessment, and remediation. This enhanced functionality provides users with capabilities extending well beyond those traditional attack surface management tools offer.

Key Big Data Security Companies:

The following are the leading companies in the big data security market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Broadcom

- IBM

- McAfee, LLC

- Microsoft

- Oracle

- Palo Alto Networks

- SAS Institute Inc.

- Splunk Inc.

- Trend Micro Incorporated

Big Data Security Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.13 billion

Revenue forecast in 2030

USD 62.97 billion

Growth rate

CAGR of 17.3% from 2024 to 2030

Historical data

2018 - 2022

Base year

2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services Inc.; Broadcom; IBM; McAfee LLC; Microsoft; Oracle; Palo Alto Networks; SAS Institute Inc.; Splunk Inc.; Trend Micro Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Big Data Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global big data security market report based on component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Data Authorization & Access

-

Data Discovery & Classification

-

Data Encryption, Tokenization, and Masking

-

Data Governance & Compliance

-

Data Auditing & Monitoring

-

Data Backup & Recovery

-

Data Security Analytics

-

-

Services

-

Managed Services

-

Professional Services

-

Training, Support, and Maintenance

-

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

Utilities

-

IT & ITES

-

Healthcare & Life Sciences

-

Retail & Ecommerce

-

Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global big data security market size was estimated at USD 20.82 billion in 2023 and is expected to reach USD 24.13 billion in 2024

b. The global big data security market is expected to grow at a compound annual growth rate of 17.3% from 2024 to 2030 to reach USD 62.97 billion by 2030

b. North America dominated the big data security market with a market share of 42.4% in 2023. The big data security market in North America is experiencing several key trends. The region's advanced technological infrastructure and high concentration of data-centric industries drive the adoption of cutting-edge security solutions. Increased regulatory scrutiny, particularly around data protection laws such as the California Consumer Privacy Act (CCPA) and the evolving landscape of federal regulations, is prompting organizations to invest in comprehensive big data security measures.

b. Some key players operating in the big data security market include Amazon Web Services, Inc., Broadcom, IBM, McAfee, LLC, Microsoft, Oracle, Palo Alto Networks, SAS Institute Inc., Splunk Inc., and Trend Micro Incorporated.

b. Several key factors primarily drive the big data security market. The exponential growth of data organizations generates, and the increasing complexity of data environments have heightened the need for robust security measures. Additionally, the rising frequency and sophistication of cyberattacks, including data breaches and ransomware, necessitate advanced security solutions to safeguard sensitive information.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.