- Home

- »

- Plastics, Polymers & Resins

- »

-

Bimodal HDPE Market Size & Share, Industry Report, 2030GVR Report cover

![Bimodal HDPE Market Size, Share & Trends Report]()

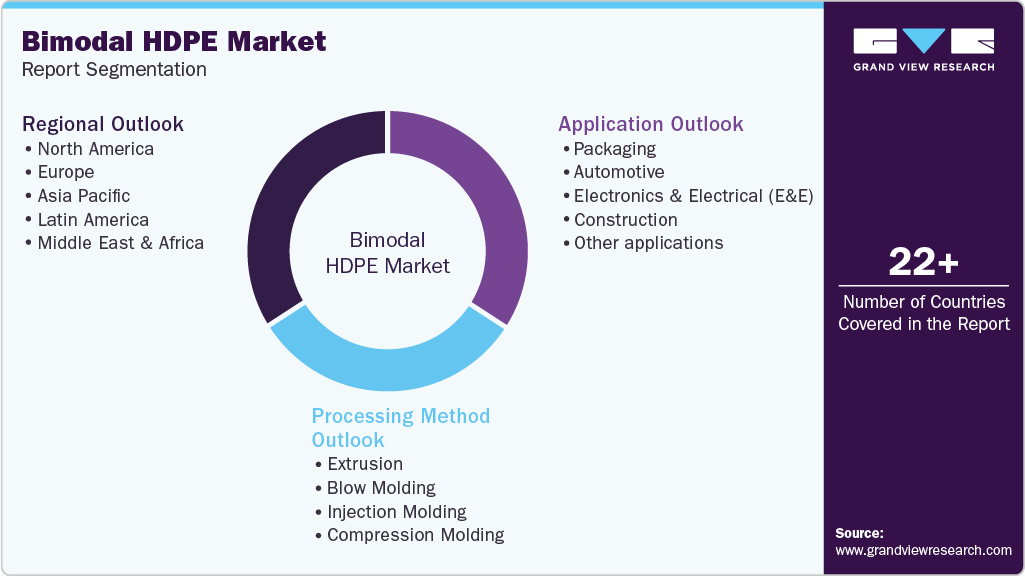

Bimodal HDPE Market (2025 - 2030) Size, Share & Trends Analysis Report By Processing Method (Extrusion, Blow Molding, Injection Molding), By Application (Packaging, Automotive, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-616-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bimodal HDPE Market Summary

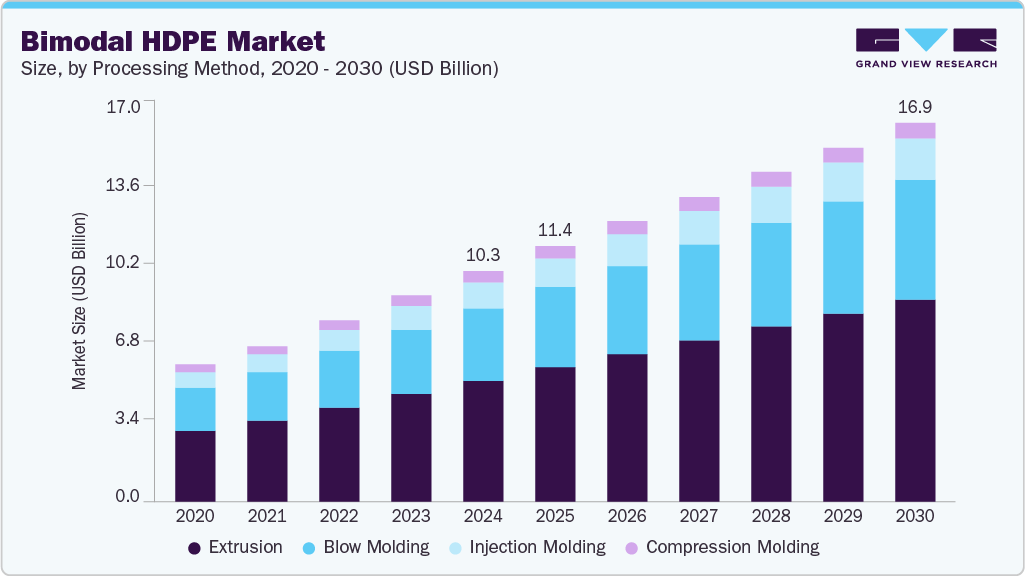

The global bimodal HDPE market size was estimated at USD 10.29 billion in 2024 and is projected to reach USD 16.89 billion by 2030, growing at a CAGR of 8.2% from 2025 to 2030. The long-term performance under harsh conditions and rising demand from the renewable energy sector are driving bimodal HDPE use in durable conduit and cable jacketing for solar and wind installations.

Key Market Trends & Insights

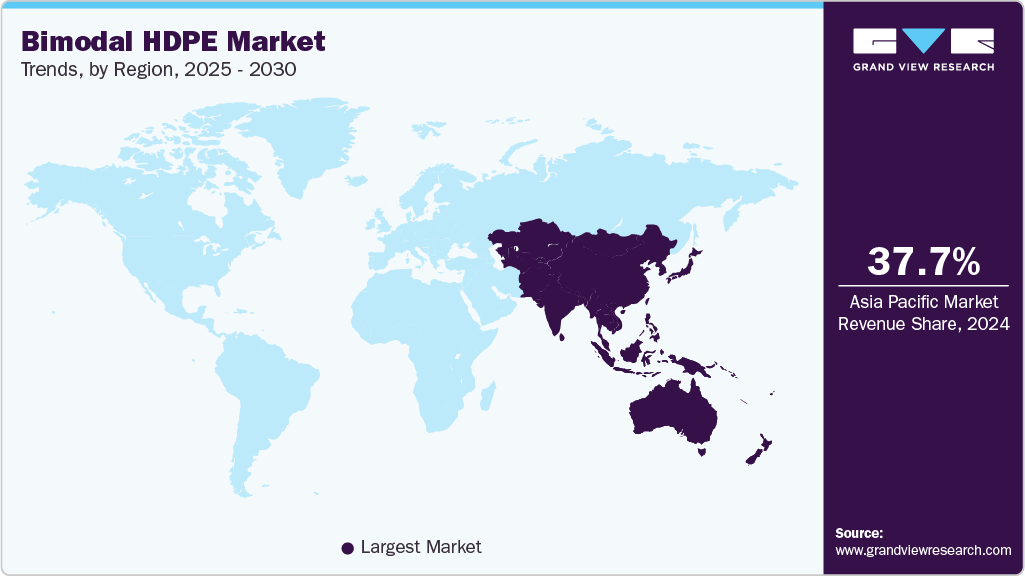

- Asia Pacific dominated the global bimodal HDPE market and accounted for the largest revenue share of 37.67% in 2024.

- The bimodal HDPE market in China dominated with the largest market revenue share in the Asia Pacific market in 2024.

- By processing method, the extrusion dominated the market across the processing method segmentation in terms of revenue, capturing a market share of 52.48% in 2024.

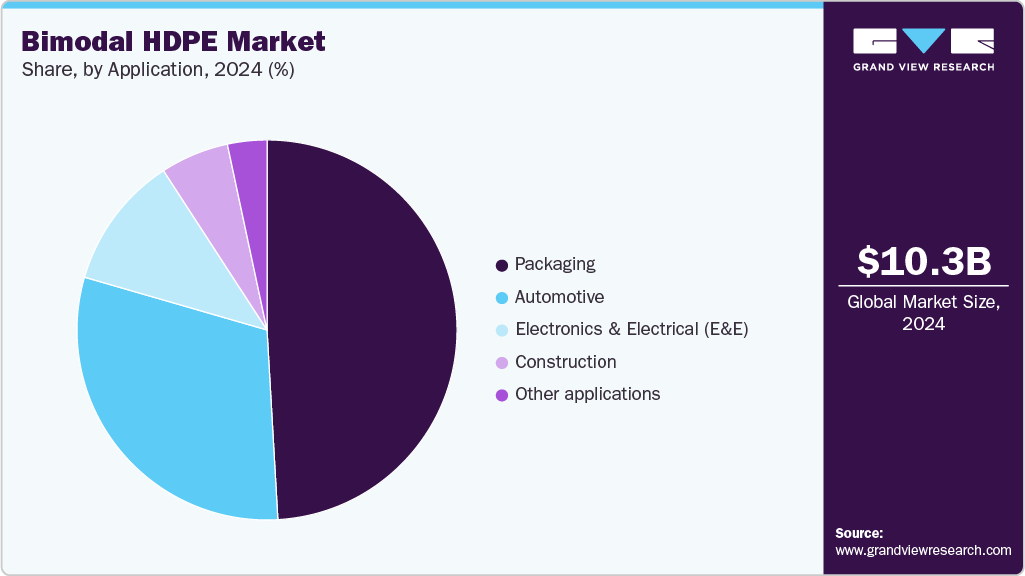

- By application, the packaging dominated the application segmentation in revenue, accounting for a market share of 49.09% in 2024.

- By application, the automotive segment is projected to witness a rapid CAGR of 8.34% through the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 10.29 Billion

- 2030 Projected Market Size: USD 16.89 Billion

- CAGR (2025-2030): 8.2%

- Asia Pacific: Largest market in 2024

In addition, increasing agricultural investments boost demand for high-strength geomembranes and irrigation tubing made from bimodal HDPE. The market is witnessing a pronounced shift toward high-performance applications, driven by the material’s exceptional balance of stiffness and toughness. Manufacturers are adopting advanced gas-phase and slurry-phase polymerization technologies to produce grades with optimized molecular weight distributions. This evolution enables producers to tailor resin properties for specific end uses, such as pressure piping and heavy-duty blow molding. Regional expansion in developing economies, particularly in Asia Pacific, is fueling capacity additions, while established players in North America and Europe focus on sustainability through recycled content incorporation and energy-efficient production methods.

Drivers, Opportunities & Restraints

Rapid urbanization and ongoing investments in water and gas infrastructure are key drivers fueling demand for bimodal HDPE, especially in pressure pipe applications. The material’s superior stress-crack resistance and high long-term hydrostatic strength guarantee reliability in municipal and industrial fluid distribution networks. Furthermore, stringent regulations mandating leak-proof piping investments systems in North America and Europe encourage utilities and contractors to prefer bimodal HDPE over traditional materials. At the same time, automotive and industrial segments are capitalizing on their enhanced impact resistance for fuel tanks and chemical drums, boosting overall market consumption.

Growing emphasis on sustainable packaging presents a compelling opportunity for bimodal HDPE producers to penetrate the rigid container and blow molding markets. As consumer goods companies seek lightweight, high-durability packaging solutions that can withstand mechanical stresses during transit, bimodal HDPE’s tailored molecular architecture enables superior processability and thinner-walled containers without compromising performance.

Volatility in feedstock prices, particularly ethylene derived from naphtha and natural gas liquids, constrains bimodal HDPE producers by squeezing margins and discouraging capital-intensive capacity expansions. Fluctuating raw material costs directly impact resin pricing, making it challenging for suppliers to offer competitive, stable rates to end users.

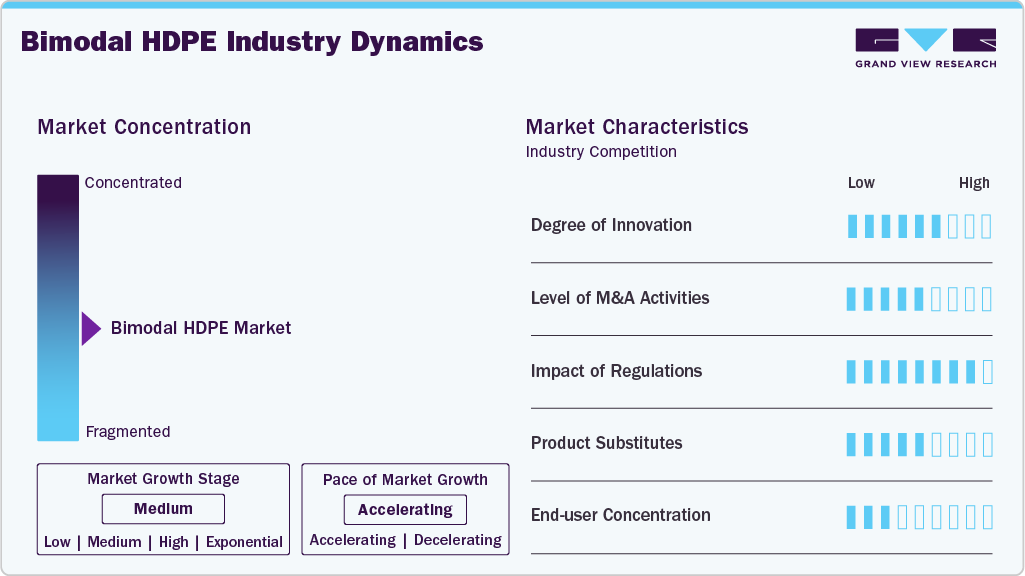

Market Characteristics

The growth stage of the bimodal HDPE industry is medium, and the pace is accelerating. The market is slightly fragmented, with key players dominating the industry landscape. Major companies Dow Inc., Chevron Phillips Chemical Company, SABIC, Exxon Mobil Corporation, Dynalab Corp., LyondellBasell Industries N.V., INEOS AG, SINOPEC Beijing Yanshan Company, PetroChina Company Ltd., Braskem S.A., Formosa Plastics Corporation, Daelim Industrial Co. Ltd., Mitsui Chemicals Inc., and others play a significant role in shaping the market dynamics. These leading players often drive innovation, introducing new products, technologies, and materials to meet evolving industry demands.

In pressure-pipe applications, bimodal HDPE increasingly faces competition from cross-linked polyethylene (PEX) and polypropylene random copolymer (PPR), offering comparable long-term hydrostatic performance but with varying cost structures. PEX’s superior thermal stability makes it a preferred choice for hot-water plumbing, while PPR benefits from weldable fittings and lower raw material costs in some regions. In packaging, biaxially oriented polypropylene (BOPP) films and high-crystallinity PP blends challenge bimodal HDPE by providing higher temperature resistance and lower density for thin-gauge film. Consequently, resin producers must continuously optimize grade formulations to preserve HDPE’s edge in stress-crack resistance and processing ease.

Recent environmental mandates-such as the EU’s Directive on Single-Use Plastics and extended producer responsibility (EPR) schemes-are compelling resin producers to integrate recycled content and enhance the recyclability of bimodal HDPE grades. In North America, stricter EPA standards on chemical leachate and microplastic emissions have led to more rigorous certification protocols for pipe liners and geomembranes, pushing manufacturers to demonstrate lifecycle compliance.

Processing Method Insights

Extrusion dominated the market across the processing method segmentation in terms of revenue, capturing a market share of 52.48% in 2024. The global market, categorized by processing methods, is largely driven by applications that depend on extrusion, particularly pipe and blown film extrusion. The demand for pipe extrusion is primarily fueled by the increasing use of PE-100 and PE-4710 grades in infrastructure projects centered on water and gas distribution, accelerated by urban development and the replacement of aging metal pipelines in regions such as Asia Pacific, the Middle East, and North America.

The blow molding segment is expected to grow at a considerable CAGR of 8.35% throughout the forecast period. The blow molding technique greatly influences the market, which is widely used to produce large containers, fuel tanks, drums, and household and industrial packaging. Due to its high molecular weight and improved melt strength, bimodal HDPE is particularly well-suited for blow molding applications that necessitate exceptional stiffness, impact resistance, and long-term environmental stress crack resistance (ESCR). The increasing demand for durable and lightweight packaging across industries such as chemicals, lubricants, food and beverages, and personal care is fueling growth in this area.

Application Insights

Packaging dominated the application segmentation in revenue, accounting for a market share of 49.09% in 2024, due to rising global demand for lightweight, impact-resistant containers that offer enhanced shelf-life and product protection. In the fast-moving consumer goods (FMCG) sector, particularly in food, personal care, and cleaning products, manufacturers favor bimodal HDPE for its superior rigidity-to-weight ratio and stress-crack resistance, which allows for thinner, more cost-efficient bottles and jerry cans.

The automotive segment is projected to witness a rapid CAGR of 8.34% through the forecast period. The push toward vehicle lightweighting and improved fuel efficiency drives increased use of bimodal HDPE in components such as fuel tanks, air ducts, and battery casings. OEMs capitalize on the material’s high impact strength, chemical resistance, and dimensional stability to replace heavier metal parts without compromising safety or performance. As electric vehicle (EV) production scales rapidly across Asia and Europe, bimodal HDPE's suitability for high-voltage cable protection and thermal shielding is also gaining traction. This aligns with automakers’ dual goals of reducing emissions and meeting circular economy targets by integrating recyclable, durable thermoplastics.

Regional Insights

Asia Pacific dominated the global bimodal HDPE market and accounted for the largest revenue share of 37.67% in 2024, owing to the rapid urbanization and infrastructure expansion in India, Southeast Asia, and China. Major highway and railway projects demand robust HDPE piping systems for efficient water management, while burgeoning e-commerce activities drive packaging needs for lightweight, high-strength containers. Government initiatives, such as India’s National Infrastructure Pipeline and Indonesia’s push for domestic polymer production, have spurred capacity additions, ensuring resilient supply chains. Moreover, increasing consumer environmental awareness has prompted brand owners to prefer recyclable materials, thereby boosting demand for HDPE grades with enhanced recyclability.

The bimodal HDPE market in China dominated with the largest market revenue share in the Asia Pacific market in 2024. In China, the 14th Five-Year Plan’s emphasis on comprehensive industrialization and smart infrastructure catalyzes the adoption of bimodal HDPE in large-scale water and gas distribution projects. Domestic resin manufacturers ramp up capacity for advanced bimodal grades to meet urban construction and municipal engineering demand.

North America Bimodal HDPE Market Trends

The bimodal HDPE market in North America is primarily driven by the region’s advanced manufacturing infrastructure and strong emphasis on sustainable packaging solutions. Major polymer producers invest heavily in R&D, and high-performance grades tailored for food and beverage containers are continuously developed to meet tightening recyclability targets.

The U.S. bimodal HDPE market benefits from abundant shale gas reserves that provide cost-competitive ethylene feedstock, enabling producers to offer competitively priced resins. Recent expansions by leading petrochemical firms into advanced mechanical and chemical recycling facilities have further strengthened domestic supply chains by ensuring a steady stream of sustainable resin. The automotive industry’s shift toward lighter-weight components for improved fuel efficiency continues stimulating the adoption of bimodal HDPE in under-the-hood and fuel-system applications.

Europe Bimodal HDPE Market Trends

The bimodal HDPE market in Europe is anchored by stringent environmental regulations, such as the EU’s directive on single-use plastics, which compel manufacturers to incorporate higher recycled content in packaging. The construction sector’s growing reliance on high-density polymer piping for underground utilities and geomembrane solutions underscores its appeal due to its excellent stress-crack resistance and extended service life. Investment in bio-based and circular-economy initiatives, especially in Germany, France, and the UK, has led polymer producers to launch eco-optimized grades that align with corporate ESG goals.

Key Bimodal HDPE Company Insights

The market is highly competitive, with several key players dominating the landscape. Major companies include Dow Inc., Chevron Phillips Chemical Company, SABIC, Exxon Mobil Corporation, Dynalab Corp., LyondellBasell Industries N.V., INEOS AG, SINOPEC Beijing Yanshan Company, PetroChina Company Ltd., Braskem S.A., Formosa Plastics Corporation, Daelim Industrial Co. Ltd., and Mitsui Chemicals Inc.. The market is characterized by a competitive landscape with several key players driving innovation and growth. Major companies in this sector are investing heavily in research and development to enhance their types' performance, cost-effectiveness, and sustainability.

Key Bimodal HDPE Companies:

The following are the leading companies in the bimodal HDPE market. These companies collectively hold the largest market share and dictate industry trends.

- Dow Inc.

- Chevron Phillips Chemical Company

- SABIC

- Exxon Mobil Corporation

- Dynalab Corp.

- LyondellBasell Industries N.V.

- INEOS AG

- SINOPEC Beijing Yanshan Company

- PetroChina Company Ltd.

- Braskem S.A.

- Formosa Plastics Corporation

- Daelim Industrial Co., Ltd.

- Mitsui Chemicals Inc.

Recent Developments

-

In June 2024, Bharat Petroleum Corporation Ltd. (BPCL) chose Univation's UNIPOL PE Process Technology for two production lines at BPCL's Bina Refinery in India. The units have a combined production capacity of 1,150,000 tons per year of polyethylene (PE)

-

In May 2025, Univation Technologies launched a new world-scale licensed design for its UNIPOL PE Process platform with a capacity of 800,000 tons per year, surpassing its previous top capacity of 650,000 tons per year. This next-generation design offers polyethylene producers significantly higher output, improved economies of scale, and flexible production capabilities for various polyethylene resins, including unimodal and bimodal HDPE, LLDPE, and metallocene PE.

Bimodal HDPE Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.39 billion

Revenue forecast in 2030

USD 16.89 billion

Growth rate

CAGR of 8.2% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Processing method, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

Dow Inc.; Chevron Phillips Chemical Company; SABIC; Exxon Mobil Corporation; Dynalab Corp.; LyondellBasell Industries N.V.; INEOS AG; SINOPEC Beijing Yanshan Company; PetroChina Company Ltd.; Braskem S.A.; Formosa Plastics Corporation; Daelim Industrial Co. Ltd.; Mitsui Chemicals Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bimodal HDPE Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global bimodal HDPE market report based on processing method, application, and region:

-

Processing Method Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Extrusion

-

Blow Molding

-

Injection Molding

-

Compression Molding

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaging

-

Automotive

-

Electronics & Electrical (E&E)

-

Construction

-

Other applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global bimodal HDPE market size was estimated at USD 10.29 billion in 2024 and is expected to reach USD 11.39 billion in 2025.

b. The global bimodal HDPE market is expected to grow at a compound annual growth rate of 8.20% from 2025 to 2030, reaching USD 16.89 billion by 2030.

b. Extrusion dominated the bimodal HDPE market across the processing method segmentation in terms of revenue, capturing a market share of 52.48% in 2024. The global bimodal HDPE market, categorized by processing methods, is largely driven by applications that depend on extrusion, particularly in pipe and blown film extrusion.

b. Some key players operating in the bimodal HDPE market include Dow Inc., Chevron Phillips Chemical Company, SABIC, Exxon Mobil Corporation, Dynalab Corp., LyondellBasell Industries N.V., INEOS AG, SINOPEC Beijing Yanshan Company, PetroChina Company Ltd., Braskem S.A., Formosa Plastics Corporation, Daelim Industrial Co. Ltd., and Mitsui Chemicals Inc.

b. Rising demand from the renewable energy sector is driving the use of bimodal HDPE in durable conduit and cable jacketing for solar and wind installations, thanks to its long-term performance under harsh conditions. Additionally, increasing agricultural investments are boosting demand for high-strength geomembranes and irrigation tubing made from bimodal HDPE.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.