- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Bio Vanillin Market Size And Share, Industry Report, 2030GVR Report cover

![Bio Vanillin Market Size, Share & Trends Report]()

Bio Vanillin Market (2025 - 2030) Size, Share & Trends Analysis Report By End-use (Food & Beverages, Fragrance, Pharmaceuticals), By Region (North America, Europe, APAC), And Segment Forecasts

- Report ID: GVR-1-68038-253-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Bio Vanillin Market Size & Trends

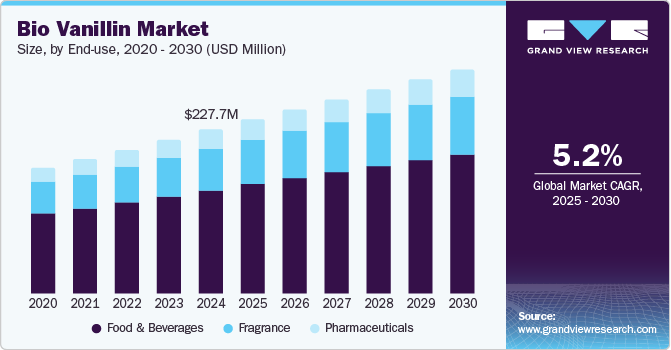

The global bio vanillin market size was estimated at USD 227.7 million in 2024 and is projected to grow at a CAGR of 5.2% from 2025 to 2030. This growth is attributed to the increasing consumer preference for natural products and heightened awareness of the adverse effects of synthetic additives are major contributors. In addition, the demand for clean-label ingredients in the food and beverage industry is rising, alongside a shift towards organic foods. Furthermore, advancements in biotechnological processes for producing biovanillin from renewable sources enhance its appeal as a sustainable alternative to synthetic vanillin, further driving market expansion.

Bio-vanillin is a natural flavoring agent produced through biotechnological methods. It is a sustainable alternative to synthetic vanillin derived from lignin or guaiacol. Its applications span various sectors, including food and beverages, cosmetics, and pharmaceuticals, driven by the rising demand for natural and sustainable ingredients. The increasing consumer preference for organic and non-GMO products compels manufacturers to seek eco-friendly alternatives in their formulations. Bio-vanillin also enhances personal care products with its appealing fragrance profile, primarily utilized in food items such as dairy, baked goods, and confectionery.

The evolving regulatory landscape that favors bio-based products and the rising demand for organic foods in emerging markets further support the expansion of the bio-vanillin market. Furthermore, in the cosmetics and personal care sector, vanillin is highly valued for its aromatic properties, contributing to the fragrance of various products. Its use in perfumery is well-documented due to its ability to impart a pleasant scent.

Moreover, vanillin is increasingly incorporated into cosmetics to provide warm and floral notes, aligning with consumer preferences for natural ingredients over synthetic alternatives. As consumers become more discerning about their products, there is a noticeable shift towards natural cosmetics that avoid chemical additives. This trend presents opportunities for bio-vanillin producers to cater to the growing demand for clean-label personal care items while enhancing their market presence through innovative product offerings.

End-use Insights

Food and beverage dominated the market and accounted for the largest revenue share of 63.1% in 2024. This growth is attributed to the rising consumer demand for natural flavors and ingredients. In addition, as health consciousness increases, consumers are gravitating toward products that are organic, non-GMO, and free from synthetic additives. This shift in preference encourages food manufacturers to incorporate biovanillin into their formulations, enhancing flavor while maintaining clean labels. Furthermore, expanding the food service sector and introducing innovative products further stimulate the demand for biovanillin, positioning it as a key ingredient in various applications such as dairy, bakery, and confectionery items.

The pharmaceutical segment is expected to grow at a CAGR of 5.9% from 2025 to 2030, driven by its extensive use as a flavoring agent to mask unpleasant medication tastes. As the pharmaceutical industry evolves, there is a growing focus on patient compliance, which drives the need for palatable formulations. In addition, bio vanillin serves as an effective solution for improving the sensory attributes of oral medications and topical treatments. Furthermore, with an increasing geriatric population and a rise in chronic diseases, the demand for pharmaceuticals continues growing, enhancing the market potential for bio vanillin.

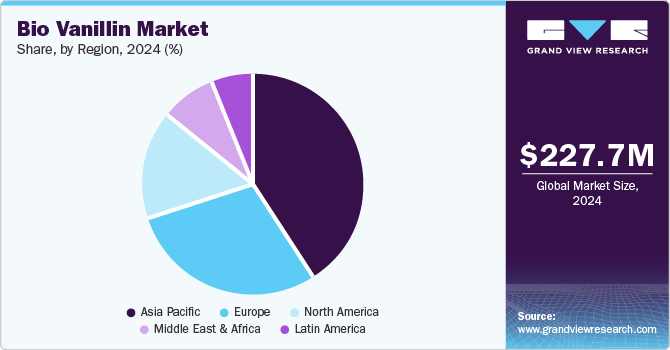

Regional Insights

The North America bio vanillin market is experiencing strong growth due to an increasing consumer preference for natural and clean-label ingredients. Health-conscious consumers actively seek alternatives to synthetic additives, leading food manufacturers to incorporate bio vanillin into their products. Furthermore, the expanding food and beverage industry, characterized by innovative product launches and a focus on sustainability, further drives demand. Moreover, regulatory support from agencies such as the FDA, which recognizes biotechnologically derived ingredients as safe, also contributes to the market's positive outlook.

U.S. Bio Vanillin Market Trends

The bio vanillin market in the U.S. led the North American market and accounted for the largest revenue share in 2024 attributed to American consumers' rising health and wellness awareness, which propels the shift toward natural flavoring agents. As more individuals adopt organic and plant-based diets, the demand for biovanillin as a flavor enhancer in various food products continues to grow. Furthermore, the increasing popularity of veganism and clean-label trends in the U.S. food industry positions biovanillin as a preferred ingredient, supporting its anticipated growth trajectory in the coming years.

Asia Pacific Bio Vanillin Market Trends

The Asia Pacific bio vanillin market dominated the global market and accounted for the largest revenue share of 40.4% in 2024 owing to the increasing demand for natural ingredients across various industries. In addition, as consumers become more health-conscious, there is a marked shift towards organic and clean-label products. The food and beverage sector is expanding rapidly, driven by rising disposable incomes and changing dietary preferences. Furthermore, the trend of Westernization and premiumization in food offerings encourages manufacturers to incorporate bio vanillin, enhancing flavor profiles while avoiding synthetic additives.

The bio vanillin market in China dominated the Asia Pacific market and accounted for the largest revenue share in 2024, driven by a booming food and beverage industry characterized by a growing appetite for flavored products. Furthermore, the rising middle class is shifting towards healthier consumption patterns, increasing demand for natural flavoring agents such as bio vanillin. Moreover, government initiatives promoting food safety and quality standards encourage manufacturers to adopt bio-based ingredients. As a result, bio vanillin is becoming a preferred choice for companies looking to meet consumer expectations for natural and sustainable products.

Middle East & Africa Bio Vanillin Market Trends

The Middle East and Africa bio vanillin market is expected to grow at a CAGR of 4.5% over the forecast period, owing to increased consumer health awareness. The region's expanding food and beverage sector focuses on natural flavors to cater to evolving consumer preferences. In addition, the rise of organic food trends is prompting manufacturers to explore bio vanillin as an alternative to synthetic flavoring agents. The growing interest in premium products further supports the adoption of bio vanillin in various applications, including confectionery and dairy.

Europe Bio Vanillin Market Trends

The bio vanillin market in Europe is expected to grow significantly over the forecast period, owing to stringent regulations favoring natural ingredients in food products. in addition, consumers increasingly seek transparency regarding ingredient sourcing, leading to a preference for clean-label options. Furthermore, sustainability initiatives within the region encourage manufacturers to adopt eco-friendly practices, further boosting the market for biovanillin.

Key Bio Vanillin Company Insights

Some of the key companies in the market include Ennolys, Advanced Biotech, Givaudan, and others. These companies are adopting various strategies to enhance their competitive edge. These include investing in research and development to innovate and improve production processes, ensuring higher efficiency and sustainability. In addition, strategic partnerships and collaborations with other firms are also being pursued to expand market reach and share resources. Furthermore, companies also focus on marketing efforts emphasizing biovanillin's natural and sustainable aspects, catering to the growing consumer preference for clean-label products.

-

Solvay manufactures Rhovanil Natural, a line of biovanillin products derived from the bioconversion of ferulic acid sourced from rice bran. Operating primarily in the food and beverage segment, Solvay aims to meet the increasing consumer demand for healthier, non-GMO, and clean-label products. Their innovative solutions cater to various applications, enhancing flavor profiles while ensuring sustainability and environmental responsibility.

-

Ennolys manufactures high-quality vanillin derived from lignin, a wood industry byproduct. Operating within the flavors and fragrances sector, the company addresses the growing market demand for natural ingredients by providing eco-friendly alternatives to synthetic vanillin. Their commitment to sustainability and innovation positions them as a key player in the bio vanillin market, catering to industries prioritizing natural and sustainable flavoring solutions.

Key Bio Vanillin Companies:

The following are the leading companies in the bio vanillin market. These companies collectively hold the largest market share and dictate industry trends.

- International Flavors & Fragrances Inc.

- Solvay

- Ennolys

- Advanced Biotech

- Givaudan

- Omega Ingredients Limited

- Takasago International Corporation

- Borregaard

- Prinova

- ADM

Recent Developments

-

In January 2023, Solvay launched Rhovanil Natural Delica, Alta, and Sublima, expanding its range of bio vanillin products. These new natural flavor ingredients are derived from Rhovanil Natural CW, produced through the bioconversion of ferulic acid found in rice bran. This development addresses the rising consumer demand for healthier and natural food options. The new products facilitate easy labeling as natural flavors, aligning with the trend toward clean-label ingredients in the food and beverage industry.

Bio Vanillin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 241.5 million

Revenue forecast in 2030

USD 310.5 million

Growth rate

CAGR of 5.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in tons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region.

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa.

Country scope

U.S.; Germany; UK; France; China; India; Japan; Brazil.

Key companies profiled

International Flavors & Fragrances Inc.; Solvay; Ennolys; Advanced Biotech; Givaudan; Omega Ingredients Limited; Takasago International Corporation; Borregaard; Prinova; ADM.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Bio Vanillin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global bio vanillin market report based on end-use, and region:

-

End-use Outlook (Volume Tons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Fragrance

-

Pharmaceuticals

-

-

Regional Outlook (Volume Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.