- Home

- »

- Agrochemicals & Fertilizers

- »

-

Bioinsecticides Market Size, Share & Trends Report, 2030GVR Report cover

![Bioinsecticides Market Size, Share & Trends Report]()

Bioinsecticides Market (2023 - 2030) Size, Share & Trends Analysis Report By Source (Microbial, Plants & Others), By Application (Cereals & Grains, Oilseed And Pulses), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-075-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Bioinsecticides Market Summary

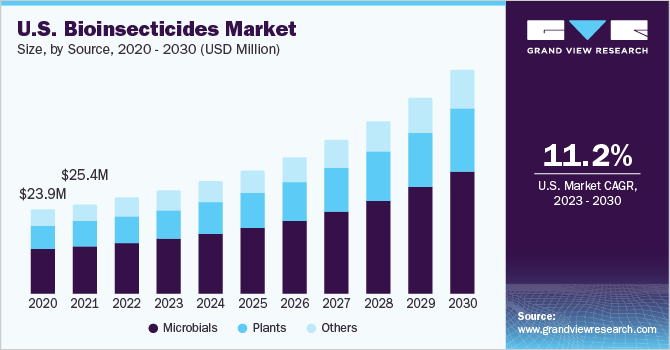

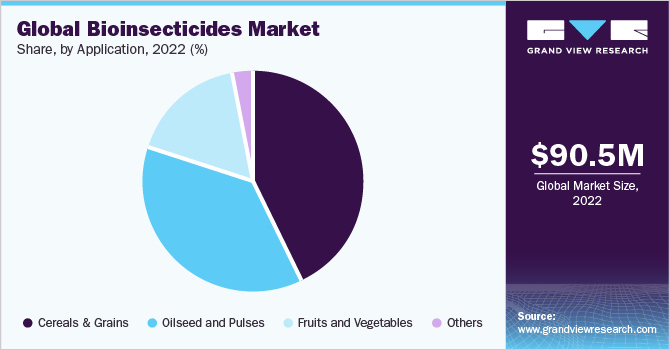

The global bioinsecticides market size was estimated at USD 90.48 million in 2022 and is projected to reach USD 208.46 million by 2030, growing at a CAGR of 11.0% from 2023 to 2030. This is attributed to the adoption of organic farming practices, government policies promoting biocontrol products, and the need for sustainable modes of pest control.

Key Market Trends & Insights

- The North America dominated the product market with the highest revenue share of 36.59% in 2022.

- Based on source, the microbial segment dominated the market with the highest revenue share of 54.24% in 2022.

- Based on application, the cereals and grains dominated the product market with the highest revenue share of 43.3% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 90.48 Million

- 2030 Projected Market Size: USD 208.46 Million

- CAGR (2023-2030): 11.0%

- North America: Largest market in 2022

The adoption of organic practices of farming is due to the harmful environmental and health impacts of synthetic pesticides.

The two major sources involved in the production of Bioinsecticides include microbes and plants. The microbial source includes the biological agents that are derived from living organisms such as bacteria, fungi, viruses, and plants. Whereas the plant source includes the oils extracted from them. For example, neem oil is extracted from the seeds of the neem tree and is effective against a wide range of pests.

Pyrethrum, derived from the flowers of Chrysanthemum cinerariaefolium, is another commonly used Bioinsecticides, which is effective in controlling aphids, whiteflies, thrips, and other pests. Thus, Bioinsecticidess offer a safer and more sustainable way of controlling pests without harming the environment and human health.

Bioinsecticidess work by controlling pests in different ways compared to synthetic pesticides. For example, some Bioinsecticidess contain spores or toxins that target specific pest species or life stages, while others may alter the behavior of the pest in a way that makes it easier to control or reduce pest populations by disrupting mating behavior.

One of the main advantages of product is that it has a low environmental impact compared to synthetic chemical pesticides. Bioinsecticidess are selective in their effect, and they tend to target the pest species of interest, thus reducing the risk of affecting non-target organisms. Additionally, when Bioinsecticidess are applied, they do not leave harmful residues in the environment.

Source Insights

Microbial segment dominated the market with the highest revenue share of 54.24% in 2022. This is due to it’s due to their broader range of target pests and generally higher effectiveness. Microbial insecticides are derived from living microorganisms such as bacteria, viruses, and fungi, and work by infecting and killing target pests, without harming non-target organisms.

One of the most commonly used microbial insecticides is Bacillus thuringiensis (Bt), a bacterium that produces a protein that is toxic to insects, including caterpillars and mosquitoes. Bt is an effective, eco-friendly and sustainable way of controlling pests, and it has been used in organic farming for many years. Another microbial insecticide is Beauveria bassiana, a fungus that infects and kills soil-dwelling pests such as termites, ants and beetles. Metarhizium anisopliae is another fungus that is used to control pests such as grasshoppers and locusts.

Microbial insecticides are highly effective when used correctly, but they require specific conditions to work. For example, the temperature and humidity levels must be within a certain range, and the application must be timed correctly for optimal results. Additionally, microbial insecticides do not offer immediate control of pests like synthetic pesticides, and multiple applications may be required for effective control.

Despite these limitations, microbial insecticides offer a sustainable solution for pest control and have numerous benefits. They reduce the use of harmful synthetic pesticides, which are known to have negative impacts on human health and the environment. They are biodegradable, and they do not leave behind harmful residues that can contaminate soil and water sources. Furthermore, their specificity and selectivity make them less likely to harm non-target organisms, such as beneficial insects that play a vital role in pollination and pest control.

Application Insights

Cereals and grains dominated the product market with the highest revenue share of 43.3% in 2022. This is attributed to the increasing consumption of cereals & grains, such as rice, barley, corn, oats, wheat and sorghum due to their nutritional benefits. The majority of the market share for Bioinsecticides is anticipated to belong to the cereals and grains segment. Due to the extensive wheat and corn cultivation in China and the U.S., Bioinsecticidess are primarily used for cereals and grains in Asia Pacific and North America. Crop protection agents are typically advised for cereals and grains.

Moreover, the Bioinsecticides market is projected to benefit from the increasing focus of farmers on oilseeds production. Oilseeds and pulses comprise a diverse range of seeds, including sunflower seeds, soybean, and leguminous seeds (pulses).

The United States Department of Agriculture (USDA) reported an increase of one million metric tons in global oilseed production in 2020/2021 due to the revised soybean harvest in Brazil for 2021. Leading oilseed producers are Brazil, China, and the U.S. Thus, high demand for Bioinsecticides is expected from these countries in the near future.

Regional Insights

North America dominated the product market with the highest revenue share of 36.59% in 2022. This is attributed to the increasing demand for sustainable and eco-friendly pest management solutions in the region. Moreover, North America is also home to a number of companies that specialize in the development and production of Bioinsecticidess. These companies are constantly working to develop new and improved products that are more effective and easier to use.

Moreover, according to the Organization for Economic Co-operation and Development (OECD) and Food and Agricultural Organization (FAO), Asia Pacific is the largest producer of agricultural commodities and is expected to account for 53% of the global output of agricultural products by 2030. The arable land in the region is shrinking and the food demand is increasing owing to the increasing population in the region. Thus, farmers are increasingly utilizing Bioinsecticides to enhance the crop yield.

The region is characterized by the availability of cheap labor and abundant raw materials. However, water scarcity, climate change, and land degradation are some of the major challenges faced by agricultural industry in Asia Pacific. Additionally, owing to unhygienic conditions in some of the under-developed countries, such as Nepal and Sri Lanka, the crops are often subject to rodent attacks. This has increased the demand for Bioinsecticidess in the region.

Key Companies & Market Share Insights

Bioinsecticides market players have been adopting strategies like mergers and acquisitions, product launches, and geographic expansions. These strategies are aimed at enhancing the product portfolio, expanding the customer base, and increasing the market share of the companies in the Asia-Pacific Bioinsecticides market.

For instance, in February 2023 Vestaron, a leading company in the production of peptide-based Bioinsecticidess, introduced a new product in its Spear series called Spear® RC. This revolutionary insecticide specifically targets lepidopteran pests like cotton bollworm, soybean looper, and armyworm in crops like cotton, soybean, and rice. Field tests with Spear® RC have demonstrated its effectiveness to be on par with that of conventional insecticides. Some prominent players in the global Bioinsecticides market include:

-

BASF SE

-

Bayer AG

-

Certis USA L.L.C.

-

Novozymes

-

Marrone Bio Innovations

-

Syngenta

-

Nufarm

-

VALENT BioSciences

-

BioWorks

-

Vestaron Corporation

Bioinsecticides Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 97.15 million

Revenue forecast in 2030

USD 208.46 million

Growth Rate

CAGR of 11.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilo tons, revenue in USD million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Netherlands, China, India, Japan, South Korea, Vietnam, Brazil, Argentina, Saudi Arabia, South Africa

Market Players

BASF SE, Bayer AG, Certis USA L.L.C., Novozymes, Marrone Bio Innovations, Syngenta, Nufarm, VALENT BioSciences, BioWorks, Vestaron Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

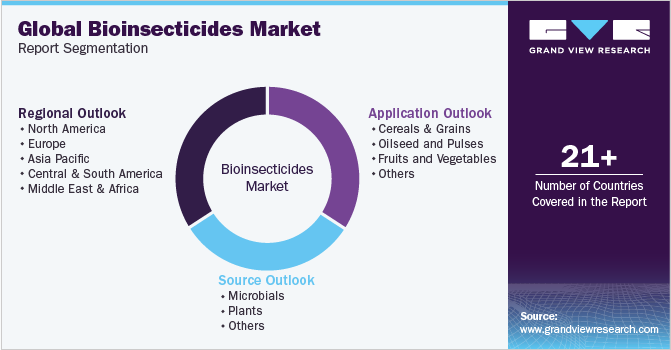

Global Bioinsecticides Market Report Segmentation

This report forecasts revenue growth at, regional, levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Bioinsecticides market report on the basis of source, application and region:

-

Source Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Microbials

-

Plants

-

Others

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Oilseed and Pulses

-

Fruits and Vegetables

-

Others

-

-

Regional Outlook (Volume, Kilotons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Vietnam

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global bioinsecticide market size was estimated at USD 90.40 million in 2022 and is expected to reach USD 97.15 million in 2023

b. The global bioinsecticide market is expected to grow at a compound annual growth rate of 11.0% from 2023 to 2030 to reach USD 208.46 million by 2030.

b. North America dominated the bioinsecticide market with a share of 36.59% in 2022. This is attributable to increasing demand for sustainable and eco-friendly pest management solutions in the region. Moreover, North America is also home to a number of companies that specialize in the development and production of bioinsecticides.

b. Some key players operating in the bioinsecticide market include BASF SE, Bayer AG, Certis USA L.L.C., Novozymes, Marrone Bio Innovations, Syngenta, Nufarm, VALENT BioSciences, BioWorks, Vestaron Corporation.

b. Key factors that are driving the bioinsecticides market growth include the adoption of organic farming practices, government policies promoting biocontrol products, and the need for sustainable modes of pest control.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.